Key Insights

The Middle East & Africa (MEA) Concentrated Solar Power (CSP) market is projected for substantial growth, driven by abundant solar resources, rising energy needs, and government mandates for energy diversification. Significant investment in renewable infrastructure and CSP's inherent thermal energy storage capabilities bolster its appeal for reliable, sustainable power generation. The market is expected to reach $590.28 million by 2024, with a CAGR of 34.7%.

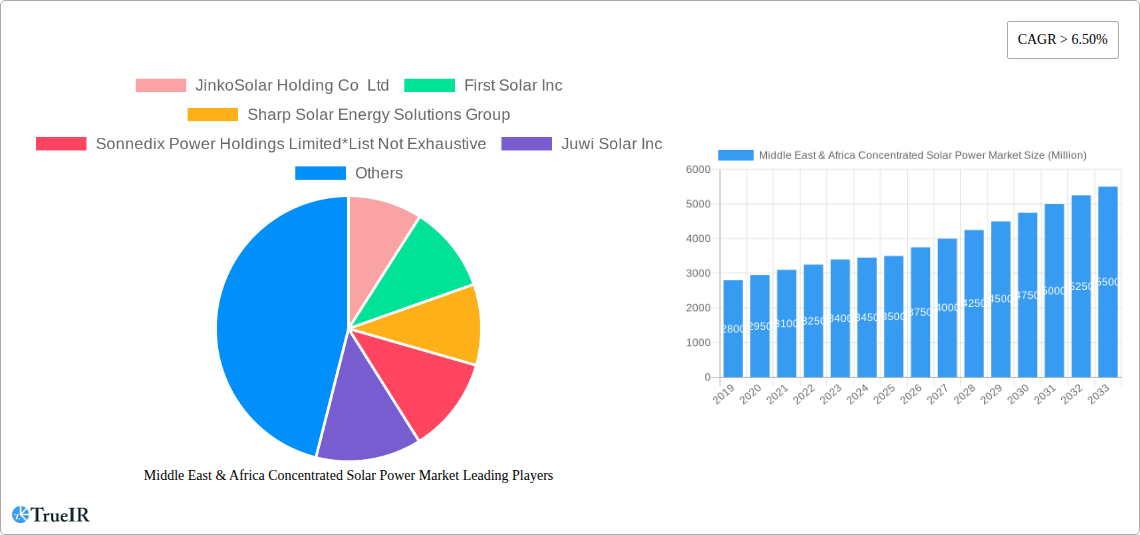

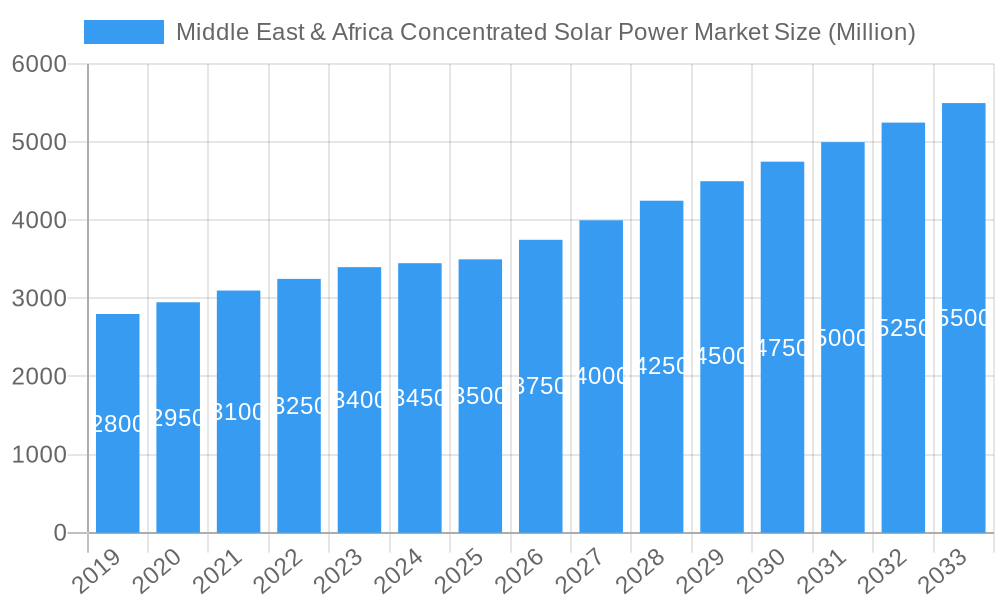

Middle East & Africa Concentrated Solar Power Market Market Size (In Million)

Key trends shaping the MEA CSP market include the development of large-scale projects led by nations like Saudi Arabia and the UAE. Technological advancements in heliostats, receivers, and thermal storage are enhancing efficiency and reducing costs. Hybrid CSP systems are also gaining traction for improved grid stability. Despite challenges like high initial investment and land acquisition, the strategic imperative for clean energy and reduced fuel import dependency will sustain market expansion and innovation.

Middle East & Africa Concentrated Solar Power Market Company Market Share

This report provides in-depth analysis of the MEA CSP market from 2019 to 2033, with a base year of 2024. It offers critical insights into market segments, key drivers, barriers, and opportunities, empowering stakeholders to navigate this evolving renewable energy landscape.

Middle East & Africa Concentrated Solar Power Market Market Structure & Competitive Landscape

The Middle East & Africa Concentrated Solar Power (CSP) market exhibits a moderately concentrated structure, characterized by a mix of established global players and emerging regional developers. Innovation drivers are primarily fueled by the urgent need for clean energy solutions and energy independence across the region, pushing for advancements in thermal energy storage technologies and system efficiency. Regulatory impacts are significant, with government mandates and renewable energy targets acting as crucial catalysts. Product substitutes, such as photovoltaic (PV) solar and wind energy, present competitive pressures, yet CSP's unique advantage in dispatchable power generation and grid stability remains a key differentiator. End-user segmentation is increasingly diverse, encompassing utility-scale power generation, industrial process heat applications, and off-grid solutions. Mergers and acquisitions (M&A) trends indicate strategic consolidation and partnerships aimed at expanding market reach and technological capabilities. For instance, recent years have seen acquisitions focusing on integrating storage solutions and developing hybrid CSP-PV projects. The overall market concentration is estimated at approximately 60%, with the top five players holding a significant share. M&A volumes have been steadily increasing, averaging 2-3 significant deals annually over the past five years, reflecting growing investor confidence.

Middle East & Africa Concentrated Solar Power Market Market Trends & Opportunities

The Middle East & Africa Concentrated Solar Power (CSP) market is poised for significant expansion, driven by a confluence of factors that are reshaping the energy landscape across both regions. The market size for CSP in MEA is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period of 2025-2033, growing from an estimated XX Million in 2025 to XX Million by 2033. This impressive growth trajectory is underpinned by an increasing global demand for sustainable energy sources and the inherent advantages of CSP technology, particularly its ability to provide dispatchable power and energy storage capabilities. Technological shifts are central to this evolution, with ongoing advancements in parabolic trough collectors, molten salt storage systems, and heliostat field optimization leading to enhanced efficiency and reduced Levelized Cost of Electricity (LCOE). The adoption of hybrid CSP-PV-storage solutions is emerging as a key trend, offering a more comprehensive approach to renewable energy generation and grid integration. Consumer preferences are shifting towards cleaner energy options, driven by heightened environmental awareness and a desire for energy security. Governments in the MEA region are actively promoting renewable energy adoption through supportive policies, incentives, and ambitious national energy strategies, creating a fertile ground for CSP investments. The competitive dynamics are intensifying, with both international and local players vying for market share. Opportunities lie in developing utility-scale power plants, exploring industrial heat applications for sectors like desalination and oil & gas, and providing off-grid solutions for remote communities. The increasing focus on green hydrogen production powered by CSP is another significant emerging opportunity. Furthermore, the region's abundant solar irradiation makes it an ideal location for CSP deployment. The trend towards larger-scale projects, coupled with advancements in thermal energy storage, is enabling CSP to compete more effectively with conventional power sources and intermittent renewables. The market penetration of CSP, while still in its nascent stages compared to PV, is expected to grow substantially as project pipelines materialize and technological maturity increases.

Dominant Markets & Segments in Middle East & Africa Concentrated Solar Power Market

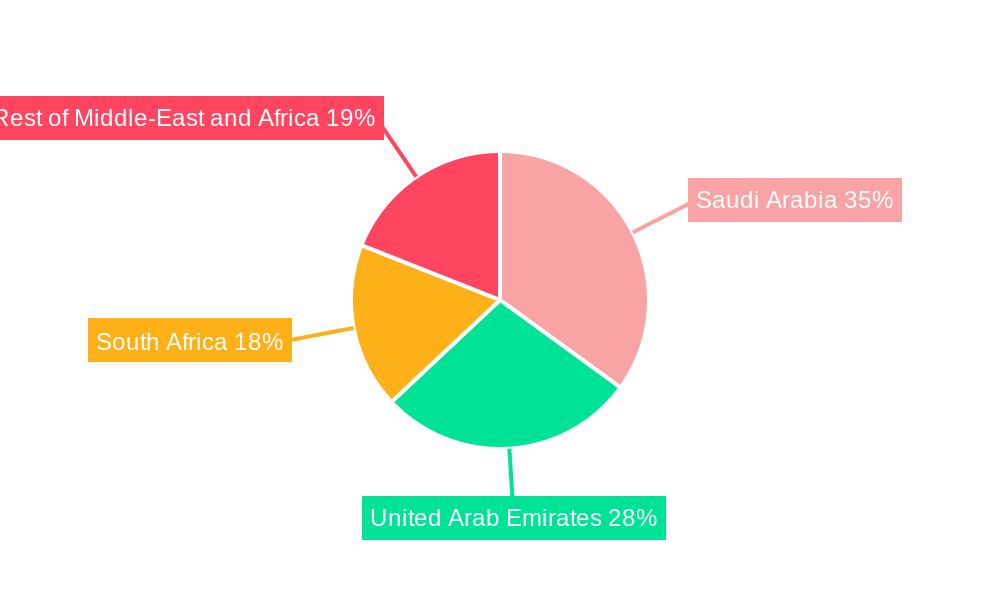

Saudi Arabia is emerging as the dominant market within the Middle East & Africa Concentrated Solar Power (CSP) sector, driven by ambitious renewable energy targets and substantial government investment in infrastructure development. The Kingdom's Vision 2030 plan explicitly outlines a significant role for solar energy, including CSP, in diversifying its energy mix and reducing reliance on fossil fuels. This strategic imperative, coupled with favorable solar irradiation levels and a commitment to technological advancement, positions Saudi Arabia at the forefront of CSP deployment. Key growth drivers in this segment include:

- Large-Scale Project Development: Saudi Arabia has a robust pipeline of large-scale CSP projects, attracting significant foreign direct investment and fostering local expertise. Projects like the planned Noor Energy 1, a massive concentrated solar power project in Dubai which Saudi Arabia is a key investor in, highlights the scale of ambition.

- Government Support and Policy Frameworks: The Saudi government has established clear policies and incentives to encourage CSP development, including favorable power purchase agreements (PPAs) and regulatory support.

- Technological Innovation and Localization: There is a growing emphasis on adopting and localizing cutting-edge CSP technologies, including advanced thermal energy storage solutions, to enhance grid stability and reliability.

- Energy Security and Diversification: CSP contributes directly to Saudi Arabia's strategic goal of enhancing energy security and diversifying its economy away from oil dependence.

The United Arab Emirates (UAE) follows closely, propelled by its commitment to clean energy and its role as a hub for innovation. The UAE's strong focus on sustainable development and its hosting of major international events like COP28 underscore its dedication to renewable energy. Key growth drivers in the UAE include:

- Strategic Renewable Energy Goals: Ambitious targets for renewable energy integration, particularly in the Emirate of Dubai and Abu Dhabi, are driving CSP adoption.

- Innovation in Hybrid Systems: The UAE is a leader in developing and implementing hybrid CSP-PV-storage systems, showcasing the potential for integrated renewable energy solutions.

- Attracting International Investment: The UAE's stable economic environment and proactive approach to attracting foreign investment make it an attractive destination for CSP projects.

South Africa represents another significant market, characterized by its established renewable energy programs and the imperative to address its growing energy demand and historical energy crises. Key growth drivers in South Africa include:

- Renewable Energy Independent Power Producer Procurement Programme (REIPPPP): This program has been instrumental in driving renewable energy projects, including CSP, by providing a structured procurement framework.

- Grid Stability and Load Shedding Mitigation: CSP's ability to provide dispatchable power is crucial for addressing South Africa's load shedding challenges and ensuring grid stability.

- Job Creation and Economic Development: CSP projects contribute to local job creation and economic development, aligning with national development agendas.

The Rest of Middle-East and Africa segment encompasses a diverse range of countries with varying levels of CSP market maturity. This segment presents significant untapped potential, particularly in North African countries with abundant solar resources and growing energy demands. Key growth drivers in this broader segment include:

- Emerging Renewable Energy Policies: An increasing number of countries in this region are introducing supportive policies and renewable energy targets, creating new opportunities for CSP.

- Off-Grid and Mini-Grid Applications: CSP's potential for decentralized energy solutions offers a viable pathway to electrify remote communities and improve energy access.

- Desalination and Industrial Process Heat: The application of CSP for industrial purposes, such as powering desalination plants and providing process heat for industries, is a growing area of interest.

- International Development Initiatives: Support from international development agencies and financial institutions is playing a crucial role in unlocking CSP potential in these markets.

Middle East & Africa Concentrated Solar Power Market Product Analysis

The Middle East & Africa Concentrated Solar Power (CSP) market is defined by continuous innovation in thermal energy storage (TES) and collector technologies. Parabolic trough systems remain prevalent, enhanced by advancements in molten salt heat transfer fluids and improved reflector coatings, boosting efficiency and reducing operational costs. Heliostat field technologies are also seeing significant development, enabling higher temperature operation and greater energy capture. The integration of TES, particularly molten salt storage, is a critical product feature, allowing CSP plants to store solar energy and dispatch electricity on demand, overcoming the intermittency challenges of solar power. Emerging product innovations focus on hybrid CSP-PV systems and CSP for industrial process heat applications, broadening the market applicability of this technology. These advancements are driven by the competitive advantage of providing dispatchable, baseload renewable power, a crucial need in the MEA region's evolving energy matrix.

Key Drivers, Barriers & Challenges in Middle East & Africa Concentrated Solar Power Market

Key Drivers: The Middle East & Africa Concentrated Solar Power (CSP) market is propelled by several key drivers. Technologically, advancements in thermal energy storage (TES) are making CSP more competitive by enabling dispatchable power generation, mirroring baseload capabilities. Economically, falling LCOE for CSP technologies, coupled with the high solar irradiation across the region, makes CSP an attractive investment. Policy-driven factors, such as ambitious renewable energy targets set by governments in countries like Saudi Arabia and the UAE, and supportive regulatory frameworks, including feed-in tariffs and PPAs, are creating a conducive environment for growth. The increasing demand for energy security and diversification of energy sources away from fossil fuels further bolsters CSP adoption.

Key Barriers & Challenges: Despite the strong drivers, significant barriers and challenges impact CSP growth. High upfront capital costs associated with CSP plants, particularly those with extensive TES capabilities, remain a hurdle, although these costs are declining. Regulatory complexities and permitting processes can cause project delays, and intermittency of solar resources (though mitigated by TES) still poses some integration challenges. Supply chain issues, particularly for specialized components, can affect project timelines and costs. Competitive pressures from cheaper photovoltaic (PV) solar technology and existing fossil fuel infrastructure also present challenges. Furthermore, a lack of skilled labor and local expertise for the installation and maintenance of complex CSP systems can hinder large-scale deployment.

Growth Drivers in the Middle East & Africa Concentrated Solar Power Market Market

The Middle East & Africa Concentrated Solar Power (CSP) market is experiencing robust growth driven by significant technological advancements, particularly in energy storage solutions that enable dispatchable power generation, crucial for grid stability. Economic factors, including the decreasing Levelized Cost of Electricity (LCOE) for CSP and the region's abundant solar resources, make it an increasingly viable investment. Policy support from governments through ambitious renewable energy targets and the creation of favorable regulatory frameworks and incentives are paramount. Moreover, the growing imperative for energy security and diversification from fossil fuels is a strong catalyst.

Challenges Impacting Middle East & Africa Concentrated Solar Power Market Growth

Challenges impacting Middle East & Africa Concentrated Solar Power (CSP) market growth include the substantial upfront capital investment required for CSP projects, which can be a barrier despite declining costs. Complex regulatory landscapes and lengthy permitting processes in some countries can lead to project delays. Supply chain vulnerabilities for specialized components and a shortage of skilled labor and local expertise for installation and maintenance also pose significant restraints. Furthermore, the competitive pricing of photovoltaic (PV) solar technology presents a constant challenge, requiring CSP to highlight its unique value proposition in dispatchability and grid services.

Key Players Shaping the Middle East & Africa Concentrated Solar Power Market Market

- JinkoSolar Holding Co Ltd

- First Solar Inc

- Sharp Solar Energy Solutions Group

- Sonnedix Power Holdings Limited

- Juwi Solar Inc

- Wuxi Suntech Power Co Ltd

- Canadian Solar Inc

- JA Solar Holdings Co Ltd

- Trina Solar Limited

Significant Middle East & Africa Concentrated Solar Power Market Industry Milestones

- December 2022: Emerge signed a strategic partnership with Al Dahra to develop a rooftop solar project at Al Dahra Food Industry at Khalifa Industrial Zone Facility Abu Dhabi (KIZAD). Under the agreement, Emerge will provide a full turnkey solution for the 1.2-Megawatt peak (MWp) project, including the design, procurement, construction, and operation and maintenance of the plant. The project is scheduled to be operational in 2023.

- March 2022: Maersk Kanoo UAE, an integrator of container logistics, inaugurated its first integrated logistics center with rooftop solar panels in Dubai. The facility is expected to get solar panels on its rooftop to cater to entire electricity requirements for facility operations. Each year, 434 MWh of clean energy is anticipated to be produced, and carbon emission worth more than 1,700 tons is expected to be reduced over ten years. These projects are signs of developments in distributed solar power generation.

Future Outlook for Middle East & Africa Concentrated Solar Power Market Market

The future outlook for the Middle East & Africa Concentrated Solar Power (CSP) market is exceptionally promising, fueled by ongoing technological innovations, particularly in advanced thermal energy storage systems, which are crucial for providing dispatchable and reliable power. Governments across the region are increasingly prioritizing renewable energy integration to achieve energy independence and meet climate commitments, leading to supportive policies and attractive investment climates. Strategic opportunities lie in the development of larger-scale utility projects, the expansion of industrial applications such as desalination and green hydrogen production, and the provision of off-grid solutions for underserved communities. The inherent advantage of CSP in providing grid stability and ancillary services positions it favorably against intermittent renewable sources, ensuring sustained market growth and a significant contribution to the region's clean energy transition.

Middle East & Africa Concentrated Solar Power Market Segmentation

-

1. Geography

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. South Africa

- 1.4. Rest of Middle-East and Africa

Middle East & Africa Concentrated Solar Power Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. South Africa

- 4. Rest of Middle East and Africa

Middle East & Africa Concentrated Solar Power Market Regional Market Share

Geographic Coverage of Middle East & Africa Concentrated Solar Power Market

Middle East & Africa Concentrated Solar Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 34.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Offshore Wind Power Projects4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adopting of Alternative Clean Energy Sources (Ex

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Clean Electricity to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East & Africa Concentrated Solar Power Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 5.1.1. Saudi Arabia

- 5.1.2. United Arab Emirates

- 5.1.3. South Africa

- 5.1.4. Rest of Middle-East and Africa

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.2.2. United Arab Emirates

- 5.2.3. South Africa

- 5.2.4. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 6. Saudi Arabia Middle East & Africa Concentrated Solar Power Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 6.1.1. Saudi Arabia

- 6.1.2. United Arab Emirates

- 6.1.3. South Africa

- 6.1.4. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 7. United Arab Emirates Middle East & Africa Concentrated Solar Power Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 7.1.1. Saudi Arabia

- 7.1.2. United Arab Emirates

- 7.1.3. South Africa

- 7.1.4. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 8. South Africa Middle East & Africa Concentrated Solar Power Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 8.1.1. Saudi Arabia

- 8.1.2. United Arab Emirates

- 8.1.3. South Africa

- 8.1.4. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 9. Rest of Middle East and Africa Middle East & Africa Concentrated Solar Power Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 9.1.1. Saudi Arabia

- 9.1.2. United Arab Emirates

- 9.1.3. South Africa

- 9.1.4. Rest of Middle-East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 JinkoSolar Holding Co Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 First Solar Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Sharp Solar Energy Solutions Group

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Sonnedix Power Holdings Limited*List Not Exhaustive

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Juwi Solar Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Wuxi Suntech Power Co Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Canadian Solar Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 JA Solar Holdings Co Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Trina Solar Limited

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 JinkoSolar Holding Co Ltd

List of Figures

- Figure 1: Middle East & Africa Concentrated Solar Power Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Middle East & Africa Concentrated Solar Power Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East & Africa Concentrated Solar Power Market Revenue million Forecast, by Geography 2020 & 2033

- Table 2: Middle East & Africa Concentrated Solar Power Market Revenue million Forecast, by Region 2020 & 2033

- Table 3: Middle East & Africa Concentrated Solar Power Market Revenue million Forecast, by Geography 2020 & 2033

- Table 4: Middle East & Africa Concentrated Solar Power Market Revenue million Forecast, by Country 2020 & 2033

- Table 5: Middle East & Africa Concentrated Solar Power Market Revenue million Forecast, by Geography 2020 & 2033

- Table 6: Middle East & Africa Concentrated Solar Power Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: Middle East & Africa Concentrated Solar Power Market Revenue million Forecast, by Geography 2020 & 2033

- Table 8: Middle East & Africa Concentrated Solar Power Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: Middle East & Africa Concentrated Solar Power Market Revenue million Forecast, by Geography 2020 & 2033

- Table 10: Middle East & Africa Concentrated Solar Power Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East & Africa Concentrated Solar Power Market?

The projected CAGR is approximately 34.7%.

2. Which companies are prominent players in the Middle East & Africa Concentrated Solar Power Market?

Key companies in the market include JinkoSolar Holding Co Ltd, First Solar Inc, Sharp Solar Energy Solutions Group, Sonnedix Power Holdings Limited*List Not Exhaustive, Juwi Solar Inc, Wuxi Suntech Power Co Ltd, Canadian Solar Inc, JA Solar Holdings Co Ltd, Trina Solar Limited.

3. What are the main segments of the Middle East & Africa Concentrated Solar Power Market?

The market segments include Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 590.28 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Offshore Wind Power Projects4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Increasing Demand for Clean Electricity to Drive the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adopting of Alternative Clean Energy Sources (Ex: Solar. Hydro).

8. Can you provide examples of recent developments in the market?

December 202: Emerge signed a strategic partnership with Al Dahra to develop a rooftop solar project at Al Dahra Food Industry at Khalifa Industrial Zone Facility Abu Dhabi (KIZAD). Under the agreement, Emerge will provide a full turnkey solution for the 1.2-Megawatt peak (MWp) project, including the design, procurement, construction, and operation and maintenance of the plant. The project is scheduled to be operational in 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East & Africa Concentrated Solar Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East & Africa Concentrated Solar Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East & Africa Concentrated Solar Power Market?

To stay informed about further developments, trends, and reports in the Middle East & Africa Concentrated Solar Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence