Key Insights

The Asia-Pacific semiconductor etch equipment market is projected to reach $19,970 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 5.7%. This expansion is driven by surging demand for advanced semiconductors in logic, memory, power devices, and MEMS. The region's strong manufacturing infrastructure, significant government investments in fabrication, and continuous technological innovation are key catalysts. Increasing chip design complexity necessitates sophisticated etch processes, while advanced packaging adoption and the proliferation of 5G, AI, and IoT further fuel demand for high-performance semiconductor components and cutting-edge etch equipment.

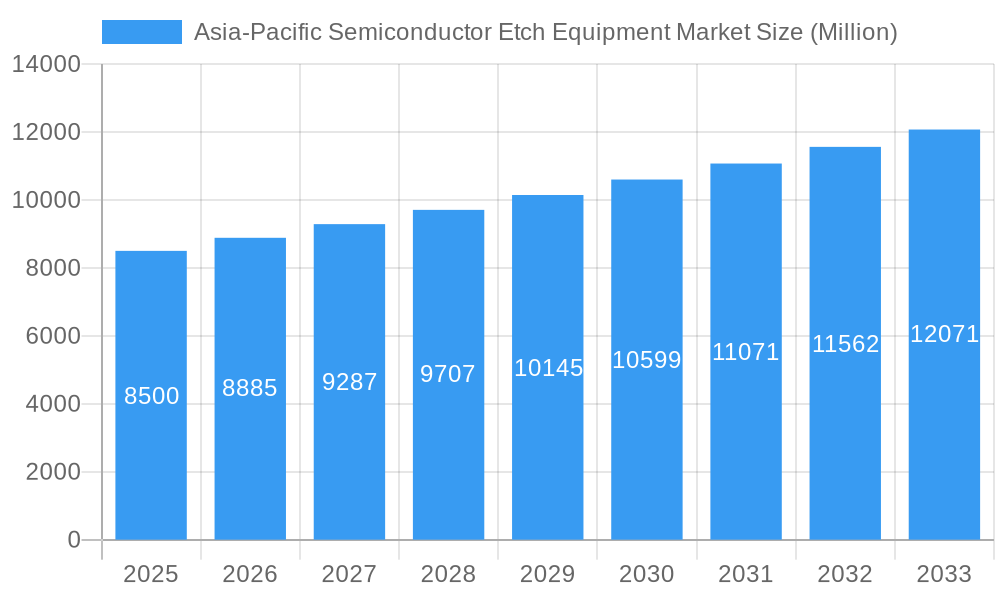

Asia-Pacific Semiconductor Etch Equipment Market Market Size (In Billion)

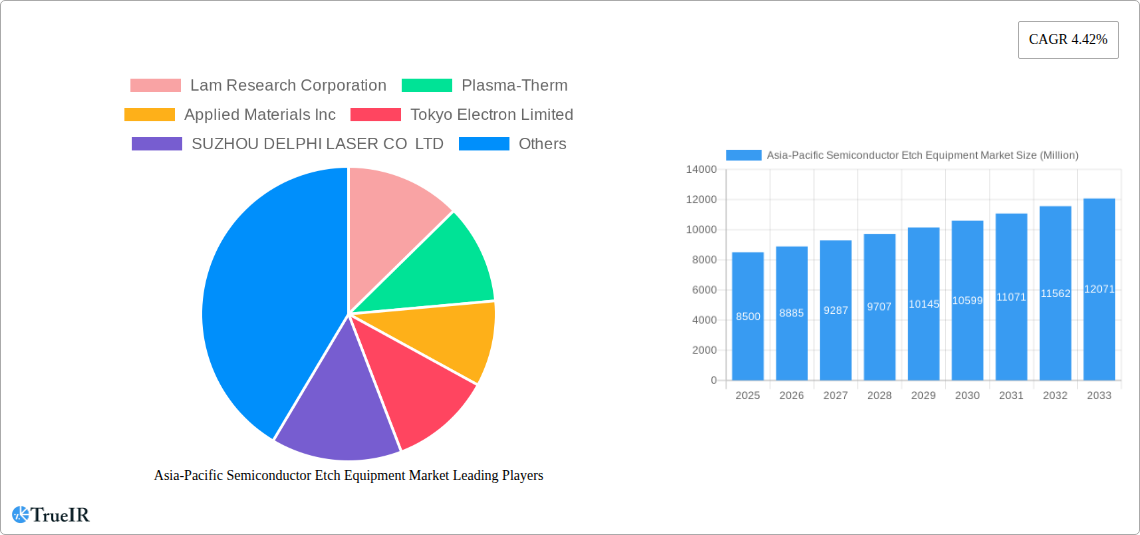

The market features intense competition among global leaders such as Lam Research Corporation, Applied Materials Inc., and Tokyo Electron Limited, alongside regional players like NAURA Technology Group Co Ltd. Continuous R&D investment focuses on plasma and dry etch technologies for enhanced precision, selectivity, and delicate material processing. However, significant capital expenditure, potential raw material supply chain disruptions, and stringent environmental regulations present market restraints. Despite these challenges, the Asia-Pacific region's dominance in global semiconductor production and consumption, led by China, Japan, and South Korea, ensures a dynamic and lucrative market for etch equipment manufacturers.

Asia-Pacific Semiconductor Etch Equipment Market Company Market Share

Asia-Pacific Semiconductor Etch Equipment Market: In-depth Analysis & Forecast (2019–2033)

This comprehensive report offers critical insights into the Asia-Pacific Semiconductor Etch Equipment Market, serving as an essential resource for understanding market dynamics, growth drivers, and competitive strategies. The analysis covers the historical period 2019-2024, with 2025 as the base year, and forecasts market performance through 2033. Utilizing high-volume keywords and detailed segmentation, this report provides actionable intelligence for industry professionals in this vital technology sector.

Asia-Pacific Semiconductor Etch Equipment Market Market Structure & Competitive Landscape

The Asia-Pacific Semiconductor Etch Equipment Market exhibits a moderately concentrated structure, with a few key players dominating the landscape. Innovation remains a primary driver, fueled by the relentless demand for miniaturization and enhanced performance in semiconductor devices. Regulatory impacts, including government incentives for domestic manufacturing and trade policies, are significantly shaping market entry and expansion strategies. Product substitutes are limited, given the specialized nature of etch equipment, but advancements in alternative patterning techniques pose a long-term consideration. End-user segmentation by application, particularly the burgeoning demand from logic and memory sectors, alongside power devices and MEMS, dictates product development trajectories. Merger and acquisition (M&A) trends are observed as companies seek to consolidate market share, acquire advanced technologies, and expand their geographical footprint within the Asia-Pacific region. For instance, strategic partnerships and acquisitions aim to secure supply chains and enhance R&D capabilities. The competitive intensity is high, demanding continuous investment in technological advancements and customer support.

Asia-Pacific Semiconductor Etch Equipment Market Market Trends & Opportunities

The Asia-Pacific Semiconductor Etch Equipment Market is poised for significant expansion, driven by robust demand from the rapidly growing electronics industry across the region. The market size is projected to reach an estimated USD 8,500 Million by 2025, with a compound annual growth rate (CAGR) of approximately 6.8% during the forecast period of 2025–2033. This impressive growth is underpinned by several key trends, including the escalating adoption of 5G technology, the proliferation of Artificial Intelligence (AI) and Machine Learning (ML) applications, and the continued expansion of the Internet of Things (IoT) ecosystem, all of which necessitate advanced semiconductor chips.

Technological shifts are predominantly centered on developing etch equipment capable of achieving higher precision, smaller feature sizes, and increased throughput. This includes advancements in plasma etch technologies, such as high-density plasma (HDP) etch, which offers superior control over etch profiles and reduces process variability. The demand for specialized etching solutions for complex 3D architectures in logic and memory devices, such as FinFETs and stacked NAND, is a major market accelerant. Consumer preferences are indirectly influencing the market through their demand for more powerful, energy-efficient, and feature-rich electronic devices, pushing semiconductor manufacturers to invest heavily in cutting-edge fabrication technologies.

Competitive dynamics are intense, with established players continuously innovating to maintain their market leadership and new entrants vying for market share. Opportunities abound in emerging markets within the Asia-Pacific, particularly in Southeast Asia and India, where governments are actively promoting semiconductor manufacturing through favorable policies and investment incentives. The increasing complexity of chip designs also creates a demand for sophisticated, multi-functional etch systems that can handle a wider range of materials and process requirements. Furthermore, the growing focus on energy efficiency in semiconductor manufacturing presents an opportunity for etch equipment providers to develop solutions that reduce power consumption and environmental impact. The shift towards specialized chip production for automotive and industrial applications also opens new avenues for growth.

Dominant Markets & Segments in Asia-Pacific Semiconductor Etch Equipment Market

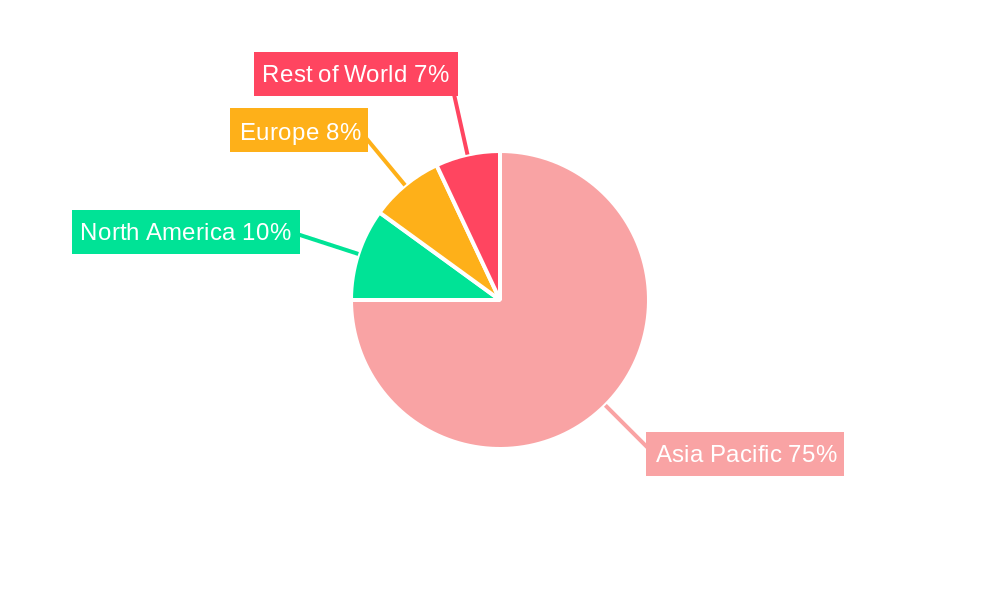

The Asia-Pacific Semiconductor Etch Equipment Market is characterized by regional dominance and significant segment-specific growth. East Asia, particularly countries like China, South Korea, and Taiwan, currently holds the largest market share due to the presence of major semiconductor fabrication hubs and significant investments in advanced manufacturing capabilities. China is emerging as a dominant force, driven by government initiatives aimed at achieving semiconductor self-sufficiency and substantial investments in domestic chip production.

Key Growth Drivers in Dominant Markets & Segments:

- Infrastructure Development: Massive investments in new semiconductor fabs and expansion of existing facilities in China, Taiwan, and South Korea are crucial growth drivers.

- Government Policies & Incentives: Favorable policies, including tax breaks, subsidies, and R&D support, are attracting significant capital investment in semiconductor manufacturing.

- Technological Advancement: The relentless pursuit of smaller node technologies and advanced packaging solutions necessitates cutting-edge etch equipment.

- Demand from End-Use Industries: The booming consumer electronics, automotive, and telecommunications sectors in the region fuel the demand for semiconductors.

Within Product Type, High-density Etch Equipment is experiencing robust growth, driven by the need for precise etching of intricate patterns in advanced logic and memory chips. Low-density Etch Equipment still holds a significant share for less complex applications.

Regarding Etching Type, Conductor Etching and Dielectric Etching are the dominant segments. Conductor etching is critical for creating the interconnects in integrated circuits, while dielectric etching is essential for isolating different circuit components. Polysilicon Etching remains important for gate formation in transistors.

The Application segment is led by Logic and Memory devices, which constitute the largest share due to their pervasive use in computing, smartphones, and data centers. The Power Devices segment is also showing considerable growth, fueled by the electrification of vehicles and the increasing demand for energy-efficient power management solutions. MEMS (Micro-Electro-Mechanical Systems) represent a growing niche, driven by applications in sensors for automotive, industrial, and consumer electronics.

Asia-Pacific Semiconductor Etch Equipment Market Product Analysis

The Asia-Pacific Semiconductor Etch Equipment Market is defined by continuous product innovation aimed at achieving atomic-level precision and enhanced process control. Leading manufacturers are introducing etch systems with advanced plasma control technologies, multi-chamber configurations for increased throughput, and intelligent software for real-time process monitoring and optimization. These innovations cater to the growing demand for etching complex 3D structures in advanced logic and memory chips, as well as specialized applications in power devices and MEMS. The competitive advantage lies in developing etch solutions that offer superior etch profile control, minimal damage to sensitive materials, and high wafer-per-hour productivity, thereby enabling the production of smaller, faster, and more power-efficient semiconductor devices.

Key Drivers, Barriers & Challenges in Asia-Pacific Semiconductor Etch Equipment Market

The Asia-Pacific Semiconductor Etch Equipment Market is propelled by several key drivers. Technologically, the relentless pursuit of Moore's Law and the increasing complexity of chip architectures are demanding more sophisticated etch capabilities. Economically, the immense growth in demand for electronics, AI, 5G, and IoT devices fuels substantial investment in semiconductor manufacturing. Policy-driven factors, such as government initiatives to bolster domestic semiconductor production and reduce reliance on foreign suppliers, are creating a favorable environment for market expansion. For instance, the push for semiconductor self-sufficiency in China and the incentives in India are significant catalysts.

However, the market faces substantial barriers and challenges. Supply chain issues, including the availability of critical raw materials and components, and geopolitical tensions can disrupt production and increase costs. Regulatory hurdles, such as varying trade policies and intellectual property protection concerns across different Asia-Pacific nations, can create complexity. Competitive pressures from established players and emerging technology providers necessitate continuous R&D investment and aggressive market strategies. The high cost of advanced etch equipment and the significant capital expenditure required for building and upgrading fabrication facilities also present a barrier for smaller players. Furthermore, the shortage of skilled labor in specialized manufacturing roles can impede growth.

Growth Drivers in the Asia-Pacific Semiconductor Etch Equipment Market Market

The Asia-Pacific Semiconductor Etch Equipment Market is experiencing robust growth primarily driven by technological advancements and surging demand for semiconductors. The expansion of 5G networks, the increasing adoption of Artificial Intelligence (AI) and Machine Learning (ML) in various sectors, and the proliferation of Internet of Things (IoT) devices are creating an unprecedented demand for advanced semiconductor chips. Governments across the region are actively promoting domestic semiconductor manufacturing through supportive policies, subsidies, and tax incentives, fostering significant investment in fab construction and expansion. For example, initiatives like the "Make in India" program aim to attract semiconductor manufacturing to the country. The ongoing transition to smaller process nodes for enhanced performance and power efficiency in logic and memory devices necessitates cutting-edge etch equipment.

Challenges Impacting Asia-Pacific Semiconductor Etch Equipment Market Growth

The Asia-Pacific Semiconductor Etch Equipment Market faces several significant challenges that can impede growth. Geopolitical tensions and supply chain vulnerabilities pose a constant threat, leading to potential disruptions in the availability of critical components and raw materials, as well as price volatility. Regulatory complexities and trade disputes between major economic blocs can create uncertainty and impact market access. The intense competition among established players and the emergence of new technologies require substantial and continuous investment in research and development to maintain a competitive edge. Furthermore, the shortage of highly skilled engineers and technicians necessary for operating and maintaining sophisticated etch equipment can limit the scalability of manufacturing operations. The high capital expenditure associated with acquiring and implementing advanced etch technology also acts as a barrier, particularly for smaller or newer market entrants.

Key Players Shaping the Asia-Pacific Semiconductor Etch Equipment Market Market

- Lam Research Corporation

- Plasma-Therm

- Applied Materials Inc

- Tokyo Electron Limited

- SUZHOU DELPHI LASER CO LTD

- Gigalane

- NAURA Technology Group Co Ltd

- Panasonic Corporation

- Hitachi High Technologies

Significant Asia-Pacific Semiconductor Etch Equipment Market Industry Milestones

- September 2021: India and Taiwan initiated discussions for a mutual agreement to bolster chip manufacturing in the Asia-Pacific, focusing on South Asia. This collaboration aims to facilitate tariff reductions on semiconductor production components by the end of the year and includes plans for a chip plant in India valued at an estimated USD 7.5 billion, catering to sectors from electric cars to 5G devices.

- August 2021: Tokyo Electron (TEL) unveiled its advanced etch platform, Episode UL. Engineered to enhance fab productivity for TEL's clientele, Episode UL offers significant advantages, including flexible multi-chamber configurations, substantial footprint savings, simplified maintenance procedures, and integrated advanced Smart tool features.

Future Outlook for Asia-Pacific Semiconductor Etch Equipment Market Market

The future outlook for the Asia-Pacific Semiconductor Etch Equipment Market is exceptionally promising, driven by sustained global demand for advanced electronic devices and a strong push for regional semiconductor manufacturing self-sufficiency. The ongoing advancements in AI, 5G, IoT, and the automotive sector will continue to fuel the need for high-performance chips, requiring state-of-the-art etch solutions. Strategic opportunities lie in emerging markets and the development of equipment for next-generation semiconductor technologies, such as advanced packaging and novel materials. Government support and increasing fab investments across the region are set to create a fertile ground for market expansion. Companies that can offer innovative, efficient, and cost-effective etch equipment, coupled with strong technical support, are poised for significant success in this dynamic and rapidly evolving market.

Asia-Pacific Semiconductor Etch Equipment Market Segmentation

-

1. Product Type

- 1.1. High-density Etch Equipment

- 1.2. Low-density Etch Equipment

-

2. Etching Type

- 2.1. Conductor Etching

- 2.2. Dielectric Etching

- 2.3. Polysilicon Etching

-

3. Application

- 3.1. Logic and Memory

- 3.2. Power Devices

- 3.3. MEMS

Asia-Pacific Semiconductor Etch Equipment Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Semiconductor Etch Equipment Market Regional Market Share

Geographic Coverage of Asia-Pacific Semiconductor Etch Equipment Market

Asia-Pacific Semiconductor Etch Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The growth in adoption of smart electronic devices in the region; Government initiative Programs in the region for domestic semiconductor manufacturing

- 3.3. Market Restrains

- 3.3.1. New semiconductor acts in Europe and America

- 3.4. Market Trends

- 3.4.1. Power devices is expected to grow in the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Semiconductor Etch Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. High-density Etch Equipment

- 5.1.2. Low-density Etch Equipment

- 5.2. Market Analysis, Insights and Forecast - by Etching Type

- 5.2.1. Conductor Etching

- 5.2.2. Dielectric Etching

- 5.2.3. Polysilicon Etching

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Logic and Memory

- 5.3.2. Power Devices

- 5.3.3. MEMS

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Lam Research Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Plasma-Therm

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Applied Materials Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tokyo Electron Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SUZHOU DELPHI LASER CO LTD

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gigalane

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NAURA Technology Group Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Panasonic Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hitachi High Technologies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Lam Research Corporation

List of Figures

- Figure 1: Asia-Pacific Semiconductor Etch Equipment Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Semiconductor Etch Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Semiconductor Etch Equipment Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Asia-Pacific Semiconductor Etch Equipment Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Asia-Pacific Semiconductor Etch Equipment Market Revenue million Forecast, by Etching Type 2020 & 2033

- Table 4: Asia-Pacific Semiconductor Etch Equipment Market Volume K Unit Forecast, by Etching Type 2020 & 2033

- Table 5: Asia-Pacific Semiconductor Etch Equipment Market Revenue million Forecast, by Application 2020 & 2033

- Table 6: Asia-Pacific Semiconductor Etch Equipment Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 7: Asia-Pacific Semiconductor Etch Equipment Market Revenue million Forecast, by Region 2020 & 2033

- Table 8: Asia-Pacific Semiconductor Etch Equipment Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Asia-Pacific Semiconductor Etch Equipment Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 10: Asia-Pacific Semiconductor Etch Equipment Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 11: Asia-Pacific Semiconductor Etch Equipment Market Revenue million Forecast, by Etching Type 2020 & 2033

- Table 12: Asia-Pacific Semiconductor Etch Equipment Market Volume K Unit Forecast, by Etching Type 2020 & 2033

- Table 13: Asia-Pacific Semiconductor Etch Equipment Market Revenue million Forecast, by Application 2020 & 2033

- Table 14: Asia-Pacific Semiconductor Etch Equipment Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 15: Asia-Pacific Semiconductor Etch Equipment Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Semiconductor Etch Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: China Asia-Pacific Semiconductor Etch Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: China Asia-Pacific Semiconductor Etch Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Japan Asia-Pacific Semiconductor Etch Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Japan Asia-Pacific Semiconductor Etch Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: South Korea Asia-Pacific Semiconductor Etch Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Asia-Pacific Semiconductor Etch Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: India Asia-Pacific Semiconductor Etch Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: India Asia-Pacific Semiconductor Etch Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Australia Asia-Pacific Semiconductor Etch Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Australia Asia-Pacific Semiconductor Etch Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: New Zealand Asia-Pacific Semiconductor Etch Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: New Zealand Asia-Pacific Semiconductor Etch Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Indonesia Asia-Pacific Semiconductor Etch Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Indonesia Asia-Pacific Semiconductor Etch Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Malaysia Asia-Pacific Semiconductor Etch Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Malaysia Asia-Pacific Semiconductor Etch Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Singapore Asia-Pacific Semiconductor Etch Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Singapore Asia-Pacific Semiconductor Etch Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Thailand Asia-Pacific Semiconductor Etch Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Thailand Asia-Pacific Semiconductor Etch Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Vietnam Asia-Pacific Semiconductor Etch Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: Vietnam Asia-Pacific Semiconductor Etch Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Philippines Asia-Pacific Semiconductor Etch Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: Philippines Asia-Pacific Semiconductor Etch Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Semiconductor Etch Equipment Market?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the Asia-Pacific Semiconductor Etch Equipment Market?

Key companies in the market include Lam Research Corporation, Plasma-Therm, Applied Materials Inc, Tokyo Electron Limited, SUZHOU DELPHI LASER CO LTD, Gigalane, NAURA Technology Group Co Ltd, Panasonic Corporation, Hitachi High Technologies.

3. What are the main segments of the Asia-Pacific Semiconductor Etch Equipment Market?

The market segments include Product Type, Etching Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 19970 million as of 2022.

5. What are some drivers contributing to market growth?

The growth in adoption of smart electronic devices in the region; Government initiative Programs in the region for domestic semiconductor manufacturing.

6. What are the notable trends driving market growth?

Power devices is expected to grow in the market.

7. Are there any restraints impacting market growth?

New semiconductor acts in Europe and America.

8. Can you provide examples of recent developments in the market?

September 2021: India and Taiwan are in talks for a mutual agreement to bring chip manufacturing to the Asia-Pacific, mainly in South Asia, along with tariff reductions on components for producing semiconductors by the end of this year. In addition, this deal would also bring a chip plant worth an estimated USD 7.5 billion to India to supply everything from electric cars to 5G devices.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Semiconductor Etch Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Semiconductor Etch Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Semiconductor Etch Equipment Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Semiconductor Etch Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence