Key Insights

The European Renewable Aviation Fuel (RAF) market is projected for significant expansion, with an estimated market size of 240.5 million by 2033, driven by a robust Compound Annual Growth Rate (CAGR) of 43.2%. This growth is propelled by stringent emission reduction mandates, escalating corporate sustainability targets within the aviation sector, and a focus on energy security. Innovations in RAF production, notably HEFA and Fischer-Tropsch technologies, enhance efficiency and economic viability. Growing consumer demand for lower-carbon air travel further supports market expansion.

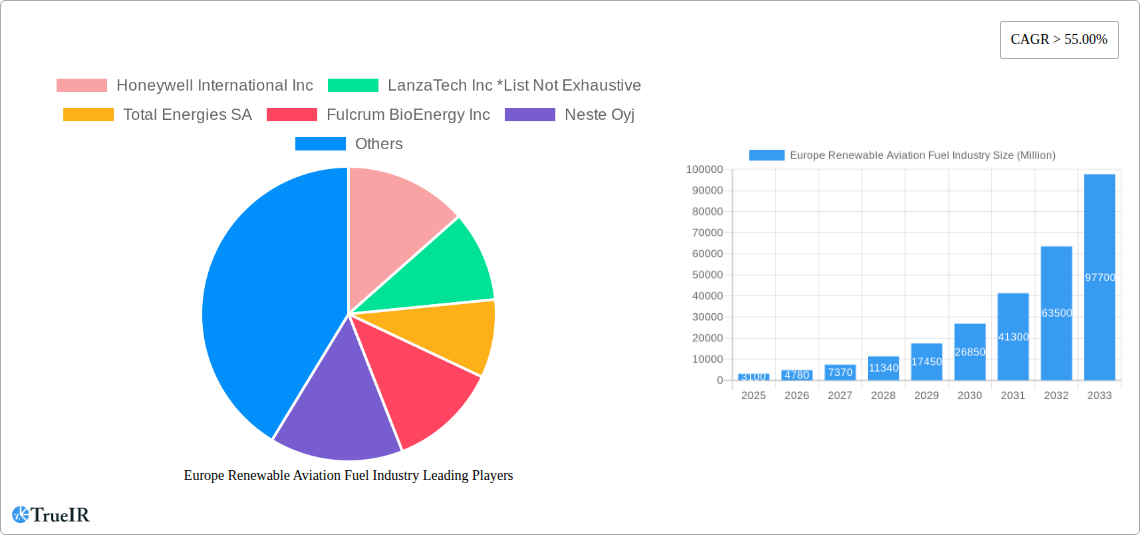

Europe Renewable Aviation Fuel Industry Market Size (In Million)

Key market trends include widespread adoption of sustainable aviation fuel (SAF) by major European airlines, substantial R&D investments in next-generation biofuels, and the development of integrated supply chains. Germany, France, and the UK are at the forefront of SAF implementation and infrastructure development. Challenges include the initial high cost of RAF production, feedstock availability, and the necessity for sustained policy support and international collaboration to achieve economies of scale. Decarbonizing aviation remains a strategic imperative, positioning Europe as a key hub for RAF innovation and investment.

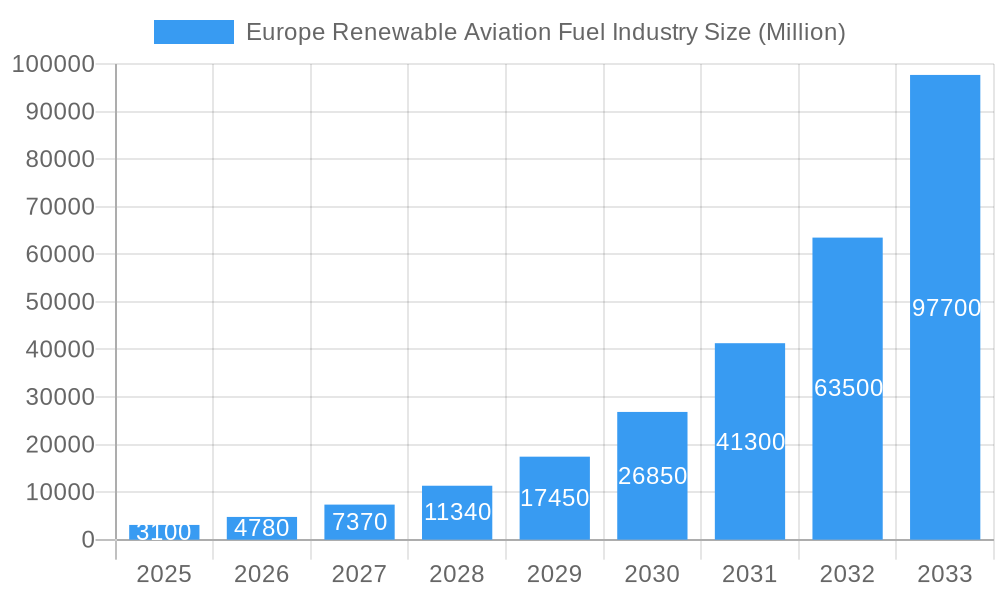

Europe Renewable Aviation Fuel Industry Company Market Share

This report provides an in-depth, SEO-optimized analysis of the Europe Renewable Aviation Fuel (SAF) Industry from 2019 to 2033, with a base year of 2023. It examines market structure, trends, key segments, product advancements, drivers, challenges, and the competitive environment. Utilizing high-volume keywords such as "sustainable aviation fuel Europe," "renewable jet fuel market," "biofuels aviation industry," and "decarbonization aviation Europe," this report delivers critical insights for industry stakeholders, investors, and policymakers navigating this dynamic sector.

Europe Renewable Aviation Fuel Industry Market Structure & Competitive Landscape

The Europe Renewable Aviation Fuel Industry is characterized by a moderately concentrated market, driven by significant capital investments and increasing regulatory mandates for decarbonizing aviation. Innovation is a key differentiator, with companies actively developing and scaling advanced SAF production technologies to meet growing demand. The regulatory environment, particularly the EU's ambitious Green Deal and ReFuelEU Aviation initiative, is a primary driver, pushing for higher SAF blending mandates and incentivizing sustainable feedstock utilization. While direct product substitutes for jet fuel are limited in the short to medium term, advancements in SAF production technologies are crucial for maintaining competitiveness. The end-user segmentation is primarily driven by the commercial aviation sector, which accounts for the largest share, followed by the defense sector and niche industrial applications. Mergers and acquisitions (M&A) activity is on the rise as larger players seek to secure feedstock access, expand production capacity, and consolidate their market positions. For instance, recent M&A volumes have seen significant investment, reflecting a strategic consolidation trend. The Herfindahl-Hirschman Index (HHI) for the market is estimated at approximately 0.25, indicating moderate concentration. Key M&A transactions in the historical period are estimated to be valued at over 500 Million.

Europe Renewable Aviation Fuel Industry Market Trends & Opportunities

The Europe Renewable Aviation Fuel Industry is poised for substantial growth, driven by a confluence of environmental imperatives, technological advancements, and supportive policy frameworks. Market size is projected to expand significantly, with estimated revenues reaching over 5,000 Million by 2025, and forecast to exceed 15,000 Million by 2033. This impressive growth trajectory is underpinned by a compound annual growth rate (CAGR) of approximately 15% during the forecast period. Technological shifts are a dominant trend, with a move towards more diverse and sustainable feedstock sources, including agricultural waste, municipal solid waste, and advanced biofuels from algae and synthetic processes. Consumer preferences, particularly within the corporate travel segment and among environmentally conscious travelers, are increasingly influencing airline purchasing decisions, creating a demand pull for SAF. Competitive dynamics are intensifying, with established oil and gas majors, dedicated biofuel producers, and innovative startups vying for market share. Strategic partnerships and joint ventures are becoming commonplace, as companies collaborate to de-risk investments, accelerate technology deployment, and secure long-term offtake agreements. The market penetration rate for SAF is currently estimated at around 2% but is expected to surge to over 10% by 2030, driven by policy mandates and increasing airline commitments. The development of advanced HEFA (Hydroprocessed Esters and Fatty Acids) and Fischer-Tropsch (FT) technologies, alongside novel synthetic pathways, are critical for enhancing the efficiency and scalability of SAF production, thereby reducing costs and improving the overall sustainability profile of aviation fuels. Opportunities abound for companies that can secure reliable and sustainable feedstock supply chains, develop cost-effective production processes, and navigate the evolving regulatory landscape.

Dominant Markets & Segments in Europe Renewable Aviation Fuel Industry

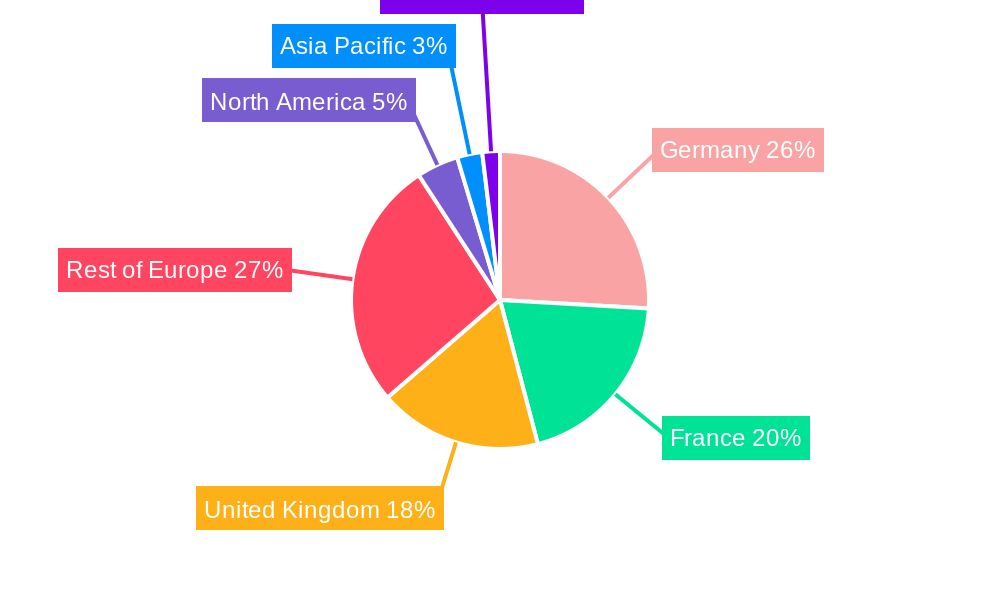

The European renewable aviation fuel market is experiencing rapid expansion, with several regions and segments demonstrating significant leadership and growth potential. Geographically, Northern Europe, particularly countries like Sweden and Norway, alongside Western European nations such as France and Germany, are at the forefront of SAF adoption and production initiatives. This dominance is largely attributed to strong governmental support, ambitious climate targets, and a well-established biofuel industry infrastructure.

- Key Growth Drivers in Dominant Regions:

- Proactive Regulatory Frameworks: Stringent biofuel mandates and incentives for renewable energy sources are creating a favorable market environment.

- Established Infrastructure: Existing biofuel production facilities and a robust logistics network facilitate the scaling of SAF production.

- Airline Commitments: Major European airlines are actively pursuing SAF procurement agreements and investing in SAF development projects.

- Public and Corporate Demand: Growing awareness of climate change and corporate sustainability goals are driving demand for lower-emission travel options.

Technology Segment Dominance:

The Hydroprocessed Esters and Fatty Acids (HEFA) technology segment currently dominates the market due to its maturity and established feedstock availability, primarily derived from waste oils and fats. However, significant growth is anticipated in Fischer-Tropsch (FT) technology, which offers greater feedstock flexibility, including biomass and waste streams, and Synthesi technologies, which hold promise for future large-scale production from various carbon sources.

- Market Dynamics within Technology Segments:

- HEFA: Benefits from existing infrastructure and a relatively lower initial capital investment. Its primary advantage lies in its ability to utilize readily available waste materials, contributing to a circular economy.

- Fischer-Tropsch (FT): Offers a pathway for producing a wide range of synthetic fuels from diverse feedstocks, including syngas derived from biomass gasification. Its versatility makes it a key technology for future SAF production, capable of utilizing non-food-based resources.

- Synthesi: Represents the cutting edge of SAF innovation, encompassing various pathways like electrofuels and advanced gasification processes. While currently more capital-intensive and in earlier stages of commercialization, these technologies are crucial for long-term decarbonization goals, offering pathways to produce SAF from CO2 and renewable electricity.

Application Segment Dominance:

The Commercial aviation segment is the largest consumer of SAF, driven by airlines' commitments to reduce their carbon footprint and comply with regulatory requirements. The Defense sector is also an emerging and significant market, with governments investing in SAF to reduce military operational emissions and enhance energy security.

- Market Dynamics within Application Segments:

- Commercial Aviation: Airlines are actively seeking long-term offtake agreements for SAF to meet blending mandates and achieve their net-zero targets. The growing demand from this sector is a primary market shaper.

- Defense Aviation: Military forces worldwide are exploring SAF as a strategic imperative for operational resilience and environmental responsibility. Investments in domestic SAF production and procurement are expected to accelerate.

Europe Renewable Aviation Fuel Industry Product Analysis

The Europe Renewable Aviation Fuel Industry is witnessing significant product innovation focused on enhancing sustainability, cost-effectiveness, and feedstock diversification. Key advancements include the refinement of Hydroprocessed Esters and Fatty Acids (HEFA) processes for greater efficiency and the development of advanced Fischer-Tropsch (FT) technologies capable of utilizing a wider array of waste and biomass feedstocks. Novel synthetic fuel pathways, including electrofuels produced using renewable electricity and captured carbon dioxide, represent the frontier of SAF development, promising a fully circular and low-carbon fuel solution. These innovations offer distinct competitive advantages, such as reduced lifecycle greenhouse gas emissions, improved fuel performance, and the potential for domestic production, thereby bolstering energy security and reducing reliance on fossil fuels. The focus remains on scaling these technologies to achieve cost parity with conventional jet fuel and meeting stringent aviation fuel specifications.

Key Drivers, Barriers & Challenges in Europe Renewable Aviation Fuel Industry

Key Drivers:

The Europe Renewable Aviation Fuel Industry is propelled by a powerful combination of factors. Technologically, advancements in HEFA, FT, and synthetic fuel pathways are enabling more efficient and scalable production from diverse, sustainable feedstocks. Economically, the increasing price volatility of fossil fuels and the growing investment in green technologies are making SAF more competitive. Policy-driven factors are paramount, with the EU's stringent SAF blending mandates, tax incentives, and carbon pricing mechanisms significantly driving demand and investment. Examples include the ReFuelEU Aviation initiative, which mandates escalating SAF usage quotas.

Barriers & Challenges:

Significant challenges, however, impede broader SAF adoption. Supply chain issues, particularly the availability of sufficient and certified sustainable feedstocks at competitive prices, remain a critical restraint, with current feedstock availability estimated at only a fraction of the projected demand. Regulatory complexities, including varying certification processes across regions and the need for consistent policy support, can create uncertainty. Competitive pressures arise from the high capital costs associated with building new SAF production facilities and the ongoing reliance on conventional jet fuel infrastructure. The estimated cost premium for SAF over conventional jet fuel can range from 50% to 200%, posing a significant hurdle for widespread adoption without continued policy support and technological cost reductions.

Growth Drivers in the Europe Renewable Aviation Fuel Industry Market

The Europe Renewable Aviation Fuel Industry is experiencing robust growth driven by several key factors. Technologically, the maturation and scaling of HEFA, Fischer-Tropsch (FT), and novel synthetic fuel production technologies are making SAF more accessible and cost-effective. Economically, increasing investor confidence in green energy solutions and the desire to hedge against fossil fuel price volatility are channeling significant capital into the sector. Crucially, policy-driven initiatives, such as the EU's ambitious ReFuelEU Aviation targets and national renewable energy directives, are establishing firm demand signals and providing essential financial incentives for SAF producers and offtakers. The growing corporate and public demand for sustainable travel options is also creating a significant market pull, further accelerating the adoption of renewable aviation fuels.

Challenges Impacting Europe Renewable Aviation Fuel Industry Growth

Despite its promising trajectory, the Europe Renewable Aviation Fuel Industry faces considerable challenges. A primary restraint is the supply chain bottleneck, with the availability of sufficient, certified, and sustainably sourced feedstocks at competitive prices remaining a significant hurdle. Regulatory complexities, including differing certification standards and the need for consistent, long-term policy frameworks, can introduce uncertainty and slow down investment. High capital expenditure required for establishing new SAF production facilities and the cost premium compared to conventional jet fuel are also substantial barriers. Competitive pressures from established fossil fuel markets and the need for significant infrastructure investment for blending and distribution further complicate the growth landscape.

Key Players Shaping the Europe Renewable Aviation Fuel Industry Market

- Honeywell International Inc

- LanzaTech Inc

- Total Energies SA

- Fulcrum BioEnergy Inc

- Neste Oyj

- Swedish Biofuels AB

- Gevo Inc

Significant Europe Renewable Aviation Fuel Industry Industry Milestones

- December 2022: TotalEnergies signed a memorandum of understanding to deliver more than one million cubic meters/800,000 tonnes of sustainable aviation fuel to Air France-KLM Group airlines over the ten years from 2023 to 2033. This agreement signifies a major offtake commitment and a substantial step towards scaling SAF deployment in commercial aviation.

- January 2022: Cepsa signed an agreement with Iberia and Iberia Express for the development and large-scale production of sustainable aviation fuel. The agreement contemplates SAF production from waste, recycled oils, and second-generation plant-based bio feedstock, highlighting a focus on circular economy principles and diverse feedstock utilization.

Future Outlook for Europe Renewable Aviation Fuel Industry Market

The future outlook for the Europe Renewable Aviation Fuel Industry is exceptionally positive, marked by continued expansion and innovation. Strategic opportunities lie in the further development and commercialization of advanced SAF technologies, such as Power-to-Liquids (PtL) and advanced biofuels from non-food feedstocks, which will diversify supply and improve sustainability credentials. The market potential is immense, driven by increasingly stringent regulatory mandates, growing airline commitments to net-zero emissions, and rising consumer awareness. Continued investment in R&D, coupled with supportive policy frameworks and robust partnerships across the value chain, will be crucial for overcoming current challenges and unlocking the full potential of renewable aviation fuels to decarbonize the aviation sector. The estimated market size is projected to surpass 25,000 Million by 2033.

Europe Renewable Aviation Fuel Industry Segmentation

-

1. Technology

- 1.1. Fischer-Tropsch (FT)

- 1.2. Hydroprocessed Esters and Fatty Acids (HEFA)

- 1.3. Synthesi

-

2. Application

- 2.1. Commercial

- 2.2. Defense

Europe Renewable Aviation Fuel Industry Segmentation By Geography

- 1. Germany

- 2. France

- 3. United Kingdom

- 4. Rest of Europe

Europe Renewable Aviation Fuel Industry Regional Market Share

Geographic Coverage of Europe Renewable Aviation Fuel Industry

Europe Renewable Aviation Fuel Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 43.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Solar Panel Costs4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Upfront Cost

- 3.4. Market Trends

- 3.4.1. Commercial Sector to be the Largest Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Renewable Aviation Fuel Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Fischer-Tropsch (FT)

- 5.1.2. Hydroprocessed Esters and Fatty Acids (HEFA)

- 5.1.3. Synthesi

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial

- 5.2.2. Defense

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. France

- 5.3.3. United Kingdom

- 5.3.4. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Germany Europe Renewable Aviation Fuel Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Fischer-Tropsch (FT)

- 6.1.2. Hydroprocessed Esters and Fatty Acids (HEFA)

- 6.1.3. Synthesi

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Commercial

- 6.2.2. Defense

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. France Europe Renewable Aviation Fuel Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Fischer-Tropsch (FT)

- 7.1.2. Hydroprocessed Esters and Fatty Acids (HEFA)

- 7.1.3. Synthesi

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Commercial

- 7.2.2. Defense

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. United Kingdom Europe Renewable Aviation Fuel Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Fischer-Tropsch (FT)

- 8.1.2. Hydroprocessed Esters and Fatty Acids (HEFA)

- 8.1.3. Synthesi

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Commercial

- 8.2.2. Defense

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Rest of Europe Europe Renewable Aviation Fuel Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Fischer-Tropsch (FT)

- 9.1.2. Hydroprocessed Esters and Fatty Acids (HEFA)

- 9.1.3. Synthesi

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Commercial

- 9.2.2. Defense

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Honeywell International Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 LanzaTech Inc *List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Total Energies SA

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Fulcrum BioEnergy Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Neste Oyj

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Swedish Biofuels AB

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Gevo Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 Honeywell International Inc

List of Figures

- Figure 1: Europe Renewable Aviation Fuel Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Renewable Aviation Fuel Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Renewable Aviation Fuel Industry Revenue million Forecast, by Technology 2020 & 2033

- Table 2: Europe Renewable Aviation Fuel Industry Volume K Tons Forecast, by Technology 2020 & 2033

- Table 3: Europe Renewable Aviation Fuel Industry Revenue million Forecast, by Application 2020 & 2033

- Table 4: Europe Renewable Aviation Fuel Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: Europe Renewable Aviation Fuel Industry Revenue million Forecast, by Region 2020 & 2033

- Table 6: Europe Renewable Aviation Fuel Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Europe Renewable Aviation Fuel Industry Revenue million Forecast, by Technology 2020 & 2033

- Table 8: Europe Renewable Aviation Fuel Industry Volume K Tons Forecast, by Technology 2020 & 2033

- Table 9: Europe Renewable Aviation Fuel Industry Revenue million Forecast, by Application 2020 & 2033

- Table 10: Europe Renewable Aviation Fuel Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 11: Europe Renewable Aviation Fuel Industry Revenue million Forecast, by Country 2020 & 2033

- Table 12: Europe Renewable Aviation Fuel Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: Europe Renewable Aviation Fuel Industry Revenue million Forecast, by Technology 2020 & 2033

- Table 14: Europe Renewable Aviation Fuel Industry Volume K Tons Forecast, by Technology 2020 & 2033

- Table 15: Europe Renewable Aviation Fuel Industry Revenue million Forecast, by Application 2020 & 2033

- Table 16: Europe Renewable Aviation Fuel Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 17: Europe Renewable Aviation Fuel Industry Revenue million Forecast, by Country 2020 & 2033

- Table 18: Europe Renewable Aviation Fuel Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 19: Europe Renewable Aviation Fuel Industry Revenue million Forecast, by Technology 2020 & 2033

- Table 20: Europe Renewable Aviation Fuel Industry Volume K Tons Forecast, by Technology 2020 & 2033

- Table 21: Europe Renewable Aviation Fuel Industry Revenue million Forecast, by Application 2020 & 2033

- Table 22: Europe Renewable Aviation Fuel Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 23: Europe Renewable Aviation Fuel Industry Revenue million Forecast, by Country 2020 & 2033

- Table 24: Europe Renewable Aviation Fuel Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Europe Renewable Aviation Fuel Industry Revenue million Forecast, by Technology 2020 & 2033

- Table 26: Europe Renewable Aviation Fuel Industry Volume K Tons Forecast, by Technology 2020 & 2033

- Table 27: Europe Renewable Aviation Fuel Industry Revenue million Forecast, by Application 2020 & 2033

- Table 28: Europe Renewable Aviation Fuel Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 29: Europe Renewable Aviation Fuel Industry Revenue million Forecast, by Country 2020 & 2033

- Table 30: Europe Renewable Aviation Fuel Industry Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Renewable Aviation Fuel Industry?

The projected CAGR is approximately 43.2%.

2. Which companies are prominent players in the Europe Renewable Aviation Fuel Industry?

Key companies in the market include Honeywell International Inc, LanzaTech Inc *List Not Exhaustive, Total Energies SA, Fulcrum BioEnergy Inc, Neste Oyj, Swedish Biofuels AB, Gevo Inc.

3. What are the main segments of the Europe Renewable Aviation Fuel Industry?

The market segments include Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 240.5 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Solar Panel Costs4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Commercial Sector to be the Largest Segment.

7. Are there any restraints impacting market growth?

4.; High Upfront Cost.

8. Can you provide examples of recent developments in the market?

December 2022: TotalEnergies signed a memorandum of understanding to deliver more than one million cubic meters/800,000 tonnes of sustainable aviation fuel to Air France-KLM Group airlines over the ten years from 2023 to 2033.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Renewable Aviation Fuel Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Renewable Aviation Fuel Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Renewable Aviation Fuel Industry?

To stay informed about further developments, trends, and reports in the Europe Renewable Aviation Fuel Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence