Key Insights

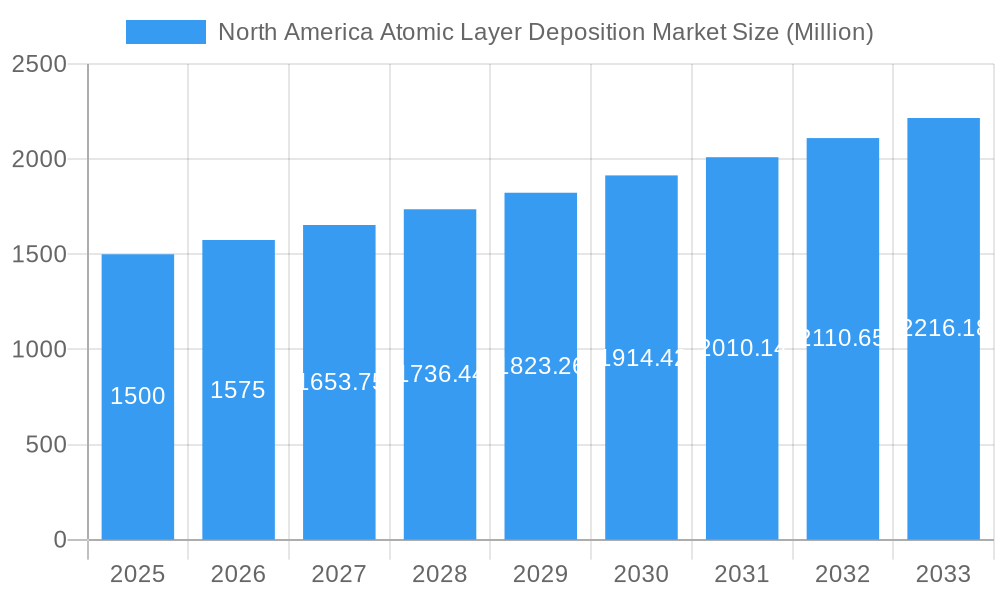

The North American Atomic Layer Deposition (ALD) market, valued at approximately $1.5 billion in 2025, is poised for robust growth, driven by escalating demand across key sectors. A compound annual growth rate (CAGR) of 5% from 2025 to 2033 projects a market exceeding $2.3 billion by 2033. This expansion is fueled by several factors. The semiconductor and electronics industry, including computing, data centers, and consumer electronics, remains the dominant application segment, leveraging ALD's precision for advanced chip manufacturing and miniaturization. Growth in the healthcare and biomedical sectors, utilizing ALD for creating sophisticated medical implants and drug delivery systems, is also a significant contributor. The automotive industry's adoption of ALD for enhancing sensor performance and improving fuel efficiency further bolsters market expansion. While the "Other Applications" segment represents a smaller portion currently, its potential for growth in areas like energy and aerospace is substantial. The presence of established players like Lam Research, Applied Materials, and Tokyo Electron, alongside emerging innovative companies such as ALD NanoSolutions and Forge Nano, indicates a competitive yet dynamic market landscape conducive to technological advancement and market penetration.

North America Atomic Layer Deposition Market Market Size (In Billion)

Despite this positive outlook, challenges exist. The high capital investment required for ALD equipment may limit entry for smaller players, and potential supply chain disruptions could impact market stability. Furthermore, the ongoing development and refinement of alternative deposition techniques might present competitive pressure. However, the continued demand for higher precision and improved performance in various end-use industries is expected to outweigh these restraints, ensuring a sustained period of growth for the North American ALD market. The market's geographical concentration in North America, particularly within the United States, reflects the region's advanced technological infrastructure and robust semiconductor industry.

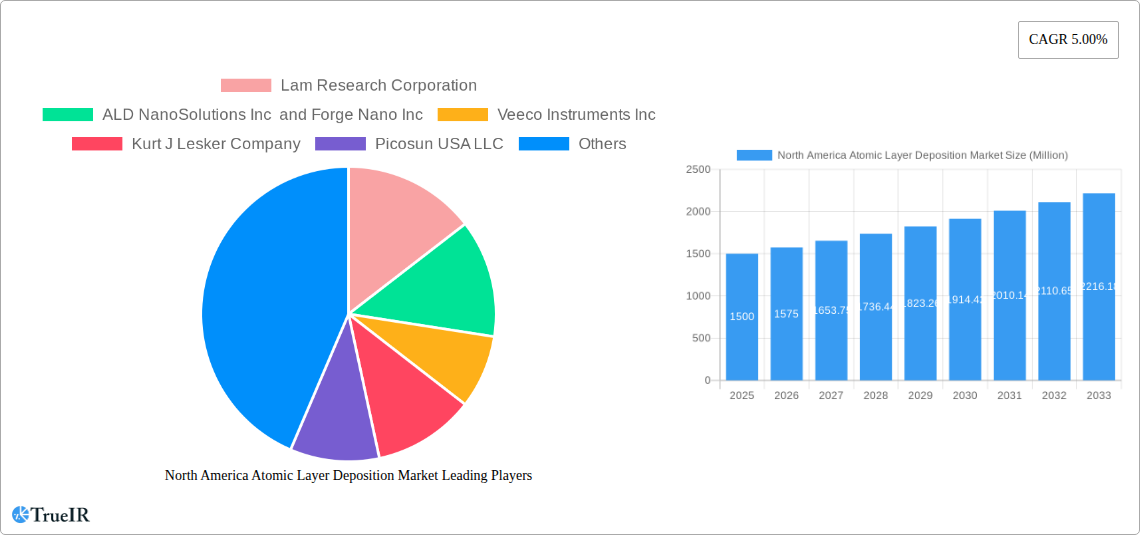

North America Atomic Layer Deposition Market Company Market Share

North America Atomic Layer Deposition (ALD) Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America Atomic Layer Deposition (ALD) market, offering invaluable insights for stakeholders seeking to understand market dynamics, competitive landscapes, and future growth prospects. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils crucial trends and opportunities within this rapidly evolving sector. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period (2025-2033).

North America Atomic Layer Deposition Market Structure & Competitive Landscape

The North American ALD market displays a moderately concentrated structure, with key players like Lam Research Corporation, Applied Materials Inc, and ASM International holding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx in 2025, indicating a moderately competitive landscape. Innovation drives market growth, particularly advancements in precursor materials and deposition techniques enabling finer feature sizes and improved film quality. Regulatory compliance, specifically concerning environmental regulations related to precursor handling and waste disposal, significantly impacts market dynamics. Product substitutes, such as chemical vapor deposition (CVD), pose some competitive pressure, particularly in specific applications. End-user segmentation is dominated by the semiconductor and electronics industry, although healthcare and automotive sectors are experiencing rising adoption. Mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with xx significant transactions recorded between 2019 and 2024. Future M&A activity is anticipated to increase as companies seek to expand their product portfolios and geographic reach.

- Market Concentration: HHI of xx in 2025.

- Innovation Drivers: Advanced precursor materials, improved deposition techniques.

- Regulatory Impacts: Environmental regulations on precursor handling and waste.

- Product Substitutes: CVD technologies.

- End-User Segmentation: Semiconductor & Electronics > Healthcare & Biomedical > Automotive.

- M&A Trends: xx significant transactions (2019-2024), with anticipated increase in future.

North America Atomic Layer Deposition Market Trends & Opportunities

The North American ALD market is experiencing substantial growth, driven by increasing demand from the semiconductor industry, particularly in advanced node manufacturing for microchips. Technological advancements, such as the development of high-k metal gate dielectrics and 3D NAND flash memory, fuel ALD adoption. The market is witnessing a shift towards high-throughput ALD systems, which improves cost-effectiveness. Consumer preferences for smaller, faster, and more energy-efficient electronic devices further stimulate market growth. Competitive dynamics are shaping the market, with established players focusing on innovation and expansion into new applications while smaller companies are striving to secure niches through specialized processes and materials. Market penetration rates in specific segments, such as automotive sensors and biomedical applications, are growing at an impressive rate, exceeding xx% in some areas. The overall market is anticipated to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. Emerging applications in areas like flexible electronics and energy storage present significant growth opportunities.

Dominant Markets & Segments in North America Atomic Layer Deposition Market

The semiconductor and electronics segment constitutes the dominant market share, driven primarily by the computing sector's relentless pursuit of miniaturization and improved performance. Data centers' escalating need for high-capacity storage fuels the demand for ALD in memory chip production. The consumer electronics sector also contributes substantially to ALD's growth due to the ever-increasing sophistication of smartphones, wearables, and other portable devices.

- Key Growth Drivers in Semiconductor & Electronics:

- Demand for advanced node manufacturing in microchips.

- Growth of data centers and cloud computing.

- Rising demand for high-performance consumer electronics.

The healthcare and biomedical segment is demonstrating impressive growth potential, primarily driven by the increasing use of ALD in the fabrication of biosensors, drug delivery systems, and medical implants. The automotive industry is adopting ALD for creating advanced sensors and coatings that enhance fuel efficiency, safety, and performance.

Growth Drivers in Healthcare & Biomedical:

- Growing demand for advanced diagnostics.

- Expansion of drug delivery systems and medical implants.

Growth Drivers in Automotive:

- Enhanced safety features like advanced driver-assistance systems (ADAS).

- Improved fuel efficiency through advanced coatings.

North America Atomic Layer Deposition Market Product Analysis

Recent innovations in ALD technology have focused on developing novel precursor materials to achieve greater control over film properties, resulting in improved deposition uniformity and reduced defects. The applications of these advancements extend to the manufacturing of higher-performing microelectronics and advanced materials for various industries. This drives a strong competitive advantage for companies at the forefront of materials science and process optimization within the ALD field. The integration of ALD into existing semiconductor manufacturing processes seamlessly enhances efficiency.

Key Drivers, Barriers & Challenges in North America Atomic Layer Deposition Market

Key Drivers: Technological advancements in precursor materials and deposition techniques, rising demand for advanced electronics and sensors, government initiatives promoting the development of advanced manufacturing technologies.

Challenges: High capital investment required for ALD equipment, supply chain constraints related to precursor materials, intense competition from established players and emerging technologies, regulatory complexities surrounding the handling and disposal of precursor chemicals, and the potential for intellectual property disputes. These factors could collectively impede the market's growth by an estimated xx% by 2030 if not adequately addressed.

Growth Drivers in the North America Atomic Layer Deposition Market Market

Technological advancements, rising demand for high-performance electronics, government investments in semiconductor research, and the growth of emerging applications in sectors like healthcare and automotive all contribute to the growth of the North American ALD market.

Challenges Impacting North America Atomic Layer Deposition Market Growth

High equipment costs, precursor material supply chain limitations, intense competition, and environmental regulations represent significant challenges for the ALD market's growth.

Key Players Shaping the North America Atomic Layer Deposition Market Market

- Lam Research Corporation

- ALD NanoSolutions Inc

- Forge Nano Inc

- Veeco Instruments Inc

- Kurt J Lesker Company

- Picosun USA LLC

- Nano-Master Inc

- Applied Materials Inc

- ASM International

- Entegris Inc

- Tokyo Electron US Holdings Inc

Significant North America Atomic Layer Deposition Market Industry Milestones

- 2020: Lam Research announces a new ALD system with enhanced throughput.

- 2021: Applied Materials partners with a materials supplier to develop novel ALD precursors.

- 2022: ASM International launches an advanced ALD system for 3D NAND fabrication.

- 2023: A significant merger between two ALD equipment manufacturers occurs. (Details unavailable – xx)

Future Outlook for North America Atomic Layer Deposition Market Market

The North America ALD market is poised for continued growth, fueled by technological advancements, increasing demand from diverse industries, and government support for advanced manufacturing. Strategic partnerships and investments in R&D will play a crucial role in shaping the market's future. The market's potential for expansion into new applications and its resilience to economic fluctuations position it for a positive outlook in the years to come.

North America Atomic Layer Deposition Market Segmentation

-

1. Application

- 1.1. Semiconductor

- 1.2. Healthcare and Biomedical Application

- 1.3. Automotive

- 1.4. Other Applications

-

2. Geography

-

2.1. North America

- 2.1.1. United States

- 2.1.2. Canada

-

2.1. North America

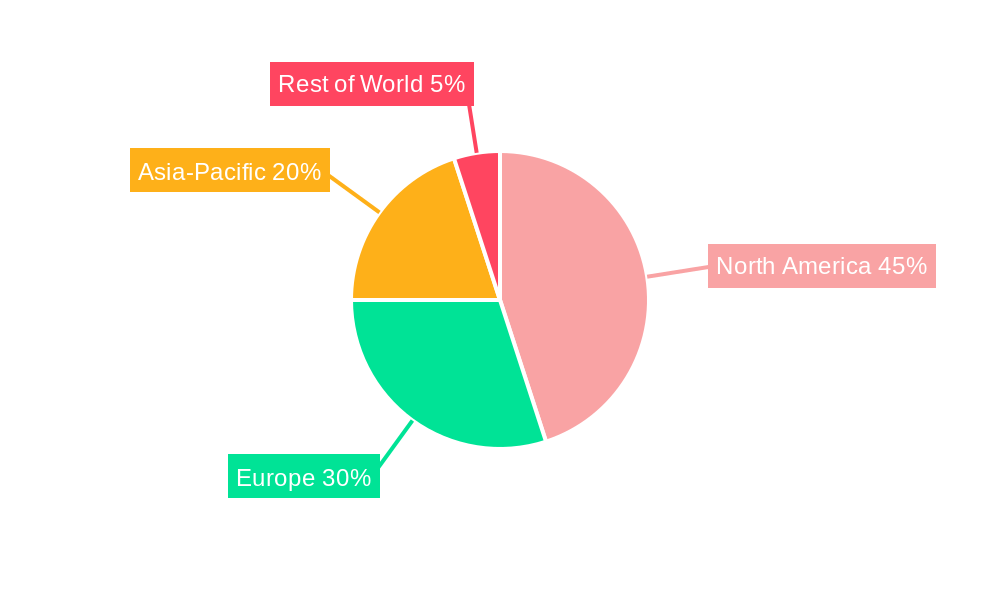

North America Atomic Layer Deposition Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

North America Atomic Layer Deposition Market Regional Market Share

Geographic Coverage of North America Atomic Layer Deposition Market

North America Atomic Layer Deposition Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.88% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand for Flexible Sensors and Related Biomedical Applications; Growing R&D Activities Involving Tissue Engineering and Drug Delivery

- 3.3. Market Restrains

- 3.3.1. ; Limitation Regarding the Substrate Size and Higher Costs for the Coating Gases

- 3.4. Market Trends

- 3.4.1. Semiconductor and Electronics Segment are Expected to Hold the Largest Market Share in the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Atomic Layer Deposition Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Semiconductor

- 5.1.2. Healthcare and Biomedical Application

- 5.1.3. Automotive

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. North America

- 5.2.1.1. United States

- 5.2.1.2. Canada

- 5.2.1. North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Lam Research Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ALD NanoSolutions Inc and Forge Nano Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Veeco Instruments Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kurt J Lesker Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Picosun USA LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nano-Master Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Applied Materials Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ASM International

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Entegris Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tokyo Electron US Holdings Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Lam Research Corporation

List of Figures

- Figure 1: North America Atomic Layer Deposition Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Atomic Layer Deposition Market Share (%) by Company 2025

List of Tables

- Table 1: North America Atomic Layer Deposition Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: North America Atomic Layer Deposition Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 3: North America Atomic Layer Deposition Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: North America Atomic Layer Deposition Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: North America Atomic Layer Deposition Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: North America Atomic Layer Deposition Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States North America Atomic Layer Deposition Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Atomic Layer Deposition Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Atomic Layer Deposition Market?

The projected CAGR is approximately 12.88%.

2. Which companies are prominent players in the North America Atomic Layer Deposition Market?

Key companies in the market include Lam Research Corporation, ALD NanoSolutions Inc and Forge Nano Inc, Veeco Instruments Inc, Kurt J Lesker Company, Picosun USA LLC, Nano-Master Inc, Applied Materials Inc, ASM International, Entegris Inc, Tokyo Electron US Holdings Inc.

3. What are the main segments of the North America Atomic Layer Deposition Market?

The market segments include Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand for Flexible Sensors and Related Biomedical Applications; Growing R&D Activities Involving Tissue Engineering and Drug Delivery.

6. What are the notable trends driving market growth?

Semiconductor and Electronics Segment are Expected to Hold the Largest Market Share in the Forecast Period.

7. Are there any restraints impacting market growth?

; Limitation Regarding the Substrate Size and Higher Costs for the Coating Gases.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Atomic Layer Deposition Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Atomic Layer Deposition Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Atomic Layer Deposition Market?

To stay informed about further developments, trends, and reports in the North America Atomic Layer Deposition Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence