Key Insights

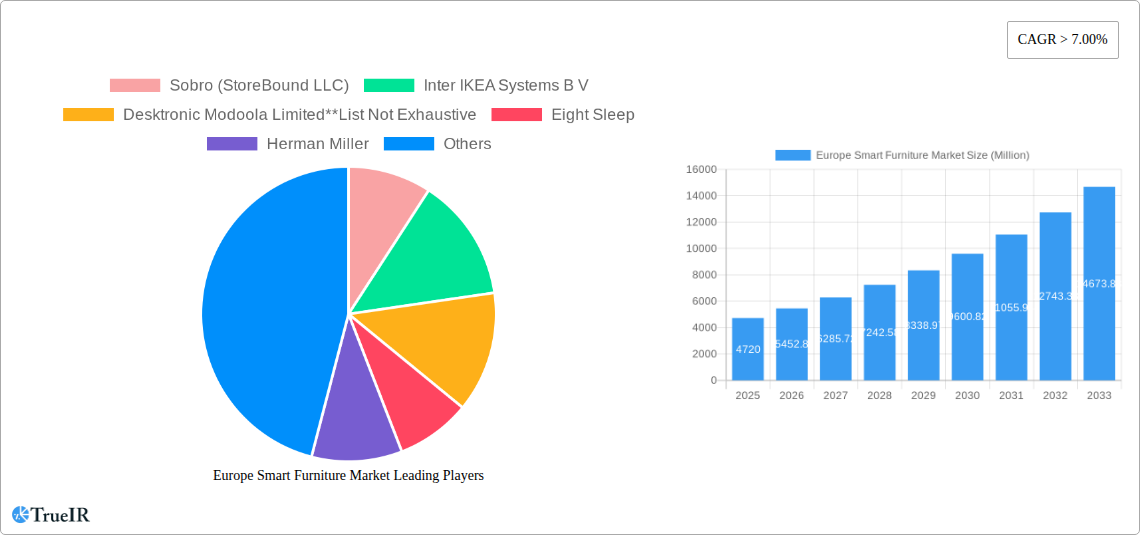

The European smart furniture market is poised for substantial growth, projected to reach $4.72 billion in 2025 and expand at an impressive CAGR of 15.5% throughout the forecast period of 2025-2033. This robust expansion is primarily fueled by increasing consumer demand for integrated technology in their living and working spaces, driven by a growing awareness of comfort, productivity, and well-being. Key segments like smart desks and smart chairs are experiencing significant traction as both residential and commercial consumers embrace the convenience and enhanced functionality offered by these innovative products. The rise of the work-from-home culture has further accelerated the adoption of smart furniture, transforming home offices into more ergonomic and technologically advanced environments. Furthermore, a heightened focus on sustainable living and the integration of IoT (Internet of Things) devices are creating new avenues for smart furniture solutions that cater to evolving lifestyle preferences.

Europe Smart Furniture Market Market Size (In Billion)

The market's upward trajectory is supported by several critical drivers, including rapid technological advancements, leading to more sophisticated and affordable smart furniture options. The increasing disposable income across European households and a strong propensity for adopting new technologies also play a crucial role. While the market enjoys strong growth, potential restraints such as high initial costs for some advanced products and consumer concerns regarding data privacy and security need to be addressed by manufacturers. However, the burgeoning distribution channels, particularly the online segment, are making these products more accessible to a wider audience. Key players like IKEA, Herman Miller, and Steelcase are actively investing in research and development, introducing innovative products that integrate seamlessly with smart home ecosystems, further solidifying the market's growth potential. Emerging trends like personalized comfort settings, integrated charging solutions, and space-saving designs are set to redefine the European smart furniture landscape.

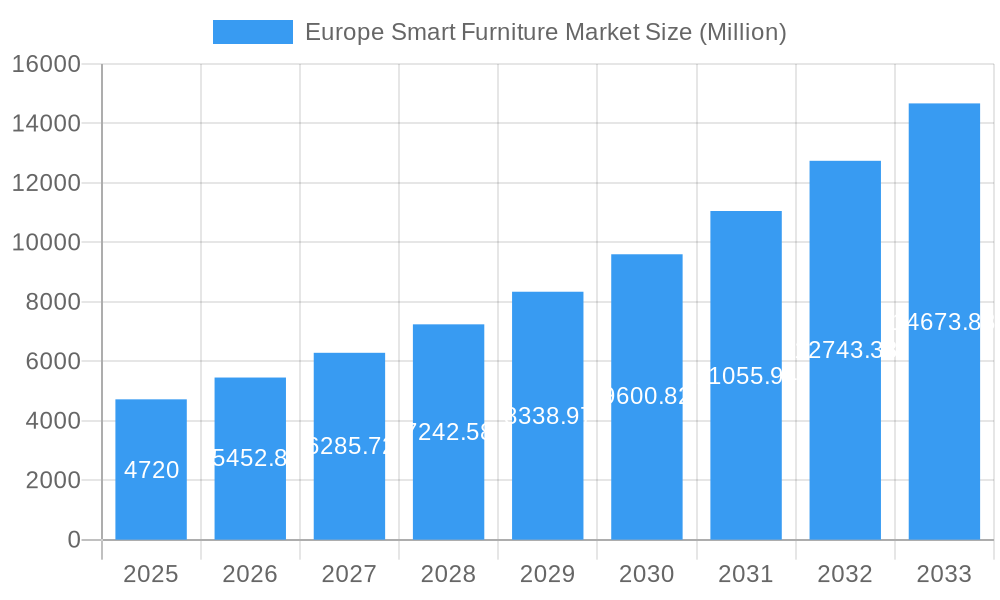

Europe Smart Furniture Market Company Market Share

This comprehensive report offers an in-depth analysis of the Europe smart furniture market, a rapidly evolving sector driven by increasing demand for connected, adaptive, and user-centric home and office environments. Explore the projected market value, estimated at over $10 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of XX% anticipated between 2025 and 2033. This study delves into the intricate market structure, key growth drivers, emerging trends, dominant segments, and competitive landscape, providing actionable insights for stakeholders navigating this dynamic industry. The Europe smart furniture market report covers the historical period from 2019 to 2024 and forecasts market performance through 2033, with the base and estimated year set for 2025.

Europe Smart Furniture Market Market Structure & Competitive Landscape

The Europe smart furniture market exhibits a moderately concentrated structure, characterized by the presence of both established furniture giants and agile, innovation-driven startups. Innovation remains a paramount driver, with companies continuously investing in R&D to integrate advanced technologies such as IoT, AI, and advanced materials into their product offerings. Regulatory impacts are minimal, with no significant industry-specific mandates currently hindering growth, although evolving data privacy regulations related to connected devices will require ongoing attention. Product substitutes, while present in the form of traditional furniture, are increasingly being overshadowed by the unique value proposition of smart furniture, particularly in terms of enhanced functionality and user experience. The end-user segmentation is crucial, with both residential and commercial sectors demonstrating strong adoption. Mergers & Acquisitions (M&A) are expected to play a significant role in market consolidation and expansion, as larger players seek to acquire innovative technologies and expand their market reach. For instance, the June 2021 merger forming Alpagroup signals the trend towards consolidation. The market concentration ratio is estimated to be around XX% for the top 5 players in 2025.

Europe Smart Furniture Market Market Trends & Opportunities

The Europe smart furniture market is poised for significant expansion, projected to grow from an estimated $10 billion in 2025 to over $XX billion by 2033, driven by a CAGR of XX%. This growth is fueled by several key technological shifts and evolving consumer preferences. The increasing adoption of smart home ecosystems and the demand for seamless integration of devices are creating substantial opportunities for smart furniture manufacturers. Consumers are increasingly seeking furniture that offers more than just aesthetic appeal; they desire functionality that enhances productivity, well-being, and convenience. This includes features like integrated charging ports, adjustable height settings for ergonomic benefits, ambient lighting controls, and even built-in entertainment systems. The rise of remote work and flexible office setups further bolsters the demand for smart desks and smart chairs that promote healthier work habits and enhance productivity in home offices and collaborative workspaces. Opportunities also lie in the growing awareness of health and wellness, leading to the development of smart beds with sleep tracking and personalized comfort settings. The expansion of the online distribution channel is democratizing access to these innovative products, allowing smaller players to reach a wider audience. The market penetration rate of smart furniture is expected to reach XX% by 2033, indicating a substantial shift in consumer purchasing habits. The competitive dynamics are intensifying, with companies differentiating themselves through unique features, intuitive user interfaces, and sustainable design practices. The development of interoperable platforms and open-source solutions will also be crucial for fostering wider adoption and creating a more connected smart furniture ecosystem.

Dominant Markets & Segments in Europe Smart Furniture Market

The smart desks segment is anticipated to dominate the Europe smart furniture market, driven by the surge in remote work and the increasing need for ergonomic and productive home office setups. This segment is projected to capture over XX% of the market share by 2033. The residential end-user segment is the primary growth engine, accounting for an estimated XX% of the market in 2025, owing to increasing disposable incomes and a growing preference for smart home integration. The online distribution channel is emerging as a significant force, expected to grow at a CAGR of XX% during the forecast period, facilitated by e-commerce penetration and the convenience it offers to consumers seeking specialized smart furniture products. Key growth drivers in this segment include:

- Technological Advancements: Continuous innovation in IoT, sensor technology, and smart connectivity enables more sophisticated features in smart desks, such as automated height adjustments, posture correction reminders, and integrated workspace management systems.

- Ergonomic and Health Consciousness: A growing emphasis on employee well-being and preventing work-related musculoskeletal disorders is driving demand for adjustable and health-monitoring smart desks, particularly in commercial settings and home offices.

- Smart Home Integration: The increasing adoption of smart home ecosystems creates a natural demand for furniture that can seamlessly integrate with other connected devices, offering a unified and convenient user experience.

- Urbanization and Smaller Living Spaces: In densely populated urban areas, multifunctional smart furniture that optimizes space utilization and offers integrated technology is becoming increasingly attractive for residential consumers.

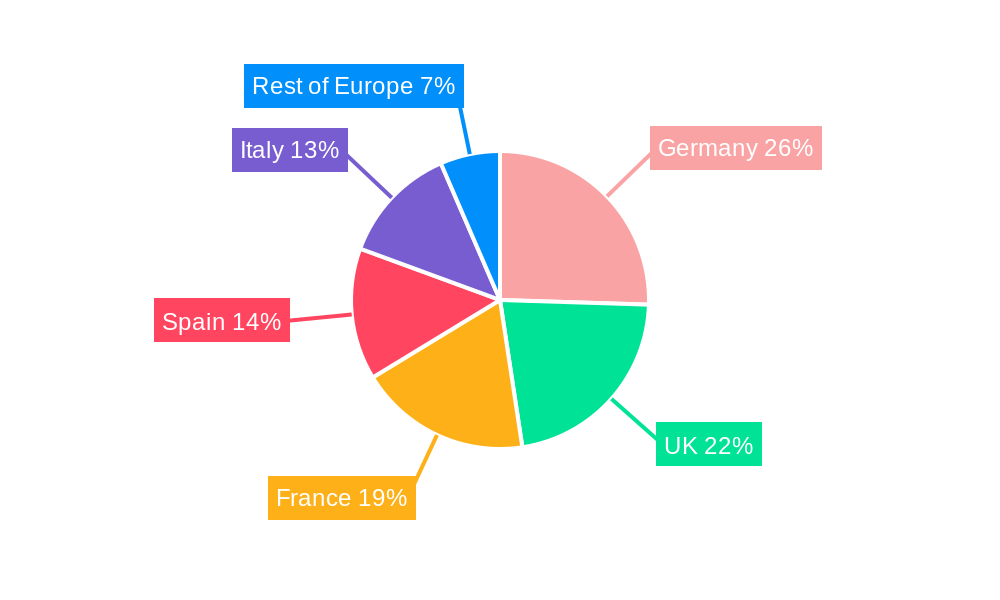

The commercial end-user segment, encompassing offices, co-working spaces, and hospitality, also presents significant growth potential, driven by the need for flexible and adaptable workspaces that cater to modern work dynamics. Policies promoting flexible work arrangements and investments in smart building technologies further bolster this segment's growth. Germany, with its strong industrial base and high disposable incomes, is expected to be a leading country in smart furniture adoption within Europe.

Europe Smart Furniture Market Product Analysis

The Europe smart furniture market is witnessing a wave of product innovations, with smart desks leading the charge. These desks are evolving beyond simple adjustable height features to incorporate advanced functionalities like integrated wireless charging, posture sensors, ambient lighting, and even built-in display screens. Smart chairs are also gaining traction, offering ergonomic adjustments, health monitoring capabilities, and integration with productivity software. While smart tables are still in their nascent stages, they are expected to see growth with the integration of interactive surfaces and charging capabilities. The competitive advantage for manufacturers lies in their ability to seamlessly blend technology with aesthetics and functionality, creating intuitive user experiences.

Key Drivers, Barriers & Challenges in Europe Smart Furniture Market

Key Drivers: The Europe smart furniture market is propelled by several significant factors. Technologically, the widespread adoption of IoT and AI allows for sophisticated features like voice control, automation, and personalized settings. Economically, rising disposable incomes and a growing demand for enhanced living and working experiences are key. Policy-driven factors, such as government initiatives promoting smart cities and sustainable living, indirectly support the market.

Barriers & Challenges: Supply chain complexities and the high cost of advanced components can pose significant restraints. Regulatory hurdles related to data security and privacy for connected devices require careful navigation. Intense competitive pressures from both established and new entrants necessitate continuous innovation and competitive pricing strategies. The initial investment cost for smart furniture can also be a barrier for some consumer segments.

Growth Drivers in the Europe Smart Furniture Market Market

Key drivers fueling the Europe smart furniture market include the burgeoning demand for integrated smart home ecosystems and the increasing adoption of remote and hybrid work models, necessitating ergonomic and technologically advanced workspaces. Economic growth, coupled with rising disposable incomes, allows consumers to invest in premium, feature-rich furniture. Furthermore, technological advancements in sensors, AI, and connectivity are enabling the creation of furniture with enhanced functionality, automation, and personalization. Government initiatives promoting digitalization and sustainable living also indirectly contribute to market expansion.

Challenges Impacting Europe Smart Furniture Market Growth

Despite robust growth potential, the Europe smart furniture market faces several challenges. The high initial cost of smart furniture compared to conventional alternatives can be a significant barrier for widespread adoption, particularly in price-sensitive markets. Navigating complex regulatory landscapes concerning data privacy and cybersecurity for connected devices requires diligent compliance efforts. Supply chain disruptions and the increasing cost of raw materials and electronic components can impact production timelines and profitability. Intense competition from both established furniture brands venturing into the smart space and specialized tech companies necessitates continuous innovation and effective differentiation strategies.

Key Players Shaping the Europe Smart Furniture Market Market

- Sobro (StoreBound LLC)

- Inter IKEA Systems B V

- Desktronic

- Modoola Limited

- Eight Sleep

- Herman Miller

- Steelcase

- Hi-Interiors

- Nitz Engineering Srl

- Srl Fonesalesman Ltd

- Sleep Number Corporation

Significant Europe Smart Furniture Market Industry Milestones

- September 2021: Bachmann announced their innovation in wireless workstations, aiming to revolutionize the future of work. This was showcased at the SICAM event.

- June 2021: The P3G Group and Alsapan agreed to merge, forming Alpagroup, a European furniture powerhouse.

Future Outlook for Europe Smart Furniture Market Market

The future outlook for the Europe smart furniture market is exceptionally promising, driven by the persistent integration of technology into daily life and the evolving demands of consumers. The market is projected to witness sustained growth, fueled by continuous innovation in areas such as AI-powered personalization, advanced health monitoring features, and seamless integration with smart home ecosystems. Strategic opportunities lie in the development of more affordable and accessible smart furniture options, catering to a wider demographic. Furthermore, the increasing focus on sustainability and eco-friendly materials within smart furniture design will also be a key growth catalyst. The market is expected to witness greater collaboration between technology providers and furniture manufacturers, fostering a more connected and intelligent living and working environment across Europe.

Europe Smart Furniture Market Segmentation

-

1. Product

- 1.1. Smart Desks

- 1.2. Smart Tables

- 1.3. Smart Chairs

- 1.4. Others

-

2. End User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Home Centers

- 3.2. Specialty Stores

- 3.3. Online

- 3.4. Other Distribution Channels

Europe Smart Furniture Market Segmentation By Geography

- 1. Germany

- 2. UK

- 3. France

- 4. Spain

- 5. Italy

- 6. Rest of Europe

Europe Smart Furniture Market Regional Market Share

Geographic Coverage of Europe Smart Furniture Market

Europe Smart Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in E-commerce is Driving the Market; Rise in Construction and Real Estate Sector Drives the Furniture Market

- 3.3. Market Restrains

- 3.3.1. Economic Fluctuations; High Competition in the Furniture Market

- 3.4. Market Trends

- 3.4.1. Home Automation Aiding the Smart Furniture Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Smart Furniture Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Smart Desks

- 5.1.2. Smart Tables

- 5.1.3. Smart Chairs

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Home Centers

- 5.3.2. Specialty Stores

- 5.3.3. Online

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. UK

- 5.4.3. France

- 5.4.4. Spain

- 5.4.5. Italy

- 5.4.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Germany Europe Smart Furniture Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Smart Desks

- 6.1.2. Smart Tables

- 6.1.3. Smart Chairs

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Home Centers

- 6.3.2. Specialty Stores

- 6.3.3. Online

- 6.3.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. UK Europe Smart Furniture Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Smart Desks

- 7.1.2. Smart Tables

- 7.1.3. Smart Chairs

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Home Centers

- 7.3.2. Specialty Stores

- 7.3.3. Online

- 7.3.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. France Europe Smart Furniture Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Smart Desks

- 8.1.2. Smart Tables

- 8.1.3. Smart Chairs

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Home Centers

- 8.3.2. Specialty Stores

- 8.3.3. Online

- 8.3.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Spain Europe Smart Furniture Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Smart Desks

- 9.1.2. Smart Tables

- 9.1.3. Smart Chairs

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Home Centers

- 9.3.2. Specialty Stores

- 9.3.3. Online

- 9.3.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Italy Europe Smart Furniture Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Smart Desks

- 10.1.2. Smart Tables

- 10.1.3. Smart Chairs

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Home Centers

- 10.3.2. Specialty Stores

- 10.3.3. Online

- 10.3.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Rest of Europe Europe Smart Furniture Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product

- 11.1.1. Smart Desks

- 11.1.2. Smart Tables

- 11.1.3. Smart Chairs

- 11.1.4. Others

- 11.2. Market Analysis, Insights and Forecast - by End User

- 11.2.1. Residential

- 11.2.2. Commercial

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. Home Centers

- 11.3.2. Specialty Stores

- 11.3.3. Online

- 11.3.4. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Product

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Sobro (StoreBound LLC)

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Inter IKEA Systems B V

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Desktronic Modoola Limited**List Not Exhaustive

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Eight Sleep

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Herman Miller

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Steel Case

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Hi-Interiors

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Nitz Engineering Srl

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Srl Fonesalesman Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Sleep Number Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Sobro (StoreBound LLC)

List of Figures

- Figure 1: Europe Smart Furniture Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe Smart Furniture Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Smart Furniture Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 2: Europe Smart Furniture Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Europe Smart Furniture Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 4: Europe Smart Furniture Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Europe Smart Furniture Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 6: Europe Smart Furniture Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 7: Europe Smart Furniture Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 8: Europe Smart Furniture Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Europe Smart Furniture Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 10: Europe Smart Furniture Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 11: Europe Smart Furniture Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 12: Europe Smart Furniture Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Europe Smart Furniture Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 14: Europe Smart Furniture Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 15: Europe Smart Furniture Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 16: Europe Smart Furniture Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Europe Smart Furniture Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 18: Europe Smart Furniture Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 19: Europe Smart Furniture Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 20: Europe Smart Furniture Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Europe Smart Furniture Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 22: Europe Smart Furniture Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 23: Europe Smart Furniture Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 24: Europe Smart Furniture Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: Europe Smart Furniture Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 26: Europe Smart Furniture Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 27: Europe Smart Furniture Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 28: Europe Smart Furniture Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Smart Furniture Market?

The projected CAGR is approximately 15.5%.

2. Which companies are prominent players in the Europe Smart Furniture Market?

Key companies in the market include Sobro (StoreBound LLC), Inter IKEA Systems B V, Desktronic Modoola Limited**List Not Exhaustive, Eight Sleep, Herman Miller, Steel Case, Hi-Interiors, Nitz Engineering Srl, Srl Fonesalesman Ltd, Sleep Number Corporation.

3. What are the main segments of the Europe Smart Furniture Market?

The market segments include Product , End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rise in E-commerce is Driving the Market; Rise in Construction and Real Estate Sector Drives the Furniture Market.

6. What are the notable trends driving market growth?

Home Automation Aiding the Smart Furniture Market Growth.

7. Are there any restraints impacting market growth?

Economic Fluctuations; High Competition in the Furniture Market.

8. Can you provide examples of recent developments in the market?

On 15th September 2021, Bachmann announced their innovation in the form of wireless workstation, which can be flexibly positioned wherever it is needed. With this innovation, Bachmann aims to revolutionize the future of the world of work.The statement was made at the SICAM event in Pordenone, Italy, which was the annual gathering of the world's leading manufacturers of furniture accessories, semi-finished goods, and components.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Smart Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Smart Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Smart Furniture Market?

To stay informed about further developments, trends, and reports in the Europe Smart Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence