Key Insights

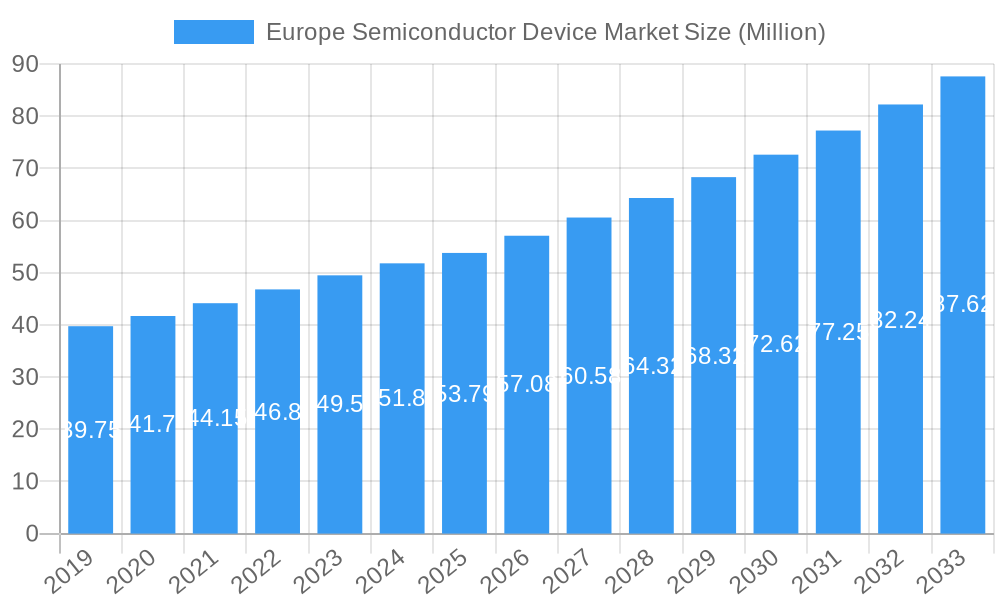

The Europe Semiconductor Device Market is poised for robust growth, with an estimated market size of USD 53.79 billion in 2025 and a projected Compound Annual Growth Rate (CAGR) of 6.24% during the forecast period of 2025-2033. This expansion is primarily fueled by the escalating demand for advanced electronics across key end-user verticals. The automotive sector, driven by the proliferation of electric vehicles (EVs) and advanced driver-assistance systems (ADAS), represents a significant growth engine. Similarly, the burgeoning communication industry, encompassing 5G deployment and the Internet of Things (IoT), is creating substantial opportunities for semiconductor manufacturers. The consumer electronics segment, with its continuous innovation in smartphones, wearables, and smart home devices, also contributes significantly to market momentum. Furthermore, the industrial sector's adoption of automation, robotics, and smart manufacturing solutions necessitates an increasing reliance on sophisticated semiconductor components.

Europe Semiconductor Device Market Market Size (In Million)

The market's trajectory is further shaped by technological advancements and evolving industry trends. The increasing complexity and miniaturization of integrated circuits (ICs), including analog, logic, and memory chips, are critical. Microprocessors (MPUs) and microcontrollers (MCUs) are integral to the development of smarter and more efficient devices. Optoelectronics are vital for displays, lighting, and optical communication. Sensors and actuators are enabling a new generation of intelligent systems. While the market benefits from these drivers, certain restraints, such as the ongoing global supply chain challenges and the high cost of research and development for cutting-edge technologies, could temper growth. However, strategic investments in manufacturing capabilities, innovation in materials science, and strong government support for the semiconductor ecosystem in Europe are expected to mitigate these challenges, paving the way for sustained expansion.

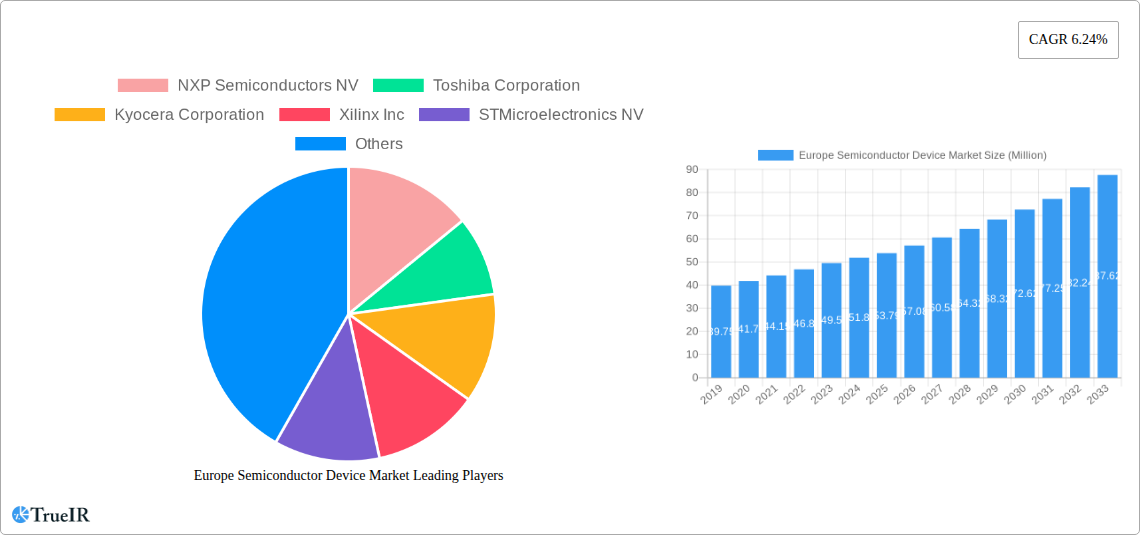

Europe Semiconductor Device Market Company Market Share

Here is a dynamic, SEO-optimized report description for the Europe Semiconductor Device Market, designed for immediate use:

Europe Semiconductor Device Market: Comprehensive Analysis & Future Outlook (2019-2033)

Gain unparalleled insights into the burgeoning Europe Semiconductor Device Market with this in-depth report. Covering the historical period from 2019 to 2024 and a robust forecast period of 2025 to 2033, with a base year of 2025, this analysis delves into market dynamics, key players, technological advancements, and critical growth drivers. Explore the intricate landscape of discrete semiconductors, optoelectronics, sensors, actuators, and integrated circuits, including analog, logic, memory, microprocessors (MPU), microcontrollers (MCU), and digital signal processors. Understand the profound impact of these devices across vital end-user verticals such as Automotive, Communication (Wired and Wireless), Consumer, Industrial, and Computing/Data Storage. This report is your essential guide to navigating the opportunities and challenges within this rapidly evolving European semiconductor ecosystem.

Europe Semiconductor Device Market Market Structure & Competitive Landscape

The Europe Semiconductor Device Market exhibits a moderately concentrated structure, with several multinational corporations vying for market share. Innovation remains a primary driver, fueled by substantial R&D investments aimed at developing advanced materials, novel architectures, and energy-efficient solutions. Regulatory impacts, particularly the European Chips Act, are reshaping the landscape by incentivizing domestic production and fostering collaboration. Product substitutes are limited due to the specialized nature of semiconductor devices, but advancements in alternative technologies are closely monitored. End-user segmentation reveals a strong demand from the automotive and industrial sectors, driving specific product development. Mergers and Acquisitions (M&A) trends are on the rise, with key players consolidating capabilities and expanding their portfolios. For instance, recent investments totaling over 10,000 Million in new fabrication facilities underscore a strategic push towards self-sufficiency and increased production capacity. The concentration ratio among the top five players is estimated to be around 65%, indicating a significant but not insurmountable market dominance.

- Innovation Drivers:

- Miniaturization of components.

- Development of AI-specific chips.

- Increased power efficiency for IoT devices.

- Advanced packaging technologies.

- Regulatory Impacts:

- Subsidies and incentives under the European Chips Act.

- Focus on supply chain resilience and security.

- Environmental compliance standards.

- M&A Trends:

- Acquisitions to gain access to new technologies and markets.

- Joint ventures for R&D and manufacturing.

- Consolidation to achieve economies of scale.

Europe Semiconductor Device Market Market Trends & Opportunities

The Europe Semiconductor Device Market is experiencing significant growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period (2025-2033). This expansion is propelled by a confluence of technological shifts and evolving consumer preferences. The increasing demand for sophisticated electronics in the automotive sector, driven by the proliferation of electric vehicles (EVs), advanced driver-assistance systems (ADAS), and in-car infotainment, is a paramount trend. Similarly, the industrial sector's adoption of Industry 4.0 initiatives, including automation, robotics, and smart manufacturing, necessitates a robust supply of high-performance semiconductors. The consumer electronics market, while mature, continues to drive demand for innovative devices, from smart home appliances to next-generation wearables. Wireless communication technologies, particularly the rollout of 5G and the anticipated deployment of 6G, are creating substantial opportunities for high-frequency and high-speed semiconductor components.

The market penetration rate for advanced integrated circuits (ICs) in critical European industries is steadily increasing, reflecting a move towards more intelligent and connected systems. Opportunities abound in areas such as power semiconductors for energy-efficient applications, sensors for environmental monitoring and precision agriculture, and advanced microcontrollers for embedded systems. The strategic focus on reshoring and strengthening the European semiconductor manufacturing ecosystem, as highlighted by recent initiatives, presents a significant opportunity for domestic players and new entrants alike. Furthermore, the growing emphasis on sustainability and the circular economy is spurring innovation in eco-friendly semiconductor manufacturing processes and materials. The market size is expected to reach over 80,000 Million by 2033, up from an estimated 35,000 Million in 2025.

Dominant Markets & Segments in Europe Semiconductor Device Market

Within the Europe Semiconductor Device Market, Integrated Circuits (ICs) represent the dominant segment, accounting for an estimated 60% of the total market value in 2025, projected to grow to over 48,000 Million by 2033. This dominance stems from their ubiquitous application across nearly all end-user verticals. Within ICs, Analog and Logic chips are particularly strong performers, driven by the increasing complexity of electronic systems in automotive, industrial automation, and telecommunications. Microprocessors (MPU) and Microcontrollers (MCU) are also pivotal, powering everything from advanced vehicle ECUs to smart home devices.

The Automotive end-user vertical stands out as a leading market, with its demand for semiconductors projected to exceed 25,000 Million by 2033. This growth is directly attributable to the accelerating transition towards electric mobility, the increasing adoption of autonomous driving features, and the sophisticated in-cabin digital experiences demanded by consumers. The Industrial sector is another key driver, with semiconductor demand projected to surpass 18,000 Million by 2033, fueled by the relentless pursuit of automation, predictive maintenance, and smart grid technologies. The Communication sector, encompassing both wired and wireless infrastructure, also presents substantial opportunities, with the ongoing 5G deployment and the future prospects of 6G creating a significant need for advanced semiconductor solutions.

- Dominant Device Segments:

- Integrated Circuits (ICs):

- Analog ICs: Essential for signal processing and control in diverse applications.

- Logic ICs: Form the backbone of digital processing and decision-making.

- Memory ICs: Crucial for data storage in all electronic devices.

- Microprocessors (MPU) & Microcontrollers (MCU): Driving embedded intelligence and control.

- Integrated Circuits (ICs):

- Dominant End-User Verticals:

- Automotive: Electric vehicles, ADAS, infotainment systems.

- Industrial: Automation, robotics, IoT, smart manufacturing.

- Communication (Wired and Wireless): 5G/6G infrastructure, network equipment.

Europe Semiconductor Device Market Product Analysis

The Europe Semiconductor Device Market is characterized by continuous product innovation, driven by the pursuit of enhanced performance, reduced power consumption, and increased functionality. Key product advancements include the development of next-generation power semiconductors (e.g., Silicon Carbide and Gallium Nitride) for higher efficiency in EVs and industrial power systems, and sophisticated sensors for advanced driver-assistance systems and industrial monitoring. Integrated circuits are seeing miniaturization and increased integration density, enabling more compact and powerful electronic devices. Microprocessors and microcontrollers are becoming more specialized and energy-efficient, catering to the growing demands of edge computing and IoT applications. These innovations offer competitive advantages by enabling new applications, improving existing ones, and meeting stringent regulatory requirements.

Key Drivers, Barriers & Challenges in Europe Semiconductor Device Market

Key Drivers: The Europe Semiconductor Device Market is propelled by several critical factors. Technological advancements, particularly in areas like artificial intelligence, 5G, and electric vehicles, are creating an insatiable demand for sophisticated semiconductors. Government initiatives, such as the European Chips Act, provide significant financial incentives and regulatory support to boost domestic manufacturing and R&D, aiming for greater supply chain resilience. The increasing digitization of industries, from manufacturing to healthcare, further fuels the need for advanced semiconductor solutions. The growing emphasis on sustainability is also a driver, pushing for energy-efficient chips and greener manufacturing processes.

Barriers & Challenges: Despite the growth, the market faces significant barriers and challenges. High capital expenditure required for semiconductor fabrication facilities presents a substantial financial hurdle. Global supply chain disruptions, as witnessed in recent years, pose a persistent risk, impacting lead times and component availability. Intense competition from established global players, particularly in Asia and North America, creates pricing pressures. Furthermore, the availability of skilled labor for advanced semiconductor manufacturing and R&D remains a critical concern. Regulatory complexities and differing national policies within the EU can also create a fragmented market landscape, hindering seamless operations and expansion.

Growth Drivers in the Europe Semiconductor Device Market Market

Key growth drivers in the Europe Semiconductor Device Market are multifaceted. Technological advancements are paramount, with the widespread adoption of electric vehicles and autonomous driving systems in the automotive sector creating massive demand for power semiconductors, sensors, and advanced processors. The ongoing build-out of 5G infrastructure and the anticipation of 6G deployment are significant catalysts for communication-related semiconductor sales. Government support, epitomized by the European Chips Act, is actively fostering innovation and domestic production through substantial investments and favorable policies, aiming to secure the region's semiconductor supply chain. The digital transformation across industrial sectors, leading to increased automation and smart manufacturing, further augments the need for embedded microcontrollers and specialized ICs.

Challenges Impacting Europe Semiconductor Device Market Growth

Several challenges impede the growth trajectory of the Europe Semiconductor Device Market. The enormous capital investment required for establishing and maintaining state-of-the-art semiconductor foundries is a significant barrier, especially when competing with established manufacturing hubs. Ongoing global supply chain volatility, including raw material shortages and logistical bottlenecks, continues to pose a risk to production schedules and cost management. The intense competition from established semiconductor manufacturing nations, particularly in Asia, leads to pricing pressures and market share battles. Moreover, a persistent shortage of highly skilled engineers and technicians in semiconductor design, manufacturing, and packaging represents a critical bottleneck for expansion and innovation. Navigating complex and evolving regulatory landscapes across different European nations can also add to operational challenges.

Key Players Shaping the Europe Semiconductor Device Market Market

- NXP Semiconductors NV

- Toshiba Corporation

- Kyocera Corporation

- Xilinx Inc

- STMicroelectronics NV

- Qualcomm Incorporated

- Samsung Electronics Co Ltd

- ON Semiconductor Corporation

- Nvidia Corporation

- Intel Corporation

Significant Europe Semiconductor Device Market Industry Milestones

- April 2024: Infineon Technologies AG is expanding its outsourced backend manufacturing in Europe through a multi-year collaboration with Amkor Technology, Inc. They will jointly operate a specialized packaging and testing facility at Amkor's Porto manufacturing hub, enhancing European semiconductor capacity.

- August 2023: TSMC, Robert Bosch GmbH, Infineon Technologies AG, and NXP Semiconductors N.V. announced a collaborative initiative to invest in the European Semiconductor Manufacturing Company (ESMC) GmbH in Dresden, Germany. This venture aims to boost cutting-edge semiconductor manufacturing services, particularly for the automotive and industrial sectors, and involves plans for a 300 mm fab, contingent on public funding confirmation under the European Chips Act.

Future Outlook for Europe Semiconductor Device Market Market

The future outlook for the Europe Semiconductor Device Market is exceptionally promising, driven by strong government support and increasing demand from key sectors. The European Chips Act is a significant catalyst, fostering substantial investments in R&D and manufacturing capabilities, thereby enhancing the region's self-sufficiency and competitiveness. The sustained growth of the automotive industry, particularly in electrification and autonomous driving, will continue to be a primary demand driver. Furthermore, the ongoing digital transformation across industrial and communication sectors, coupled with advancements in AI and IoT, will fuel the need for increasingly sophisticated and specialized semiconductor devices. Strategic partnerships and the development of advanced manufacturing technologies will be crucial for market players to capitalize on emerging opportunities and navigate evolving market dynamics. The market is poised for robust growth, driven by innovation and a concerted effort to build a resilient European semiconductor ecosystem.

Europe Semiconductor Device Market Segmentation

-

1. Device Type

- 1.1. Discrete Semiconductors

- 1.2. Optoelectronics

- 1.3. Sensors and Actuators

-

1.4. Integrated Circuits

- 1.4.1. Analog

- 1.4.2. Logic

- 1.4.3. Memory

-

1.5. Micro

- 1.5.1. Microprocessors (MPU)

- 1.5.2. Microcontrollers (MCU)

- 1.5.3. Digital Signal Processors

-

2. End-user Vertical

- 2.1. Automotive

- 2.2. Communication (Wired and Wireless)

- 2.3. Consumer

- 2.4. Industrial

- 2.5. Computing/Data Storage

- 2.6. Other End Users

Europe Semiconductor Device Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

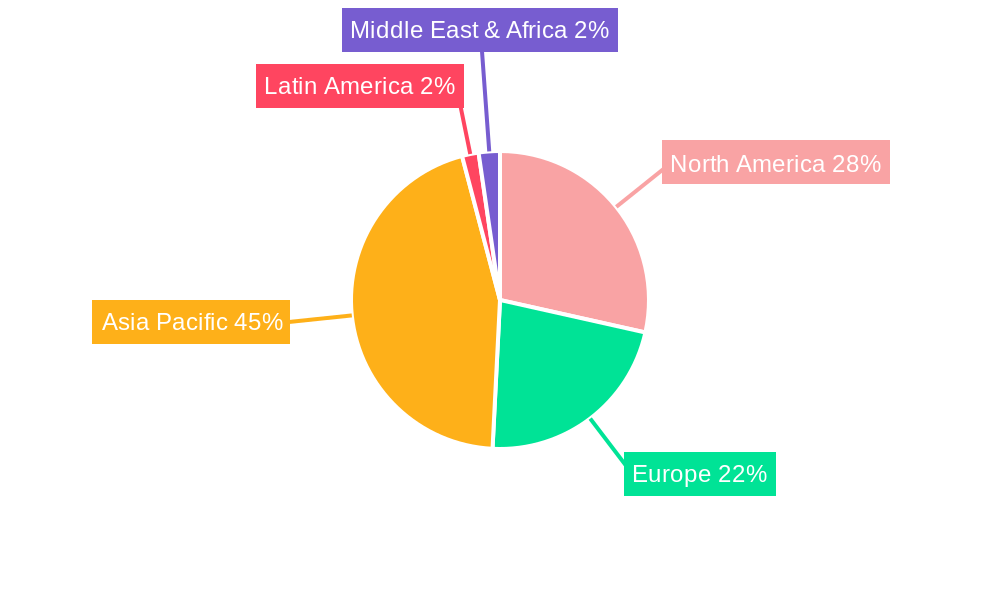

Europe Semiconductor Device Market Regional Market Share

Geographic Coverage of Europe Semiconductor Device Market

Europe Semiconductor Device Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Technologies like IoT and AI; Rising Demand for Consumer Electronics Goods

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness

- 3.4. Market Trends

- 3.4.1. Rising Demand for Consumer Electronics Goods

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Semiconductor Device Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Discrete Semiconductors

- 5.1.2. Optoelectronics

- 5.1.3. Sensors and Actuators

- 5.1.4. Integrated Circuits

- 5.1.4.1. Analog

- 5.1.4.2. Logic

- 5.1.4.3. Memory

- 5.1.5. Micro

- 5.1.5.1. Microprocessors (MPU)

- 5.1.5.2. Microcontrollers (MCU)

- 5.1.5.3. Digital Signal Processors

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Automotive

- 5.2.2. Communication (Wired and Wireless)

- 5.2.3. Consumer

- 5.2.4. Industrial

- 5.2.5. Computing/Data Storage

- 5.2.6. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NXP Semiconductors NV

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Toshiba Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kyocera Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Xilinx Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 STMicroelectronics NV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Qualcomm Incorporated

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Samsung Electronics Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ON Semiconductor Corporatio

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nvidia Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Intel Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 NXP Semiconductors NV

List of Figures

- Figure 1: Europe Semiconductor Device Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Semiconductor Device Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Semiconductor Device Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 2: Europe Semiconductor Device Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 3: Europe Semiconductor Device Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Semiconductor Device Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 5: Europe Semiconductor Device Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 6: Europe Semiconductor Device Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Semiconductor Device Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Semiconductor Device Market?

The projected CAGR is approximately 6.24%.

2. Which companies are prominent players in the Europe Semiconductor Device Market?

Key companies in the market include NXP Semiconductors NV, Toshiba Corporation, Kyocera Corporation, Xilinx Inc, STMicroelectronics NV, Qualcomm Incorporated, Samsung Electronics Co Ltd, ON Semiconductor Corporatio, Nvidia Corporation, Intel Corporation.

3. What are the main segments of the Europe Semiconductor Device Market?

The market segments include Device Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 53.79 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Technologies like IoT and AI; Rising Demand for Consumer Electronics Goods.

6. What are the notable trends driving market growth?

Rising Demand for Consumer Electronics Goods.

7. Are there any restraints impacting market growth?

Lack of Awareness.

8. Can you provide examples of recent developments in the market?

April 2024 - Infineon Technologies AG, a prominent player in power systems and IoT, is bolstering its outsourced backend manufacturing presence in Europe. The company has unveiled a strategic, multi-year collaboration with Amkor Technology, Inc., a key player in semiconductor packaging and testing. As part of this partnership, both entities will jointly run a specialized packaging and testing facility at Amkor's Porto manufacturing hub.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Semiconductor Device Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Semiconductor Device Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Semiconductor Device Market?

To stay informed about further developments, trends, and reports in the Europe Semiconductor Device Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence