Key Insights

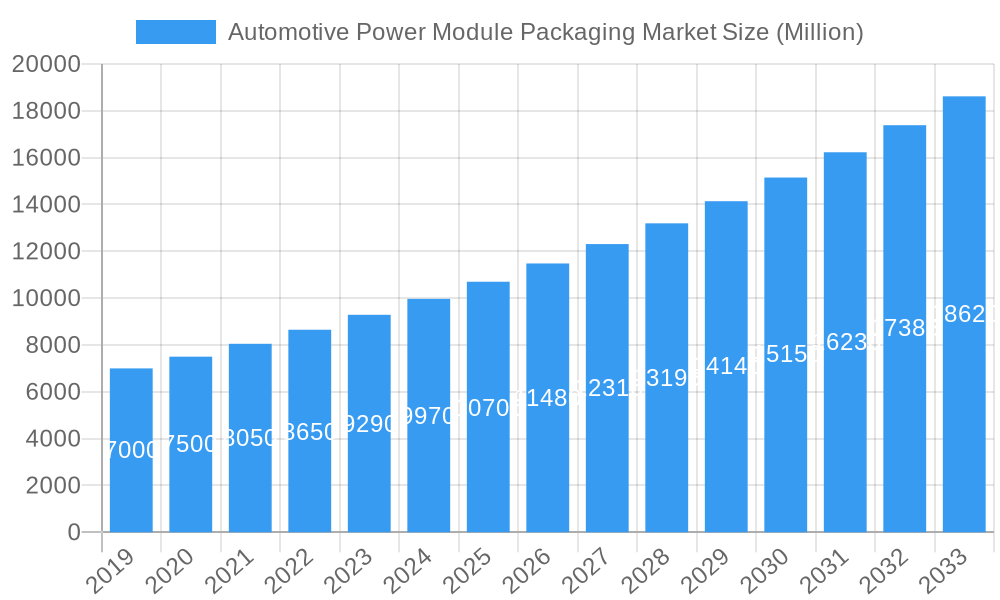

The global Automotive Power Module Packaging market is projected to reach $9.86 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 14.3%. This significant growth is propelled by the widespread adoption of electric and hybrid electric vehicles, requiring advanced power module packaging for efficient propulsion systems. The increasing demand for sophisticated safety systems, ADAS, and in-car infotainment, all dependent on robust power management, further fuels market expansion. Global shifts towards sustainable transportation and stringent emission regulations are key catalysts, driving innovation in compact, high-performance, and reliable power module solutions.

Automotive Power Module Packaging Market Market Size (In Billion)

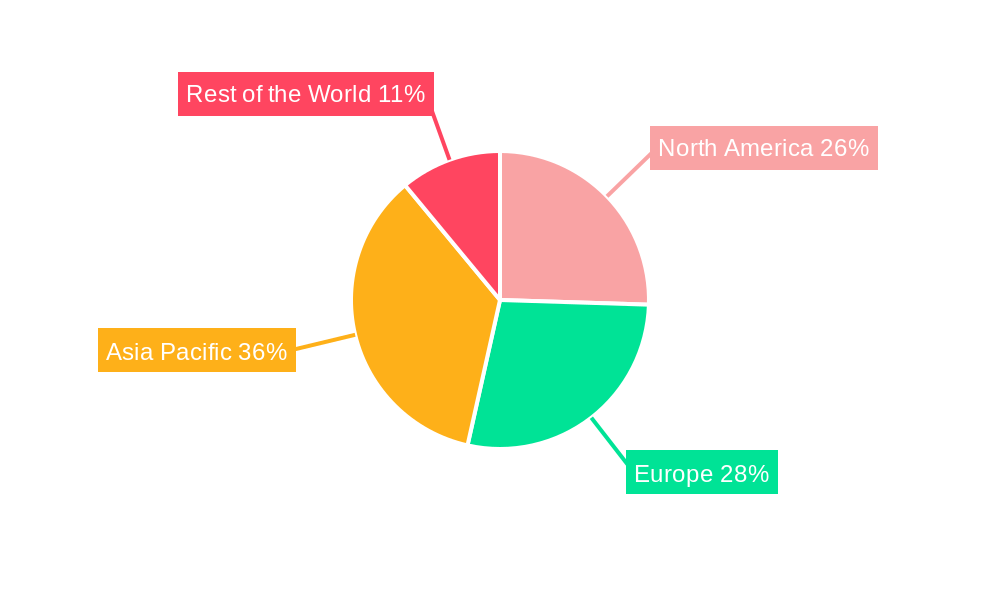

The market is segmented by Intelligent Power Modules (IPMs) and SiC (Silicon Carbide) Modules, recognized for their superior efficiency and thermal management. GaN (Gallium Nitride) modules represent a significant growth area, promising enhanced performance for future automotive applications. Challenges include the high cost of advanced materials like SiC and GaN and manufacturing complexities. However, continuous R&D and increased production are expected to alleviate these cost concerns. Key industry players, including Infineon Technologies, STMicroelectronics, and Fuji Electric, are investing in R&D and strategic alliances. Asia Pacific leads market growth due to its automotive manufacturing dominance, followed by Europe and North America, driven by electrification initiatives.

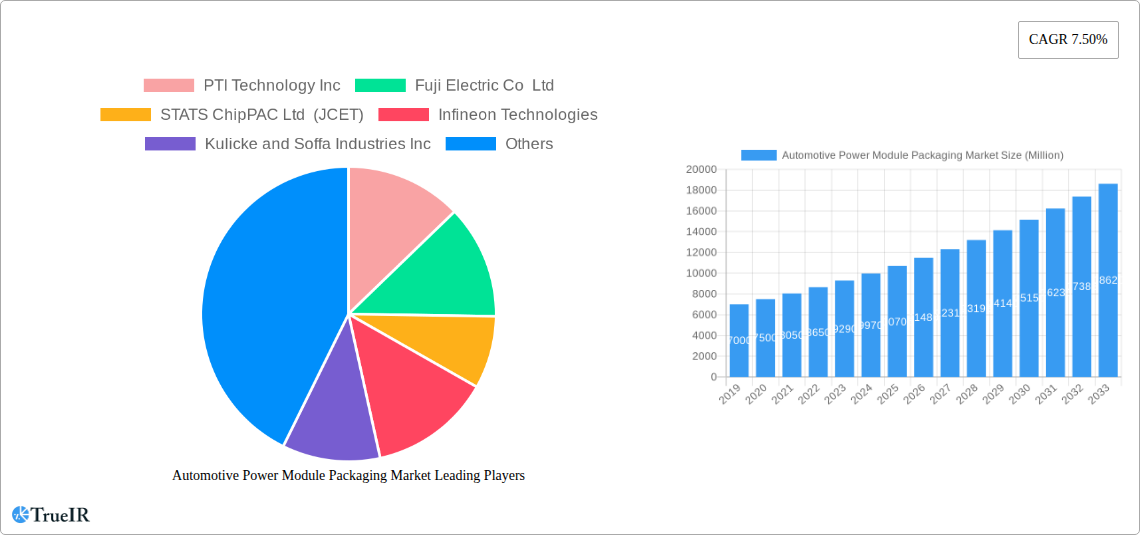

Automotive Power Module Packaging Market Company Market Share

Automotive Power Module Packaging Market: Size, Share, and Trends Analysis to 2033

This report offers a comprehensive analysis of the global Automotive Power Module Packaging Market, detailing market dynamics, growth trends, and competitive landscapes. The market's substantial expansion is driven by vehicle electrification and semiconductor advancements. This analysis covers the historical period 2019-2024, with 2025 as the base and estimated year, and forecasts market performance through 2033.

Automotive Power Module Packaging Market Market Structure & Competitive Landscape

The Automotive Power Module Packaging Market is characterized by a moderate to high concentration, with key players like Infineon Technologies, STMicroelectronics, Fuji Electric Co Ltd, Toshiba Electronic Device & Storage Corporation, and Semikron holding significant market share. Innovation drivers are primarily focused on enhancing power density, thermal management, and reliability for increasingly demanding electric vehicle (EV) applications. Regulatory impacts, particularly concerning emissions standards and safety certifications, are shaping product development and market entry strategies. Product substitutes, such as discrete semiconductor devices, are gradually being displaced by integrated power modules offering superior performance and space efficiency. End-user segmentation is dominated by the passenger car and commercial vehicle segments, with a growing contribution from specialized applications like autonomous driving systems and advanced driver-assistance systems (ADAS). Merger and acquisition (M&A) trends are evident as companies seek to consolidate market positions, acquire new technologies, and expand their geographical reach. M&A volumes are projected to remain robust, driven by the need for vertical integration and access to next-generation semiconductor materials like Silicon Carbide (SiC) and Gallium Nitride (GaN). The market concentration ratio is estimated at XX% for the top five players in the base year 2025.

Automotive Power Module Packaging Market Market Trends & Opportunities

The Automotive Power Module Packaging Market is experiencing a period of unprecedented growth, with an estimated market size expected to reach XX Million USD by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025–2033). This expansion is fundamentally driven by the global surge in electric vehicle (EV) adoption, which necessitates sophisticated and efficient power electronics. Governments worldwide are implementing stringent emissions regulations and offering incentives for EV purchases, further accelerating this trend. Technological shifts are central to market evolution, with a pronounced move towards wide-bandgap (WBG) semiconductor materials like Silicon Carbide (SiC) and Gallium Nitride (GaN). These materials offer superior efficiency, higher operating temperatures, and reduced size compared to traditional silicon-based solutions, making them ideal for high-performance EV powertrains, charging systems, and battery management systems. Consumer preferences are increasingly aligning with sustainable mobility solutions, creating a strong demand for EVs and, consequently, the power modules that enable them. Competitive dynamics are intensifying, with established semiconductor manufacturers and specialized power module providers vying for market leadership. Opportunities abound for companies that can offer innovative packaging solutions that enhance thermal performance, reduce form factors, and improve reliability in harsh automotive environments. The integration of advanced cooling technologies and novel interconnect methods are emerging as key differentiators. Furthermore, the increasing complexity of automotive electrical architectures, driven by advanced driver-assistance systems (ADAS), autonomous driving capabilities, and in-car entertainment systems, is creating new avenues for power module integration and demand. The penetration rate of WBG power modules in the EV market is projected to grow significantly, from approximately XX% in 2025 to XX% by 2033.

Dominant Markets & Segments in Automotive Power Module Packaging Market

The Automotive Power Module Packaging Market is segmented by type, with SiC Module and GaN Module segments demonstrating the most significant growth potential and dominance in the forecast period. The dominance of these WBG materials is attributed to their superior performance characteristics essential for the demanding requirements of electric vehicles.

SiC Module: Silicon Carbide modules are rapidly becoming the preferred choice for high-power applications within EVs, including inverters, on-board chargers, and DC-DC converters. Their ability to handle higher voltages and temperatures, coupled with reduced switching losses, leads to increased vehicle range and faster charging times. The robust infrastructure development in charging networks and the increasing demand for long-range EVs are key growth drivers for SiC modules. Government policies promoting EV adoption and investments in semiconductor manufacturing facilities further bolster this segment. The market size for SiC modules is projected to reach XX Million USD by 2033.

GaN Module: Gallium Nitride modules, while still in earlier stages of automotive adoption compared to SiC, are gaining traction in applications requiring high switching frequencies and compact form factors, such as DC-DC converters and auxiliary power units. Their potential for further miniaturization and efficiency gains presents significant opportunities. The ongoing research and development in GaN technology, along with its cost reduction, will be crucial for its widespread adoption in the automotive sector. The market size for GaN modules is anticipated to reach XX Million USD by 2033.

Intelligent Power Module (IPM): Intelligent Power Modules, which integrate power switching devices with control and protection circuitry, continue to be a vital segment, particularly in conventional automotive powertrains and hybrid vehicles. They offer ease of integration and enhanced system reliability. However, their growth is expected to be outpaced by WBG modules in the EV segment. The market size for IPMs is estimated to reach XX Million USD by 2033.

Others (IGBT, FET): This category, encompassing Insulated-Gate Bipolar Transistors (IGBTs) and Field-Effect Transistors (FETs) based on silicon, will see a gradual decline in market share within the EV powertrain domain as WBG technologies mature and become more cost-competitive. However, they will continue to find applications in specific automotive subsystems where their cost-effectiveness and established performance are sufficient. The market size for these traditional technologies is projected to reach XX Million USD by 2033.

Geographically, Asia Pacific is expected to remain the dominant region, driven by its strong position in automotive manufacturing, significant EV market penetration, and government support for semiconductor innovation. North America and Europe are also crucial markets, with strong policy initiatives and consumer demand for electrified vehicles.

Automotive Power Module Packaging Market Product Analysis

Product innovations in the Automotive Power Module Packaging Market are centered on enhancing thermal management and power density. Advanced packaging techniques, such as sintering and copper clip bonding, are crucial for dissipating heat effectively, enabling higher power output from smaller footprints. Applications span across EV powertrains, battery management systems, on-board chargers, and DC-DC converters, where reliability and efficiency are paramount. Competitive advantages stem from the ability to integrate WBG materials (SiC and GaN) with robust packaging, offering superior performance, extended lifespan, and reduced system costs for automakers.

Key Drivers, Barriers & Challenges in Automotive Power Module Packaging Market

Key Drivers:

- Surging Electric Vehicle (EV) Adoption: The primary growth catalyst is the exponential increase in EV sales globally, driven by environmental concerns and supportive government policies.

- Technological Advancements in WBG Semiconductors: The maturation and cost reduction of Silicon Carbide (SiC) and Gallium Nitride (GaN) technologies are enabling higher efficiency and performance in power modules.

- Stringent Emission Regulations: Global mandates on reducing carbon emissions are compelling automakers to transition to electrified powertrains.

Key Barriers & Challenges:

- High Cost of WBG Materials: Despite declining, the initial cost of SiC and GaN power modules remains higher than traditional silicon-based solutions, posing a barrier to mass adoption in price-sensitive segments.

- Supply Chain Complexities and Raw Material Availability: Ensuring a consistent and secure supply of raw materials for WBG semiconductor fabrication can be challenging.

- Thermal Management and Reliability: Automotive environments are harsh, and ensuring the long-term reliability and effective thermal management of high-power modules is a critical engineering challenge.

- Standardization and Interoperability: The lack of universal standards in power module interfaces and packaging can create integration challenges for automakers.

Growth Drivers in the Automotive Power Module Packaging Market Market

The Automotive Power Module Packaging Market is propelled by several key drivers. The relentless global push towards vehicle electrification, fueled by stringent emission standards and consumer demand for sustainable transportation, is the most significant factor. Advancements in wide-bandgap (WBG) semiconductor materials like Silicon Carbide (SiC) and Gallium Nitride (GaN) are enabling power modules with superior efficiency, higher power density, and improved thermal performance. Government incentives for EV adoption and infrastructure development, such as charging stations, further accelerate market growth. Technological innovation in packaging techniques, aimed at enhancing reliability and reducing the form factor of power modules, also plays a crucial role.

Challenges Impacting Automotive Power Module Packaging Market Growth

Several challenges impact the growth of the Automotive Power Module Packaging Market. The high initial cost of advanced materials like SiC and GaN compared to traditional silicon-based solutions remains a significant barrier, especially for mass-market vehicle segments. Ensuring the long-term reliability and effective thermal management of these high-power modules in the demanding automotive environment is a complex engineering challenge. Supply chain disruptions, coupled with potential shortages of critical raw materials for semiconductor manufacturing, pose a risk to production volumes. Furthermore, the need for standardization in power module interfaces and packaging across the industry can lead to integration complexities for automakers.

Key Players Shaping the Automotive Power Module Packaging Market Market

- PTI Technology Inc

- Fuji Electric Co Ltd

- STATS ChipPAC Ltd (JCET)

- Infineon Technologies

- Kulicke and Soffa Industries Inc

- STMicroelectronics

- Amkor Technology

- Toshiba Electronic Device & Storage Corporation

- Starpower Semiconductor Ltd

- Semikron

Significant Automotive Power Module Packaging Market Industry Milestones

- 2023 Q1: Infineon Technologies announces a new generation of SiC power modules designed for higher voltage applications in commercial EVs, enhancing efficiency by XX%.

- 2023 Q2: STMicroelectronics expands its GaN transistor portfolio for automotive applications, targeting advanced DC-DC converters.

- 2023 Q3: Fuji Electric Co Ltd unveils an advanced packaging technology for IGBT modules, improving thermal performance and increasing power density by XX%.

- 2024 Q1: Amkor Technology announces strategic partnerships to enhance its semiconductor packaging capabilities for WBG devices in the automotive sector.

- 2024 Q2: Toshiba Electronic Device & Storage Corporation launches a new series of SiC MOSFET modules with integrated gate driver ICs, simplifying system design.

- 2024 Q3: Semikron introduces a modular power electronic system for hydrogen fuel cell vehicles, showcasing its versatility beyond battery electric vehicles.

Future Outlook for Automotive Power Module Packaging Market Market

The future outlook for the Automotive Power Module Packaging Market is exceptionally positive, fueled by the accelerating transition to electric and hybrid vehicles. Strategic opportunities lie in the continued development and cost reduction of wide-bandgap semiconductor technologies, enabling even greater efficiency and performance. Companies that can offer integrated solutions, advanced thermal management, and robust reliability will be well-positioned for success. The increasing demand for sophisticated power electronics in autonomous driving and advanced driver-assistance systems presents further growth avenues. The market is expected to see sustained investment in research and development, capacity expansion, and strategic collaborations to meet the evolving needs of the automotive industry.

Automotive Power Module Packaging Market Segmentation

-

1. Type

- 1.1. Intelligent Power Module (IPM)

- 1.2. SiC Module

- 1.3. GaN Module

- 1.4. Others (IGBT,FET)

Automotive Power Module Packaging Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Automotive Power Module Packaging Market Regional Market Share

Geographic Coverage of Automotive Power Module Packaging Market

Automotive Power Module Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Electric Vehicle and Hybrid Electric Vehicle to Drive the Automotive Power Module Packaging; Growing Demand Energy Efficient Battery Powered Devices.; Increasing Stringency of Emission Standards

- 3.3. Market Restrains

- 3.3.1. ; Lack of Standard Protocols for the Development of Power Modules; Slow Adoption of New Technologies Derailing Innovation

- 3.4. Market Trends

- 3.4.1. Electric Vehicle and Hybrid Electric Vehicle to Drive the Automotive Power Module Packaging

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Power Module Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Intelligent Power Module (IPM)

- 5.1.2. SiC Module

- 5.1.3. GaN Module

- 5.1.4. Others (IGBT,FET)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Automotive Power Module Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Intelligent Power Module (IPM)

- 6.1.2. SiC Module

- 6.1.3. GaN Module

- 6.1.4. Others (IGBT,FET)

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Automotive Power Module Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Intelligent Power Module (IPM)

- 7.1.2. SiC Module

- 7.1.3. GaN Module

- 7.1.4. Others (IGBT,FET)

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Automotive Power Module Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Intelligent Power Module (IPM)

- 8.1.2. SiC Module

- 8.1.3. GaN Module

- 8.1.4. Others (IGBT,FET)

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Automotive Power Module Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Intelligent Power Module (IPM)

- 9.1.2. SiC Module

- 9.1.3. GaN Module

- 9.1.4. Others (IGBT,FET)

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 PTI Technology Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Fuji Electric Co Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 STATS ChipPAC Ltd (JCET)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Infineon Technologies

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Kulicke and Soffa Industries Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 STMicroelectronics

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Amkor Technology

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Toshiba Electronic Device & Storage Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Starpower Semiconductor Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Semikron

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 PTI Technology Inc

List of Figures

- Figure 1: Global Automotive Power Module Packaging Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Automotive Power Module Packaging Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Automotive Power Module Packaging Market Revenue (billion), by Type 2025 & 2033

- Figure 4: North America Automotive Power Module Packaging Market Volume (K Unit), by Type 2025 & 2033

- Figure 5: North America Automotive Power Module Packaging Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Automotive Power Module Packaging Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Automotive Power Module Packaging Market Revenue (billion), by Country 2025 & 2033

- Figure 8: North America Automotive Power Module Packaging Market Volume (K Unit), by Country 2025 & 2033

- Figure 9: North America Automotive Power Module Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Automotive Power Module Packaging Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Automotive Power Module Packaging Market Revenue (billion), by Type 2025 & 2033

- Figure 12: Europe Automotive Power Module Packaging Market Volume (K Unit), by Type 2025 & 2033

- Figure 13: Europe Automotive Power Module Packaging Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Automotive Power Module Packaging Market Volume Share (%), by Type 2025 & 2033

- Figure 15: Europe Automotive Power Module Packaging Market Revenue (billion), by Country 2025 & 2033

- Figure 16: Europe Automotive Power Module Packaging Market Volume (K Unit), by Country 2025 & 2033

- Figure 17: Europe Automotive Power Module Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Automotive Power Module Packaging Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Automotive Power Module Packaging Market Revenue (billion), by Type 2025 & 2033

- Figure 20: Asia Pacific Automotive Power Module Packaging Market Volume (K Unit), by Type 2025 & 2033

- Figure 21: Asia Pacific Automotive Power Module Packaging Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Asia Pacific Automotive Power Module Packaging Market Volume Share (%), by Type 2025 & 2033

- Figure 23: Asia Pacific Automotive Power Module Packaging Market Revenue (billion), by Country 2025 & 2033

- Figure 24: Asia Pacific Automotive Power Module Packaging Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Asia Pacific Automotive Power Module Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Automotive Power Module Packaging Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Rest of the World Automotive Power Module Packaging Market Revenue (billion), by Type 2025 & 2033

- Figure 28: Rest of the World Automotive Power Module Packaging Market Volume (K Unit), by Type 2025 & 2033

- Figure 29: Rest of the World Automotive Power Module Packaging Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Rest of the World Automotive Power Module Packaging Market Volume Share (%), by Type 2025 & 2033

- Figure 31: Rest of the World Automotive Power Module Packaging Market Revenue (billion), by Country 2025 & 2033

- Figure 32: Rest of the World Automotive Power Module Packaging Market Volume (K Unit), by Country 2025 & 2033

- Figure 33: Rest of the World Automotive Power Module Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Rest of the World Automotive Power Module Packaging Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Power Module Packaging Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Automotive Power Module Packaging Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Global Automotive Power Module Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Automotive Power Module Packaging Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Global Automotive Power Module Packaging Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global Automotive Power Module Packaging Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 7: Global Automotive Power Module Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Global Automotive Power Module Packaging Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: Global Automotive Power Module Packaging Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Global Automotive Power Module Packaging Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: Global Automotive Power Module Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Automotive Power Module Packaging Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global Automotive Power Module Packaging Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Automotive Power Module Packaging Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 15: Global Automotive Power Module Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Automotive Power Module Packaging Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Global Automotive Power Module Packaging Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Global Automotive Power Module Packaging Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 19: Global Automotive Power Module Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Global Automotive Power Module Packaging Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Power Module Packaging Market?

The projected CAGR is approximately 14.3%.

2. Which companies are prominent players in the Automotive Power Module Packaging Market?

Key companies in the market include PTI Technology Inc, Fuji Electric Co Ltd, STATS ChipPAC Ltd (JCET), Infineon Technologies, Kulicke and Soffa Industries Inc, STMicroelectronics, Amkor Technology, Toshiba Electronic Device & Storage Corporation, Starpower Semiconductor Ltd , Semikron.

3. What are the main segments of the Automotive Power Module Packaging Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.86 billion as of 2022.

5. What are some drivers contributing to market growth?

; Electric Vehicle and Hybrid Electric Vehicle to Drive the Automotive Power Module Packaging; Growing Demand Energy Efficient Battery Powered Devices.; Increasing Stringency of Emission Standards.

6. What are the notable trends driving market growth?

Electric Vehicle and Hybrid Electric Vehicle to Drive the Automotive Power Module Packaging.

7. Are there any restraints impacting market growth?

; Lack of Standard Protocols for the Development of Power Modules; Slow Adoption of New Technologies Derailing Innovation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Power Module Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Power Module Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Power Module Packaging Market?

To stay informed about further developments, trends, and reports in the Automotive Power Module Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence