Key Insights

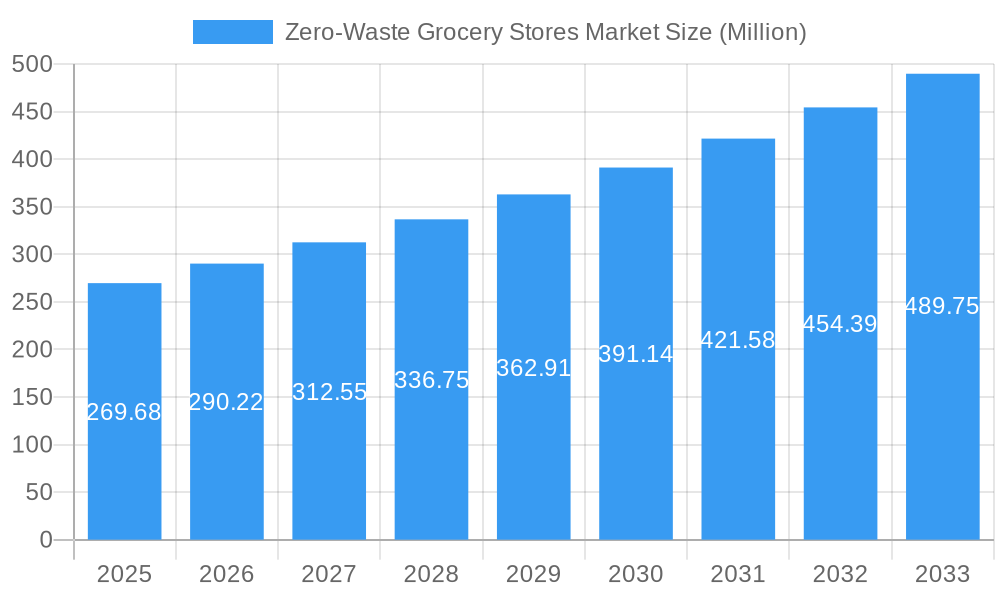

The zero-waste grocery store market is experiencing robust growth, projected to reach $269.68 million in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 7.87% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing consumer awareness of environmental sustainability and the desire to reduce plastic waste are significant factors. The growing popularity of eco-conscious lifestyles, coupled with the rising demand for ethically sourced and locally produced goods, further propels market growth. Furthermore, innovative business models such as refill stations and bulk purchasing options are attracting a wider consumer base, making zero-waste shopping more accessible and convenient. The market is segmented by product type (e.g., grains, produce, cleaning supplies), store format (e.g., independent stores, supermarket chains), and geographic location. While competitive pressures exist, especially from established supermarket chains incorporating sustainable initiatives, the unique appeal of the zero-waste model offers a strong differentiation strategy. The market’s expansion is also driven by evolving consumer preferences favoring transparency and traceability in supply chains.

Zero-Waste Grocery Stores Market Market Size (In Million)

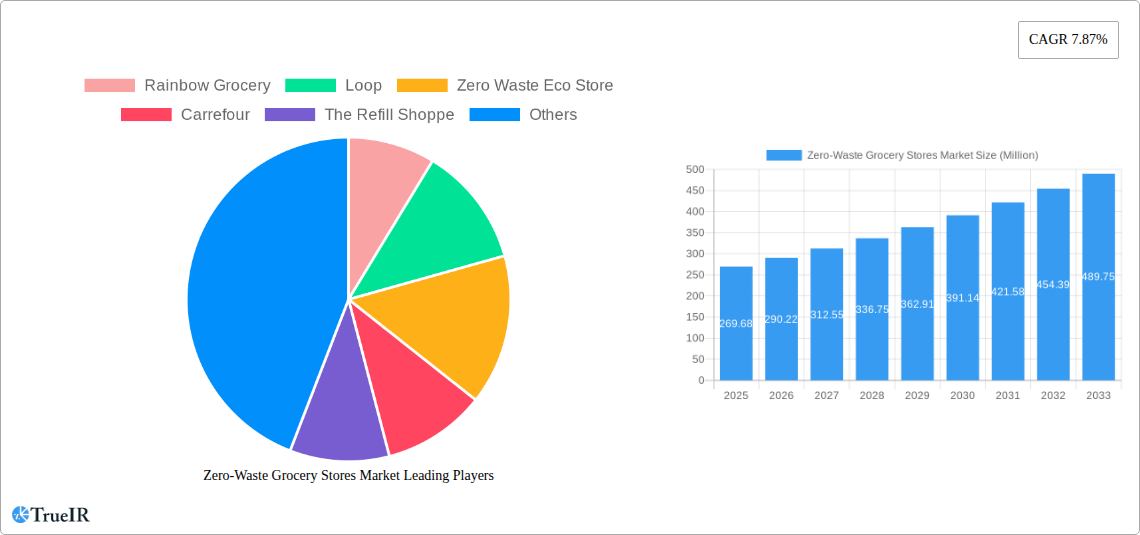

Despite the positive outlook, the market faces certain challenges. High initial setup costs for stores specializing in zero-waste practices and the potential for higher per-unit pricing compared to conventional supermarkets pose obstacles for smaller businesses. Education and awareness initiatives remain critical in addressing consumer perception of the higher prices. Successful market penetration requires strategies that emphasize value, convenience, and the long-term environmental and health benefits. The competitive landscape is increasingly dynamic with a range of players including independent retailers (such as Rainbow Grocery, Loop, and Zero Waste Eco Store), larger chains incorporating zero-waste sections (like Carrefour and Lidl), and niche refill shops (The Refill Shoppe, Just Gaia, Zero Muda, EcoRefill, ecoTopia). Successful strategies will focus on innovative packaging solutions, expanding product offerings, and building strong brand loyalty.

Zero-Waste Grocery Stores Market Company Market Share

Zero-Waste Grocery Stores Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the burgeoning Zero-Waste Grocery Stores market, offering invaluable insights for investors, industry professionals, and strategic planners. Leveraging extensive market research and data analysis covering the period 2019-2033 (base year 2025, forecast period 2025-2033), this report illuminates key trends, challenges, and opportunities within this rapidly evolving sector. The market is projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period.

Zero-Waste Grocery Stores Market Structure & Competitive Landscape

The zero-waste grocery stores market exhibits a moderately fragmented structure, with both established supermarket chains and smaller, independent stores vying for market share. The concentration ratio (CR4) is estimated at xx%, indicating a competitive landscape with no single dominant player. Innovation is a key driver, with companies continuously developing new packaging solutions, refill systems, and supply chain strategies. Stringent environmental regulations are increasingly impacting the market, pushing businesses towards sustainable practices. Product substitutes, such as conventional grocery stores and online retailers offering limited sustainable options, pose a challenge. The market is segmented by store size (small, medium, large), product type (bulk foods, packaged goods), and geographic location. M&A activity within the sector is relatively low, with an estimated xx number of deals in the historical period (2019-2024), but there is potential for consolidation as larger chains explore expansion into zero-waste offerings.

Zero-Waste Grocery Stores Market Market Trends & Opportunities

The zero-waste grocery stores market is experiencing significant growth driven by a confluence of factors. Increasing consumer awareness of environmental issues and a preference for sustainable products are major catalysts. Technological advancements, such as improved packaging materials and digital inventory management systems, are enhancing efficiency and reducing waste. The market size is projected to grow from xx Million in 2025 (estimated year) to xx Million by 2033, with a CAGR of xx%. The penetration rate of zero-waste grocery stores is currently estimated at xx% in developed markets, with substantial growth potential in emerging economies. However, competitive dynamics remain intense, with established players adapting their strategies to cater to the growing demand for sustainable products. This presents both opportunities and challenges for new entrants. Pricing strategies, marketing efforts focusing on sustainability, and supply chain optimization are critical factors in determining market success.

Dominant Markets & Segments in Zero-Waste Grocery Stores Market

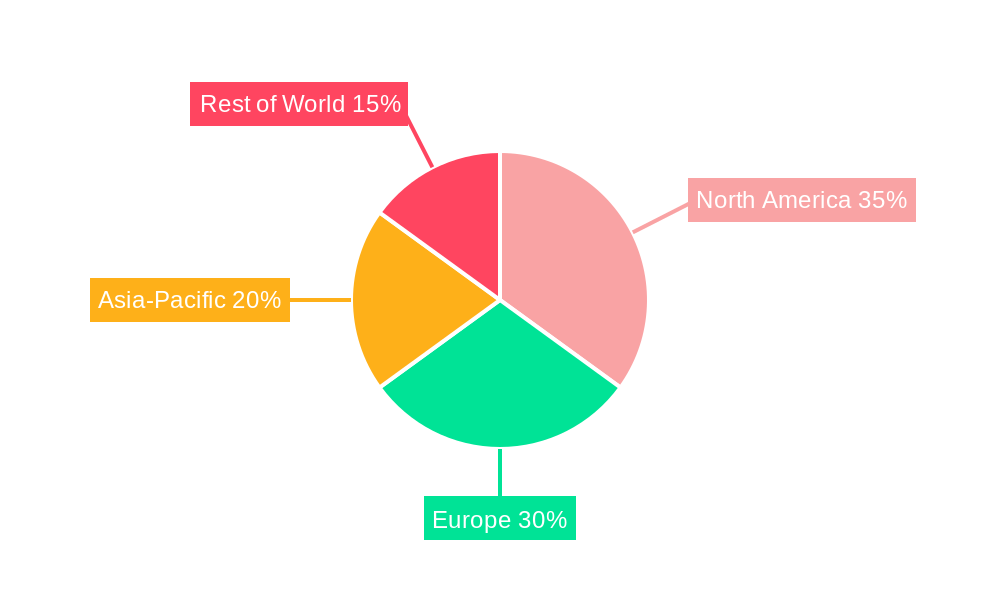

Currently, North America and Europe are the dominant regions in the zero-waste grocery stores market, driven by high consumer awareness and supportive government policies. Within these regions, urban areas with high population densities and a strong environmental consciousness show the highest market penetration.

- Key Growth Drivers in North America: Strong consumer demand for sustainable products, supportive environmental regulations, and a relatively well-developed infrastructure.

- Key Growth Drivers in Europe: High consumer awareness of environmental issues, stringent environmental regulations promoting waste reduction, and government incentives for sustainable businesses.

- Asia-Pacific: While presently less developed compared to North America and Europe, it shows significant potential for rapid growth in the coming years, driven by increasing environmental concerns and rising disposable incomes.

The segment of bulk food stores and refill stations exhibits particularly strong growth due to the significant reduction in packaging waste achieved.

Zero-Waste Grocery Stores Market Product Analysis

The Zero-Waste Grocery Stores market showcases innovative products designed to minimize waste and promote sustainability. These include reusable containers, innovative packaging solutions made from recycled or biodegradable materials, bulk food dispensers, and refill systems for various household products. The competitive advantages lie in the convenience, cost-effectiveness, and positive environmental impact these offerings present. Technological advancements drive improvements in packaging design, inventory management, and supply chain optimization, increasing efficiency and reducing costs for both businesses and consumers. The market fit is strong, driven by growing consumer demand for eco-friendly solutions.

Key Drivers, Barriers & Challenges in Zero-Waste Grocery Stores Market

Key Drivers:

- Growing consumer awareness of environmental sustainability.

- Increasing government regulations and incentives for waste reduction.

- Technological advancements in packaging and supply chain management.

- Rising demand for healthy and ethically sourced food.

Key Barriers & Challenges:

- Higher initial investment costs associated with implementing zero-waste practices.

- Difficulty in establishing reliable and efficient supply chains.

- Potential for higher product prices compared to conventional options.

- Competition from traditional grocery stores and online retailers. The lack of standardization in product packaging and refill systems poses a challenge to consumers and retailers alike. This negatively impacts scale and inhibits wider adoption.

Growth Drivers in the Zero-Waste Grocery Stores Market Market

The market is propelled by a rise in eco-conscious consumers, government policies incentivizing sustainable practices, and technological innovations in packaging and logistics. Economic factors such as the increasing cost of conventional waste disposal also contribute to market growth.

Challenges Impacting Zero-Waste Grocery Stores Market Growth

Significant challenges include supply chain complexities, the high initial investment required for zero-waste infrastructure, and competition from established, less sustainable players. Regulatory hurdles in some markets add further complexity.

Key Players Shaping the Zero-Waste Grocery Stores Market Market

- Rainbow Grocery

- Loop

- Zero Waste Eco Store

- Carrefour

- The Refill Shoppe

- Just Gaia

- Zero Muda

- EcoRefill

- ecoTopia

- Lidl

Significant Zero-Waste Grocery Stores Market Industry Milestones

- July 2024: Carrefour partnered with GreenYellow to install solar panels across 350 stores in France, Spain, and Brazil. This demonstrates a commitment to sustainability and potentially lowers operating costs.

- November 2023: Carrefour partnered with JIP Retail, expanding its product reach in the Czech Republic. This enhances market penetration and distribution capabilities.

- January 2023: Good Earth Natural Foods partnered with USEFULL to reduce single-use packaging waste, showcasing a focus on sustainable alternatives.

Future Outlook for Zero-Waste Grocery Stores Market Market

The zero-waste grocery stores market is poised for continued expansion, driven by increasing consumer demand for sustainable products and supportive government policies. Strategic partnerships and technological innovations will play a crucial role in shaping the market's future. The market presents significant opportunities for businesses that can effectively address the challenges related to supply chain management, pricing, and consumer education. The focus on reducing plastic waste and embracing circular economy principles will continue to be a key driver of market growth.

Zero-Waste Grocery Stores Market Segmentation

-

1. Distribution Channel

- 1.1. Supermarkets/Hypermarkets

- 1.2. Speciality Stores

- 1.3. Online Stores

Zero-Waste Grocery Stores Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Italy

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Zero-Waste Grocery Stores Market Regional Market Share

Geographic Coverage of Zero-Waste Grocery Stores Market

Zero-Waste Grocery Stores Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Environmental Consciousness Driving the Market; Consumer Demand for Eco-friendly Options Fuels Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Rising Environmental Consciousness Driving the Market; Consumer Demand for Eco-friendly Options Fuels Growth of the Market

- 3.4. Market Trends

- 3.4.1 Zero-Waste Grocery Stores Proliferate in Supermarkets and Hypermarkets

- 3.4.2 Propelling Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Zero-Waste Grocery Stores Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.1.1. Supermarkets/Hypermarkets

- 5.1.2. Speciality Stores

- 5.1.3. Online Stores

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6. North America Zero-Waste Grocery Stores Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.1.1. Supermarkets/Hypermarkets

- 6.1.2. Speciality Stores

- 6.1.3. Online Stores

- 6.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 7. Europe Zero-Waste Grocery Stores Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.1.1. Supermarkets/Hypermarkets

- 7.1.2. Speciality Stores

- 7.1.3. Online Stores

- 7.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 8. Asia Pacific Zero-Waste Grocery Stores Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.1.1. Supermarkets/Hypermarkets

- 8.1.2. Speciality Stores

- 8.1.3. Online Stores

- 8.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 9. South America Zero-Waste Grocery Stores Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.1.1. Supermarkets/Hypermarkets

- 9.1.2. Speciality Stores

- 9.1.3. Online Stores

- 9.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 10. Middle East and Africa Zero-Waste Grocery Stores Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.1.1. Supermarkets/Hypermarkets

- 10.1.2. Speciality Stores

- 10.1.3. Online Stores

- 10.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Rainbow Grocery

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Loop

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Zero Waste Eco Store

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Carrefour

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Refill Shoppe

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Just Gaia

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Zero Muda

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 EcoRefill

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ecoTopia

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Lidl**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Rainbow Grocery

List of Figures

- Figure 1: Global Zero-Waste Grocery Stores Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Zero-Waste Grocery Stores Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Zero-Waste Grocery Stores Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 4: North America Zero-Waste Grocery Stores Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 5: North America Zero-Waste Grocery Stores Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Zero-Waste Grocery Stores Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 7: North America Zero-Waste Grocery Stores Market Revenue (Million), by Country 2025 & 2033

- Figure 8: North America Zero-Waste Grocery Stores Market Volume (Billion), by Country 2025 & 2033

- Figure 9: North America Zero-Waste Grocery Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Zero-Waste Grocery Stores Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Zero-Waste Grocery Stores Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 12: Europe Zero-Waste Grocery Stores Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 13: Europe Zero-Waste Grocery Stores Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: Europe Zero-Waste Grocery Stores Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 15: Europe Zero-Waste Grocery Stores Market Revenue (Million), by Country 2025 & 2033

- Figure 16: Europe Zero-Waste Grocery Stores Market Volume (Billion), by Country 2025 & 2033

- Figure 17: Europe Zero-Waste Grocery Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Zero-Waste Grocery Stores Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Zero-Waste Grocery Stores Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 20: Asia Pacific Zero-Waste Grocery Stores Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 21: Asia Pacific Zero-Waste Grocery Stores Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Asia Pacific Zero-Waste Grocery Stores Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 23: Asia Pacific Zero-Waste Grocery Stores Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Asia Pacific Zero-Waste Grocery Stores Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Zero-Waste Grocery Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Zero-Waste Grocery Stores Market Volume Share (%), by Country 2025 & 2033

- Figure 27: South America Zero-Waste Grocery Stores Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 28: South America Zero-Waste Grocery Stores Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 29: South America Zero-Waste Grocery Stores Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: South America Zero-Waste Grocery Stores Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 31: South America Zero-Waste Grocery Stores Market Revenue (Million), by Country 2025 & 2033

- Figure 32: South America Zero-Waste Grocery Stores Market Volume (Billion), by Country 2025 & 2033

- Figure 33: South America Zero-Waste Grocery Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Zero-Waste Grocery Stores Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Middle East and Africa Zero-Waste Grocery Stores Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 36: Middle East and Africa Zero-Waste Grocery Stores Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 37: Middle East and Africa Zero-Waste Grocery Stores Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 38: Middle East and Africa Zero-Waste Grocery Stores Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 39: Middle East and Africa Zero-Waste Grocery Stores Market Revenue (Million), by Country 2025 & 2033

- Figure 40: Middle East and Africa Zero-Waste Grocery Stores Market Volume (Billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Zero-Waste Grocery Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Zero-Waste Grocery Stores Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Zero-Waste Grocery Stores Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 2: Global Zero-Waste Grocery Stores Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Zero-Waste Grocery Stores Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Zero-Waste Grocery Stores Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Global Zero-Waste Grocery Stores Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Zero-Waste Grocery Stores Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global Zero-Waste Grocery Stores Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Zero-Waste Grocery Stores Market Volume Billion Forecast, by Country 2020 & 2033

- Table 9: United States Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United States Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 11: Canada Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 13: Rest of North America Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Rest of North America Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Global Zero-Waste Grocery Stores Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 16: Global Zero-Waste Grocery Stores Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 17: Global Zero-Waste Grocery Stores Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Zero-Waste Grocery Stores Market Volume Billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: United Kingdom Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Germany Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Germany Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: France Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: France Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Russia Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Russia Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Italy Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Italy Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Spain Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Spain Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Europe Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Global Zero-Waste Grocery Stores Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global Zero-Waste Grocery Stores Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Zero-Waste Grocery Stores Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Zero-Waste Grocery Stores Market Volume Billion Forecast, by Country 2020 & 2033

- Table 37: India Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: India Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: China Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: China Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Japan Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Australia Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Australia Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Rest of Asia Pacific Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Global Zero-Waste Grocery Stores Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 48: Global Zero-Waste Grocery Stores Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 49: Global Zero-Waste Grocery Stores Market Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Global Zero-Waste Grocery Stores Market Volume Billion Forecast, by Country 2020 & 2033

- Table 51: Brazil Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Brazil Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: Argentina Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Argentina Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Rest of South America Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Rest of South America Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Global Zero-Waste Grocery Stores Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 58: Global Zero-Waste Grocery Stores Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 59: Global Zero-Waste Grocery Stores Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Zero-Waste Grocery Stores Market Volume Billion Forecast, by Country 2020 & 2033

- Table 61: United Arab Emirates Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: United Arab Emirates Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: South Africa Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: South Africa Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Zero-Waste Grocery Stores Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Zero-Waste Grocery Stores Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Zero-Waste Grocery Stores Market?

The projected CAGR is approximately 7.87%.

2. Which companies are prominent players in the Zero-Waste Grocery Stores Market?

Key companies in the market include Rainbow Grocery, Loop, Zero Waste Eco Store, Carrefour, The Refill Shoppe, Just Gaia, Zero Muda, EcoRefill, ecoTopia, Lidl**List Not Exhaustive.

3. What are the main segments of the Zero-Waste Grocery Stores Market?

The market segments include Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 269.68 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Environmental Consciousness Driving the Market; Consumer Demand for Eco-friendly Options Fuels Growth of the Market.

6. What are the notable trends driving market growth?

Zero-Waste Grocery Stores Proliferate in Supermarkets and Hypermarkets. Propelling Growth.

7. Are there any restraints impacting market growth?

Rising Environmental Consciousness Driving the Market; Consumer Demand for Eco-friendly Options Fuels Growth of the Market.

8. Can you provide examples of recent developments in the market?

July 2024: Carrefour, a prominent supermarket chain, partnered with GreenYellow, a key player in France's energy transition, to install solar panels across its national store network. This joint effort focuses on installing photovoltaic units in the parking lots of 350 hypermarkets and supermarkets in France, Spain, and Brazil.November 2023: Carrefour into a new partnership with Czech Group JIP Retail. All stores of the chain’s network started selling a large range of Carrefour products.January 2023: Good Earth Natural Foods partnered with USEFULL to reduce single-use packaging waste. As part of its commitment to sustainability, Good Earth began offering USEFULL’s tech-enabled, insulated stainless steel cups in its in-store cafes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Zero-Waste Grocery Stores Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Zero-Waste Grocery Stores Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Zero-Waste Grocery Stores Market?

To stay informed about further developments, trends, and reports in the Zero-Waste Grocery Stores Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence