Key Insights

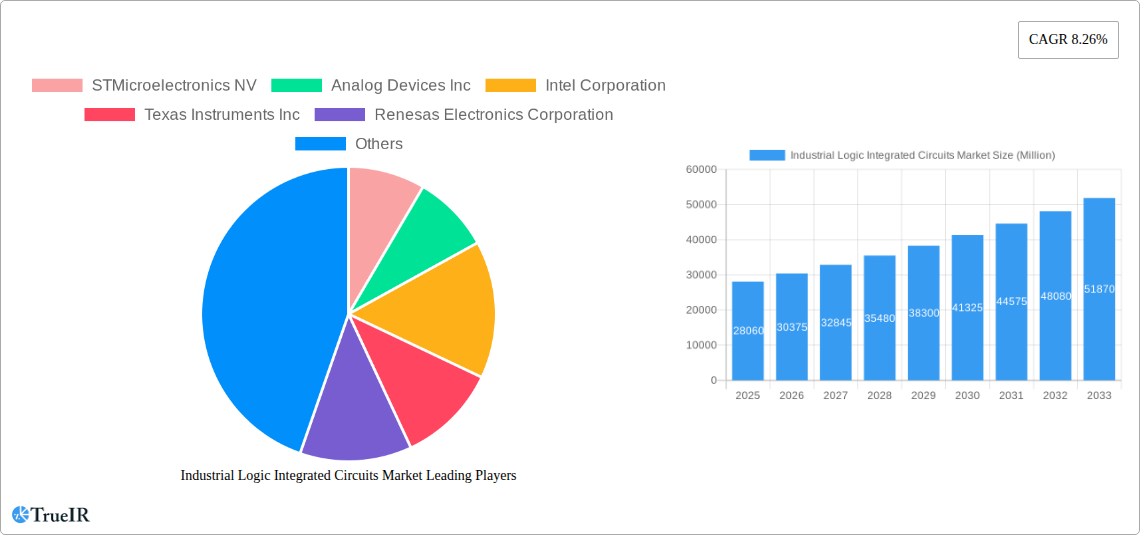

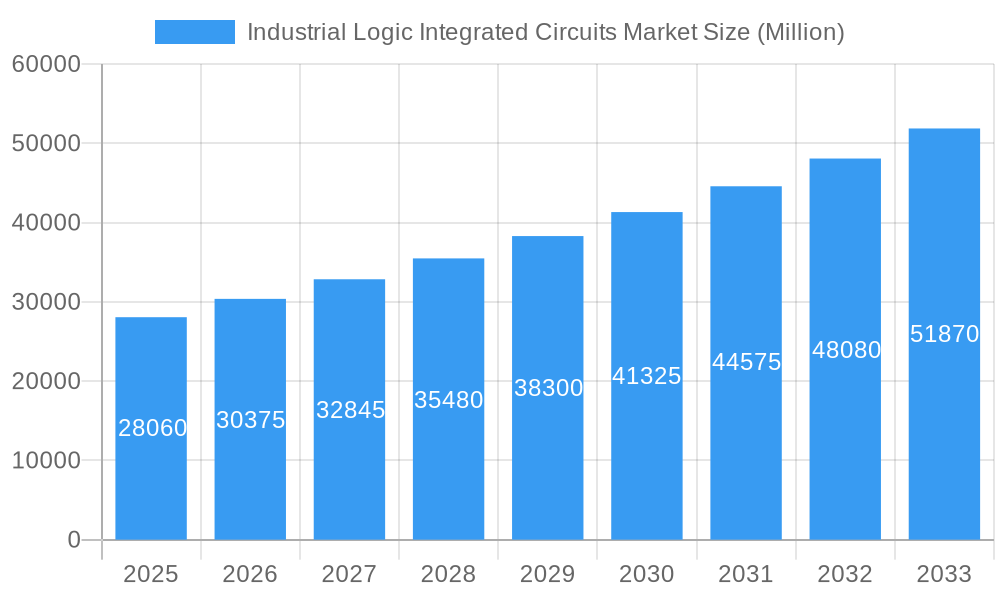

The global Industrial Logic Integrated Circuits (IC) Market is poised for robust expansion, projected to reach a substantial size of USD 28.06 billion by 2025. This growth is fueled by an impressive Compound Annual Growth Rate (CAGR) of 8.26%, indicating a dynamic and evolving landscape for industrial semiconductor solutions. The primary drivers behind this surge include the escalating demand for automation across various industrial sectors, the increasing complexity of industrial machinery requiring sophisticated control and processing capabilities, and the continuous integration of Artificial Intelligence (AI) and Machine Learning (ML) in industrial applications. Furthermore, the ongoing adoption of Industry 4.0 principles, emphasizing interconnected systems and data-driven decision-making, directly translates to a greater need for advanced logic ICs. Emerging trends such as the miniaturization of electronic components, the development of more energy-efficient ICs to meet sustainability goals, and the rise of edge computing in industrial environments are also shaping market dynamics.

Industrial Logic Integrated Circuits Market Market Size (In Billion)

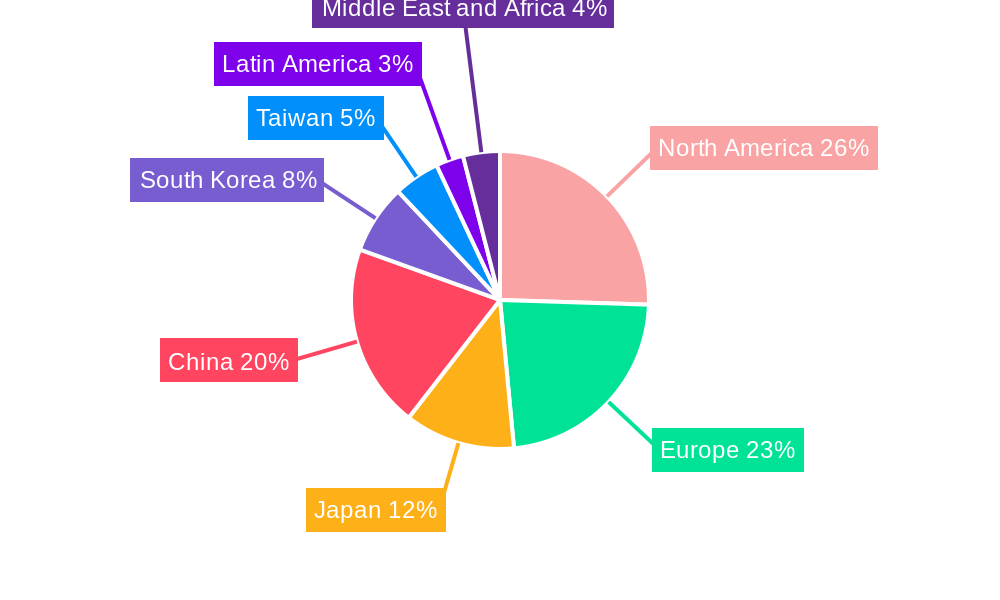

Despite the strong growth trajectory, certain restraints could influence the market's pace. These include potential supply chain disruptions, particularly concerning raw material availability and manufacturing capacities, which can lead to price volatility and lead time extensions. Intense competition among established and emerging players, necessitating significant R&D investments to stay ahead, also presents a challenge. However, the market's segmentation offers diverse opportunities. The 'Digital Bipolar' and 'MOS Logic' categories, with sub-segments like MOS General Purpose, MOS Gate Arrays, MOS Drivers/Controllers, MOS Standard Cells, and MOS Special Purpose, cater to a wide spectrum of industrial needs. Key industry giants such as STMicroelectronics NV, Analog Devices Inc, Intel Corporation, Texas Instruments Inc, and Renesas Electronics Corporation are at the forefront, driving innovation and catering to regional demands across North America, Europe, Asia-Pacific (including China, South Korea, and Taiwan), and other emerging markets. The market’s historical trajectory from 2019 to 2024, with a base year of 2025 and a forecast period extending to 2033, underscores a sustained period of growth and technological advancement.

Industrial Logic Integrated Circuits Market Company Market Share

This comprehensive report dives deep into the Industrial Logic Integrated Circuits (ICs) Market, a critical sector powering the Fourth Industrial Revolution. With a study period spanning 2019 to 2033, including a base year of 2025, an estimated year of 2025, and a forecast period from 2025 to 2033, this analysis provides unparalleled insights into market dynamics, technological advancements, and growth opportunities. We meticulously examine Digital Bipolar and MOS Logic segments, including MOS General Purpose, MOS Gate Arrays, MOS Drivers/Controllers, MOS Standard Cells, and MOS Special Purpose ICs, alongside key industry players.

Industrial Logic Integrated Circuits Market Market Structure & Competitive Landscape

The Industrial Logic Integrated Circuits Market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. Innovation remains a primary driver, fueled by continuous advancements in semiconductor technology and the burgeoning demand for intelligent automation across various industrial verticals. Regulatory impacts are being felt, particularly concerning supply chain security and environmental sustainability in manufacturing processes, influencing strategic decisions and R&D investments. Product substitutes are emerging, primarily from advancements in software-defined logic and programmable logic devices, though dedicated industrial logic ICs retain their edge in performance and reliability for critical applications. The end-user segmentation is diverse, with key sectors including manufacturing, energy, transportation, and healthcare demonstrating robust adoption. Mergers and acquisitions (M&A) trends are indicative of strategic consolidation and a focus on expanding product portfolios and geographical reach. For instance, recent M&A activities in the broader semiconductor landscape signal a trend towards acquiring specialized logic capabilities to cater to the evolving needs of industrial automation. The market is characterized by a constant interplay between established giants and agile innovators, striving to meet the escalating performance and efficiency demands of modern industrial operations.

Industrial Logic Integrated Circuits Market Market Trends & Opportunities

The Industrial Logic Integrated Circuits Market is poised for substantial growth, driven by an insatiable appetite for enhanced automation, improved operational efficiency, and the proliferation of the Industrial Internet of Things (IIoT). The market size is projected to experience a significant Compound Annual Growth Rate (CAGR) over the forecast period, fueled by the increasing adoption of Industry 4.0 technologies across diverse industrial sectors. Key technological shifts include the miniaturization of components, advancements in power efficiency, and the integration of AI and machine learning capabilities directly into logic ICs for real-time decision-making on the factory floor. Consumer preferences, in this context, translate to demand for more reliable, robust, and feature-rich semiconductor solutions capable of withstanding harsh industrial environments and delivering predictable performance. Competitive dynamics are intensifying, with companies investing heavily in R&D to develop next-generation logic ICs that offer superior processing power, lower power consumption, and enhanced connectivity features. Opportunities abound for companies that can provide integrated solutions, catering to the complex needs of smart factories, autonomous systems, and advanced robotics. The growing emphasis on predictive maintenance and energy management within industrial settings further amplifies the demand for sophisticated logic ICs that enable data acquisition, processing, and control. The market penetration rates for advanced industrial logic solutions are expected to rise steadily as more industries embrace digital transformation. The burgeoning demand for semiconductors in sectors like renewable energy, electric vehicles, and advanced manufacturing will act as significant tailwinds for this market.

Dominant Markets & Segments in Industrial Logic Integrated Circuits Market

The Industrial Logic Integrated Circuits Market is experiencing significant growth across various regions and segments, with the MOS Logic segment emerging as a particularly dominant force. Within MOS Logic, MOS General Purpose ICs are seeing widespread adoption due to their versatility and cost-effectiveness in a multitude of industrial control applications. Furthermore, MOS Drivers/Controllers are witnessing robust demand, directly correlating with the increasing complexity of industrial automation systems that require precise control of actuators, motors, and other electromechanical components. The growth in these segments is propelled by key drivers such as the continuous expansion of smart manufacturing initiatives globally, which necessitate sophisticated control and processing capabilities. Government policies promoting industrial modernization and digital transformation also play a crucial role in fostering market expansion.

- MOS Logic Dominance: The inherent advantages of Metal-Oxide-Semiconductor (MOS) technology, including low power consumption and high integration density, make it the preferred choice for a vast array of industrial applications. This segment is expected to continue its upward trajectory, outperforming other logic types.

- Growth in Drivers/Controllers: The escalating adoption of robotics, automated guided vehicles (AGVs), and advanced assembly lines directly fuels the demand for specialized MOS Drivers/Controllers. These ICs are fundamental for precise movement and operational sequencing.

- Infrastructure Development: Investments in smart grid technologies and the modernization of existing industrial infrastructure worldwide are creating substantial opportunities for logic ICs, particularly those designed for high reliability and long operational lifespans.

- Emerging Markets: The rapid industrialization in developing economies presents a significant opportunity for market expansion. As these regions adopt advanced manufacturing techniques, the demand for industrial logic ICs will surge.

Industrial Logic Integrated Circuits Market Product Analysis

Product innovation in the Industrial Logic Integrated Circuits Market is characterized by a relentless pursuit of higher performance, lower power consumption, and enhanced reliability. Key advancements include the development of logic ICs with integrated AI capabilities for edge computing, enabling faster data processing and decision-making closer to the source of data generation. Competitive advantages are being carved out through the design of specialized ICs tailored for extreme operating conditions, such as high temperatures and harsh environments, common in industrial settings. Furthermore, advancements in packaging technologies are contributing to smaller form factors and improved thermal management, allowing for denser integration and more efficient designs in industrial equipment. The focus is on delivering solutions that directly address the evolving needs of automation, robotics, and smart manufacturing.

Key Drivers, Barriers & Challenges in Industrial Logic Integrated Circuits Market

The Industrial Logic Integrated Circuits Market is primarily propelled by the relentless drive towards automation and the increasing adoption of Industry 4.0 technologies. Technological advancements in semiconductor manufacturing, leading to more powerful and energy-efficient logic ICs, act as significant growth catalysts. Economic factors, such as global manufacturing output and infrastructure investments, directly influence demand. Policy-driven initiatives promoting digital transformation and smart manufacturing further bolster market expansion. The increasing demand for IIoT devices and connected industrial systems also serves as a major growth driver.

- Technological Innovation: Miniaturization, increased processing power, and the integration of AI/ML capabilities.

- Automation & IIoT: Growing adoption of smart factories, robotics, and connected industrial ecosystems.

- Infrastructure Investment: Government and private sector spending on modernizing industrial facilities.

Growth Drivers in the Industrial Logic Integrated Circuits Market Market

Key growth drivers in the Industrial Logic Integrated Circuits Market are multifaceted, stemming from technological advancements, economic imperatives, and supportive regulatory frameworks. The ongoing evolution of Industry 4.0 principles, emphasizing interconnectedness and intelligent automation, necessitates increasingly sophisticated logic ICs. Economic trends, such as the global push for increased manufacturing efficiency and productivity, directly translate to higher demand for advanced semiconductor solutions. Policy-driven initiatives aimed at fostering domestic semiconductor manufacturing and promoting technological innovation within industrial sectors further accelerate growth. The expanding use of robotics and the growing complexity of industrial control systems are also significant contributors to market expansion.

Challenges Impacting Industrial Logic Integrated Circuits Market Growth

The Industrial Logic Integrated Circuits Market faces several significant challenges that could impact its growth trajectory. Supply chain disruptions, particularly those affecting raw material availability and geopolitical stability, pose a persistent threat to production and delivery timelines. Regulatory complexities and evolving standards related to product safety, environmental impact, and data security can create hurdles for market entry and product development. Intense competitive pressures, driven by both established players and emerging innovators, necessitate continuous investment in R&D and cost optimization. Furthermore, the cyclical nature of the semiconductor industry and the long lead times for new product development can present financial and strategic challenges. The skilled workforce shortage in semiconductor manufacturing and design also remains a concern.

Key Players Shaping the Industrial Logic Integrated Circuits Market Market

- STMicroelectronics NV

- Analog Devices Inc

- Intel Corporation

- Texas Instruments Inc

- Renesas Electronics Corporation

- Broadcom Inc

- Diodes Incorporated

- NXP Semiconductors NV

- Toshiba Corporation

- On Semiconductor Corporation

Significant Industrial Logic Integrated Circuits Market Industry Milestones

- June 2024: STMicroelectronics announced plans to establish an advanced manufacturing facility in Catania, Italy, for producing 200mm silicon carbide (SiC) power devices, including testing and packaging. This initiative aims to support customers across industrial, communications, consumer, and cloud infrastructure sectors by enhancing their utilization of SiC devices.

- October 2023: Samsung Electronics Co. Ltd. revealed its latest analog and logic semiconductor innovations and future technology roadmap at the Samsung System LSI Tech Day. The company emphasized its commitment to leading hyper-connected, hyper-intelligent, and hyper-data technologies for the Fourth Industrial Revolution, showcasing comprehensive logic solutions for various industries.

Future Outlook for Industrial Logic Integrated Circuits Market Market

The future outlook for the Industrial Logic Integrated Circuits Market is exceptionally promising, driven by sustained demand for automation, intelligence, and efficiency across global industries. Strategic opportunities lie in the development of highly integrated, low-power logic ICs for edge computing applications, enabling real-time data analysis and control in increasingly complex IIoT environments. The growing demand for semiconductors in emerging fields like sustainable energy, advanced electric mobility, and intelligent infrastructure will further propel market expansion. Companies focusing on robust, reliable solutions capable of operating in harsh industrial conditions, coupled with a commitment to innovation and supply chain resilience, are well-positioned to capitalize on this robust growth trajectory and solidify their market presence.

Industrial Logic Integrated Circuits Market Segmentation

-

1. IC Type

- 1.1. Digital Bipolar

-

1.2. MOS Logic

- 1.2.1. MOS General Purpose

- 1.2.2. MOS Gate Arrays

- 1.2.3. MOS Drivers/Controllers

- 1.2.4. MOS Standard Cells

- 1.2.5. MOS Special Purpose

Industrial Logic Integrated Circuits Market Segmentation By Geography

- 1. United States

- 2. Europe

- 3. Japan

- 4. China

- 5. South Korea

- 6. Taiwan

- 7. Latin America

- 8. Middle East and Africa

Industrial Logic Integrated Circuits Market Regional Market Share

Geographic Coverage of Industrial Logic Integrated Circuits Market

Industrial Logic Integrated Circuits Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus on Device Integration; Increasing Capital Expenditures of Fabs to Augment Production Capacity; Increase in Factory Automation

- 3.3. Market Restrains

- 3.3.1. Increasing Focus on Device Integration; Increasing Capital Expenditures of Fabs to Augment Production Capacity; Increase in Factory Automation

- 3.4. Market Trends

- 3.4.1. The MOS Logic Segment is Anticipated to Hold a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Logic Integrated Circuits Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by IC Type

- 5.1.1. Digital Bipolar

- 5.1.2. MOS Logic

- 5.1.2.1. MOS General Purpose

- 5.1.2.2. MOS Gate Arrays

- 5.1.2.3. MOS Drivers/Controllers

- 5.1.2.4. MOS Standard Cells

- 5.1.2.5. MOS Special Purpose

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.2.2. Europe

- 5.2.3. Japan

- 5.2.4. China

- 5.2.5. South Korea

- 5.2.6. Taiwan

- 5.2.7. Latin America

- 5.2.8. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by IC Type

- 6. United States Industrial Logic Integrated Circuits Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by IC Type

- 6.1.1. Digital Bipolar

- 6.1.2. MOS Logic

- 6.1.2.1. MOS General Purpose

- 6.1.2.2. MOS Gate Arrays

- 6.1.2.3. MOS Drivers/Controllers

- 6.1.2.4. MOS Standard Cells

- 6.1.2.5. MOS Special Purpose

- 6.1. Market Analysis, Insights and Forecast - by IC Type

- 7. Europe Industrial Logic Integrated Circuits Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by IC Type

- 7.1.1. Digital Bipolar

- 7.1.2. MOS Logic

- 7.1.2.1. MOS General Purpose

- 7.1.2.2. MOS Gate Arrays

- 7.1.2.3. MOS Drivers/Controllers

- 7.1.2.4. MOS Standard Cells

- 7.1.2.5. MOS Special Purpose

- 7.1. Market Analysis, Insights and Forecast - by IC Type

- 8. Japan Industrial Logic Integrated Circuits Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by IC Type

- 8.1.1. Digital Bipolar

- 8.1.2. MOS Logic

- 8.1.2.1. MOS General Purpose

- 8.1.2.2. MOS Gate Arrays

- 8.1.2.3. MOS Drivers/Controllers

- 8.1.2.4. MOS Standard Cells

- 8.1.2.5. MOS Special Purpose

- 8.1. Market Analysis, Insights and Forecast - by IC Type

- 9. China Industrial Logic Integrated Circuits Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by IC Type

- 9.1.1. Digital Bipolar

- 9.1.2. MOS Logic

- 9.1.2.1. MOS General Purpose

- 9.1.2.2. MOS Gate Arrays

- 9.1.2.3. MOS Drivers/Controllers

- 9.1.2.4. MOS Standard Cells

- 9.1.2.5. MOS Special Purpose

- 9.1. Market Analysis, Insights and Forecast - by IC Type

- 10. South Korea Industrial Logic Integrated Circuits Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by IC Type

- 10.1.1. Digital Bipolar

- 10.1.2. MOS Logic

- 10.1.2.1. MOS General Purpose

- 10.1.2.2. MOS Gate Arrays

- 10.1.2.3. MOS Drivers/Controllers

- 10.1.2.4. MOS Standard Cells

- 10.1.2.5. MOS Special Purpose

- 10.1. Market Analysis, Insights and Forecast - by IC Type

- 11. Taiwan Industrial Logic Integrated Circuits Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by IC Type

- 11.1.1. Digital Bipolar

- 11.1.2. MOS Logic

- 11.1.2.1. MOS General Purpose

- 11.1.2.2. MOS Gate Arrays

- 11.1.2.3. MOS Drivers/Controllers

- 11.1.2.4. MOS Standard Cells

- 11.1.2.5. MOS Special Purpose

- 11.1. Market Analysis, Insights and Forecast - by IC Type

- 12. Latin America Industrial Logic Integrated Circuits Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by IC Type

- 12.1.1. Digital Bipolar

- 12.1.2. MOS Logic

- 12.1.2.1. MOS General Purpose

- 12.1.2.2. MOS Gate Arrays

- 12.1.2.3. MOS Drivers/Controllers

- 12.1.2.4. MOS Standard Cells

- 12.1.2.5. MOS Special Purpose

- 12.1. Market Analysis, Insights and Forecast - by IC Type

- 13. Middle East and Africa Industrial Logic Integrated Circuits Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by IC Type

- 13.1.1. Digital Bipolar

- 13.1.2. MOS Logic

- 13.1.2.1. MOS General Purpose

- 13.1.2.2. MOS Gate Arrays

- 13.1.2.3. MOS Drivers/Controllers

- 13.1.2.4. MOS Standard Cells

- 13.1.2.5. MOS Special Purpose

- 13.1. Market Analysis, Insights and Forecast - by IC Type

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 STMicroelectronics NV

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Analog Devices Inc

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Intel Corporation

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Texas Instruments Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Renesas Electronics Corporation

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Broadcom Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Diodes Incorporated

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 NXP Semiconductors NV

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Toshiba Corporation

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 On Semiconductor Corporation*List Not Exhaustive

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 STMicroelectronics NV

List of Figures

- Figure 1: Global Industrial Logic Integrated Circuits Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Industrial Logic Integrated Circuits Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: United States Industrial Logic Integrated Circuits Market Revenue (Million), by IC Type 2025 & 2033

- Figure 4: United States Industrial Logic Integrated Circuits Market Volume (Billion), by IC Type 2025 & 2033

- Figure 5: United States Industrial Logic Integrated Circuits Market Revenue Share (%), by IC Type 2025 & 2033

- Figure 6: United States Industrial Logic Integrated Circuits Market Volume Share (%), by IC Type 2025 & 2033

- Figure 7: United States Industrial Logic Integrated Circuits Market Revenue (Million), by Country 2025 & 2033

- Figure 8: United States Industrial Logic Integrated Circuits Market Volume (Billion), by Country 2025 & 2033

- Figure 9: United States Industrial Logic Integrated Circuits Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: United States Industrial Logic Integrated Circuits Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Industrial Logic Integrated Circuits Market Revenue (Million), by IC Type 2025 & 2033

- Figure 12: Europe Industrial Logic Integrated Circuits Market Volume (Billion), by IC Type 2025 & 2033

- Figure 13: Europe Industrial Logic Integrated Circuits Market Revenue Share (%), by IC Type 2025 & 2033

- Figure 14: Europe Industrial Logic Integrated Circuits Market Volume Share (%), by IC Type 2025 & 2033

- Figure 15: Europe Industrial Logic Integrated Circuits Market Revenue (Million), by Country 2025 & 2033

- Figure 16: Europe Industrial Logic Integrated Circuits Market Volume (Billion), by Country 2025 & 2033

- Figure 17: Europe Industrial Logic Integrated Circuits Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Industrial Logic Integrated Circuits Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Japan Industrial Logic Integrated Circuits Market Revenue (Million), by IC Type 2025 & 2033

- Figure 20: Japan Industrial Logic Integrated Circuits Market Volume (Billion), by IC Type 2025 & 2033

- Figure 21: Japan Industrial Logic Integrated Circuits Market Revenue Share (%), by IC Type 2025 & 2033

- Figure 22: Japan Industrial Logic Integrated Circuits Market Volume Share (%), by IC Type 2025 & 2033

- Figure 23: Japan Industrial Logic Integrated Circuits Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Japan Industrial Logic Integrated Circuits Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Japan Industrial Logic Integrated Circuits Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Japan Industrial Logic Integrated Circuits Market Volume Share (%), by Country 2025 & 2033

- Figure 27: China Industrial Logic Integrated Circuits Market Revenue (Million), by IC Type 2025 & 2033

- Figure 28: China Industrial Logic Integrated Circuits Market Volume (Billion), by IC Type 2025 & 2033

- Figure 29: China Industrial Logic Integrated Circuits Market Revenue Share (%), by IC Type 2025 & 2033

- Figure 30: China Industrial Logic Integrated Circuits Market Volume Share (%), by IC Type 2025 & 2033

- Figure 31: China Industrial Logic Integrated Circuits Market Revenue (Million), by Country 2025 & 2033

- Figure 32: China Industrial Logic Integrated Circuits Market Volume (Billion), by Country 2025 & 2033

- Figure 33: China Industrial Logic Integrated Circuits Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: China Industrial Logic Integrated Circuits Market Volume Share (%), by Country 2025 & 2033

- Figure 35: South Korea Industrial Logic Integrated Circuits Market Revenue (Million), by IC Type 2025 & 2033

- Figure 36: South Korea Industrial Logic Integrated Circuits Market Volume (Billion), by IC Type 2025 & 2033

- Figure 37: South Korea Industrial Logic Integrated Circuits Market Revenue Share (%), by IC Type 2025 & 2033

- Figure 38: South Korea Industrial Logic Integrated Circuits Market Volume Share (%), by IC Type 2025 & 2033

- Figure 39: South Korea Industrial Logic Integrated Circuits Market Revenue (Million), by Country 2025 & 2033

- Figure 40: South Korea Industrial Logic Integrated Circuits Market Volume (Billion), by Country 2025 & 2033

- Figure 41: South Korea Industrial Logic Integrated Circuits Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: South Korea Industrial Logic Integrated Circuits Market Volume Share (%), by Country 2025 & 2033

- Figure 43: Taiwan Industrial Logic Integrated Circuits Market Revenue (Million), by IC Type 2025 & 2033

- Figure 44: Taiwan Industrial Logic Integrated Circuits Market Volume (Billion), by IC Type 2025 & 2033

- Figure 45: Taiwan Industrial Logic Integrated Circuits Market Revenue Share (%), by IC Type 2025 & 2033

- Figure 46: Taiwan Industrial Logic Integrated Circuits Market Volume Share (%), by IC Type 2025 & 2033

- Figure 47: Taiwan Industrial Logic Integrated Circuits Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Taiwan Industrial Logic Integrated Circuits Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Taiwan Industrial Logic Integrated Circuits Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Taiwan Industrial Logic Integrated Circuits Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America Industrial Logic Integrated Circuits Market Revenue (Million), by IC Type 2025 & 2033

- Figure 52: Latin America Industrial Logic Integrated Circuits Market Volume (Billion), by IC Type 2025 & 2033

- Figure 53: Latin America Industrial Logic Integrated Circuits Market Revenue Share (%), by IC Type 2025 & 2033

- Figure 54: Latin America Industrial Logic Integrated Circuits Market Volume Share (%), by IC Type 2025 & 2033

- Figure 55: Latin America Industrial Logic Integrated Circuits Market Revenue (Million), by Country 2025 & 2033

- Figure 56: Latin America Industrial Logic Integrated Circuits Market Volume (Billion), by Country 2025 & 2033

- Figure 57: Latin America Industrial Logic Integrated Circuits Market Revenue Share (%), by Country 2025 & 2033

- Figure 58: Latin America Industrial Logic Integrated Circuits Market Volume Share (%), by Country 2025 & 2033

- Figure 59: Middle East and Africa Industrial Logic Integrated Circuits Market Revenue (Million), by IC Type 2025 & 2033

- Figure 60: Middle East and Africa Industrial Logic Integrated Circuits Market Volume (Billion), by IC Type 2025 & 2033

- Figure 61: Middle East and Africa Industrial Logic Integrated Circuits Market Revenue Share (%), by IC Type 2025 & 2033

- Figure 62: Middle East and Africa Industrial Logic Integrated Circuits Market Volume Share (%), by IC Type 2025 & 2033

- Figure 63: Middle East and Africa Industrial Logic Integrated Circuits Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Middle East and Africa Industrial Logic Integrated Circuits Market Volume (Billion), by Country 2025 & 2033

- Figure 65: Middle East and Africa Industrial Logic Integrated Circuits Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East and Africa Industrial Logic Integrated Circuits Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Logic Integrated Circuits Market Revenue Million Forecast, by IC Type 2020 & 2033

- Table 2: Global Industrial Logic Integrated Circuits Market Volume Billion Forecast, by IC Type 2020 & 2033

- Table 3: Global Industrial Logic Integrated Circuits Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Industrial Logic Integrated Circuits Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Global Industrial Logic Integrated Circuits Market Revenue Million Forecast, by IC Type 2020 & 2033

- Table 6: Global Industrial Logic Integrated Circuits Market Volume Billion Forecast, by IC Type 2020 & 2033

- Table 7: Global Industrial Logic Integrated Circuits Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Industrial Logic Integrated Circuits Market Volume Billion Forecast, by Country 2020 & 2033

- Table 9: Global Industrial Logic Integrated Circuits Market Revenue Million Forecast, by IC Type 2020 & 2033

- Table 10: Global Industrial Logic Integrated Circuits Market Volume Billion Forecast, by IC Type 2020 & 2033

- Table 11: Global Industrial Logic Integrated Circuits Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Industrial Logic Integrated Circuits Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Global Industrial Logic Integrated Circuits Market Revenue Million Forecast, by IC Type 2020 & 2033

- Table 14: Global Industrial Logic Integrated Circuits Market Volume Billion Forecast, by IC Type 2020 & 2033

- Table 15: Global Industrial Logic Integrated Circuits Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Industrial Logic Integrated Circuits Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: Global Industrial Logic Integrated Circuits Market Revenue Million Forecast, by IC Type 2020 & 2033

- Table 18: Global Industrial Logic Integrated Circuits Market Volume Billion Forecast, by IC Type 2020 & 2033

- Table 19: Global Industrial Logic Integrated Circuits Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Industrial Logic Integrated Circuits Market Volume Billion Forecast, by Country 2020 & 2033

- Table 21: Global Industrial Logic Integrated Circuits Market Revenue Million Forecast, by IC Type 2020 & 2033

- Table 22: Global Industrial Logic Integrated Circuits Market Volume Billion Forecast, by IC Type 2020 & 2033

- Table 23: Global Industrial Logic Integrated Circuits Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Industrial Logic Integrated Circuits Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global Industrial Logic Integrated Circuits Market Revenue Million Forecast, by IC Type 2020 & 2033

- Table 26: Global Industrial Logic Integrated Circuits Market Volume Billion Forecast, by IC Type 2020 & 2033

- Table 27: Global Industrial Logic Integrated Circuits Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Industrial Logic Integrated Circuits Market Volume Billion Forecast, by Country 2020 & 2033

- Table 29: Global Industrial Logic Integrated Circuits Market Revenue Million Forecast, by IC Type 2020 & 2033

- Table 30: Global Industrial Logic Integrated Circuits Market Volume Billion Forecast, by IC Type 2020 & 2033

- Table 31: Global Industrial Logic Integrated Circuits Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global Industrial Logic Integrated Circuits Market Volume Billion Forecast, by Country 2020 & 2033

- Table 33: Global Industrial Logic Integrated Circuits Market Revenue Million Forecast, by IC Type 2020 & 2033

- Table 34: Global Industrial Logic Integrated Circuits Market Volume Billion Forecast, by IC Type 2020 & 2033

- Table 35: Global Industrial Logic Integrated Circuits Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Industrial Logic Integrated Circuits Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Logic Integrated Circuits Market?

The projected CAGR is approximately 8.26%.

2. Which companies are prominent players in the Industrial Logic Integrated Circuits Market?

Key companies in the market include STMicroelectronics NV, Analog Devices Inc, Intel Corporation, Texas Instruments Inc, Renesas Electronics Corporation, Broadcom Inc, Diodes Incorporated, NXP Semiconductors NV, Toshiba Corporation, On Semiconductor Corporation*List Not Exhaustive.

3. What are the main segments of the Industrial Logic Integrated Circuits Market?

The market segments include IC Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 28.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus on Device Integration; Increasing Capital Expenditures of Fabs to Augment Production Capacity; Increase in Factory Automation.

6. What are the notable trends driving market growth?

The MOS Logic Segment is Anticipated to Hold a Major Market Share.

7. Are there any restraints impacting market growth?

Increasing Focus on Device Integration; Increasing Capital Expenditures of Fabs to Augment Production Capacity; Increase in Factory Automation.

8. Can you provide examples of recent developments in the market?

June 2024: STMicroelectronics unveiled its plan to construct an advanced manufacturing facility in Catania, Italy, dedicated to producing power devices and modules using 200mm silicon carbide (SiC) technology. The facility is also claimed to include testing and packaging facilities. According to the company, the establishment is a significant achievement aimed at assisting customers in utilizing SiC devices in many sectors, such as industrial, communications, consumer, and cloud infrastructure.October 2023: Samsung Electronics Co. Ltd, a prominent advanced semiconductor technology company, unveiled its latest analog and logic semiconductor technology innovations and outlined its blueprint for technological advancements at the Samsung System LSI Tech Day event. With comprehensive logic solutions tailored for various industries, Samsung emphasized its vision to lead hyper-connected, hyper-intelligent, and hyper-data technologies in the Fourth Industrial Revolution era.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Logic Integrated Circuits Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Logic Integrated Circuits Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Logic Integrated Circuits Market?

To stay informed about further developments, trends, and reports in the Industrial Logic Integrated Circuits Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence