Key Insights

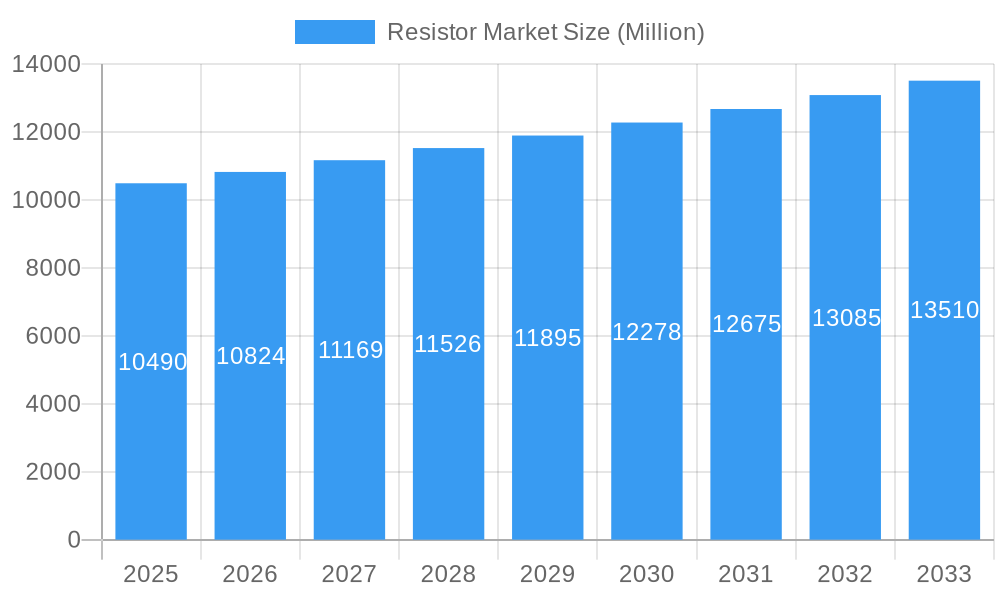

The global Resistor Market is projected to reach an estimated value of approximately $10.49 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 3.20% over the forecast period of 2025-2033. This steady growth is underpinned by the pervasive and ever-increasing demand for electronic components across a multitude of industries. Key drivers for this expansion include the relentless innovation in consumer electronics, the burgeoning automotive sector with its increasing electrification and advanced driver-assistance systems (ADAS), and the critical role resistors play in aerospace and defense applications. Furthermore, the rapid advancements in communication technologies, particularly 5G infrastructure deployment and the Internet of Things (IoT), necessitate a continuous supply of high-performance resistors.

Resistor Market Market Size (In Billion)

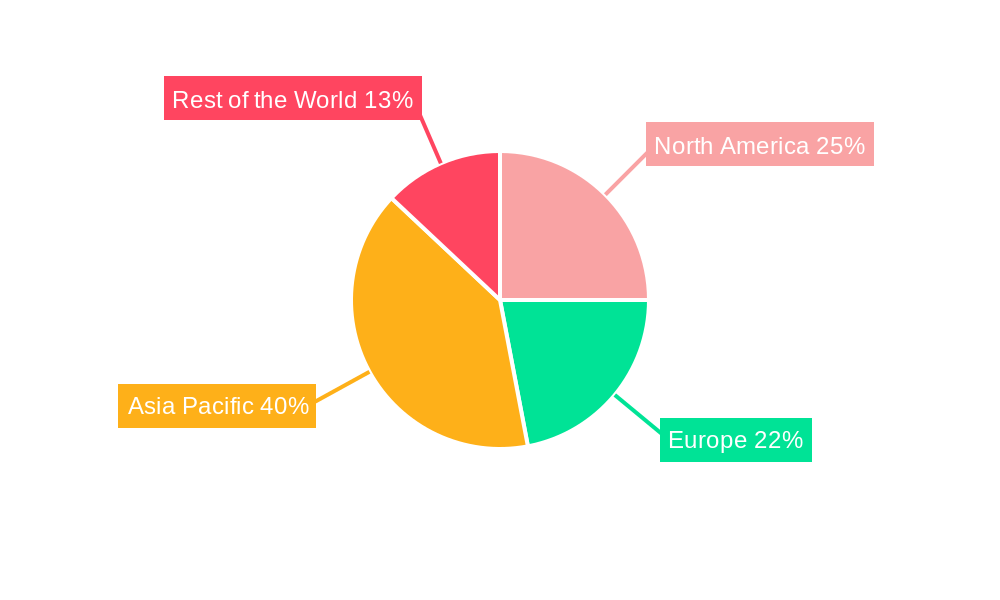

The market is segmented by type, with Surface-mounted Chips dominating due to their miniaturization capabilities and suitability for automated manufacturing processes. However, other segments such as Wirewound and Film/Oxide/Foil resistors continue to hold significant sway in specialized applications requiring high power handling or precise resistance values. The End-User Industry segment highlights the expansive reach of resistors, with Automotive, Communications, and Consumer Electronics and Computing emerging as primary growth engines. The Asia Pacific region is anticipated to lead market expansion, driven by its robust manufacturing base and high adoption rates of new technologies. While the market enjoys strong growth, potential restraints could include fluctuations in raw material prices and intense competition among leading manufacturers like Murata Manufacturing Co., Ltd., Yageo Corporation, and TE Connectivity Ltd., who are constantly striving for technological advancements and cost-effectiveness.

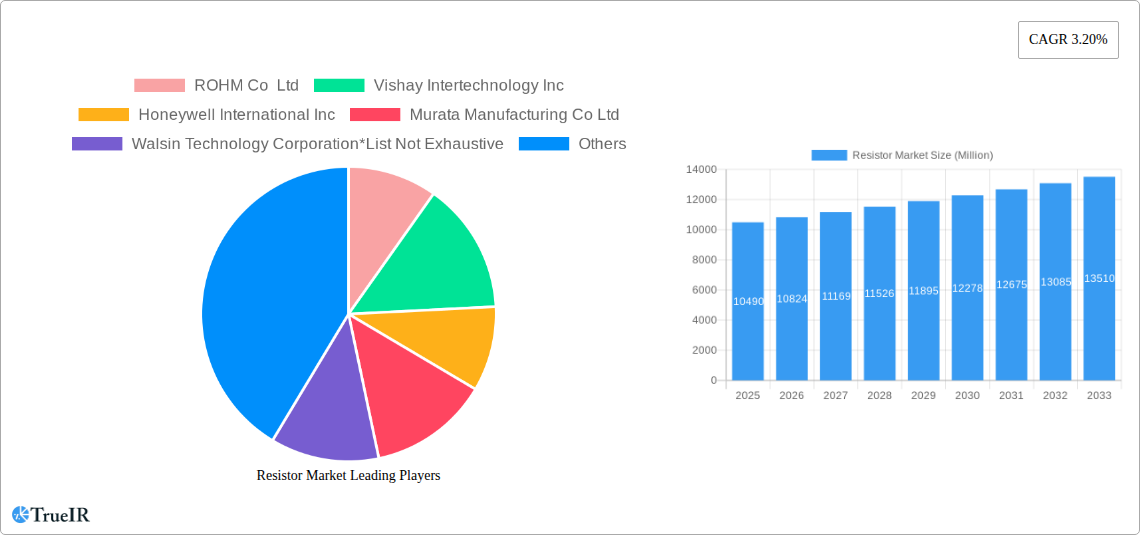

Resistor Market Company Market Share

Unveiling the Future: A Comprehensive Analysis of the Global Resistor Market (2019-2033)

This in-depth report provides a definitive analysis of the global resistor market, forecasting significant growth and evolution from 2019 to 2033. With a base year of 2025, the report delves into market dynamics, key players, technological advancements, and emerging opportunities. We project the global resistor market to reach $XX Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). Our research encompasses a detailed examination of historical trends from 2019-2024, providing essential context for understanding current market conditions and future trajectories.

Resistor Market Market Structure & Competitive Landscape

The global resistor market exhibits a moderately concentrated structure, with a significant portion of the market share held by a few dominant players. Key innovation drivers include the relentless demand for miniaturization, increased power handling capabilities, and enhanced precision across diverse end-user industries. Regulatory impacts, while generally favorable towards technological advancement, can influence material sourcing and manufacturing processes. Product substitutes are limited due to the fundamental role resistors play in electronic circuits, but advancements in integrated passive components and novel materials are being closely monitored. End-user segmentation reveals robust demand from the automotive, communications, and consumer electronics sectors, each contributing substantially to market expansion. Merger and acquisition (M&A) trends indicate strategic consolidation aimed at expanding product portfolios, geographical reach, and technological expertise. In the historical period, we observed XX M&A activities, with a market concentration ratio of approximately XX% held by the top X companies. Future M&A will likely focus on companies with expertise in advanced resistor technologies and specialized applications.

Resistor Market Market Trends & Opportunities

The global resistor market is poised for substantial growth, driven by the pervasive digitalization of nearly every sector. The market size is projected to expand significantly, fueled by the increasing adoption of electronic devices, the rollout of 5G networks, and the burgeoning electric vehicle (EV) and autonomous driving technologies. Technological shifts are a primary catalyst, with a strong emphasis on surface-mounted device (SMD) resistors, particularly multilayer ceramic capacitors (MLCCs) and thin-film resistors, offering superior performance characteristics like high frequency response and low parasitic inductance. The demand for high-power resistors is also escalating due to advancements in power electronics and renewable energy systems. Consumer preferences are increasingly leaning towards smaller, more efficient, and integrated electronic components, which directly translates to a higher demand for advanced resistor solutions. Competitive dynamics are characterized by intense innovation, with companies constantly striving to improve power ratings, temperature coefficients, and reliability. Emerging opportunities lie in niche applications such as medical devices, industrial automation, and the Internet of Things (IoT), where specialized resistor functionalities are critical. The market penetration rate for advanced resistor technologies is expected to reach XX% by 2033. The CAGR for the forecast period is estimated at XX%, underscoring the robust expansion anticipated.

Dominant Markets & Segments in Resistor Market

The Asia Pacific region is currently the dominant market for resistors, driven by its expansive manufacturing base for consumer electronics, telecommunications equipment, and automotive components. Within this region, China stands out as a leading country due to its sheer volume of production and consumption.

Type Segments:

- Surface-mounted Chips (SMD): This segment is experiencing the most significant growth, accounting for over XX% of the market. The miniaturization trend in electronics directly fuels the demand for SMD resistors, enabling smaller and more complex circuit designs. Key growth drivers include the proliferation of smartphones, laptops, and wearable devices.

- Film/Oxide/Foil: These resistors offer high precision and stability, making them crucial for applications in communications infrastructure, aerospace, and medical equipment. Growth in these sub-segments is linked to the increasing complexity and performance demands of these industries.

- Wirewound: While a more established technology, wirewound resistors continue to see demand in high-power applications and specialized industrial equipment where robustness and power dissipation are paramount.

- Network: Resistor networks offer space-saving advantages and improved reliability by integrating multiple resistors into a single package, driving their adoption in complex circuit boards.

- Carbon: Carbon resistors, though less precise than film-based types, remain cost-effective for general-purpose applications in consumer electronics.

End-User Industry Segments:

- Consumer Electronics and Computing: This segment consistently represents the largest share of the resistor market, driven by the continuous innovation and high sales volumes of smartphones, tablets, personal computers, and gaming consoles.

- Automotive: The rapid electrification of vehicles, coupled with the increasing integration of advanced driver-assistance systems (ADAS) and infotainment systems, is a major growth driver for resistors. The demand for reliable and high-performance resistors in automotive applications is paramount.

- Communications: The ongoing global rollout of 5G networks, along with the expansion of broadband infrastructure, fuels significant demand for resistors used in base stations, routers, and other telecommunication equipment.

- Aerospace and Defense: This sector requires highly reliable and robust resistors for critical applications in navigation systems, communication equipment, and defense electronics, contributing to steady demand.

- Other En: This broad category includes industrial automation, medical devices, power supplies, and renewable energy systems, all of which are experiencing growth and contributing to the diversified demand for resistors.

Resistor Market Product Analysis

Recent product innovations in the resistor market are focused on enhancing performance metrics such as power density, precision, and temperature stability, while simultaneously reducing physical size. Advancements in materials science have led to the development of new thin-film and thick-film resistor technologies capable of handling higher power loads and operating in extreme environments. These innovations are crucial for the automotive industry's transition to electric vehicles and the aerospace sector's demand for lightweight, high-reliability components. The competitive advantage for manufacturers lies in their ability to offer customized solutions that meet the stringent requirements of specialized applications, thereby securing lucrative contracts and driving market growth.

Key Drivers, Barriers & Challenges in Resistor Market

The resistor market is propelled by several key drivers. Technological advancements, particularly in miniaturization and power handling, are paramount, driven by the relentless demand for more sophisticated and compact electronic devices across all sectors. Economic factors, including global economic growth and increased disposable income, fuel consumer spending on electronics. Policy-driven initiatives, such as government investments in telecommunications infrastructure and the promotion of electric vehicles, create substantial market opportunities.

Conversely, several barriers and challenges impede growth. Supply chain disruptions, as witnessed in recent years, can impact the availability and cost of raw materials, leading to production delays and price volatility. Regulatory hurdles, while generally supportive of innovation, can impose compliance costs and stringent testing requirements, particularly for specialized applications like medical devices. Competitive pressures from established players and emerging manufacturers intensify, leading to price erosion in some market segments. The XX% impact of semiconductor shortages in the historical period highlights the vulnerability of the supply chain.

Growth Drivers in the Resistor Market Market

Several pivotal factors are driving the growth of the resistor market. Technological innovation remains a cornerstone, with continuous advancements in material science and manufacturing processes enabling the creation of smaller, more powerful, and more precise resistors. The increasing pervasiveness of electronic devices across all facets of life, from consumer gadgets to industrial machinery, directly translates to a higher demand for these essential components. Furthermore, significant investments in 5G infrastructure globally, the rapid expansion of the electric vehicle market, and the growing adoption of the Internet of Things (IoT) are creating substantial new avenues for resistor consumption. Government initiatives promoting digitalization and smart technologies further bolster this upward trend.

Challenges Impacting Resistor Market Growth

Despite robust growth prospects, the resistor market faces several significant challenges. The inherent complexity and fragility of global supply chains pose a constant threat, with potential disruptions in raw material availability and logistics impacting production schedules and costs. Regulatory complexities, particularly concerning environmental compliance and product safety standards in different regions, can necessitate substantial investment in testing and certification. Intense competitive pressures, both from established global players and increasingly capable regional manufacturers, can lead to price sensitivity and margin erosion, especially in high-volume segments. Moreover, the ongoing evolution of integrated circuit technologies could, in the long term, impact the demand for discrete passive components in certain applications.

Key Players Shaping the Resistor Market Market

- ROHM Co Ltd

- Vishay Intertechnology Inc

- Honeywell International Inc

- Murata Manufacturing Co Ltd

- Walsin Technology Corporation

- TT Electronics

- Viking Tech Corporation

- KOA Speer Electronics Inc

- Yageo Corporation

- TE Connectivity Ltd

- Bourns Inc

- Susumu International U S A

- Ohmite Manufacturing Company

- Panasonic Corporation

Significant Resistor Market Industry Milestones

- August 2023: Texas Instruments (TI) announced the introduction of new current sensing solutions designed to enhance accuracy, integration, and streamline the design process. This release includes an innovative Hall-effect current sensor with exceptionally low drift and new current shunt monitors incorporating a shunt resistor.

- March 2023: Vishay Intertechnology, Inc. enhanced its Vishay Draloric RCS0805 e3 anti-surge thick film resistor in the 0805 case size with a higher power rating of 0.5 W. This upgrade allows the RCS0805 e3 to replace four standard parallel resistors, enabling designers to save board space in critical industries such as automotive, industrial, telecommunications, and medical applications.

Future Outlook for Resistor Market Market

The future outlook for the resistor market is exceptionally bright, characterized by sustained growth and ongoing innovation. The convergence of several powerful trends—including the proliferation of IoT devices, the expansion of 5G networks, the electrification of transportation, and advancements in artificial intelligence—will continue to fuel demand. Strategic opportunities lie in developing highly specialized resistors for emerging applications in areas like advanced medical diagnostics, quantum computing, and renewable energy storage solutions. Companies that invest in research and development, focusing on high-performance, miniaturized, and sustainable resistor technologies, will be well-positioned to capitalize on the evolving market landscape and secure long-term success. The market is expected to witness increased demand for resistors with enhanced thermal management capabilities and improved resistance to electromagnetic interference.

Resistor Market Segmentation

-

1. Type

- 1.1. Surface-mounted Chips

- 1.2. Network

- 1.3. Wirewound

- 1.4. Film/Oxide/Foil

- 1.5. Carbon

-

2. End-User Industry

- 2.1. Automotive

- 2.2. Aerospace and Defense

- 2.3. Communications

- 2.4. Consumer Electronics and Computing

- 2.5. Other En

Resistor Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Resistor Market Regional Market Share

Geographic Coverage of Resistor Market

Resistor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from the Automotive Industry; Growing Demand for High-performance Electronics

- 3.3. Market Restrains

- 3.3.1. Growth in the Metal Prices to Impact Production Cost

- 3.4. Market Trends

- 3.4.1. Consumer Electronics Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Resistor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Surface-mounted Chips

- 5.1.2. Network

- 5.1.3. Wirewound

- 5.1.4. Film/Oxide/Foil

- 5.1.5. Carbon

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Automotive

- 5.2.2. Aerospace and Defense

- 5.2.3. Communications

- 5.2.4. Consumer Electronics and Computing

- 5.2.5. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Resistor Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Surface-mounted Chips

- 6.1.2. Network

- 6.1.3. Wirewound

- 6.1.4. Film/Oxide/Foil

- 6.1.5. Carbon

- 6.2. Market Analysis, Insights and Forecast - by End-User Industry

- 6.2.1. Automotive

- 6.2.2. Aerospace and Defense

- 6.2.3. Communications

- 6.2.4. Consumer Electronics and Computing

- 6.2.5. Other En

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Resistor Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Surface-mounted Chips

- 7.1.2. Network

- 7.1.3. Wirewound

- 7.1.4. Film/Oxide/Foil

- 7.1.5. Carbon

- 7.2. Market Analysis, Insights and Forecast - by End-User Industry

- 7.2.1. Automotive

- 7.2.2. Aerospace and Defense

- 7.2.3. Communications

- 7.2.4. Consumer Electronics and Computing

- 7.2.5. Other En

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Resistor Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Surface-mounted Chips

- 8.1.2. Network

- 8.1.3. Wirewound

- 8.1.4. Film/Oxide/Foil

- 8.1.5. Carbon

- 8.2. Market Analysis, Insights and Forecast - by End-User Industry

- 8.2.1. Automotive

- 8.2.2. Aerospace and Defense

- 8.2.3. Communications

- 8.2.4. Consumer Electronics and Computing

- 8.2.5. Other En

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Resistor Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Surface-mounted Chips

- 9.1.2. Network

- 9.1.3. Wirewound

- 9.1.4. Film/Oxide/Foil

- 9.1.5. Carbon

- 9.2. Market Analysis, Insights and Forecast - by End-User Industry

- 9.2.1. Automotive

- 9.2.2. Aerospace and Defense

- 9.2.3. Communications

- 9.2.4. Consumer Electronics and Computing

- 9.2.5. Other En

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ROHM Co Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Vishay Intertechnology Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Honeywell International Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Murata Manufacturing Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Walsin Technology Corporation*List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 TT Electronics

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Viking Tech Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 KOA Speer Electronics Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Yageo Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 TE Connectivity Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Bourns Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Susumu International U S A

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Ohmite Manufacturing Company

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Panasonic Corporation

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.1 ROHM Co Ltd

List of Figures

- Figure 1: Global Resistor Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Resistor Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Resistor Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Resistor Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 5: North America Resistor Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 6: North America Resistor Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Resistor Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Resistor Market Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Resistor Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Resistor Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 11: Europe Resistor Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 12: Europe Resistor Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Resistor Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Resistor Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Resistor Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Resistor Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 17: Asia Pacific Resistor Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 18: Asia Pacific Resistor Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Resistor Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Resistor Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Rest of the World Resistor Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Rest of the World Resistor Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 23: Rest of the World Resistor Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 24: Rest of the World Resistor Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Resistor Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Resistor Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Resistor Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 3: Global Resistor Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Resistor Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Resistor Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: Global Resistor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Resistor Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Resistor Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 9: Global Resistor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Resistor Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Resistor Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 12: Global Resistor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Resistor Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Resistor Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 15: Global Resistor Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Resistor Market?

The projected CAGR is approximately 3.20%.

2. Which companies are prominent players in the Resistor Market?

Key companies in the market include ROHM Co Ltd, Vishay Intertechnology Inc, Honeywell International Inc, Murata Manufacturing Co Ltd, Walsin Technology Corporation*List Not Exhaustive, TT Electronics, Viking Tech Corporation, KOA Speer Electronics Inc, Yageo Corporation, TE Connectivity Ltd, Bourns Inc, Susumu International U S A, Ohmite Manufacturing Company, Panasonic Corporation.

3. What are the main segments of the Resistor Market?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.49 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from the Automotive Industry; Growing Demand for High-performance Electronics.

6. What are the notable trends driving market growth?

Consumer Electronics Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Growth in the Metal Prices to Impact Production Cost.

8. Can you provide examples of recent developments in the market?

August 2023: Texas Instruments (TI) has announced the introduction of new current sensing solutions, which have been specifically designed to enhance accuracy and integration while also streamlining the overall design process. As part of this release, TI is offering two innovative products: a Hall-effect current sensor, renowned for its remarkably low drift within TI's product range, and new current shunt monitors that incorporate a shunt resistor.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Resistor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Resistor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Resistor Market?

To stay informed about further developments, trends, and reports in the Resistor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence