Key Insights

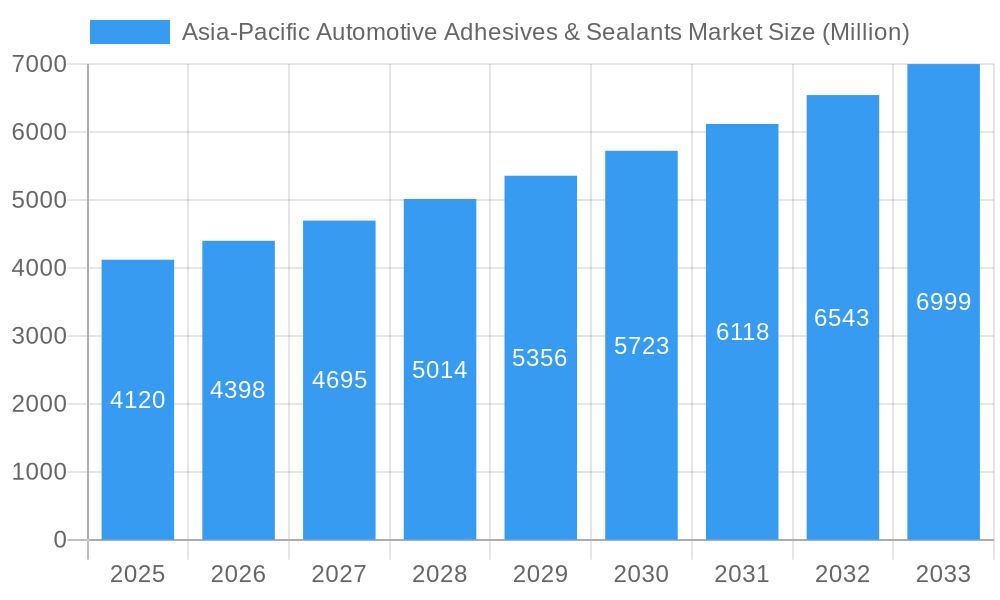

The Asia-Pacific automotive adhesives and sealants market is poised for robust expansion, driven by a confluence of factors including increasing vehicle production, stringent safety and environmental regulations, and the growing demand for lightweighting solutions in the automotive industry. With a current market size estimated at USD 4,120 million in 2025, the region is a significant contributor to the global market. The study period, spanning from 2019 to 2033 with a strong focus on the forecast period of 2025-2033, indicates a sustained period of growth. The Compound Annual Growth Rate (CAGR) for this dynamic market is projected to be substantial, reflecting the region's economic development and its pivotal role in global automotive manufacturing. We can logically estimate this CAGR to be around 6.5% to 7.5% for the forecast period, aligning with broader industry trends and the increasing adoption of advanced bonding and sealing technologies across diverse vehicle segments. This growth is further fueled by investments in research and development aimed at creating innovative, high-performance adhesive and sealant solutions that cater to the evolving needs of electric vehicles (EVs) and advanced driver-assistance systems (ADAS).

Asia-Pacific Automotive Adhesives & Sealants Market Market Size (In Billion)

The market's trajectory is shaped by the region's diverse automotive landscape, with key economies such as China, Japan, South Korea, and India leading the charge. The rising disposable incomes in emerging economies are translating into higher vehicle sales, thereby increasing the demand for automotive components, including adhesives and sealants. Furthermore, manufacturers are increasingly adopting these advanced materials to improve vehicle structural integrity, enhance NVH (Noise, Vibration, and Harshness) performance, and reduce overall vehicle weight, contributing to improved fuel efficiency and reduced emissions. The transition towards EVs, which often utilize different material compositions and require specialized bonding solutions for battery packs and lightweight components, presents a significant opportunity. The forecast period of 2025-2033 is expected to witness a strategic shift towards sustainable and environmentally friendly adhesive and sealant formulations, driven by government initiatives and consumer preference. This evolution underscores the market's adaptive nature and its commitment to innovation within the automotive sector.

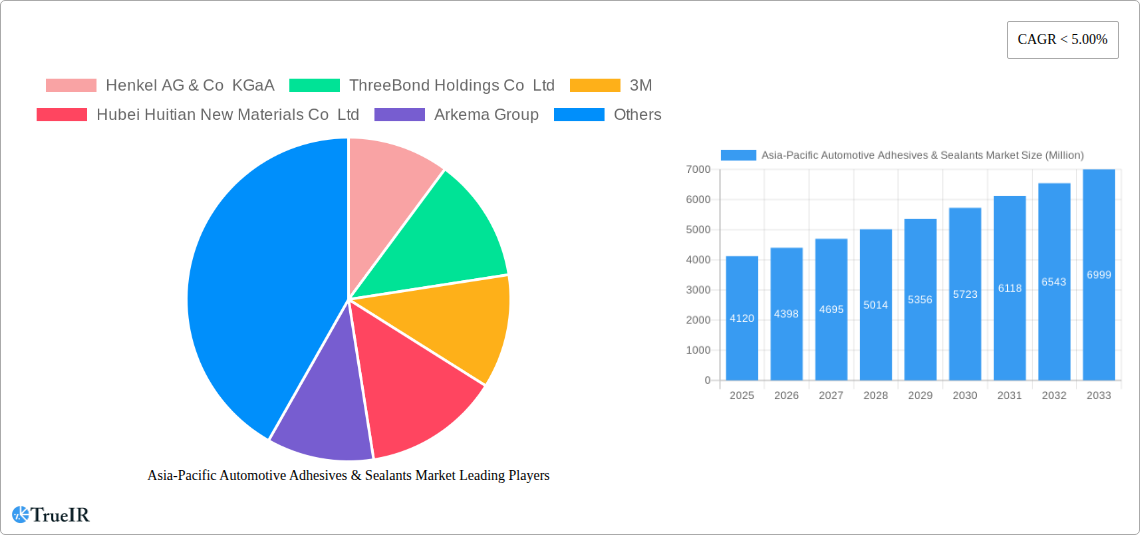

Asia-Pacific Automotive Adhesives & Sealants Market Company Market Share

Asia-Pacific Automotive Adhesives & Sealants Market: Comprehensive Growth Analysis & Forecast (2019–2033)

This in-depth report provides a detailed analysis of the Asia-Pacific automotive adhesives and sealants market, offering critical insights into its structure, trends, dominant segments, product innovations, growth drivers, challenges, and key players. Leveraging a robust research methodology, this study covers the historical period from 2019 to 2024, with a base year of 2025 and a comprehensive forecast period extending to 2033.

Asia-Pacific Automotive Adhesives & Sealants Market Market Structure & Competitive Landscape

The Asia-Pacific automotive adhesives and sealants market is characterized by a moderately consolidated structure, with leading global players holding significant market share. Innovation is a key differentiator, driven by continuous research and development in areas like lightweighting, electric vehicle (EV) battery thermal management, and enhanced structural integrity. Regulatory impacts, particularly concerning environmental standards and safety regulations, are increasingly shaping product development and market entry strategies. The threat of product substitutes is moderate, with traditional fastening methods like welding and mechanical fasteners still present, though adhesives and sealants offer superior performance in many applications. End-user segmentation is crucial, with the automotive manufacturing sector being the primary consumer, followed by the aftermarket. Mergers and acquisitions (M&A) are a significant trend, as companies seek to expand their product portfolios, geographical reach, and technological capabilities. For instance, the period between 2021 and 2023 saw several strategic acquisitions and investments aimed at bolstering market presence and innovation. Concentration ratios are estimated to be around 65-70% among the top 5 players. M&A volumes have seen a consistent upward trend, averaging 10-15 significant transactions annually in the past three years, driven by the pursuit of synergies and market leadership.

Asia-Pacific Automotive Adhesives & Sealants Market Market Trends & Opportunities

The Asia-Pacific automotive adhesives and sealants market is poised for substantial growth, with a projected Compound Annual Growth Rate (CAGR) of approximately 7.8% from 2025 to 2033. This expansion is primarily fueled by the burgeoning automotive production in the region, particularly in China, India, and Southeast Asian nations. The increasing demand for lightweight vehicles to improve fuel efficiency and reduce emissions is a major catalyst. Advanced adhesives and sealants play a critical role in joining dissimilar materials like aluminum, composites, and high-strength steel, enabling weight reduction without compromising structural integrity. The rapid electrification of vehicles presents a significant opportunity, with specialized adhesives and sealants required for battery pack assembly, thermal management, and electromagnetic shielding. The growing trend of autonomous driving and advanced driver-assistance systems (ADAS) necessitates innovative bonding solutions for sensor integration and structural reinforcement. Furthermore, rising consumer preferences for enhanced safety, durability, and a quieter cabin experience are driving the adoption of high-performance sealants and acoustic damping materials. The aftermarket segment, including repair and maintenance, is also a growing area, driven by an increasing vehicle parc. Technological shifts are evident in the move towards solvent-free and water-borne adhesive technologies, driven by environmental regulations and a focus on sustainability. The development of fast-curing and high-strength adhesives is another key trend, addressing the need for faster assembly times in modern automotive manufacturing. The market penetration of advanced adhesive and sealant solutions is projected to increase significantly as manufacturers embrace these technologies to meet evolving vehicle design and performance standards. The competitive dynamics are intensifying, with both global leaders and regional players investing heavily in R&D and strategic partnerships to capture market share. Opportunities also lie in developing customized solutions for niche applications and emerging vehicle types, such as electric scooters and commercial EVs. The increasing adoption of smart manufacturing techniques, including automation and AI in production lines, is also creating demand for adhesives and sealants compatible with these advanced processes. The overall market size is expected to reach an estimated value of over $8,500 Million by 2033, indicating a robust and dynamic growth trajectory.

Dominant Markets & Segments in Asia-Pacific Automotive Adhesives & Sealants Market

The Asia-Pacific automotive adhesives and sealants market exhibits distinct regional dominance and segment leadership. China stands out as the largest and fastest-growing market, driven by its colossal automotive manufacturing base, significant investments in electric vehicle technology, and supportive government policies. India follows closely, with its rapidly expanding automotive sector and increasing focus on domestic manufacturing under initiatives like "Make in India." Key growth drivers in these dominant markets include:

- Infrastructure Development: Government investments in road networks and transportation infrastructure indirectly boost automotive production and, consequently, the demand for automotive adhesives and sealants.

- Policy Support: Favorable policies promoting electric vehicle adoption, domestic manufacturing, and automotive component production significantly influence market expansion. For example, China's strong push for EVs directly translates to increased demand for specialized battery adhesives.

- Automotive Production Hubs: The presence of major automotive manufacturing hubs across countries like Japan, South Korea, Thailand, and Indonesia ensures a sustained demand for these essential materials.

In terms of resin segments, Polyurethane resins are expected to maintain their dominant position due to their versatility, excellent adhesion to various substrates, and good flexibility, making them ideal for structural bonding, sealing, and glass bonding. Epoxy resins are gaining traction for their high strength and durability, particularly in structural applications requiring significant load-bearing capabilities. Silicone sealants are crucial for their excellent weather resistance, temperature stability, and flexibility, finding extensive use in weather stripping and sealing applications.

Technologically, Reactive Adhesives are a dominant segment, encompassing a wide range of chemistries like epoxies, polyurethanes, and silicones that cure through chemical reactions, offering high strength and permanent bonding. Hot Melt Adhesives continue to hold a significant share due to their fast setting times and ease of application, particularly in interior applications and trim bonding. Water-borne Adhesives are witnessing growing adoption, driven by environmental regulations and the demand for lower VOC (Volatile Organic Compound) emissions. The increasing focus on sustainable automotive manufacturing practices is a key driver for the growth of water-borne and other eco-friendly technologies.

The market dominance is further influenced by the continuous innovation in these segments, leading to enhanced performance characteristics such as improved crashworthiness, reduced NVH (Noise, Vibration, and Harshness) levels, and lightweighting capabilities. The increasing complexity of automotive designs and the integration of new materials present ongoing opportunities for specialized adhesive and sealant solutions.

Asia-Pacific Automotive Adhesives & Sealants Market Product Analysis

The Asia-Pacific automotive adhesives and sealants market is witnessing a wave of product innovations focused on enhancing vehicle performance, safety, and manufacturing efficiency. Key advancements include the development of high-strength, low-viscosity adhesives for lightweighting applications, enabling the bonding of dissimilar materials such as aluminum, carbon fiber composites, and advanced plastics. Innovations in thermal management adhesives are crucial for the booming electric vehicle sector, ensuring efficient heat dissipation in battery packs and electronic components. Furthermore, advancements in acoustic sealants are contributing to quieter cabin experiences by effectively damping noise and vibrations. The market also sees a growing trend towards UV-cured adhesives offering rapid curing times and precise application, while water-borne and solvent-free formulations are gaining prominence due to their environmental benefits. These product developments are driven by the need for improved crashworthiness, enhanced durability, and streamlined assembly processes in the highly competitive automotive industry.

Key Drivers, Barriers & Challenges in Asia-Pacific Automotive Adhesives & Sealants Market

The Asia-Pacific automotive adhesives and sealants market is propelled by several key drivers including the robust growth of the automotive industry across the region, particularly in China and India, and the increasing demand for lightweight vehicles to improve fuel efficiency. The rising production of electric vehicles (EVs) is a significant growth driver, necessitating specialized adhesives for battery assembly and thermal management. Technological advancements in adhesive formulations, offering enhanced strength, durability, and faster curing times, also contribute to market expansion. Favorable government policies promoting domestic manufacturing and EV adoption further bolster growth.

However, the market faces several barriers and challenges. Stringent environmental regulations regarding VOC emissions necessitate the development of eco-friendly adhesive solutions, which can involve higher research and development costs. Supply chain disruptions, as experienced globally, can impact the availability and cost of raw materials. Intense competition among global and local players can lead to price pressures. Furthermore, the need for specialized application equipment and skilled labor for certain advanced adhesive technologies can pose adoption challenges for smaller manufacturers.

Growth Drivers in the Asia-Pacific Automotive Adhesives & Sealants Market Market

The Asia-Pacific automotive adhesives and sealants market is significantly driven by the substantial expansion of the automotive manufacturing sector, especially in emerging economies like China and India. The escalating demand for electric vehicles (EVs) is a paramount growth catalyst, creating a need for specialized adhesives in battery pack assembly, thermal management, and structural bonding of lightweight components. Technological advancements in adhesive formulations, such as high-strength structural adhesives and fast-curing systems, are enabling manufacturers to meet evolving vehicle design requirements for safety and performance. Furthermore, government initiatives promoting automotive production and the adoption of greener technologies are playing a crucial role in market expansion.

Challenges Impacting Asia-Pacific Automotive Adhesives & Sealants Market Growth

Despite robust growth prospects, the Asia-Pacific automotive adhesives and sealants market confronts several challenges. The increasing stringency of environmental regulations regarding volatile organic compound (VOC) emissions necessitates a shift towards more sustainable and often more expensive, eco-friendly formulations. Fluctuations in raw material prices and potential supply chain disruptions can impact production costs and availability. Intense price competition among a crowded field of global and local manufacturers can squeeze profit margins. Additionally, the specialized application techniques and skilled labor required for certain advanced adhesive technologies can create a barrier to adoption for some automotive manufacturers.

Key Players Shaping the Asia-Pacific Automotive Adhesives & Sealants Market Market

- Henkel AG & Co KGaA

- ThreeBond Holdings Co Ltd

- 3M

- Hubei Huitian New Materials Co Ltd

- Arkema Group

- Huntsman International LLC

- Dow

- H B Fuller Company

- SHINSUNG PETROCHEMICAL

- Sika AG

Significant Asia-Pacific Automotive Adhesives & Sealants Market Industry Milestones

- December 2021: Sika AG planned to establish a new technology center and manufacturing factory for high-quality adhesives and sealants in Pune, India. The company primarily manufactures products for the transportation and construction industries through its three new production lines.

- May 2021: Henkel announced an investment of EUR 60 million to construct a new innovation center for its Adhesive Technologies unit in Shanghai to strengthen its footprint in China.

- April 2021: Sika AG signed an agreement to acquire The Yokohama Rubber Co. Ltd's adhesives division, Hamatite, based in Japan. Hamatite offers polyurethanes, hot melts, and modified silicones technology adhesives and sealants for the automotive and construction industries.

Future Outlook for Asia-Pacific Automotive Adhesives & Sealants Market Market

The future outlook for the Asia-Pacific automotive adhesives and sealants market is exceptionally promising, driven by sustained automotive production growth and the transformative shift towards electric and autonomous vehicles. Strategic opportunities lie in developing advanced bonding solutions for battery pack integration, thermal management, and lightweight composite structures. The increasing emphasis on sustainability will continue to fuel demand for water-borne, solvent-free, and recyclable adhesive technologies. Market players that focus on innovation, customer collaboration, and expanding their presence in high-growth markets like India and Southeast Asia are well-positioned to capitalize on the evolving landscape. The integration of smart factory technologies will also present opportunities for adhesives and sealants compatible with automated application processes, ensuring a robust and dynamic market trajectory.

Asia-Pacific Automotive Adhesives & Sealants Market Segmentation

-

1. Resin

- 1.1. Acrylic

- 1.2. Cyanoacrylate

- 1.3. Epoxy

- 1.4. Polyurethane

- 1.5. Silicone

- 1.6. VAE/EVA

- 1.7. Other Resins

-

2. Technology

- 2.1. Hot Melt

- 2.2. Reactive

- 2.3. Sealants

- 2.4. Solvent-borne

- 2.5. UV Cured Adhesives

- 2.6. Water-borne

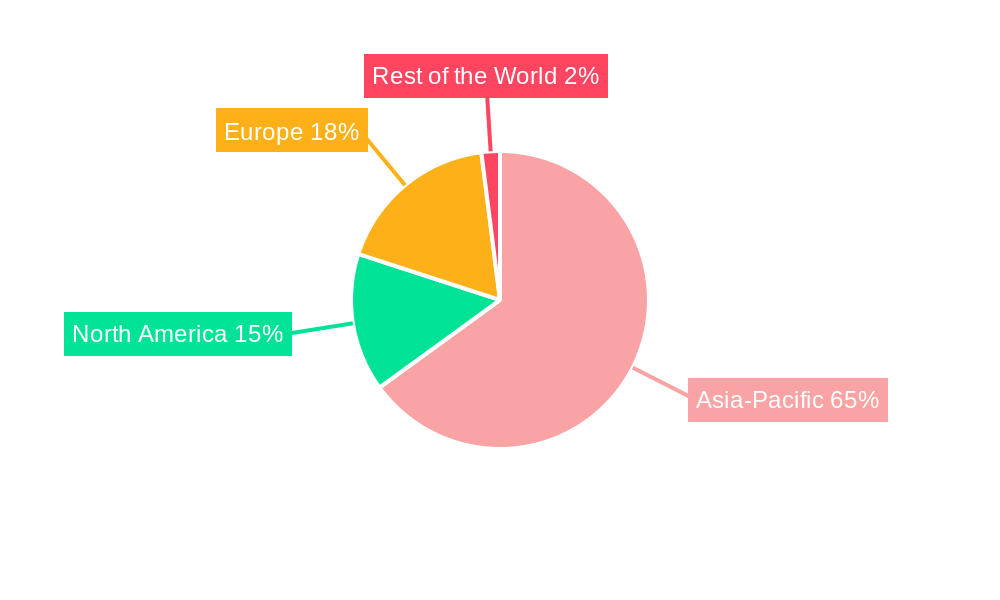

Asia-Pacific Automotive Adhesives & Sealants Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Automotive Adhesives & Sealants Market Regional Market Share

Geographic Coverage of Asia-Pacific Automotive Adhesives & Sealants Market

Asia-Pacific Automotive Adhesives & Sealants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of < 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from Aerospace Industry; Rising Demand for Fuel Efficient and Light-weight Vehicles; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Non-Degradable Nature of Reinforced Plastic; Other Restraints

- 3.4. Market Trends

- 3.4.1. China to hold the pole position in the market owing to being major automobile manufacturer

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Automotive Adhesives & Sealants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 5.1.1. Acrylic

- 5.1.2. Cyanoacrylate

- 5.1.3. Epoxy

- 5.1.4. Polyurethane

- 5.1.5. Silicone

- 5.1.6. VAE/EVA

- 5.1.7. Other Resins

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Hot Melt

- 5.2.2. Reactive

- 5.2.3. Sealants

- 5.2.4. Solvent-borne

- 5.2.5. UV Cured Adhesives

- 5.2.6. Water-borne

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Henkel AG & Co KGaA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ThreeBond Holdings Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 3M

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hubei Huitian New Materials Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Arkema Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Huntsman International LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Dow

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 H B Fuller Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SHINSUNG PETROCHEMICAL

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sika AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: Asia-Pacific Automotive Adhesives & Sealants Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Automotive Adhesives & Sealants Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Automotive Adhesives & Sealants Market Revenue Million Forecast, by Resin 2020 & 2033

- Table 2: Asia-Pacific Automotive Adhesives & Sealants Market Volume K Tons Forecast, by Resin 2020 & 2033

- Table 3: Asia-Pacific Automotive Adhesives & Sealants Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 4: Asia-Pacific Automotive Adhesives & Sealants Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 5: Asia-Pacific Automotive Adhesives & Sealants Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Automotive Adhesives & Sealants Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Automotive Adhesives & Sealants Market Revenue Million Forecast, by Resin 2020 & 2033

- Table 8: Asia-Pacific Automotive Adhesives & Sealants Market Volume K Tons Forecast, by Resin 2020 & 2033

- Table 9: Asia-Pacific Automotive Adhesives & Sealants Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 10: Asia-Pacific Automotive Adhesives & Sealants Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 11: Asia-Pacific Automotive Adhesives & Sealants Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Asia-Pacific Automotive Adhesives & Sealants Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: China Asia-Pacific Automotive Adhesives & Sealants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: China Asia-Pacific Automotive Adhesives & Sealants Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: Japan Asia-Pacific Automotive Adhesives & Sealants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Japan Asia-Pacific Automotive Adhesives & Sealants Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: South Korea Asia-Pacific Automotive Adhesives & Sealants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: South Korea Asia-Pacific Automotive Adhesives & Sealants Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: India Asia-Pacific Automotive Adhesives & Sealants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: India Asia-Pacific Automotive Adhesives & Sealants Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Australia Asia-Pacific Automotive Adhesives & Sealants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Australia Asia-Pacific Automotive Adhesives & Sealants Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: New Zealand Asia-Pacific Automotive Adhesives & Sealants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: New Zealand Asia-Pacific Automotive Adhesives & Sealants Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Indonesia Asia-Pacific Automotive Adhesives & Sealants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Indonesia Asia-Pacific Automotive Adhesives & Sealants Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Malaysia Asia-Pacific Automotive Adhesives & Sealants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Malaysia Asia-Pacific Automotive Adhesives & Sealants Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: Singapore Asia-Pacific Automotive Adhesives & Sealants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Singapore Asia-Pacific Automotive Adhesives & Sealants Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Thailand Asia-Pacific Automotive Adhesives & Sealants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Thailand Asia-Pacific Automotive Adhesives & Sealants Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 33: Vietnam Asia-Pacific Automotive Adhesives & Sealants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Vietnam Asia-Pacific Automotive Adhesives & Sealants Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 35: Philippines Asia-Pacific Automotive Adhesives & Sealants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Philippines Asia-Pacific Automotive Adhesives & Sealants Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Automotive Adhesives & Sealants Market?

The projected CAGR is approximately < 5.00%.

2. Which companies are prominent players in the Asia-Pacific Automotive Adhesives & Sealants Market?

Key companies in the market include Henkel AG & Co KGaA, ThreeBond Holdings Co Ltd, 3M, Hubei Huitian New Materials Co Ltd, Arkema Group, Huntsman International LLC, Dow, H B Fuller Company, SHINSUNG PETROCHEMICAL, Sika AG.

3. What are the main segments of the Asia-Pacific Automotive Adhesives & Sealants Market?

The market segments include Resin, Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 4120 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from Aerospace Industry; Rising Demand for Fuel Efficient and Light-weight Vehicles; Other Drivers.

6. What are the notable trends driving market growth?

China to hold the pole position in the market owing to being major automobile manufacturer.

7. Are there any restraints impacting market growth?

Non-Degradable Nature of Reinforced Plastic; Other Restraints.

8. Can you provide examples of recent developments in the market?

December 2021: Sika planned to establish a new technology center and manufacturing factory for high-quality adhesives and sealants in Pune, India. The company primarily manufactures products for the transportation and construction industries through its three new production lines.May 2021: Henkel announced an investment of EUR 60 million to construct a new innovation center for its Adhesive Technologies unit in Shanghai to strengthen its footprint in China.April 2021: Sika AG signed an agreement to acquire The Yokohama Rubber Co. Ltd's adhesives division, Hamatite, based in Japan. Hamatite offers polyurethanes, hot melts, and modified silicones technology adhesives and sealants for the automotive and construction industries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Automotive Adhesives & Sealants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Automotive Adhesives & Sealants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Automotive Adhesives & Sealants Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Automotive Adhesives & Sealants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence