Key Insights

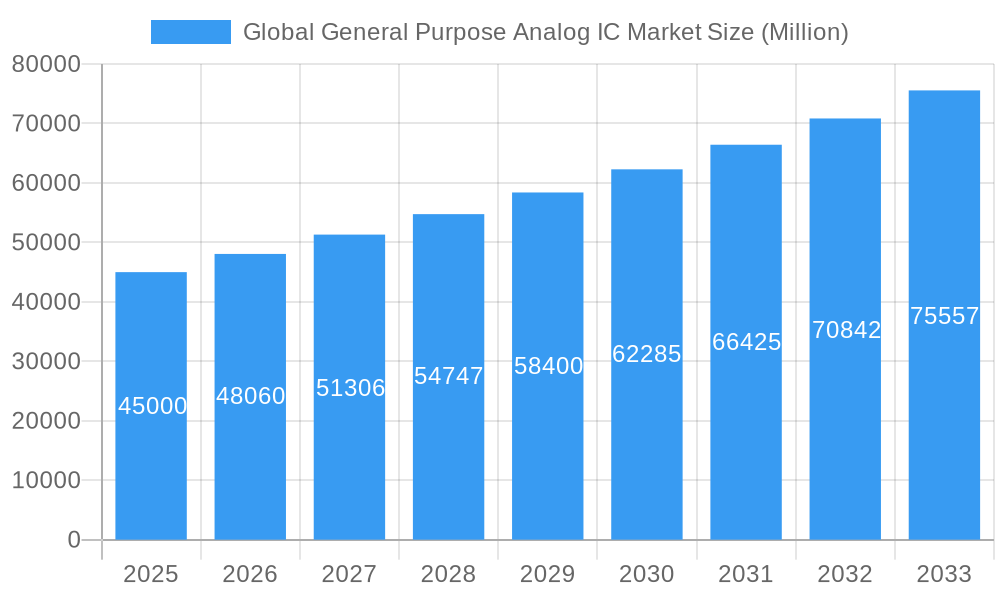

The Global General Purpose Analog IC Market is projected for significant expansion, anticipated to reach $102.52 billion by 2025, with a projected CAGR of 10.2% from 2025 to 2033. This growth is driven by escalating demand for advanced electronics across multiple industries. Analog ICs are critical for power management, signal conditioning, and data conversion in consumer electronics, automotive systems, industrial automation, and IoT devices. Strong historical adoption and technological progress from 2019-2024 have established a solid base for accelerated growth. Innovations in high-precision analog signal processing, reduced power consumption, and enhanced integration are further propelling market penetration and the development of next-generation electronics.

Global General Purpose Analog IC Market Market Size (In Billion)

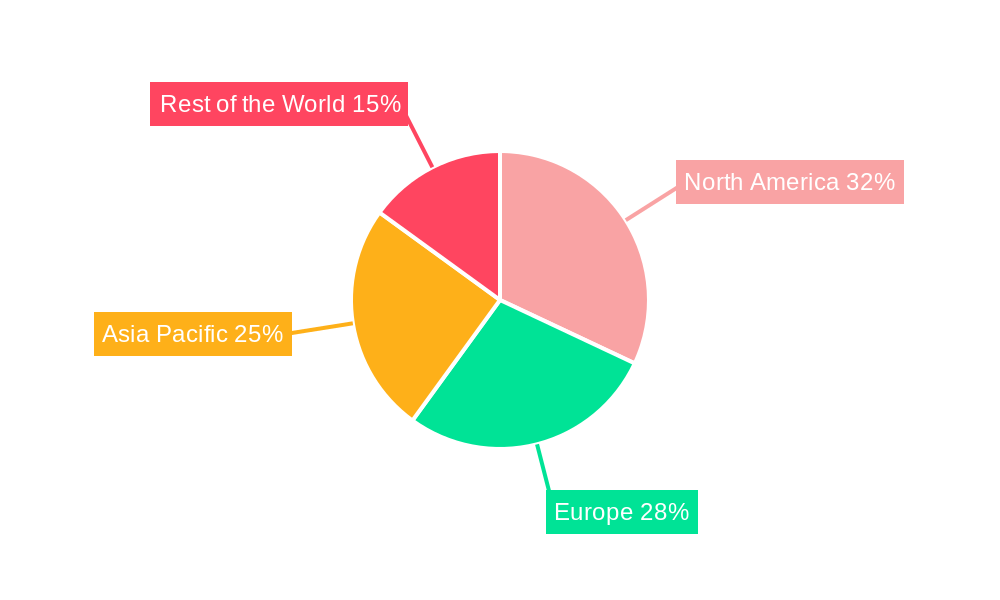

Leading semiconductor manufacturers' R&D investments in intelligent and efficient analog solutions are shaping market growth. The automotive sector, particularly with electrification and ADAS, is a key driver, requiring more specialized analog components. The industrial sector's adoption of Industry 4.0 and smart manufacturing also fuels demand for advanced analog ICs for real-time data acquisition and control. North America is expected to lead in market share due to its strong tech ecosystem, while Asia Pacific is poised for the fastest growth, supported by its manufacturing base and consumer electronics demand. Europe remains a stable market, driven by its advanced industrial and automotive sectors. This sustained growth highlights the essential role of general-purpose analog ICs in modern electronic systems.

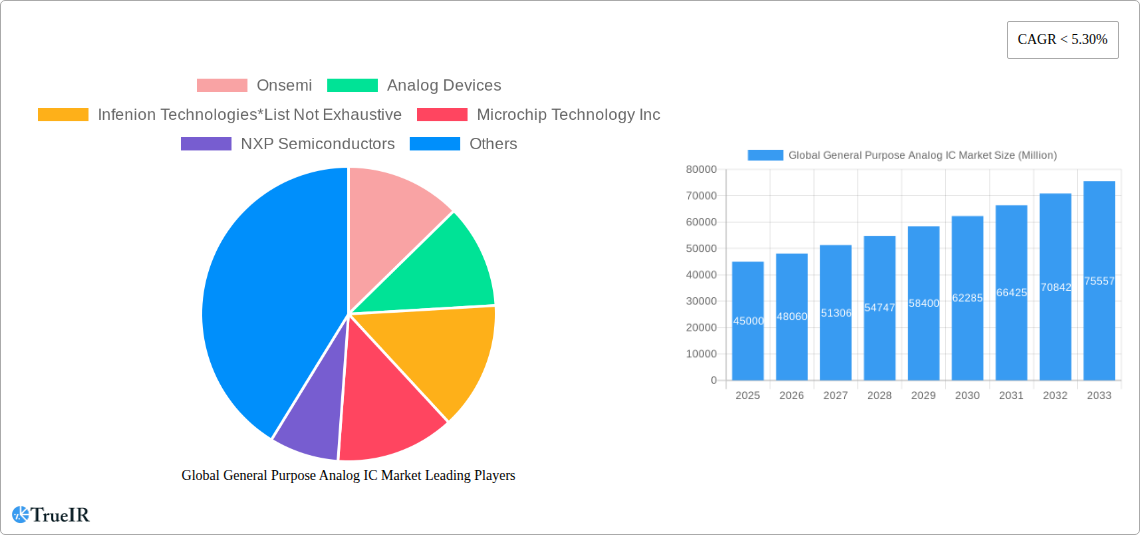

Global General Purpose Analog IC Market Company Market Share

Global General Purpose Analog IC Market: Comprehensive Forecast & Strategic Analysis (2019-2033)

Unlock critical insights into the dynamic Global General Purpose Analog IC Market with this in-depth report. Covering the historical period of 2019-2024, base year 2025, and a comprehensive forecast period of 2025-2033, this analysis provides a strategic roadmap for stakeholders. Discover market size projections, key trends, dominant segments, and competitive landscapes, fueled by high-volume SEO keywords such as "analog integrated circuits," "general purpose ICs," "semiconductor market," "power management ICs," and "signal conversion chips." This report is essential for understanding the evolving demands in consumer electronics, automotive, industrial automation, and telecommunications.

Global General Purpose Analog IC Market Market Structure & Competitive Landscape

The Global General Purpose Analog IC Market exhibits a moderately concentrated structure, characterized by the presence of a few large, established players alongside a growing number of specialized manufacturers. Innovation serves as a primary driver, with companies heavily investing in Research and Development to enhance performance, reduce power consumption, and integrate advanced functionalities into their analog ICs. Regulatory impacts, particularly concerning environmental standards and semiconductor manufacturing practices, also play a significant role in shaping market dynamics. Product substitutes, while limited for core analog functions, can emerge from advancements in digital processing or integrated System-on-Chips (SoCs). End-user segmentation reveals diverse adoption across consumer electronics, automotive, industrial, and telecommunications sectors. Mergers and acquisitions (M&A) are a recurring trend, with larger players acquiring smaller innovators to expand their product portfolios and market reach. For instance, the period has seen notable M&A activities aiming to consolidate market share and technological expertise. The market concentration ratio for the top 5 players is estimated to be around 65%, indicating significant market influence. M&A volumes in the past three years have averaged $10 Billion annually.

Global General Purpose Analog IC Market Market Trends & Opportunities

The Global General Purpose Analog IC Market is poised for robust expansion, driven by an insatiable demand for sophisticated electronic devices and the relentless advancement of technology. The market size is projected to grow from an estimated $XX Million in 2025 to a substantial $XX Million by 2033, registering a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. This growth is underpinned by several transformative trends. The burgeoning Internet of Things (IoT) ecosystem necessitates a vast array of analog ICs for sensing, signal conditioning, and power management in countless connected devices, ranging from smart home appliances to industrial sensors. The automotive sector's evolution towards electric vehicles (EVs) and autonomous driving systems is a significant catalyst, demanding high-performance analog components for battery management, sensor interfaces, motor control, and advanced driver-assistance systems (ADAS). Consumer electronics continue to innovate, with advancements in mobile devices, wearables, and high-definition displays requiring more powerful and energy-efficient analog solutions. Furthermore, the increasing adoption of 5G technology in telecommunications infrastructure and devices is creating substantial demand for high-frequency analog components. The miniaturization trend in electronics also pushes for smaller, more integrated analog ICs with lower power consumption, a key area of R&D focus. Opportunities abound for companies that can deliver solutions with superior performance, lower power footprints, and enhanced integration capabilities. The market penetration rate for advanced analog ICs in emerging applications is rapidly increasing. Competitive dynamics are characterized by intense innovation and a strategic focus on product differentiation and cost optimization.

Dominant Markets & Segments in Global General Purpose Analog IC Market

The Global General Purpose Analog IC Market is characterized by distinct regional dominance and segment leadership. Asia Pacific currently stands as the dominant region, driven by its vast manufacturing capabilities, a burgeoning consumer electronics market, and significant investments in telecommunications infrastructure, particularly 5G deployment. Within Asia Pacific, China leads in terms of market size and consumption, fueled by its status as a global manufacturing hub and a rapidly growing domestic demand for advanced electronics.

From an application perspective, Power Management is a consistently dominant segment, reflecting the universal need for efficient energy management across all electronic devices. This segment's growth is propelled by the increasing power demands of complex systems, the drive for energy efficiency in consumer electronics and data centers, and the proliferation of portable and battery-powered devices.

- Power Management ICs:

- Key Growth Drivers: Growing adoption of electric vehicles (EVs), demand for energy-efficient consumer electronics, expansion of data centers, and the widespread deployment of renewable energy systems.

- Detailed Analysis: The shift towards electrification in transportation, coupled with stricter energy efficiency regulations worldwide, makes power management ICs a critical component. These ICs are essential for regulating voltage, managing battery charging and discharging, and optimizing power delivery in everything from smartphones to industrial power supplies. The increasing complexity of modern electronics, with multiple power rails and voltage requirements, further solidifies the dominance of this segment.

Signal Conversion is another highly influential segment, crucial for interfacing the analog world with the digital realm.

- Signal Conversion ICs:

- Key Growth Drivers: Advancements in high-resolution audio and video processing, increasing sensor integration in IoT devices, and the need for accurate data acquisition in industrial automation and medical equipment.

- Detailed Analysis: As devices become more sophisticated, the accurate and efficient conversion of analog signals (from sensors, microphones, etc.) into digital data, and vice versa, becomes paramount. This segment is critical for applications requiring high fidelity and precise measurement.

The Interface segment also plays a vital role, enabling seamless communication between different components and systems.

- Interface ICs:

- Key Growth Drivers: Proliferation of wired and wireless communication technologies, growing complexity of electronic systems requiring specialized interconnects, and the expansion of high-speed data transfer standards.

- Detailed Analysis: These ICs facilitate the flow of data and control signals, essential for connecting microcontrollers to sensors, displays, and other peripherals. Their importance is underscored by the ever-increasing number of devices needing to communicate with each other.

Finally, the Amplifier/Comparator segment, while perhaps smaller in overall market value than Power Management, remains fundamental to signal amplification and processing tasks.

- Amplifier/Comparator ICs:

- Key Growth Drivers: Demand for improved audio quality in consumer devices, critical sensing applications requiring high gain, and the need for precise decision-making in control systems.

- Detailed Analysis: Amplifiers boost weak analog signals for processing, while comparators are essential for making threshold-based decisions. Their widespread use in audio systems, sensor interfaces, and control logic ensures their continued relevance.

Global General Purpose Analog IC Market Product Analysis

The Global General Purpose Analog IC Market is characterized by continuous product innovation focused on enhancing performance, reducing power consumption, and increasing integration. Key product advancements include the development of ultra-low-power analog ICs for battery-operated devices, high-speed data converters enabling faster data acquisition and processing, and advanced power management solutions for efficient energy utilization in complex systems. Companies are also focusing on integrating multiple analog functions onto single chips, leading to smaller form factors and reduced system complexity. These technological leaps are driven by the evolving needs of demanding applications such as the Internet of Things (IoT), automotive electronics, and advanced communication systems, where superior performance, reliability, and miniaturization are critical competitive advantages.

Key Drivers, Barriers & Challenges in Global General Purpose Analog IC Market

Key Drivers: The Global General Purpose Analog IC Market is primarily propelled by the relentless demand for advanced electronic devices across various sectors. Technological advancements, including the proliferation of IoT, the electrification of vehicles, and the rollout of 5G networks, are significant growth catalysts. Economic factors such as increasing consumer disposable income and growing industrial automation investments further fuel demand. Policy-driven initiatives, particularly those promoting energy efficiency and digital transformation, also create a favorable market environment. For example, government incentives for electric vehicle adoption directly boost demand for analog ICs used in battery management and power control.

Barriers and Challenges: Supply chain disruptions, exacerbated by geopolitical tensions and semiconductor shortages, pose a significant challenge, leading to increased lead times and price volatility. Regulatory hurdles related to environmental compliance and product safety can also impact manufacturing costs and product development cycles. Intense competitive pressures among established players and emerging innovators drive down profit margins. Furthermore, the specialized nature of analog IC design and the high cost of R&D can be significant barriers to entry for new players. Quantifiable impacts include extended product launch timelines due to component shortages, estimated to be up to 6 months on average for critical components.

Growth Drivers in the Global General Purpose Analog IC Market Market

The Global General Purpose Analog IC Market is experiencing substantial growth driven by several key factors. Technological advancements are paramount, with the increasing complexity of electronic devices, the expansion of the Internet of Things (IoT), and the growing adoption of electric and autonomous vehicles creating unprecedented demand for sophisticated analog components. The rollout of 5G networks necessitates high-performance analog ICs for efficient signal transmission and reception. Economic factors such as rising global consumer spending on electronics and increased industrial automation investments provide a strong demand base. Furthermore, policy-driven initiatives focused on energy efficiency, digitalization, and semiconductor manufacturing are creating a favorable ecosystem for growth. For instance, government support for domestic semiconductor production and incentives for green technologies directly contribute to market expansion.

Challenges Impacting Global General Purpose Analog IC Market Growth

The growth of the Global General Purpose Analog IC Market is not without its hurdles. Regulatory complexities related to product certifications, environmental standards, and trade policies can create barriers to market entry and increase compliance costs. Supply chain issues, including raw material availability, manufacturing capacity constraints, and logistical challenges, continue to impact production volumes and lead times, as evidenced by recent global shortages. Intense competitive pressures from both established giants and agile startups drive down profit margins and necessitate continuous innovation. The specialized nature of analog design also requires a highly skilled workforce, posing a talent acquisition challenge. Quantifiable impacts include extended lead times for certain components, potentially affecting product development schedules by several months.

Key Players Shaping the Global General Purpose Analog IC Market Market

- Onsemi

- Analog Devices

- Infineon Technologies

- Microchip Technology Inc.

- NXP Semiconductors

- STMicroelectronics

- Skywork Solutions Inc.

- Renesas Electronics Corporation

- Texas Instruments Incorporated

- Maxim Integrated Products Inc.

- Taiwan Semiconductor Manufacturing Company (TSMC)

Significant Global General Purpose Analog IC Market Industry Milestones

- November 2021: Texas Instruments announced its plans to begin construction of its new 300-millimeter semiconductor wafer fabrication plants (or "fabs") in Sherman, Texas. The company's analog and embedded processing 300-mm fabs at the Sherman site are part of its long-term capacity planning to continue to strengthen its manufacturing and technology competitive advantage.

Future Outlook for Global General Purpose Analog IC Market Market

The future outlook for the Global General Purpose Analog IC Market is exceptionally bright, driven by a confluence of accelerating technological trends and expanding application horizons. The continued proliferation of the Internet of Things (IoT) will generate sustained demand for low-power, high-performance analog ICs. The automotive sector's transition to electric and autonomous vehicles will remain a significant growth catalyst, requiring sophisticated analog solutions for power management, sensor interfacing, and control systems. Furthermore, advancements in artificial intelligence (AI) and machine learning will necessitate powerful analog front-ends for data acquisition and processing. Strategic opportunities lie in developing highly integrated, energy-efficient, and cost-effective analog solutions that cater to the evolving needs of these dynamic markets, promising continued market expansion and innovation.

Global General Purpose Analog IC Market Segmentation

-

1. Application

- 1.1. Interface

- 1.2. Power Management

- 1.3. Signal Conversion

- 1.4. Amplifier/Comparator

Global General Purpose Analog IC Market Segmentation By Geography

- 1. North America

- 2. Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. South Korea

- 3.4. Rest of Asia Pacific

- 4. Rest of the World

Global General Purpose Analog IC Market Regional Market Share

Geographic Coverage of Global General Purpose Analog IC Market

Global General Purpose Analog IC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Advancements in fabrication techniques; Increasing end-user applications; Advancements in Internet of Things and Artificial Intelligence

- 3.3. Market Restrains

- 3.3.1. Design Complexity and high costs; Increasing popularity of application specific analog Ics

- 3.4. Market Trends

- 3.4.1. Increasing Factory Automation is Expected to Drive the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global General Purpose Analog IC Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Interface

- 5.1.2. Power Management

- 5.1.3. Signal Conversion

- 5.1.4. Amplifier/Comparator

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Global General Purpose Analog IC Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Interface

- 6.1.2. Power Management

- 6.1.3. Signal Conversion

- 6.1.4. Amplifier/Comparator

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Global General Purpose Analog IC Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Interface

- 7.1.2. Power Management

- 7.1.3. Signal Conversion

- 7.1.4. Amplifier/Comparator

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Global General Purpose Analog IC Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Interface

- 8.1.2. Power Management

- 8.1.3. Signal Conversion

- 8.1.4. Amplifier/Comparator

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of the World Global General Purpose Analog IC Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Interface

- 9.1.2. Power Management

- 9.1.3. Signal Conversion

- 9.1.4. Amplifier/Comparator

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Onsemi

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Analog Devices

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Infenion Technologies*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Microchip Technology Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 NXP Semiconductors

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 STMicroelectronics

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Skywork Solutions Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Renesas Electronics Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Texas Instruments Incorporated

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Maxim Integrated Products Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Taiwan Semiconductor

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Onsemi

List of Figures

- Figure 1: Global Global General Purpose Analog IC Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Global General Purpose Analog IC Market Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Global General Purpose Analog IC Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Global General Purpose Analog IC Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Global General Purpose Analog IC Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Global General Purpose Analog IC Market Revenue (billion), by Application 2025 & 2033

- Figure 7: Europe Global General Purpose Analog IC Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe Global General Purpose Analog IC Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Global General Purpose Analog IC Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Global General Purpose Analog IC Market Revenue (billion), by Application 2025 & 2033

- Figure 11: Asia Pacific Global General Purpose Analog IC Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pacific Global General Purpose Analog IC Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Global General Purpose Analog IC Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Global General Purpose Analog IC Market Revenue (billion), by Application 2025 & 2033

- Figure 15: Rest of the World Global General Purpose Analog IC Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Rest of the World Global General Purpose Analog IC Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Rest of the World Global General Purpose Analog IC Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global General Purpose Analog IC Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global General Purpose Analog IC Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global General Purpose Analog IC Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global General Purpose Analog IC Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global General Purpose Analog IC Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global General Purpose Analog IC Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global General Purpose Analog IC Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global General Purpose Analog IC Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: China Global General Purpose Analog IC Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Japan Global General Purpose Analog IC Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: South Korea Global General Purpose Analog IC Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of Asia Pacific Global General Purpose Analog IC Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global General Purpose Analog IC Market Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global General Purpose Analog IC Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global General Purpose Analog IC Market?

The projected CAGR is approximately 10.2%.

2. Which companies are prominent players in the Global General Purpose Analog IC Market?

Key companies in the market include Onsemi, Analog Devices, Infenion Technologies*List Not Exhaustive, Microchip Technology Inc, NXP Semiconductors, STMicroelectronics, Skywork Solutions Inc, Renesas Electronics Corporation, Texas Instruments Incorporated, Maxim Integrated Products Inc, Taiwan Semiconductor.

3. What are the main segments of the Global General Purpose Analog IC Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 102.52 billion as of 2022.

5. What are some drivers contributing to market growth?

Advancements in fabrication techniques; Increasing end-user applications; Advancements in Internet of Things and Artificial Intelligence.

6. What are the notable trends driving market growth?

Increasing Factory Automation is Expected to Drive the Market's Growth.

7. Are there any restraints impacting market growth?

Design Complexity and high costs; Increasing popularity of application specific analog Ics.

8. Can you provide examples of recent developments in the market?

November 2021 - Texas Instruments announced its plans to begin construction of its new 300-millimeter semiconductor wafer fabrication plants (or "fabs") in Sherman, Texas. The company's analog and embedded processing 300-mm fabs at the Sherman site are part of its long-term capacity planning to continue to strengthen its manufacturing and technology competitive advantage.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global General Purpose Analog IC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global General Purpose Analog IC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global General Purpose Analog IC Market?

To stay informed about further developments, trends, and reports in the Global General Purpose Analog IC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence