Key Insights

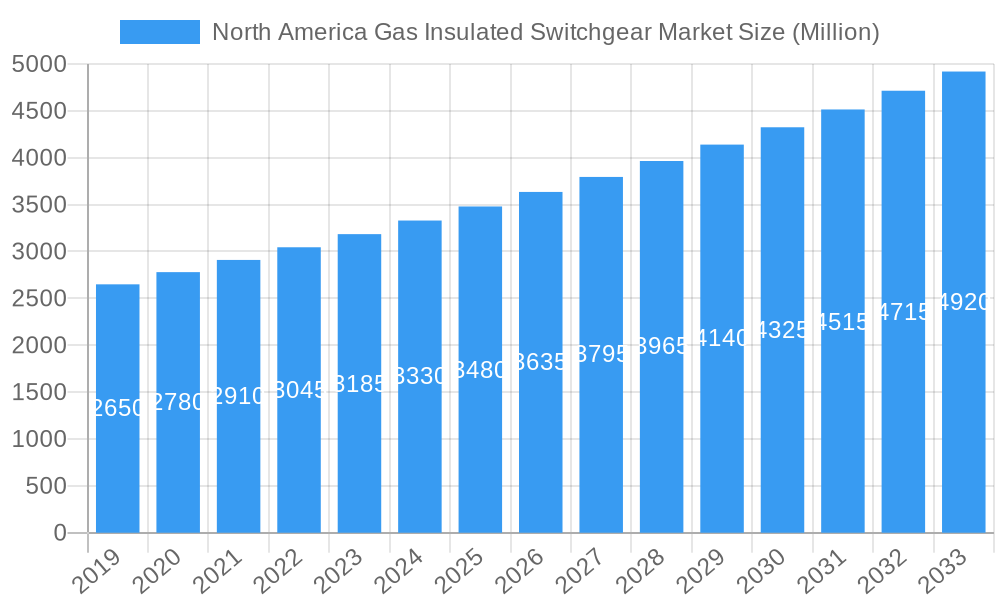

The North America Gas Insulated Switchgear (GIS) market is projected for substantial growth, driven by the increasing demand for reliable and efficient power distribution across various sectors. The market is estimated to reach $5.8 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.8%. Key growth drivers include the modernization of aging electrical grids, the integration of renewable energy sources necessitating advanced switchgear for grid stability, and stringent safety regulations favoring GIS due to its compact design and superior insulation properties. Residential, commercial, and industrial sectors will all contribute to this expansion, supported by new construction, smart city initiatives, and increasing industrial electrification. The United States is expected to lead market growth, followed by Canada and Mexico.

North America Gas Insulated Switchgear Market Market Size (In Billion)

Emerging trends such as the integration of IoT sensors and advanced monitoring systems are enhancing GIS operational efficiency, predictive maintenance, and safety. The development of eco-friendly insulating gases and improved manufacturing processes are also addressing sustainability concerns. While the high initial cost of GIS compared to traditional switchgear may present a challenge, its long-term benefits in reduced footprint, enhanced reliability, and lower operational costs are expected to ensure sustained market expansion. Leading companies like Siemens Energy AG, General Electric Company, and Schneider Electric SE are actively innovating to meet evolving market demands.

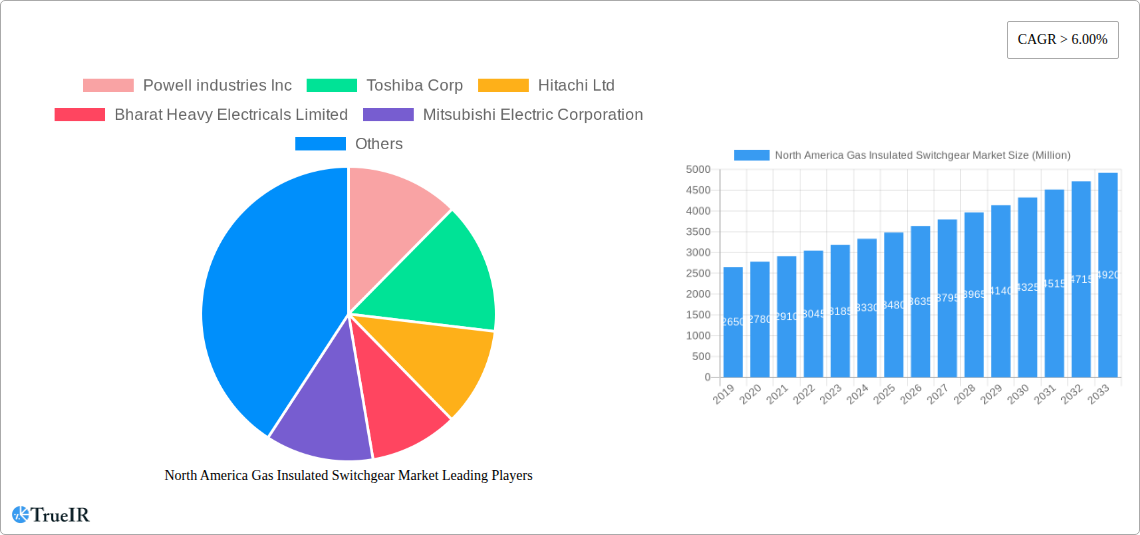

North America Gas Insulated Switchgear Market Company Market Share

This comprehensive report analyzes the North America Gas Insulated Switchgear (GIS) market from 2019 to 2024, with 2025 as the base year and forecasts extending to 2033. It provides deep insights into market dynamics, competitive strategies, emerging trends, and future growth prospects. Optimized for search engines with keywords like "gas insulated switchgear," "GIS market," "electrical substations," "power distribution," and "grid modernization," this report is designed for a diverse industry audience.

North America Gas Insulated Switchgear Market Market Structure & Competitive Landscape

The North America Gas Insulated Switchgear market is characterized by a moderately concentrated landscape, with leading players investing heavily in research and development to drive innovation and maintain a competitive edge. Innovation in GIS technology, particularly in developing eco-friendly alternatives to sulfur hexafluoride (SF6) gas, is a significant driver. Regulatory impacts, such as stringent environmental standards and mandates for grid reliability, are shaping product development and market entry strategies. Product substitutes, while present, are gradually being phased out due to performance and environmental advantages offered by advanced GIS solutions. The end-user segmentation of commercial, residential, and industrial sectors highlights the diverse application areas and demand drivers within the market. Mergers and acquisitions (M&A) activity is moderate, focusing on strategic consolidations and technology acquisitions to expand market reach and enhance product portfolios. For instance, the market has witnessed a XX% increase in M&A volume over the historical period, with a focus on acquiring companies with specialized GIS expertise. Concentration ratios suggest that the top 5 players hold approximately XX% of the market share.

North America Gas Insulated Switchgear Market Market Trends & Opportunities

The North America Gas Insulated Switchgear market is poised for robust growth, driven by escalating demand for reliable and efficient power distribution solutions. The market size is projected to reach USD XXXX Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% from the base year 2025. Key technological shifts include the increasing adoption of hybrid GIS, advanced monitoring and control systems, and the development of SF6-free GIS alternatives, responding to growing environmental concerns. Consumer preferences are leaning towards compact, highly reliable, and low-maintenance switchgear solutions that minimize environmental impact and operational costs. Competitive dynamics are intensifying, with companies focusing on product differentiation, cost optimization, and strategic partnerships to secure market share. Market penetration rates for advanced GIS technologies are expected to rise significantly as utilities and industrial end-users prioritize grid modernization and resilience. Opportunities abound in the replacement of aging infrastructure and the expansion of new renewable energy projects, both of which necessitate advanced switchgear solutions. The trend towards digitalization and smart grid integration further fuels the demand for sophisticated GIS equipment capable of seamless communication and data exchange. Furthermore, the increasing electrification of transportation and industries is creating new avenues for market expansion.

Dominant Markets & Segments in North America Gas Insulated Switchgear Market

The United States currently dominates the North America Gas Insulated Switchgear market, accounting for an estimated XX% of the total market revenue in 2025. This dominance is attributed to its extensive existing power infrastructure, significant investments in grid modernization, and a robust industrial base. Canada and Mexico follow, with growing contributions driven by similar factors and an increasing focus on upgrading their respective power grids.

- Voltage Segmentation: The Medium and High Voltage segment is the largest and fastest-growing segment within the North America GIS market. This is primarily due to their critical role in transmitting and distributing electricity across vast geographical areas and serving large industrial consumers.

- Key Growth Drivers:

- Infrastructure Upgrades: Extensive government and private sector investments in upgrading aging transmission and distribution networks.

- Renewable Energy Integration: The growing need for high-voltage switchgear to connect and manage renewable energy sources like wind and solar farms to the grid.

- Industrial Expansion: The burgeoning industrial sector, particularly in manufacturing and mining, requires reliable medium and high-voltage power distribution solutions.

- Key Growth Drivers:

- End-User Segmentation: The Industrial end-user segment represents the largest market share, followed by Commercial and Residential.

- Industrial Sector Dominance:

- Critical Infrastructure: Industries such as oil & gas, mining, chemicals, and manufacturing depend heavily on uninterrupted power supply, making GIS essential for their operations.

- Expansion and Modernization: Ongoing industrial expansion and the need to modernize existing facilities to improve efficiency and safety drive demand for advanced GIS.

- Commercial Sector Growth:

- Data Centers and Urban Development: The rapid growth of data centers and ongoing urban development projects necessitate reliable and compact power distribution solutions offered by GIS.

- Commercial Buildings: Hospitals, airports, and large retail complexes increasingly opt for GIS for its space-saving benefits and high reliability.

- Residential Sector Applications: While smaller, the residential sector's demand is growing with the integration of smart home technologies and the need for localized, safe power distribution within large residential complexes.

- Industrial Sector Dominance:

North America Gas Insulated Switchgear Market Product Analysis

Product innovation in the North America Gas Insulated Switchgear market is heavily focused on enhancing environmental sustainability and operational efficiency. The development of SF6-free alternatives, such as dry-air insulated switchgear, is a significant advancement, offering zero global warming potential. These innovations cater to stricter environmental regulations and the growing demand for eco-friendly solutions. Key product applications span power transmission and distribution substations, industrial facilities, renewable energy integration, and commercial infrastructure, providing compact, reliable, and safe electrical power switching. The competitive advantage lies in superior dielectric properties, reduced footprint, and extended service life.

Key Drivers, Barriers & Challenges in North America Gas Insulated Switchgear Market

Key Drivers: The North America Gas Insulated Switchgear market is propelled by several key factors. Grid modernization initiatives undertaken by governments and utility companies, aimed at improving grid reliability and resilience, are a primary driver. The increasing integration of renewable energy sources into the power grid necessitates advanced switchgear for efficient management. Furthermore, growing industrialization and urbanization, particularly in commercial and industrial sectors, fuel the demand for safe and compact power distribution solutions. Technological advancements in GIS, such as the development of SF6-free alternatives, are also significantly boosting market adoption.

Barriers & Challenges: Despite robust growth, the market faces several challenges. High initial investment costs associated with GIS equipment can be a deterrent for some smaller utilities or developing regions. Supply chain disruptions, as witnessed in recent years, can impact the availability of raw materials and components, leading to project delays and increased costs. Stringent regulatory frameworks and lengthy approval processes can also pose hurdles for new product introductions and market entry. Competitive pressures from established players and the ongoing need for skilled labor for installation and maintenance further add to the market's complexities.

Growth Drivers in the North America Gas Insulated Switchgear Market Market

Key growth drivers for the North America Gas Insulated Switchgear market include the urgent need for grid modernization and expansion to accommodate increasing electricity demand and enhance reliability. Government initiatives and funding, such as the Bipartisan Infrastructure Law's Transmission Facilitation Program (TFP), are directly stimulating investment in grid infrastructure, where GIS plays a pivotal role. The accelerating adoption of renewable energy sources, including solar and wind power, requires advanced switchgear for their seamless integration into the existing grid. Furthermore, the ongoing electrification of industries and transportation is creating new demand for robust and efficient power distribution systems.

Challenges Impacting North America Gas Insulated Switchgear Market Growth

Challenges impacting North America Gas Insulated Switchgear market growth include the complex regulatory landscape and evolving environmental standards that require continuous adaptation of product designs and manufacturing processes. Supply chain vulnerabilities, affecting the availability and cost of critical components, can lead to project delays and increased operational expenses. Intense competitive pressures from both established global manufacturers and emerging regional players necessitate constant innovation and cost optimization. The high upfront cost of advanced GIS solutions can also be a barrier to adoption for some segments of the market, particularly for smaller utilities or in less developed regions.

Key Players Shaping the North America Gas Insulated Switchgear Market Market

- Powell industries Inc

- Toshiba Corp

- Hitachi Ltd

- Bharat Heavy Electricals Limited

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Eaton Corporation PLC

- Siemens Energy AG

- General Electric Company

- Hyosung Heavy Industries Corp

Significant North America Gas Insulated Switchgear Market Industry Milestones

- October 2022: Mitsubishi Electric Power Product Company, Inc. (MEPPI) announced the first shipments of its 72 kV vacuum circuit breaker (VCB) with dry-air insulation. These are designed, assembled, and tested in the United States of America. The company's 72 kV vacuum circuit breaker meets all applicable IEEE, IEC, and ANSI certification standards. The 72 kV vacuum circuit breaker employs the company's 65-year history of vacuum interrupter technology. It provides customers with a cost-effective, environmentally responsible, zero-global-warming potential alternative to SF6 gas and alternative gas-insulating mediums.

- May 2022: The federal government launched USD 2.5 billion in funds to modernize and expand the country's power grid capacity under the Transmission Facilitation Program (TFP) created by the Bipartisan Infrastructure Law. As part of this, the U.S. Department of Energy (DOE) issued a request for information (RFI) to seek public input on the structure of the new revolving fund program.

Future Outlook for North America Gas Insulated Switchgear Market Market

The future outlook for the North America Gas Insulated Switchgear market is exceptionally promising, driven by sustained investments in grid modernization and the ongoing energy transition. Strategic opportunities lie in the development and widespread adoption of advanced, environmentally sustainable GIS solutions, particularly those that are SF6-free. The increasing demand for smart grid technologies and digital integration will create further market potential for intelligent GIS. Continued emphasis on grid resilience, security, and the reliable integration of distributed energy resources will ensure a steady demand for high-performance GIS across all voltage levels and end-user segments. The market is expected to witness further consolidation and strategic alliances as companies seek to expand their technological capabilities and geographical reach.

North America Gas Insulated Switchgear Market Segmentation

-

1. Voltage

- 1.1. Low Voltage

- 1.2. Medium and High Voltage

-

2. End-User

- 2.1. Commercial

- 2.2. Residential

- 2.3. Industrial

-

3. Geography

- 3.1. Canada

- 3.2. United states

- 3.3. Mexico

North America Gas Insulated Switchgear Market Segmentation By Geography

- 1. Canada

- 2. United states

- 3. Mexico

North America Gas Insulated Switchgear Market Regional Market Share

Geographic Coverage of North America Gas Insulated Switchgear Market

North America Gas Insulated Switchgear Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Government Focus on Waste Management4.; Decline in Fossil-fuel based Electricity Generation

- 3.3. Market Restrains

- 3.3.1. 4.; High Price of Incinerators and Decline in Energy Price of Other Renewable Energy Sources

- 3.4. Market Trends

- 3.4.1. High Voltage Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Gas Insulated Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Voltage

- 5.1.1. Low Voltage

- 5.1.2. Medium and High Voltage

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Commercial

- 5.2.2. Residential

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Canada

- 5.3.2. United states

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.4.2. United states

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Voltage

- 6. Canada North America Gas Insulated Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Voltage

- 6.1.1. Low Voltage

- 6.1.2. Medium and High Voltage

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Commercial

- 6.2.2. Residential

- 6.2.3. Industrial

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Canada

- 6.3.2. United states

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Voltage

- 7. United states North America Gas Insulated Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Voltage

- 7.1.1. Low Voltage

- 7.1.2. Medium and High Voltage

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Commercial

- 7.2.2. Residential

- 7.2.3. Industrial

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Canada

- 7.3.2. United states

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Voltage

- 8. Mexico North America Gas Insulated Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Voltage

- 8.1.1. Low Voltage

- 8.1.2. Medium and High Voltage

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Commercial

- 8.2.2. Residential

- 8.2.3. Industrial

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Canada

- 8.3.2. United states

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Voltage

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Powell industries Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Toshiba Corp

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Hitachi Ltd

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Bharat Heavy Electricals Limited

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Mitsubishi Electric Corporation

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Schneider Electric SE

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Eaton Corporation PLC

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Siemens Energy AG

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 General Electric Company

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Hyosung Heavy Industries Corp

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Powell industries Inc

List of Figures

- Figure 1: North America Gas Insulated Switchgear Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Gas Insulated Switchgear Market Share (%) by Company 2025

List of Tables

- Table 1: North America Gas Insulated Switchgear Market Revenue billion Forecast, by Voltage 2020 & 2033

- Table 2: North America Gas Insulated Switchgear Market Volume Gigawatt Forecast, by Voltage 2020 & 2033

- Table 3: North America Gas Insulated Switchgear Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 4: North America Gas Insulated Switchgear Market Volume Gigawatt Forecast, by End-User 2020 & 2033

- Table 5: North America Gas Insulated Switchgear Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: North America Gas Insulated Switchgear Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 7: North America Gas Insulated Switchgear Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: North America Gas Insulated Switchgear Market Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 9: North America Gas Insulated Switchgear Market Revenue billion Forecast, by Voltage 2020 & 2033

- Table 10: North America Gas Insulated Switchgear Market Volume Gigawatt Forecast, by Voltage 2020 & 2033

- Table 11: North America Gas Insulated Switchgear Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 12: North America Gas Insulated Switchgear Market Volume Gigawatt Forecast, by End-User 2020 & 2033

- Table 13: North America Gas Insulated Switchgear Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: North America Gas Insulated Switchgear Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 15: North America Gas Insulated Switchgear Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America Gas Insulated Switchgear Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 17: North America Gas Insulated Switchgear Market Revenue billion Forecast, by Voltage 2020 & 2033

- Table 18: North America Gas Insulated Switchgear Market Volume Gigawatt Forecast, by Voltage 2020 & 2033

- Table 19: North America Gas Insulated Switchgear Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 20: North America Gas Insulated Switchgear Market Volume Gigawatt Forecast, by End-User 2020 & 2033

- Table 21: North America Gas Insulated Switchgear Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: North America Gas Insulated Switchgear Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 23: North America Gas Insulated Switchgear Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: North America Gas Insulated Switchgear Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 25: North America Gas Insulated Switchgear Market Revenue billion Forecast, by Voltage 2020 & 2033

- Table 26: North America Gas Insulated Switchgear Market Volume Gigawatt Forecast, by Voltage 2020 & 2033

- Table 27: North America Gas Insulated Switchgear Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 28: North America Gas Insulated Switchgear Market Volume Gigawatt Forecast, by End-User 2020 & 2033

- Table 29: North America Gas Insulated Switchgear Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: North America Gas Insulated Switchgear Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 31: North America Gas Insulated Switchgear Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: North America Gas Insulated Switchgear Market Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Gas Insulated Switchgear Market?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the North America Gas Insulated Switchgear Market?

Key companies in the market include Powell industries Inc, Toshiba Corp, Hitachi Ltd, Bharat Heavy Electricals Limited, Mitsubishi Electric Corporation, Schneider Electric SE, Eaton Corporation PLC, Siemens Energy AG, General Electric Company, Hyosung Heavy Industries Corp.

3. What are the main segments of the North America Gas Insulated Switchgear Market?

The market segments include Voltage, End-User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.8 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Government Focus on Waste Management4.; Decline in Fossil-fuel based Electricity Generation.

6. What are the notable trends driving market growth?

High Voltage Hold Significant Market Share.

7. Are there any restraints impacting market growth?

4.; High Price of Incinerators and Decline in Energy Price of Other Renewable Energy Sources.

8. Can you provide examples of recent developments in the market?

October 2022: Mitsubishi Electric Power Product Company, Inc. (MEPPI) announced the first shipments of its 72 kV vacuum circuit breaker (VCB) with dry-air insulation. These are designed, assembled, and tested in the United States of America. The company's 72 kV vacuum circuit breaker meets all applicable IEEE, IEC, and ANSI certification standards. The 72 kV vacuum circuit breaker employs the company's 65-year history of vacuum interrupter technology. It provides customers with a cost-effective, environmentally responsible, zero-global-warming potential alternative to SF6 gas and alternative gas-insulating mediums.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Gas Insulated Switchgear Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Gas Insulated Switchgear Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Gas Insulated Switchgear Market?

To stay informed about further developments, trends, and reports in the North America Gas Insulated Switchgear Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence