Key Insights

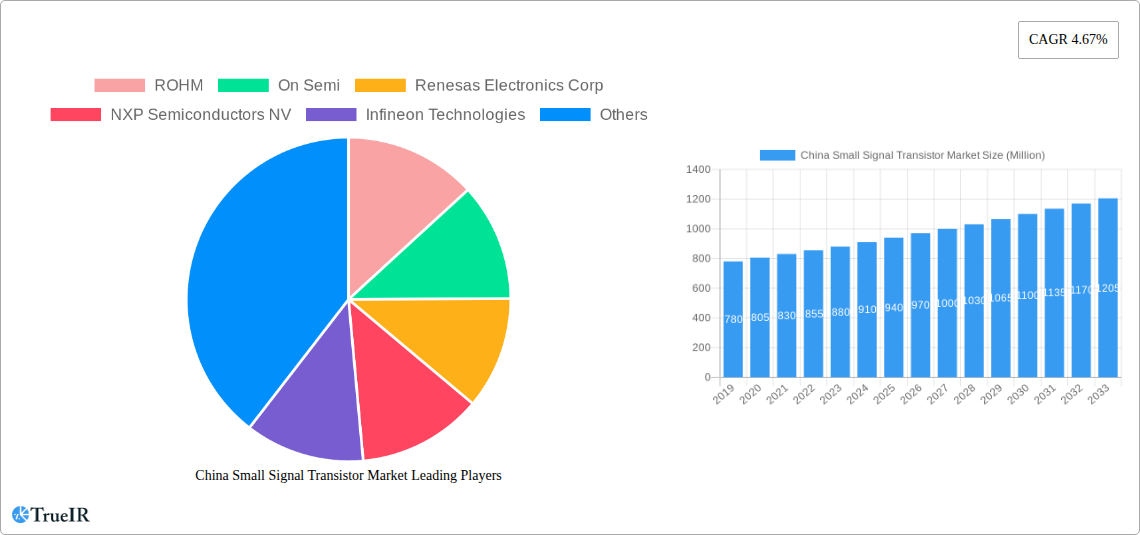

The China Small Signal Transistor Market is poised for robust expansion, projected to reach a valuation of approximately USD 940 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 4.67% extending through 2033. This growth is primarily fueled by the escalating demand across key application sectors. The automotive industry, driven by the burgeoning electric vehicle (EV) market and advanced driver-assistance systems (ADAS), represents a significant growth engine. Similarly, the industrial sector's relentless pursuit of automation, smart manufacturing, and energy efficiency necessitates a constant influx of advanced semiconductor components, including small signal transistors. Consumer electronics and appliances, characterized by their rapid innovation cycles and increasing feature sets, also contribute substantially to this upward trajectory. Emerging applications in areas like high-speed communication and advanced power management further underscore the market's dynamism.

China Small Signal Transistor Market Market Size (In Million)

The market's expansion is further bolstered by technological advancements and evolving consumer preferences. The proliferation of 5G infrastructure, the Internet of Things (IoT) devices, and the increasing integration of sophisticated electronics in everyday appliances are creating unprecedented demand for high-performance, low-power small signal transistors. While the market is generally optimistic, potential restraints include global supply chain volatilities, geopolitical trade tensions, and the intense price competition among manufacturers. However, the strong domestic manufacturing capabilities within China, coupled with strategic investments in research and development by leading players such as Infineon Technologies, Texas Instruments, and STMicroelectronics, are expected to mitigate these challenges. The continued focus on miniaturization, enhanced performance, and improved power efficiency in transistor design will be crucial for market participants to maintain their competitive edge and capitalize on the significant opportunities presented by China's dynamic electronics ecosystem.

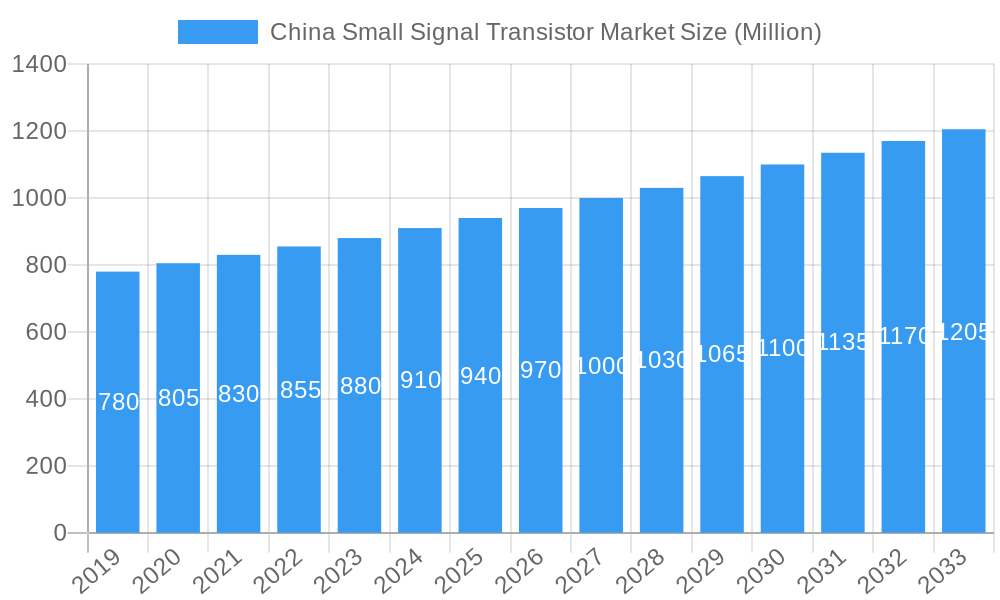

China Small Signal Transistor Market Company Market Share

This in-depth report provides a dynamic and SEO-optimized analysis of the China Small Signal Transistor Market. Leveraging high-volume keywords such as "China semiconductor market," "small signal transistors," "automotive electronics," "consumer electronics," and "industrial automation," this report targets industry professionals, investors, and researchers seeking critical insights into this rapidly evolving sector. With a study period spanning from 2019 to 2033, a base year of 2025, and a forecast period of 2025–2033, this report offers a robust understanding of historical trends, current market dynamics, and future growth trajectories. Discover the key players, emerging trends, dominant segments, and the critical drivers and challenges shaping the China small signal transistor landscape.

China Small Signal Transistor Market Market Structure & Competitive Landscape

The China small signal transistor market is characterized by a moderately fragmented structure, with both established global players and a growing number of domestic manufacturers vying for market share. Innovation remains a key differentiator, driven by the increasing demand for higher performance, smaller form factors, and enhanced energy efficiency across various applications. Regulatory impacts, particularly government initiatives promoting domestic semiconductor production and technological self-sufficiency, are significantly influencing market dynamics and investment. Product substitutes exist, but the unique functionalities of small signal transistors in precise amplification and switching applications limit their widespread replacement. End-user segmentation is diverse, with automotive and industrial sectors exhibiting robust growth. Mergers and acquisitions (M&A) activity, while not at peak levels, are present as companies seek to consolidate their market position, expand their product portfolios, and acquire advanced technological capabilities. The market is witnessing a steady inflow of investments aimed at boosting local manufacturing capacity and R&D.

- Market Concentration: Moderately fragmented with a mix of large multinational corporations and burgeoning domestic firms.

- Innovation Drivers: Miniaturization, power efficiency, high-frequency performance, and advanced packaging technologies.

- Regulatory Impacts: Government support for the domestic semiconductor industry, import substitution policies, and R&D incentives.

- Product Substitutes: While some functionalities can be replicated by integrated circuits, specialized applications heavily rely on discrete small signal transistors.

- End-User Segmentation: Automotive, Industrial, Consumer Electronics, and Telecommunications represent the primary demand centers.

- M&A Trends: Strategic acquisitions focused on technological expertise and market access.

China Small Signal Transistor Market Market Trends & Opportunities

The China small signal transistor market is poised for significant expansion, driven by a confluence of technological advancements, evolving consumer preferences, and robust industrial growth. The estimated market size is projected to reach USD 5,500 Million by 2025, with a projected Compound Annual Growth Rate (CAGR) of 8.5% during the forecast period of 2025–2033. This growth is underpinned by the relentless digitalization across key sectors. The automotive industry, in particular, is a major catalyst, with the rapid adoption of electric vehicles (EVs) and advanced driver-assistance systems (ADAS) demanding a substantial increase in sophisticated semiconductor components, including small signal transistors for power management, sensor interfaces, and communication systems. The ongoing expansion of 5G infrastructure and the proliferation of IoT devices further fuel demand for high-frequency and low-power small signal transistors. Consumer electronics, from smartphones and wearables to smart home appliances, continue to be a bedrock of demand, with consumers seeking more integrated, powerful, and energy-efficient devices. Industrial automation and smart manufacturing initiatives are also creating substantial opportunities, as factories integrate more intelligent control systems and robotics that rely on precise signal amplification and switching. The Chinese government's strategic focus on developing a self-sufficient and advanced semiconductor ecosystem presents a fertile ground for both domestic and international players to innovate and capture market share. The increasing emphasis on miniaturization and higher performance specifications presents ongoing opportunities for manufacturers to develop next-generation small signal transistors that cater to these evolving demands. Furthermore, the "dual circulation" strategy, emphasizing domestic consumption and production, is expected to further bolster the demand for locally manufactured electronic components. The market penetration of small signal transistors is high across traditional electronics but is seeing new growth avenues in emerging applications like advanced medical devices and sustainable energy solutions.

Dominant Markets & Segments in China Small Signal Transistor Market

The China small signal transistor market exhibits distinct dominance across various segments, driven by specific application needs and technological advancements.

Dominant Segments by Device Type:

- Bipolar Small Signal Transistors: This category remains a cornerstone of the market due to its cost-effectiveness and wide range of applications in signal amplification and switching across various electronic devices. Their robustness and established manufacturing processes ensure continued demand in mature consumer electronics and industrial control systems. The estimated market share for bipolar small signal transistors is around 45%.

- Field Effect Transistors (FETs): FETs, particularly MOSFETs, are experiencing robust growth due to their superior switching speeds, lower power consumption, and higher input impedance. This makes them indispensable in modern power management circuits, digital logic, and high-speed applications found in consumer electronics and automotive systems. The estimated market share for FETs is around 35%.

- RF & Microwave Small Signal Transistors: This segment is witnessing the highest growth rates, driven by the exponential expansion of wireless communication technologies. The deployment of 5G networks, the increasing sophistication of wireless communication modules in IoT devices, and the growing demand for high-performance radar systems in automotive applications are creating a significant surge in demand for specialized RF and microwave transistors. The estimated market share for RF & Microwave small signal transistors is around 20%.

Dominant Segments by Application:

- Automotive and Charging Infrastructure: This segment is emerging as a primary growth engine. The electrification of vehicles (EVs) necessitates a vast array of small signal transistors for battery management systems, power inverters, onboard chargers, infotainment systems, and ADAS. The rapid expansion of EV charging infrastructure further accentuates this demand. Government policies promoting EV adoption and the technological advancements in automotive electronics are key growth drivers.

- Industrial: Industrial automation, smart manufacturing, and the Internet of Things (IoT) in industrial settings are driving significant demand for small signal transistors. These components are crucial for control systems, sensor interfaces, motor drives, and communication modules within industrial equipment. Increased investment in upgrading manufacturing facilities and the adoption of Industry 4.0 principles are key growth drivers.

- Consumer Electronics & Appliances: Despite being a mature market, consumer electronics continues to be a significant contributor to overall demand. The ongoing innovation in smartphones, wearables, smart home devices, and home appliances ensures a steady requirement for small signal transistors for various functions, including signal processing, power control, and display interfaces. The trend towards more powerful, compact, and energy-efficient devices fuels demand.

China Small Signal Transistor Market Product Analysis

The China small signal transistor market is witnessing continuous product innovation focused on enhancing performance, reducing size, and improving power efficiency. Manufacturers are investing heavily in research and development to introduce next-generation transistors with improved switching speeds, lower leakage currents, and wider operating temperature ranges. Advancements in fabrication technologies, such as employing smaller process nodes and novel materials, are enabling the creation of highly integrated and specialized transistors. Key product innovations include low-voltage bipolar transistors for battery-powered devices, high-frequency Gallium Nitride (GaN) and Silicon Carbide (SiC) transistors for RF and power applications, and ultra-low-power FETs for IoT nodes. These innovations directly cater to the evolving needs of the automotive sector for robust and efficient electronic components, the burgeoning consumer electronics market demanding compact and powerful devices, and the industrial sector's drive towards automation and smarter systems. Competitive advantages are increasingly derived from a combination of technological superiority, cost-competitiveness, and reliable supply chains, allowing companies to secure market share in these dynamic application areas.

Key Drivers, Barriers & Challenges in China Small Signal Transistor Market

Key Drivers:

- Rapid Electrification of Vehicles: The booming electric vehicle (EV) market in China requires a substantial number of small signal transistors for various automotive systems, from battery management to advanced driver-assistance systems (ADAS).

- Growth in 5G Infrastructure and IoT: The widespread deployment of 5G networks and the proliferation of Internet of Things (IoT) devices necessitate high-performance, low-power small signal transistors for communication and data processing.

- Government Support for Domestic Semiconductor Industry: Policies aimed at fostering self-sufficiency and technological advancement in China's semiconductor sector are driving investment and innovation.

- Industrial Automation and Smart Manufacturing: The push towards Industry 4.0 and advanced automation in factories creates a strong demand for reliable transistors in control and sensor systems.

- Consumer Electronics Innovation: Continuous upgrades and new product launches in smartphones, wearables, and smart home devices maintain a steady demand.

Barriers & Challenges:

- Geopolitical Tensions and Supply Chain Disruptions: Global trade dynamics and potential disruptions can impact the availability and cost of raw materials and advanced manufacturing equipment.

- Intense Competition: The market is highly competitive, with numerous global and domestic players vying for market share, leading to price pressures.

- Talent Shortage: A lack of highly skilled engineers and technicians in semiconductor design and manufacturing can hinder rapid growth and innovation.

- High R&D Costs: Developing cutting-edge semiconductor technologies requires significant and ongoing investment in research and development.

- Intellectual Property Protection: Ensuring robust intellectual property protection in a rapidly evolving technological landscape can be a challenge.

Growth Drivers in the China Small Signal Transistor Market Market

The China small signal transistor market is propelled by several significant growth drivers. Technologically, the relentless pursuit of miniaturization and increased power efficiency is paramount, directly benefiting applications in mobile devices and IoT. Economically, the burgeoning middle class and increasing disposable incomes in China fuel demand for advanced consumer electronics and vehicles. Policy-driven factors, such as the government's "Made in China 2025" initiative and its focus on semiconductor self-sufficiency, are creating a favorable environment for domestic players and attracting foreign investment. The rapid expansion of electric vehicle (EV) production and sales, supported by substantial government subsidies and infrastructure development, is a critical economic and policy-driven growth catalyst. Furthermore, the ongoing global push towards 5G network deployment and the associated expansion of connected devices provide substantial technological impetus.

Challenges Impacting China Small Signal Transistor Market Growth

Several challenges are impacting the growth of the China small signal transistor market. Regulatory complexities, particularly concerning trade policies and international sanctions, can create uncertainty and disrupt established supply chains. Supply chain issues, including potential shortages of specialized raw materials and manufacturing equipment, pose a significant restraint. Competitive pressures from both established global semiconductor giants and increasingly capable domestic manufacturers lead to price erosion and the need for continuous innovation to maintain market share. Furthermore, the high capital expenditure required for advanced semiconductor fabrication facilities presents a substantial financial barrier for new entrants and smaller players. Ensuring consistent quality and reliability across a diverse range of applications also remains a critical operational challenge.

Key Players Shaping the China Small Signal Transistor Market Market

- ROHM

- On Semi

- Renesas Electronics Corp

- NXP Semiconductors NV

- Infineon Technologies

- Texas Instruments Inc

- Fairchild

- Diodes Incorporated

- STMicroelectronics NV

- Fuji Electric

- Central Semiconductor Corp

Significant China Small Signal Transistor Market Industry Milestones

- April 2023: Kia showcased its entire line-up of electric vehicles (EVs) at the National Exhibition and Convention Center in Shanghai, highlighting the growing demand for automotive electronics components. Kia's exhibition featured six models from its EV line-up, including four EV6 GT models and one each from the Concept EV5 and Concept EV9, underscoring the importance of advanced transistors in EV technology.

- January 2023: Huawei started the mass production of its own 12 nm - 14 nm chips for its flagship series. This development signifies a significant step towards domestic advanced semiconductor manufacturing, as a lower process node number indicates the use of smaller transistors, allowing more to fit inside a chip, thus enhancing performance and energy efficiency.

Future Outlook for China Small Signal Transistor Market Market

The future outlook for the China small signal transistor market remains exceptionally robust, driven by continued technological innovation and the persistent demand from its core application sectors. The increasing integration of advanced semiconductors in electric vehicles, coupled with the ongoing rollout of 5G networks and the expanding ecosystem of IoT devices, will serve as significant growth catalysts. The market is also expected to benefit from strategic investments in domestic semiconductor manufacturing capabilities, aiming to reduce reliance on foreign suppliers and foster technological sovereignty. Opportunities lie in the development of next-generation transistors with even higher performance, lower power consumption, and specialized functionalities for emerging applications such as artificial intelligence, advanced medical devices, and sustainable energy solutions. The shift towards greater automation across industries will further solidify demand.

China Small Signal Transistor Market Segmentation

-

1. Device Type

- 1.1. Bipolar Small Signal Transistor

- 1.2. Field Effect Transistor

- 1.3. RF & Microwave Small Signal Transistor

-

2. Application

- 2.1. Automotive and Charging Infrastructure

- 2.2. Industrial

- 2.3. Consumer Electronics & Appliances

- 2.4. Rail

- 2.5. Other Applications

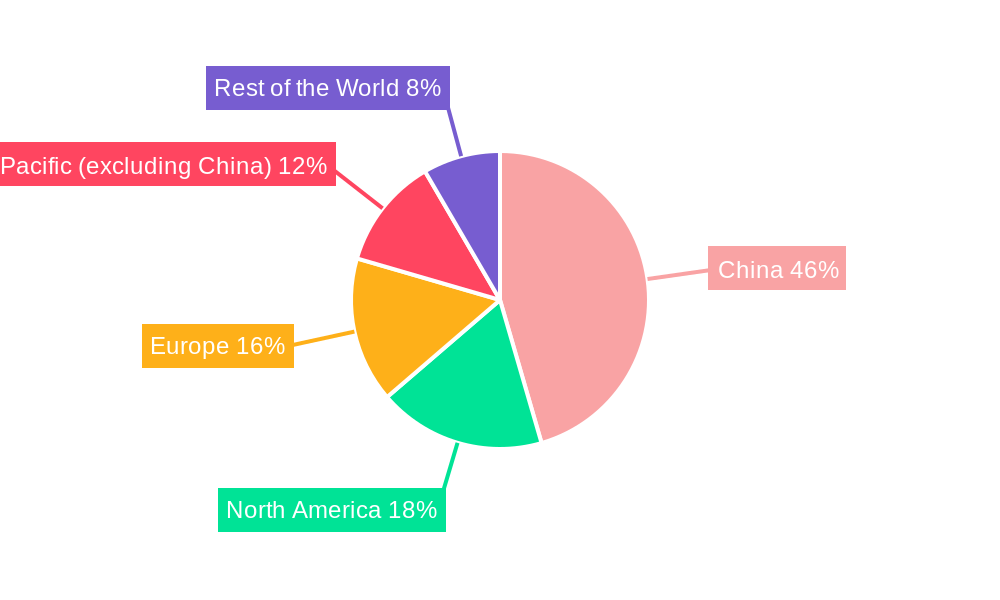

China Small Signal Transistor Market Segmentation By Geography

- 1. China

China Small Signal Transistor Market Regional Market Share

Geographic Coverage of China Small Signal Transistor Market

China Small Signal Transistor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Proliferation of Consumer Electronics and Increased Use of Electronics in the Industrial Sector will Drive the Demand; Growing demand for IoT

- 3.3. Market Restrains

- 3.3.1. Adoption of Power Transistors is Analyzed Pose a Challenge for the Market

- 3.4. Market Trends

- 3.4.1. Bipolar Small Signal Transistor is Expected to Have a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Small Signal Transistor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Bipolar Small Signal Transistor

- 5.1.2. Field Effect Transistor

- 5.1.3. RF & Microwave Small Signal Transistor

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Automotive and Charging Infrastructure

- 5.2.2. Industrial

- 5.2.3. Consumer Electronics & Appliances

- 5.2.4. Rail

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ROHM

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 On Semi

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Renesas Electronics Corp

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 NXP Semiconductors NV

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Infineon Technologies

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Texas Instruments Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fairchild

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Diodes Incorporated

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 STMicroelectronics NV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fuji Electric

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Central Semiconductor Corp*List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 ROHM

List of Figures

- Figure 1: China Small Signal Transistor Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Small Signal Transistor Market Share (%) by Company 2025

List of Tables

- Table 1: China Small Signal Transistor Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 2: China Small Signal Transistor Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: China Small Signal Transistor Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: China Small Signal Transistor Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 5: China Small Signal Transistor Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: China Small Signal Transistor Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Small Signal Transistor Market?

The projected CAGR is approximately 4.67%.

2. Which companies are prominent players in the China Small Signal Transistor Market?

Key companies in the market include ROHM, On Semi, Renesas Electronics Corp, NXP Semiconductors NV, Infineon Technologies, Texas Instruments Inc, Fairchild, Diodes Incorporated, STMicroelectronics NV, Fuji Electric, Central Semiconductor Corp*List Not Exhaustive.

3. What are the main segments of the China Small Signal Transistor Market?

The market segments include Device Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Proliferation of Consumer Electronics and Increased Use of Electronics in the Industrial Sector will Drive the Demand; Growing demand for IoT.

6. What are the notable trends driving market growth?

Bipolar Small Signal Transistor is Expected to Have a Significant Growth.

7. Are there any restraints impacting market growth?

Adoption of Power Transistors is Analyzed Pose a Challenge for the Market.

8. Can you provide examples of recent developments in the market?

April 2023: Kia showcased its entire line-up of electric vehicles (EVs) at the National Exhibition and Convention Center in Shanghai. Kia's exhibition showcased six models from its EV line-up, including four EV6 GT models and one of each from the Concept EV5 and Concept EV9.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Small Signal Transistor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Small Signal Transistor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Small Signal Transistor Market?

To stay informed about further developments, trends, and reports in the China Small Signal Transistor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence