Key Insights

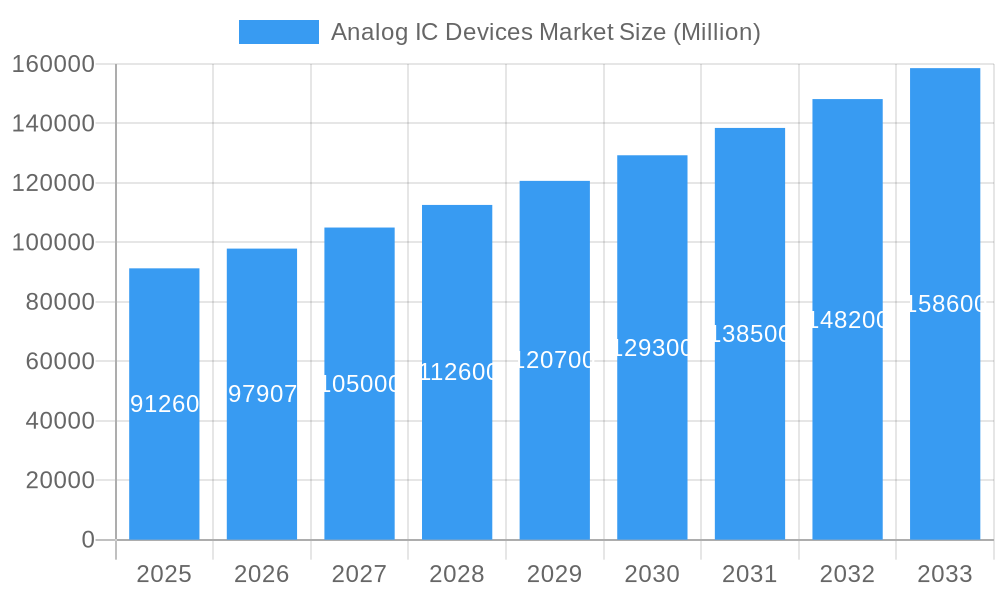

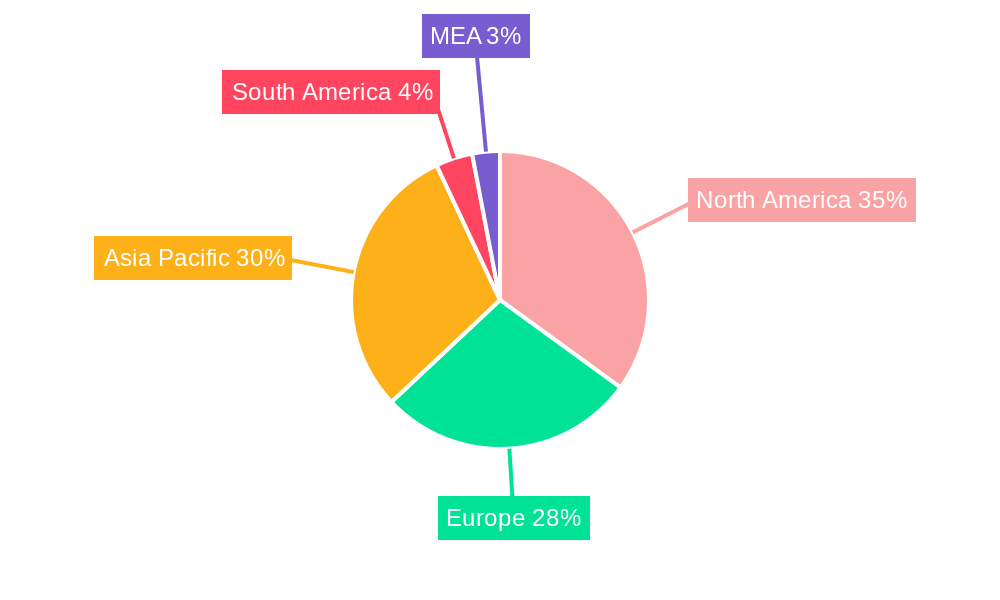

The Analog Integrated Circuit (IC) Devices market is experiencing robust growth, projected to reach a substantial size driven by increasing demand across diverse sectors. The market's Compound Annual Growth Rate (CAGR) of 7.28% from 2019 to 2024 indicates a consistent upward trajectory, expected to continue throughout the forecast period (2025-2033). Key drivers include the proliferation of smart devices, the rise of the Internet of Things (IoT), and the ongoing advancement of automotive electronics, particularly in electric vehicles and advanced driver-assistance systems (ADAS). The increasing integration of analog ICs within these applications necessitates higher performance and efficiency, stimulating innovation and market expansion. Significant growth is anticipated in segments like Application-Specific ICs (ASICs) tailored for specific functionalities and Amplifiers/Comparators for signal conditioning, reflecting the growing need for customized solutions and improved signal processing capabilities. Geographically, North America and Asia Pacific are expected to be major contributors to market growth, fueled by substantial investments in technology and manufacturing within these regions. However, potential restraints include supply chain disruptions and the cyclical nature of the electronics industry, which could influence market dynamics in the coming years.

Analog IC Devices Market Market Size (In Billion)

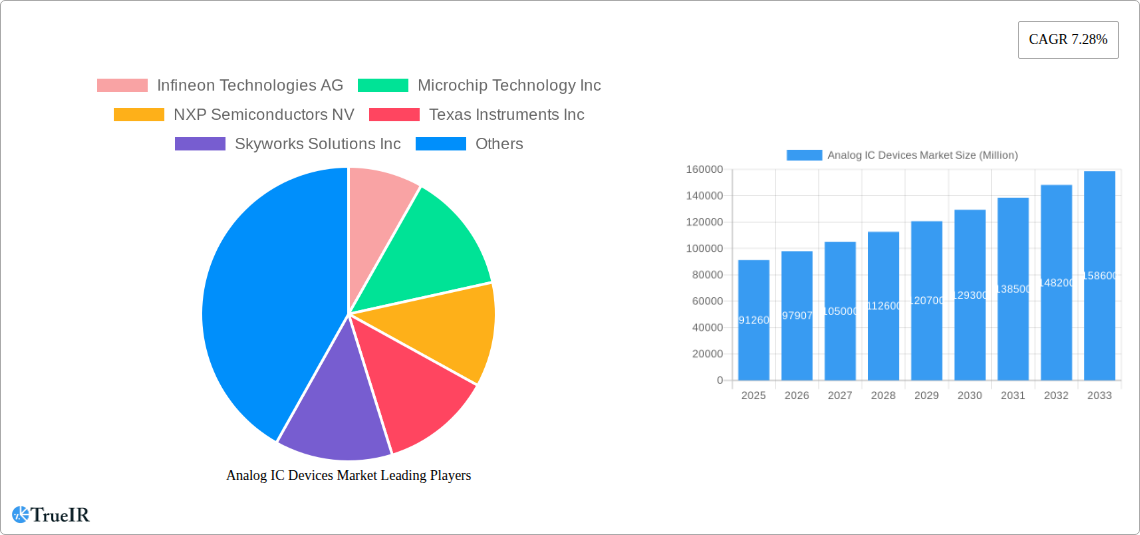

The competitive landscape is characterized by established players like Texas Instruments, Analog Devices, and Infineon Technologies, alongside emerging companies focusing on niche applications. Continuous innovation in semiconductor technology, focusing on miniaturization, power efficiency, and enhanced performance, is crucial for maintaining a competitive edge. The market segmentation by application (consumer electronics, automotive, communication, and computer) provides valuable insights into sector-specific trends and growth potentials. Furthermore, the regional breakdown allows for focused strategies tailored to the specific needs and market characteristics of each geographic area. Understanding these regional nuances and adapting to local market dynamics is key for companies aiming to establish a strong presence within the Analog IC Devices market. Market expansion is anticipated to be fueled by the ongoing integration of sophisticated technologies in diverse applications, ensuring continued market expansion in the long term.

Analog IC Devices Market Company Market Share

Analog IC Devices Market: A Comprehensive Report (2019-2033)

This dynamic report provides a comprehensive analysis of the Analog IC Devices Market, offering invaluable insights for industry stakeholders, investors, and researchers. With a detailed examination spanning the period from 2019 to 2033, this study unveils the market's structure, competitive landscape, trends, and future growth potential. The report leverages extensive data analysis, incorporating both quantitative and qualitative research to deliver a holistic understanding of this rapidly evolving market. The Base Year is 2025, with the Estimated Year also set at 2025, and a Forecast Period of 2025-2033 based on the Historical Period of 2019-2024. The market size is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx%.

Analog IC Devices Market Market Structure & Competitive Landscape

The Analog IC Devices market exhibits a moderately concentrated structure, with key players holding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a competitive landscape with room for both established players and new entrants. Innovation is a crucial driver, with companies constantly developing advanced ICs to meet the growing demand for high-performance electronics across various applications. Regulatory changes, particularly concerning energy efficiency and environmental standards, significantly impact the market. Product substitutes, such as digital ICs, pose a competitive threat, necessitating continuous product innovation. End-user segmentation plays a pivotal role, with the automotive and consumer electronics sectors being the primary revenue generators. The market has witnessed several significant mergers and acquisitions (M&A) in recent years, contributing to market consolidation. The total value of M&A transactions in the last 5 years is estimated at xx Million.

- High Market Concentration: The top 5 players account for approximately xx% of the market share.

- Innovation Drivers: Miniaturization, increased performance, reduced power consumption, and enhanced functionality drive innovation.

- Regulatory Impacts: Stringent environmental and safety regulations impact product design and manufacturing.

- Product Substitutes: Digital ICs are emerging as a potential substitute, driving competitive pressures.

- End-User Segmentation: Automotive, Consumer Electronics, Industrial, and Communication sectors dominate demand.

- M&A Trends: Consolidation through acquisitions has intensified in recent years.

Analog IC Devices Market Market Trends & Opportunities

The Analog IC Devices market is experiencing significant growth driven by the escalating demand for high-performance, low-power electronic devices across numerous applications. Technological advancements, including the integration of AI and IoT capabilities, are reshaping the market landscape. Consumer preferences for smaller, more energy-efficient, and feature-rich devices are driving innovation in analog IC design. The market is becoming increasingly competitive, with established players and new entrants vying for market share. This competitive pressure fuels innovation and drives down costs, benefiting consumers. The market size is expected to reach xx Million by 2033. The automotive sector demonstrates the highest growth potential, driven by the increasing adoption of advanced driver-assistance systems (ADAS) and electric vehicles (EVs). Technological shifts, like the rise of 5G and advancements in power management ICs, are unlocking new opportunities for market expansion. The market penetration rate for automotive applications is projected to reach xx% by 2033.

Dominant Markets & Segments in Analog IC Devices Market

The automotive segment represents the largest share of the Analog IC Devices market, driven by the increasing demand for advanced driver-assistance systems (ADAS), electric vehicles (EVs), and improved fuel efficiency. The Asia-Pacific region leads in terms of market size and growth rate, fueled by strong economic growth, rising disposable incomes, and expanding consumer electronics markets.

Key Growth Drivers:

- Automotive: ADAS, EVs, and increasing electronic content in vehicles.

- Consumer Electronics: Smartphones, wearables, and other consumer gadgets.

- Industrial Automation: Rising automation across various industrial sectors.

- Communication Infrastructure: Expansion of 5G networks and IoT deployments.

Dominant Segments:

- Type: Application-Specific ICs are the fastest-growing segment due to their tailored functionalities.

- Application: Automotive leads in terms of revenue, followed by consumer electronics.

Analog IC Devices Market Product Analysis

The market is witnessing continuous innovation in analog ICs, with new products offering enhanced performance, reduced power consumption, and improved integration capabilities. This innovation encompasses miniaturization, higher precision, wider bandwidths, and enhanced noise reduction. The competitive landscape is characterized by strong competition on features, performance, and pricing, leading to rapid product improvement and broader availability.

Key Drivers, Barriers & Challenges in Analog IC Devices Market

Key Drivers:

- Technological advancements: miniaturization, higher performance, lower power consumption.

- Increasing demand for electronics in various sectors: automotive, consumer electronics, industrial automation.

- Government initiatives: supporting technological innovation and industry development.

Key Barriers and Challenges:

- Supply chain disruptions: impacting component availability and pricing.

- Intense competition: among established players and new entrants.

- Regulatory compliance: increasing regulatory scrutiny impacting product development and deployment.

Growth Drivers in the Analog IC Devices Market Market

Growth is driven by increasing demand from automotive and consumer electronics, adoption of advanced technologies, and supportive government policies promoting technological advancement.

Challenges Impacting Analog IC Devices Market Growth

Challenges include supply chain vulnerabilities, heightened competition, and regulatory complexities impacting product development and market access.

Key Players Shaping the Analog IC Devices Market Market

- Infineon Technologies AG

- Microchip Technology Inc

- NXP Semiconductors NV

- Texas Instruments Inc

- Skyworks Solutions Inc

- STMicroelectronics NV

- ON Semiconductor

- Renesas Electronics Corporation

- Qorvo Inc

- Richtek Technology Corporation (MediaTek Inc )

- Analog Devices Inc

Significant Analog IC Devices Market Industry Milestones

- October 2023: Vitesco Technologies and Infineon Technologies AG announced a strategic partnership for next-generation automotive controllers, strengthening Infineon's position in the automotive sector.

- September 2023: Intelligent Hardware Korea (IHWK) and Microchip Technology collaborated on a neuromorphic analog computing platform, showcasing advancements in AI and neuromorphic computing.

Future Outlook for Analog IC Devices Market Market

The Analog IC Devices market is poised for sustained growth, driven by technological innovations, rising demand across diverse sectors, and increasing adoption of advanced electronic systems. Strategic partnerships, product diversification, and geographic expansion will be key for companies to capitalize on the market's potential. The market is expected to witness continuous innovation and a growing demand for specialized analog ICs.

Analog IC Devices Market Segmentation

-

1. Type

-

1.1. General-Purpose IC

- 1.1.1. Interface

- 1.1.2. Power Management

- 1.1.3. Signal Conversion

- 1.1.4. Amplifiers/Comparators (Signal Conditioning)

-

1.2. Application-Specific IC

-

1.2.1. Consumer

- 1.2.1.1. Audio/Video

- 1.2.1.2. Digital Still Camera and Camcorder

- 1.2.1.3. Other Consumers

-

1.2.2. Automotive

- 1.2.2.1. Infotainment

- 1.2.2.2. Other Infotainment

-

1.2.3. Communication

- 1.2.3.1. Cell Phone

- 1.2.3.2. Infrastructure

- 1.2.3.3. Wired Communication

- 1.2.3.4. Short Range

- 1.2.3.5. Other Wireless

-

1.2.4. Computer

- 1.2.4.1. Computer System and Display

- 1.2.4.2. Computer Periphery

- 1.2.4.3. Storage

- 1.2.4.4. Other Computers

- 1.2.5. Industrial and Others

-

1.2.1. Consumer

-

1.1. General-Purpose IC

Analog IC Devices Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Analog IC Devices Market Regional Market Share

Geographic Coverage of Analog IC Devices Market

Analog IC Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Penetration of Smartphones

- 3.2.2 Feature Phones

- 3.2.3 and Tablets

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations; Lack of Skilled Radiation Professionals

- 3.4. Market Trends

- 3.4.1. Cell Phone within Communication Segment to Hold Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Analog IC Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. General-Purpose IC

- 5.1.1.1. Interface

- 5.1.1.2. Power Management

- 5.1.1.3. Signal Conversion

- 5.1.1.4. Amplifiers/Comparators (Signal Conditioning)

- 5.1.2. Application-Specific IC

- 5.1.2.1. Consumer

- 5.1.2.1.1. Audio/Video

- 5.1.2.1.2. Digital Still Camera and Camcorder

- 5.1.2.1.3. Other Consumers

- 5.1.2.2. Automotive

- 5.1.2.2.1. Infotainment

- 5.1.2.2.2. Other Infotainment

- 5.1.2.3. Communication

- 5.1.2.3.1. Cell Phone

- 5.1.2.3.2. Infrastructure

- 5.1.2.3.3. Wired Communication

- 5.1.2.3.4. Short Range

- 5.1.2.3.5. Other Wireless

- 5.1.2.4. Computer

- 5.1.2.4.1. Computer System and Display

- 5.1.2.4.2. Computer Periphery

- 5.1.2.4.3. Storage

- 5.1.2.4.4. Other Computers

- 5.1.2.5. Industrial and Others

- 5.1.2.1. Consumer

- 5.1.1. General-Purpose IC

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Australia and New Zealand

- 5.2.5. Latin America

- 5.2.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Analog IC Devices Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. General-Purpose IC

- 6.1.1.1. Interface

- 6.1.1.2. Power Management

- 6.1.1.3. Signal Conversion

- 6.1.1.4. Amplifiers/Comparators (Signal Conditioning)

- 6.1.2. Application-Specific IC

- 6.1.2.1. Consumer

- 6.1.2.1.1. Audio/Video

- 6.1.2.1.2. Digital Still Camera and Camcorder

- 6.1.2.1.3. Other Consumers

- 6.1.2.2. Automotive

- 6.1.2.2.1. Infotainment

- 6.1.2.2.2. Other Infotainment

- 6.1.2.3. Communication

- 6.1.2.3.1. Cell Phone

- 6.1.2.3.2. Infrastructure

- 6.1.2.3.3. Wired Communication

- 6.1.2.3.4. Short Range

- 6.1.2.3.5. Other Wireless

- 6.1.2.4. Computer

- 6.1.2.4.1. Computer System and Display

- 6.1.2.4.2. Computer Periphery

- 6.1.2.4.3. Storage

- 6.1.2.4.4. Other Computers

- 6.1.2.5. Industrial and Others

- 6.1.2.1. Consumer

- 6.1.1. General-Purpose IC

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Analog IC Devices Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. General-Purpose IC

- 7.1.1.1. Interface

- 7.1.1.2. Power Management

- 7.1.1.3. Signal Conversion

- 7.1.1.4. Amplifiers/Comparators (Signal Conditioning)

- 7.1.2. Application-Specific IC

- 7.1.2.1. Consumer

- 7.1.2.1.1. Audio/Video

- 7.1.2.1.2. Digital Still Camera and Camcorder

- 7.1.2.1.3. Other Consumers

- 7.1.2.2. Automotive

- 7.1.2.2.1. Infotainment

- 7.1.2.2.2. Other Infotainment

- 7.1.2.3. Communication

- 7.1.2.3.1. Cell Phone

- 7.1.2.3.2. Infrastructure

- 7.1.2.3.3. Wired Communication

- 7.1.2.3.4. Short Range

- 7.1.2.3.5. Other Wireless

- 7.1.2.4. Computer

- 7.1.2.4.1. Computer System and Display

- 7.1.2.4.2. Computer Periphery

- 7.1.2.4.3. Storage

- 7.1.2.4.4. Other Computers

- 7.1.2.5. Industrial and Others

- 7.1.2.1. Consumer

- 7.1.1. General-Purpose IC

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Analog IC Devices Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. General-Purpose IC

- 8.1.1.1. Interface

- 8.1.1.2. Power Management

- 8.1.1.3. Signal Conversion

- 8.1.1.4. Amplifiers/Comparators (Signal Conditioning)

- 8.1.2. Application-Specific IC

- 8.1.2.1. Consumer

- 8.1.2.1.1. Audio/Video

- 8.1.2.1.2. Digital Still Camera and Camcorder

- 8.1.2.1.3. Other Consumers

- 8.1.2.2. Automotive

- 8.1.2.2.1. Infotainment

- 8.1.2.2.2. Other Infotainment

- 8.1.2.3. Communication

- 8.1.2.3.1. Cell Phone

- 8.1.2.3.2. Infrastructure

- 8.1.2.3.3. Wired Communication

- 8.1.2.3.4. Short Range

- 8.1.2.3.5. Other Wireless

- 8.1.2.4. Computer

- 8.1.2.4.1. Computer System and Display

- 8.1.2.4.2. Computer Periphery

- 8.1.2.4.3. Storage

- 8.1.2.4.4. Other Computers

- 8.1.2.5. Industrial and Others

- 8.1.2.1. Consumer

- 8.1.1. General-Purpose IC

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Analog IC Devices Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. General-Purpose IC

- 9.1.1.1. Interface

- 9.1.1.2. Power Management

- 9.1.1.3. Signal Conversion

- 9.1.1.4. Amplifiers/Comparators (Signal Conditioning)

- 9.1.2. Application-Specific IC

- 9.1.2.1. Consumer

- 9.1.2.1.1. Audio/Video

- 9.1.2.1.2. Digital Still Camera and Camcorder

- 9.1.2.1.3. Other Consumers

- 9.1.2.2. Automotive

- 9.1.2.2.1. Infotainment

- 9.1.2.2.2. Other Infotainment

- 9.1.2.3. Communication

- 9.1.2.3.1. Cell Phone

- 9.1.2.3.2. Infrastructure

- 9.1.2.3.3. Wired Communication

- 9.1.2.3.4. Short Range

- 9.1.2.3.5. Other Wireless

- 9.1.2.4. Computer

- 9.1.2.4.1. Computer System and Display

- 9.1.2.4.2. Computer Periphery

- 9.1.2.4.3. Storage

- 9.1.2.4.4. Other Computers

- 9.1.2.5. Industrial and Others

- 9.1.2.1. Consumer

- 9.1.1. General-Purpose IC

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Analog IC Devices Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. General-Purpose IC

- 10.1.1.1. Interface

- 10.1.1.2. Power Management

- 10.1.1.3. Signal Conversion

- 10.1.1.4. Amplifiers/Comparators (Signal Conditioning)

- 10.1.2. Application-Specific IC

- 10.1.2.1. Consumer

- 10.1.2.1.1. Audio/Video

- 10.1.2.1.2. Digital Still Camera and Camcorder

- 10.1.2.1.3. Other Consumers

- 10.1.2.2. Automotive

- 10.1.2.2.1. Infotainment

- 10.1.2.2.2. Other Infotainment

- 10.1.2.3. Communication

- 10.1.2.3.1. Cell Phone

- 10.1.2.3.2. Infrastructure

- 10.1.2.3.3. Wired Communication

- 10.1.2.3.4. Short Range

- 10.1.2.3.5. Other Wireless

- 10.1.2.4. Computer

- 10.1.2.4.1. Computer System and Display

- 10.1.2.4.2. Computer Periphery

- 10.1.2.4.3. Storage

- 10.1.2.4.4. Other Computers

- 10.1.2.5. Industrial and Others

- 10.1.2.1. Consumer

- 10.1.1. General-Purpose IC

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East and Africa Analog IC Devices Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. General-Purpose IC

- 11.1.1.1. Interface

- 11.1.1.2. Power Management

- 11.1.1.3. Signal Conversion

- 11.1.1.4. Amplifiers/Comparators (Signal Conditioning)

- 11.1.2. Application-Specific IC

- 11.1.2.1. Consumer

- 11.1.2.1.1. Audio/Video

- 11.1.2.1.2. Digital Still Camera and Camcorder

- 11.1.2.1.3. Other Consumers

- 11.1.2.2. Automotive

- 11.1.2.2.1. Infotainment

- 11.1.2.2.2. Other Infotainment

- 11.1.2.3. Communication

- 11.1.2.3.1. Cell Phone

- 11.1.2.3.2. Infrastructure

- 11.1.2.3.3. Wired Communication

- 11.1.2.3.4. Short Range

- 11.1.2.3.5. Other Wireless

- 11.1.2.4. Computer

- 11.1.2.4.1. Computer System and Display

- 11.1.2.4.2. Computer Periphery

- 11.1.2.4.3. Storage

- 11.1.2.4.4. Other Computers

- 11.1.2.5. Industrial and Others

- 11.1.2.1. Consumer

- 11.1.1. General-Purpose IC

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Infineon Technologies AG

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Microchip Technology Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 NXP Semiconductors NV

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Texas Instruments Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Skyworks Solutions Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 STMicroelectronics NV

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 ON Semiconductor

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Renesas Electronics Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Qorvo Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Richtek Technology Corporation (MediaTek Inc )

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Analog Devices Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Global Analog IC Devices Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Analog IC Devices Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Analog IC Devices Market Revenue (Million), by Type 2025 & 2033

- Figure 4: North America Analog IC Devices Market Volume (K Unit), by Type 2025 & 2033

- Figure 5: North America Analog IC Devices Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Analog IC Devices Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Analog IC Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 8: North America Analog IC Devices Market Volume (K Unit), by Country 2025 & 2033

- Figure 9: North America Analog IC Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Analog IC Devices Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Analog IC Devices Market Revenue (Million), by Type 2025 & 2033

- Figure 12: Europe Analog IC Devices Market Volume (K Unit), by Type 2025 & 2033

- Figure 13: Europe Analog IC Devices Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Analog IC Devices Market Volume Share (%), by Type 2025 & 2033

- Figure 15: Europe Analog IC Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 16: Europe Analog IC Devices Market Volume (K Unit), by Country 2025 & 2033

- Figure 17: Europe Analog IC Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Analog IC Devices Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Analog IC Devices Market Revenue (Million), by Type 2025 & 2033

- Figure 20: Asia Analog IC Devices Market Volume (K Unit), by Type 2025 & 2033

- Figure 21: Asia Analog IC Devices Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Asia Analog IC Devices Market Volume Share (%), by Type 2025 & 2033

- Figure 23: Asia Analog IC Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Asia Analog IC Devices Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Asia Analog IC Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Analog IC Devices Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Australia and New Zealand Analog IC Devices Market Revenue (Million), by Type 2025 & 2033

- Figure 28: Australia and New Zealand Analog IC Devices Market Volume (K Unit), by Type 2025 & 2033

- Figure 29: Australia and New Zealand Analog IC Devices Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Australia and New Zealand Analog IC Devices Market Volume Share (%), by Type 2025 & 2033

- Figure 31: Australia and New Zealand Analog IC Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Australia and New Zealand Analog IC Devices Market Volume (K Unit), by Country 2025 & 2033

- Figure 33: Australia and New Zealand Analog IC Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Australia and New Zealand Analog IC Devices Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Latin America Analog IC Devices Market Revenue (Million), by Type 2025 & 2033

- Figure 36: Latin America Analog IC Devices Market Volume (K Unit), by Type 2025 & 2033

- Figure 37: Latin America Analog IC Devices Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Latin America Analog IC Devices Market Volume Share (%), by Type 2025 & 2033

- Figure 39: Latin America Analog IC Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 40: Latin America Analog IC Devices Market Volume (K Unit), by Country 2025 & 2033

- Figure 41: Latin America Analog IC Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Latin America Analog IC Devices Market Volume Share (%), by Country 2025 & 2033

- Figure 43: Middle East and Africa Analog IC Devices Market Revenue (Million), by Type 2025 & 2033

- Figure 44: Middle East and Africa Analog IC Devices Market Volume (K Unit), by Type 2025 & 2033

- Figure 45: Middle East and Africa Analog IC Devices Market Revenue Share (%), by Type 2025 & 2033

- Figure 46: Middle East and Africa Analog IC Devices Market Volume Share (%), by Type 2025 & 2033

- Figure 47: Middle East and Africa Analog IC Devices Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East and Africa Analog IC Devices Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Middle East and Africa Analog IC Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Analog IC Devices Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Analog IC Devices Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Analog IC Devices Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Global Analog IC Devices Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Analog IC Devices Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Global Analog IC Devices Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Analog IC Devices Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 7: Global Analog IC Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Analog IC Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: Global Analog IC Devices Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Analog IC Devices Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: Global Analog IC Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Analog IC Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global Analog IC Devices Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Analog IC Devices Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 15: Global Analog IC Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Analog IC Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Global Analog IC Devices Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Analog IC Devices Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 19: Global Analog IC Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Analog IC Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: Global Analog IC Devices Market Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Analog IC Devices Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 23: Global Analog IC Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Analog IC Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Analog IC Devices Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global Analog IC Devices Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 27: Global Analog IC Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Analog IC Devices Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Analog IC Devices Market?

The projected CAGR is approximately 7.28%.

2. Which companies are prominent players in the Analog IC Devices Market?

Key companies in the market include Infineon Technologies AG, Microchip Technology Inc, NXP Semiconductors NV, Texas Instruments Inc, Skyworks Solutions Inc, STMicroelectronics NV, ON Semiconductor, Renesas Electronics Corporation, Qorvo Inc, Richtek Technology Corporation (MediaTek Inc ), Analog Devices Inc.

3. What are the main segments of the Analog IC Devices Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 91.26 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Penetration of Smartphones. Feature Phones. and Tablets.

6. What are the notable trends driving market growth?

Cell Phone within Communication Segment to Hold Major Share.

7. Are there any restraints impacting market growth?

Stringent Government Regulations; Lack of Skilled Radiation Professionals.

8. Can you provide examples of recent developments in the market?

October 2023 - Vitesco Technologies and Infineon Technologies AG announced the reinforcement of their longstanding collaboration. In the forthcoming generation of master and zone controllers for electric-electronic vehicle architectures (E/E architectures), as well as in their new electrification system solutions, Vitesco Technologies will incorporate the AURIX TC4x microcontroller family from Infineon. This strategic partnership, set to commence in 2027, is expected to span multiple years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Analog IC Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Analog IC Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Analog IC Devices Market?

To stay informed about further developments, trends, and reports in the Analog IC Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence