Key Insights

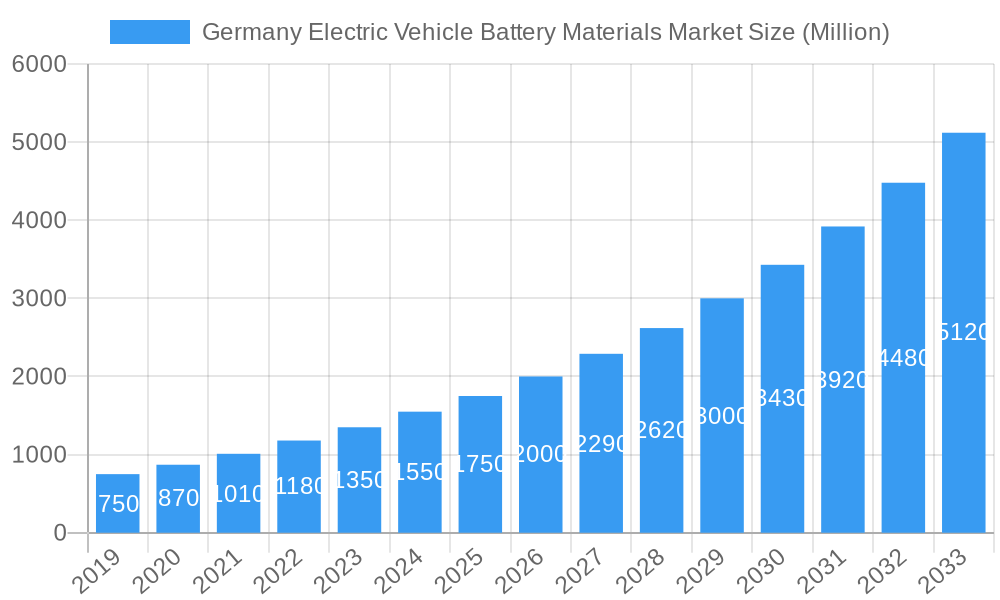

The German electric vehicle (EV) battery materials market is poised for significant expansion, driven by a robust CAGR of 14.30%. With a current market size of approximately $1.36 billion (value unit: Million), this sector is projected to witness substantial growth throughout the study period of 2019-2033. The primary catalyst for this surge is Germany's unwavering commitment to decarbonization and its leading position in the European automotive industry. Government incentives, stringent emissions regulations, and increasing consumer adoption of EVs are fueling demand for advanced battery components. The market is segmented by battery type, with Lithium-ion batteries dominating due to their superior energy density and performance, catering to the evolving needs of the EV sector. The Lead-Acid battery segment, while historically significant, is gradually yielding ground to newer technologies. The "Others" category for battery types likely encompasses emerging chemistries and solid-state technologies, hinting at future innovation.

Germany Electric Vehicle Battery Materials Market Market Size (In Million)

Further segmentation by material reveals a dynamic interplay of cathode, anode, electrolyte, and separator materials. Demand for high-performance cathode materials, such as nickel-manganese-cobalt (NMC) and lithium-iron-phosphate (LFP), is expected to be particularly strong, alongside advancements in anode materials like graphite and silicon. Electrolyte development, crucial for battery safety and lifespan, and innovative separator technologies are also key areas of investment and growth. Key players like BASF SE, Umicore SA, and Mitsubishi Chemical Group Corporation are at the forefront, investing heavily in research and development to secure their market share and capitalize on the burgeoning demand for sustainable and efficient EV battery solutions. Despite the immense growth potential, challenges such as raw material sourcing, cost fluctuations, and the need for advanced recycling infrastructure will require strategic management by market participants to ensure sustained progress.

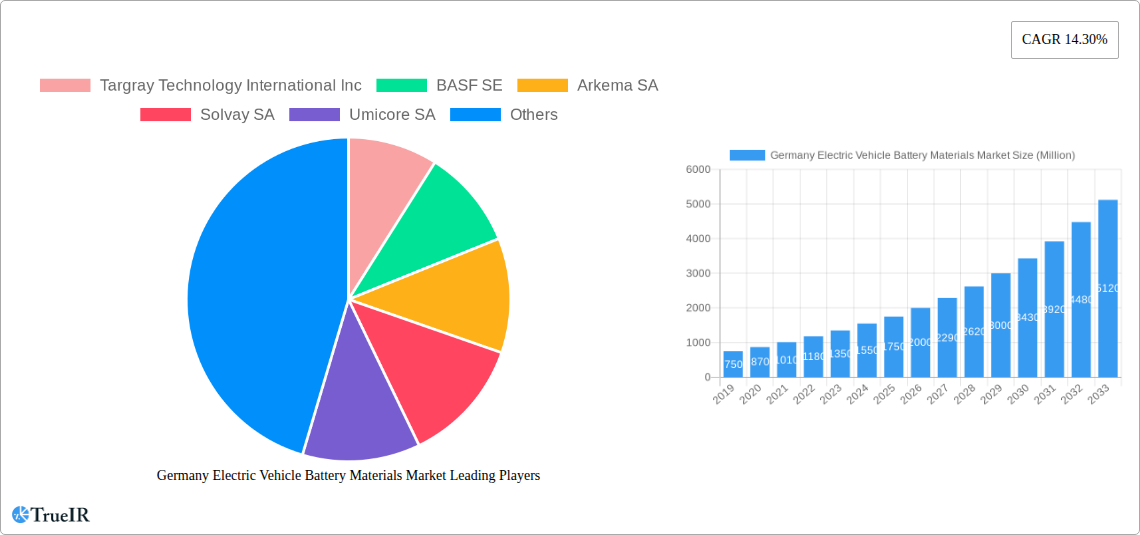

Germany Electric Vehicle Battery Materials Market Company Market Share

This comprehensive report delves into the dynamic Germany Electric Vehicle Battery Materials Market, offering in-depth analysis, critical trends, and future projections for the period 2019–2033. With a base year of 2025 and a forecast period extending to 2033, this research provides invaluable insights for stakeholders navigating this rapidly evolving sector.

Germany Electric Vehicle Battery Materials Market Market Structure & Competitive Landscape

The Germany Electric Vehicle Battery Materials Market is characterized by a moderately concentrated structure, driven by significant R&D investments and increasing regulatory support for sustainable energy solutions. Innovation remains a key differentiator, with companies heavily focused on developing advanced cathode and anode materials to boost battery energy density, charging speeds, and lifespan. The regulatory landscape, particularly the EU's Battery Regulation, is increasingly shaping market dynamics, pushing for higher recycled content and greater material traceability. Product substitutes, such as solid-state batteries, are emerging but are still in early development stages and face significant cost and manufacturing challenges. End-user segmentation is primarily dominated by the automotive industry, with a growing emphasis on battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). Mergers and acquisitions (M&A) are becoming more prevalent as established chemical giants and battery manufacturers seek to secure critical raw material supply chains and expand their technological capabilities. For instance, investments in upstream mining and refining, as well as downstream battery component manufacturing, are becoming strategic priorities.

- Market Concentration: Moderate, with a few key players holding significant market share, but with increasing opportunities for specialized material providers.

- Innovation Drivers: Enhanced battery performance (energy density, charging speed, safety), cost reduction, and sustainability (recycling, ethical sourcing).

- Regulatory Impacts: Stringent environmental regulations, battery passport initiatives, and support for domestic production are shaping strategic decisions.

- Product Substitutes: While solid-state batteries are on the horizon, lithium-ion remains dominant in the short to medium term.

- End-User Segmentation: Dominated by electric vehicle manufacturers; growing interest from energy storage and portable electronics sectors.

- M&A Trends: Focus on vertical integration, securing raw material access, and acquiring advanced material technologies.

Germany Electric Vehicle Battery Materials Market Market Trends & Opportunities

The Germany Electric Vehicle Battery Materials Market is poised for substantial growth, driven by a confluence of escalating electric vehicle adoption, stringent emission reduction targets, and robust government incentives. Market size is projected to expand significantly, fueled by the increasing demand for high-performance lithium-ion battery components. Technological advancements are at the forefront, with ongoing research and development focusing on next-generation cathode materials (e.g., high-nickel NCA and NMC chemistries, lithium iron phosphate (LFP)), advanced anode materials (e.g., silicon-based anodes), and novel electrolyte formulations to improve energy density, reduce charging times, and enhance battery safety. Consumer preferences are increasingly leaning towards longer-range EVs with faster charging capabilities, directly influencing the demand for these advanced materials. The competitive landscape is intensifying, with established global chemical companies vying for market share alongside specialized battery material innovators.

The German government's "National Platform for Electric Mobility" and the broader European Green Deal initiatives are creating a fertile ground for market expansion and investment. Opportunities abound in the development and localization of battery material production within Germany and Europe, aiming to reduce reliance on external supply chains and foster a circular economy. The demand for ethically sourced and sustainably produced battery materials is also a growing trend, presenting an opportunity for companies that can demonstrate strong ESG credentials. Furthermore, the development of advanced recycling technologies for end-of-life EV batteries will be crucial for a sustainable battery ecosystem, creating a closed-loop system and recovering valuable materials. The integration of artificial intelligence and machine learning in material discovery and process optimization is also expected to accelerate innovation and reduce production costs. The expanding charging infrastructure across Germany is a significant catalyst, alleviating range anxiety and further encouraging EV adoption, thereby boosting the demand for battery materials.

- Market Size Growth: Expecting significant CAGR driven by EV sales and battery production expansion.

- Technological Shifts: Focus on higher energy density, faster charging, improved safety, and longer cycle life in battery materials.

- Consumer Preferences: Demand for longer EV range, rapid charging, and cost-effective battery solutions.

- Competitive Dynamics: Intense competition from global chemical giants and emerging battery material specialists, with increasing strategic partnerships.

- Market Penetration: Growing penetration of EVs in the German automotive market directly translates to increased demand for battery materials.

Dominant Markets & Segments in Germany Electric Vehicle Battery Materials Market

The Lithium-ion Battery segment is overwhelmingly dominant within the Germany Electric Vehicle Battery Materials Market, reflecting the global shift towards this technology for electric mobility. Within this segment, the Cathode materials sub-segment commands the largest market share, driven by their critical role in determining battery capacity, energy density, and cost. Advancements in cathode chemistry, such as the widespread adoption of Nickel-Manganese-Cobalt (NMC) and Nickel-Cobalt-Aluminum (NCA) variants with higher nickel content, are fueling this dominance.

The Anode segment is experiencing rapid growth, particularly with the increasing interest and development in silicon-based anodes, which promise significantly higher energy densities compared to traditional graphite anodes. This innovation is crucial for meeting the demand for longer-range EVs. The Electrolyte segment is also vital, with ongoing research focused on developing safer, more stable, and higher-performing electrolytes, including solid-state electrolytes, to enhance battery safety and performance. The Separator segment, while smaller in market value compared to cathode and anode, is essential for preventing short circuits and ensuring battery safety, with innovations focusing on improved thermal stability and ionic conductivity.

- Dominant Battery Type: Lithium-ion Battery

- Key Growth Drivers: Growing EV adoption, advancements in energy density and charging speeds, government subsidies for EVs, and a supportive charging infrastructure.

- Detailed Analysis: Lithium-ion batteries are the cornerstone of modern electric vehicles due to their high energy density, relatively long cycle life, and declining costs. Germany's commitment to decarbonizing its transportation sector and its strong automotive industry are primary drivers for the robust demand in this segment.

- Dominant Material: Cathode

- Key Growth Drivers: Essential for determining battery capacity and energy density; ongoing development of high-nickel chemistries and LFP for cost-effectiveness and safety.

- Detailed Analysis: Cathode materials constitute a significant portion of battery cost and performance. The continuous innovation in cathode formulations, including the exploration of cobalt-free alternatives and improved synthesis processes, is critical for driving market growth and meeting evolving EV performance requirements.

- Promising Segment: Anode

- Key Growth Drivers: Potential for significantly higher energy density with silicon-based anodes; ongoing research into advanced graphite and composite materials.

- Detailed Analysis: The development of silicon anodes represents a major technological leap, offering the potential to substantially increase EV range. Significant investment is being channeled into overcoming the challenges associated with silicon expansion during charging and discharging cycles.

- Emerging Segments: Electrolyte and Separator

- Key Growth Drivers: Focus on enhanced safety, thermal stability, and improved ionic conductivity; development of solid-state electrolytes for next-generation batteries.

- Detailed Analysis: While currently smaller in market share, advancements in electrolytes and separators are crucial for enabling higher performance and safer batteries, particularly as power demands and operating conditions become more extreme.

Germany Electric Vehicle Battery Materials Market Product Analysis

The Germany Electric Vehicle Battery Materials Market is characterized by continuous product innovation aimed at enhancing battery performance, safety, and sustainability. Key advancements include the development of high-nickel cathode materials like NMC 811 and NCA, which significantly boost energy density, allowing for longer EV ranges. Innovations in anode technology, particularly the integration of silicon into graphite anodes, promise a substantial increase in charge capacity and faster charging capabilities. Furthermore, the exploration of novel electrolyte formulations and solid-state electrolytes is addressing safety concerns and improving thermal stability. These product innovations are directly catering to the evolving demands of the electric vehicle industry for more efficient, reliable, and cost-effective battery solutions, enhancing their competitive advantage in the global market.

Key Drivers, Barriers & Challenges in Germany Electric Vehicle Battery Materials Market

Key Drivers: The Germany Electric Vehicle Battery Materials Market is propelled by strong government support through ambitious climate targets and EV subsidies, alongside the robust growth of the German automotive industry's transition to electric mobility. Technological advancements in battery chemistry and manufacturing processes are also key drivers, enabling higher energy densities and faster charging. The increasing consumer awareness and demand for sustainable transportation solutions further accelerate market growth.

Barriers & Challenges: Significant challenges include the high upfront cost of establishing battery material production facilities and the reliance on imported raw materials like lithium and cobalt, creating supply chain vulnerabilities. Regulatory complexities and the need for extensive permitting processes can also slow down development. Intense global competition and the fluctuating prices of raw materials add to the market's volatility.

Growth Drivers in the Germany Electric Vehicle Battery Materials Market Market

The growth of the Germany Electric Vehicle Battery Materials Market is fundamentally driven by the accelerating adoption of electric vehicles across the country, supported by generous government incentives and the German automotive industry's commitment to electrification. Technological advancements in battery chemistry, such as the development of higher-energy-density cathode and anode materials, are crucial for meeting the increasing demand for longer EV ranges and faster charging times. Supportive regulatory frameworks, including ambitious CO2 emission standards and investments in charging infrastructure, are creating a conducive environment for market expansion. The increasing focus on battery recycling and the development of a circular economy for battery materials are also emerging as significant growth catalysts, fostering domestic production capabilities.

Challenges Impacting Germany Electric Vehicle Battery Materials Market Growth

Several challenges are impacting the growth of the Germany Electric Vehicle Battery Materials Market. Supply chain disruptions and the dependence on imported critical raw materials, such as lithium, cobalt, and nickel, pose significant risks to production stability and cost. The high capital expenditure required for building advanced battery material manufacturing facilities and the complex regulatory landscape for chemical production and environmental compliance can create substantial hurdles. Furthermore, intense global competition, particularly from Asian manufacturers with established supply chains and economies of scale, presents a competitive pressure that German producers must navigate. The need for continuous innovation to keep pace with rapid technological advancements in battery technology and the challenges associated with scaling up new material production processes also contribute to these impediments.

Key Players Shaping the Germany Electric Vehicle Battery Materials Market Market

- Targray Technology International Inc

- BASF SE

- Arkema SA

- Solvay SA

- Umicore SA

- Mitsubishi Chemical Group Corporation

- UBE Corporation

- Johnson Matthey

- Henkel Adhesive Technologies

- Heraeus Group

- Wacker Chemie AG

Significant Germany Electric Vehicle Battery Materials Market Industry Milestones

- July 2024: Group 14, a Next-gen battery materials manufacturer, signed a deal with CustomCells, a German battery cell company, to purchase USD 300 Million worth of Group 14’s silicon anode product. CustomCells is likely to incorporate Group14’s product into its battery cells to enhance battery performance for electric vehicles, aviation, and “e-mobility.

- January 2024: EIT InnoEnergy and Demeter Investment Managers announced the launch of a fund dedicated to developing a resilient and diverse battery raw material supply chain in Europe. With a target size of EUR 500 Million (USD 544.5 Million), the EBA Strategic Battery Materials Fund is building to boost domestic capacities for EV battery materials such as lithium, nickel, cobalt, manganese, and graphite.

Future Outlook for Germany Electric Vehicle Battery Materials Market Market

The future outlook for the Germany Electric Vehicle Battery Materials Market is exceptionally promising, driven by the sustained global momentum towards electric mobility and Germany's pivotal role in the European automotive landscape. Strategic opportunities lie in the continued development and localization of battery material production, fostering a more resilient and sustainable European supply chain. Investments in advanced materials, including next-generation cathode and anode technologies, as well as solid-state battery components, will be critical for maintaining a competitive edge. The growing emphasis on battery recycling and the circular economy presents a significant avenue for growth, creating value from end-of-life batteries and reducing reliance on virgin raw materials. Government policies supporting domestic manufacturing, R&D, and the expansion of charging infrastructure will continue to act as significant growth catalysts, positioning Germany as a key player in the global EV battery materials ecosystem.

Germany Electric Vehicle Battery Materials Market Segmentation

-

1. Battery Type

- 1.1. Lithium-ion Battery

- 1.2. Lead-Acid Battery

- 1.3. Others

-

2. Material

- 2.1. Cathode

- 2.2. Anode

- 2.3. Electrolyte

- 2.4. Separator

- 2.5. Others

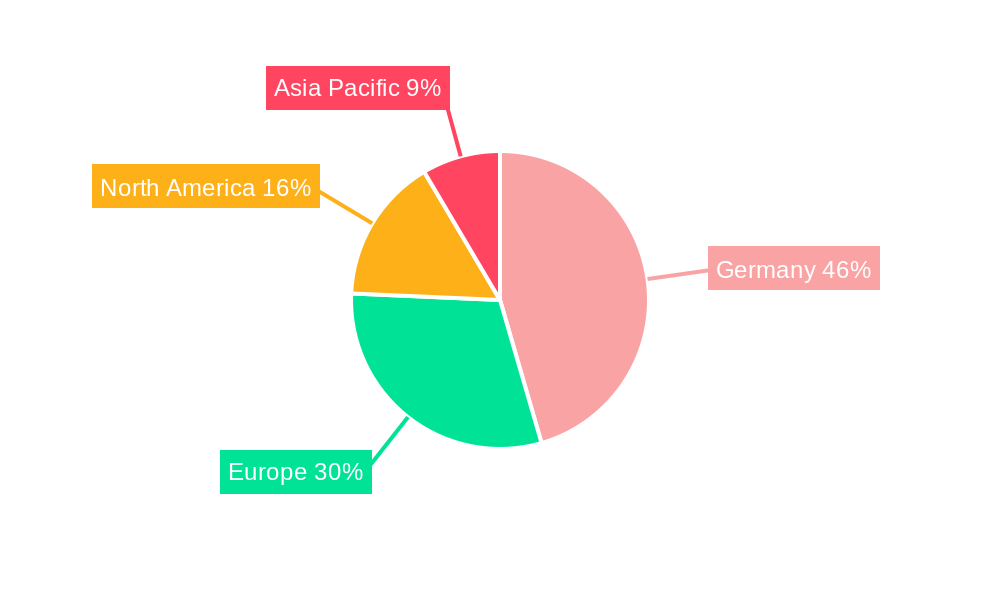

Germany Electric Vehicle Battery Materials Market Segmentation By Geography

- 1. Germany

Germany Electric Vehicle Battery Materials Market Regional Market Share

Geographic Coverage of Germany Electric Vehicle Battery Materials Market

Germany Electric Vehicle Battery Materials Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations

- 3.3. Market Restrains

- 3.3.1. 4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations

- 3.4. Market Trends

- 3.4.1. Growing Electric Vehicle (EVs) Sales Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Electric Vehicle Battery Materials Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 5.1.1. Lithium-ion Battery

- 5.1.2. Lead-Acid Battery

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Cathode

- 5.2.2. Anode

- 5.2.3. Electrolyte

- 5.2.4. Separator

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Targray Technology International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BASF SE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Arkema SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Solvay SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Umicore SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mitsubishi Chemical Group Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 UBE Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Johnson Matthey

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Henkel Adhesive Technologies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Heraeus Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Wacker Chemie AG*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/ Share Analysi

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Targray Technology International Inc

List of Figures

- Figure 1: Germany Electric Vehicle Battery Materials Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Germany Electric Vehicle Battery Materials Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Electric Vehicle Battery Materials Market Revenue Million Forecast, by Battery Type 2020 & 2033

- Table 2: Germany Electric Vehicle Battery Materials Market Volume Billion Forecast, by Battery Type 2020 & 2033

- Table 3: Germany Electric Vehicle Battery Materials Market Revenue Million Forecast, by Material 2020 & 2033

- Table 4: Germany Electric Vehicle Battery Materials Market Volume Billion Forecast, by Material 2020 & 2033

- Table 5: Germany Electric Vehicle Battery Materials Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Germany Electric Vehicle Battery Materials Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Germany Electric Vehicle Battery Materials Market Revenue Million Forecast, by Battery Type 2020 & 2033

- Table 8: Germany Electric Vehicle Battery Materials Market Volume Billion Forecast, by Battery Type 2020 & 2033

- Table 9: Germany Electric Vehicle Battery Materials Market Revenue Million Forecast, by Material 2020 & 2033

- Table 10: Germany Electric Vehicle Battery Materials Market Volume Billion Forecast, by Material 2020 & 2033

- Table 11: Germany Electric Vehicle Battery Materials Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Germany Electric Vehicle Battery Materials Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Electric Vehicle Battery Materials Market?

The projected CAGR is approximately 14.30%.

2. Which companies are prominent players in the Germany Electric Vehicle Battery Materials Market?

Key companies in the market include Targray Technology International Inc, BASF SE, Arkema SA, Solvay SA, Umicore SA, Mitsubishi Chemical Group Corporation, UBE Corporation, Johnson Matthey, Henkel Adhesive Technologies, Heraeus Group, Wacker Chemie AG*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/ Share Analysi.

3. What are the main segments of the Germany Electric Vehicle Battery Materials Market?

The market segments include Battery Type, Material.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.36 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations.

6. What are the notable trends driving market growth?

Growing Electric Vehicle (EVs) Sales Drives the Market.

7. Are there any restraints impacting market growth?

4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations.

8. Can you provide examples of recent developments in the market?

July 2024: Group 14, a Next-gen battery materials manufacturer, signed a deal with CustomCells, a German battery cell company, to purchase USD 300 million worth of Group 14’s silicon anode product. CustomCells is likely to incorporate Group14’s product into its battery cells to enhance battery performance for electric vehicles, aviation, and “e-mobility.January 2024: EIT InnoEnergy and Demeter Investment Managers announced the launch of a fund dedicated to developing a resilient and diverse battery raw material supply chain in Europe. With a target size of EUR 500 million (USD 544.5 million), the EBA Strategic Battery Materials Fund is building to boost domestic capacities for EV battery materials such as lithium, nickel, cobalt, manganese, and graphite.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Electric Vehicle Battery Materials Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Electric Vehicle Battery Materials Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Electric Vehicle Battery Materials Market?

To stay informed about further developments, trends, and reports in the Germany Electric Vehicle Battery Materials Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence