Key Insights

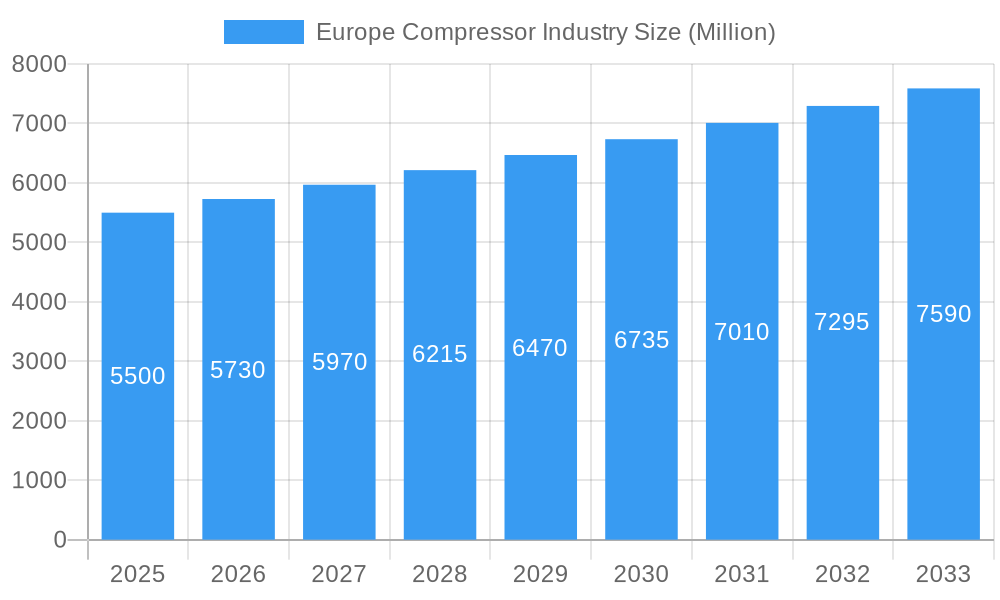

The European compressor market is projected for substantial expansion, propelled by heightened industrial activity and significant infrastructure investments across vital sectors. The market is estimated at $9.4 billion in the base year 2025, with a projected Compound Annual Growth Rate (CAGR) of 5.7% through 2033. Key growth drivers include escalating demand from the oil and gas sector (upstream and downstream) and the power industry's need for efficient compression in generation and grid stabilization. Ongoing modernization in manufacturing and expansion in petrochemicals also contribute significantly. Emerging trends like energy-efficient technologies, smart diagnostics, and IoT integration for predictive maintenance are optimizing operational efficiency and reducing environmental impact.

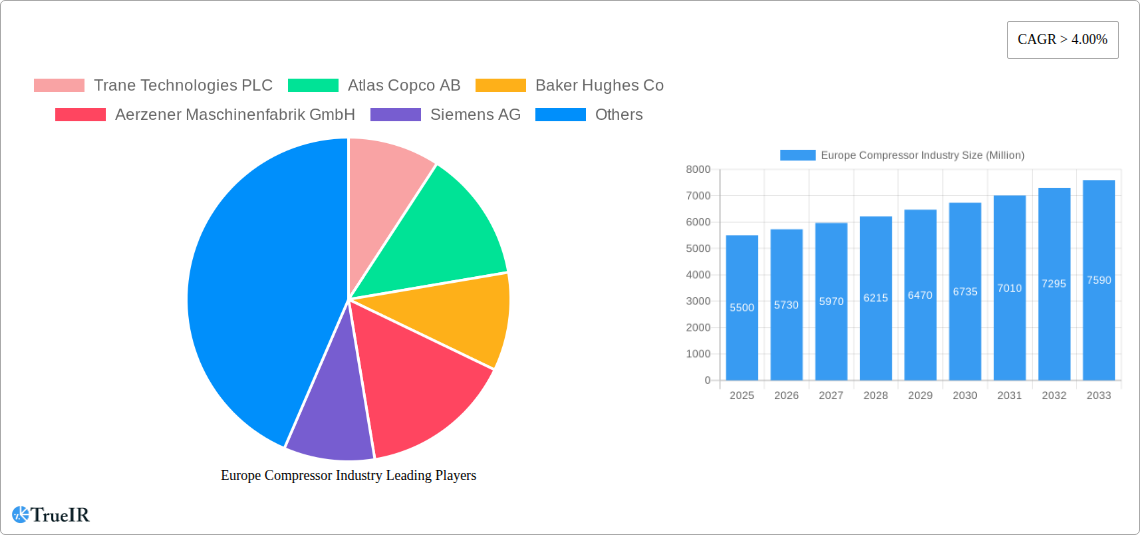

Europe Compressor Industry Market Size (In Billion)

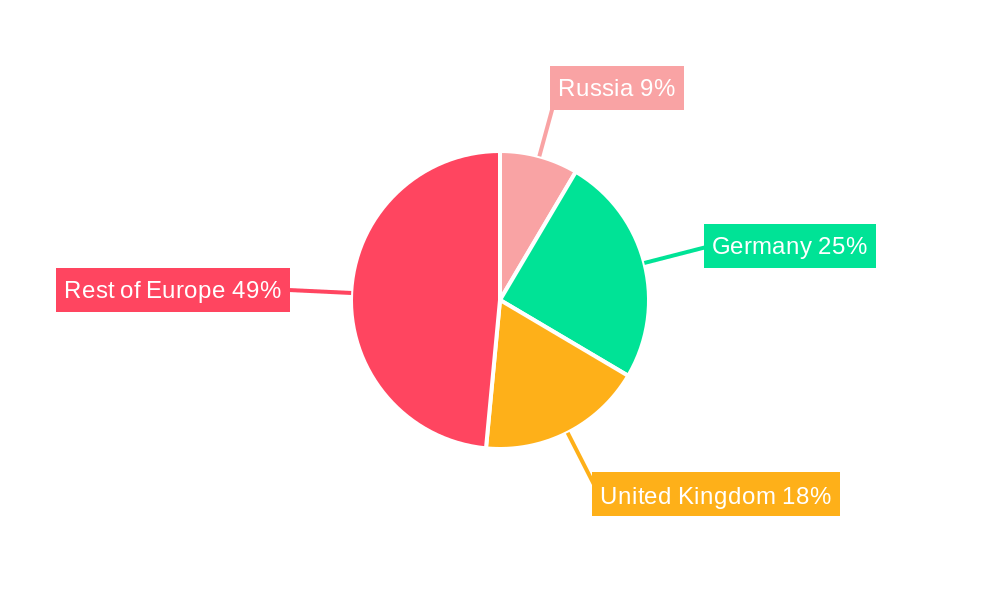

Market restraints include stringent environmental regulations and high initial capital expenditure for advanced systems. Geopolitical and economic uncertainties in Europe may also impact investment and project timelines. Leading companies such as Trane Technologies PLC, Atlas Copco AB, Baker Hughes Co, and Siemens AG are driving innovation. Germany and the United Kingdom exhibit strong market presence, with the Rest of Europe also showing promising growth, indicating a positive outlook for the European compressor industry.

Europe Compressor Industry Company Market Share

Europe Compressor Industry Market Report: Growth, Trends, and Opportunities (2019–2033)

Unlock critical insights into the dynamic Europe compressor market, a sector projected to reach an estimated value of XX Million by 2033. This comprehensive report delves into market structure, key trends, dominant segments, product analysis, growth drivers, challenges, competitive landscape, and future outlook. Leveraging a study period from 2019 to 2033, with 2025 as the base and estimated year, this analysis provides actionable intelligence for stakeholders in the industrial compressor sector.

Europe Compressor Industry Market Structure & Competitive Landscape

The Europe compressor market exhibits a moderately consolidated structure, with leading players commanding significant market share, estimated at around 65% by the top 5 companies. Innovation serves as a primary driver, fueled by increasing demand for energy-efficient solutions and advanced compression technologies. Regulatory impacts, particularly stringent environmental regulations concerning refrigerants and emissions, are reshaping product development and market entry strategies. Product substitutes, such as on-site air generation systems and alternative energy sources, present a moderate threat, necessitating continuous technological advancement by compressor manufacturers. End-user segmentation reveals strong demand from the Manufacturing Sector, followed by the Oil and Gas Industry and the Power Sector, each with unique requirements and growth trajectories. Mergers and Acquisitions (M&A) activity remains robust, with approximately XX M&A deals recorded in the historical period (2019-2024), indicating strategic consolidation and expansion efforts.

Europe Compressor Industry Market Trends & Opportunities

The Europe compressor market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This expansion is underpinned by increasing industrialization, a burgeoning demand for energy-efficient compressed air systems, and significant investments in infrastructure development across various European nations. Technological shifts are characterized by the widespread adoption of variable speed drives (VSDs) in compressors, leading to considerable energy savings and reduced operational costs for end-users. Furthermore, there is a discernible trend towards smart compressors equipped with IoT capabilities for remote monitoring, predictive maintenance, and optimized performance, enhancing overall operational efficiency.

Consumer preferences are increasingly leaning towards sustainable and environmentally friendly compressor solutions. This includes a growing demand for compressors utilizing natural refrigerants, aligning with the EU’s F-gas regulations and its commitment to reducing greenhouse gas emissions. The focus on circular economy principles is also influencing product design and service offerings, with an emphasis on extending product lifespan and promoting repair and refurbishment services.

Competitive dynamics are intensifying, with both established global players and specialized regional manufacturers vying for market share. Strategic partnerships and collaborations are becoming crucial for market penetration and technological advancement. The ongoing digitalization of industries is creating new avenues for growth, particularly in providing integrated compressed air solutions that seamlessly connect with broader industrial automation systems. Opportunities abound in the retrofitting of existing industrial facilities with energy-efficient compressors, as well as in emerging sectors like hydrogen production and carbon capture, utilization, and storage (CCUS), which require specialized compression technologies. The market penetration rate for advanced compressor technologies is expected to rise significantly in the coming years, driven by favorable economic conditions and supportive government policies aimed at enhancing industrial productivity and sustainability.

Dominant Markets & Segments in Europe Compressor Industry

The Manufacturing Sector stands as the dominant end-user segment within the Europe compressor industry, driven by its pervasive need for compressed air across a wide spectrum of applications, from assembly lines to material handling and process control. This sector is experiencing robust growth fueled by reshoring initiatives, advanced manufacturing techniques, and the automotive and aerospace industries’ continuous demand for high-performance pneumatic systems.

The Oil and Gas Industry also represents a significant market, with compressors critical for exploration, extraction, processing, and transportation of hydrocarbons. While subject to global energy market fluctuations, ongoing investments in maintaining and upgrading existing infrastructure, along with a growing focus on liquefied natural gas (LNG) terminals, contribute to sustained demand.

The Power Sector is another key consumer, utilizing compressors in power generation plants for various functions, including instrumentation air, soot blowing, and turbine starting. The transition towards renewable energy sources, such as wind and solar, is also creating new opportunities for specialized compressor applications in grid balancing and energy storage solutions.

Key Growth Drivers by Segment:

- Manufacturing Sector:

- Automation and Robotics: Increasing adoption of automated systems requiring reliable pneumatic power.

- Industry 4.0 Initiatives: Demand for smart, connected compressors that integrate with digital manufacturing ecosystems.

- Reshoring and Localization: Government support and strategic shifts leading to increased domestic manufacturing output.

- Oil and Gas Industry:

- LNG Infrastructure Development: Expansion of liquefaction plants and regasification terminals.

- Operational Efficiency Upgrades: Investments in modern, energy-efficient compressors to reduce operational expenditures.

- Offshore and Onshore Exploration: Continued activity in specific regions driving demand for robust compression solutions.

- Power Sector:

- Renewable Energy Integration: Demand for compressors in energy storage systems (e.g., compressed air energy storage - CAES).

- Plant Modernization: Upgrades to existing thermal power plants to improve efficiency and meet emissions standards.

- District Heating and Cooling: Application of compressors in large-scale thermal management systems.

The Positive Displacement compressor type is a significant segment, encompassing technologies like rotary screw, reciprocating, and scroll compressors, which are widely favored for their efficiency and versatility across many industrial applications. Dynamic compressors, including centrifugal and axial types, are also gaining traction, particularly in large-scale industrial processes and high-flow applications. Geographically, countries with strong industrial bases such as Germany, France, and the United Kingdom are leading the market, with Eastern European nations showing promising growth potential due to increasing industrial investments.

Europe Compressor Industry Product Analysis

The Europe compressor industry is witnessing a surge in product innovation driven by the imperative for energy efficiency and environmental sustainability. Manufacturers are focusing on developing compressors with advanced control systems, such as variable speed drives (VSDs), which dynamically adjust output to match demand, leading to substantial energy savings of up to 30%. New designs are incorporating lighter-weight materials and improved sealing technologies to enhance durability and reduce maintenance requirements. Applications are broadening beyond traditional industrial uses to include specialized solutions for hydrogen compression, carbon capture, and advanced medical equipment. The competitive advantage lies in offering integrated systems that provide not only compression but also air treatment, filtration, and intelligent monitoring, thereby delivering holistic solutions to end-users.

Key Drivers, Barriers & Challenges in Europe Compressor Industry

Key Drivers:

- Energy Efficiency Mandates: Growing pressure from governmental regulations and corporate sustainability goals to reduce energy consumption in industrial processes.

- Industrial Automation and Digitization: The widespread adoption of Industry 4.0 principles necessitates reliable, smart, and connected compressor systems.

- Infrastructure Development and Modernization: Significant investments in upgrading and expanding industrial facilities across various sectors, including manufacturing, energy, and chemicals.

- Technological Advancements: Continuous innovation in compressor design, materials, and control systems leading to more efficient and durable products.

Barriers & Challenges:

- Supply Chain Disruptions: Global supply chain volatility, impacting the availability of raw materials and components, leading to increased lead times and costs.

- Regulatory Complexities: Navigating diverse and evolving environmental regulations across European countries, particularly concerning refrigerants and emissions.

- High Initial Investment Costs: The upfront cost of advanced, energy-efficient compressor systems can be a deterrent for some small and medium-sized enterprises (SMEs).

- Intensified Competition: Growing market saturation and price sensitivity in certain segments, pressuring profit margins. The estimated impact of supply chain issues on market growth is a reduction of XX% in the short term.

Growth Drivers in the Europe Compressor Industry Market

The Europe compressor industry is propelled by a confluence of technological, economic, and regulatory factors. A primary driver is the increasing emphasis on energy efficiency across all industrial sectors, fueled by EU directives and corporate sustainability targets. This is spurring demand for advanced compressor technologies like variable speed drives (VSDs) and oil-free compressors. Furthermore, the ongoing digitalization of manufacturing (Industry 4.0) is creating a need for smart, connected compressors that offer predictive maintenance and real-time performance monitoring. Economic recovery and significant investments in infrastructure development and the expansion of key industries such as pharmaceuticals, food and beverage, and automotive are also contributing to market growth. Policy-driven initiatives promoting decarbonization and the circular economy are creating new opportunities for specialized compressors, particularly in green hydrogen production and carbon capture technologies.

Challenges Impacting Europe Compressor Industry Growth

Despite robust growth prospects, the Europe compressor industry faces several significant challenges. Regulatory complexities, particularly concerning the phase-out of certain refrigerants and increasingly stringent emissions standards, necessitate substantial research and development investment for compliance. Supply chain disruptions, stemming from geopolitical events and logistical bottlenecks, continue to pose a risk to timely delivery of components and finished products, leading to increased lead times and costs. Intense competitive pressure, with a mix of global giants and agile regional players, can lead to price erosion in certain market segments. The high initial capital expenditure associated with acquiring state-of-the-art, energy-efficient compressor systems can be a barrier for some end-users, especially SMEs, despite long-term operational savings. Quantifiable impacts include potential delays in project timelines by up to XX% due to component shortages.

Key Players Shaping the Europe Compressor Industry Market

- Trane Technologies PLC

- Atlas Copco AB

- Baker Hughes Co

- Aerzener Maschinenfabrik GmbH

- Siemens AG

- Burckhardt Compression Holding AG

- Sulzer AG

- General Electric Company

Significant Europe Compressor Industry Industry Milestones

- Nov 2022: Atlas Copco, a Swedish multinational industrial company, acquired Precision Pneumatics Ltd and Wearside Pneumatics Ltd, two compressed air distributors and service providers located in the North of England. Both companies provide compressed air solutions to manufacturing industries, such as general manufacturing, electronics, automotive and automotive supply chain, food and beverage, and metal fabrication. This acquisition strengthens Atlas Copco's service network and market presence in the UK manufacturing sector.

- Oct 2022: Danfoss, the Danish multinational company, announced the intent to acquire compressor manufacturer BOCK GmbH, headquartered in Frickenhausen, Baden-Württemberg, Germany, from NORD Holding GmbH. Nord Holding is involved in developing compressors for the natural refrigerant CO2. This move signals Danfoss's strategic focus on natural refrigerants and expands its portfolio in the climate-friendly compressor market.

Future Outlook for Europe Compressor Industry Market

The future outlook for the Europe compressor industry is overwhelmingly positive, driven by a sustained demand for energy-efficient and sustainable compressed air solutions. Strategic opportunities lie in the growing demand for compressors in emerging sectors such as green hydrogen production, carbon capture, and advanced energy storage systems. The ongoing digitalization of industries will further fuel the adoption of smart compressors with advanced analytics and IoT capabilities, enhancing operational efficiency and reducing downtime. Manufacturers investing in the development of compressors utilizing natural refrigerants and adhering to stringent environmental regulations will be well-positioned for long-term success. Market growth will also be influenced by government incentives for industrial modernization and the adoption of green technologies, creating a favorable environment for innovation and expansion. The market is expected to witness continued consolidation and strategic alliances as companies seek to enhance their technological offerings and market reach.

Europe Compressor Industry Segmentation

-

1. Type

- 1.1. Positive Diplacement

- 1.2. Dynamic

-

2. End User

- 2.1. Oil and Gas Industry

- 2.2. Power Sector

- 2.3. Manufacturing Sector

- 2.4. Chemicals and Petrochemical Industry

- 2.5. Other End Users

Europe Compressor Industry Segmentation By Geography

- 1. Russia

- 2. Germany

- 3. United Kingdom

- 4. Rest of Europe

Europe Compressor Industry Regional Market Share

Geographic Coverage of Europe Compressor Industry

Europe Compressor Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Oil and Gas Industry4.; Rapid Growth in the Industrial Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Fluctuation in Oil and Gas Prices

- 3.4. Market Trends

- 3.4.1. Oil and Gas Industry Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Compressor Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Positive Diplacement

- 5.1.2. Dynamic

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Oil and Gas Industry

- 5.2.2. Power Sector

- 5.2.3. Manufacturing Sector

- 5.2.4. Chemicals and Petrochemical Industry

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.3.2. Germany

- 5.3.3. United Kingdom

- 5.3.4. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Russia Europe Compressor Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Positive Diplacement

- 6.1.2. Dynamic

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Oil and Gas Industry

- 6.2.2. Power Sector

- 6.2.3. Manufacturing Sector

- 6.2.4. Chemicals and Petrochemical Industry

- 6.2.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Germany Europe Compressor Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Positive Diplacement

- 7.1.2. Dynamic

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Oil and Gas Industry

- 7.2.2. Power Sector

- 7.2.3. Manufacturing Sector

- 7.2.4. Chemicals and Petrochemical Industry

- 7.2.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. United Kingdom Europe Compressor Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Positive Diplacement

- 8.1.2. Dynamic

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Oil and Gas Industry

- 8.2.2. Power Sector

- 8.2.3. Manufacturing Sector

- 8.2.4. Chemicals and Petrochemical Industry

- 8.2.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Europe Europe Compressor Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Positive Diplacement

- 9.1.2. Dynamic

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Oil and Gas Industry

- 9.2.2. Power Sector

- 9.2.3. Manufacturing Sector

- 9.2.4. Chemicals and Petrochemical Industry

- 9.2.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Trane Technologies PLC

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Atlas Copco AB

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Baker Hughes Co

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Aerzener Maschinenfabrik GmbH

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Siemens AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Burckhardt Compression Holding AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Sulzer AG*List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 General Electric Company

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Trane Technologies PLC

List of Figures

- Figure 1: Europe Compressor Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Compressor Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Compressor Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Compressor Industry Volume K Units Forecast, by Type 2020 & 2033

- Table 3: Europe Compressor Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Europe Compressor Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 5: Europe Compressor Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe Compressor Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Europe Compressor Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Europe Compressor Industry Volume K Units Forecast, by Type 2020 & 2033

- Table 9: Europe Compressor Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 10: Europe Compressor Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 11: Europe Compressor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Europe Compressor Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 13: Europe Compressor Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Europe Compressor Industry Volume K Units Forecast, by Type 2020 & 2033

- Table 15: Europe Compressor Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 16: Europe Compressor Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 17: Europe Compressor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Europe Compressor Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 19: Europe Compressor Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Europe Compressor Industry Volume K Units Forecast, by Type 2020 & 2033

- Table 21: Europe Compressor Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 22: Europe Compressor Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 23: Europe Compressor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Europe Compressor Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Europe Compressor Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 26: Europe Compressor Industry Volume K Units Forecast, by Type 2020 & 2033

- Table 27: Europe Compressor Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 28: Europe Compressor Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 29: Europe Compressor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Europe Compressor Industry Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Compressor Industry?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the Europe Compressor Industry?

Key companies in the market include Trane Technologies PLC, Atlas Copco AB, Baker Hughes Co, Aerzener Maschinenfabrik GmbH, Siemens AG, Burckhardt Compression Holding AG, Sulzer AG*List Not Exhaustive, General Electric Company.

3. What are the main segments of the Europe Compressor Industry?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.4 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Oil and Gas Industry4.; Rapid Growth in the Industrial Sector.

6. What are the notable trends driving market growth?

Oil and Gas Industry Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Fluctuation in Oil and Gas Prices.

8. Can you provide examples of recent developments in the market?

Nov 2022: Atlas Copco, a Swedish multinational industrial company, acquired Precision Pneumatics Ltd and Wearside Pneumatics Ltd, two compressed air distributors and service providers located in the North of England. Both companies provide compressed air solutions to manufacturing industries, such as general manufacturing, electronics, automotive and automotive supply chain, food and beverage, and metal fabrication.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Compressor Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Compressor Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Compressor Industry?

To stay informed about further developments, trends, and reports in the Europe Compressor Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence