Key Insights

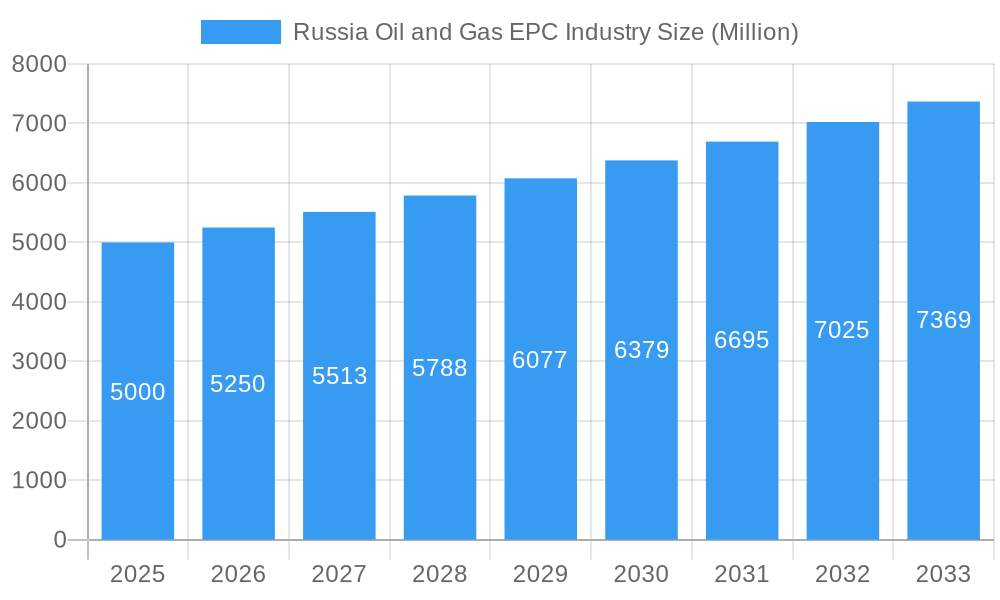

The Russia Oil and Gas EPC (Engineering, Procurement, and Construction) industry, while facing significant geopolitical headwinds, presents a complex and evolving market landscape. The period from 2019 to 2024 witnessed a period of fluctuating growth, influenced by international sanctions, fluctuating oil prices, and internal economic factors. While precise figures are unavailable publicly, we can reasonably infer a moderate growth trajectory, likely impacted by reduced foreign investment and a shift towards domestically-focused projects. The base year of 2025, therefore, reflects a market size adjusted to these challenges. Looking ahead to 2033, the forecast period suggests continued growth, albeit at a potentially slower CAGR than observed in periods of less geopolitical volatility. This projected growth is underpinned by the continued need for infrastructure maintenance and upgrades within Russia's existing oil and gas infrastructure, as well as potential new projects driven by domestic demand and exploration. However, sanctions and limited access to international technology and financing remain significant constraints, potentially impacting the pace of expansion.

Russia Oil and Gas EPC Industry Market Size (In Billion)

The industry’s future trajectory hinges on several key factors. The ongoing impact of sanctions and their effectiveness in curbing Russian oil and gas production will play a crucial role. The government's investment in domestic technology and its success in mitigating technological dependencies will also determine growth. Furthermore, fluctuations in global energy prices and the overall global economic climate will influence investor confidence and project viability. The industry's ability to adapt to these challenges and secure funding will be critical in determining its ultimate success. Diversification into renewable energy sources, though currently limited, might also shape the sector's long-term prospects. A thorough understanding of these dynamic factors is crucial for any strategic assessment of the Russian Oil and Gas EPC market.

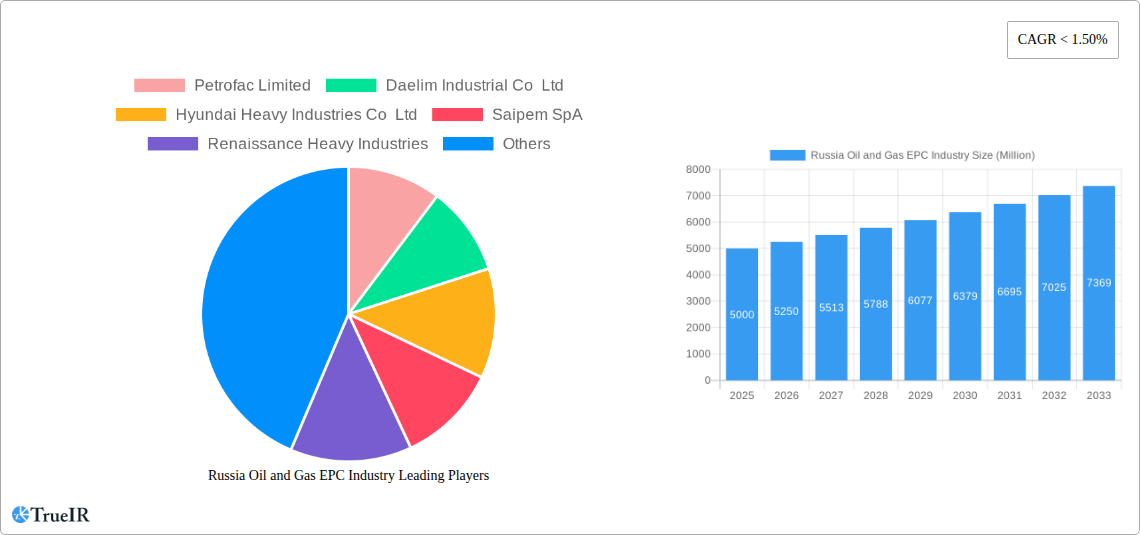

Russia Oil and Gas EPC Industry Company Market Share

Russia Oil and Gas EPC Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a deep dive into the Russia Oil and Gas Engineering, Procurement, and Construction (EPC) industry, offering invaluable insights for investors, industry professionals, and strategic planners. With a focus on the period 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report leverages extensive data analysis and expert insights to illuminate the market's current state, future trajectory, and key players. The report incorporates analysis across upstream, midstream, and downstream sectors, examining oil and gas production, transportation, and refining activities within Russia and the broader Middle East and Asia-Pacific region. Discover crucial market trends, competitive landscapes, major projects, and growth opportunities shaping this vital industry.

Russia Oil and Gas EPC Industry Market Structure & Competitive Landscape

The Russian Oil and Gas EPC market exhibits a moderately concentrated structure, with a handful of international and domestic giants commanding significant market share. While precise concentration ratios are challenging to ascertain due to data limitations, analysis suggests a Herfindahl-Hirschman Index (HHI) value of approximately xx, indicating a moderately concentrated market. Innovation in this sector is primarily driven by the need for enhanced efficiency, cost reduction, and environmental sustainability. Stringent government regulations, particularly concerning safety and environmental protection, significantly impact industry operations. The market witnesses continuous technological advancements, including the adoption of digital technologies, automation, and advanced materials, alongside the use of product substitutes like improved pipeline technologies and alternative energy sources. End-user segmentation includes major oil and gas producers, independent operators, and government entities. Mergers and Acquisitions (M&A) activity has been relatively moderate in recent years, with a total M&A volume of approximately xx Million USD during the period 2019-2024, reflecting a cautious approach influenced by geopolitical factors and fluctuating oil prices.

- Market Concentration: Moderately concentrated, with a HHI of approximately xx.

- Innovation Drivers: Efficiency gains, cost reduction, environmental sustainability.

- Regulatory Impacts: Stringent safety and environmental regulations.

- Product Substitutes: Advanced pipeline technologies, alternative energy sources.

- End-User Segmentation: Major oil and gas producers, independent operators, government entities.

- M&A Trends: Moderate activity (xx Million USD in 2019-2024), influenced by geopolitical and economic factors.

Russia Oil and Gas EPC Industry Market Trends & Opportunities

The Russian Oil and Gas EPC market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by increasing investments in oil and gas infrastructure development, government initiatives promoting energy security, and growing domestic demand. Technological advancements, particularly in digitalization and automation, are enhancing efficiency and optimizing operational processes. This is leading to increased adoption of advanced technologies with a market penetration rate reaching xx% by 2033. The market is also witnessing a shift in consumer preferences towards environmentally friendly and sustainable solutions, pushing EPC companies to adopt greener technologies. Competitive dynamics are intense, with both domestic and international players vying for market share. Strategic partnerships and collaborations are increasingly common, as companies seek to leverage complementary expertise and resources. Government policies supporting the development of the domestic oil and gas sector create substantial opportunities for growth. However, fluctuating oil prices and geopolitical uncertainties continue to present challenges. The market size is projected to reach xx Million USD by 2033.

Dominant Markets & Segments in Russia Oil and Gas EPC Industry

The dominant segment within the Russia Oil and Gas EPC industry is the upstream sector, specifically focused on oil and gas production within Russia. This dominance is fueled by Russia's vast oil and gas reserves and the ongoing need for efficient exploration and extraction techniques.

- Key Growth Drivers (Upstream, Russia):

- Abundant oil and gas reserves.

- Government investment in exploration and production.

- Technological advancements enhancing extraction efficiency.

- Growing domestic demand for energy.

The Midstream and Downstream sectors also present significant, albeit smaller, segments. The Middle East and Asia-Pacific regions represent important geographical markets for Russian EPC firms seeking international expansion. However, geopolitical factors and international sanctions can impact this market's growth potential.

Russia Oil and Gas EPC Industry Product Analysis

Technological advancements are transforming the product landscape, with a focus on enhanced efficiency, reduced emissions, and improved safety features. Innovations in materials, automation, and digitalization are delivering more efficient and environmentally friendly solutions. EPC companies are focusing on developing modular and pre-fabricated solutions for faster project delivery and cost reduction. The ability to integrate complex systems and offer comprehensive project management services presents a significant competitive advantage.

Key Drivers, Barriers & Challenges in Russia Oil and Gas EPC Industry

Key Drivers:

- Technological advancements (automation, digitalization).

- Government investment in oil and gas infrastructure.

- Increasing domestic demand for energy.

- Opportunities in international markets (Middle East, Asia-Pacific).

Challenges:

- Geopolitical uncertainties and sanctions.

- Fluctuating oil prices impacting project viability.

- Supply chain disruptions, particularly for specialized equipment.

- Regulatory complexities and bureaucratic hurdles. These can add xx% to project costs, for example.

Growth Drivers in the Russia Oil and Gas EPC Industry Market

Growth is fueled by consistent government investments, technological improvements driving efficiency, and rising domestic demand for energy resources. International collaborations and partnerships also contribute, although sanctions and geopolitical factors represent significant headwinds.

Challenges Impacting Russia Oil and Gas EPC Industry Growth

Sanctions, fluctuating oil prices, and logistical complexities related to international partnerships hinder growth. Regulatory uncertainties and competition from both international and domestic firms also constrain market expansion.

Key Players Shaping the Russia Oil and Gas EPC Industry Market

- Petrofac Limited

- Daelim Industrial Co Ltd

- Hyundai Heavy Industries Co Ltd

- Saipem SpA

- Renaissance Heavy Industries

- McDermott International Inc

- VELESSTROY

- Assystem SA

- Linde plc

- TechnipFMC PLC

Significant Russia Oil and Gas EPC Industry Industry Milestones

- January 2022: DL E&C secured a USD 1.33 Billion contract for the Russian Baltic Complex Project, encompassing design, equipment procurement, and construction of a major polymer plant.

- January 2022: Maire Tecnimont S.p.A. and MT Russia LLC signed a USD 1.24 Billion EPC contract with Rosneft for the VGO Hydrocracking Complex at Ryazan Refining Company.

Future Outlook for Russia Oil and Gas EPC Industry Market

The Russian Oil and Gas EPC industry faces a complex future, balancing immense resource potential with geopolitical challenges and international sanctions. Strategic partnerships, technological innovation, and government support will be crucial in navigating these uncertainties and capitalizing on long-term growth opportunities. Despite short-term headwinds, the long-term outlook remains positive given Russia's vast reserves and ongoing investment in energy infrastructure.

Russia Oil and Gas EPC Industry Segmentation

-

1. Sector

- 1.1. Upstream

- 1.2. Midstream

- 1.3. Downstream

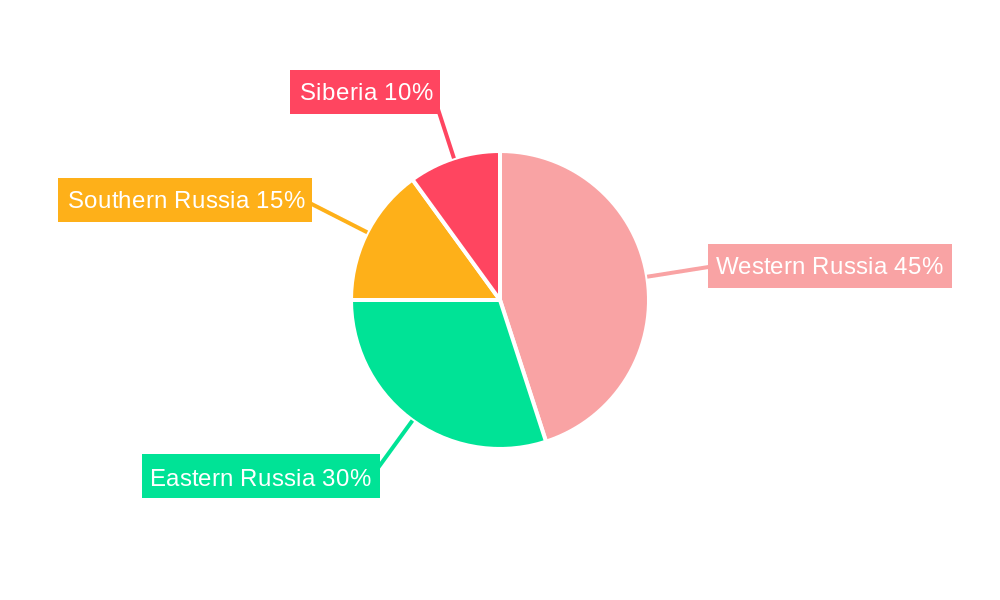

Russia Oil and Gas EPC Industry Segmentation By Geography

- 1. Russia

Russia Oil and Gas EPC Industry Regional Market Share

Geographic Coverage of Russia Oil and Gas EPC Industry

Russia Oil and Gas EPC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of < 1.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Increasing Demand for Crude Oil and Natural Gas4.; Growing Emphasis on Safe

- 3.2.2 Economic

- 3.2.3 and Reliable Connectivity for Oil and Gas Exploration

- 3.3. Market Restrains

- 3.3.1 4.; Technical Challenges Like Construction

- 3.3.2 Deep-Water Challenges

- 3.3.3 and High Construction Costs

- 3.4. Market Trends

- 3.4.1. Midstream Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Upstream

- 5.1.2. Midstream

- 5.1.3. Downstream

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Western Russia Russia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2020-2032

- 7. Eastern Russia Russia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2020-2032

- 8. Southern Russia Russia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2020-2032

- 9. Northern Russia Russia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2020-2032

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Petrofac Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Daelim Industrial Co Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Hyundai Heavy Industries Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Saipem SpA

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Renaissance Heavy Industries

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 McDermott International Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 VELESSTROY

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Assystem SA

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Linde plc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 TechnipFMC PLC

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Petrofac Limited

List of Figures

- Figure 1: Russia Oil and Gas EPC Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Russia Oil and Gas EPC Industry Share (%) by Company 2025

List of Tables

- Table 1: Russia Oil and Gas EPC Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Russia Oil and Gas EPC Industry Revenue Million Forecast, by Sector 2020 & 2033

- Table 3: Russia Oil and Gas EPC Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Russia Oil and Gas EPC Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Western Russia Russia Oil and Gas EPC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Eastern Russia Russia Oil and Gas EPC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Southern Russia Russia Oil and Gas EPC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Northern Russia Russia Oil and Gas EPC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Russia Oil and Gas EPC Industry Revenue Million Forecast, by Sector 2020 & 2033

- Table 10: Russia Oil and Gas EPC Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Oil and Gas EPC Industry?

The projected CAGR is approximately < 1.50%.

2. Which companies are prominent players in the Russia Oil and Gas EPC Industry?

Key companies in the market include Petrofac Limited, Daelim Industrial Co Ltd, Hyundai Heavy Industries Co Ltd, Saipem SpA, Renaissance Heavy Industries, McDermott International Inc, VELESSTROY, Assystem SA, Linde plc, TechnipFMC PLC.

3. What are the main segments of the Russia Oil and Gas EPC Industry?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Crude Oil and Natural Gas4.; Growing Emphasis on Safe. Economic. and Reliable Connectivity for Oil and Gas Exploration.

6. What are the notable trends driving market growth?

Midstream Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Technical Challenges Like Construction. Deep-Water Challenges. and High Construction Costs.

8. Can you provide examples of recent developments in the market?

January 2022: an agreement was signed by DL E&C to participate in the Russian Baltic Complex Project. The contract is worth USD 1.33 billion, and DL E&C will be responsible for the project's design and procurement of all equipment. Among the objectives of the project is to construct the largest polymer plant in the world on a single-line basis in Ust-Luga, 110 kilometers southwest of St. Petersburg. Upon completion, the plant will be able to produce 3 million tons of polyethylene, 120,000 tons of butane, and 50,000 tons of hexane each year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Oil and Gas EPC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Oil and Gas EPC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Oil and Gas EPC Industry?

To stay informed about further developments, trends, and reports in the Russia Oil and Gas EPC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence