Key Insights

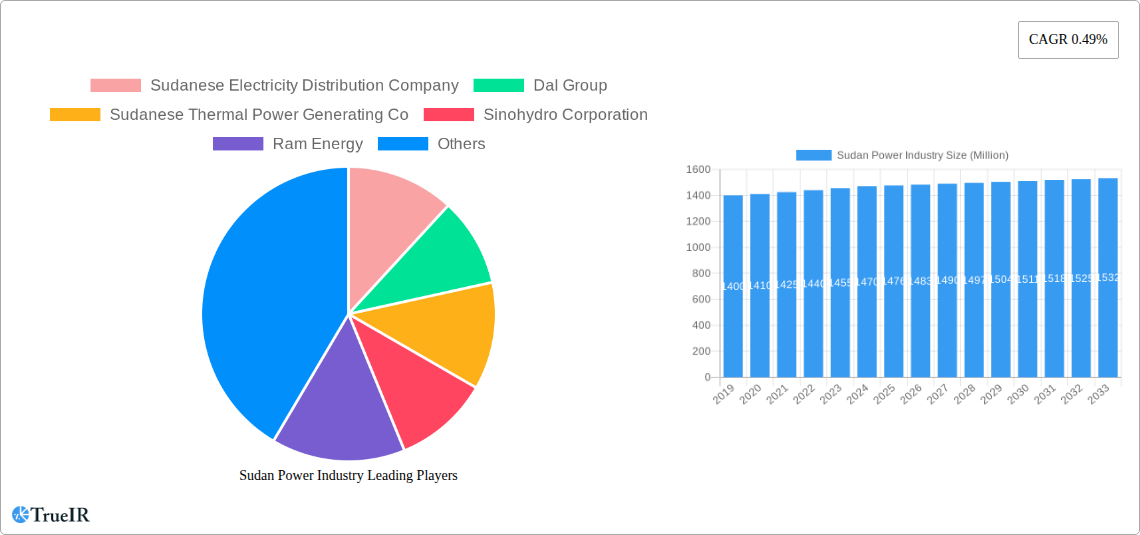

The Sudan Power Industry is projected to achieve a market size of 1.9 million by 2025, with a Compound Annual Growth Rate (CAGR) of 0.49% through 2033. Key growth drivers include expanding electricity access to rural areas and increasing demand from population growth and emerging industries. Investments in renewable energy and hybrid solutions are vital for diversifying the energy mix. Government initiatives focused on infrastructure development and foreign investment, particularly from companies like Sinohydro Corporation and China National Nuclear Corporation, are expected to facilitate expansion. Modernizing existing grids and adopting smart grid technologies will further enhance efficiency and reliability.

Sudan Power Industry Market Size (In Million)

Significant challenges to the sector include economic instability, political uncertainty, and restricted access to finance, which can impede large-scale infrastructure projects. The market size, estimated at 1.9 million in 2025, necessitates substantial capital investment. While domestic consumption is expected to rise with electrification efforts, the import market for advanced technologies and equipment will remain crucial. Export opportunities are currently limited. Price dynamics will be influenced by global energy commodity prices, domestic subsidy policies, and the cost of adopting new technologies. Key industry players such as Sudanese Electricity Distribution Company, Dal Group, and Siemens Energy AG are strategically focused on operational efficiency and partnerships to navigate these market conditions.

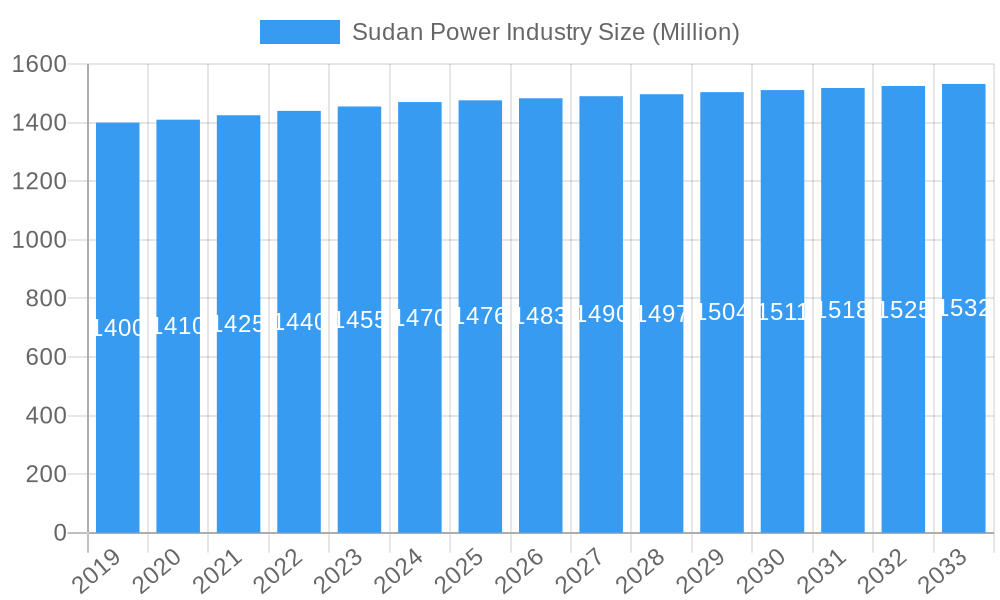

Sudan Power Industry Company Market Share

Sudan Power Industry: Comprehensive Market Analysis & Forecast (2019-2033)

Gain unparalleled insights into the dynamic Sudan power industry, a sector poised for significant transformation. This in-depth report delves into market structures, competitive landscapes, emerging trends, and future opportunities. Analyze key segments including power production, electricity consumption, import/export markets, and price dynamics. Discover the impact of influential players like the Sudanese Electricity Distribution Company, Dal Group, Sinohydro Corporation, Ram Energy, Siemens Energy AG, China National Nuclear Corporation, and Russian State Corporation for Atomic Energy (Rosatom). Understand the strategic importance of initiatives like the Desert to Power and the Sudan-Egypt power grid link, crucial for national energy security and economic growth. This report is essential for investors, policymakers, and industry stakeholders seeking to navigate the evolving Sudanese energy sector.

Sudan Power Industry Market Structure & Competitive Landscape

The Sudan power industry exhibits a moderate to high market concentration, with key players dominating generation and distribution. Innovation drivers are primarily centered on enhancing grid stability, expanding access to electricity, and integrating renewable energy sources. Regulatory impacts are significant, with government policies influencing investment incentives, tariff structures, and the pace of liberalization. Product substitutes are limited in the immediate term, but the long-term potential for alternative energy solutions like distributed solar power presents a growing challenge to traditional grid-based supply. End-user segmentation reveals a strong reliance on industrial and residential consumption, with commercial and agricultural sectors showing promising growth potential. Mergers and acquisitions (M&A) activity has been relatively subdued but is expected to increase as foreign investment seeks opportunities in infrastructure development and energy generation. Historical M&A volumes are in the range of tens of millions of USD, with strategic partnerships forming a significant portion of competitive consolidation. The Sudan power market is characterized by a few large state-owned enterprises alongside an increasing number of private sector participants, creating a complex competitive environment. Understanding these dynamics is crucial for strategic market entry and expansion.

Sudan Power Industry Market Trends & Opportunities

The Sudan power industry is on the cusp of a significant growth trajectory, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period of 2025–2033. This expansion is fueled by a growing demand for electricity driven by population growth, industrial development, and the government's commitment to universal electrification. Market size growth is substantial, with the total market value expected to reach over $5,000 million by 2033. Technological shifts are a critical trend, with a strong emphasis on modernizing the existing infrastructure, integrating smart grid technologies, and exploring renewable energy solutions. The Sudan electricity market is actively seeking to diversify its energy mix beyond traditional thermal and hydro sources. Consumer preferences are evolving, with a growing demand for reliable and affordable electricity, particularly in urban and peri-urban areas. The Sudan energy sector is also seeing an increased appetite for off-grid and mini-grid solutions to reach remote populations. Competitive dynamics are intensifying, with both domestic and international players vying for market share in generation, transmission, and distribution. Opportunities abound for investment in new power generation projects, particularly in renewable energy, as well as in upgrading and expanding the transmission and distribution networks. The Sudan power generation market is ripe for innovation, with advancements in solar photovoltaic (PV) and wind energy technologies offering cost-effective and sustainable solutions. Furthermore, the increasing adoption of energy-efficient technologies presents a market for specialized equipment and services. The Sudan power infrastructure is a key area for development, with significant potential for improvement to meet the rising demand and ensure grid stability. The Sudan power export potential is also being explored, particularly through enhanced regional interconnections.

Dominant Markets & Segments in Sudan Power Industry

The Sudan power industry is characterized by several dominant markets and segments, each with unique growth drivers.

Production Analysis:

- Dominant Segment: Thermal power generation currently holds a significant share in the overall Sudan power production. This is primarily due to existing infrastructure and the availability of fuel sources, though environmental concerns are driving a shift.

- Growth Drivers: Investment in new thermal power plants, particularly those utilizing cleaner technologies, and the expansion of existing facilities are key drivers. The government's focus on energy security also underpins continued investment in this segment.

- Emerging Segments: Hydropower and renewable energy sources, especially solar, are gaining traction. The vast solar potential of Sudan is a significant opportunity.

Consumption Analysis:

- Dominant Segment: The residential sector constitutes the largest share of electricity consumption, reflecting the growing population and increasing access to electricity in households.

- Growth Drivers: Urbanization, improved living standards, and government initiatives to expand electricity access are fueling residential demand. The Sudan electricity market is seeing a steady rise in appliance ownership.

- Emerging Segments: The industrial and commercial sectors represent substantial growth potential, driven by economic development and the establishment of new businesses. Agricultural demand for irrigation is also a key growth area.

Import Market Analysis (Value & Volume):

- Dominant Segment: Imports are crucial for supplying power generation equipment and specialized components that are not locally manufactured. This includes turbines, transformers, and advanced control systems.

- Growth Drivers: The need to upgrade aging infrastructure, build new generation capacity, and expand the transmission and distribution networks are driving import volumes and value. The Sudan power import market is highly dependent on foreign technology and expertise.

- Future Outlook: As Sudan seeks to diversify its energy sources, imports of components for renewable energy projects, such as solar panels and wind turbines, are expected to rise significantly.

Export Market Analysis (Value & Volume):

- Dominant Segment: Currently, Sudan's power export market is nascent but holds substantial future potential, particularly with the planned enhancement of regional grid interconnections.

- Growth Drivers: The strategic location of Sudan and its potential to generate surplus power from new projects could lead to significant export opportunities to neighboring countries. The Sudan-Egypt power grid link is a prime example of this developing trend.

- Market Dominance: The potential for dominance lies in providing electricity to countries with significant energy deficits, fostering regional energy integration and economic cooperation.

Price Trend Analysis:

- Dominant Factor: Fuel costs for thermal power generation and the cost of importing new technologies are primary determinants of electricity prices.

- Growth Drivers: Government subsidies play a significant role in moderating electricity prices for consumers. However, rising operational costs and the need for infrastructure investment are creating upward price pressures.

- Market Impact: Price volatility can impact investment decisions and consumer affordability. A stable and predictable pricing regime is essential for attracting long-term investment in the Sudan power sector.

Sudan Power Industry Product Analysis

The Sudan power industry is characterized by a focus on improving the reliability and efficiency of its electricity generation, transmission, and distribution products. Innovations are driven by the need to address the country's growing energy demand and to enhance grid stability. Key advancements include the deployment of more efficient thermal power plant technologies and the increasing integration of renewable energy solutions, particularly solar photovoltaic (PV) systems. Competitive advantages are being gained through investments in smart grid technologies that enable better load management and reduced transmission losses. The Sudan power market is also seeing the introduction of more robust and durable electrical equipment designed to withstand local environmental conditions. Applications range from large-scale grid-connected power plants to decentralized off-grid solutions, catering to diverse end-user needs.

Key Drivers, Barriers & Challenges in Sudan Power Industry

Key Drivers, Barriers & Challenges in Sudan Power Industry

The Sudan power industry is propelled by several key drivers. Government commitment to energy access and economic development fuels investment in power generation and infrastructure upgrades. The immense renewable energy potential, particularly solar, offers a sustainable and cost-effective pathway for expansion. Furthermore, increasing regional energy interconnections, like the Sudan-Egypt power grid link, open avenues for increased trade and grid stability. These factors collectively drive growth and create opportunities for enhanced energy security.

The industry faces significant barriers and challenges. Political instability and security concerns can deter foreign investment and disrupt project timelines. Infrastructure deficits, particularly in transmission and distribution networks, lead to significant power losses and limit the reach of electricity. Limited access to finance for large-scale projects and the need for advanced technical expertise are persistent restraints. Regulatory complexities and the absence of a fully liberalized market can also impede private sector participation and innovation. Supply chain issues for critical components and the maintenance of existing aging equipment further compound these challenges.

Growth Drivers in the Sudan Power Industry Market

The Sudan power industry market is experiencing robust growth driven by a confluence of technological, economic, and regulatory factors. Government initiatives focused on expanding electricity access to underserved populations are a primary catalyst, stimulating investment in both generation and distribution infrastructure. The significant untapped renewable energy potential, especially solar and wind, presents a compelling opportunity for diversification and cost reduction. Economic growth and industrial development further amplify the demand for reliable and affordable electricity. Furthermore, strategic regional interconnections, such as the planned Sudan-Egypt power grid link, are set to enhance grid stability and facilitate power trade, creating a more integrated and resilient energy landscape.

Challenges Impacting Sudan Power Industry Growth

Several challenges significantly impact the Sudan power industry growth. Ongoing political and economic instability can deter essential foreign direct investment and disrupt project implementation. The existing power infrastructure, particularly the transmission and distribution networks, requires substantial upgrades to reduce inefficiencies and expand reach, posing considerable capital expenditure hurdles. Limited access to financing for large-scale power projects and the dependence on imported technology and expertise remain critical constraints. Furthermore, regulatory complexities and the need for a streamlined investment framework can slow down project approvals and market liberalization. Supply chain disruptions for critical equipment and the ongoing maintenance of aging generation assets also present ongoing operational challenges.

Key Players Shaping the Sudan Power Industry Market

- Sudanese Electricity Distribution Company

- Dal Group

- Sudanese Thermal Power Generating Co

- Sinohydro Corporation

- Ram Energy

- China National Nuclear Corporation

- Russian State Corporation for Atomic Energy (Rosatom)

- Siemens Energy AG

Significant Sudan Power Industry Industry Milestones

- April 2022: The African Development Fund approved a USD 5.5 million technical assistance grant to kick-start the roll-out of the flagship Desert to Power initiative in the Eastern Sahel countries of Djibouti, Eritrea, Ethiopia, and Sudan.

- April 2022: The Egyptian embassy in Khartoum announced that Sudan would raise the capacity of its power grid link with Egypt from 70 MW to 300 MW and later to 1,000 MW.

Future Outlook for Sudan Power Industry Market

The future outlook for the Sudan power industry is exceptionally promising, driven by a clear strategic vision and significant untapped potential. The Desert to Power initiative and the expansion of the Sudan-Egypt power grid link are critical growth catalysts, signaling a commitment to regional energy integration and increased electricity access. Substantial investment is anticipated in renewable energy sources, particularly solar power, offering a sustainable and cost-effective solution to meet rising demand. Modernization of the existing power infrastructure, including transmission and distribution networks, will further enhance grid reliability and reduce losses. This period will likely see increased foreign direct investment, driven by the sector's strategic importance and the potential for high returns. The Sudan electricity market is poised for transformation, moving towards a more diversified, efficient, and accessible energy future.

Sudan Power Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Sudan Power Industry Segmentation By Geography

- 1. Sudan

Sudan Power Industry Regional Market Share

Geographic Coverage of Sudan Power Industry

Sudan Power Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.49% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Renewable Energy Installations 4.; Energy Infrastructure Development

- 3.3. Market Restrains

- 3.3.1. 4.; Political and Economic Instability

- 3.4. Market Trends

- 3.4.1. Hydropower Generating Source to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sudan Power Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Sudan

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sudanese Electricity Distribution Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dal Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sudanese Thermal Power Generating Co

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sinohydro Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ram Energy

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 China National Nuclear Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Russian State Corporation for Atomic Energy (Rosatom)*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Siemens Energy AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Sudanese Electricity Distribution Company

List of Figures

- Figure 1: Sudan Power Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Sudan Power Industry Share (%) by Company 2025

List of Tables

- Table 1: Sudan Power Industry Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 2: Sudan Power Industry Volume gigawatt Forecast, by Production Analysis 2020 & 2033

- Table 3: Sudan Power Industry Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 4: Sudan Power Industry Volume gigawatt Forecast, by Consumption Analysis 2020 & 2033

- Table 5: Sudan Power Industry Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: Sudan Power Industry Volume gigawatt Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: Sudan Power Industry Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: Sudan Power Industry Volume gigawatt Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: Sudan Power Industry Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: Sudan Power Industry Volume gigawatt Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: Sudan Power Industry Revenue million Forecast, by Region 2020 & 2033

- Table 12: Sudan Power Industry Volume gigawatt Forecast, by Region 2020 & 2033

- Table 13: Sudan Power Industry Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 14: Sudan Power Industry Volume gigawatt Forecast, by Production Analysis 2020 & 2033

- Table 15: Sudan Power Industry Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 16: Sudan Power Industry Volume gigawatt Forecast, by Consumption Analysis 2020 & 2033

- Table 17: Sudan Power Industry Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: Sudan Power Industry Volume gigawatt Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Sudan Power Industry Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Sudan Power Industry Volume gigawatt Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: Sudan Power Industry Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: Sudan Power Industry Volume gigawatt Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: Sudan Power Industry Revenue million Forecast, by Country 2020 & 2033

- Table 24: Sudan Power Industry Volume gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sudan Power Industry?

The projected CAGR is approximately 0.49%.

2. Which companies are prominent players in the Sudan Power Industry?

Key companies in the market include Sudanese Electricity Distribution Company, Dal Group, Sudanese Thermal Power Generating Co, Sinohydro Corporation, Ram Energy, China National Nuclear Corporation, Russian State Corporation for Atomic Energy (Rosatom)*List Not Exhaustive, Siemens Energy AG.

3. What are the main segments of the Sudan Power Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.9 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Renewable Energy Installations 4.; Energy Infrastructure Development.

6. What are the notable trends driving market growth?

Hydropower Generating Source to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Political and Economic Instability.

8. Can you provide examples of recent developments in the market?

April 2022: The African Development Fund approved a USD 5.5 million technical assistance grant to kick-start the roll-out of the flagship Desert to Power initiative in the Eastern Sahel countries of Djibouti, Eritrea, Ethiopia, and Sudan.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sudan Power Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sudan Power Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sudan Power Industry?

To stay informed about further developments, trends, and reports in the Sudan Power Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence