Key Insights

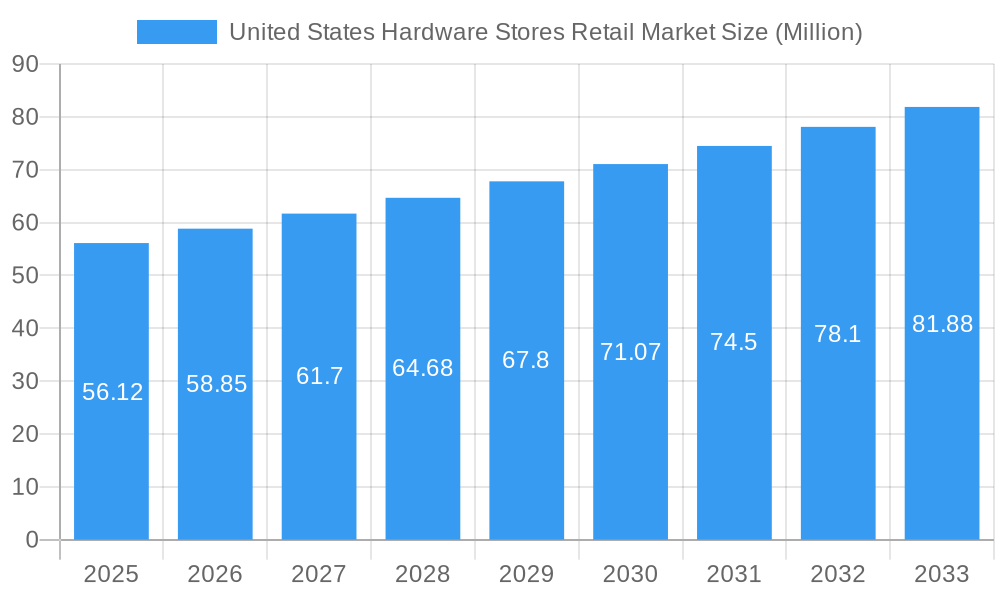

The United States Hardware Stores Retail Market is poised for steady growth, with a current market size estimated at $56.12 million in 2025. This robust expansion is projected to continue at a Compound Annual Growth Rate (CAGR) of 4.89% through 2033. This indicates a dynamic and resilient sector, driven by several key factors. The increasing demand for home improvement and renovation projects, fueled by homeowners looking to enhance their living spaces and a rising interest in DIY activities, forms a significant driver. Furthermore, the ongoing trend of urbanization and new construction projects in suburban areas also contributes to the sustained need for hardware products. The market is also influenced by technological advancements in building materials and the growing popularity of online retail channels, offering consumers greater convenience and wider product selections.

United States Hardware Stores Retail Market Market Size (In Million)

The market is segmented across various product types, including essential Door Hardware, fundamental Building Materials, convenient Kitchen and Toilet Products, and Other Product Types catering to specialized needs. Distribution channels are predominantly split between traditional Offline retail stores, which benefit from immediate customer interaction and expert advice, and increasingly prominent Online platforms, offering accessibility and competitive pricing. Key players such as Home Depot Inc., Lowe's Companies Inc., Menard Inc., Ace Hardware, and True Value Hardware are actively shaping the competitive landscape through strategic expansions, product innovations, and omnichannel retail approaches. The United States remains the primary region of focus, with its mature market and consistent consumer spending on home improvement.

United States Hardware Stores Retail Market Company Market Share

United States Hardware Stores Retail Market Market Structure & Competitive Landscape

The United States hardware stores retail market is characterized by a highly fragmented yet competitive landscape, with a mix of large national chains, regional players, and numerous independent retailers. Market concentration is moderate, with the top five companies estimated to hold approximately 60% of the market share. Home Depot Inc. and Lowe's Companies Inc. are the dominant forces, commanding significant portions of the market due to their extensive store networks, vast product offerings, and strong brand recognition. Innovation drivers include the increasing demand for DIY solutions, smart home integration, sustainable products, and enhanced in-store and online customer experiences. Regulatory impacts are relatively low, primarily concerning consumer protection, safety standards, and environmental regulations. Product substitutes are abundant, ranging from general merchandise retailers and online marketplaces to specialized suppliers for specific home improvement needs. End-user segmentation reveals a strong divide between professional contractors and DIY homeowners, each with distinct purchasing behaviors and product preferences. Mergers and acquisitions (M&A) trends are present, particularly among smaller independent chains consolidating to gain economies of scale and compete more effectively. For instance, Ace Hardware's strategic acquisitions aim to expand its service offerings and market reach. The estimated M&A volume in the last two years is in the range of $500 Million to $1 Billion, indicating active consolidation.

United States Hardware Stores Retail Market Market Trends & Opportunities

The United States hardware stores retail market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 5.2% from 2025 to 2033, reaching an estimated market size of $150 Billion by 2033. The base year of 2025 sets a strong foundation for this expansion, building upon the historical performance of the 2019-2024 period. Technological shifts are fundamentally reshaping the retail landscape. E-commerce penetration, while still a smaller percentage of total sales compared to offline channels, is rapidly growing, presenting a significant opportunity for retailers to enhance their online presence, offer convenient click-and-collect services, and leverage digital marketing strategies. The integration of artificial intelligence (AI) for personalized recommendations and inventory management, alongside augmented reality (AR) for visualizing products in a home setting, are emerging as key differentiators. Consumer preferences are increasingly geared towards convenience, value, and sustainability. Homeowners are investing more in home improvement projects, driven by a desire to enhance living spaces, improve energy efficiency, and increase property value. The aging housing stock across the US necessitates ongoing maintenance and renovation, further fueling demand. Millennials and Gen Z are also becoming significant consumer groups, often seeking DIY-friendly products and online resources for guidance. Competitive dynamics are intensifying, with established players investing heavily in omnichannel strategies and private label offerings to capture market share. Opportunities abound for retailers who can effectively blend digital innovation with a superior in-store experience, offering expert advice and a curated product selection. The rise of subscription-based services for recurring needs, such as filters or cleaning supplies, also presents an untapped market potential. Furthermore, the increasing focus on sustainable building materials and energy-efficient solutions aligns with growing environmental consciousness among consumers, creating a niche for eco-friendly product lines. The "Do It For Me" (DIFM) segment, driven by an aging population and busy lifestyles, is also creating opportunities for retailers to partner with service providers and offer installation services, expanding their revenue streams beyond product sales. The market penetration rate for online hardware sales is projected to reach 25% by 2033, up from approximately 12% in 2024.

Dominant Markets & Segments in United States Hardware Stores Retail Market

The United States hardware stores retail market exhibits dominance across several key segments and channels. Building Materials represent the largest and most consistent segment by revenue, accounting for an estimated 45% of the total market. This dominance is driven by ongoing new construction, extensive home renovation activities, and the fundamental need for infrastructure development across the nation. Key growth drivers within this segment include government infrastructure spending, a strong housing market, and an aging housing stock requiring regular repairs and upgrades. The Offline distribution channel continues to be the primary revenue generator, holding approximately 70% of the market share. This is attributed to the tactile nature of many hardware purchases, the need for expert advice, and the established shopping habits of a significant portion of the consumer base. However, the Online distribution channel is experiencing rapid growth, with an estimated CAGR of 8.5% over the forecast period, driven by convenience, competitive pricing, and wider product availability.

Key Growth Drivers within Dominant Segments:

Building Materials:

- Infrastructure Investment: Federal and state initiatives for road, bridge, and utility upgrades directly boost demand for lumber, concrete, fasteners, and related construction supplies.

- Housing Market Stability: Continued demand for new homes and existing home sales fuels residential construction and renovation projects.

- Energy Efficiency Mandates: Growing emphasis on sustainable building practices and energy-efficient materials drives sales of insulation, windows, and energy-saving fixtures.

- DIY Home Improvement Culture: A persistent interest in personalizing and improving living spaces contributes to consistent demand for a wide array of building components.

Offline Distribution Channel:

- In-Store Expertise: The ability to consult with knowledgeable staff for advice on product selection and project execution remains a critical advantage.

- Immediate Availability: Customers often require materials and tools on short notice for immediate project needs.

- Tangible Product Experience: Consumers prefer to see, touch, and compare physical products like paint colors, tile samples, and lumber quality before purchasing.

- Established Retail Presence: The vast network of physical stores, including big-box retailers and local hardware stores, ensures accessibility for a broad customer base.

Online Distribution Channel:

- Convenience and Accessibility: 24/7 shopping, delivery to doorsteps, and easy comparison of products from multiple vendors.

- Competitive Pricing: Online platforms often offer more competitive pricing due to lower overhead costs.

- Wider Product Selection: Access to a broader range of niche products and brands not typically stocked in physical stores.

- Digital Tools and Resources: Online retailers often provide helpful content, tutorials, and virtual design tools.

While Door Hardware and Kitchen and Toilet Products represent smaller but significant segments, their growth is intrinsically linked to new construction and remodeling trends. The "Other Product Types" category, encompassing tools, lawn and garden supplies, and paint, also remains a substantial contributor to overall market revenue, reflecting the diverse needs of homeowners and professionals. The market share for Online distribution is projected to increase from 20% in 2025 to 30% by 2033.

United States Hardware Stores Retail Market Product Analysis

The United States hardware stores retail market is experiencing a surge in product innovation driven by technological advancements and evolving consumer demands. Smart home integration is a key focus, with manufacturers developing connected door locks, thermostats, and lighting systems that enhance convenience and security. Sustainable product development is also gaining traction, with an increased offering of eco-friendly paints, low-VOC building materials, and water-saving plumbing fixtures. Competitive advantages lie in product durability, ease of installation, energy efficiency, and aesthetic appeal. Companies are increasingly investing in proprietary technologies and advanced materials to differentiate their offerings in a crowded marketplace. The market fit for these innovations is strong, as consumers actively seek solutions that improve their homes’ functionality, sustainability, and overall value.

Key Drivers, Barriers & Challenges in United States Hardware Stores Retail Market

Key Drivers:

- Robust Housing Market: Continued new construction and a strong resale market fuel demand for building materials, renovation supplies, and home improvement products.

- DIY Home Improvement Trend: A persistent interest in personal projects and home upgrades drives consistent consumer spending.

- Aging Infrastructure and Housing Stock: The need for repairs and upgrades to existing homes and public infrastructure provides a steady demand for hardware products.

- Technological Advancements: Innovations in smart home technology, energy-efficient products, and digital retail experiences enhance customer engagement and product appeal.

- Government Initiatives: Infrastructure spending and incentives for energy efficiency and sustainable building practices directly boost market growth.

Barriers & Challenges:

- Supply Chain Disruptions: Global supply chain issues can lead to material shortages, increased costs, and delivery delays, impacting inventory availability and pricing. Estimated impact: $500 Million to $1 Billion in lost revenue annually.

- Intensifying Competition: The presence of large big-box retailers, specialized online stores, and discount retailers creates significant price pressure and market saturation.

- Skilled Labor Shortage: A lack of qualified tradespeople can hinder the growth of the "Do It For Me" segment and impact project completion timelines.

- Economic Volatility: Fluctuations in the economy, interest rates, and consumer confidence can directly affect discretionary spending on home improvement projects.

- Regulatory Compliance: Adhering to evolving safety, environmental, and building codes requires continuous investment and adaptation.

Growth Drivers in the United States Hardware Stores Retail Market Market

The United States hardware stores retail market is propelled by several key growth drivers. The resilient housing market, characterized by sustained demand for new construction and existing home sales, directly translates to increased sales of building materials, tools, and finishing products. The persistent DIY home improvement culture among American consumers continues to be a significant revenue generator, with individuals actively investing in personalizing and upgrading their living spaces. Furthermore, the aging housing stock necessitates ongoing maintenance and repairs, creating a constant demand for essential hardware. Technological advancements are also playing a crucial role, with the integration of smart home devices, energy-efficient solutions, and digital retail platforms enhancing customer experience and expanding product offerings. Government initiatives, such as infrastructure spending and incentives for sustainable building, further stimulate market expansion by driving demand for construction and renovation materials.

Challenges Impacting United States Hardware Stores Retail Market Growth

Despite positive growth trajectories, the United States hardware stores retail market faces significant challenges. Supply chain disruptions remain a critical concern, leading to unpredictable material availability, increased freight costs, and potential project delays, impacting profitability. The highly competitive landscape, with established national retailers, numerous independent stores, and aggressive online players, exerts constant pressure on pricing and margins. Economic uncertainties, including inflation and interest rate fluctuations, can dampen consumer confidence and discretionary spending on home improvement projects. Regulatory complexities, encompassing evolving building codes, safety standards, and environmental regulations, require continuous adaptation and investment from market participants. The shortage of skilled labor in construction and trades further constrains the "Do It For Me" segment and can impact the overall pace of renovation projects.

Key Players Shaping the United States Hardware Stores Retail Market Market

- Home Depot Inc.

- Lowe's Companies Inc.

- Menard Inc.

- Ace Hardware

- True Value Hardware

- 84 Lumber

- Handy Andy Home Improvement Centers Inc

- Hippo Hardware and Trading Company

- Orchard Supply Hardware

- Harbor Freight Tools

Significant United States Hardware Stores Retail Market Industry Milestones

- September 2023: Lowe's declared the extension of its multi-year agreement with the NFL for the current year's season. The collaboration commenced with a comprehensive marketing campaign, including a national television commercial, an updated lineup of Lowe's Home Team players, and the introduction of a limited-edition DIY Wrist Coach accessory.

- June 2023: Ace Hardware purchased 12 independent heating and air, plumbing, and electrical home services companies from Unique Indoor Comfort's portfolio, which was owned by the Atlanta-based private equity firm Grove Mountain.

Future Outlook for United States Hardware Stores Retail Market Market

The future outlook for the United States hardware stores retail market is optimistic, with continued growth anticipated throughout the forecast period ending in 2033. Key growth catalysts include the ongoing modernization of existing homes, increasing demand for smart home technology, and a sustained interest in DIY projects. The expansion of the online retail channel, coupled with innovative omnichannel strategies, will be crucial for capturing market share. Opportunities lie in the increasing consumer preference for sustainable products and energy-efficient solutions. Strategic collaborations and acquisitions, such as those seen with Ace Hardware expanding its service offerings, are likely to shape the competitive landscape. The market is poised to benefit from infrastructure investments and a stable housing market, ensuring a consistent demand for building materials and renovation supplies. The estimated market size by 2033 is projected to reach $150 Billion, reflecting a strong and evolving industry.

United States Hardware Stores Retail Market Segmentation

-

1. Product Type

- 1.1. Door Hardware

- 1.2. Building Materials

- 1.3. Kitchen and Toilet Products

- 1.4. Other Product Types

-

2. Distribution Channel

- 2.1. Offline

- 2.2. Online

United States Hardware Stores Retail Market Segmentation By Geography

- 1. United States

United States Hardware Stores Retail Market Regional Market Share

Geographic Coverage of United States Hardware Stores Retail Market

United States Hardware Stores Retail Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Home Improvement and Renovation Projects

- 3.3. Market Restrains

- 3.3.1. Rise in Home Improvement and Renovation Projects

- 3.4. Market Trends

- 3.4.1. Increased Focus on Home Improvement and Renovation Projects

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Hardware Stores Retail Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Door Hardware

- 5.1.2. Building Materials

- 5.1.3. Kitchen and Toilet Products

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Offline

- 5.2.2. Online

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Home Depot Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lowe's Companies Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Menard Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ace Hardware

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 True Value Hardware

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 84 Lumber

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Handy Andy Home Improvement Centers Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hippo Hardware and Trading Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Orchard Supply Hardware

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Harbor Freight Tools

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Home Depot Inc

List of Figures

- Figure 1: United States Hardware Stores Retail Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Hardware Stores Retail Market Share (%) by Company 2025

List of Tables

- Table 1: United States Hardware Stores Retail Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: United States Hardware Stores Retail Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: United States Hardware Stores Retail Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: United States Hardware Stores Retail Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: United States Hardware Stores Retail Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: United States Hardware Stores Retail Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: United States Hardware Stores Retail Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: United States Hardware Stores Retail Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 9: United States Hardware Stores Retail Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: United States Hardware Stores Retail Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: United States Hardware Stores Retail Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United States Hardware Stores Retail Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Hardware Stores Retail Market?

The projected CAGR is approximately 4.89%.

2. Which companies are prominent players in the United States Hardware Stores Retail Market?

Key companies in the market include Home Depot Inc, Lowe's Companies Inc, Menard Inc, Ace Hardware, True Value Hardware, 84 Lumber, Handy Andy Home Improvement Centers Inc, Hippo Hardware and Trading Company, Orchard Supply Hardware, Harbor Freight Tools.

3. What are the main segments of the United States Hardware Stores Retail Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 56.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Home Improvement and Renovation Projects.

6. What are the notable trends driving market growth?

Increased Focus on Home Improvement and Renovation Projects.

7. Are there any restraints impacting market growth?

Rise in Home Improvement and Renovation Projects.

8. Can you provide examples of recent developments in the market?

September 2023: Lowe declared the extension of its multi-year agreement with the NFL for the current year's season. The collaboration will commence with a comprehensive marketing campaign, including a national television commercial, an updated lineup of Lowe's Home Team players, and the introduction of a limited-edition DIY Wrist Coach accessory.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Hardware Stores Retail Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Hardware Stores Retail Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Hardware Stores Retail Market?

To stay informed about further developments, trends, and reports in the United States Hardware Stores Retail Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence