Key Insights

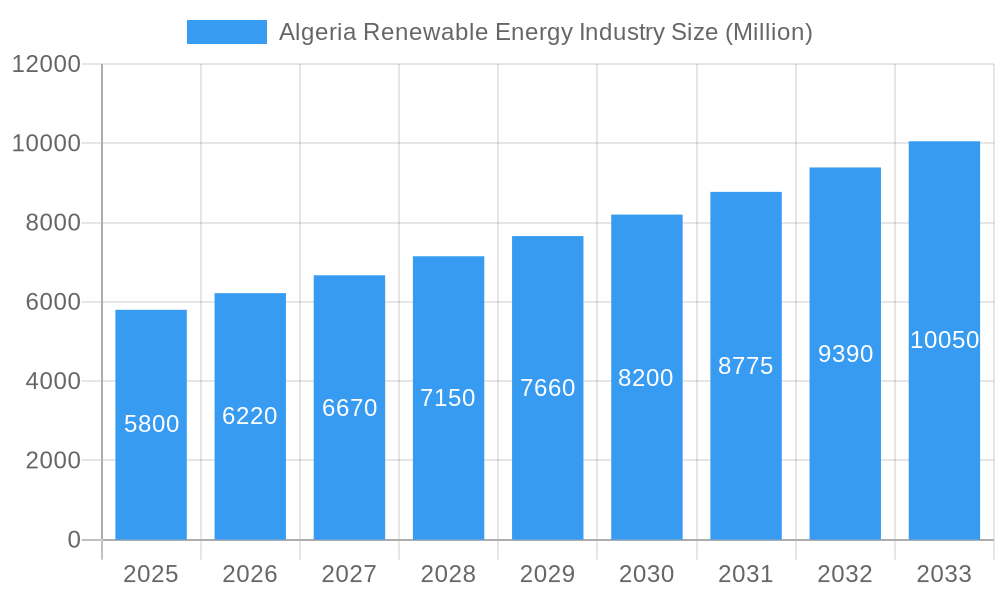

Algeria's renewable energy sector is set for substantial growth, driven by national diversification strategies and abundant solar and wind resources. The market is projected to reach $15.2 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 8.7% from 2025 to 2033. Key investments in solar photovoltaic (PV) and wind power aim to decrease hydrocarbon export reliance, satisfy rising domestic energy needs, and support climate change mitigation. Supportive government policies, including ambitious renewable energy targets and streamlined investment frameworks, are attracting significant domestic and international interest. These efforts are cultivating a favorable environment for utility-scale solar and wind farms, associated infrastructure, and grid modernization, vital for enhancing energy security and economic diversification.

Algeria Renewable Energy Industry Market Size (In Billion)

The rising cost-competitiveness of renewable technologies and increasing global demand for sustainable energy solutions are further propelling this expansion. Algeria's strategic location and extensive land resources offer significant potential for large-scale renewable energy projects. The period from 2019 to 2024 was foundational, marked by policy development and initial project exploration. 2025 serves as a pivotal base year, with accelerated project deployment and market maturation expected. The forecast period through 2033 positions Algeria as a key North African renewable energy player, attracting foreign direct investment and fostering local expertise. This expansion will not only meet domestic energy demands but also open avenues for regional energy cooperation and potential renewable electricity exports.

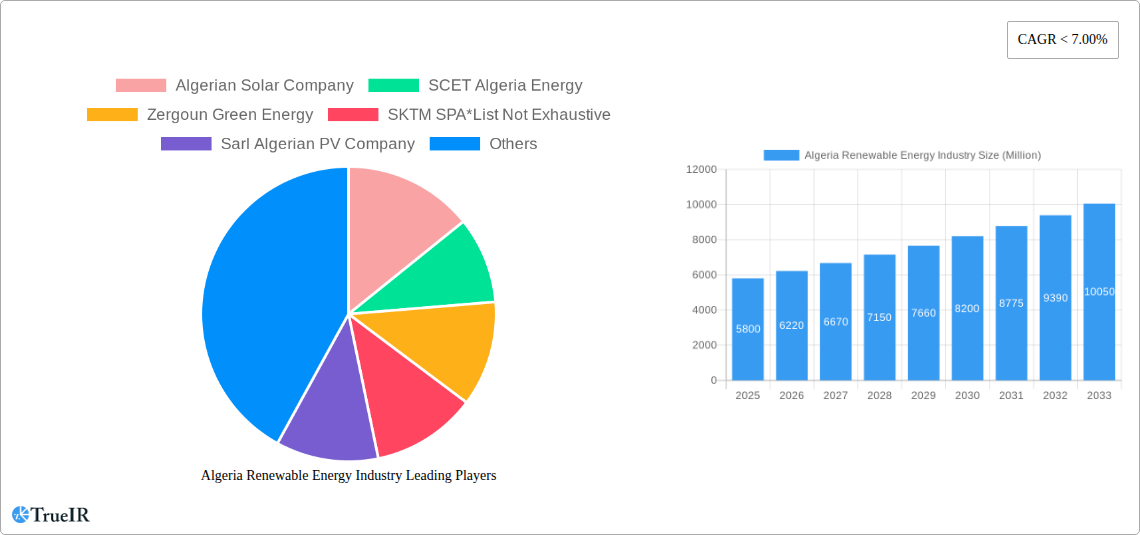

Algeria Renewable Energy Industry Company Market Share

Algeria Renewable Energy Industry Report: Market Analysis, Trends, and Future Outlook (2019-2033)

Unlock the potential of Algeria's burgeoning renewable energy sector with this comprehensive market analysis report. Spanning from 2019 to 2033, this study provides deep insights into market structure, competitive dynamics, emerging trends, and future opportunities. Leveraging high-volume keywords such as "Algeria solar energy," "Algeria wind power," "renewable energy investment Algeria," and "green energy transition Algeria," this report is optimized for search engines and designed to engage industry professionals, investors, and policymakers.

Algeria Renewable Energy Industry Market Structure & Competitive Landscape

The Algerian renewable energy market, while nascent, is characterized by a dynamic and evolving competitive landscape. Market concentration is currently moderate, with a significant presence of state-backed entities alongside an increasing number of private sector players. Innovation drivers are primarily centered around cost reduction in solar photovoltaic (PV) technologies and the exploration of wind energy potential. Regulatory impacts are profound, with government policies and incentives playing a crucial role in shaping market entry and expansion. Product substitutes, while limited in the short term, include the ongoing reliance on fossil fuels, necessitating a clear strategic advantage for renewable solutions. End-user segmentation is gradually diversifying, moving beyond large-scale industrial applications to include commercial and eventually residential sectors. Mergers and acquisitions (M&A) trends are still in their early stages, with potential for consolidation as the market matures. The report will delve into the specific concentration ratios of key players and analyze the volume of M&A activities within the historical and forecast periods, providing a quantitative foundation for strategic decision-making. Qualitative insights will explore the strategic rationale behind potential future M&A, including technology acquisition and market share expansion.

Algeria Renewable Energy Industry Market Trends & Opportunities

The Algerian renewable energy industry is poised for substantial growth, driven by a confluence of factors that are reshaping its market size and penetration. The market is projected to experience a robust Compound Annual Growth Rate (CAGR) of approximately 15% over the forecast period of 2025-2033, a testament to the country's commitment to diversifying its energy mix. Technological shifts are at the forefront, with significant advancements in solar PV efficiency and the increasing viability of wind energy installations, especially in the northern coastal regions and the Saharan plains. Consumer preferences are slowly but surely leaning towards sustainable energy solutions, spurred by environmental concerns and the potential for long-term cost savings. Competitive dynamics are intensifying, as both domestic and international companies vie for a share of this promising market. Market penetration rates, while currently at a modest XX%, are expected to surge as large-scale projects gain traction and grid infrastructure is enhanced.

The government's proactive stance in developing new legislation for a green energy transition, as highlighted in June 2022, is a critical trend that will accelerate this growth. This legislative push aims to foster an environment conducive to investment and innovation, addressing economic efficiency and resource diversity. The increasing adoption of smart grid technologies and energy storage solutions will further enhance the reliability and attractiveness of renewable energy sources, mitigating intermittency concerns. Opportunities abound in utility-scale solar farms, distributed solar PV systems for industrial and commercial use, and wind energy projects capitalizing on Algeria's considerable wind resources. Furthermore, the development of localized manufacturing and supply chains for renewable energy components presents a significant economic opportunity, fostering job creation and technological self-sufficiency. The integration of renewable energy into the existing oil and gas infrastructure, as exemplified by Eni and Sonatrach's initiatives, signals a strategic diversification that will unlock new avenues for expansion. The growing demand for clean energy in sectors such as desalination, agriculture, and tourism will also contribute to market expansion, creating a multifaceted growth trajectory for the Algerian renewable energy industry.

Dominant Markets & Segments in Algeria Renewable Energy Industry

The Solar energy segment is currently the most dominant and fastest-growing sector within Algeria's renewable energy industry. This dominance is propelled by a combination of abundant solar irradiance across vast desert regions and supportive government policies aimed at leveraging this natural resource. The country's strategic focus on solar power is evident in numerous ongoing and planned projects.

- Key Growth Drivers for Solar Dominance:

- High Solar Irradiance: Algeria receives an average of over 3,000 hours of sunshine annually, with solar radiation levels often exceeding 5 kWh/m²/day in many regions, making it ideal for solar PV and thermal applications.

- Government Targets and Incentives: The Algerian government has set ambitious renewable energy targets, with solar power being a cornerstone of these plans. Favorable feed-in tariffs, tax exemptions, and streamlined permitting processes are actively encouraging investment.

- Cost Competitiveness: The declining global costs of solar PV technology have made it increasingly competitive against traditional energy sources, further bolstering its adoption.

- Industrial Applications: As seen with the Eni and Sonatrach project at Bir Rebaa North, there is a significant opportunity for solar energy to power upstream oil and gas operations, reducing reliance on fossil fuels for self-consumption and contributing to decarbonization efforts within the energy sector itself. This integration strategy provides a stable demand base and facilitates larger-scale deployments.

- Scalability and Technological Maturity: Solar PV technology is highly scalable, suitable for both large utility-scale power plants and smaller distributed generation systems. Its maturity ensures reliability and predictable performance.

While solar currently leads, the Wind energy segment holds immense untapped potential and is expected to witness significant growth in the coming years, particularly in regions with consistent wind speeds, such as the northern coastal areas and certain inland plateaus. Investment in wind farms is projected to increase as the country diversifies its renewable energy portfolio. The Hydro energy segment, though established in certain areas, has a more limited potential for large-scale expansion due to geographical constraints. However, it plays a vital role in the current renewable energy mix, providing a stable baseload. Other Types of renewable energy, including biomass and geothermal, are in their nascent stages of development but represent future growth avenues as technological advancements and market demand evolve. The dominance of solar is thus driven by a strategic alignment of natural resources, policy support, and economic viability, setting a clear path for its continued leadership in Algeria's green energy transition.

Algeria Renewable Energy Industry Product Analysis

The Algerian renewable energy industry's product offerings are rapidly evolving, with a focus on enhancing efficiency and reducing costs. Solar photovoltaic (PV) modules, ranging from crystalline silicon to emerging thin-film technologies, are central to the market. Innovations in module design, such as bifacial panels and advanced encapsulation techniques, are maximizing energy capture. In the wind sector, the focus is on larger, more efficient turbine designs optimized for Algeria's specific wind conditions. Energy storage solutions, particularly battery energy storage systems (BESS) using lithium-ion technology, are becoming crucial for grid stability and reliable power delivery. Competitive advantages are being built on the basis of durability in harsh environmental conditions, competitive pricing for large-scale projects, and the integration of smart monitoring and control systems.

Key Drivers, Barriers & Challenges in Algeria Renewable Energy Industry

Key Drivers: The Algerian renewable energy industry is primarily propelled by a strong governmental mandate to diversify its energy portfolio away from heavy reliance on hydrocarbons. Ambitious national targets for renewable energy deployment, coupled with attractive incentive schemes, are significant drivers. Technological advancements leading to cost reductions in solar PV and wind energy technologies also play a crucial role, making renewables increasingly economically viable. Furthermore, growing awareness of climate change and the need for sustainable development are fostering a supportive environment for green energy initiatives.

Barriers & Challenges: Significant barriers to growth include challenges in grid infrastructure, which requires substantial upgrades to accommodate the intermittent nature of renewables. Bureaucratic hurdles and the complexity of regulatory frameworks can sometimes slow down project development and investment. Securing consistent and long-term financing for large-scale projects remains a challenge, as does the development of a robust domestic supply chain for renewable energy components. Competition from established fossil fuel industries also presents a hurdle.

Growth Drivers in the Algeria Renewable Energy Industry Market

The growth drivers for Algeria's renewable energy market are multifaceted and strategically aligned. Governmental commitment is paramount, with clear national targets and policies designed to encourage investment and deployment of renewable technologies. The declining costs of renewable energy technologies, particularly solar PV, have made them increasingly competitive against traditional energy sources, making them economically attractive for both utilities and end-users. Algeria's abundant natural resources, especially high solar irradiance and significant wind potential, provide a strong foundation for large-scale development. Furthermore, the increasing global and domestic emphasis on energy security and diversification, driven by fluctuating fossil fuel prices and the imperative to reduce carbon emissions, creates a robust demand for renewable energy solutions. The strategic integration of renewable energy into existing energy infrastructure, as demonstrated by initiatives in the oil and gas sector, also opens up new avenues for growth.

Challenges Impacting Algeria Renewable Energy Industry Growth

Several challenges are impacting the growth trajectory of Algeria's renewable energy industry. Grid integration and stability remain a significant concern, as the existing infrastructure needs substantial upgrades to effectively manage the intermittency of solar and wind power. Regulatory complexities and bureaucratic processes can create delays and uncertainty for investors, hindering the pace of project development. Financing and investment attraction for large-scale renewable projects can be challenging, requiring innovative financial instruments and sustained investor confidence. Supply chain development for components and skilled labor is still in its nascent stages, potentially leading to cost overruns and project delays. Finally, the established dominance of fossil fuels in the national economy presents a continuous competitive pressure and necessitates strong policy support for renewables to gain significant traction.

Key Players Shaping the Algeria Renewable Energy Industry Market

- Algerian Solar Company

- SCET Algeria Energy

- Zergoun Green Energy

- SKTM SPA

- Sarl Algerian PV Company

Significant Algeria Renewable Energy Industry Industry Milestones

- November 2022: Eni and Sonatrach, Algeria's national gas and oil suppliers, announced plans to construct a new 10 MW solar project at the Bir Rebaa North (BRN) oil production complex in the Berkine basin in southeastern Algeria. With an existing 10 MW facility launched in 2018 at the BRN complex, the new solar installation will have more than double the renewable energy available to power upstream oil field processes.

- June 2022: According to Algeria's minister of renewable energy, Benattou Ziane, the government has begun work on new legislation for the transition to green energy to support the transformation in all aspects. The country intends to accomplish a smooth and safe energy transition based on economic efficiency and diverse resources.

Future Outlook for Algeria Renewable Energy Industry Market

The future outlook for Algeria's renewable energy industry is exceptionally bright, characterized by sustained growth and increasing diversification. Strategic opportunities lie in expanding utility-scale solar and wind projects, leveraging the country's vast natural resources. Further development of distributed solar PV systems for commercial and industrial applications, alongside grid modernization efforts, will enhance energy security and drive down costs. The government's ongoing commitment to green energy legislation and investment incentives will be critical catalysts. As the market matures, we anticipate increased foreign direct investment, the growth of local manufacturing capabilities, and the potential for Algeria to become a regional leader in renewable energy technology and deployment. The integration of energy storage solutions will further solidify the reliability and attractiveness of renewable sources, paving the way for a greener and more sustainable energy future.

Algeria Renewable Energy Industry Segmentation

-

1. Source Type

- 1.1. Solar

- 1.2. Wind

- 1.3. Hydro

- 1.4. Other Types

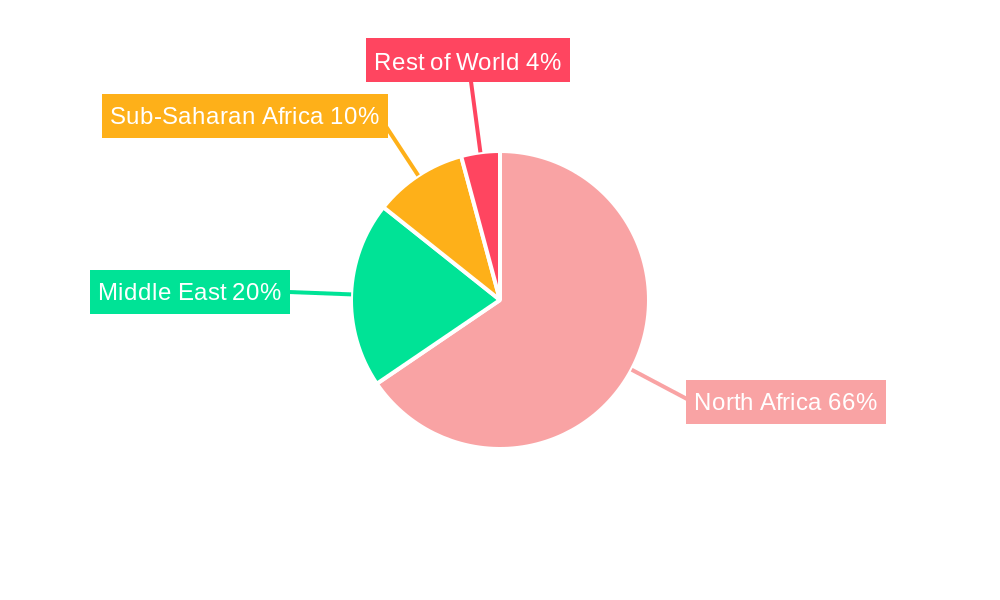

Algeria Renewable Energy Industry Segmentation By Geography

- 1. Algeria

Algeria Renewable Energy Industry Regional Market Share

Geographic Coverage of Algeria Renewable Energy Industry

Algeria Renewable Energy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Industrialization across the World4.; Expansion and Development of New Power Plants

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Solar Energy to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Algeria Renewable Energy Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source Type

- 5.1.1. Solar

- 5.1.2. Wind

- 5.1.3. Hydro

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Algeria

- 5.1. Market Analysis, Insights and Forecast - by Source Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Algerian Solar Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SCET Algeria Energy

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Zergoun Green Energy

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SKTM SPA*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sarl Algerian PV Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Algerian Solar Company

List of Figures

- Figure 1: Algeria Renewable Energy Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Algeria Renewable Energy Industry Share (%) by Company 2025

List of Tables

- Table 1: Algeria Renewable Energy Industry Revenue billion Forecast, by Source Type 2020 & 2033

- Table 2: Algeria Renewable Energy Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Algeria Renewable Energy Industry Revenue billion Forecast, by Source Type 2020 & 2033

- Table 4: Algeria Renewable Energy Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Algeria Renewable Energy Industry?

The projected CAGR is approximately 8.7%.

2. Which companies are prominent players in the Algeria Renewable Energy Industry?

Key companies in the market include Algerian Solar Company, SCET Algeria Energy, Zergoun Green Energy, SKTM SPA*List Not Exhaustive, Sarl Algerian PV Company.

3. What are the main segments of the Algeria Renewable Energy Industry?

The market segments include Source Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.2 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Industrialization across the World4.; Expansion and Development of New Power Plants.

6. What are the notable trends driving market growth?

Solar Energy to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Renewable Energy.

8. Can you provide examples of recent developments in the market?

November 2022: Eni and Sonatrach, Algeria's national gas and oil suppliers, announced plans to construct a new 10 MW solar project at the Bir Rebaa North (BRN) oil production complex in the Berkine basin in southeastern Algeria. With an existing 10 MW facility launched in 2018 at the BRN complex, the new solar installation will have more than double the renewable energy available to power upstream oil field processes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Algeria Renewable Energy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Algeria Renewable Energy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Algeria Renewable Energy Industry?

To stay informed about further developments, trends, and reports in the Algeria Renewable Energy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence