Key Insights

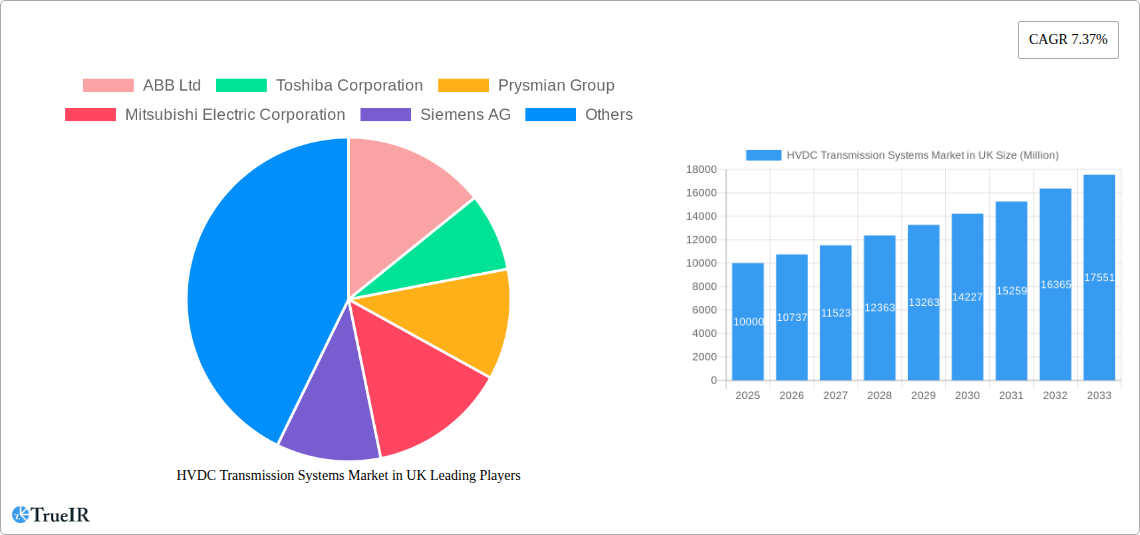

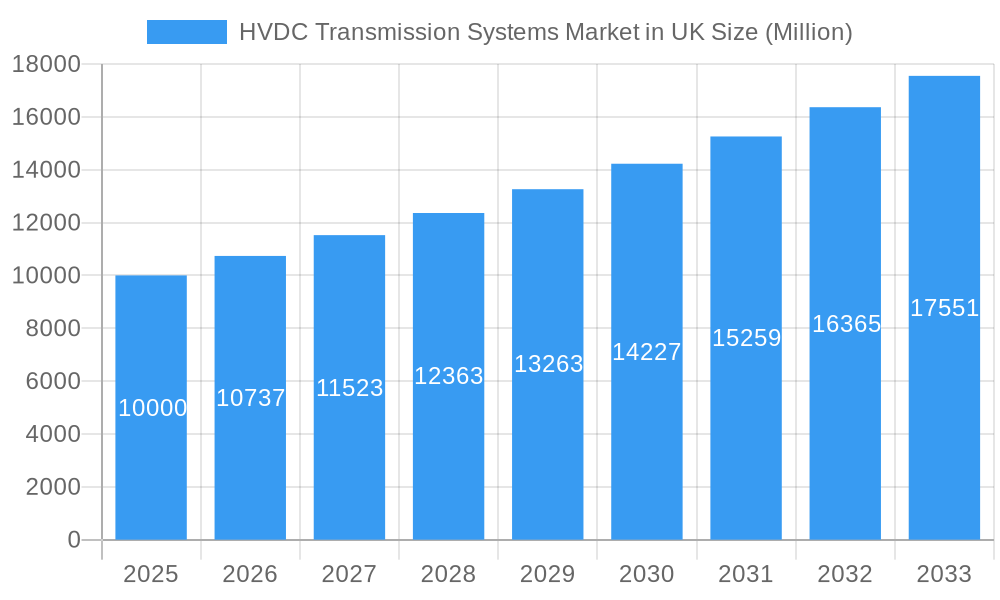

The United Kingdom's High Voltage Direct Current (HVDC) transmission systems market is set for substantial growth, propelled by key energy strategies and increasing demand for efficient power transfer. The market, valued at approximately £15.62 billion in 2025, is forecast to expand at a Compound Annual Growth Rate (CAGR) of 7.2% through 2033. This significant expansion is largely driven by the UK's ambitious renewable energy objectives, especially in offshore wind, requiring advanced grid infrastructure to connect remote generation sources to urban centers. Essential upgrades to the existing power grid for improved reliability and capacity, alongside greater integration of distributed energy resources, are also critical growth factors. Submarine HVDC cable investments are anticipated to lead, owing to the UK's extensive coastline and large-scale offshore wind farm developments. Converter stations, vital for HVDC conversion, will also attract considerable investment as the foundation of these sophisticated transmission networks.

HVDC Transmission Systems Market in UK Market Size (In Billion)

HVDC technology is paramount to the UK's energy transition, offering superior efficiency over High Voltage Alternating Current (HVAC) for long-distance power transmission. This reduces energy losses, fostering a more sustainable and cost-effective electricity supply. Leading companies such as Siemens AG, ABB Ltd, and Prysmian Group are actively engaged in the development and deployment of these advanced systems, indicating a competitive environment focused on innovation and project delivery. While the market benefits from strong government support for decarbonization and grid modernization, challenges including substantial upfront project costs and complexities in permitting and land acquisition must be addressed. Nevertheless, the prevailing trend points to sustained and accelerated adoption of HVDC transmission systems, crucial for securing the UK's energy future and meeting its climate targets.

HVDC Transmission Systems Market in UK Company Market Share

SEO-optimized report description for the UK's HVDC Transmission Systems Market, detailing market size, growth forecasts, and key drivers.

HVDC Transmission Systems Market in UK Market Structure & Competitive Landscape

The UK's High Voltage Direct Current (HVDC) transmission systems market exhibits a moderately concentrated structure, characterized by a blend of established global giants and specialized domestic players. Key innovators driving this dynamic include ABB Ltd, Toshiba Corporation, Prysmian Group, Mitsubishi Electric Corporation, Siemens AG, Alstom SA, Schneider Electric SE, Hitachi Ltd, and General Electric Company. The market's competitive intensity is fueled by continuous innovation in converter technologies, cable manufacturing, and grid integration solutions, essential for supporting the UK's ambitious renewable energy targets and grid modernization efforts. Regulatory impacts, primarily driven by the UK government's net-zero commitments and the Office of Gas and Electricity Markets (Ofgem)'s regulatory frameworks, significantly shape investment decisions and project timelines. The threat of product substitutes is relatively low for high-capacity, long-distance power transmission, where HVDC offers superior efficiency and environmental benefits over traditional High Voltage Alternating Current (HVDC) systems. End-user segmentation spans offshore wind farm connections, interconnector projects linking the UK to European grids, and critical national infrastructure upgrades. Mergers and acquisitions (M&A) activity, while not at an exceptionally high volume, plays a crucial role in market consolidation and technology acquisition, with an estimated xx M&A deals observed in the historical period. The market's evolving landscape necessitates strategic partnerships and a focus on advanced HVDC technologies to maintain a competitive edge.

HVDC Transmission Systems Market in UK Market Trends & Opportunities

The HVDC transmission systems market in the UK is poised for substantial expansion, driven by a confluence of technological advancements, strategic governmental policies, and the imperative to decarbonize the nation's energy infrastructure. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025–2033, reaching an estimated market size of £xx Billion by 2033, up from £xx Billion in 2025. This growth trajectory is underpinned by the increasing demand for efficient and reliable power transmission solutions, particularly for integrating large-scale renewable energy sources such as offshore wind farms. Technological shifts are a significant trend, with advancements in voltage source converter (VSC) technology enabling more flexible grid control, reduced environmental footprint, and enhanced capacity for managing intermittent renewable generation. Consumer preferences are increasingly aligned with sustainability and the reliable delivery of clean energy, creating a strong market pull for HVDC solutions that minimize energy losses and support grid stability. Competitive dynamics are intensifying, with major global players vying for lucrative contracts related to new offshore wind projects, interconnector developments, and grid upgrades. The UK's commitment to achieving net-zero emissions by 2050 acts as a powerful catalyst, creating numerous opportunities for HVDC deployment. Opportunities abound in the expansion of offshore wind capacity, necessitating robust grid connections. Furthermore, the development of new subsea and underground HVDC cables for interconnector projects, linking the UK to continental Europe and beyond, presents a significant growth avenue. The modernization of the existing UK power grid to enhance its resilience and capacity also requires advanced HVDC solutions. Emerging trends include the adoption of superconducting HVDC cables for even higher efficiency and capacity, although this is still in its nascent stages for widespread commercial application. The increasing focus on grid flexibility and the integration of distributed energy resources further amplifies the demand for HVDC technology's inherent advantages. The market penetration rate of HVDC technology, while already significant in specific applications like offshore wind, is expected to grow substantially as its economic and environmental benefits become more widely recognized and implemented across the broader transmission network.

Dominant Markets & Segments in HVDC Transmission Systems Market in UK

The HVDC Overhead Transmission System currently holds a dominant position within the UK's HVDC transmission landscape, largely due to its established infrastructure and widespread application in backbone grid reinforcement and the connection of onshore renewable generation. However, the Submarine HVDC Transmission System segment is experiencing the most rapid growth and is anticipated to become increasingly dominant in the coming years, driven by the UK's vast offshore wind resources and its strategic imperative to bolster energy independence through international interconnectors. The market for submarine systems is propelled by ambitious offshore wind farm developments located far from the onshore grid, requiring highly efficient and reliable subsea power transmission. Key growth drivers for this segment include government policies supporting offshore renewable energy deployment, such as Contracts for Difference (CfDs), which de-risk investments in large-scale offshore projects. The inherent capacity and lower energy losses over long distances make submarine HVDC the optimal solution for connecting these offshore powerhouses.

The HVDC Overhead Transmission System remains crucial for reinforcing the national grid and connecting onshore wind and solar farms. Its dominance is supported by existing land-based infrastructure and a mature supply chain for its components. However, environmental considerations and land-use planning can pose challenges for new overhead line projects.

The HVDC Underground Transmission System segment, while less dominant than overhead or submarine systems, is gaining traction for specific applications, particularly in urban areas or where overhead lines are impractical or undesirable due to visual impact or environmental concerns. Its growth is tied to localized grid upgrades and the need for discreet power transmission solutions.

In terms of components, Converter Stations are critical for both AC/DC conversion and voltage level adjustments, representing a significant portion of the market value. The increasing number and capacity of HVDC schemes directly translate to higher demand for sophisticated and high-capacity converter stations. The Transmission Medium (Cables) segment, encompassing both subsea and underground cables, is directly influenced by the volume and length of HVDC projects. The ongoing expansion of offshore wind and interconnector projects is driving substantial demand for advanced, high-voltage subsea cables, positioning this segment for considerable growth.

HVDC Transmission Systems Market in UK Product Analysis

The UK's HVDC transmission systems market is characterized by continuous product innovation aimed at enhancing efficiency, reliability, and environmental performance. Key technological advancements include the widespread adoption of Voltage Source Converters (VSCs) over LCC (Line Commutated Converters), offering superior grid control, black-start capabilities, and compatibility with weaker grids, making them ideal for integrating renewable energy sources. Innovations in converter station technology focus on reducing footprint, improving cooling systems, and increasing modularity for faster deployment. In the realm of transmission mediums, advancements in cable insulation materials and manufacturing processes are enabling higher voltage ratings and increased power transfer capacities for both submarine and underground cables, while also improving their durability and lifespan. These product innovations are crucial for meeting the demands of increasingly complex grid integration challenges, supporting the UK's transition to a low-carbon energy future.

Key Drivers, Barriers & Challenges in HVDC Transmission Systems Market in UK

Key Drivers:

- Ambitious Renewable Energy Targets: The UK's commitment to net-zero emissions by 2050 fuels massive investments in offshore wind and other renewable sources, necessitating robust HVDC infrastructure for efficient power transmission.

- Grid Modernization & Decarbonization: The need to upgrade an aging grid, enhance its resilience, and accommodate the intermittency of renewables drives the adoption of HVDC for its superior efficiency and controllability.

- Interconnector Projects: Strategic interconnector projects with continental Europe enhance energy security and market integration, requiring high-capacity HVDC links.

- Technological Advancements: Innovations in VSC technology and cable manufacturing are improving HVDC system performance and reducing costs.

Barriers & Challenges:

- High Initial Capital Costs: HVDC projects, particularly converter stations, require substantial upfront investment, posing a financial hurdle.

- Regulatory Complexity & Permitting: Navigating the intricate regulatory landscape and obtaining permits for large-scale transmission projects can be time-consuming and complex.

- Supply Chain Constraints: The global demand for specialized HVDC components, especially high-voltage cables and converter technologies, can lead to supply chain bottlenecks and extended lead times.

- Skilled Workforce Shortage: A lack of specialized engineers and technicians with expertise in HVDC systems can impede project execution and maintenance.

- Environmental & Land-Use Concerns: Routing of overhead lines can face public opposition and environmental impact assessments, while undergrounding can be cost-prohibitive for long distances.

Growth Drivers in the HVDC Transmission Systems Market in UK Market

The UK HVDC transmission systems market is propelled by strong growth drivers. Foremost is the UK's ambitious renewable energy strategy, particularly the expansion of offshore wind farms, which necessitates efficient, long-distance power transmission capabilities that HVDC excels at. Government policies and incentives aimed at decarbonization and energy security further bolster investment in HVDC infrastructure. Technological advancements, such as the increased efficiency and flexibility of Voltage Source Converters (VSCs), are making HVDC a more attractive and cost-effective solution for grid integration. The need to upgrade and modernize the existing national grid to enhance its capacity, reliability, and resilience against climate change impacts also serves as a significant growth driver. Furthermore, the development of interconnector projects to link the UK with other European energy markets to improve energy security and market efficiency directly drives demand for HVDC technology.

Challenges Impacting HVDC Transmission Systems Market in UK Growth

Several challenges can impact the growth of the HVDC transmission systems market in the UK. Regulatory complexities and lengthy permitting processes for new transmission lines and converter stations can significantly delay project timelines and increase costs. Supply chain constraints, particularly for specialized components like high-voltage cables and advanced converter technologies, can lead to extended lead times and price volatility. The substantial upfront capital investment required for HVDC projects remains a significant barrier, especially for smaller developers or in less economically viable projects. Competition from established AC transmission technologies, though less efficient for long-distance high-capacity transmission, can still influence decision-making in certain contexts. Finally, a shortage of skilled personnel in the HVDC sector, from design and installation to operation and maintenance, poses a considerable challenge to the timely and efficient execution of projects.

Key Players Shaping the HVDC Transmission Systems Market in UK Market

- ABB Ltd

- Toshiba Corporation

- Prysmian Group

- Mitsubishi Electric Corporation

- Siemens AG

- Alstom SA

- Schneider Electric SE

- Hitachi Ltd

- General Electric Company

Significant HVDC Transmission Systems Market in UK Industry Milestones

- October 2022: Vattenfall signed a contract with Siemens Energy and Aker Solutions AS to deliver grid connection infrastructure for the Norfolk Boreas Offshore Wind Farm off the British coast. It plans to deliver its first power in 2027, with a capacity of 1.4 GW. This milestone highlights the increasing scale of offshore wind projects and the crucial role of HVDC in their grid connection.

- 2023: Continued development and awarding of contracts for multiple offshore wind farm grid connection projects, significantly boosting the demand for submarine HVDC cables and converter stations.

- 2024: Progress on the Viking Link interconnector, a major HVDC subsea cable connecting the UK to Denmark, nearing its full operational capacity, showcasing the strategic importance of international HVDC connections.

- 2025 (Estimated): Anticipated commencement of construction for new phases of major offshore wind developments, further driving procurement of HVDC transmission systems.

Future Outlook for HVDC Transmission Systems Market in UK Market

The future outlook for the UK's HVDC transmission systems market is exceptionally robust, driven by the nation's unwavering commitment to renewable energy and grid modernization. Strategic investments in offshore wind, coupled with the ongoing need to replace aging infrastructure and enhance grid stability, will continue to fuel demand for HVDC solutions. Opportunities will arise from the development of increasingly larger and more distant offshore wind farms, necessitating longer and higher-capacity submarine HVDC cables. The expansion of international interconnectors to bolster energy security and market integration will also remain a significant growth catalyst. Technological advancements in converter stations and cable technology will further enhance the efficiency and cost-effectiveness of HVDC, making it the preferred choice for critical grid infrastructure. The market is poised for sustained expansion, playing a pivotal role in the UK's transition to a low-carbon and resilient energy future.

HVDC Transmission Systems Market in UK Segmentation

-

1. Transmission Type

- 1.1. Submarine HVDC Transmission System

- 1.2. HVDC Overhead Transmission System

- 1.3. HVDC Underground Transmission System

-

2. Component

- 2.1. Converter Stations

- 2.2. Transmission Medium (Cables)

HVDC Transmission Systems Market in UK Segmentation By Geography

- 1. United Kingdom

HVDC Transmission Systems Market in UK Regional Market Share

Geographic Coverage of HVDC Transmission Systems Market in UK

HVDC Transmission Systems Market in UK REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Integration Of Renewable Energy Generation4.; Aging Power Grids And Investments In Transmission And Distribution Infrastructure

- 3.3. Market Restrains

- 3.3.1. Lack Of Investor Confidence Due To Sociopolitical Instability In Some Countries

- 3.4. Market Trends

- 3.4.1. Submarine HVDC Transmission System to Grow at the Fastest Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global HVDC Transmission Systems Market in UK Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Transmission Type

- 5.1.1. Submarine HVDC Transmission System

- 5.1.2. HVDC Overhead Transmission System

- 5.1.3. HVDC Underground Transmission System

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Converter Stations

- 5.2.2. Transmission Medium (Cables)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Transmission Type

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ABB Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Toshiba Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Prysmian Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mitsubishi Electric Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Alstom SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Schneider Electric SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hitachi Ltd *List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 General Electric Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 ABB Ltd

List of Figures

- Figure 1: Global HVDC Transmission Systems Market in UK Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: United Kingdom HVDC Transmission Systems Market in UK Revenue (billion), by Transmission Type 2025 & 2033

- Figure 3: United Kingdom HVDC Transmission Systems Market in UK Revenue Share (%), by Transmission Type 2025 & 2033

- Figure 4: United Kingdom HVDC Transmission Systems Market in UK Revenue (billion), by Component 2025 & 2033

- Figure 5: United Kingdom HVDC Transmission Systems Market in UK Revenue Share (%), by Component 2025 & 2033

- Figure 6: United Kingdom HVDC Transmission Systems Market in UK Revenue (billion), by Country 2025 & 2033

- Figure 7: United Kingdom HVDC Transmission Systems Market in UK Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global HVDC Transmission Systems Market in UK Revenue billion Forecast, by Transmission Type 2020 & 2033

- Table 2: Global HVDC Transmission Systems Market in UK Revenue billion Forecast, by Component 2020 & 2033

- Table 3: Global HVDC Transmission Systems Market in UK Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global HVDC Transmission Systems Market in UK Revenue billion Forecast, by Transmission Type 2020 & 2033

- Table 5: Global HVDC Transmission Systems Market in UK Revenue billion Forecast, by Component 2020 & 2033

- Table 6: Global HVDC Transmission Systems Market in UK Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the HVDC Transmission Systems Market in UK?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the HVDC Transmission Systems Market in UK?

Key companies in the market include ABB Ltd, Toshiba Corporation, Prysmian Group, Mitsubishi Electric Corporation, Siemens AG, Alstom SA, Schneider Electric SE, Hitachi Ltd *List Not Exhaustive, General Electric Company.

3. What are the main segments of the HVDC Transmission Systems Market in UK?

The market segments include Transmission Type, Component.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.62 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Integration Of Renewable Energy Generation4.; Aging Power Grids And Investments In Transmission And Distribution Infrastructure.

6. What are the notable trends driving market growth?

Submarine HVDC Transmission System to Grow at the Fastest Rate.

7. Are there any restraints impacting market growth?

Lack Of Investor Confidence Due To Sociopolitical Instability In Some Countries.

8. Can you provide examples of recent developments in the market?

In October 2022, Vattenfall signed a contract with Siemens Energy and Aker Solutions AS to deliver grid connection infrastructure for the Norfolk Boreas Offshore Wind Farm off the British coast. It plans to deliver its first power in 2027, with a capacity of 1.4 GW.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "HVDC Transmission Systems Market in UK," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the HVDC Transmission Systems Market in UK report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the HVDC Transmission Systems Market in UK?

To stay informed about further developments, trends, and reports in the HVDC Transmission Systems Market in UK, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence