Key Insights

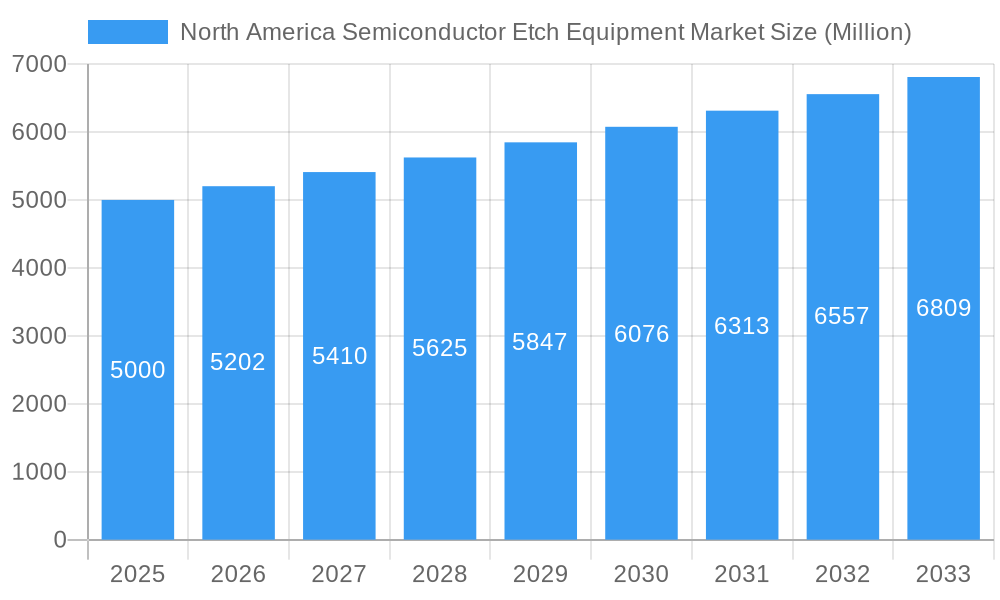

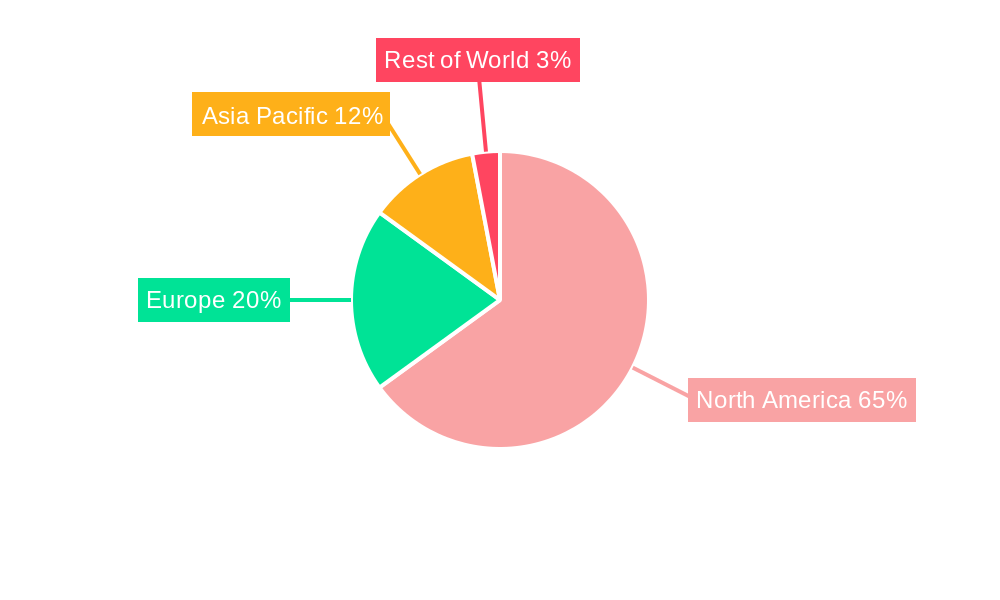

The North America semiconductor etch equipment market, projected at $118.88 billion in 2025, is set for significant expansion. This growth, with a CAGR of 8.4% from 2025 to 2033, is propelled by the escalating demand for sophisticated semiconductor devices. Key drivers include the need for high-performance computing, widespread 5G infrastructure, and the automotive sector's adoption of advanced driver-assistance systems (ADAS) and electric vehicles (EVs). High-density etch equipment and conductor etching segments are anticipated to lead this expansion due to technological advancements in premium chip manufacturing. The United States commands the largest share, followed by Canada, reflecting established semiconductor manufacturing and research hubs. Emerging investments in Mexico's semiconductor sector may influence regional market dynamics.

North America Semiconductor Etch Equipment Market Market Size (In Billion)

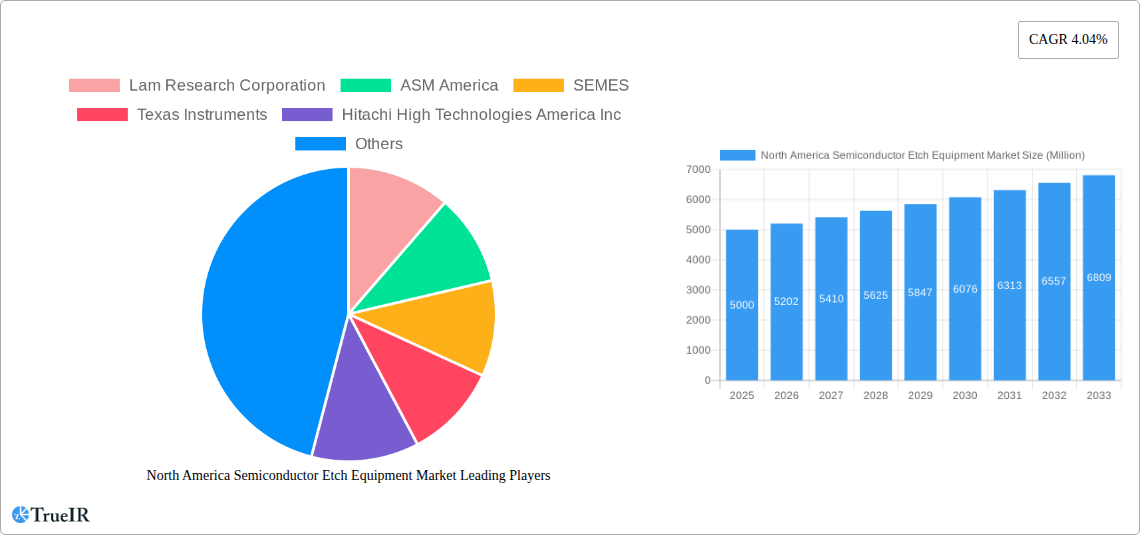

The North America semiconductor etch equipment landscape is highly competitive, characterized by innovation and strategic alliances among prominent companies such as Lam Research, Applied Materials, and ASM America. Key technological advancements include novel etching techniques for finer feature sizes and the integration of AI/ML for optimized processes and enhanced yield. Market constraints encompass the semiconductor industry's inherent cyclicality, potential supply chain vulnerabilities, and the substantial investment required for cutting-edge etch equipment. Nevertheless, the long-term outlook remains strong, driven by continuous semiconductor miniaturization and the growing demand for advanced electronic components across diverse industries. The market presents considerable growth potential for established and emerging players.

North America Semiconductor Etch Equipment Market Company Market Share

North America Semiconductor Etch Equipment Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America semiconductor etch equipment market, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, growth drivers, challenges, and future opportunities, making it an essential resource for industry stakeholders, investors, and researchers. The report leverages extensive data analysis and industry expertise to deliver actionable intelligence for informed decision-making. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

North America Semiconductor Etch Equipment Market Structure & Competitive Landscape

The North American semiconductor etch equipment market is characterized by a moderately concentrated competitive landscape, with a few major players holding significant market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately concentrated market. This concentration is driven by significant barriers to entry, including high R&D costs, specialized manufacturing expertise, and stringent regulatory compliance. Innovation is a key driver, with companies continuously developing advanced etch technologies to meet the demands of increasingly complex semiconductor fabrication processes. The market is also subject to regulatory influences, particularly related to export controls and national security considerations. Product substitution is limited due to the highly specialized nature of etch equipment, though competition exists based on performance, cost, and features. The market is segmented by end-users, primarily logic and memory chip manufacturers, power device manufacturers, and MEMS manufacturers. Mergers and acquisitions (M&A) activity has been moderate, with a focus on consolidating technology and market share. The estimated M&A volume in the past five years is xx deals resulting in approximately xx Million in aggregate transaction value. These activities often involve smaller companies being acquired by larger established players for technological expansion or to enhance their product portfolio.

North America Semiconductor Etch Equipment Market Market Trends & Opportunities

The North America semiconductor etch equipment market is experiencing robust growth, driven by increasing demand for advanced semiconductor devices across various applications. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033. This growth is fueled by technological advancements in semiconductor manufacturing, including the shift toward smaller node sizes, which necessitates higher precision and efficiency in etch processes. The adoption of advanced materials and processing techniques, such as EUV lithography, are further driving market expansion. Consumer preferences for high-performance electronics, including smartphones, personal computers, and data center servers, are contributing significantly to this growth. The market’s competitive dynamics are marked by continuous innovation, strategic partnerships, and investments in R&D. The increasing adoption of artificial intelligence (AI) and the Internet of Things (IoT) also drives demand for advanced semiconductor devices, creating significant opportunities for the etch equipment market. The market penetration rate of high-density etch equipment is currently estimated at xx%, while that of low-density etch equipment is at xx%. These rates are projected to increase significantly over the forecast period.

Dominant Markets & Segments in North America Semiconductor Etch Equipment Market

Leading Region/Country: The United States represents the dominant market for semiconductor etch equipment in North America, accounting for approximately xx% of the total market share. This dominance is driven by a robust domestic semiconductor industry, significant investments in R&D, and supportive government policies. Canada holds a smaller but still significant share.

Leading Product Type: High-density etch equipment holds a larger market share compared to low-density etch equipment, driven by the increasing demand for advanced logic and memory chips that require more precise and complex etching processes.

Leading Etching Type: Conductor etching constitutes a significant portion of the market, followed by dielectric etching and polysilicon etching. This is due to their crucial roles in creating intricate semiconductor structures.

Leading Application: The Logic and Memory segment represents the largest application segment due to the high volume of devices produced in this category. The Power Devices and MEMS segments are also experiencing strong growth, contributing significantly to overall market expansion.

Key Growth Drivers:

- Strong presence of major semiconductor manufacturers in the US.

- Government initiatives promoting domestic semiconductor manufacturing.

- Significant investments in research and development by leading companies.

- Growing demand for advanced semiconductor devices in various industries.

North America Semiconductor Etch Equipment Market Product Analysis

Technological advancements are driving significant innovations in semiconductor etch equipment. This includes the development of more precise and efficient etching processes, the incorporation of advanced process control systems, and the integration of artificial intelligence for enhanced performance and optimization. New products are being designed to address the challenges posed by smaller node sizes, complex three-dimensional structures, and the adoption of new materials. These innovations are improving productivity, reducing manufacturing costs, and enhancing the quality of semiconductor devices. The market is seeing a strong demand for equipment that offers higher throughput, better uniformity, and improved control over etch profiles.

Key Drivers, Barriers & Challenges in North America Semiconductor Etch Equipment Market

Key Drivers: The market is primarily driven by the increasing demand for advanced semiconductor chips, fueled by the growth of electronics, AI, and IoT. Government initiatives to boost domestic semiconductor production, significant investments in R&D by key players, and technological advancements in etching processes are also important drivers. The trend towards miniaturization and increased complexity in chip design necessitates more sophisticated etching equipment.

Challenges: The market faces challenges such as high capital expenditure requirements, dependence on global supply chains (leading to potential disruptions), intense competition, and evolving regulatory landscapes. Fluctuations in demand due to macroeconomic conditions also represent a challenge. Supply chain disruptions have caused significant delays and increased costs, impacting manufacturers.

Growth Drivers in the North America Semiconductor Etch Equipment Market

The North American semiconductor etch equipment market is driven by the increasing demand for advanced semiconductor devices across various applications, coupled with ongoing technological advancements in semiconductor manufacturing. Government incentives and policies encouraging domestic chip production further stimulate market growth. The rising adoption of AI and the expanding IoT ecosystem also fuels this expansion.

Challenges Impacting North America Semiconductor Etch Equipment Market Growth

The market faces challenges, including high capital expenditure for advanced equipment, potential supply chain disruptions, stringent regulatory compliance, and the impact of geopolitical factors on the semiconductor industry. Competition is intense, and achieving a competitive advantage demands substantial investment in R&D.

Key Players Shaping the North America Semiconductor Etch Equipment Market

Significant North America Semiconductor Etch Equipment Market Industry Milestones

- November 2021: PSK selected as the world's leading strip equipment provider by SEMI's U.S. semiconductor supply chain report. Announced plans to release the 'Bevel Etcher' (slope etching equipment). This highlights innovation within the etch equipment segment.

- May 2022: The US government's initiative to boost domestic capacity for high-purity materials underscores the importance of a robust domestic semiconductor supply chain and increased demand for domestically produced etch equipment. This signals increased investment and opportunity.

Future Outlook for North America Semiconductor Etch Equipment Market

The North American semiconductor etch equipment market is poised for continued growth, driven by technological advancements, increased demand for advanced semiconductors across various applications, and supportive government policies. Strategic partnerships and investments in R&D will be crucial for companies to maintain a competitive edge. The market presents substantial opportunities for innovative players to develop and deploy next-generation etch technologies. The projected growth is underpinned by the long-term trends of miniaturization in chip manufacturing and the expanding demand for advanced electronics.

North America Semiconductor Etch Equipment Market Segmentation

-

1. Product Type

- 1.1. High-density Etch Equipment

- 1.2. Low-density Etch Equipment

-

2. Etching Type

- 2.1. Conductor Etching

- 2.2. Dielectric Etching

- 2.3. Polysilicon Etching

-

3. Application

- 3.1. Logic and Memory

- 3.2. Power Devices

- 3.3. MEMS

- 3.4. Others

North America Semiconductor Etch Equipment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Semiconductor Etch Equipment Market Regional Market Share

Geographic Coverage of North America Semiconductor Etch Equipment Market

North America Semiconductor Etch Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The United States' strategies for the manufacturing in-house semiconductors and peripheral products to avoid trade tensions with China; The application of advanced semiconductor chips in 5G and Industry 4.0

- 3.3. Market Restrains

- 3.3.1. Non-transparent and chance of Government discriminatory subsidies

- 3.4. Market Trends

- 3.4.1. The United States’ strategies for manufacturing semiconductors and peripheral products to avoid trade tensions with China are driving the market in North America.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Semiconductor Etch Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. High-density Etch Equipment

- 5.1.2. Low-density Etch Equipment

- 5.2. Market Analysis, Insights and Forecast - by Etching Type

- 5.2.1. Conductor Etching

- 5.2.2. Dielectric Etching

- 5.2.3. Polysilicon Etching

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Logic and Memory

- 5.3.2. Power Devices

- 5.3.3. MEMS

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Lam Research Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ASM America

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SEMES

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Texas Instruments

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hitachi High Technologies America Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Applied Materials Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Lattice Semiconductor Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Panasonic Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Axcelis Technologies Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Lam Research Corporation

List of Figures

- Figure 1: North America Semiconductor Etch Equipment Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Semiconductor Etch Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: North America Semiconductor Etch Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: North America Semiconductor Etch Equipment Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: North America Semiconductor Etch Equipment Market Revenue billion Forecast, by Etching Type 2020 & 2033

- Table 4: North America Semiconductor Etch Equipment Market Volume K Unit Forecast, by Etching Type 2020 & 2033

- Table 5: North America Semiconductor Etch Equipment Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: North America Semiconductor Etch Equipment Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 7: North America Semiconductor Etch Equipment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: North America Semiconductor Etch Equipment Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: North America Semiconductor Etch Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: North America Semiconductor Etch Equipment Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 11: North America Semiconductor Etch Equipment Market Revenue billion Forecast, by Etching Type 2020 & 2033

- Table 12: North America Semiconductor Etch Equipment Market Volume K Unit Forecast, by Etching Type 2020 & 2033

- Table 13: North America Semiconductor Etch Equipment Market Revenue billion Forecast, by Application 2020 & 2033

- Table 14: North America Semiconductor Etch Equipment Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 15: North America Semiconductor Etch Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America Semiconductor Etch Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States North America Semiconductor Etch Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: United States North America Semiconductor Etch Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada North America Semiconductor Etch Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Canada North America Semiconductor Etch Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico North America Semiconductor Etch Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Mexico North America Semiconductor Etch Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Semiconductor Etch Equipment Market?

The projected CAGR is approximately 8.4%.

2. Which companies are prominent players in the North America Semiconductor Etch Equipment Market?

Key companies in the market include Lam Research Corporation, ASM America, SEMES, Texas Instruments, Hitachi High Technologies America Inc, Applied Materials Inc, Lattice Semiconductor Corporation, Panasonic Corporation, Axcelis Technologies Inc.

3. What are the main segments of the North America Semiconductor Etch Equipment Market?

The market segments include Product Type, Etching Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 118.88 billion as of 2022.

5. What are some drivers contributing to market growth?

The United States' strategies for the manufacturing in-house semiconductors and peripheral products to avoid trade tensions with China; The application of advanced semiconductor chips in 5G and Industry 4.0.

6. What are the notable trends driving market growth?

The United States’ strategies for manufacturing semiconductors and peripheral products to avoid trade tensions with China are driving the market in North America..

7. Are there any restraints impacting market growth?

Non-transparent and chance of Government discriminatory subsidies.

8. Can you provide examples of recent developments in the market?

In November 2021, PSK was selected as the world's 'leader' in the strip equipment field in the analysis data of the 'U.S. semiconductor supply chain report' announced by the SEMI. The company has planned to release one of the etching equipment, called 'Bevel Etcher (Slope Etching Equipment).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Semiconductor Etch Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Semiconductor Etch Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Semiconductor Etch Equipment Market?

To stay informed about further developments, trends, and reports in the North America Semiconductor Etch Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence