Key Insights

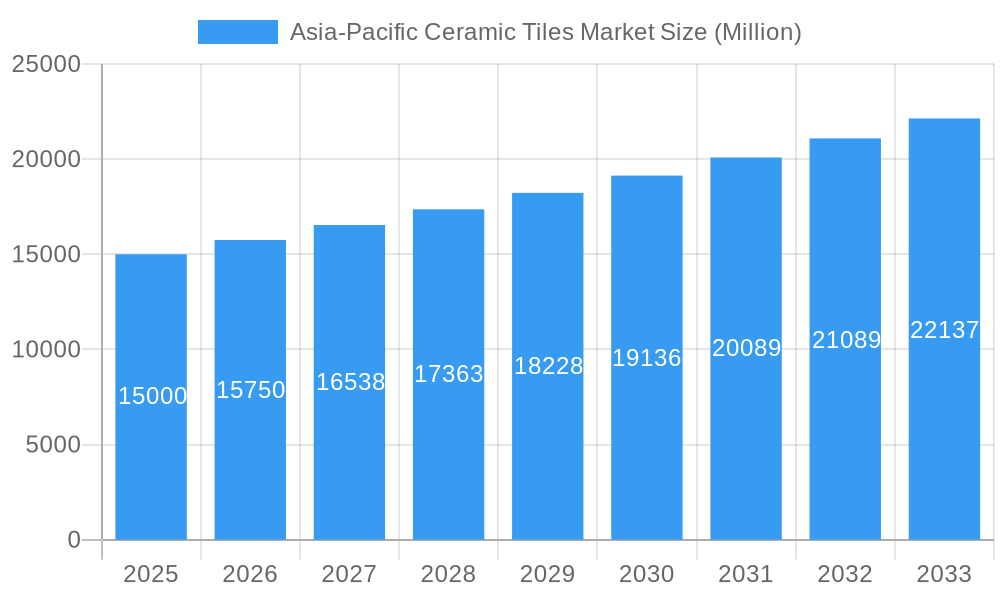

The Asia-Pacific ceramic tile market is projected for significant expansion, with an estimated market size of $13.59 billion by 2025. The sector is anticipated to grow at a robust Compound Annual Growth Rate (CAGR) of 9.02%. This growth is propelled by the region's thriving construction sector, driven by rapid urbanization, increasing disposable incomes, and a rising preference for high-quality, aesthetically appealing ceramic tiles in both residential and commercial developments. Key markets like China, India, and Japan are leading this demand surge. The escalating popularity of porcelain and glazed tiles, valued for their enhanced durability and water resistance, further bolsters market momentum. Additionally, government-backed initiatives promoting sustainable construction and eco-friendly manufacturing processes are positively influencing market dynamics.

Asia-Pacific Ceramic Tiles Market Market Size (In Billion)

Despite these positive indicators, the market faces challenges, including volatility in raw material costs (clay, energy) and intense competition from both established and emerging players. Strategic pricing and product innovation are therefore crucial for maintaining profitability. Segmentation analysis reveals that floor and wall tiles represent the largest application segments, with residential replacement and new construction activities being primary end-user drivers. The fundamental strength of the Asia-Pacific market, supported by ongoing infrastructure development and growing consumer spending, points to a promising future. Key industry leaders, including RAK Ceramics, Kajaria Ceramics, and China Ceramics Co Ltd, are strategically positioned to leverage these growth opportunities.

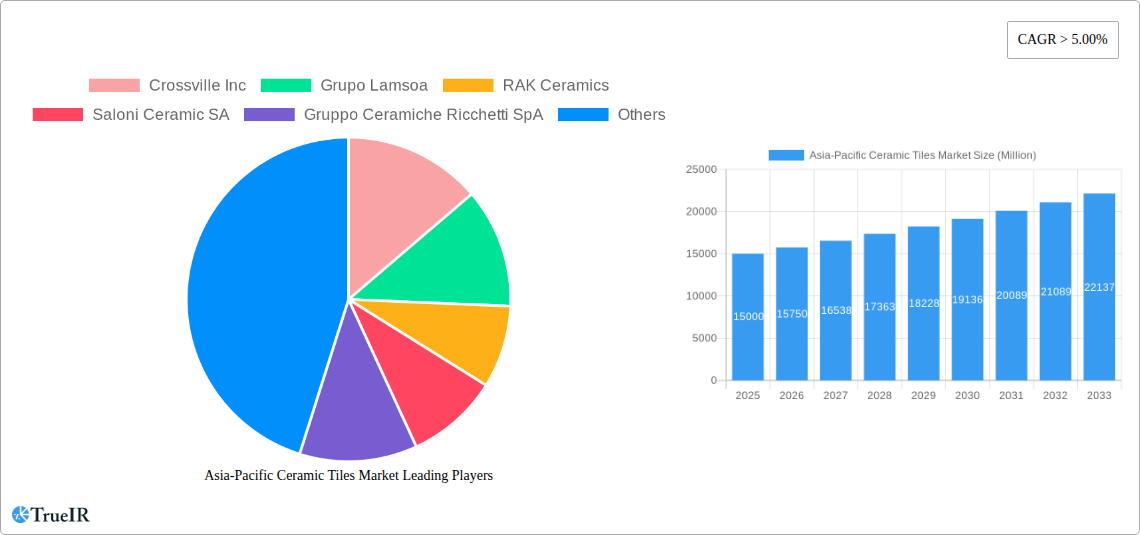

Asia-Pacific Ceramic Tiles Market Company Market Share

Asia-Pacific Ceramic Tiles Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Asia-Pacific ceramic tiles market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study period spans 2019-2033, with 2025 serving as the base and estimated year. The report utilizes a robust methodology, incorporating historical data (2019-2024) and projecting future trends (2025-2033) to deliver a precise forecast of market growth and evolution. The market is segmented by application, end-user, construction type, and product type, providing a granular understanding of the dynamic landscape. Key players like Crossville Inc, Grupo Lamsoa, and RAK Ceramics are profiled, highlighting their strategies and market positions.

Asia-Pacific Ceramic Tiles Market Structure & Competitive Landscape

The Asia-Pacific ceramic tiles market exhibits a moderately consolidated structure. The leading players, including Crossville Inc, RAK Ceramics, and Kajaria Ceramics, hold significant market share, but a diverse range of smaller regional and national players also contribute substantially. The market concentration ratio (CR4) is estimated at xx%, indicating moderate concentration with significant room for competition.

- Innovation Drivers: Technological advancements in tile manufacturing, including the development of larger-format tiles, enhanced durability, and aesthetic designs, are driving market growth. The incorporation of antibacterial properties, as seen with Dongpeng's recent launch, represents a key innovation trend.

- Regulatory Impacts: Government regulations regarding building codes and environmental standards influence production methods and material choices. Stringent emission norms and sustainable manufacturing practices are shaping the market.

- Product Substitutes: Alternative flooring materials such as vinyl, wood, and laminate pose competitive pressure, particularly in the residential segment. However, ceramic tiles maintain a strong advantage in durability and cost-effectiveness for many applications.

- End-User Segmentation: The market is significantly driven by the residential sector, with the commercial segment contributing a sizable share and experiencing robust growth. Within residential, replacement and new construction both contribute substantially.

- M&A Trends: The past five years have seen xx merger and acquisition deals in the Asia-Pacific ceramic tiles market, with an estimated value of xx Million. This activity largely involved smaller companies being acquired by larger multinational players seeking expansion.

Asia-Pacific Ceramic Tiles Market Trends & Opportunities

The Asia-Pacific ceramic tiles market is projected to experience significant growth during the forecast period, with a CAGR of xx% from 2025 to 2033. The market size in 2025 is estimated at xx Million, and it is expected to reach xx Million by 2033. This growth is fueled by several key factors: a surge in construction activity across various sectors (residential and commercial); increasing disposable incomes and urbanization in many countries; rising consumer preference for aesthetically pleasing and durable flooring options; and continuous innovation in tile designs, materials, and functionalities.

Technological shifts towards sustainable and eco-friendly production methods are gaining traction, aligning with growing environmental awareness and regulatory pressures. Consumer preferences are shifting towards larger-format tiles, diverse design options, and enhanced performance features, like scratch resistance and antibacterial properties. Competitive dynamics are characterized by both intense competition among established players and the emergence of innovative smaller players. Market penetration rates for premium segments, such as large-format porcelain tiles, are witnessing steady growth, reflecting increased consumer willingness to pay for enhanced quality and design.

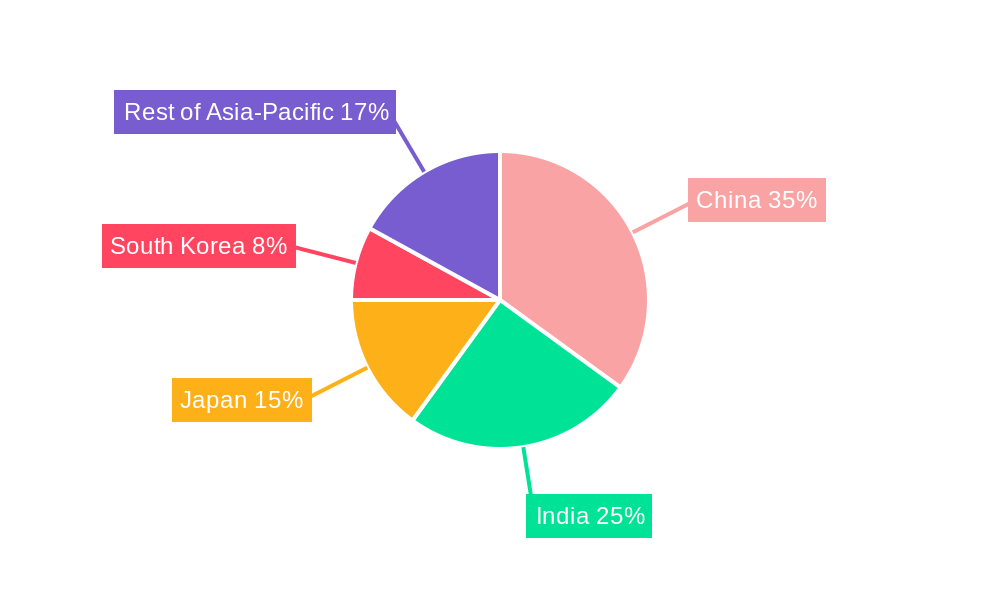

Dominant Markets & Segments in Asia-Pacific Ceramic Tiles Market

China and India dominate the Asia-Pacific ceramic tiles market, driven by robust construction activity and high demand. Other rapidly developing nations such as Vietnam and Indonesia are experiencing significant growth.

- By Application: Floor tiles constitute the largest segment, followed by wall tiles. The "others" category is experiencing growth driven by innovative applications in specialized areas.

- By End-User: Residential replacement and new construction are the dominant segments, reflecting continuous needs for home renovations and new housing developments. Commercial construction contributes significantly, especially in rapidly developing urban centers.

- By Construction Type: New construction dominates, followed by the replacement and renovation segment. Growth in this segment is propelled by refurbishment projects and improvements in existing infrastructure.

- By Product: Porcelain tiles hold the largest market share due to their superior durability and aesthetic appeal. Glazed tiles are the next largest, while the "others" segment is comprised of niche specialized products.

Key Growth Drivers:

- Rapid urbanization and infrastructure development across the Asia-Pacific region.

- Increased disposable incomes and rising consumer spending.

- Government initiatives promoting affordable housing and infrastructure development.

Asia-Pacific Ceramic Tiles Market Product Analysis

The Asia-Pacific ceramic tiles market is witnessing significant product innovation, particularly in porcelain tiles. Manufacturers are focusing on larger formats, enhanced durability (scratch-free options), improved aesthetics, and functionalities like antibacterial properties. These innovations cater to consumer demands for high-quality, long-lasting, and visually appealing flooring solutions, driving market growth in premium segments. The integration of advanced technologies in manufacturing processes is enabling the creation of tiles with superior performance characteristics and design flexibility.

Key Drivers, Barriers & Challenges in Asia-Pacific Ceramic Tiles Market

Key Drivers:

- Increasing urbanization and infrastructure development

- Rising disposable incomes and consumer spending

- Technological advancements leading to improved product features

- Government initiatives supporting construction and housing

Key Challenges & Restraints:

- Fluctuations in raw material prices, impacting profitability.

- Intense competition from other flooring materials.

- Supply chain disruptions affecting timely delivery and production efficiency.

- Stringent environmental regulations, necessitating investments in sustainable manufacturing practices. The estimated impact of these factors on market growth is a reduction of xx% by 2033.

Growth Drivers in the Asia-Pacific Ceramic Tiles Market

The Asia-Pacific ceramic tiles market is driven by a confluence of factors. Rapid urbanization across major economies fuels demand for new construction and renovation projects. Rising disposable incomes, particularly in emerging markets, are increasing consumer spending on home improvement and interior design. Technological advancements lead to superior product features, attracting consumers seeking durability and aesthetics. Lastly, government initiatives supporting infrastructure development contribute to higher overall demand.

Challenges Impacting Asia-Pacific Ceramic Tiles Market Growth

Several challenges impact growth. Raw material price volatility creates uncertainty in production costs. Competition from substitutes like vinyl and wood flooring remains substantial. Supply chain complexities and potential disruptions hinder production and distribution efficiency. Moreover, strict environmental regulations necessitate investments in sustainable practices, adding to operational costs.

Key Players Shaping the Asia-Pacific Ceramic Tiles Market

- Crossville Inc

- Grupo Lamsoa

- RAK Ceramics

- Saloni Ceramic SA

- Gruppo Ceramiche Ricchetti SpA

- Del Conca USA

- Mosa

- NITCO

- Porcelanosa Grupo

- Atlas Concorde S P A

- Johnson Tiles

- Florida Tile Inc

- Iris Ceramica

- Siam Cement Group

- Grespania

- Centura Tile Inc

- Mohawk Industries

- Blackstone Industrial (Foshan) Ltd

- Kajaria Ceramics

- China Ceramics Co Ltd

Significant Asia-Pacific Ceramic Tiles Market Industry Milestones

- July 2023: Crossville Inc expands its porcelain portfolio with the launch of its Access Point collection, featuring on-trend concrete, travertine, and white marble visuals. This launch strengthens its position in the premium segment and ensures readily available inventory.

- September 2022: Dongpeng launches an antibacterial ceramic tile range using Microban technology. This highlights the increasing focus on hygiene and health-conscious design in the industry.

- March 2022: Kajaria Ceramics opens its largest store in India, signifying expansion efforts and increased market penetration within the country.

Future Outlook for Asia-Pacific Ceramic Tiles Market

The Asia-Pacific ceramic tiles market is poised for sustained growth, driven by ongoing urbanization, rising disposable incomes, and continuous product innovation. Strategic opportunities exist for manufacturers to capitalize on the increasing demand for sustainable and high-performance tiles. The market's potential is substantial, with significant growth expected across various segments and countries within the region.

Asia-Pacific Ceramic Tiles Market Segmentation

-

1. Product

- 1.1. Glazed

- 1.2. Porcelain

- 1.3. Scratch Free

- 1.4. Others

-

2. Application

- 2.1. Floor Tiles

- 2.2. Wall Tiles

- 2.3. Others

-

3. End-User

- 3.1. Residential Replacement

- 3.2. Commercial

-

4. Construction Type

- 4.1. New Construction

- 4.2. Replacement & Renovation

-

5. Geography

- 5.1. China

- 5.2. Japan

- 5.3. India

- 5.4. South Korea

- 5.5. Australia

- 5.6. Rest of Asia-Pacific

Asia-Pacific Ceramic Tiles Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. South Korea

- 5. Australia

- 6. Rest of Asia Pacific

Asia-Pacific Ceramic Tiles Market Regional Market Share

Geographic Coverage of Asia-Pacific Ceramic Tiles Market

Asia-Pacific Ceramic Tiles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Real-Estate Industry Is Driving The Market; Export of Furniture From UK Is Driving The Market

- 3.3. Market Restrains

- 3.3.1. Fluctuating Price of Raw Materials; Limitations in Supply Chain Restraints The Market Growth

- 3.4. Market Trends

- 3.4.1. China is One of the Leading Producers of Ceramic Tiles in Asia- Pacific Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Glazed

- 5.1.2. Porcelain

- 5.1.3. Scratch Free

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Floor Tiles

- 5.2.2. Wall Tiles

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Residential Replacement

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Construction Type

- 5.4.1. New Construction

- 5.4.2. Replacement & Renovation

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. China

- 5.5.2. Japan

- 5.5.3. India

- 5.5.4. South Korea

- 5.5.5. Australia

- 5.5.6. Rest of Asia-Pacific

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. China

- 5.6.2. Japan

- 5.6.3. India

- 5.6.4. South Korea

- 5.6.5. Australia

- 5.6.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. China Asia-Pacific Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Glazed

- 6.1.2. Porcelain

- 6.1.3. Scratch Free

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Floor Tiles

- 6.2.2. Wall Tiles

- 6.2.3. Others

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Residential Replacement

- 6.3.2. Commercial

- 6.4. Market Analysis, Insights and Forecast - by Construction Type

- 6.4.1. New Construction

- 6.4.2. Replacement & Renovation

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. China

- 6.5.2. Japan

- 6.5.3. India

- 6.5.4. South Korea

- 6.5.5. Australia

- 6.5.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Japan Asia-Pacific Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Glazed

- 7.1.2. Porcelain

- 7.1.3. Scratch Free

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Floor Tiles

- 7.2.2. Wall Tiles

- 7.2.3. Others

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Residential Replacement

- 7.3.2. Commercial

- 7.4. Market Analysis, Insights and Forecast - by Construction Type

- 7.4.1. New Construction

- 7.4.2. Replacement & Renovation

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. China

- 7.5.2. Japan

- 7.5.3. India

- 7.5.4. South Korea

- 7.5.5. Australia

- 7.5.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. India Asia-Pacific Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Glazed

- 8.1.2. Porcelain

- 8.1.3. Scratch Free

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Floor Tiles

- 8.2.2. Wall Tiles

- 8.2.3. Others

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Residential Replacement

- 8.3.2. Commercial

- 8.4. Market Analysis, Insights and Forecast - by Construction Type

- 8.4.1. New Construction

- 8.4.2. Replacement & Renovation

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. China

- 8.5.2. Japan

- 8.5.3. India

- 8.5.4. South Korea

- 8.5.5. Australia

- 8.5.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. South Korea Asia-Pacific Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Glazed

- 9.1.2. Porcelain

- 9.1.3. Scratch Free

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Floor Tiles

- 9.2.2. Wall Tiles

- 9.2.3. Others

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Residential Replacement

- 9.3.2. Commercial

- 9.4. Market Analysis, Insights and Forecast - by Construction Type

- 9.4.1. New Construction

- 9.4.2. Replacement & Renovation

- 9.5. Market Analysis, Insights and Forecast - by Geography

- 9.5.1. China

- 9.5.2. Japan

- 9.5.3. India

- 9.5.4. South Korea

- 9.5.5. Australia

- 9.5.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Australia Asia-Pacific Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Glazed

- 10.1.2. Porcelain

- 10.1.3. Scratch Free

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Floor Tiles

- 10.2.2. Wall Tiles

- 10.2.3. Others

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Residential Replacement

- 10.3.2. Commercial

- 10.4. Market Analysis, Insights and Forecast - by Construction Type

- 10.4.1. New Construction

- 10.4.2. Replacement & Renovation

- 10.5. Market Analysis, Insights and Forecast - by Geography

- 10.5.1. China

- 10.5.2. Japan

- 10.5.3. India

- 10.5.4. South Korea

- 10.5.5. Australia

- 10.5.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Rest of Asia Pacific Asia-Pacific Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product

- 11.1.1. Glazed

- 11.1.2. Porcelain

- 11.1.3. Scratch Free

- 11.1.4. Others

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Floor Tiles

- 11.2.2. Wall Tiles

- 11.2.3. Others

- 11.3. Market Analysis, Insights and Forecast - by End-User

- 11.3.1. Residential Replacement

- 11.3.2. Commercial

- 11.4. Market Analysis, Insights and Forecast - by Construction Type

- 11.4.1. New Construction

- 11.4.2. Replacement & Renovation

- 11.5. Market Analysis, Insights and Forecast - by Geography

- 11.5.1. China

- 11.5.2. Japan

- 11.5.3. India

- 11.5.4. South Korea

- 11.5.5. Australia

- 11.5.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Product

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Crossville Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Grupo Lamsoa

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 RAK Ceramics

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Saloni Ceramic SA

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Gruppo Ceramiche Ricchetti SpA

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Del Conca USA

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Mosa

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 NITCO

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Porcelanosa Grupo

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Atlas Concorde S P A

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Johnson Tiles

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Florida Tile Inc

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Iris Ceramica

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Siam Cement Group

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Grespania

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.16 Centura Tile Inc **List Not Exhaustive

- 12.2.16.1. Overview

- 12.2.16.2. Products

- 12.2.16.3. SWOT Analysis

- 12.2.16.4. Recent Developments

- 12.2.16.5. Financials (Based on Availability)

- 12.2.17 Mohawk Industries

- 12.2.17.1. Overview

- 12.2.17.2. Products

- 12.2.17.3. SWOT Analysis

- 12.2.17.4. Recent Developments

- 12.2.17.5. Financials (Based on Availability)

- 12.2.18 Blackstone Industrial (Foshan) Ltd

- 12.2.18.1. Overview

- 12.2.18.2. Products

- 12.2.18.3. SWOT Analysis

- 12.2.18.4. Recent Developments

- 12.2.18.5. Financials (Based on Availability)

- 12.2.19 Kajaria Ceramics

- 12.2.19.1. Overview

- 12.2.19.2. Products

- 12.2.19.3. SWOT Analysis

- 12.2.19.4. Recent Developments

- 12.2.19.5. Financials (Based on Availability)

- 12.2.20 China Ceramics Co Ltd

- 12.2.20.1. Overview

- 12.2.20.2. Products

- 12.2.20.3. SWOT Analysis

- 12.2.20.4. Recent Developments

- 12.2.20.5. Financials (Based on Availability)

- 12.2.1 Crossville Inc

List of Figures

- Figure 1: Asia-Pacific Ceramic Tiles Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Ceramic Tiles Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 4: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 5: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Product 2020 & 2033

- Table 8: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 10: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 11: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Product 2020 & 2033

- Table 14: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 16: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 17: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Product 2020 & 2033

- Table 20: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Application 2020 & 2033

- Table 21: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 22: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 23: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Product 2020 & 2033

- Table 26: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Application 2020 & 2033

- Table 27: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 28: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 29: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Product 2020 & 2033

- Table 32: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Application 2020 & 2033

- Table 33: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 34: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 35: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 36: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Product 2020 & 2033

- Table 38: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Application 2020 & 2033

- Table 39: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 40: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 41: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 42: Asia-Pacific Ceramic Tiles Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Ceramic Tiles Market?

The projected CAGR is approximately 9.02%.

2. Which companies are prominent players in the Asia-Pacific Ceramic Tiles Market?

Key companies in the market include Crossville Inc, Grupo Lamsoa, RAK Ceramics, Saloni Ceramic SA, Gruppo Ceramiche Ricchetti SpA, Del Conca USA, Mosa, NITCO, Porcelanosa Grupo, Atlas Concorde S P A, Johnson Tiles, Florida Tile Inc, Iris Ceramica, Siam Cement Group, Grespania, Centura Tile Inc **List Not Exhaustive, Mohawk Industries, Blackstone Industrial (Foshan) Ltd, Kajaria Ceramics, China Ceramics Co Ltd.

3. What are the main segments of the Asia-Pacific Ceramic Tiles Market?

The market segments include Product, Application, End-User, Construction Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.59 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Real-Estate Industry Is Driving The Market; Export of Furniture From UK Is Driving The Market.

6. What are the notable trends driving market growth?

China is One of the Leading Producers of Ceramic Tiles in Asia- Pacific Region.

7. Are there any restraints impacting market growth?

Fluctuating Price of Raw Materials; Limitations in Supply Chain Restraints The Market Growth.

8. Can you provide examples of recent developments in the market?

July 2023: Crossville expand its porcelain portfolio with the launch of its Access Point porcelain tile collection. Crossville developed the tile collection offering designers and installers on-trend products, including concrete, travertine and white marble visuals, that will be deeply inventoried and readily available for immediate shipping.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Ceramic Tiles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Ceramic Tiles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Ceramic Tiles Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Ceramic Tiles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence