Key Insights

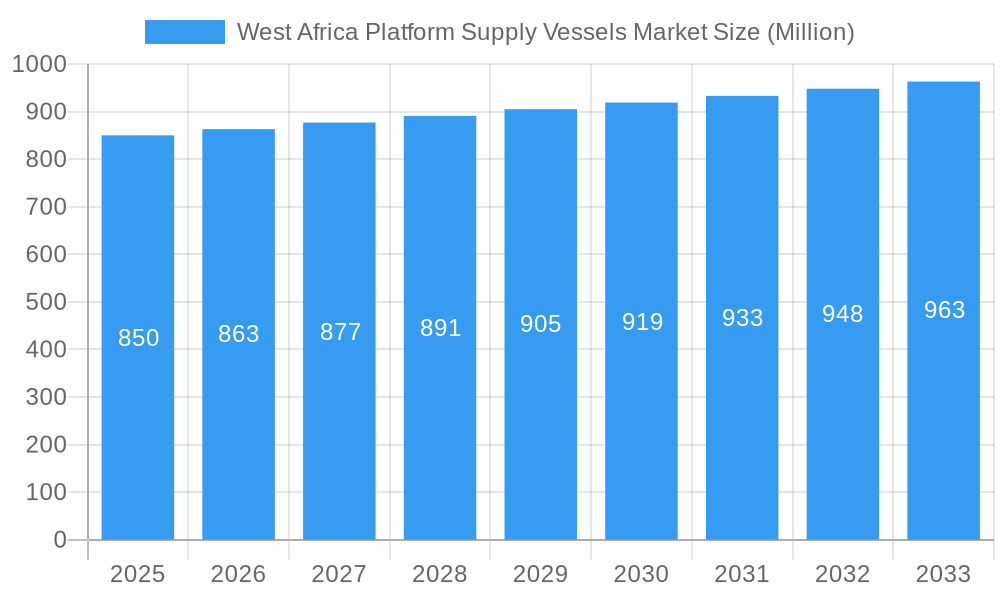

The West Africa Platform Supply Vessels (PSV) market is projected to experience robust expansion, driven by escalating offshore oil and gas exploration and production (E&P) activities. The market is valued at 4.26 billion in 2024, with an anticipated Compound Annual Growth Rate (CAGR) of 2.9% through 2033. This growth is underpinned by significant new field developments, ongoing maintenance of existing offshore infrastructure, and consistent demand for logistics supporting exploration ventures. Emerging offshore discoveries and West Africa's pivotal role in global energy supply highlight the market's fundamental strength. Technological advancements in vessel design and operational efficiency further enhance the supply chain and market dynamics.

West Africa Platform Supply Vessels Market Market Size (In Billion)

Market evolution is shaped by key trends and challenges. Dominant trends include the intensifying focus on deepwater exploration, the integration of advanced vessel technologies for improved safety and efficiency, and strategic alliances between major oil companies and local service providers to cultivate regional capabilities. Conversely, the market contends with stringent environmental regulations, the impact of fluctuating oil prices on exploration budgets, and the substantial capital required for fleet modernization. Nigeria, Ghana, and Senegal are expected to lead the West African PSV market due to their established offshore E&P sectors and active development projects. Emerging opportunities also exist in other West African regions as exploration broadens into less developed offshore basins. Key contributors to market development include Petromarine Nigeria Limited and GE Offshore Marine Services S.L.

West Africa Platform Supply Vessels Market Company Market Share

West Africa Platform Supply Vessels Market: Comprehensive Analysis and Future Outlook (2019-2033)

This comprehensive report delves into the dynamic West Africa Platform Supply Vessels (PSV) Market, offering in-depth analysis and strategic insights for stakeholders. Spanning a study period from 2019 to 2033, with a base and estimated year of 2025, this report provides a detailed examination of market structure, trends, opportunities, and future outlook. Leveraging high-volume keywords crucial for SEO, this report aims to reach and engage industry professionals seeking a definitive resource on the West African offshore support vessel sector.

West Africa Platform Supply Vessels Market Market Structure & Competitive Landscape

The West Africa Platform Supply Vessels Market exhibits a moderately concentrated structure, with a handful of key players dominating a significant portion of the market share. Innovation drivers are primarily centered around vessel efficiency, environmental compliance, and advanced technological integration for enhanced operational capabilities. Regulatory impacts, while varied across different West African nations, are increasingly geared towards promoting local content, safety standards, and sustainable offshore practices. Product substitutes, such as other offshore support vessel types and evolving drilling technologies, are present but often lack the specialized functionality of PSVs for platform support operations. End-user segmentation is predominantly driven by the offshore oil and gas exploration and production (E&P) sector. Mergers and Acquisitions (M&A) trends, while not extensively recorded in public domain, are likely to see strategic consolidation to achieve economies of scale and expand service portfolios. The market concentration ratio is estimated to be around 60-70% among the top 5-7 players. M&A volumes are projected to see a gradual increase in the forecast period, driven by the need for fleet modernization and market expansion, potentially reaching 2-3 significant transactions annually.

West Africa Platform Supply Vessels Market Market Trends & Opportunities

The West Africa Platform Supply Vessels Market is poised for robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 4.5% during the forecast period of 2025-2033. This expansion is fueled by increasing offshore oil and gas exploration activities, particularly in frontier basins across the region. As existing fields mature and new discoveries are made, the demand for reliable and efficient platform supply vessels to transport vital supplies, equipment, and personnel to offshore installations will steadily rise. Technological shifts are playing a crucial role, with a growing emphasis on the adoption of greener vessel designs, including those powered by alternative fuels and equipped with advanced navigation and communication systems for improved safety and operational efficiency. Consumer preferences are leaning towards service providers who can offer integrated solutions, demonstrating a commitment to environmental sustainability, and adhering to stringent health, safety, and environmental (HSE) regulations. Competitive dynamics are intensifying, with established international players vying for market share alongside emerging regional operators. Opportunities abound in areas such as specialized vessel chartering for complex deepwater operations, provision of integrated logistics support, and the deployment of vessels equipped with advanced survey and inspection capabilities. Market penetration rates for modern, fuel-efficient PSVs are expected to climb as operators seek to optimize operational costs and meet evolving environmental standards. The market size is estimated to reach approximately $2,500 Million by 2033, up from an estimated $1,800 Million in 2025.

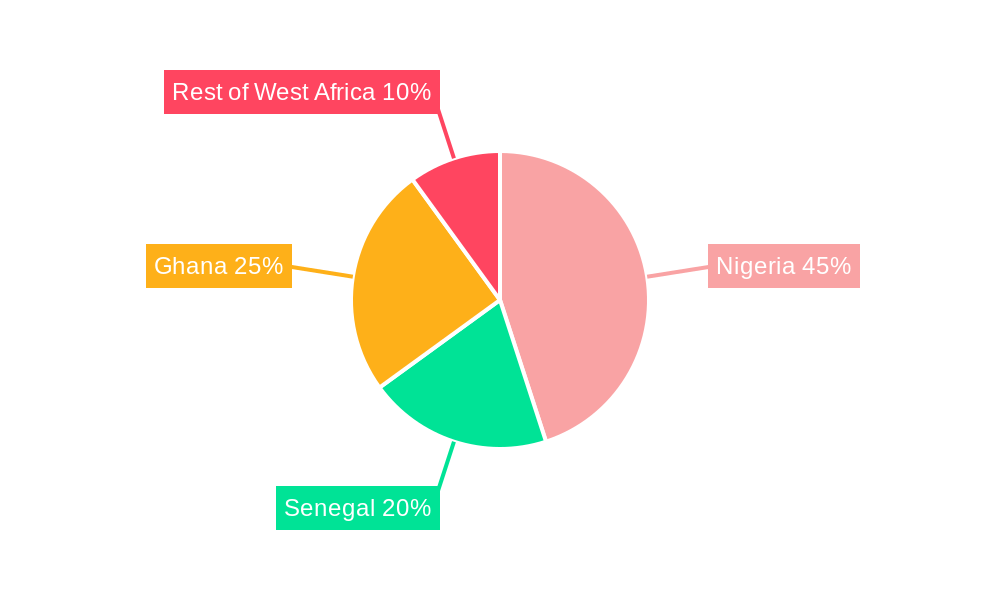

Dominant Markets & Segments in West Africa Platform Supply Vessels Market

Nigeria stands as the undisputed dominant market within the West Africa Platform Supply Vessels sector, accounting for an estimated 50-60% of the total regional market value. Its established offshore oil and gas industry, characterized by numerous active production platforms and ongoing exploration campaigns, creates a consistent and substantial demand for PSVs. Key growth drivers in Nigeria include:

- Mature Offshore Production: A large number of aging offshore fields require continuous supply of materials and personnel for maintenance and enhanced oil recovery (EOR) operations.

- New Field Development: Ongoing and planned projects for the development of new offshore oil and gas reserves necessitate the deployment of PSVs for construction and operational support.

- Local Content Policies: Government initiatives to promote local participation in the oil and gas sector often translate into increased demand for locally owned or operated PSV fleets.

- Infrastructure Investment: Continuous investment in offshore infrastructure, including new platform installations and subsea facilities, directly boosts PSV requirements.

Ghana and Senegal are emerging as significant growth markets, each contributing an estimated 10-15% and 5-10% respectively to the regional market. Their importance is escalating due to:

- Ghana: A maturing offshore oil and gas sector with established production hubs and ongoing exploration in deepwater blocks. Government commitment to expanding its energy sector further fuels demand.

- Senegal: The discovery of substantial offshore gas reserves and the commencement of major LNG projects are rapidly transforming Senegal into a key player, driving significant demand for offshore support vessels, including PSVs.

The Rest of West Africa, encompassing countries like Angola, Equatorial Guinea, and Mauritania, collectively represents the remaining market share. While individually smaller, these markets offer niche opportunities driven by specific exploration projects and the development of offshore oil and gas resources. The growth in these regions is often project-specific, linked to the exploration and production schedules of major international oil companies.

West Africa Platform Supply Vessels Market Product Analysis

The West Africa Platform Supply Vessels Market is characterized by a range of PSV types designed to meet diverse offshore operational needs. Innovations are focused on enhancing fuel efficiency, reducing emissions through advanced engine technologies and hull designs, and improving cargo capacity and handling capabilities. These vessels are critical for transporting a wide array of supplies, including drilling fluids, cement, provisions, spare parts, and specialized equipment to offshore platforms. Competitive advantages are derived from vessel reliability, operational efficiency, adherence to stringent safety and environmental standards, and the ability to offer customized support services. The market is witnessing a shift towards larger, more sophisticated PSVs capable of supporting complex deepwater operations and increasingly stringent regulatory requirements.

Key Drivers, Barriers & Challenges in West Africa Platform Supply Vessels Market

Key Drivers:

- Robust Offshore Exploration & Production Activities: Continued investment in exploring and producing oil and gas reserves in West Africa's offshore basins is the primary growth catalyst.

- Demand for Logistics Support: The inherent need for efficient and reliable transportation of supplies and personnel to remote offshore platforms directly drives PSV demand.

- Technological Advancements: Adoption of more fuel-efficient and environmentally friendly vessel technologies is becoming a competitive necessity.

- Favorable Regulatory Frameworks (in some nations): Policies promoting local content and offshore development can incentivize investment and operational growth.

Barriers & Challenges:

- Volatile Oil Prices: Fluctuations in global crude oil prices can impact the profitability of E&P companies, leading to potential cutbacks in exploration and production budgets, thereby affecting PSV demand.

- Regulatory Complexities and Bureaucracy: Navigating diverse and sometimes cumbersome regulatory environments across different West African countries can pose significant challenges for vessel operators.

- Infrastructure Deficiencies: Inadequate port facilities and logistical infrastructure in some offshore regions can hinder efficient vessel operations and turnaround times.

- Intense Competition: A highly competitive market landscape can lead to pressure on charter rates and reduced profit margins for PSV providers.

- Supply Chain Disruptions: Global supply chain issues can affect the availability of critical spare parts and equipment for vessel maintenance and operations, leading to potential downtime.

Growth Drivers in the West Africa Platform Supply Vessels Market Market

The West Africa Platform Supply Vessels Market is propelled by several key growth drivers. Economically, the region's significant hydrocarbon reserves continue to attract substantial investment in exploration and production activities. Technologically, the increasing adoption of advanced drilling techniques and the development of deeper offshore fields necessitate the deployment of specialized and efficient PSVs. Regulatory factors, particularly policies aimed at local content development and enhancing the safety and environmental performance of offshore operations, are also significant drivers, encouraging investment in modern fleets and service capabilities. The ongoing need for reliable logistics to support established and emerging offshore projects forms the bedrock of demand.

Challenges Impacting West Africa Platform Supply Vessels Market Growth

Several challenges can impede the growth of the West Africa Platform Supply Vessels Market. Regulatory complexities and bureaucratic hurdles across different nations can create operational inefficiencies and increase compliance costs. Supply chain issues, including the availability of spare parts and skilled maintenance personnel, can lead to unscheduled vessel downtime, impacting service reliability. Competitive pressures from a crowded market can drive down charter rates, affecting profitability. Furthermore, the inherent volatility of global oil prices poses a significant risk, as a downturn can lead to reduced exploration and production budgets by oil companies, directly impacting the demand for PSVs.

Key Players Shaping the West Africa Platform Supply Vessels Market Market

- Petromarine Nigeria Limited

- GE Offshore Marine Services S L

- Team Offshore Nigeria Limited

- Aquashield Oil & Marine Services Limited

Significant West Africa Platform Supply Vessels Market Industry Milestones

- September 2021: Norwegian offshore vessel owner Solstad Offshore secured contracts for seven platform supply vessels in West Africa. The total firm duration of the contracts is approximately 1,000 vessel days, starting from the fourth quarter of 2021. This significant development highlights the ongoing demand for PSVs and the active participation of international players in the region.

Future Outlook for West Africa Platform Supply Vessels Market Market

The future outlook for the West Africa Platform Supply Vessels Market is promising, driven by continued exploration and development of hydrocarbon resources. Strategic opportunities lie in offering integrated logistics solutions, adapting to evolving environmental regulations with greener vessel technologies, and capitalizing on the development of emerging offshore basins. The market is expected to witness steady growth, with a particular emphasis on vessels that can provide efficient, safe, and environmentally compliant support to offshore oil and gas operations. Investment in modern, technologically advanced PSVs will be crucial for companies aiming to secure long-term contracts and maintain a competitive edge in this dynamic regional market. The market is projected to experience sustained demand, further boosted by potential new discoveries and the ongoing need for efficient operational support.

West Africa Platform Supply Vessels Market Segmentation

-

1. Geography

- 1.1. Nigeria

- 1.2. Senegal

- 1.3. Ghana

- 1.4. Rest of West Africa

West Africa Platform Supply Vessels Market Segmentation By Geography

- 1. Nigeria

- 2. Senegal

- 3. Ghana

- 4. Rest of West Africa

West Africa Platform Supply Vessels Market Regional Market Share

Geographic Coverage of West Africa Platform Supply Vessels Market

West Africa Platform Supply Vessels Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The High Amount of Waste Generation in the Country4.; The growing Focus on Non-Fossil Fuel Sources

- 3.3. Market Restrains

- 3.3.1. 4.; The Recycling Rate of Waste in Germany

- 3.4. Market Trends

- 3.4.1. Upcoming Upstream Activities are Likely to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. West Africa Platform Supply Vessels Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 5.1.1. Nigeria

- 5.1.2. Senegal

- 5.1.3. Ghana

- 5.1.4. Rest of West Africa

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Nigeria

- 5.2.2. Senegal

- 5.2.3. Ghana

- 5.2.4. Rest of West Africa

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 6. Nigeria West Africa Platform Supply Vessels Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 6.1.1. Nigeria

- 6.1.2. Senegal

- 6.1.3. Ghana

- 6.1.4. Rest of West Africa

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 7. Senegal West Africa Platform Supply Vessels Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 7.1.1. Nigeria

- 7.1.2. Senegal

- 7.1.3. Ghana

- 7.1.4. Rest of West Africa

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 8. Ghana West Africa Platform Supply Vessels Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 8.1.1. Nigeria

- 8.1.2. Senegal

- 8.1.3. Ghana

- 8.1.4. Rest of West Africa

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 9. Rest of West Africa West Africa Platform Supply Vessels Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 9.1.1. Nigeria

- 9.1.2. Senegal

- 9.1.3. Ghana

- 9.1.4. Rest of West Africa

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Petromarine Nigeria Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 GE Offshore Marine Services S L*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Team Offshore Nigeria Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Aquashield Oil & Marine Services Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.1 Petromarine Nigeria Limited

List of Figures

- Figure 1: West Africa Platform Supply Vessels Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: West Africa Platform Supply Vessels Market Share (%) by Company 2025

List of Tables

- Table 1: West Africa Platform Supply Vessels Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 2: West Africa Platform Supply Vessels Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: West Africa Platform Supply Vessels Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: West Africa Platform Supply Vessels Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: West Africa Platform Supply Vessels Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: West Africa Platform Supply Vessels Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: West Africa Platform Supply Vessels Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: West Africa Platform Supply Vessels Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: West Africa Platform Supply Vessels Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: West Africa Platform Supply Vessels Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the West Africa Platform Supply Vessels Market?

The projected CAGR is approximately 2.9%.

2. Which companies are prominent players in the West Africa Platform Supply Vessels Market?

Key companies in the market include Petromarine Nigeria Limited, GE Offshore Marine Services S L*List Not Exhaustive, Team Offshore Nigeria Limited, Aquashield Oil & Marine Services Limited.

3. What are the main segments of the West Africa Platform Supply Vessels Market?

The market segments include Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.26 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; The High Amount of Waste Generation in the Country4.; The growing Focus on Non-Fossil Fuel Sources.

6. What are the notable trends driving market growth?

Upcoming Upstream Activities are Likely to Drive the Market.

7. Are there any restraints impacting market growth?

4.; The Recycling Rate of Waste in Germany.

8. Can you provide examples of recent developments in the market?

In September 2021, Norwegian offshore vessel owner Solstad Offshore secured contracts for seven platform supply vessels in West Africa. The total firm duration of the contracts is approximately 1,000 vessel days, starting from the fourth quarter of 2021.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "West Africa Platform Supply Vessels Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the West Africa Platform Supply Vessels Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the West Africa Platform Supply Vessels Market?

To stay informed about further developments, trends, and reports in the West Africa Platform Supply Vessels Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence