Key Insights

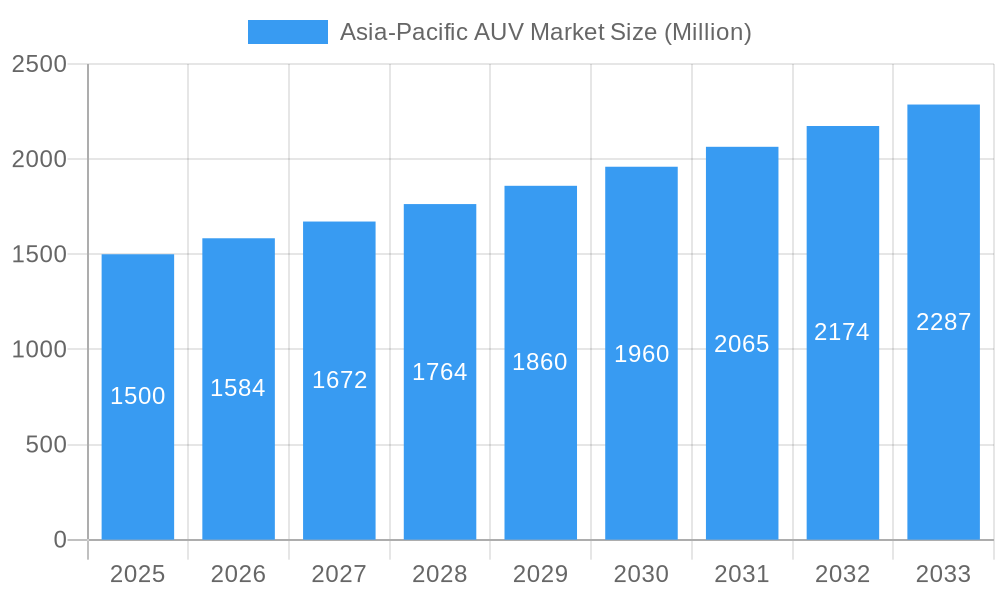

The Asia-Pacific Autonomous Underwater Vehicle (AUV) market is poised for robust expansion, projected to reach a significant market size of approximately $1,500 million by 2025, with a Compound Annual Growth Rate (CAGR) of 5.50% extending through 2033. This growth is primarily propelled by escalating investments in offshore oil and gas exploration and production activities across the region, particularly in deep-sea reserves. The increasing demand for efficient and safer underwater surveying and inspection for critical infrastructure, such as pipelines and subsea cables, further fuels market adoption. Furthermore, the burgeoning defense sector's requirement for advanced surveillance, mine countermeasures, and reconnaissance capabilities in maritime domains is a critical growth driver. Emerging economies are recognizing the strategic importance of AUVs for oceanographic research, environmental monitoring, and resource management, contributing to a broader market appeal.

Asia-Pacific AUV Market Market Size (In Billion)

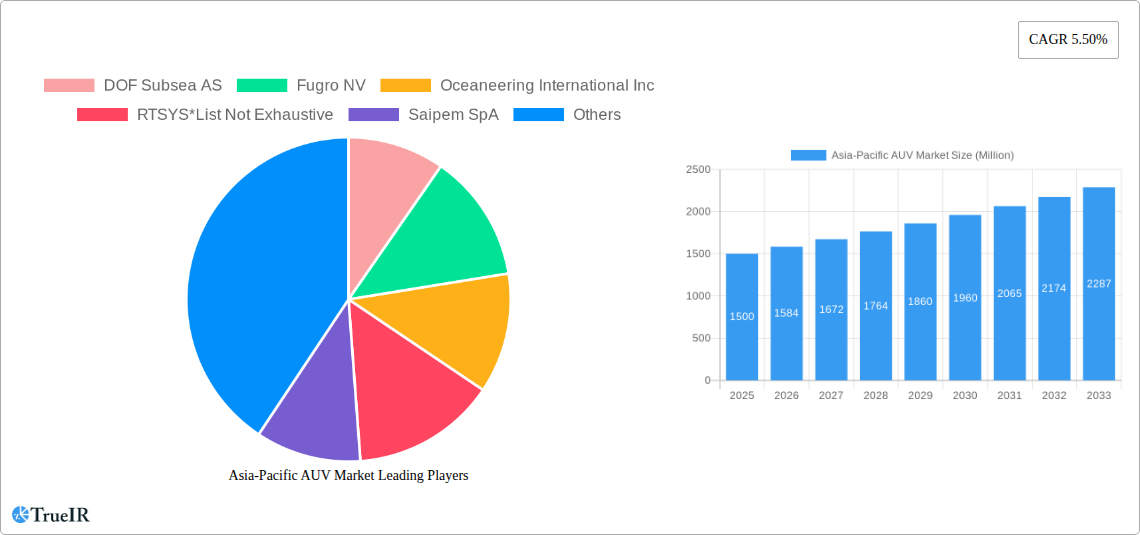

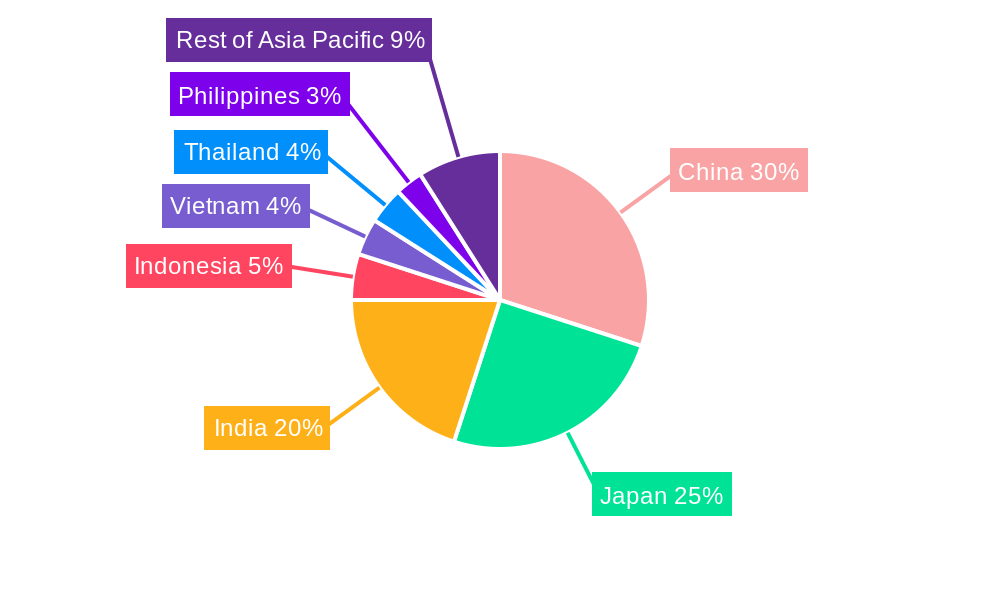

The market segmentation reveals distinct opportunities across various vehicle sizes and end-user applications. Small-size AUVs are likely to dominate in niche applications requiring high maneuverability and detailed surveying, while medium and large-size AUVs will cater to broader survey operations and heavier payload requirements in the oil and gas and defense sectors. Geographically, China, Japan, and India represent the most substantial markets due to their extensive coastlines, significant offshore energy interests, and well-established maritime defense programs. Emerging markets like Indonesia, Vietnam, Thailand, and the Philippines are exhibiting strong growth potential, driven by increasing offshore exploration activities and a growing awareness of the benefits of AUV technology for national security and resource management. Key players such as DOF Subsea AS, Fugro NV, Oceaneering International Inc, RTSYS, Saipem SpA, and DeepOcean AS are actively participating in this dynamic market, offering a range of innovative AUV solutions.

Asia-Pacific AUV Market Company Market Share

Asia-Pacific AUV Market: Comprehensive Market Analysis & Future Projections (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific Autonomous Underwater Vehicle (AUV) market, exploring its structure, trends, opportunities, dominant segments, and competitive landscape. Covering the period from 2019 to 2033, with a base year of 2025, this research offers critical insights for stakeholders seeking to capitalize on the burgeoning AUV sector in this dynamic region. The report delves into key industry developments, technological advancements, and the strategic initiatives of leading players, offering a detailed roadmap for future growth and investment.

Asia-Pacific AUV Market Market Structure & Competitive Landscape

The Asia-Pacific AUV market exhibits a moderately concentrated structure, with a blend of established global players and emerging regional manufacturers. Innovation drivers are primarily fueled by advancements in sensor technology, AI-powered navigation, and increased demand for efficient subsea data acquisition. Regulatory impacts, while still evolving, are gradually shaping the market, with governments in key countries like China and India investing in autonomous systems for defense and maritime security. Product substitutes, such as Remotely Operated Vehicles (ROVs), are present but are increasingly being superseded by AUVs due to their enhanced autonomy and reduced operational costs. End-user segmentation reveals a strong dominance of the Oil and Gas sector, followed by Defense and Research applications. Mergers and Acquisitions (M&A) trends are on the rise as companies seek to expand their technological capabilities and market reach. The concentration ratio is estimated to be around 40%, with the top five players holding a significant market share. M&A volumes are projected to increase by 15% over the forecast period as consolidation efforts intensify.

Asia-Pacific AUV Market Market Trends & Opportunities

The Asia-Pacific AUV market is poised for substantial growth, driven by escalating investments in subsea exploration, infrastructure development, and defense modernization across the region. The market size is projected to reach an estimated $15,000 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 12.5% during the forecast period (2025-2033). Technological shifts, including the integration of advanced AI for autonomous decision-making, real-time data processing capabilities, and enhanced mission endurance, are revolutionizing AUV capabilities. Consumer preferences are increasingly leaning towards smaller, more versatile, and cost-effective AUV solutions for specific niche applications, alongside the demand for high-capacity, long-endurance vehicles for large-scale projects. Competitive dynamics are intensifying, with both established international players and agile local manufacturers vying for market share through product innovation, strategic partnerships, and aggressive pricing strategies. Opportunities abound in the burgeoning offshore wind sector for survey and inspection tasks, as well as in maritime security operations and scientific research expeditions. The growing emphasis on sustainable ocean practices and resource management further amplifies the demand for sophisticated underwater monitoring and data collection tools. Market penetration rates for AUVs in various end-user applications are expected to rise significantly, driven by cost efficiencies and the inherent advantages of autonomous operations over traditional methods.

Dominant Markets & Segments in Asia-Pacific AUV Market

The China AUV market is projected to lead the Asia-Pacific region in terms of growth and adoption, driven by its extensive coastline, significant investments in naval modernization, and burgeoning offshore energy sector. The Defense end-user application segment is anticipated to be a major growth driver, fueled by increasing geopolitical tensions and national security imperatives across the region, with projected market share of approximately 35%. The Oil and Gas sector remains a cornerstone of the AUV market, particularly for subsea inspection, maintenance, and repair (IMR) activities, contributing an estimated 40% to the overall market.

- Dominant Geography: China

- Massive investments in naval technology and autonomous systems.

- Extensive offshore oil and gas exploration and production activities.

- Government support for advanced maritime research and development.

- Rapid expansion of port infrastructure and maritime trade routes, requiring robust survey and security capabilities.

- Dominant End-User Application: Oil and Gas

- Critical for subsea pipeline inspection, platform surveys, and field development.

- Increasing demand for efficient and cost-effective subsea asset management.

- Growth in offshore renewable energy projects (wind farms) requiring site surveys and installation support.

- Dominant Vehicle Type: Medium-Size AUVs

- Offer a balance of payload capacity, endurance, and operational flexibility.

- Suitable for a wide range of applications including survey, inspection, and light intervention tasks.

- Advancements in battery technology are further enhancing their capabilities.

- Key Growth Drivers:

- Infrastructure Development: Expansion of offshore energy infrastructure and maritime trade routes.

- Policy Support: Government initiatives promoting indigenous defense manufacturing and maritime autonomy.

- Technological Advancements: Miniaturization of sensors, improved AI algorithms, and longer battery life.

- Cost-Effectiveness: AUVs offer a more economical alternative to manned operations for many subsea tasks.

Asia-Pacific AUV Market Product Analysis

Product innovation in the Asia-Pacific AUV market is characterized by the development of highly specialized vehicles tailored for specific applications. Key advancements include enhanced sensor integration, such as synthetic aperture sonars and advanced imaging systems, enabling higher resolution data acquisition. Increased autonomy and AI-driven navigation systems allow for more complex mission planning and execution, reducing the need for constant human intervention. These innovations provide competitive advantages by offering greater efficiency, accuracy, and operational flexibility, thereby meeting the evolving demands of sectors like oil and gas, defense, and scientific research.

Key Drivers, Barriers & Challenges in Asia-Pacific AUV Market

The Asia-Pacific AUV market is propelled by significant technological advancements, including miniaturization of sensors and improvements in AI for autonomous navigation. Economic factors, such as growing investments in offshore energy exploration and the expansion of maritime trade, also act as key drivers. Policy-driven factors, such as government initiatives to bolster naval capabilities and develop indigenous defense technologies, are further accelerating market growth. For instance, India's push for self-reliance in defense manufacturing encourages the development and adoption of AUVs.

However, the market faces several barriers and challenges. Supply chain issues, particularly concerning specialized components and skilled labor, can hinder production and deployment. Regulatory hurdles, including evolving standards for autonomous system operation and data security, can create complexities for market entry and expansion. Competitive pressures from established global players and the high initial cost of advanced AUV systems can also pose significant restraints, especially for smaller enterprises. The estimated market size for AUVs is $7,500 Million in the base year 2025.

Growth Drivers in the Asia-Pacific AUV Market Market

Key growth drivers in the Asia-Pacific AUV market stem from rapid technological advancements, particularly in sensor technology and artificial intelligence, enabling greater autonomy and data processing capabilities. Economic factors, such as increased investments in offshore oil and gas exploration, renewable energy projects, and the expansion of maritime infrastructure, are creating a substantial demand for subsea survey and inspection solutions. Furthermore, supportive government policies in several Asia-Pacific nations aimed at enhancing defense capabilities and promoting indigenous technological development are significant catalysts. For example, India's "Make in India" initiative encourages domestic AUV production.

Challenges Impacting Asia-Pacific AUV Market Growth

Challenges impacting Asia-Pacific AUV market growth include the complexities of navigating diverse and evolving regulatory landscapes across different countries, which can slow down adoption and deployment. Supply chain vulnerabilities, particularly for high-tech components and specialized sub-systems, can lead to production delays and increased costs. Intense competitive pressures from established global manufacturers and the significant upfront investment required for advanced AUV systems can also act as barriers for new entrants and smaller regional players. Cybersecurity concerns and the need for robust data protection measures are also paramount.

Key Players Shaping the Asia-Pacific AUV Market Market

- DOF Subsea AS

- Fugro NV

- Oceaneering International Inc

- RTSYS

- Saipem SpA

- DeepOcean AS

Significant Asia-Pacific AUV Market Industry Milestones

- October 2022: India's Ministry of Defence (MoD) initiated a preliminary procedure to acquire autonomous underwater vehicles (AUVs) with dual observation and strike capabilities, while the Defense Research and Development Organisation (DRDO) of India is attempting to improve submarine situational awareness and real-time imagery.

- January 2022: iXblue PLE Ltd, a Singapore-based provider of navigation, photonics, and maritime autonomy solutions, announced the successful delivery of a synthetic aperture sonar for a 6,000-meter-rated AUV operated by IFREMER.

Future Outlook for Asia-Pacific AUV Market Market

The future outlook for the Asia-Pacific AUV market is exceptionally promising, driven by the accelerating adoption of autonomous technologies across multiple sectors. Strategic opportunities lie in the expansion of offshore renewable energy infrastructure, where AUVs are crucial for site surveys, installation monitoring, and ongoing inspection. The increasing focus on maritime security and defense modernization will continue to fuel demand for advanced AUVs with enhanced surveillance and operational capabilities. Further technological advancements in AI, swarm robotics, and longer endurance power systems will unlock new applications and drive market growth, with the market projected to reach an estimated $15,000 Million by 2033.

Asia-Pacific AUV Market Segmentation

-

1. Vehicle Type

- 1.1. Small-Size

- 1.2. Medium-Size

- 1.3. Large-Size

-

2. End-User Applications

- 2.1. Oil and Gas

- 2.2. Defense

- 2.3. Research

- 2.4. Other End-User Applications

-

3. Geography

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Indonesia

- 3.5. Vietnam

- 3.6. Thailand

- 3.7. Philippines

- 3.8. Rest of Asia-Pacific

Asia-Pacific AUV Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Indonesia

- 5. Vietnam

- 6. Thailand

- 7. Philippines

- 8. Rest of Asia Pacific

Asia-Pacific AUV Market Regional Market Share

Geographic Coverage of Asia-Pacific AUV Market

Asia-Pacific AUV Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Automobiles4.; The Government Policy Regarding Pollution Emission Control Parameters

- 3.3. Market Restrains

- 3.3.1. The Technological Limitations of Air Filters

- 3.4. Market Trends

- 3.4.1. Oil and Gas Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific AUV Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Small-Size

- 5.1.2. Medium-Size

- 5.1.3. Large-Size

- 5.2. Market Analysis, Insights and Forecast - by End-User Applications

- 5.2.1. Oil and Gas

- 5.2.2. Defense

- 5.2.3. Research

- 5.2.4. Other End-User Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. India

- 5.3.4. Indonesia

- 5.3.5. Vietnam

- 5.3.6. Thailand

- 5.3.7. Philippines

- 5.3.8. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Indonesia

- 5.4.5. Vietnam

- 5.4.6. Thailand

- 5.4.7. Philippines

- 5.4.8. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. China Asia-Pacific AUV Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Small-Size

- 6.1.2. Medium-Size

- 6.1.3. Large-Size

- 6.2. Market Analysis, Insights and Forecast - by End-User Applications

- 6.2.1. Oil and Gas

- 6.2.2. Defense

- 6.2.3. Research

- 6.2.4. Other End-User Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. Japan

- 6.3.3. India

- 6.3.4. Indonesia

- 6.3.5. Vietnam

- 6.3.6. Thailand

- 6.3.7. Philippines

- 6.3.8. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Japan Asia-Pacific AUV Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Small-Size

- 7.1.2. Medium-Size

- 7.1.3. Large-Size

- 7.2. Market Analysis, Insights and Forecast - by End-User Applications

- 7.2.1. Oil and Gas

- 7.2.2. Defense

- 7.2.3. Research

- 7.2.4. Other End-User Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. Japan

- 7.3.3. India

- 7.3.4. Indonesia

- 7.3.5. Vietnam

- 7.3.6. Thailand

- 7.3.7. Philippines

- 7.3.8. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. India Asia-Pacific AUV Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Small-Size

- 8.1.2. Medium-Size

- 8.1.3. Large-Size

- 8.2. Market Analysis, Insights and Forecast - by End-User Applications

- 8.2.1. Oil and Gas

- 8.2.2. Defense

- 8.2.3. Research

- 8.2.4. Other End-User Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. Japan

- 8.3.3. India

- 8.3.4. Indonesia

- 8.3.5. Vietnam

- 8.3.6. Thailand

- 8.3.7. Philippines

- 8.3.8. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Indonesia Asia-Pacific AUV Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Small-Size

- 9.1.2. Medium-Size

- 9.1.3. Large-Size

- 9.2. Market Analysis, Insights and Forecast - by End-User Applications

- 9.2.1. Oil and Gas

- 9.2.2. Defense

- 9.2.3. Research

- 9.2.4. Other End-User Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. Japan

- 9.3.3. India

- 9.3.4. Indonesia

- 9.3.5. Vietnam

- 9.3.6. Thailand

- 9.3.7. Philippines

- 9.3.8. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Vietnam Asia-Pacific AUV Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Small-Size

- 10.1.2. Medium-Size

- 10.1.3. Large-Size

- 10.2. Market Analysis, Insights and Forecast - by End-User Applications

- 10.2.1. Oil and Gas

- 10.2.2. Defense

- 10.2.3. Research

- 10.2.4. Other End-User Applications

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. Japan

- 10.3.3. India

- 10.3.4. Indonesia

- 10.3.5. Vietnam

- 10.3.6. Thailand

- 10.3.7. Philippines

- 10.3.8. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Thailand Asia-Pacific AUV Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11.1.1. Small-Size

- 11.1.2. Medium-Size

- 11.1.3. Large-Size

- 11.2. Market Analysis, Insights and Forecast - by End-User Applications

- 11.2.1. Oil and Gas

- 11.2.2. Defense

- 11.2.3. Research

- 11.2.4. Other End-User Applications

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. Japan

- 11.3.3. India

- 11.3.4. Indonesia

- 11.3.5. Vietnam

- 11.3.6. Thailand

- 11.3.7. Philippines

- 11.3.8. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 12. Philippines Asia-Pacific AUV Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 12.1.1. Small-Size

- 12.1.2. Medium-Size

- 12.1.3. Large-Size

- 12.2. Market Analysis, Insights and Forecast - by End-User Applications

- 12.2.1. Oil and Gas

- 12.2.2. Defense

- 12.2.3. Research

- 12.2.4. Other End-User Applications

- 12.3. Market Analysis, Insights and Forecast - by Geography

- 12.3.1. China

- 12.3.2. Japan

- 12.3.3. India

- 12.3.4. Indonesia

- 12.3.5. Vietnam

- 12.3.6. Thailand

- 12.3.7. Philippines

- 12.3.8. Rest of Asia-Pacific

- 12.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 13. Rest of Asia Pacific Asia-Pacific AUV Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 13.1.1. Small-Size

- 13.1.2. Medium-Size

- 13.1.3. Large-Size

- 13.2. Market Analysis, Insights and Forecast - by End-User Applications

- 13.2.1. Oil and Gas

- 13.2.2. Defense

- 13.2.3. Research

- 13.2.4. Other End-User Applications

- 13.3. Market Analysis, Insights and Forecast - by Geography

- 13.3.1. China

- 13.3.2. Japan

- 13.3.3. India

- 13.3.4. Indonesia

- 13.3.5. Vietnam

- 13.3.6. Thailand

- 13.3.7. Philippines

- 13.3.8. Rest of Asia-Pacific

- 13.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 DOF Subsea AS

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Fugro NV

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Oceaneering International Inc

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 RTSYS*List Not Exhaustive

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Saipem SpA

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 DeepOcean AS

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.1 DOF Subsea AS

List of Figures

- Figure 1: Asia-Pacific AUV Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific AUV Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific AUV Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 2: Asia-Pacific AUV Market Volume K Unit Forecast, by Vehicle Type 2020 & 2033

- Table 3: Asia-Pacific AUV Market Revenue undefined Forecast, by End-User Applications 2020 & 2033

- Table 4: Asia-Pacific AUV Market Volume K Unit Forecast, by End-User Applications 2020 & 2033

- Table 5: Asia-Pacific AUV Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific AUV Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 7: Asia-Pacific AUV Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Asia-Pacific AUV Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Asia-Pacific AUV Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 10: Asia-Pacific AUV Market Volume K Unit Forecast, by Vehicle Type 2020 & 2033

- Table 11: Asia-Pacific AUV Market Revenue undefined Forecast, by End-User Applications 2020 & 2033

- Table 12: Asia-Pacific AUV Market Volume K Unit Forecast, by End-User Applications 2020 & 2033

- Table 13: Asia-Pacific AUV Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 14: Asia-Pacific AUV Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific AUV Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific AUV Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific AUV Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 18: Asia-Pacific AUV Market Volume K Unit Forecast, by Vehicle Type 2020 & 2033

- Table 19: Asia-Pacific AUV Market Revenue undefined Forecast, by End-User Applications 2020 & 2033

- Table 20: Asia-Pacific AUV Market Volume K Unit Forecast, by End-User Applications 2020 & 2033

- Table 21: Asia-Pacific AUV Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 22: Asia-Pacific AUV Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: Asia-Pacific AUV Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Asia-Pacific AUV Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific AUV Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 26: Asia-Pacific AUV Market Volume K Unit Forecast, by Vehicle Type 2020 & 2033

- Table 27: Asia-Pacific AUV Market Revenue undefined Forecast, by End-User Applications 2020 & 2033

- Table 28: Asia-Pacific AUV Market Volume K Unit Forecast, by End-User Applications 2020 & 2033

- Table 29: Asia-Pacific AUV Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 30: Asia-Pacific AUV Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 31: Asia-Pacific AUV Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Asia-Pacific AUV Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 33: Asia-Pacific AUV Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 34: Asia-Pacific AUV Market Volume K Unit Forecast, by Vehicle Type 2020 & 2033

- Table 35: Asia-Pacific AUV Market Revenue undefined Forecast, by End-User Applications 2020 & 2033

- Table 36: Asia-Pacific AUV Market Volume K Unit Forecast, by End-User Applications 2020 & 2033

- Table 37: Asia-Pacific AUV Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 38: Asia-Pacific AUV Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 39: Asia-Pacific AUV Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: Asia-Pacific AUV Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Asia-Pacific AUV Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 42: Asia-Pacific AUV Market Volume K Unit Forecast, by Vehicle Type 2020 & 2033

- Table 43: Asia-Pacific AUV Market Revenue undefined Forecast, by End-User Applications 2020 & 2033

- Table 44: Asia-Pacific AUV Market Volume K Unit Forecast, by End-User Applications 2020 & 2033

- Table 45: Asia-Pacific AUV Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 46: Asia-Pacific AUV Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 47: Asia-Pacific AUV Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 48: Asia-Pacific AUV Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 49: Asia-Pacific AUV Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 50: Asia-Pacific AUV Market Volume K Unit Forecast, by Vehicle Type 2020 & 2033

- Table 51: Asia-Pacific AUV Market Revenue undefined Forecast, by End-User Applications 2020 & 2033

- Table 52: Asia-Pacific AUV Market Volume K Unit Forecast, by End-User Applications 2020 & 2033

- Table 53: Asia-Pacific AUV Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 54: Asia-Pacific AUV Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 55: Asia-Pacific AUV Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 56: Asia-Pacific AUV Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 57: Asia-Pacific AUV Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 58: Asia-Pacific AUV Market Volume K Unit Forecast, by Vehicle Type 2020 & 2033

- Table 59: Asia-Pacific AUV Market Revenue undefined Forecast, by End-User Applications 2020 & 2033

- Table 60: Asia-Pacific AUV Market Volume K Unit Forecast, by End-User Applications 2020 & 2033

- Table 61: Asia-Pacific AUV Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 62: Asia-Pacific AUV Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 63: Asia-Pacific AUV Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 64: Asia-Pacific AUV Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 65: Asia-Pacific AUV Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 66: Asia-Pacific AUV Market Volume K Unit Forecast, by Vehicle Type 2020 & 2033

- Table 67: Asia-Pacific AUV Market Revenue undefined Forecast, by End-User Applications 2020 & 2033

- Table 68: Asia-Pacific AUV Market Volume K Unit Forecast, by End-User Applications 2020 & 2033

- Table 69: Asia-Pacific AUV Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 70: Asia-Pacific AUV Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 71: Asia-Pacific AUV Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 72: Asia-Pacific AUV Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific AUV Market?

The projected CAGR is approximately 8.66%.

2. Which companies are prominent players in the Asia-Pacific AUV Market?

Key companies in the market include DOF Subsea AS, Fugro NV, Oceaneering International Inc, RTSYS*List Not Exhaustive, Saipem SpA, DeepOcean AS.

3. What are the main segments of the Asia-Pacific AUV Market?

The market segments include Vehicle Type, End-User Applications, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Automobiles4.; The Government Policy Regarding Pollution Emission Control Parameters.

6. What are the notable trends driving market growth?

Oil and Gas Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

The Technological Limitations of Air Filters.

8. Can you provide examples of recent developments in the market?

October 2022: The Ministry of Defence (MoD) initiated a preliminary procedure to acquire autonomous underwater vehicles (AUVs) with dual observation and strike capabilities. The Defense Research and Development Organisation (DRDO) of India is attempting to improve submarine situational awareness and real-time imagery.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific AUV Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific AUV Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific AUV Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific AUV Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence