Key Insights

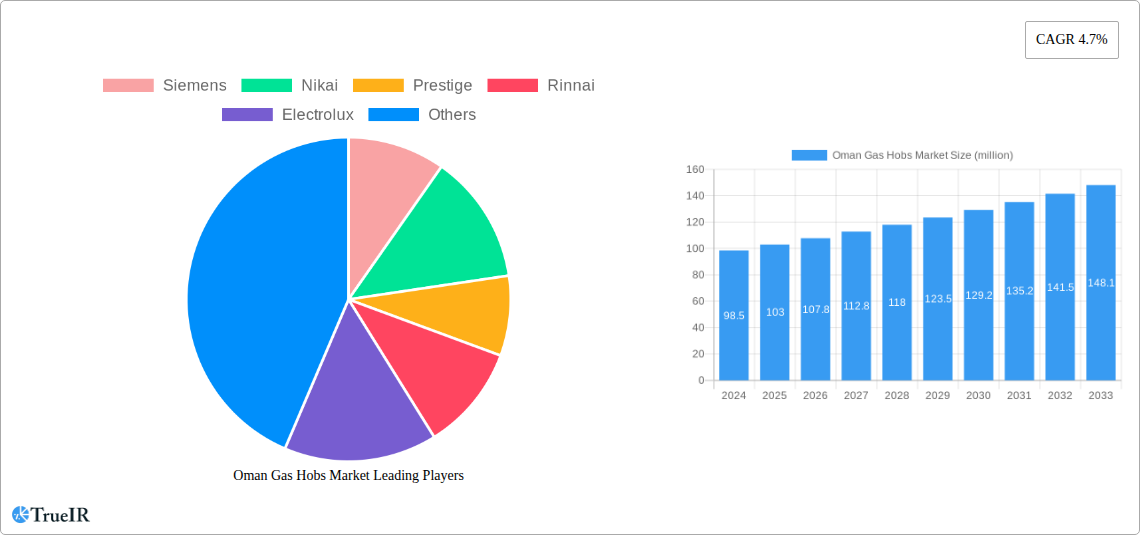

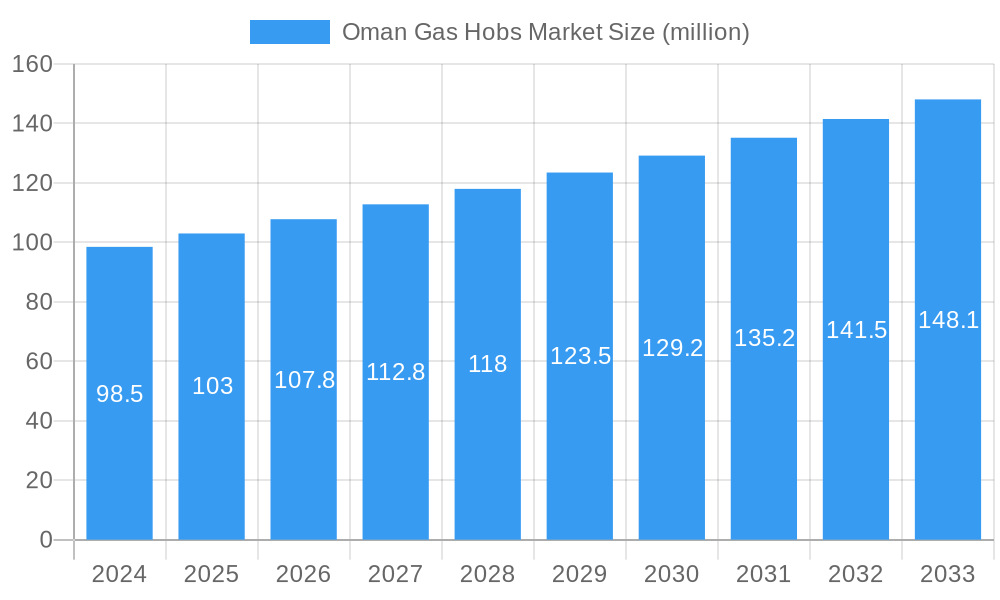

The Oman Gas Hobs Market is poised for significant growth, with an estimated market size of approximately 98.5 million USD in 2024. This expansion is driven by a burgeoning demand for convenient and efficient cooking solutions within both household and commercial sectors. Factors such as increasing disposable incomes, a rising awareness of energy-efficient appliances, and evolving lifestyle preferences are contributing to this upward trajectory. The market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 4.7% from 2025 to 2033, indicating a robust and sustained expansion. Key market drivers include government initiatives promoting modern kitchen infrastructure, a growing expatriate population with diverse cooking needs, and the increasing popularity of modern kitchen designs that favor integrated gas hob solutions. The availability of a wide range of product types, including both freestanding and built-in gas hobs, caters to diverse consumer preferences and installation requirements across Oman.

Oman Gas Hobs Market Market Size (In Million)

The market segmentation reveals a balanced demand across different end-users, with both household and commercial establishments contributing to sales volume. The distribution channels are also diversifying, with a notable increase in online sales alongside traditional offline retail networks. This omnichannel approach is crucial for reaching a broader customer base. Leading companies like Siemens, Rinnai, Electrolux, and Bosch are actively engaged in the Omani market, introducing innovative products and competitive pricing strategies. While the market is generally positive, potential restraints such as the increasing adoption of electric and induction hobs in some segments, and the initial cost associated with certain advanced gas hob models, need to be considered. However, the inherent advantages of gas cooking, including precise temperature control and faster heating, are expected to maintain its strong position in Oman's culinary landscape.

Oman Gas Hobs Market Company Market Share

Here's a dynamic, SEO-optimized report description for the Oman Gas Hobs Market, designed for immediate use:

Oman Gas Hobs Market Size, Share, Trends, Growth & Forecast 2024-2033 | Key Players Analysis

Gain comprehensive insights into the Oman Gas Hobs Market with this in-depth report, covering market structure, competitive landscape, trends, opportunities, segmentation, product analysis, drivers, challenges, key players, industry milestones, and future outlook. This report offers an unparalleled understanding of the Oman gas hob market, exploring its evolution from 2019 to 2033, with a base year of 2025 and a detailed forecast for 2025-2033.

Oman Gas Hobs Market Market Structure & Competitive Landscape

The Oman gas hobs market exhibits a moderate to high level of concentration, with key players like Siemens, Nikai, Prestige, Rinnai, Electrolux, Haier, Sonashi, Bosch, Simfer, and Candy Home Appliances vying for market share. Innovation drivers are primarily focused on energy efficiency, enhanced safety features, and aesthetic designs that cater to modern kitchen aesthetics. Regulatory impacts, while generally supportive of consumer safety, can influence product development cycles and manufacturing standards. Product substitutes, such as electric hobs and induction cooktops, present a competitive threat, though gas hobs retain their appeal due to perceived cost-effectiveness and cooking performance. End-user segmentation reveals a strong demand from the household sector, with a growing influence of the commercial segment driven by the hospitality industry's expansion. Mergers and acquisitions (M&A) activity, while not extensive in recent history, could shape future market dynamics as established players seek to consolidate their positions or new entrants aim for market penetration. Concentration ratios are estimated to be around 60%, indicating a significant market share held by the top five players. M&A volumes have been modest, with an estimated 1-2 significant deals in the historical period (2019-2024).

Oman Gas Hobs Market Market Trends & Opportunities

The Oman gas hobs market is poised for significant growth, driven by a confluence of economic development, increasing disposable incomes, and a burgeoning expatriate population that often favors traditional cooking methods. The market size is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 5.5% over the forecast period (2025-2033), reaching an estimated value of $350 million by 2033. Technological shifts are evident in the increasing adoption of advanced safety mechanisms, such as flame failure devices and auto-ignition systems, enhancing user convenience and security. Consumer preferences are leaning towards sleeker, more integrated designs that align with contemporary kitchen interiors, leading to a greater demand for embedded gas hobs. The competitive dynamics are characterized by a blend of international brands and local distributors, each leveraging different strategies to capture market share. Opportunities lie in the premium segment, offering technologically advanced and aesthetically superior gas hobs, as well as in catering to the growing demand for energy-efficient models. Furthermore, the expansion of the hospitality sector presents a substantial opportunity for commercial-grade gas hobs. Market penetration rates for gas hobs in Oman currently stand at an estimated 70% in urban households.

Dominant Markets & Segments in Oman Gas Hobs Market

Within the Oman Gas Hobs Market, the Embedded Gas Hobs segment is emerging as the dominant force, projected to capture over 60% of the market share by 2033. This dominance is fueled by evolving consumer preferences for modern, built-in kitchen designs and a growing number of new residential constructions and kitchen renovations that prioritize integrated appliances. The Household end-user segment continues to be the largest revenue generator, accounting for approximately 85% of the market, driven by consistent demand from a growing population and changing lifestyle choices that emphasize home cooking.

- Product Type Dominance: Embedded Gas Hobs are increasingly favored over Desktop Gas Hobs due to their seamless integration into countertops, offering a cleaner and more sophisticated aesthetic.

- End-User Dominance: The Household segment benefits from factors such as increasing nuclear families, rising disposable incomes, and a growing emphasis on kitchen as the heart of the home.

- Distribution Channel Dynamics: The Offline distribution channel, encompassing traditional retail stores and showrooms, still holds a significant majority of the market share (estimated 75%). However, the Online channel is experiencing rapid growth, projected to increase its share to 25% by 2033, driven by e-commerce convenience and wider product availability.

Key growth drivers for embedded gas hobs include advanced features like tempered glass surfaces, touch controls, and multiple burner configurations, which enhance both functionality and visual appeal. Infrastructure development, particularly in the real estate sector, plays a crucial role in dictating the adoption rates of built-in appliances. Government policies promoting modern housing standards also indirectly support the growth of the embedded gas hob segment.

Oman Gas Hobs Market Product Analysis

Product innovation in the Oman gas hobs market is centered on enhancing user experience and safety. Leading manufacturers are introducing hobs with advanced features such as high-efficiency burners for faster cooking and reduced gas consumption, integrated flame failure safety devices, and user-friendly auto-ignition systems. Tempered glass finishes are becoming increasingly popular for their durability and aesthetic appeal, complementing modern kitchen designs. Competitive advantages are being carved out through a combination of superior build quality, innovative functionalities, and appealing designs that cater to diverse consumer needs, from basic functionality to premium, feature-rich appliances. The market fit is strong, as gas hobs continue to be the preferred cooking appliance for a significant portion of the Omani population due to their reliability and performance.

Key Drivers, Barriers & Challenges in Oman Gas Hobs Market

The Oman Gas Hobs Market is propelled by several key drivers. Technological advancements, such as the introduction of more energy-efficient burners and sophisticated safety features, are enhancing product appeal and functionality. Economic growth in Oman, leading to increased disposable incomes, directly translates to higher consumer spending on home appliances. Government initiatives aimed at boosting the real estate sector and promoting modern living standards also indirectly fuel demand.

Conversely, the market faces several barriers and challenges. While not overly restrictive, regulatory compliance regarding safety standards can influence product design and costs. Supply chain disruptions, particularly for imported components or finished goods, can impact product availability and pricing. Intense competitive pressures from both international and domestic brands, coupled with price sensitivity in certain consumer segments, can affect profit margins.

Growth Drivers in the Oman Gas Hobs Market Market

The Oman Gas Hobs Market is experiencing robust growth driven by several key factors. Technological innovations, such as the integration of advanced safety features like flame failure shut-off and precise temperature control, are making gas hobs more attractive to consumers. Economic prosperity in Oman, characterized by rising per capita income and a growing expatriate population with a preference for traditional cooking methods, significantly boosts demand. Furthermore, government support for infrastructure development, including new housing projects and commercial establishments like hotels and restaurants, creates a steady demand for kitchen appliances, including gas hobs.

Challenges Impacting Oman Gas Hobs Market Growth

Despite positive growth trajectories, the Oman Gas Hobs Market faces certain challenges that impact its expansion. Regulatory complexities, though generally supportive, can sometimes lead to longer product approval cycles and increased compliance costs for manufacturers. Vulnerabilities in the global and local supply chains, including potential shipping delays and component shortages, can disrupt product availability and inflate prices. Intense competitive pressures from a multitude of brands, both established and emerging, often lead to price wars and a squeeze on profit margins, particularly in the mid-range and budget segments of the market.

Key Players Shaping the Oman Gas Hobs Market Market

- Siemens

- Nikai

- Prestige

- Rinnai

- Electrolux

- Haier

- Sonashi

- Bosch

- Simfer

- Candy Home Appliances

Significant Oman Gas Hobs Market Industry Milestones

- 2022: Jashanmal, continuing its 100-year legacy, opened its first department store in Oman, showcasing a wide array of world-class brands including De Longhi, Kenwood, Nespresso, Blendtec, Jura, Hoover, and Bertazzoni, impacting the retail landscape for kitchen appliances.

- 2020: Muscat Kitchen Appliances was established, quickly rising to become a market leader in Oman's kitchen appliance sector, serving as the sole distributor for prominent European brands like Gorenje, Carysil, Fiesta, and Nsk.

Future Outlook for Oman Gas Hobs Market Market

The future outlook for the Oman Gas Hobs Market is exceptionally promising, driven by sustained economic development and evolving consumer lifestyles. The increasing emphasis on modern kitchen designs will continue to favor embedded gas hobs, while technological advancements focusing on energy efficiency and enhanced safety will cater to a discerning consumer base. The expansion of the tourism and hospitality sectors will create a consistent demand for commercial-grade gas hobs. Strategic opportunities lie in leveraging digital platforms for broader market reach and offering premium product lines that combine sophisticated aesthetics with cutting-edge functionality. The market is expected to witness steady growth, with innovation and consumer-centric offerings being key determinants of success.

Oman Gas Hobs Market Segmentation

-

1. Product Type

- 1.1. Desktop Gas Hobs

- 1.2. Embedded Gas Hobs

-

2. End User

- 2.1. Household

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Online

- 3.2. Offline

Oman Gas Hobs Market Segmentation By Geography

- 1. Oman

Oman Gas Hobs Market Regional Market Share

Geographic Coverage of Oman Gas Hobs Market

Oman Gas Hobs Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in the Tech-Savvy Millennial Population; Increasing Purchasing Power and Rising Disposable Incomes

- 3.3. Market Restrains

- 3.3.1. Risk of Malware Attacks; Higher Cost of Maintenance4.3.2.1; Market Opportunities4.; Technological Advancements in Smart Fridges

- 3.4. Market Trends

- 3.4.1. Rising Disposable Income is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman Gas Hobs Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Desktop Gas Hobs

- 5.1.2. Embedded Gas Hobs

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Household

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Siemens

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nikai

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Prestige

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rinnai

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Electrolux

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Haier

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sonashi

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bosch

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Simfer

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Candy Home Appliances

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Siemens

List of Figures

- Figure 1: Oman Gas Hobs Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Oman Gas Hobs Market Share (%) by Company 2025

List of Tables

- Table 1: Oman Gas Hobs Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Oman Gas Hobs Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Oman Gas Hobs Market Revenue million Forecast, by End User 2020 & 2033

- Table 4: Oman Gas Hobs Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 5: Oman Gas Hobs Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Oman Gas Hobs Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: Oman Gas Hobs Market Revenue million Forecast, by Region 2020 & 2033

- Table 8: Oman Gas Hobs Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Oman Gas Hobs Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 10: Oman Gas Hobs Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 11: Oman Gas Hobs Market Revenue million Forecast, by End User 2020 & 2033

- Table 12: Oman Gas Hobs Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 13: Oman Gas Hobs Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Oman Gas Hobs Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: Oman Gas Hobs Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Oman Gas Hobs Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman Gas Hobs Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the Oman Gas Hobs Market?

Key companies in the market include Siemens, Nikai, Prestige, Rinnai, Electrolux, Haier, Sonashi, Bosch, Simfer, Candy Home Appliances.

3. What are the main segments of the Oman Gas Hobs Market?

The market segments include Product Type, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 98.5 million as of 2022.

5. What are some drivers contributing to market growth?

Growth in the Tech-Savvy Millennial Population; Increasing Purchasing Power and Rising Disposable Incomes.

6. What are the notable trends driving market growth?

Rising Disposable Income is Driving the Market.

7. Are there any restraints impacting market growth?

Risk of Malware Attacks; Higher Cost of Maintenance4.3.2.1; Market Opportunities4.; Technological Advancements in Smart Fridges.

8. Can you provide examples of recent developments in the market?

2022 - Jashanmal, carrying its 100-year legacy of trust and quality, announced the opening of its first department store in Oman, bringing some of the world's best brands under one roof. Jashanmal is retailing many leading, bestselling brands like De Longhi, Kenwood, Nespresso, Blendtec, Jura, Hoover, and Bertazzoni.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman Gas Hobs Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman Gas Hobs Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman Gas Hobs Market?

To stay informed about further developments, trends, and reports in the Oman Gas Hobs Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence