Key Insights

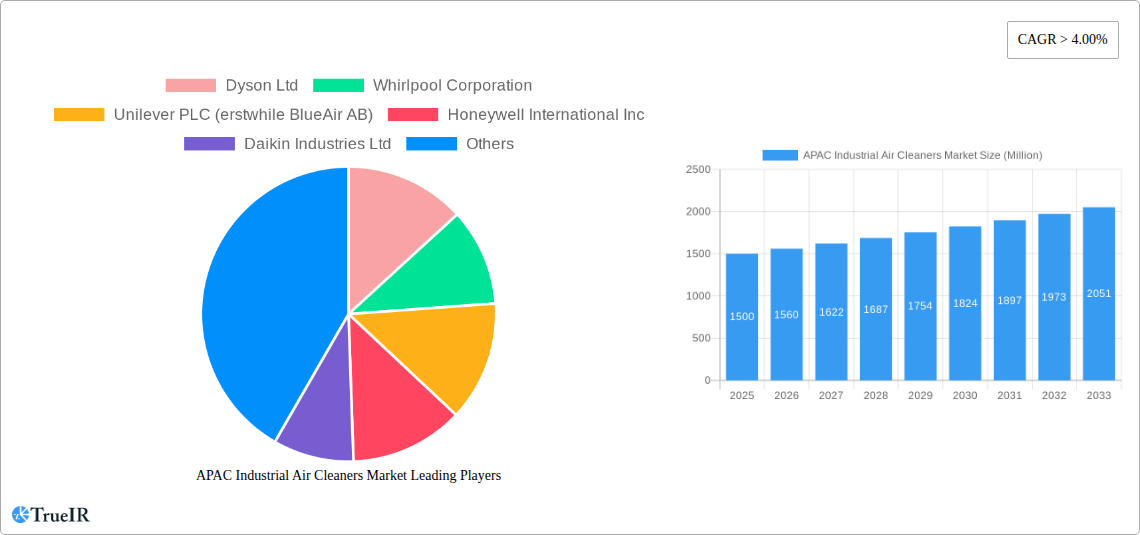

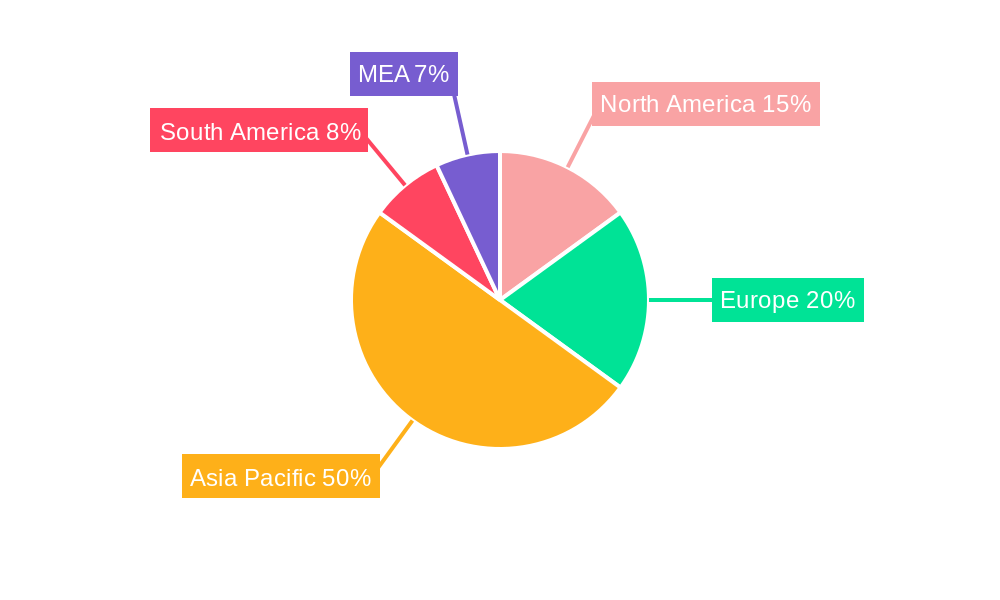

The Asia-Pacific (APAC) industrial air cleaner market is experiencing robust growth, driven by increasing industrialization, stringent government regulations on air quality, and rising awareness of the health risks associated with poor indoor air quality. The market's Compound Annual Growth Rate (CAGR) exceeding 4.00% signifies a consistently expanding demand for these systems across various industries, including manufacturing, pharmaceuticals, and electronics. Key factors contributing to this growth include the escalating prevalence of respiratory illnesses among industrial workers and the growing adoption of advanced filtration technologies like High-efficiency Particulate Air (HEPA) filters, offering superior particulate matter removal. Furthermore, the increasing prevalence of automation and smart manufacturing initiatives is driving the adoption of smart and connected air cleaners capable of remote monitoring and control, improving operational efficiency and reducing maintenance costs. The regional breakdown indicates significant market potential across diverse nations within APAC, with China, India, and Japan emerging as major consumers due to their large industrial sectors and increasing focus on environmental sustainability. The segment analysis highlights a strong preference for standalone units due to their flexibility and ease of deployment, although in-duct systems are gaining traction in larger industrial settings for seamless integration into existing ventilation systems.

APAC Industrial Air Cleaners Market Market Size (In Billion)

While the market presents significant opportunities, challenges remain. High initial investment costs for advanced air cleaning systems can hinder adoption, particularly among smaller businesses. The need for regular maintenance and filter replacements contributes to ongoing operational expenses. However, technological advancements are addressing these concerns through the development of energy-efficient and longer-lasting filter technologies. The competitive landscape is dynamic, with both established international players and regional manufacturers vying for market share. Companies are focusing on product innovation, strategic partnerships, and expansion into new markets to gain a competitive edge. The long-term forecast suggests continued growth, driven by increasing government support for clean air initiatives, growing emphasis on worker safety and productivity, and the sustained expansion of the industrial sector across APAC. The market is expected to show consistent expansion throughout the forecast period (2025-2033) fueled by industrial growth in key APAC economies.

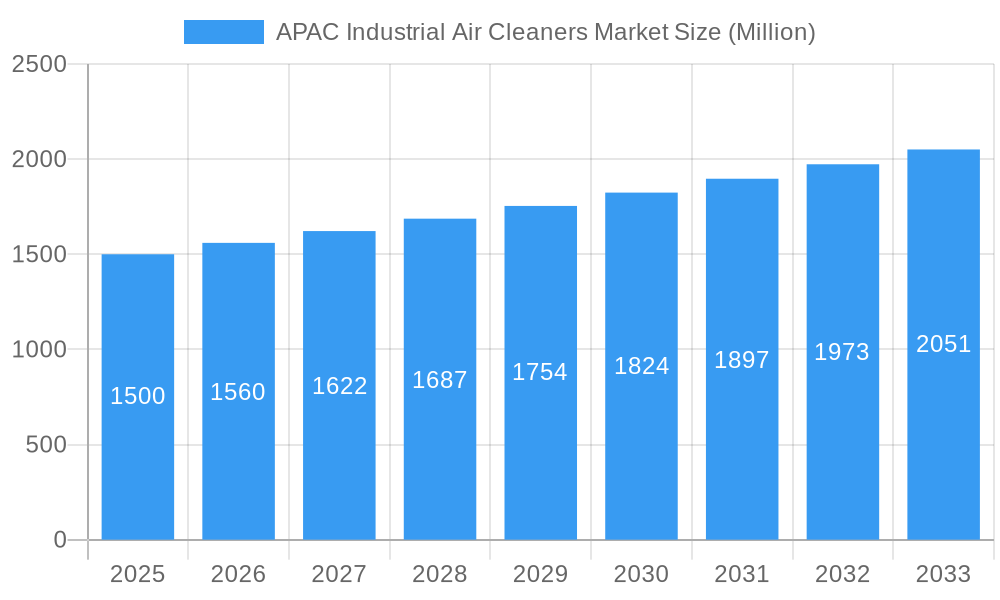

APAC Industrial Air Cleaners Market Company Market Share

This comprehensive report provides a detailed analysis of the APAC Industrial Air Cleaners Market, offering invaluable insights into market dynamics, competitive landscapes, and future growth prospects. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. The report leverages extensive primary and secondary research to deliver actionable intelligence for businesses operating in or planning to enter this dynamic market. Expect detailed breakdowns by filtration technology (HEPA, other), type (stand-alone, in-duct), and end-user (residential, commercial, industrial).

APAC Industrial Air Cleaners Market Structure & Competitive Landscape

The APAC industrial air cleaner market exhibits a moderately concentrated structure, with several key players vying for market share. The market concentration ratio (CR4) for 2024 is estimated at xx%, indicating the presence of both established multinational corporations and regional players. Innovation is a key driver, with companies continuously developing advanced filtration technologies to meet evolving needs for cleaner air in industrial settings. Stringent environmental regulations across the region also significantly impact market dynamics, encouraging adoption of more efficient and environmentally friendly air cleaners. Product substitutes, such as specialized ventilation systems, pose a competitive threat, albeit a niche one. The market is further segmented by end-user, with the industrial segment dominating in terms of volume and value. Mergers and acquisitions (M&A) activity in the sector has been moderate in recent years, with approximately xx M&A deals recorded between 2019 and 2024, primarily focused on expanding product portfolios and geographical reach.

- Market Concentration: CR4 (2024) estimated at xx%

- Innovation Drivers: Advanced filtration technologies, IoT integration, energy efficiency improvements.

- Regulatory Impacts: Stringent emission standards driving adoption of high-performance air cleaners.

- Product Substitutes: Specialized ventilation systems, natural ventilation techniques.

- End-User Segmentation: Industrial segment leading in market share, followed by commercial and residential.

- M&A Trends: Moderate activity, focused on expansion and technological acquisition.

APAC Industrial Air Cleaners Market Trends & Opportunities

The APAC industrial air cleaners market is experiencing robust growth, projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several key trends, including increasing industrialization across the region, rising awareness of indoor air quality (IAQ) issues, and stringent government regulations aimed at improving air quality standards. Technological advancements, such as the incorporation of smart features and improved filtration technologies, are further driving market penetration. Consumer preferences are shifting towards energy-efficient and user-friendly products, pushing manufacturers to innovate in these areas. The competitive landscape is dynamic, with both established players and new entrants vying for market share, leading to increased product diversity and competitive pricing. The market penetration rate for industrial air cleaners in key APAC markets is expected to increase from xx% in 2024 to xx% by 2033.

Dominant Markets & Segments in APAC Industrial Air Cleaners Market

China and India are currently the leading markets for industrial air cleaners in APAC, driven by rapid industrial expansion and increasing urbanization. Within the product segments, High-efficiency Particulate Air (HEPA) filtration technology dominates the market due to its superior performance in removing harmful particles. Stand-alone units account for a larger market share than in-duct systems, due to their ease of installation and flexibility. The industrial end-user segment is the largest and fastest-growing, driven by the high concentration of manufacturing and industrial activities in the region.

- Key Growth Drivers for China:

- Rapid industrialization and manufacturing growth.

- Stringent environmental regulations.

- Increasing investment in infrastructure projects.

- Key Growth Drivers for India:

- Rising industrial output and urbanization.

- Growing awareness of IAQ issues.

- Government initiatives promoting cleaner air.

- HEPA Filtration Technology Dominance: Superior particle removal efficiency, growing consumer preference.

- Stand-alone Unit Market Leadership: Ease of installation, flexibility, and lower cost compared to in-duct systems.

- Industrial End-User Segment Growth: High concentration of manufacturing and industrial activities.

APAC Industrial Air Cleaners Market Product Analysis

Recent product innovations have focused on enhancing filtration efficiency, incorporating smart features (IoT connectivity, remote control), and improving energy efficiency. Advanced HEPA filters, combined with activated carbon filters for gaseous pollutants removal, are gaining traction. Companies are also developing more compact and user-friendly designs to cater to diverse needs. The market fit of these innovations depends on successful balancing of performance, price, and user experience.

Key Drivers, Barriers & Challenges in APAC Industrial Air Cleaners Market

Key Drivers: Rising industrialization, growing awareness of IAQ, stringent environmental regulations, technological advancements (IoT integration, improved filtration), increasing disposable incomes in some areas.

Key Challenges: High initial investment costs, limited awareness in certain segments, complexities in supply chain management due to global disruptions(quantifiable impact xx%), competition from cheaper, less effective alternatives, uneven regulatory implementation across the region impacting market growth in certain areas by xx%.

Growth Drivers in the APAP Industrial Air Cleaners Market Market

The market is boosted by strong industrial growth, increased focus on workplace safety and environmental concerns, and technological advancements offering higher efficiency and smart features. Government regulations on air quality further stimulate demand.

Challenges Impacting APAC Industrial Air Cleaners Market Growth

High upfront costs, inconsistent regulatory frameworks across regions, and the presence of cheaper alternatives pose considerable challenges. Supply chain vulnerabilities and competition from established players further complicate market expansion.

Key Players Shaping the APAC Industrial Air Cleaners Market Market

- Dyson Ltd

- Whirlpool Corporation

- Unilever PLC (erstwhile BlueAir AB)

- Honeywell International Inc

- Daikin Industries Ltd

- LG Electronics Inc

- AllerAir Industries Inc

- Samsung Electronics Co Ltd

- Xiaomi Corp

- Koninklijke Philips NV

- Panasonic Corporation

- IQAir

Significant APAC Industrial Air Cleaners Market Industry Milestones

- November 2022: Havells Studio launched the Meditate air purifier, verified by Equinox Lab for efficacy against gaseous pollutants and microorganisms. This launch signifies a push towards advanced filtration capabilities.

- November 2022: Samsung launched AX46 and AX32 air purifiers in India, claiming 99.97% removal of nano-sized particles, dust, bacteria, and allergens. This highlights the focus on high-efficiency filtration within the market.

Future Outlook for APAC Industrial Air Cleaners Market Market

The APAC industrial air cleaners market is poised for continued expansion, driven by sustained industrial growth, rising environmental consciousness, and ongoing technological innovations. Strategic partnerships, expansion into emerging markets, and development of sustainable and cost-effective solutions will be crucial for success. The market presents significant opportunities for companies that can effectively address the challenges related to affordability, regulation, and supply chain resilience.

APAC Industrial Air Cleaners Market Segmentation

-

1. Filtration Technology

- 1.1. High-efficiency Particulate Air (HEPA)

- 1.2. Other Technologies

-

2. Type

- 2.1. Stand-alone

- 2.2. In-duct

-

3. End User

- 3.1. Residential

- 3.2. Commercial

- 3.3. Industrial

-

4. Geography

- 4.1. China

- 4.2. India

- 4.3. Japan

- 4.4. Rest of Asia-Pacific

APAC Industrial Air Cleaners Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Rest of Asia Pacific

APAC Industrial Air Cleaners Market Regional Market Share

Geographic Coverage of APAC Industrial Air Cleaners Market

APAC Industrial Air Cleaners Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Number of Automobiles4.; The Government Policy Regarding Pollution Emission Control Parameters

- 3.3. Market Restrains

- 3.3.1. 4.; The Technological Limitations of Air Filters

- 3.4. Market Trends

- 3.4.1. Residential Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Industrial Air Cleaners Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 5.1.1. High-efficiency Particulate Air (HEPA)

- 5.1.2. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Stand-alone

- 5.2.2. In-duct

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.3.3. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. India

- 5.5.3. Japan

- 5.5.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 6. China APAC Industrial Air Cleaners Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 6.1.1. High-efficiency Particulate Air (HEPA)

- 6.1.2. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Stand-alone

- 6.2.2. In-duct

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Residential

- 6.3.2. Commercial

- 6.3.3. Industrial

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. India

- 6.4.3. Japan

- 6.4.4. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 7. India APAC Industrial Air Cleaners Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 7.1.1. High-efficiency Particulate Air (HEPA)

- 7.1.2. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Stand-alone

- 7.2.2. In-duct

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Residential

- 7.3.2. Commercial

- 7.3.3. Industrial

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. India

- 7.4.3. Japan

- 7.4.4. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 8. Japan APAC Industrial Air Cleaners Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 8.1.1. High-efficiency Particulate Air (HEPA)

- 8.1.2. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Stand-alone

- 8.2.2. In-duct

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Residential

- 8.3.2. Commercial

- 8.3.3. Industrial

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. India

- 8.4.3. Japan

- 8.4.4. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 9. Rest of Asia Pacific APAC Industrial Air Cleaners Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 9.1.1. High-efficiency Particulate Air (HEPA)

- 9.1.2. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Stand-alone

- 9.2.2. In-duct

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Residential

- 9.3.2. Commercial

- 9.3.3. Industrial

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. India

- 9.4.3. Japan

- 9.4.4. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Dyson Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Whirlpool Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Unilever PLC (erstwhile BlueAir AB)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Honeywell International Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Daikin Industries Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 LG Electronics Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 AllerAir Industries Inc*List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Samsung Electronics Co Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Xiaomi Corp

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Koninklijke Philips NV

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Panasonic Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 IQAir

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Dyson Ltd

List of Figures

- Figure 1: Global APAC Industrial Air Cleaners Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global APAC Industrial Air Cleaners Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: China APAC Industrial Air Cleaners Market Revenue (undefined), by Filtration Technology 2025 & 2033

- Figure 4: China APAC Industrial Air Cleaners Market Volume (K Unit), by Filtration Technology 2025 & 2033

- Figure 5: China APAC Industrial Air Cleaners Market Revenue Share (%), by Filtration Technology 2025 & 2033

- Figure 6: China APAC Industrial Air Cleaners Market Volume Share (%), by Filtration Technology 2025 & 2033

- Figure 7: China APAC Industrial Air Cleaners Market Revenue (undefined), by Type 2025 & 2033

- Figure 8: China APAC Industrial Air Cleaners Market Volume (K Unit), by Type 2025 & 2033

- Figure 9: China APAC Industrial Air Cleaners Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: China APAC Industrial Air Cleaners Market Volume Share (%), by Type 2025 & 2033

- Figure 11: China APAC Industrial Air Cleaners Market Revenue (undefined), by End User 2025 & 2033

- Figure 12: China APAC Industrial Air Cleaners Market Volume (K Unit), by End User 2025 & 2033

- Figure 13: China APAC Industrial Air Cleaners Market Revenue Share (%), by End User 2025 & 2033

- Figure 14: China APAC Industrial Air Cleaners Market Volume Share (%), by End User 2025 & 2033

- Figure 15: China APAC Industrial Air Cleaners Market Revenue (undefined), by Geography 2025 & 2033

- Figure 16: China APAC Industrial Air Cleaners Market Volume (K Unit), by Geography 2025 & 2033

- Figure 17: China APAC Industrial Air Cleaners Market Revenue Share (%), by Geography 2025 & 2033

- Figure 18: China APAC Industrial Air Cleaners Market Volume Share (%), by Geography 2025 & 2033

- Figure 19: China APAC Industrial Air Cleaners Market Revenue (undefined), by Country 2025 & 2033

- Figure 20: China APAC Industrial Air Cleaners Market Volume (K Unit), by Country 2025 & 2033

- Figure 21: China APAC Industrial Air Cleaners Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: China APAC Industrial Air Cleaners Market Volume Share (%), by Country 2025 & 2033

- Figure 23: India APAC Industrial Air Cleaners Market Revenue (undefined), by Filtration Technology 2025 & 2033

- Figure 24: India APAC Industrial Air Cleaners Market Volume (K Unit), by Filtration Technology 2025 & 2033

- Figure 25: India APAC Industrial Air Cleaners Market Revenue Share (%), by Filtration Technology 2025 & 2033

- Figure 26: India APAC Industrial Air Cleaners Market Volume Share (%), by Filtration Technology 2025 & 2033

- Figure 27: India APAC Industrial Air Cleaners Market Revenue (undefined), by Type 2025 & 2033

- Figure 28: India APAC Industrial Air Cleaners Market Volume (K Unit), by Type 2025 & 2033

- Figure 29: India APAC Industrial Air Cleaners Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: India APAC Industrial Air Cleaners Market Volume Share (%), by Type 2025 & 2033

- Figure 31: India APAC Industrial Air Cleaners Market Revenue (undefined), by End User 2025 & 2033

- Figure 32: India APAC Industrial Air Cleaners Market Volume (K Unit), by End User 2025 & 2033

- Figure 33: India APAC Industrial Air Cleaners Market Revenue Share (%), by End User 2025 & 2033

- Figure 34: India APAC Industrial Air Cleaners Market Volume Share (%), by End User 2025 & 2033

- Figure 35: India APAC Industrial Air Cleaners Market Revenue (undefined), by Geography 2025 & 2033

- Figure 36: India APAC Industrial Air Cleaners Market Volume (K Unit), by Geography 2025 & 2033

- Figure 37: India APAC Industrial Air Cleaners Market Revenue Share (%), by Geography 2025 & 2033

- Figure 38: India APAC Industrial Air Cleaners Market Volume Share (%), by Geography 2025 & 2033

- Figure 39: India APAC Industrial Air Cleaners Market Revenue (undefined), by Country 2025 & 2033

- Figure 40: India APAC Industrial Air Cleaners Market Volume (K Unit), by Country 2025 & 2033

- Figure 41: India APAC Industrial Air Cleaners Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: India APAC Industrial Air Cleaners Market Volume Share (%), by Country 2025 & 2033

- Figure 43: Japan APAC Industrial Air Cleaners Market Revenue (undefined), by Filtration Technology 2025 & 2033

- Figure 44: Japan APAC Industrial Air Cleaners Market Volume (K Unit), by Filtration Technology 2025 & 2033

- Figure 45: Japan APAC Industrial Air Cleaners Market Revenue Share (%), by Filtration Technology 2025 & 2033

- Figure 46: Japan APAC Industrial Air Cleaners Market Volume Share (%), by Filtration Technology 2025 & 2033

- Figure 47: Japan APAC Industrial Air Cleaners Market Revenue (undefined), by Type 2025 & 2033

- Figure 48: Japan APAC Industrial Air Cleaners Market Volume (K Unit), by Type 2025 & 2033

- Figure 49: Japan APAC Industrial Air Cleaners Market Revenue Share (%), by Type 2025 & 2033

- Figure 50: Japan APAC Industrial Air Cleaners Market Volume Share (%), by Type 2025 & 2033

- Figure 51: Japan APAC Industrial Air Cleaners Market Revenue (undefined), by End User 2025 & 2033

- Figure 52: Japan APAC Industrial Air Cleaners Market Volume (K Unit), by End User 2025 & 2033

- Figure 53: Japan APAC Industrial Air Cleaners Market Revenue Share (%), by End User 2025 & 2033

- Figure 54: Japan APAC Industrial Air Cleaners Market Volume Share (%), by End User 2025 & 2033

- Figure 55: Japan APAC Industrial Air Cleaners Market Revenue (undefined), by Geography 2025 & 2033

- Figure 56: Japan APAC Industrial Air Cleaners Market Volume (K Unit), by Geography 2025 & 2033

- Figure 57: Japan APAC Industrial Air Cleaners Market Revenue Share (%), by Geography 2025 & 2033

- Figure 58: Japan APAC Industrial Air Cleaners Market Volume Share (%), by Geography 2025 & 2033

- Figure 59: Japan APAC Industrial Air Cleaners Market Revenue (undefined), by Country 2025 & 2033

- Figure 60: Japan APAC Industrial Air Cleaners Market Volume (K Unit), by Country 2025 & 2033

- Figure 61: Japan APAC Industrial Air Cleaners Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Japan APAC Industrial Air Cleaners Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Rest of Asia Pacific APAC Industrial Air Cleaners Market Revenue (undefined), by Filtration Technology 2025 & 2033

- Figure 64: Rest of Asia Pacific APAC Industrial Air Cleaners Market Volume (K Unit), by Filtration Technology 2025 & 2033

- Figure 65: Rest of Asia Pacific APAC Industrial Air Cleaners Market Revenue Share (%), by Filtration Technology 2025 & 2033

- Figure 66: Rest of Asia Pacific APAC Industrial Air Cleaners Market Volume Share (%), by Filtration Technology 2025 & 2033

- Figure 67: Rest of Asia Pacific APAC Industrial Air Cleaners Market Revenue (undefined), by Type 2025 & 2033

- Figure 68: Rest of Asia Pacific APAC Industrial Air Cleaners Market Volume (K Unit), by Type 2025 & 2033

- Figure 69: Rest of Asia Pacific APAC Industrial Air Cleaners Market Revenue Share (%), by Type 2025 & 2033

- Figure 70: Rest of Asia Pacific APAC Industrial Air Cleaners Market Volume Share (%), by Type 2025 & 2033

- Figure 71: Rest of Asia Pacific APAC Industrial Air Cleaners Market Revenue (undefined), by End User 2025 & 2033

- Figure 72: Rest of Asia Pacific APAC Industrial Air Cleaners Market Volume (K Unit), by End User 2025 & 2033

- Figure 73: Rest of Asia Pacific APAC Industrial Air Cleaners Market Revenue Share (%), by End User 2025 & 2033

- Figure 74: Rest of Asia Pacific APAC Industrial Air Cleaners Market Volume Share (%), by End User 2025 & 2033

- Figure 75: Rest of Asia Pacific APAC Industrial Air Cleaners Market Revenue (undefined), by Geography 2025 & 2033

- Figure 76: Rest of Asia Pacific APAC Industrial Air Cleaners Market Volume (K Unit), by Geography 2025 & 2033

- Figure 77: Rest of Asia Pacific APAC Industrial Air Cleaners Market Revenue Share (%), by Geography 2025 & 2033

- Figure 78: Rest of Asia Pacific APAC Industrial Air Cleaners Market Volume Share (%), by Geography 2025 & 2033

- Figure 79: Rest of Asia Pacific APAC Industrial Air Cleaners Market Revenue (undefined), by Country 2025 & 2033

- Figure 80: Rest of Asia Pacific APAC Industrial Air Cleaners Market Volume (K Unit), by Country 2025 & 2033

- Figure 81: Rest of Asia Pacific APAC Industrial Air Cleaners Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Rest of Asia Pacific APAC Industrial Air Cleaners Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Industrial Air Cleaners Market Revenue undefined Forecast, by Filtration Technology 2020 & 2033

- Table 2: Global APAC Industrial Air Cleaners Market Volume K Unit Forecast, by Filtration Technology 2020 & 2033

- Table 3: Global APAC Industrial Air Cleaners Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 4: Global APAC Industrial Air Cleaners Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 5: Global APAC Industrial Air Cleaners Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Global APAC Industrial Air Cleaners Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: Global APAC Industrial Air Cleaners Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Global APAC Industrial Air Cleaners Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 9: Global APAC Industrial Air Cleaners Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 10: Global APAC Industrial Air Cleaners Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: Global APAC Industrial Air Cleaners Market Revenue undefined Forecast, by Filtration Technology 2020 & 2033

- Table 12: Global APAC Industrial Air Cleaners Market Volume K Unit Forecast, by Filtration Technology 2020 & 2033

- Table 13: Global APAC Industrial Air Cleaners Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global APAC Industrial Air Cleaners Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 15: Global APAC Industrial Air Cleaners Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 16: Global APAC Industrial Air Cleaners Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 17: Global APAC Industrial Air Cleaners Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 18: Global APAC Industrial Air Cleaners Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 19: Global APAC Industrial Air Cleaners Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: Global APAC Industrial Air Cleaners Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: Global APAC Industrial Air Cleaners Market Revenue undefined Forecast, by Filtration Technology 2020 & 2033

- Table 22: Global APAC Industrial Air Cleaners Market Volume K Unit Forecast, by Filtration Technology 2020 & 2033

- Table 23: Global APAC Industrial Air Cleaners Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 24: Global APAC Industrial Air Cleaners Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 25: Global APAC Industrial Air Cleaners Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 26: Global APAC Industrial Air Cleaners Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 27: Global APAC Industrial Air Cleaners Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 28: Global APAC Industrial Air Cleaners Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 29: Global APAC Industrial Air Cleaners Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: Global APAC Industrial Air Cleaners Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Global APAC Industrial Air Cleaners Market Revenue undefined Forecast, by Filtration Technology 2020 & 2033

- Table 32: Global APAC Industrial Air Cleaners Market Volume K Unit Forecast, by Filtration Technology 2020 & 2033

- Table 33: Global APAC Industrial Air Cleaners Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 34: Global APAC Industrial Air Cleaners Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 35: Global APAC Industrial Air Cleaners Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 36: Global APAC Industrial Air Cleaners Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 37: Global APAC Industrial Air Cleaners Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 38: Global APAC Industrial Air Cleaners Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 39: Global APAC Industrial Air Cleaners Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: Global APAC Industrial Air Cleaners Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Global APAC Industrial Air Cleaners Market Revenue undefined Forecast, by Filtration Technology 2020 & 2033

- Table 42: Global APAC Industrial Air Cleaners Market Volume K Unit Forecast, by Filtration Technology 2020 & 2033

- Table 43: Global APAC Industrial Air Cleaners Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 44: Global APAC Industrial Air Cleaners Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 45: Global APAC Industrial Air Cleaners Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 46: Global APAC Industrial Air Cleaners Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 47: Global APAC Industrial Air Cleaners Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 48: Global APAC Industrial Air Cleaners Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 49: Global APAC Industrial Air Cleaners Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 50: Global APAC Industrial Air Cleaners Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Industrial Air Cleaners Market?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the APAC Industrial Air Cleaners Market?

Key companies in the market include Dyson Ltd, Whirlpool Corporation, Unilever PLC (erstwhile BlueAir AB), Honeywell International Inc, Daikin Industries Ltd, LG Electronics Inc, AllerAir Industries Inc*List Not Exhaustive, Samsung Electronics Co Ltd, Xiaomi Corp, Koninklijke Philips NV, Panasonic Corporation, IQAir.

3. What are the main segments of the APAC Industrial Air Cleaners Market?

The market segments include Filtration Technology, Type, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Number of Automobiles4.; The Government Policy Regarding Pollution Emission Control Parameters.

6. What are the notable trends driving market growth?

Residential Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Technological Limitations of Air Filters.

8. Can you provide examples of recent developments in the market?

November 2022: Havells Studio launched a new product, the Meditate air purifier. The company said the air purifier is tested and verified by Equinox Lab for efficacy against the removal of hazardous gaseous pollutants as well as microorganisms like bacteria, viruses, and fungal strains.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Industrial Air Cleaners Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Industrial Air Cleaners Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Industrial Air Cleaners Market?

To stay informed about further developments, trends, and reports in the APAC Industrial Air Cleaners Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence