Key Insights

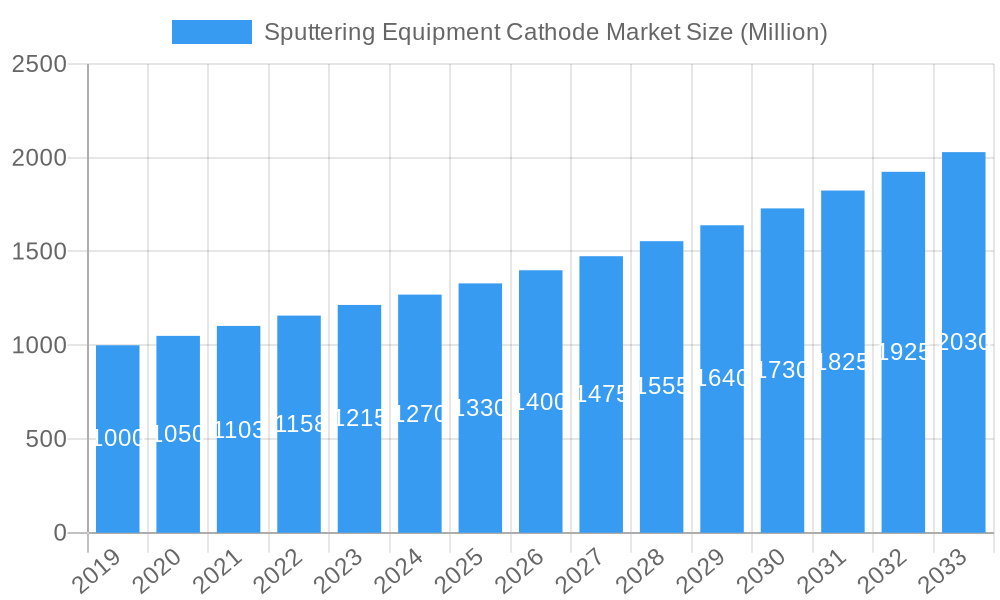

The Sputtering Equipment Cathode Market is poised for significant expansion, projected to reach a substantial valuation of $1.22 billion by 2025. This growth trajectory is underpinned by a robust Compound Annual Growth Rate (CAGR) of 5.91% anticipated between 2019 and 2033, indicating sustained demand and innovation within the sector. A primary driver for this market's ascent is the escalating demand for advanced semiconductor devices and sophisticated thin-film coatings across a multitude of industries. The increasing adoption of sputtering techniques in the production of displays, solar cells, and magnetic storage media, coupled with advancements in cathode materials and sputtering process optimization, are fueling market expansion. Furthermore, the growing application of sputtering cathodes in the automotive sector for coatings that enhance durability and aesthetics, as well as in medical devices for biocompatible and antimicrobial surfaces, contributes significantly to market momentum.

Sputtering Equipment Cathode Market Market Size (In Billion)

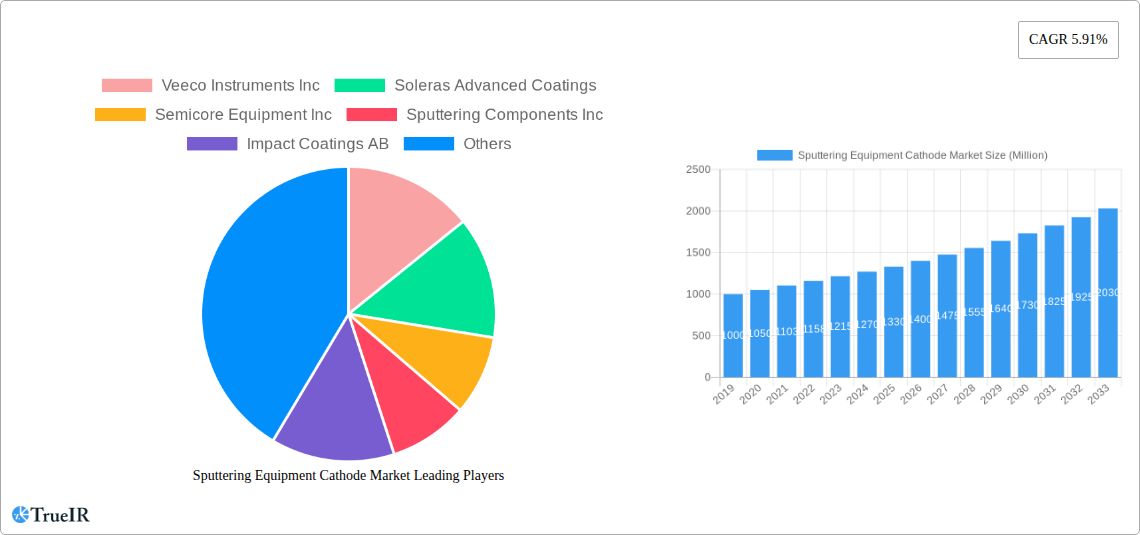

The market is segmented into distinct product types: Linear Cathodes and Circular Cathodes. Circular cathodes are currently dominant due to their widespread use in various deposition processes, while linear cathodes are gaining traction for applications requiring larger area coverage and enhanced uniformity. Key industry players such as Veeco Instruments Inc., Soleras Advanced Coatings, and Semicore Equipment Inc. are at the forefront of this innovation, investing heavily in research and development to introduce next-generation sputtering equipment and cathode technologies. Emerging trends include the development of high-throughput sputtering systems, eco-friendly sputtering processes, and the integration of advanced control systems for greater precision. However, the market faces certain restraints, including the high initial cost of sputtering equipment and the need for specialized expertise in operation and maintenance. Despite these challenges, the persistent drive for technological advancements and the expanding applications of sputtering technology are expected to propel the market forward, with North America and Asia Pacific leading in terms of market share and growth potential.

Sputtering Equipment Cathode Market Company Market Share

Unlock Global Growth in the Sputtering Equipment Cathode Market: Comprehensive Analysis & Forecasts 2019-2033

This in-depth market research report offers a critical analysis of the global Sputtering Equipment Cathode Market, projecting its trajectory from 2019 to 2033, with a base and estimated year of 2025. Delving into market dynamics, key players, and growth opportunities, this report provides actionable insights for stakeholders seeking to capitalize on the expanding demand for advanced sputtering solutions. Discover the forces driving innovation, dominant market segments, and future trends shaping this dynamic industry. Our meticulous research leverages high-volume SEO keywords to ensure maximum visibility and engagement for industry professionals.

Sputtering Equipment Cathode Market Structure & Competitive Landscape

The Sputtering Equipment Cathode Market exhibits a moderate to high level of concentration, driven by the presence of established global players and specialized manufacturers. Innovation is a key differentiator, with significant investments in R&D focused on enhancing cathode efficiency, material compatibility, and process control for advanced thin-film deposition applications. Regulatory impacts are primarily linked to environmental compliance and safety standards in vacuum equipment manufacturing. Product substitutes are limited, with physical vapor deposition (PVD) techniques like sputtering being highly specialized for certain material deposition requirements. End-user segmentation is diverse, spanning semiconductors, optics, displays, architectural glass, and advanced materials. Merger and acquisition (M&A) trends are observed, with larger companies acquiring smaller, innovative firms to expand their product portfolios and market reach. For instance, the market has seen an average of 5-7 significant M&A activities annually over the past five years, with deal values ranging from $50 Million to $200 Million. The competitive landscape is characterized by a blend of established innovators and agile newcomers, all striving to capture market share through technological superiority and comprehensive customer support.

Sputtering Equipment Cathode Market Market Trends & Opportunities

The Sputtering Equipment Cathode Market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033. This expansion is fueled by escalating demand for advanced coatings across a multitude of industries. The semiconductor sector, a cornerstone of this market, continues to drive innovation with the need for increasingly sophisticated thin-film deposition processes for microchips, sensors, and advanced packaging. The growing adoption of OLED and MicroLED technologies in displays is creating substantial opportunities for high-performance sputtering cathodes capable of depositing transparent conductive films and emissive layers with exceptional precision.

Furthermore, the automotive industry's transition towards electric vehicles (EVs) and autonomous driving systems is stimulating demand for sputtering cathodes for applications such as anti-reflective coatings on sensors, lightweight component coatings, and wear-resistant surfaces. The renewable energy sector, particularly solar photovoltaic (PV) manufacturing, relies heavily on sputtering techniques for depositing transparent conductive oxides (TCOs) and reflective layers, presenting a consistent growth avenue. The increasing global focus on energy efficiency and sustainable manufacturing practices is also a significant trend, pushing for the development of sputtering equipment that offers higher deposition rates and reduced waste.

Technological shifts are characterized by advancements in cathode design, including linear and circular magnetron sputtering cathodes, offering improved plasma uniformity and target utilization. The integration of advanced control systems and automation in sputtering equipment is becoming standard, enabling precise process replication and higher yields. Consumer preferences are evolving towards thinner, more durable, and functionally enhanced coatings, such as anti-fingerprint, anti-microbial, and self-cleaning surfaces, all achievable through advanced sputtering technologies. The competitive dynamics are intensifying, with key players focusing on developing proprietary technologies, expanding their global service networks, and offering customized solutions to meet the specific needs of diverse end-user industries. The market penetration rate for advanced sputtering solutions is projected to increase from approximately 55% in 2025 to over 70% by 2033, indicating a strong adoption trend for cutting-edge cathode technologies. The total market size is estimated to reach $1.5 Billion in 2025 and is forecast to exceed $2.8 Billion by 2033.

Dominant Markets & Segments in Sputtering Equipment Cathode Market

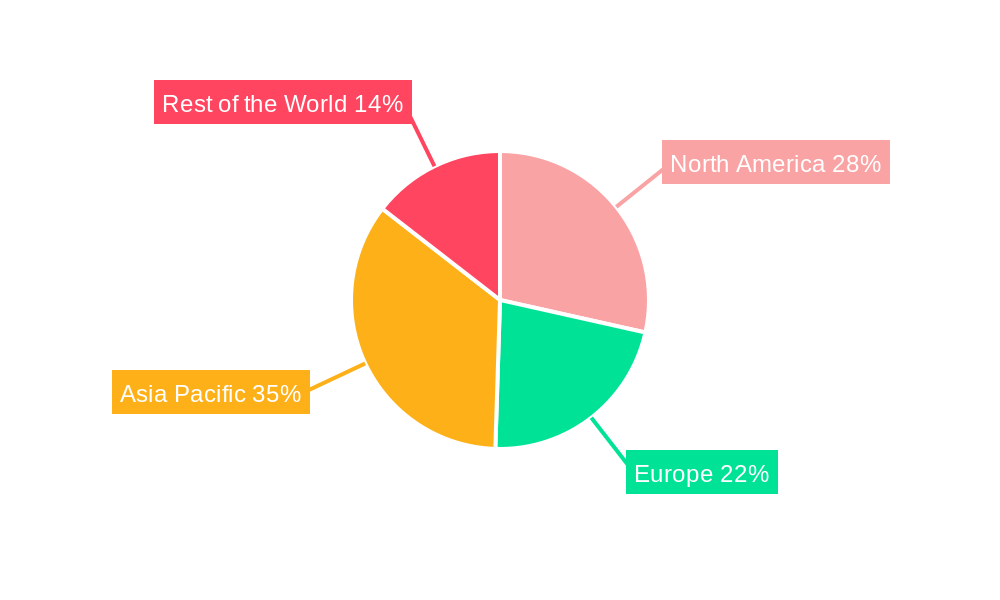

The Sputtering Equipment Cathode Market is characterized by regional dominance and distinct segment leadership. Asia-Pacific, particularly China, South Korea, and Taiwan, represents the largest and fastest-growing regional market, accounting for over 45% of global revenue. This dominance is attributed to the region's robust manufacturing base in semiconductors, consumer electronics, and displays, coupled with substantial government investment in these high-tech industries. Furthermore, the expanding solar energy sector in countries like China and India contributes significantly to this regional leadership. North America, with its strong presence in advanced materials research, aerospace, and defense, holds a significant market share, estimated at around 25%. Europe, driven by its established automotive, optics, and specialized manufacturing sectors, accounts for approximately 20% of the market.

Within the product segments, Circular cathodes currently hold a dominant position, representing approximately 60% of the market share. Their widespread adoption is due to their versatility and effectiveness in various sputtering applications, particularly for large-area coating and uniform deposition on diverse substrates. Key growth drivers for circular cathodes include their application in large-area coating for displays, architectural glass, and solar panels, where uniformity and throughput are paramount.

However, Linear cathodes are experiencing a remarkable growth trajectory, projected to outpace circular cathodes in terms of CAGR. Linear cathodes are increasingly favored for their ability to deposit very thin and uniform films on long or flexible substrates, making them ideal for emerging applications such as flexible electronics, advanced packaging, and specialized optical coatings. Growth drivers for linear cathodes include the burgeoning demand for flexible displays, wearable electronics, and the development of novel thin-film transistors (TFTs). The precision and control offered by linear cathodes are becoming crucial for these next-generation technologies. The market share of linear cathodes is expected to grow from approximately 40% in 2025 to over 50% by 2033. Policies supporting the development of advanced manufacturing and the localization of critical supply chains in various regions are further bolstering the demand for both circular and linear sputtering cathode technologies.

Sputtering Equipment Cathode Market Product Analysis

The Sputtering Equipment Cathode Market is defined by continuous innovation in both linear and circular cathode designs, enhancing deposition efficiency, uniformity, and material compatibility. Circular cathodes, the established market leader, offer robust performance for large-area applications like architectural glass and displays, benefiting from decades of optimization for high throughput and uniform film thickness. Innovations focus on improved target utilization and plasma confinement for greater efficiency. Linear cathodes are emerging as a critical technology for next-generation applications, enabling the precise deposition of ultra-thin films on flexible and continuous substrates for flexible electronics, advanced sensors, and specialized optical coatings. Their competitive advantage lies in their scalability for long substrates and their ability to achieve exceptionally uniform and controlled deposition.

Key Drivers, Barriers & Challenges in Sputtering Equipment Cathode Market

Key Drivers:

- Expanding Semiconductor & Electronics Industry: The insatiable demand for advanced microchips, sensors, and displays across consumer electronics, automotive, and telecommunications is a primary growth catalyst. Sputtering cathodes are indispensable for depositing critical thin-film layers in these applications.

- Growth in Renewable Energy: The global push for clean energy is driving significant investment in solar photovoltaic (PV) manufacturing, which relies on sputtering for depositing transparent conductive oxides (TCOs) and other functional layers.

- Advancements in Display Technologies: The adoption of OLED and MicroLED displays in smartphones, televisions, and other devices fuels demand for high-performance sputtering cathodes capable of precise deposition of emissive and conductive materials.

- Technological Innovations: Continuous improvements in cathode design, plasma control, and target materials lead to higher efficiency, better film quality, and novel deposition capabilities, expanding the application scope.

Barriers & Challenges:

- High Initial Capital Investment: The cost of sophisticated sputtering equipment can be substantial, posing a barrier for smaller manufacturers or research institutions with limited budgets, with typical system costs ranging from $500,000 to $2 Million.

- Complex Process Optimization: Achieving optimal film properties requires intricate process control and expertise, demanding skilled technicians and significant R&D investment from end-users.

- Supply Chain Disruptions: Geopolitical events and global economic fluctuations can impact the availability and cost of raw materials and critical components for sputtering equipment manufacturing, potentially leading to delays and increased production expenses.

- Stringent Environmental Regulations: Manufacturers must adhere to evolving environmental regulations concerning vacuum systems and material handling, adding to compliance costs and operational complexity.

Growth Drivers in the Sputtering Equipment Cathode Market Market

The Sputtering Equipment Cathode Market is propelled by several intertwined growth drivers. The escalating demand for advanced semiconductors, driven by AI, 5G technology, and the Internet of Things (IoT), necessitates more sophisticated thin-film deposition processes where sputtering cathodes play a crucial role. The rapid expansion of the electric vehicle market, with its increasing reliance on advanced sensors, batteries, and lightweight components, creates substantial opportunities for specialized coatings applied via sputtering. Furthermore, the growing adoption of energy-efficient technologies, including advanced solar panels and low-emissivity architectural glass, directly fuels the need for high-performance sputtering cathodes. Government initiatives promoting domestic semiconductor manufacturing and advanced materials research in key regions are also significant accelerators.

Challenges Impacting Sputtering Equipment Cathode Market Growth

Challenges impacting the Sputtering Equipment Cathode Market primarily revolve around the inherent complexity and cost associated with the technology. The high initial investment required for advanced sputtering systems can be a significant hurdle, particularly for emerging players or in budget-constrained sectors, with system prices often starting in the low to mid six figures. Ensuring consistent and high-quality thin-film deposition requires intricate process optimization and highly skilled personnel, representing an ongoing operational challenge for end-users. Furthermore, the global supply chain for specialized materials and components used in sputtering cathodes can be vulnerable to disruptions, leading to extended lead times and increased manufacturing costs. Competitive pressures from alternative deposition techniques, though limited in specific high-end applications, also necessitate continuous innovation and cost-effectiveness.

Key Players Shaping the Sputtering Equipment Cathode Market Market

- Veeco Instruments Inc

- Soleras Advanced Coatings

- Semicore Equipment Inc

- Sputtering Components Inc

- Impact Coatings AB

- KDF Technologies

- Kurt J Lesker Company

- Angstrom Sciences Inc

- Angstrom Engineering Inc

- AJA International Inc

Significant Sputtering Equipment Cathode Market Industry Milestones

- March 2022: Kurt J. Leskar Company, a leading provider of high-quality vacuum equipment, announced that it is expanding in Dresden, Germany in order to serve EU customers with dedicated local support and fast delivery from the distribution center. This strategic expansion aims to strengthen its presence in the European market, offering enhanced service and rapid product availability to a key customer base.

Future Outlook for Sputtering Equipment Cathode Market Market

The future outlook for the Sputtering Equipment Cathode Market is exceptionally bright, fueled by persistent technological advancements and the insatiable global demand for high-performance thin-film coatings. The market is expected to witness significant growth driven by emerging applications in flexible electronics, advanced sensors for autonomous systems, and next-generation display technologies. Strategic opportunities lie in the continued development of more efficient, cost-effective, and environmentally friendly sputtering solutions, as well as in catering to the evolving needs of the semiconductor and renewable energy sectors. Companies focusing on R&D for novel cathode materials and advanced process control systems will be well-positioned to capture market share. The market is projected to reach approximately $3.5 Billion by 2033, indicating a sustained period of innovation and expansion.

Sputtering Equipment Cathode Market Segmentation

-

1. Product

- 1.1. Linear

- 1.2. Circular

Sputtering Equipment Cathode Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Latin America

- 4.2. Middle East and Africa

Sputtering Equipment Cathode Market Regional Market Share

Geographic Coverage of Sputtering Equipment Cathode Market

Sputtering Equipment Cathode Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Applications of Semiconductors; Advancement in Technology Such as Magnetron Sputtering Technology

- 3.3. Market Restrains

- 3.3.1. Rise of Alternative Technologies Such as Thermal Evaporation

- 3.4. Market Trends

- 3.4.1. Rise in the Application of Semiconductors is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sputtering Equipment Cathode Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Linear

- 5.1.2. Circular

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Sputtering Equipment Cathode Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Linear

- 6.1.2. Circular

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Sputtering Equipment Cathode Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Linear

- 7.1.2. Circular

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Sputtering Equipment Cathode Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Linear

- 8.1.2. Circular

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Rest of the World Sputtering Equipment Cathode Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Linear

- 9.1.2. Circular

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Veeco Instruments Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Soleras Advanced Coatings

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Semicore Equipment Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Sputtering Components Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Impact Coatings AB

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 KDF Technologies

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Kurt J Lesker Company

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Angstrom Sciences Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Angstrom Engineering Inc *List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 AJA International Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Veeco Instruments Inc

List of Figures

- Figure 1: Global Sputtering Equipment Cathode Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Sputtering Equipment Cathode Market Revenue (Million), by Product 2025 & 2033

- Figure 3: North America Sputtering Equipment Cathode Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Sputtering Equipment Cathode Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Sputtering Equipment Cathode Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Sputtering Equipment Cathode Market Revenue (Million), by Product 2025 & 2033

- Figure 7: Europe Sputtering Equipment Cathode Market Revenue Share (%), by Product 2025 & 2033

- Figure 8: Europe Sputtering Equipment Cathode Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Sputtering Equipment Cathode Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Sputtering Equipment Cathode Market Revenue (Million), by Product 2025 & 2033

- Figure 11: Asia Pacific Sputtering Equipment Cathode Market Revenue Share (%), by Product 2025 & 2033

- Figure 12: Asia Pacific Sputtering Equipment Cathode Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Sputtering Equipment Cathode Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Sputtering Equipment Cathode Market Revenue (Million), by Product 2025 & 2033

- Figure 15: Rest of the World Sputtering Equipment Cathode Market Revenue Share (%), by Product 2025 & 2033

- Figure 16: Rest of the World Sputtering Equipment Cathode Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Rest of the World Sputtering Equipment Cathode Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Sputtering Equipment Cathode Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global Sputtering Equipment Cathode Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Sputtering Equipment Cathode Market Revenue Million Forecast, by Product 2020 & 2033

- Table 4: Global Sputtering Equipment Cathode Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Sputtering Equipment Cathode Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Sputtering Equipment Cathode Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global Sputtering Equipment Cathode Market Revenue Million Forecast, by Product 2020 & 2033

- Table 8: Global Sputtering Equipment Cathode Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Germany Sputtering Equipment Cathode Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom Sputtering Equipment Cathode Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Sputtering Equipment Cathode Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of Europe Sputtering Equipment Cathode Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Sputtering Equipment Cathode Market Revenue Million Forecast, by Product 2020 & 2033

- Table 14: Global Sputtering Equipment Cathode Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: China Sputtering Equipment Cathode Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Japan Sputtering Equipment Cathode Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: India Sputtering Equipment Cathode Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Asia Pacific Sputtering Equipment Cathode Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Sputtering Equipment Cathode Market Revenue Million Forecast, by Product 2020 & 2033

- Table 20: Global Sputtering Equipment Cathode Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Latin America Sputtering Equipment Cathode Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Middle East and Africa Sputtering Equipment Cathode Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sputtering Equipment Cathode Market?

The projected CAGR is approximately 5.91%.

2. Which companies are prominent players in the Sputtering Equipment Cathode Market?

Key companies in the market include Veeco Instruments Inc, Soleras Advanced Coatings, Semicore Equipment Inc, Sputtering Components Inc, Impact Coatings AB, KDF Technologies, Kurt J Lesker Company, Angstrom Sciences Inc, Angstrom Engineering Inc *List Not Exhaustive, AJA International Inc.

3. What are the main segments of the Sputtering Equipment Cathode Market?

The market segments include Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Applications of Semiconductors; Advancement in Technology Such as Magnetron Sputtering Technology.

6. What are the notable trends driving market growth?

Rise in the Application of Semiconductors is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Rise of Alternative Technologies Such as Thermal Evaporation.

8. Can you provide examples of recent developments in the market?

March 2022 - Kurt J. Leskar Company, a leading provider of high-quality vacuum equipment, announced that it is expanding in Dresden, Germany in order to serve EU customers with dedicated local support and fast delivery from the distribution center.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sputtering Equipment Cathode Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sputtering Equipment Cathode Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sputtering Equipment Cathode Market?

To stay informed about further developments, trends, and reports in the Sputtering Equipment Cathode Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence