Key Insights

The United States Battery Cell Market is projected for significant expansion, driven by technological advancements and escalating demand across key sectors. The market is estimated at $16.04 billion in the base year 2025, with a projected Compound Annual Growth Rate (CAGR) of 10.3% through the forecast period. This robust growth is primarily fueled by the burgeoning automotive sector, with the widespread adoption of electric vehicles (EVs) necessitating increased battery cell production. The electrification of transportation is a key driver and a testament to the nation's commitment to sustainable energy solutions. Industrial sectors are increasingly relying on advanced battery solutions for energy storage, grid stabilization, and powering heavy machinery, further augmenting market demand. Consumer electronics continue to contribute to market expansion as portable devices become more sophisticated and power-hungry. The transition towards renewable energy sources also plays a crucial role, as battery cells are indispensable for storing intermittent solar and wind power, enhancing grid reliability and efficiency. This dynamic interplay of innovation and demand across diverse applications underscores the immense potential and strategic importance of the U.S. battery cell market.

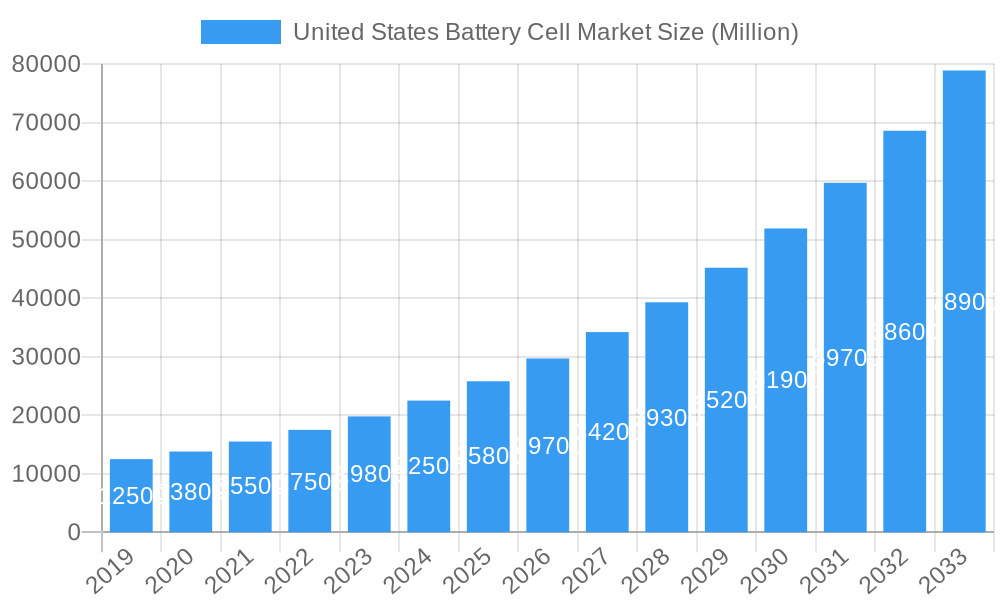

United States Battery Cell Market Market Size (In Billion)

Market growth is further propelled by continuous innovation in battery chemistries, leading to improved energy density, faster charging, and enhanced safety. Companies are investing heavily in R&D for next-generation battery technologies offering superior performance and cost-effectiveness. The diversification of battery cell types, including prismatic, cylindrical, and pouch formats, caters to a wide array of specialized needs across different applications. However, the market faces restraints, including volatile raw material prices like lithium and cobalt, impacting manufacturing costs. Supply chain disruptions and the need for robust recycling infrastructure for end-of-life batteries also present challenges. Despite these hurdles, overwhelming demand from automotive, industrial, and consumer electronics sectors, coupled with supportive government policies and a strong focus on domestic manufacturing, positions the United States Battery Cell Market for sustained and impressive growth, solidifying its role in the nation's energy transition and technological advancement.

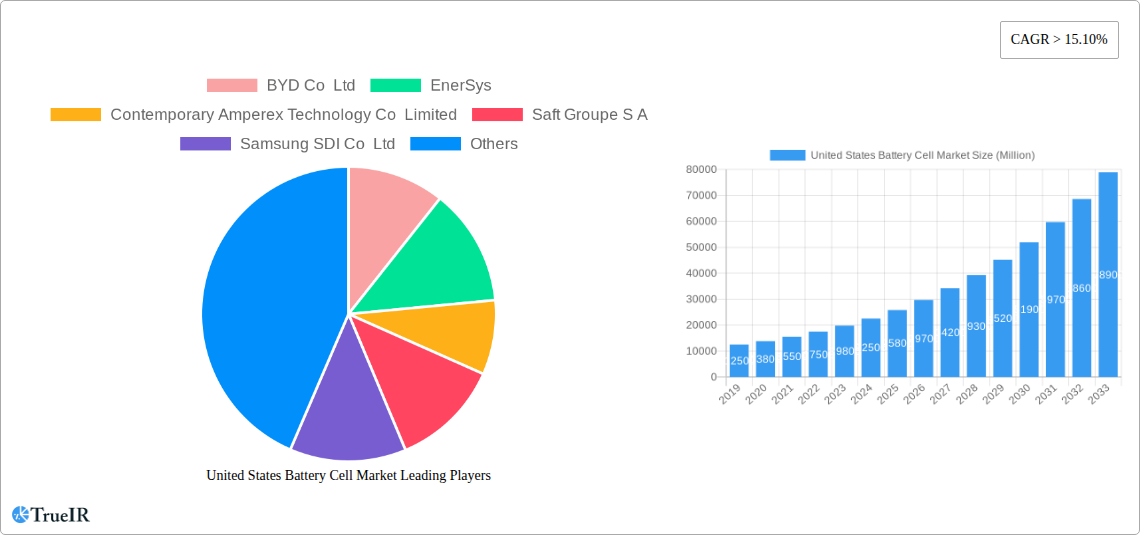

United States Battery Cell Market Company Market Share

United States Battery Cell Market: Comprehensive Analysis and Forecast (2019–2033)

This in-depth report provides a granular analysis of the United States battery cell market, a critical sector powering innovation across automotive, industrial, and consumer electronics. Leveraging high-volume keywords such as "US battery market," "lithium-ion battery cells USA," "EV battery manufacturing," and "energy storage solutions," this report is meticulously crafted for optimal SEO performance and to deliver actionable insights to industry stakeholders. Our study covers the historical period (2019–2024), the base year (2025), and a detailed forecast period (2025–2033), with estimated market valuations for 2025.

United States Battery Cell Market Market Structure & Competitive Landscape

The United States battery cell market exhibits a dynamic and evolving competitive landscape, characterized by increasing investments and strategic collaborations aimed at bolstering domestic manufacturing capabilities and technological advancements. Market concentration is gradually shifting as new players enter and existing ones expand their operations, driven by robust demand for electric vehicles (EVs) and renewable energy storage solutions. Innovation is a key differentiator, with companies focusing on developing higher energy density, faster charging capabilities, and improved safety features in their battery cell technologies. Regulatory impacts, including government incentives for domestic production and the Inflation Reduction Act, play a significant role in shaping market dynamics and encouraging localized supply chains. Product substitutes, though emerging, are still in nascent stages compared to the dominance of lithium-ion chemistries. End-user segmentation reveals the automotive sector as the primary consumer, followed by industrial applications and consumer electronics. Mergers and acquisitions (M&A) are becoming more prevalent as larger corporations seek to secure market share and technological expertise, alongside significant capital investments in new battery gigafactories across the nation. The market is witnessing substantial growth, with an estimated market size of \$XX Billion in 2025 and projected to reach \$XX Billion by 2033, demonstrating a robust CAGR of XX%.

United States Battery Cell Market Market Trends & Opportunities

The United States battery cell market is experiencing an unprecedented surge in growth, fueled by a confluence of technological advancements, surging consumer demand for electric vehicles, and supportive government policies. The market size is projected to witness substantial expansion, moving from an estimated \$XX Billion in 2025 to a commanding \$XX Billion by 2033. This impressive trajectory is underpinned by a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. A significant technological shift is underway, with a pronounced move towards next-generation battery chemistries, including solid-state batteries, which promise enhanced safety, higher energy density, and faster charging times, addressing key consumer pain points. Consumer preferences are increasingly aligned with sustainability and performance, driving demand for longer-range EVs and more efficient energy storage solutions for residential and commercial use.

Key trends shaping the US battery cell market include:

- Electrification of Transportation: The rapid adoption of electric vehicles by consumers and commercial fleets is the primary demand driver. Federal and state incentives, coupled with an expanding charging infrastructure, are accelerating this transition.

- Grid-Scale Energy Storage: The growing integration of renewable energy sources like solar and wind power necessitates robust energy storage solutions to ensure grid stability and reliability. Battery cells are at the forefront of this development.

- Domestic Manufacturing Push: Government initiatives and private sector investments are focused on building a self-sufficient domestic battery manufacturing ecosystem, reducing reliance on foreign supply chains and creating high-skilled jobs.

- Technological Innovation: Continuous research and development in battery materials, cell design, and manufacturing processes are leading to improved performance, lower costs, and enhanced safety.

- Diversification of Applications: Beyond EVs and grid storage, battery cells are finding increasing applications in portable electronics, aerospace, defense, and medical devices.

The market presents significant opportunities for battery cell manufacturers, raw material suppliers, technology developers, and component providers. Strategic partnerships, joint ventures, and substantial capital investments in R&D and production capacity are critical for players looking to capitalize on this burgeoning market. The increasing focus on sustainability and circular economy principles also opens avenues for battery recycling and second-life applications, further enhancing the market's long-term potential. The penetration rate of battery-powered solutions across various sectors is expected to climb steadily, creating a sustained demand for advanced battery cell technologies.

Dominant Markets & Segments in United States Battery Cell Market

The United States battery cell market is characterized by the significant dominance of certain segments and applications, driven by ongoing technological advancements, policy support, and evolving consumer demands.

Dominant Segments:

Application:

- Automotive: This segment is the undisputed leader, propelled by the rapid electrification of vehicles across the nation. The surge in EV adoption, supported by government mandates and consumer preference for sustainable transportation, is creating an insatiable demand for high-performance battery cells. This includes battery cells for passenger EVs, commercial vehicles, and specialty vehicles. The market for automotive battery cells is projected to account for over 70% of the total market value by 2033.

- Industrial: This segment encompasses energy storage systems for grid stabilization, renewable energy integration, industrial machinery, and backup power solutions. The increasing reliance on renewable energy sources and the need for reliable power backup are driving substantial growth in this sector.

- Consumer Electronics: While a mature market, demand for battery cells in smartphones, laptops, wearables, and other portable devices remains consistent, contributing steadily to market growth.

Type:

- Pouch: Pouch cells are gaining significant traction, particularly in the automotive sector, due to their flexibility in design, lightweight nature, and efficient thermal management. Their adaptability to various vehicle architectures makes them a preferred choice for many EV manufacturers.

- Cylindrical: Cylindrical cells remain a staple, especially in consumer electronics and some EV applications, offering established manufacturing processes and robust performance.

- Prismatic: Prismatic cells offer a balance of energy density and form factor, finding applications across various sectors including automotive and industrial storage.

Key Growth Drivers for Dominant Segments:

- Automotive:

- Federal and State EV Incentives: Tax credits, rebates, and emissions regulations are significantly encouraging EV purchases.

- Expanding Charging Infrastructure: The continuous build-out of public and private charging stations is alleviating range anxiety for consumers.

- Battery Technology Advancements: Improvements in energy density, charging speed, and cost reduction are making EVs more competitive and appealing.

- Industrial:

- Renewable Energy Integration: The need to store intermittent renewable energy to ensure grid stability is a major driver.

- Grid Modernization: Investments in upgrading grid infrastructure to enhance reliability and resilience are boosting demand for energy storage solutions.

- Corporate Sustainability Goals: Businesses are increasingly investing in on-site energy storage to reduce their carbon footprint and manage energy costs.

The market dominance is further solidified by substantial investments in gigafactories and R&D for these key segments. Policies aimed at reshoring battery manufacturing and securing critical raw material supply chains are also playing a crucial role in bolstering the growth of these dominant segments within the United States.

United States Battery Cell Market Product Analysis

The United States battery cell market is defined by a relentless pursuit of enhanced performance, safety, and cost-efficiency. Innovations are primarily focused on advancing lithium-ion chemistries, with manufacturers like BYD and CATL pushing the boundaries of energy density and charging speeds. Pouch cells, favored for their design flexibility and thermal management, are increasingly being adopted in electric vehicles, while cylindrical cells continue to be a workhorse in consumer electronics and certain EV models. The development of next-generation technologies, such as solid-state batteries, promises a paradigm shift with higher energy density and improved safety profiles, albeit with current challenges in scalability and cost. Competitive advantages are being forged through optimized material compositions, advanced manufacturing techniques, and integrated battery management systems that enhance longevity and performance across diverse applications, from high-performance electric vehicles to grid-scale energy storage.

Key Drivers, Barriers & Challenges in United States Battery Cell Market

Key Drivers:

- Technological Advancements: Continuous innovation in battery chemistries (e.g., high-nickel cathodes, silicon anodes) and manufacturing processes is enhancing energy density, safety, and reducing costs, making battery-powered solutions more attractive.

- Government Support and Incentives: Federal initiatives like the Inflation Reduction Act, coupled with state-level policies, provide significant tax credits, grants, and subsidies for domestic battery cell manufacturing and EV adoption, stimulating market growth.

- Rising Demand for Electric Vehicles (EVs): The accelerating consumer and commercial adoption of EVs, driven by environmental concerns and improving vehicle performance, is the primary demand catalyst for battery cells.

- Growth in Energy Storage Systems: The increasing integration of renewable energy sources (solar, wind) necessitates robust grid-scale battery storage solutions for grid stability and reliability.

Barriers & Challenges:

- Supply Chain Vulnerabilities: Reliance on imported raw materials (e.g., lithium, cobalt, nickel) and components creates supply chain risks and price volatility, impacting production costs and schedules.

- High Capital Investment: Establishing battery cell manufacturing facilities, particularly gigafactories, requires substantial upfront capital investment, posing a barrier for smaller players.

- Regulatory Hurdles and Permitting: Navigating complex environmental regulations and obtaining permits for large-scale manufacturing facilities can be time-consuming and challenging.

- Talent Shortage: A growing demand for skilled labor in battery research, development, and manufacturing creates a talent gap, potentially hindering production ramp-up.

- Competition from Established Players: Intense competition from established global battery manufacturers with extensive experience and economies of scale presents a challenge for new entrants.

Growth Drivers in the United States Battery Cell Market Market

The United States battery cell market is experiencing robust growth fueled by several key drivers. Technological innovation is paramount, with advancements in lithium-ion chemistries and the exploration of solid-state batteries promising higher energy density, faster charging, and improved safety. Government policies, particularly the Inflation Reduction Act, are providing significant financial incentives for domestic manufacturing and EV adoption, creating a favorable investment climate. The economic imperative of reducing carbon emissions and achieving energy independence is also a strong motivator. Furthermore, the rapid expansion of the electric vehicle market, coupled with the increasing demand for grid-scale energy storage solutions to support renewable energy integration, are creating sustained market opportunities. These interconnected factors are propelling the United States to the forefront of global battery cell production and innovation.

Challenges Impacting United States Battery Cell Market Growth

Despite the strong growth trajectory, the United States battery cell market faces significant challenges. Supply chain dependencies, particularly for critical raw materials like lithium, cobalt, and nickel, pose a vulnerability to price fluctuations and geopolitical risks. The high capital expenditure required for building gigafactories and R&D facilities presents a substantial barrier to entry and expansion. Navigating complex regulatory landscapes, including environmental permitting processes, can lead to project delays. Furthermore, a shortage of skilled labor in specialized battery manufacturing and research roles can hinder production ramp-up and technological advancement. Intense global competition from established players with existing economies of scale and established supply networks also presents a considerable challenge for domestic manufacturers aiming to gain market share.

Key Players Shaping the United States Battery Cell Market Market

- BYD Co Ltd

- EnerSys

- Contemporary Amperex Technology Co Limited

- Saft Groupe S A

- Samsung SDI Co Ltd

- GS Yuasa Corporation

- Maxell Ltd

- Duracell Inc

- ElringKlinger AG

- LG Energy Solution Ltd

- Panasonic Corporation

Significant United States Battery Cell Market Industry Milestones

- March 2022: Microvast Holdings, Inc. introduced two new lithium-ion battery cells (48Ah and 53.5Ah NMC Li-ion) and upgraded Gen 4 battery packs. These new pouch cells are designed for commercial and specialty vehicles and were available for immediate orders, with high-volume production expected in 2023.

- May 2021: Ford and SK Innovation announced a joint venture, BlueOval SK, to manufacture battery cells and arrays in the United States. This venture is projected to produce approximately 60-gigawatt hours (GWh) annually and includes plans for a new global battery center of excellence and investment in a solid-state battery start-up.

Future Outlook for United States Battery Cell Market Market

The future outlook for the United States battery cell market is exceptionally bright, driven by continued technological innovation and robust policy support. The market is poised for sustained growth as the nation prioritizes domestic manufacturing and the widespread adoption of electric vehicles and renewable energy storage. Strategic investments in R&D for next-generation battery technologies, including solid-state batteries, will be crucial for maintaining a competitive edge and addressing evolving market demands for higher energy density, faster charging, and enhanced safety. Opportunities lie in strengthening domestic supply chains for critical raw materials, fostering a skilled workforce, and promoting battery recycling initiatives to create a circular economy. The expansion of gigafactories and collaborations between automotive manufacturers and battery producers will further solidify the US position as a global leader in battery cell production.

United States Battery Cell Market Segmentation

-

1. Type

- 1.1. Prismatic

- 1.2. Cylindrical

- 1.3. Pouch

-

2. Application

- 2.1. Automotive

- 2.2. Industri

- 2.3. Consumer Electronics

- 2.4. Other Applications

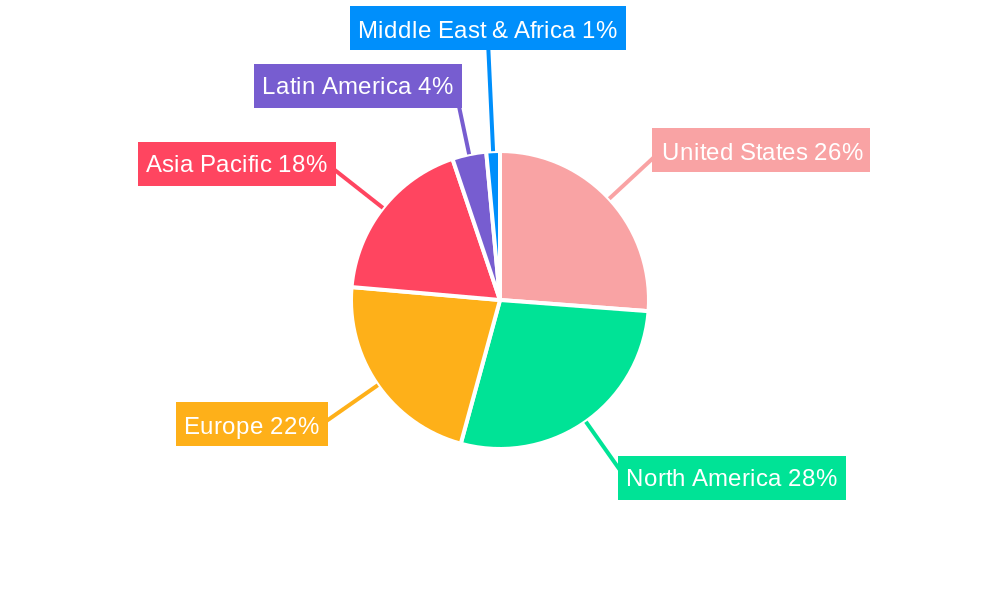

United States Battery Cell Market Segmentation By Geography

- 1. United States

United States Battery Cell Market Regional Market Share

Geographic Coverage of United States Battery Cell Market

United States Battery Cell Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand for Natural Gas and Developing Gas Infrastructure 4.; Increasing Offshore Oil & Gas Exploration Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Adoption of Cleaner Alternatives4.; High Volatility of Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. Automobile Batteries Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Battery Cell Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Prismatic

- 5.1.2. Cylindrical

- 5.1.3. Pouch

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Automotive

- 5.2.2. Industri

- 5.2.3. Consumer Electronics

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BYD Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 EnerSys

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Contemporary Amperex Technology Co Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Saft Groupe S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Samsung SDI Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GS Yuasa Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Maxell Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Duracell Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ElringKlinger AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LG Energy Solution Ltd*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Panasonic Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 BYD Co Ltd

List of Figures

- Figure 1: United States Battery Cell Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Battery Cell Market Share (%) by Company 2025

List of Tables

- Table 1: United States Battery Cell Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: United States Battery Cell Market Volume K Units Forecast, by Type 2020 & 2033

- Table 3: United States Battery Cell Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: United States Battery Cell Market Volume K Units Forecast, by Application 2020 & 2033

- Table 5: United States Battery Cell Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: United States Battery Cell Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: United States Battery Cell Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: United States Battery Cell Market Volume K Units Forecast, by Type 2020 & 2033

- Table 9: United States Battery Cell Market Revenue billion Forecast, by Application 2020 & 2033

- Table 10: United States Battery Cell Market Volume K Units Forecast, by Application 2020 & 2033

- Table 11: United States Battery Cell Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United States Battery Cell Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Battery Cell Market?

The projected CAGR is approximately 10.3%.

2. Which companies are prominent players in the United States Battery Cell Market?

Key companies in the market include BYD Co Ltd, EnerSys, Contemporary Amperex Technology Co Limited, Saft Groupe S A, Samsung SDI Co Ltd, GS Yuasa Corporation, Maxell Ltd, Duracell Inc, ElringKlinger AG, LG Energy Solution Ltd*List Not Exhaustive, Panasonic Corporation.

3. What are the main segments of the United States Battery Cell Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.04 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Natural Gas and Developing Gas Infrastructure 4.; Increasing Offshore Oil & Gas Exploration Activities.

6. What are the notable trends driving market growth?

Automobile Batteries Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Adoption of Cleaner Alternatives4.; High Volatility of Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

In March 2022, Microvast Holdings, Inc. announced the introduction of two new lithium-ion battery cells to its product portfolio, as well as upgraded Gen 4 battery packs. The new 48Ah and 53.5Ah NMC Li-ion battery cells are new pouch cells that were explicitly designed to meet diverse technical requirements for powering commercial and specialty vehicles. The 48Ah, 53.5Ah cells, and Gen 4 battery packs are available for instant orders. Microvast expects to begin high-volume production in 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Battery Cell Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Battery Cell Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Battery Cell Market?

To stay informed about further developments, trends, and reports in the United States Battery Cell Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence