Key Insights

The global institutional furniture market is projected to experience robust growth, reaching a market size of 264.98 billion by 2025. This expansion is driven by a significant CAGR of 7.4%. Key growth catalysts include escalating investments in educational infrastructure, modernization of public spaces such as libraries and theaters, and the increasing demand for durable, functional furniture solutions across diverse institutional settings. Government initiatives focused on enhancing educational facilities, the requirement for ergonomic and aesthetically pleasing furniture in healthcare and corporate environments, and a rising trend toward flexible, adaptable furniture designs are pivotal drivers. Advancements in manufacturing technology are also contributing to more sustainable and cost-effective production.

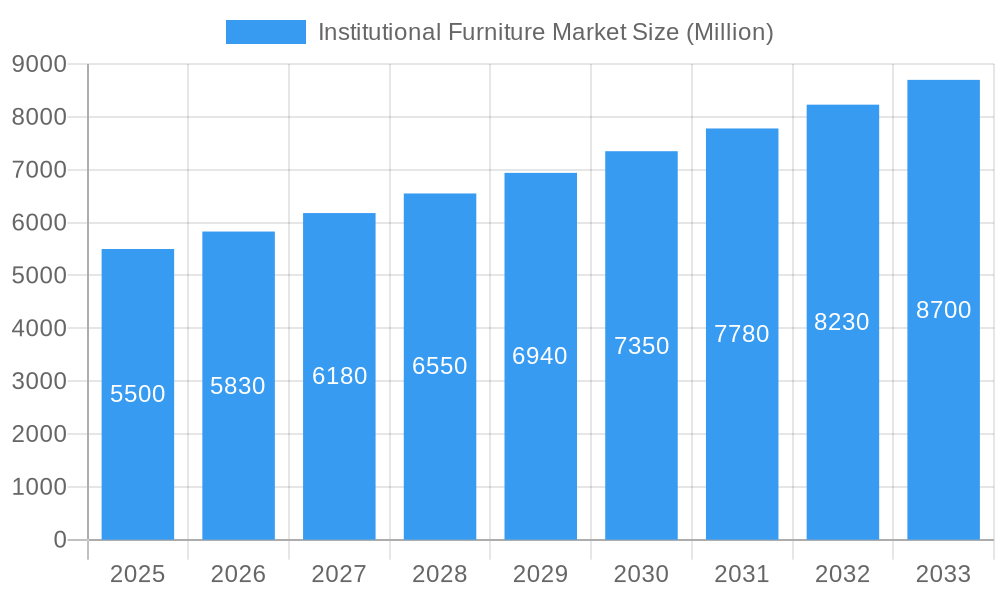

Institutional Furniture Market Market Size (In Billion)

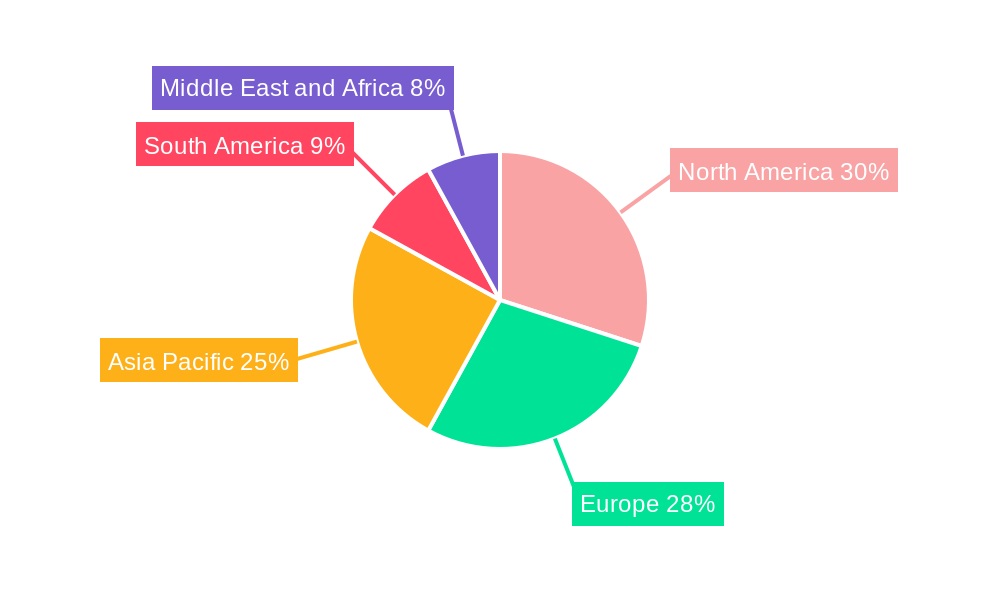

Market segmentation highlights substantial opportunities across furniture types, end-users, and distribution channels. The "Metal" and "Wood" segments are expected to dominate revenue due to their inherent durability and widespread adoption. "Schools" and "Libraries" are identified as major revenue contributors, driven by ongoing upgrades and expansion projects. The "Online" distribution channel is rapidly gaining prominence, offering convenience and expanded reach, though "Supermarkets & Hypermarkets" and "Specialty Stores" will remain important. Geographically, "North America" and "Europe" are anticipated to maintain market leadership, while the "Asia Pacific" region presents the highest growth potential, fueled by rapid urbanization and increasing disposable incomes. Despite challenges like fluctuating raw material prices and intense competition, the overall market dynamics indicate sustained growth for the institutional furniture sector.

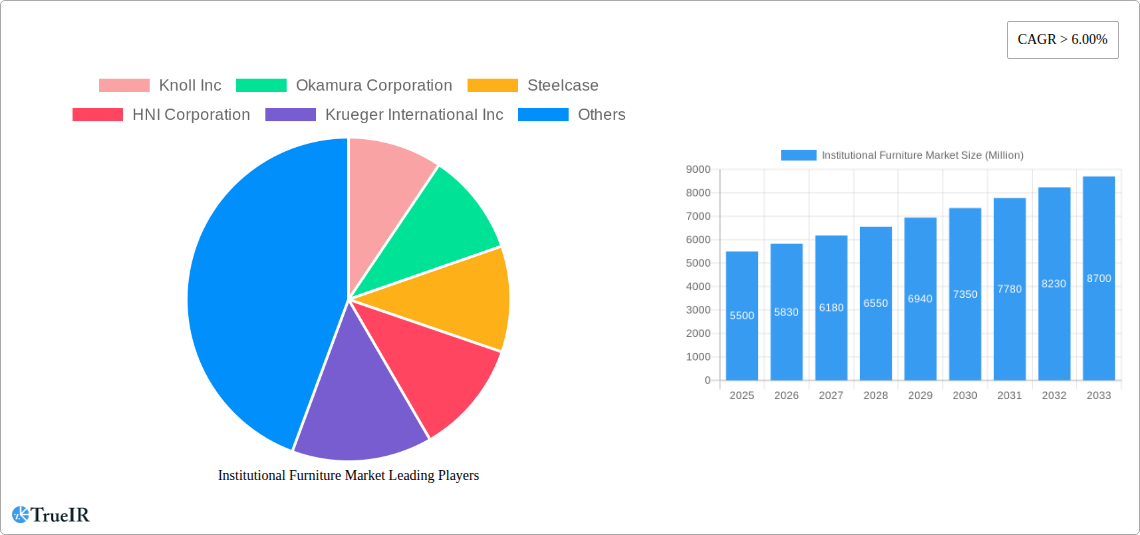

Institutional Furniture Market Company Market Share

This comprehensive report offers a dynamic, SEO-optimized analysis of the Institutional Furniture Market, providing clarity, engagement, and enhanced search engine visibility.

Institutional Furniture Market Analysis & Forecast: 2025–2033

Gain critical insights into the global Institutional Furniture Market with this in-depth analysis. Covering the forecast period through 2033, this report provides a definitive roadmap for stakeholders. It examines market dynamics, explores emerging trends, identifies lucrative opportunities, and details the competitive landscape, delivering strategic intelligence for this evolving sector. This report utilizes high-volume keywords such as "institutional furniture," "commercial furniture," "education furniture," "library furniture," "church furniture," "theater seating," "workplace furniture," and "office furniture solutions" to maximize search visibility and industry professional engagement.

Institutional Furniture Market Market Structure & Competitive Landscape

The Institutional Furniture Market exhibits a moderately concentrated structure, with key players like Steelcase, Herman Miller Inc., Haworth, Knoll Inc., and Okamura Corporation holding significant market shares. The concentration ratio is estimated at XX% for the top 5 players in the base year 2025. Innovation drivers are primarily fueled by the demand for ergonomic, sustainable, and adaptable furniture solutions across educational institutions, healthcare facilities, corporate offices, and public spaces. Regulatory impacts, particularly those concerning safety standards, environmental certifications (e.g., LEED), and accessibility, play a crucial role in product development and market entry. Product substitutes, such as modular furniture systems and reconfigurable spaces, are increasingly challenging traditional offerings, particularly in dynamic work and learning environments. End-user segmentation analysis reveals distinct preferences and requirements for schools, libraries, churches, and theaters, each necessitating specialized designs and functionalities. Merger and Acquisition (M&A) trends are active, with notable activity seen in consolidating market presence and expanding product portfolios. For instance, the June 2023 acquisition of Kimball International Inc. by HNI Corporation underscores a strategic move to enhance scale and broaden offerings, creating a market leader with proforma revenue of approximately USD 3 billion. This consolidation aims to leverage synergies and capture a larger share of the institutional furniture market.

Institutional Furniture Market Market Trends & Opportunities

The Institutional Furniture Market is poised for substantial growth, with an estimated market size projected to reach USD XXX Million by 2033, expanding from USD XX Million in the base year 2025. This growth trajectory is underpinned by a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025–2033. Technological shifts are revolutionizing the sector, with an increasing integration of smart features in furniture, such as built-in charging ports, adjustable height desks, and modular components for flexible space utilization. The demand for sustainable and eco-friendly furniture materials is escalating, driven by growing environmental consciousness among institutional buyers and end-users alike. Consumer preferences are evolving, leaning towards furniture that promotes well-being, collaboration, and adaptability in diverse institutional settings. The education sector's ongoing modernization and the expansion of remote and hybrid work models are significant demand catalysts, requiring versatile and comfortable furniture solutions. Libraries are transitioning into community hubs, demanding more collaborative and technology-integrated spaces. The healthcare sector's continuous expansion and the focus on patient comfort and caregiver efficiency also present lucrative opportunities. The growing emphasis on creating welcoming and functional spaces in churches and community centers further contributes to market expansion. Competitive dynamics are intensifying, with companies focusing on product innovation, supply chain optimization, and strategic partnerships to gain market share. The rise of online distribution channels is also democratizing access to institutional furniture, empowering smaller institutions to procure necessary supplies efficiently. The market penetration rate for smart and sustainable institutional furniture is projected to increase significantly as awareness and adoption grow.

Dominant Markets & Segments in Institutional Furniture Market

The Schools segment is a dominant force within the Institutional Furniture Market, driven by consistent demand for classroom furniture, library furnishings, and administrative office setups. Infrastructure development in emerging economies and government initiatives to improve educational facilities worldwide are key growth drivers. For instance, increased government spending on education in regions like Asia Pacific and Latin America fuels the demand for new school furniture and replacements. The Metal type of institutional furniture holds a significant market share due to its durability, cost-effectiveness, and ease of maintenance, particularly in high-traffic environments like schools and public libraries.

The Libraries segment, while smaller than schools, is experiencing robust growth. The transformation of libraries into modern learning and community centers, incorporating technology and flexible seating arrangements, boosts demand for specialized furniture. Libraries often require a blend of traditional reading desks and chairs alongside collaborative spaces with modular furniture.

The Theaters segment, encompassing cinema halls, auditoriums, and performance venues, presents a niche but high-value market. Demand here is driven by upgrades to existing facilities and the construction of new entertainment venues, emphasizing comfort, ergonomics, and safety features in seating solutions. The need for durable and aesthetically pleasing seating for extended viewing periods is paramount.

The Online distribution channel is rapidly gaining traction. It offers institutional buyers convenience, wider product selection, and competitive pricing, enabling easier access to a diverse range of institutional furniture from manufacturers and distributors globally. While specialty stores and supermarkets & hypermarkets also play a role, the online channel's scalability and reach are reshaping procurement patterns.

Key growth drivers across these segments include:

- Infrastructure Development: Continuous investment in building and renovating educational institutions, healthcare facilities, and public spaces.

- Government Policies & Funding: Increased government expenditure on education, healthcare, and public amenities, particularly in developing nations.

- Technological Integration: Demand for furniture that supports technology, such as integrated power outlets, adjustable workstations, and collaborative technology solutions.

- Focus on Ergonomics & Well-being: Growing awareness of the importance of comfortable and supportive furniture for productivity and health in all institutional settings.

- Sustainability Initiatives: A rising preference for eco-friendly and durable furniture made from sustainable materials.

Institutional Furniture Market Product Analysis

Product innovations in the Institutional Furniture Market are focused on enhancing functionality, durability, and user experience. Advancements include the development of modular and reconfigurable furniture systems that allow for flexible space utilization, catering to dynamic needs in educational and corporate environments. Ergonomic designs, featuring adjustable heights, lumbar support, and comfortable seating, are becoming standard, promoting user well-being and productivity. The integration of technology, such as built-in charging ports, wireless connectivity, and smart lighting, further elevates the competitive advantage of new products. Sustainability is a key differentiator, with manufacturers increasingly utilizing recycled materials, eco-friendly finishes, and durable construction for a longer product lifecycle. These innovations meet market demands for adaptable, comfortable, and environmentally conscious furniture solutions.

Key Drivers, Barriers & Challenges in Institutional Furniture Market

Key Drivers:

- Infrastructure Development & Renovation: Global investments in educational facilities, healthcare centers, and public spaces are a primary growth catalyst.

- Technological Advancements: Integration of smart features, ergonomic designs, and sustainable materials to enhance user experience and meet evolving institutional needs.

- Government Initiatives & Funding: Increased public spending on education and healthcare drives demand for furniture solutions.

- Focus on Hybrid Work & Learning Models: The need for flexible, collaborative, and well-being-focused furniture solutions in evolving work and study environments.

Key Barriers & Challenges:

- Supply Chain Disruptions: Volatility in raw material prices and logistical challenges can impact production costs and delivery timelines, potentially increasing the cost of furniture by XX% for certain materials.

- Regulatory Compliance: Adhering to stringent safety, environmental, and accessibility standards across different regions requires significant investment and can slow down product development cycles.

- Intense Competition: A fragmented market with numerous players leads to price pressures and the need for continuous innovation to maintain market share.

- Economic Downturns: Budgetary constraints in institutional sectors can lead to reduced capital expenditure on furniture, impacting sales. For example, a XX% reduction in education budgets can lead to a proportional decrease in furniture orders.

Growth Drivers in the Institutional Furniture Market Market

Key growth drivers for the Institutional Furniture Market are deeply rooted in societal and economic trends. The continuous need for modernization and expansion of educational infrastructure, from K-12 schools to higher education institutions, forms a bedrock of demand. Government policies that prioritize educational reforms and infrastructure upgrades, often backed by substantial funding, directly translate into increased orders for classroom furniture, library furnishings, and administrative office setups. Furthermore, the burgeoning trend of hybrid and remote work models necessitates the redesign of corporate office spaces to foster collaboration, flexibility, and employee well-being, driving demand for adaptable and ergonomic office furniture. The growing emphasis on sustainable practices and products across all sectors is also a significant driver, pushing manufacturers to develop eco-friendly and durable furniture solutions. Economic growth in emerging markets, coupled with increased disposable income for institutional bodies, further fuels the expansion of the market.

Challenges Impacting Institutional Furniture Market Growth

Several challenges can impede the growth of the Institutional Furniture Market. Significant supply chain issues, including fluctuating raw material costs and transportation disruptions, can lead to increased production expenses and delivery delays, potentially impacting profit margins by XX%. Navigating complex and varied regulatory landscapes across different countries, especially concerning safety certifications and environmental standards, adds to compliance costs and can slow down market entry for new products. The highly competitive nature of the market, characterized by numerous players and intense price wars, puts pressure on profitability and requires continuous innovation to stay ahead. Moreover, economic slowdowns or recessions can lead to reduced capital expenditure by institutions, directly affecting demand for furniture. The shift towards online purchasing also presents challenges for traditional brick-and-mortar retailers and distributors who may struggle to adapt to new sales models.

Key Players Shaping the Institutional Furniture Market Market

- Knoll Inc.

- Okamura Corporation

- Steelcase

- HNI Corporation

- Krueger International Inc

- Smith System Inc

- Bonton Furniture

- Herman Miller Inc.

- Haworth

- Edsal Manufacturing Company

- Seats Inc

- Irwin Seating Company

Significant Institutional Furniture Market Industry Milestones

- June 2023: HNI Corporation acquired Kimball International Inc., a leading commercial furnishings company with expertise in workplace, health, and hospitality. The combination creates a market leader with proforma revenue of approximately USD 3 billion, enhancing market consolidation and product portfolio breadth.

- April 2022: Knoll partnered with the Illinois Institute of Technology (IIT) Mies van der Rohe Society to transform the lobby space in the Michael Paul Galvin Tower into a gallery, showcasing innovative furniture design and its application in architectural spaces.

- April 2022: Haworth opened a new office furniture showroom of 6,700 square feet at the T3 Building in the Atlantic Station and Midtown area of Atlanta. The new Atlanta showroom demonstrates its family of brands with individual work points and collaboration spaces, emphasizing its commitment to providing comprehensive workspace solutions.

Future Outlook for Institutional Furniture Market Market

The future outlook for the Institutional Furniture Market is exceptionally promising, driven by sustained demand for adaptable and well-designed spaces. The ongoing trend towards smart cities and sustainable infrastructure development will continue to fuel the need for modern institutional furniture in schools, libraries, healthcare facilities, and public venues. The evolution of work and learning environments, embracing flexibility and collaboration, will spur innovation in modular and ergonomic furniture solutions. Strategic opportunities lie in tapping into emerging markets, investing in sustainable product development, and leveraging e-commerce platforms for wider reach. The market is expected to witness further consolidation through strategic mergers and acquisitions, leading to the emergence of stronger, more diversified players capable of addressing a broad spectrum of institutional furniture needs. Continuous product innovation, focusing on user comfort, technological integration, and environmental responsibility, will be critical for market leadership in the coming years.

Institutional Furniture Market Segmentation

-

1. Type

- 1.1. Metal

- 1.2. Wood

- 1.3. Other Types

-

2. End-User

- 2.1. Schools

- 2.2. Libraries

- 2.3. Churches

- 2.4. Theaters

- 2.5. Other End-Users

-

3. Distribution Channel

- 3.1. Supermarkets & Hypermarkets

- 3.2. Specialty Stores

- 3.3. Online

- 3.4. Other Distribution Channels

Institutional Furniture Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Institutional Furniture Market Regional Market Share

Geographic Coverage of Institutional Furniture Market

Institutional Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing number of nuclear families; Customizing appearances of the room

- 3.3. Market Restrains

- 3.3.1. Availability of alternatives; Breaking or Detaching of wall beds from the wall

- 3.4. Market Trends

- 3.4.1. Schools' End-User Segment is Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Institutional Furniture Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Metal

- 5.1.2. Wood

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Schools

- 5.2.2. Libraries

- 5.2.3. Churches

- 5.2.4. Theaters

- 5.2.5. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets & Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Online

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Institutional Furniture Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Metal

- 6.1.2. Wood

- 6.1.3. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Schools

- 6.2.2. Libraries

- 6.2.3. Churches

- 6.2.4. Theaters

- 6.2.5. Other End-Users

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets & Hypermarkets

- 6.3.2. Specialty Stores

- 6.3.3. Online

- 6.3.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Institutional Furniture Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Metal

- 7.1.2. Wood

- 7.1.3. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Schools

- 7.2.2. Libraries

- 7.2.3. Churches

- 7.2.4. Theaters

- 7.2.5. Other End-Users

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets & Hypermarkets

- 7.3.2. Specialty Stores

- 7.3.3. Online

- 7.3.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Institutional Furniture Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Metal

- 8.1.2. Wood

- 8.1.3. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Schools

- 8.2.2. Libraries

- 8.2.3. Churches

- 8.2.4. Theaters

- 8.2.5. Other End-Users

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarkets & Hypermarkets

- 8.3.2. Specialty Stores

- 8.3.3. Online

- 8.3.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Institutional Furniture Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Metal

- 9.1.2. Wood

- 9.1.3. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Schools

- 9.2.2. Libraries

- 9.2.3. Churches

- 9.2.4. Theaters

- 9.2.5. Other End-Users

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Supermarkets & Hypermarkets

- 9.3.2. Specialty Stores

- 9.3.3. Online

- 9.3.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Institutional Furniture Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Metal

- 10.1.2. Wood

- 10.1.3. Other Types

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Schools

- 10.2.2. Libraries

- 10.2.3. Churches

- 10.2.4. Theaters

- 10.2.5. Other End-Users

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Supermarkets & Hypermarkets

- 10.3.2. Specialty Stores

- 10.3.3. Online

- 10.3.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Knoll Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Okamura Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Steelcase

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 HNI Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Krueger International Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Smith System Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bonton Furniture

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Herman Miller Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Haworth

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Edsal Manufacturing Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Seats Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Irwin Seating Company

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Knoll Inc

List of Figures

- Figure 1: Global Institutional Furniture Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Institutional Furniture Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Institutional Furniture Market Revenue (billion), by Type 2025 & 2033

- Figure 4: North America Institutional Furniture Market Volume (K Unit), by Type 2025 & 2033

- Figure 5: North America Institutional Furniture Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Institutional Furniture Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Institutional Furniture Market Revenue (billion), by End-User 2025 & 2033

- Figure 8: North America Institutional Furniture Market Volume (K Unit), by End-User 2025 & 2033

- Figure 9: North America Institutional Furniture Market Revenue Share (%), by End-User 2025 & 2033

- Figure 10: North America Institutional Furniture Market Volume Share (%), by End-User 2025 & 2033

- Figure 11: North America Institutional Furniture Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 12: North America Institutional Furniture Market Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 13: North America Institutional Furniture Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: North America Institutional Furniture Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 15: North America Institutional Furniture Market Revenue (billion), by Country 2025 & 2033

- Figure 16: North America Institutional Furniture Market Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Institutional Furniture Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Institutional Furniture Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Institutional Furniture Market Revenue (billion), by Type 2025 & 2033

- Figure 20: Europe Institutional Furniture Market Volume (K Unit), by Type 2025 & 2033

- Figure 21: Europe Institutional Furniture Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Institutional Furniture Market Volume Share (%), by Type 2025 & 2033

- Figure 23: Europe Institutional Furniture Market Revenue (billion), by End-User 2025 & 2033

- Figure 24: Europe Institutional Furniture Market Volume (K Unit), by End-User 2025 & 2033

- Figure 25: Europe Institutional Furniture Market Revenue Share (%), by End-User 2025 & 2033

- Figure 26: Europe Institutional Furniture Market Volume Share (%), by End-User 2025 & 2033

- Figure 27: Europe Institutional Furniture Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 28: Europe Institutional Furniture Market Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 29: Europe Institutional Furniture Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Europe Institutional Furniture Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 31: Europe Institutional Furniture Market Revenue (billion), by Country 2025 & 2033

- Figure 32: Europe Institutional Furniture Market Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Institutional Furniture Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Institutional Furniture Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Institutional Furniture Market Revenue (billion), by Type 2025 & 2033

- Figure 36: Asia Pacific Institutional Furniture Market Volume (K Unit), by Type 2025 & 2033

- Figure 37: Asia Pacific Institutional Furniture Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Asia Pacific Institutional Furniture Market Volume Share (%), by Type 2025 & 2033

- Figure 39: Asia Pacific Institutional Furniture Market Revenue (billion), by End-User 2025 & 2033

- Figure 40: Asia Pacific Institutional Furniture Market Volume (K Unit), by End-User 2025 & 2033

- Figure 41: Asia Pacific Institutional Furniture Market Revenue Share (%), by End-User 2025 & 2033

- Figure 42: Asia Pacific Institutional Furniture Market Volume Share (%), by End-User 2025 & 2033

- Figure 43: Asia Pacific Institutional Furniture Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 44: Asia Pacific Institutional Furniture Market Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 45: Asia Pacific Institutional Furniture Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: Asia Pacific Institutional Furniture Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: Asia Pacific Institutional Furniture Market Revenue (billion), by Country 2025 & 2033

- Figure 48: Asia Pacific Institutional Furniture Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Institutional Furniture Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Institutional Furniture Market Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Institutional Furniture Market Revenue (billion), by Type 2025 & 2033

- Figure 52: South America Institutional Furniture Market Volume (K Unit), by Type 2025 & 2033

- Figure 53: South America Institutional Furniture Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: South America Institutional Furniture Market Volume Share (%), by Type 2025 & 2033

- Figure 55: South America Institutional Furniture Market Revenue (billion), by End-User 2025 & 2033

- Figure 56: South America Institutional Furniture Market Volume (K Unit), by End-User 2025 & 2033

- Figure 57: South America Institutional Furniture Market Revenue Share (%), by End-User 2025 & 2033

- Figure 58: South America Institutional Furniture Market Volume Share (%), by End-User 2025 & 2033

- Figure 59: South America Institutional Furniture Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 60: South America Institutional Furniture Market Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 61: South America Institutional Furniture Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 62: South America Institutional Furniture Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 63: South America Institutional Furniture Market Revenue (billion), by Country 2025 & 2033

- Figure 64: South America Institutional Furniture Market Volume (K Unit), by Country 2025 & 2033

- Figure 65: South America Institutional Furniture Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: South America Institutional Furniture Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Middle East and Africa Institutional Furniture Market Revenue (billion), by Type 2025 & 2033

- Figure 68: Middle East and Africa Institutional Furniture Market Volume (K Unit), by Type 2025 & 2033

- Figure 69: Middle East and Africa Institutional Furniture Market Revenue Share (%), by Type 2025 & 2033

- Figure 70: Middle East and Africa Institutional Furniture Market Volume Share (%), by Type 2025 & 2033

- Figure 71: Middle East and Africa Institutional Furniture Market Revenue (billion), by End-User 2025 & 2033

- Figure 72: Middle East and Africa Institutional Furniture Market Volume (K Unit), by End-User 2025 & 2033

- Figure 73: Middle East and Africa Institutional Furniture Market Revenue Share (%), by End-User 2025 & 2033

- Figure 74: Middle East and Africa Institutional Furniture Market Volume Share (%), by End-User 2025 & 2033

- Figure 75: Middle East and Africa Institutional Furniture Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 76: Middle East and Africa Institutional Furniture Market Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 77: Middle East and Africa Institutional Furniture Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 78: Middle East and Africa Institutional Furniture Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 79: Middle East and Africa Institutional Furniture Market Revenue (billion), by Country 2025 & 2033

- Figure 80: Middle East and Africa Institutional Furniture Market Volume (K Unit), by Country 2025 & 2033

- Figure 81: Middle East and Africa Institutional Furniture Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East and Africa Institutional Furniture Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Institutional Furniture Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Institutional Furniture Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Global Institutional Furniture Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 4: Global Institutional Furniture Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 5: Global Institutional Furniture Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Institutional Furniture Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global Institutional Furniture Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Global Institutional Furniture Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Institutional Furniture Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Global Institutional Furniture Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: Global Institutional Furniture Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 12: Global Institutional Furniture Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 13: Global Institutional Furniture Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global Institutional Furniture Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Institutional Furniture Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Institutional Furniture Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Global Institutional Furniture Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Global Institutional Furniture Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 19: Global Institutional Furniture Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 20: Global Institutional Furniture Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 21: Global Institutional Furniture Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global Institutional Furniture Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Institutional Furniture Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Institutional Furniture Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Institutional Furniture Market Revenue billion Forecast, by Type 2020 & 2033

- Table 26: Global Institutional Furniture Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 27: Global Institutional Furniture Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 28: Global Institutional Furniture Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 29: Global Institutional Furniture Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global Institutional Furniture Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Institutional Furniture Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Global Institutional Furniture Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 33: Global Institutional Furniture Market Revenue billion Forecast, by Type 2020 & 2033

- Table 34: Global Institutional Furniture Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 35: Global Institutional Furniture Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 36: Global Institutional Furniture Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 37: Global Institutional Furniture Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 38: Global Institutional Furniture Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global Institutional Furniture Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Global Institutional Furniture Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Global Institutional Furniture Market Revenue billion Forecast, by Type 2020 & 2033

- Table 42: Global Institutional Furniture Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 43: Global Institutional Furniture Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 44: Global Institutional Furniture Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 45: Global Institutional Furniture Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 46: Global Institutional Furniture Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 47: Global Institutional Furniture Market Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Global Institutional Furniture Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Institutional Furniture Market?

The projected CAGR is approximately 7.4%.

2. Which companies are prominent players in the Institutional Furniture Market?

Key companies in the market include Knoll Inc, Okamura Corporation, Steelcase, HNI Corporation, Krueger International Inc, Smith System Inc, Bonton Furniture, Herman Miller Inc, Haworth, Edsal Manufacturing Company, Seats Inc, Irwin Seating Company.

3. What are the main segments of the Institutional Furniture Market?

The market segments include Type, End-User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 264.98 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing number of nuclear families; Customizing appearances of the room.

6. What are the notable trends driving market growth?

Schools' End-User Segment is Dominating the Market.

7. Are there any restraints impacting market growth?

Availability of alternatives; Breaking or Detaching of wall beds from the wall.

8. Can you provide examples of recent developments in the market?

June 2023: HNI Corporation acquired Kimball International Inc., a leading commercial furnishings company with expertise in workplace, health, and hospitality. The combination creates a market leader with proforma revenue of approximately USD 3 billion

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Institutional Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Institutional Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Institutional Furniture Market?

To stay informed about further developments, trends, and reports in the Institutional Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence