Key Insights

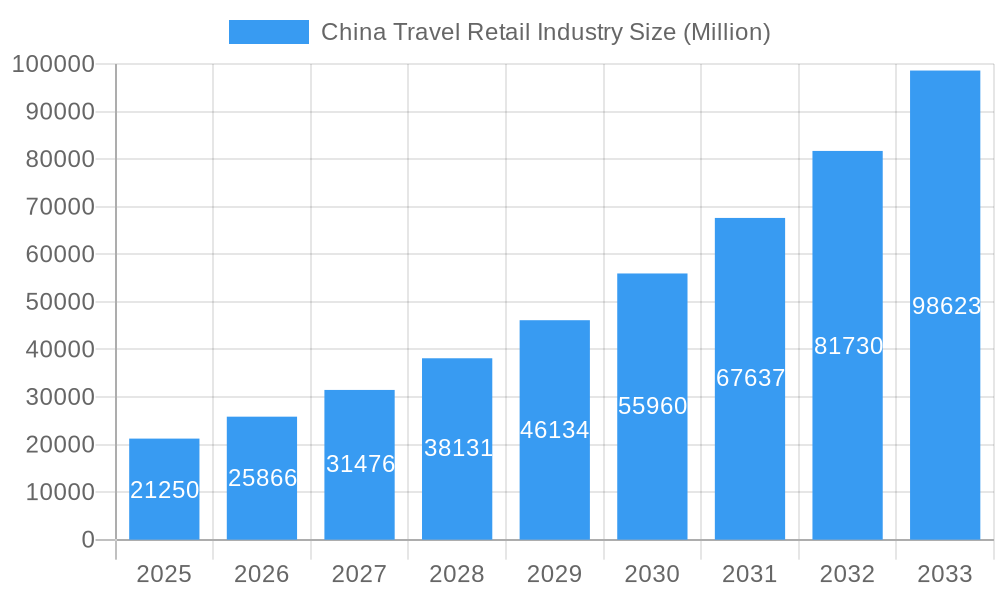

The China travel retail industry is experiencing robust growth, projected to reach a market size of $21.25 billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 21.39% from 2019 to 2033. This significant expansion is fueled by several key drivers. Firstly, the burgeoning Chinese outbound tourism market contributes substantially to the industry's revenue. Increased disposable incomes among Chinese consumers, coupled with a desire for luxury goods and unique experiences, significantly boosts spending in travel retail channels. Secondly, the evolution of airport infrastructure and retail spaces within China and across key international transit points enhances the shopping experience, attracting more consumers and increasing sales. Furthermore, strategic partnerships between international brands and Chinese travel retailers create wider product access and cater to the evolving preferences of Chinese tourists. The industry's segmentation includes various product categories like cosmetics and perfumes (dominated by L'Oréal), luxury goods (with brands like Samsung and Huawei), food and beverages (Starbucks, Haagen-Dazs), and other consumer electronics. Key players such as China Duty Free Group, Lagardere Travel Retail, and DFS Group actively shape the market landscape through their extensive retail networks and strategic brand collaborations.

China Travel Retail Industry Market Size (In Billion)

However, challenges remain. While growth is substantial, the industry's success is intrinsically linked to the stability and growth of the Chinese outbound tourism sector. Government regulations regarding cross-border trade and fluctuations in the Chinese currency can impact purchasing power and overall market dynamics. Competitive pressures from both established players and emerging e-commerce platforms also necessitate continuous innovation and strategic adaptation. The forecast period (2025-2033) anticipates continued growth, driven by further infrastructure development, brand diversification, and the consistent increase in Chinese consumer spending power globally. The industry's future hinges on successfully navigating these challenges while capitalizing on the considerable growth opportunities.

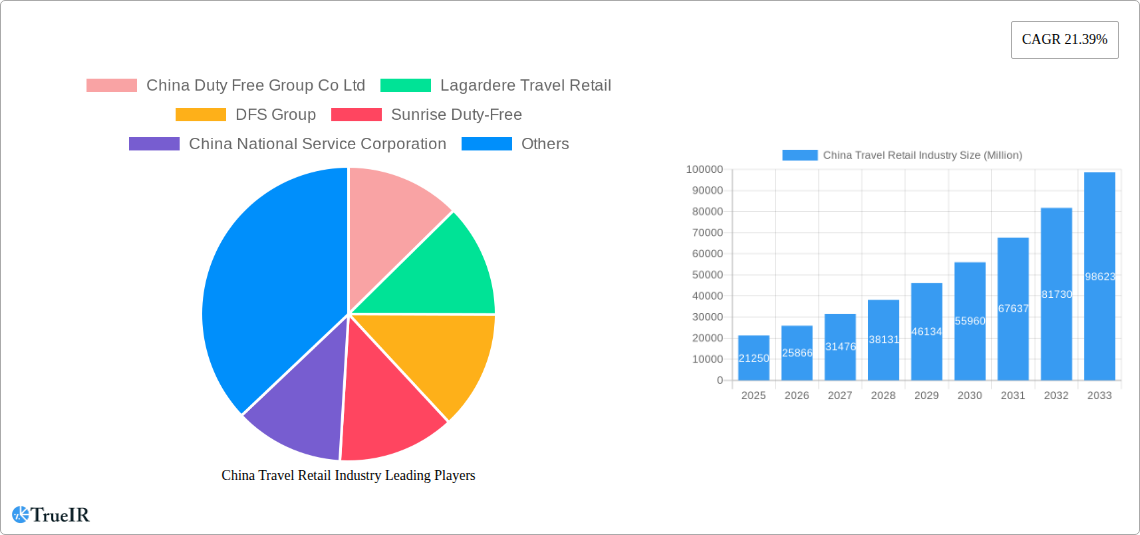

China Travel Retail Industry Company Market Share

China Travel Retail Industry Report: 2019-2033 Forecast

This comprehensive report provides a detailed analysis of the dynamic China travel retail industry, offering invaluable insights for businesses, investors, and policymakers. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report forecasts market trends and growth opportunities until 2033. Leveraging high-volume keywords like "China travel retail market," "duty-free sales China," and "luxury travel retail," this report is optimized for maximum search visibility and industry engagement. The market is expected to reach xx Million by 2033, exhibiting a strong CAGR.

China Travel Retail Industry Market Structure & Competitive Landscape

The China travel retail market is characterized by a concentrated landscape, with key players such as China Duty Free Group Co Ltd, Lagardere Travel Retail, DFS Group, and Sunrise Duty-Free holding significant market share. The estimated market concentration ratio (CR4) in 2025 is xx%, indicating a relatively high level of consolidation. Innovation drivers include technological advancements in digital payment systems, personalized marketing strategies, and the increasing adoption of omnichannel retail models. Regulatory impacts, including import tariffs and tax policies, significantly influence market dynamics. Product substitutes, such as online shopping platforms, present a competitive challenge. End-user segmentation, largely categorized by demographics (age, income) and travel purpose (leisure, business), informs targeted marketing and product development strategies. Mergers and acquisitions (M&A) activity has been notable in recent years, with xx Million in deals recorded between 2019 and 2024, largely driven by the pursuit of scale and diversification.

- Market Concentration: CR4 of xx% in 2025.

- Innovation Drivers: Digital payments, personalized marketing, omnichannel retail.

- Regulatory Impacts: Import tariffs, tax policies.

- M&A Activity: xx Million in deals (2019-2024).

China Travel Retail Industry Market Trends & Opportunities

The China travel retail market is experiencing robust growth, driven by rising disposable incomes, increased outbound tourism, and a burgeoning middle class with a preference for luxury goods. The market size reached xx Million in 2024 and is projected to reach xx Million by 2033, indicating significant growth potential. Technological advancements, particularly in mobile payment and data analytics, are transforming the customer experience and optimizing supply chain management. Shifting consumer preferences towards personalized experiences and sustainable products present both opportunities and challenges. Intense competition among established players and emerging brands necessitates strategic investments in innovation and customer engagement. The market penetration rate for online travel retail platforms is estimated at xx% in 2025, indicating room for further expansion. The CAGR for the forecast period (2025-2033) is projected to be xx%.

Dominant Markets & Segments in China Travel Retail Industry

The most dominant segment within the China travel retail industry is the luxury goods sector, driven by high demand from affluent Chinese consumers. Key growth drivers in this segment include:

- Expanding Middle Class: A growing population with disposable income to spend on luxury goods.

- Government Initiatives: Supportive policies and infrastructure development boosting tourism.

- Brand Recognition: Strong global brand recognition and prestige amongst Chinese consumers.

Other notable segments include cosmetics and perfumes, electronics, and food and beverages. The major geographical regions driving growth include key international airports and high-traffic tourist destinations. These areas benefit from high foot traffic and proximity to major transportation hubs, enhancing accessibility and sales potential.

China Travel Retail Industry Product Analysis

Product innovation in the China travel retail market is driven by the demand for premium quality, exclusive offerings, and seamless digital experiences. Technologically advanced products like smart wearables and high-end electronics attract significant consumer interest. The competitive advantage lies in offering unique and personalized products catered to specific consumer segments, coupled with efficient supply chain management to ensure availability and timely delivery. The increasing emphasis on sustainability and ethical sourcing further influences product development strategies.

Key Drivers, Barriers & Challenges in China Travel Retail Industry

Key Drivers:

- Rising disposable incomes and increased outbound tourism.

- Technological advancements (e.g., mobile payments, digital marketing).

- Government support for tourism infrastructure development.

Challenges:

- Geopolitical uncertainties impacting tourism flows. (Quantifiable impact: xx% reduction in sales during periods of heightened geopolitical risk).

- Supply chain disruptions due to global events (e.g., pandemics). (Quantifiable impact: xx% increase in product costs).

- Intense competition among existing players and the emergence of new competitors.

Growth Drivers in the China Travel Retail Industry Market

The China travel retail market's growth is primarily fuelled by escalating disposable incomes, expanding middle class, robust outbound tourism, and continuous advancements in technology that enhance consumer experience and streamline operations. Government support for tourism infrastructure further propels market expansion. The increasing integration of omnichannel strategies also contributes significantly to revenue growth.

Challenges Impacting China Travel Retail Industry Growth

Growth is hindered by factors such as geopolitical uncertainties impacting tourist numbers, supply chain disruptions affecting product availability and costs, and the ever-increasing competition, demanding continuous innovation and adaptability. Stringent regulatory frameworks also pose challenges to market expansion.

Key Players Shaping the China Travel Retail Industry Market

- China Duty Free Group Co Ltd

- Lagardere Travel Retail

- DFS Group

- Sunrise Duty-Free

- China National Service Corporation

- L'Oreal

- Starbucks

- Samsung Electronics

- Huawei Technologies

- Haagen-Dazs China

List Not Exhaustive

Significant China Travel Retail Industry Industry Milestones

- June 2023: DFS partnered with Ctrip Global Shopping and Unipay International to enhance digitalization. This significantly improved online sales and accessibility.

- February 2024: DFS partnered with Douyin Life Service, boosting brand awareness and reach amongst a younger demographic. This directly influenced sales growth in luxury products.

Future Outlook for China Travel Retail Industry Market

The future outlook for the China travel retail industry remains positive, fueled by sustained economic growth, rising consumer spending, and continuous technological advancements. Strategic partnerships, enhanced digitalization, and a focus on personalized customer experiences will be key factors driving future growth. The market’s potential for expansion is considerable, with opportunities for both established and emerging players to capitalize on the growing demand for premium goods and services within the travel retail sector.

China Travel Retail Industry Segmentation

-

1. Product Type

- 1.1. Fashion and Accessories

- 1.2. Jewelry and Watches

- 1.3. Wine & Spirits

- 1.4. Food & Confectionery

- 1.5. Fragrances and Cosmetics

- 1.6. Tobacco

- 1.7. Others

-

2. Distribution Channel

- 2.1. Airports

- 2.2. Railway Stations

- 2.3. Others

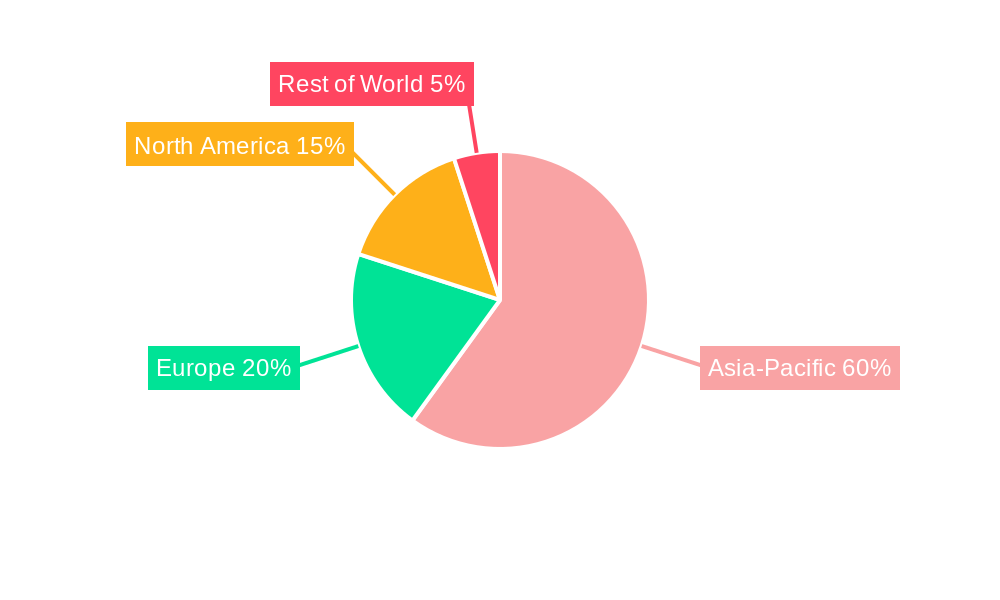

China Travel Retail Industry Segmentation By Geography

- 1. China

China Travel Retail Industry Regional Market Share

Geographic Coverage of China Travel Retail Industry

China Travel Retail Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.39% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise of Duty-Free Shopping; Government Policies Supporting Tourism

- 3.3. Market Restrains

- 3.3.1. Rise of Duty-Free Shopping; Government Policies Supporting Tourism

- 3.4. Market Trends

- 3.4.1. Expansion of Duty-Free Shopping Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Travel Retail Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Fashion and Accessories

- 5.1.2. Jewelry and Watches

- 5.1.3. Wine & Spirits

- 5.1.4. Food & Confectionery

- 5.1.5. Fragrances and Cosmetics

- 5.1.6. Tobacco

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Airports

- 5.2.2. Railway Stations

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 China Duty Free Group Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lagardere Travel Retail

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DFS Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sunrise Duty-Free

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 China National Service Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 L'Oreal

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Starbucks

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Samsung Electronics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Huawei Technologies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Haagen-Dazs China**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 China Duty Free Group Co Ltd

List of Figures

- Figure 1: China Travel Retail Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Travel Retail Industry Share (%) by Company 2025

List of Tables

- Table 1: China Travel Retail Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: China Travel Retail Industry Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: China Travel Retail Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: China Travel Retail Industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: China Travel Retail Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: China Travel Retail Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 7: China Travel Retail Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: China Travel Retail Industry Volume Billion Forecast, by Product Type 2020 & 2033

- Table 9: China Travel Retail Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: China Travel Retail Industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: China Travel Retail Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: China Travel Retail Industry Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Travel Retail Industry?

The projected CAGR is approximately 21.39%.

2. Which companies are prominent players in the China Travel Retail Industry?

Key companies in the market include China Duty Free Group Co Ltd, Lagardere Travel Retail, DFS Group, Sunrise Duty-Free, China National Service Corporation, L'Oreal, Starbucks, Samsung Electronics, Huawei Technologies, Haagen-Dazs China**List Not Exhaustive.

3. What are the main segments of the China Travel Retail Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.25 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise of Duty-Free Shopping; Government Policies Supporting Tourism.

6. What are the notable trends driving market growth?

Expansion of Duty-Free Shopping Driving the Market.

7. Are there any restraints impacting market growth?

Rise of Duty-Free Shopping; Government Policies Supporting Tourism.

8. Can you provide examples of recent developments in the market?

February 2024: DFS Group partnered with Douyin Life Service, a short video platform in China. The partnership aims to improve international travel retail shopping experiences.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Travel Retail Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Travel Retail Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Travel Retail Industry?

To stay informed about further developments, trends, and reports in the China Travel Retail Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence