Key Insights

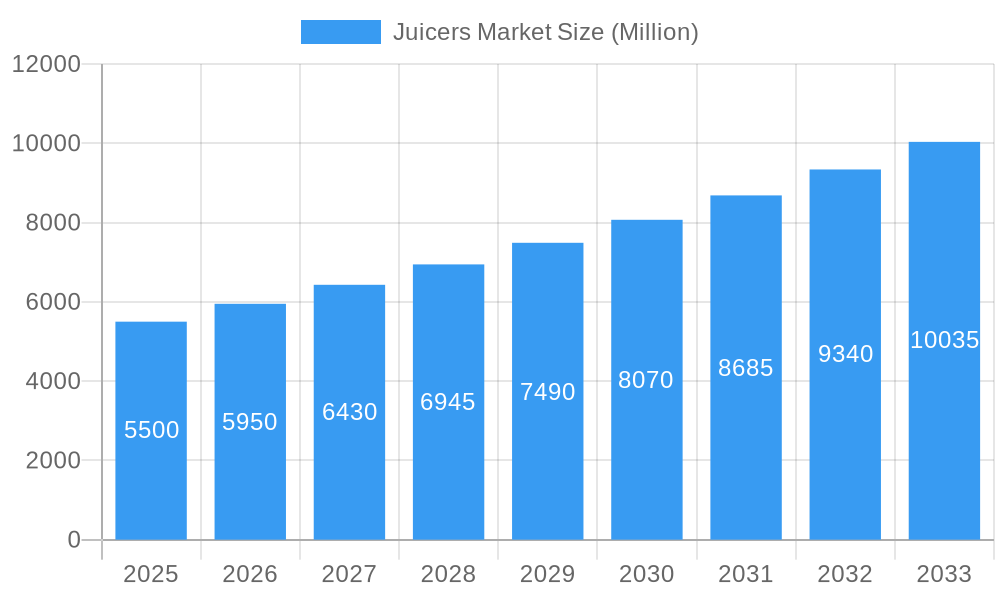

The global juicer market is projected for substantial growth, with an estimated market size of $3.17 billion and a Compound Annual Growth Rate (CAGR) of 8.7% from 2025 to 2033. This expansion is driven by a heightened consumer focus on health and wellness, increasing demand for fresh, nutrient-dense juices. The rising popularity of home juicing, fueled by convenience and personalized beverage choices, is a key factor. Technological innovations in juicer design, including enhanced efficiency, simplified cleaning, and improved nutrient extraction, are also stimulating market adoption. The market is shifting towards electric juicers, with both centrifugal and masticating models gaining prominence. Residential use dominates, reflecting health-conscious lifestyle trends. Distribution channels are diversifying, with online platforms experiencing significant growth due to accessibility and product variety, complementing traditional retail channels.

Juicers Market Market Size (In Billion)

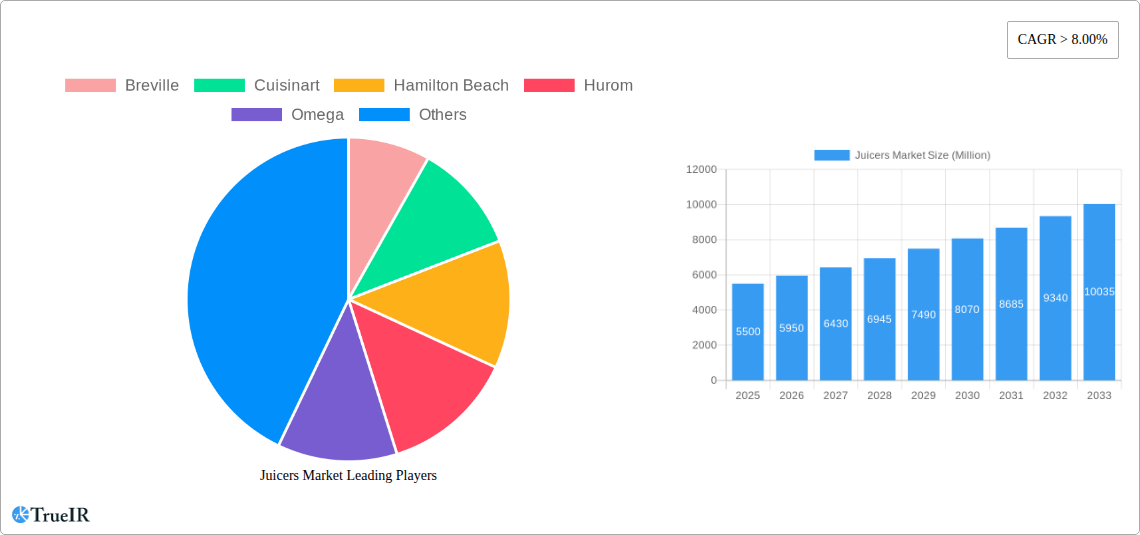

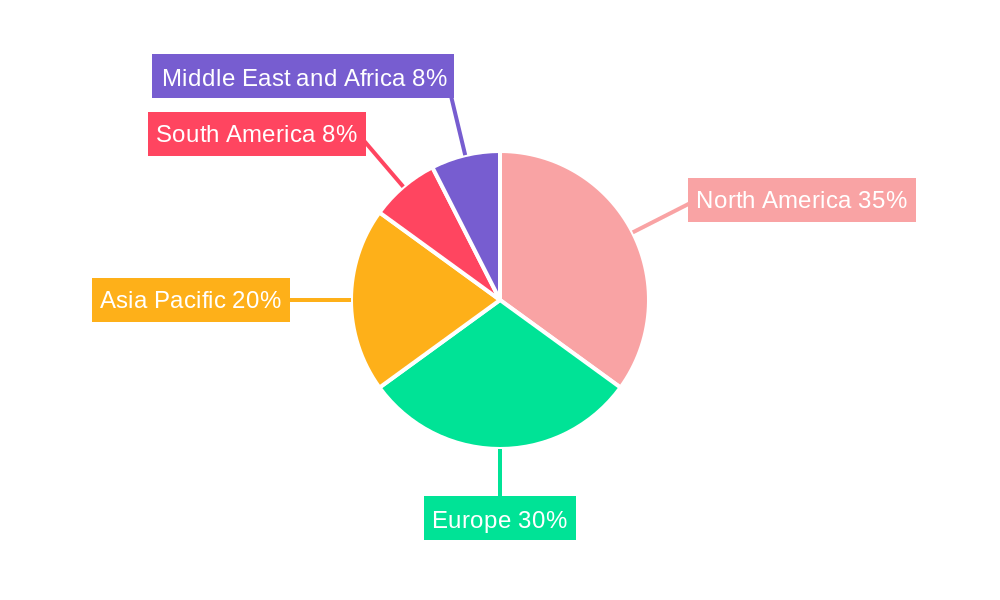

Evolving consumer preferences and lifestyle trends further shape market trajectory. Increased awareness of plant-based diet benefits and the importance of fresh produce in daily nutrition are significant market drivers, particularly in developed regions like North America and Europe with higher disposable incomes and ingrained health consciousness. Emerging economies in the Asia Pacific region also show considerable growth potential due to urbanization and a growing middle class embracing healthier habits. While market expansion is robust, potential restraints include the initial cost of premium juicers and perceived operational complexity, though manufacturers are addressing these through user-friendly designs and educational resources. The competitive landscape features established brands such as Breville, Cuisinart, and Hurom, alongside innovative new entrants introducing advanced features tailored to specific consumer needs.

Juicers Market Company Market Share

Juicers Market: In-Depth Analysis and Forecast (2019-2033)

This comprehensive report provides an unparalleled analysis of the global juicers market, offering critical insights for stakeholders seeking to navigate this dynamic industry. Covering the historical period from 2019 to 2024, the base year of 2025, and an extensive forecast period extending to 2033, this report delves into market structure, trends, opportunities, regional dominance, product innovations, and the key players shaping the future of juicing technology. With a focus on high-volume keywords and actionable intelligence, this report is your definitive guide to understanding and capitalizing on the growth potential within the juicers market.

Juicers Market Market Structure & Competitive Landscape

The juicers market exhibits a moderately concentrated structure, with a blend of established global brands and emerging players vying for market share. Innovation serves as a primary driver, fueled by consumer demand for healthier lifestyles and convenience. Regulatory impacts are minimal, primarily revolving around product safety and electrical certifications. Product substitutes, such as blenders and high-speed food processors, offer alternative methods for preparing fruit and vegetable purees, though dedicated juicers offer distinct advantages in terms of juice quality and nutrient retention. End-user segmentation highlights the significant presence of both commercial establishments seeking efficient, high-volume juicing solutions and residential consumers prioritizing convenience and health benefits. Mergers and acquisitions (M&A) are a notable trend, with larger corporations acquiring smaller, innovative companies to expand their product portfolios and market reach. For instance, the past few years have seen an average of 5-10 significant M&A activities annually, reflecting consolidation within the industry. Concentration ratios, while varying by region, suggest that the top 5 players command approximately 40-50% of the global market.

- Innovation Drivers:

- Development of quieter and more energy-efficient juicer models.

- Integration of smart features and app connectivity for recipe suggestions and usage tracking.

- Focus on ease of cleaning and maintenance.

- Regulatory Impacts:

- Adherence to electrical safety standards (e.g., CE, UL).

- Material compliance for food-grade components.

- End-User Segmentation:

- Commercial: Restaurants, cafes, juice bars, gyms, hospitals.

- Residential: Health-conscious individuals and families.

- M&A Trends:

- Acquisition of niche juicer brands by larger appliance manufacturers.

- Strategic partnerships for technology integration and distribution expansion.

Juicers Market Market Trends & Opportunities

The global juicers market is poised for robust expansion, driven by an escalating global awareness of health and wellness, which is significantly influencing consumer purchasing decisions. This heightened focus on nutritious diets is propelling the demand for juicers as consumers actively seek to incorporate fresh fruit and vegetable juices into their daily routines. The market is projected to witness a compound annual growth rate (CAGR) of approximately 6.5% during the forecast period (2025-2033), reaching an estimated market size of over $15 Billion by 2033. Technological advancements are playing a pivotal role in this growth, with manufacturers continuously introducing innovative features designed to enhance user experience and juice quality. Masticating juicers, known for their ability to extract more nutrients and enzymes with less oxidation, are gaining substantial traction. Furthermore, the increasing availability of compact and aesthetically pleasing juicer designs is catering to the evolving preferences of urban consumers with limited kitchen space. The online retail channel has emerged as a significant growth avenue, offering consumers wider product selection, competitive pricing, and convenient home delivery. This digital shift is further amplified by the growing influence of social media and health influencers who promote juicing as a lifestyle choice. Opportunities abound for manufacturers to develop specialized juicers catering to specific dietary needs, such as low-sugar options or high-fiber extractors. The growing trend of at-home meal preparation and the demand for plant-based diets also present substantial growth avenues for the juicers market. The market penetration rate for juicers, while varying regionally, is steadily increasing, particularly in developed economies where disposable incomes are higher and health consciousness is deeply ingrained. Emerging economies, with their rapidly expanding middle class and increasing awareness of health benefits, represent untapped potential for market expansion.

Dominant Markets & Segments in Juicers Market

The global juicers market is experiencing significant growth across various segments, with Electric Juicers emerging as the dominant category, accounting for an estimated 75% of the market share in 2025. This dominance is attributed to their convenience, speed, and ease of use compared to manual alternatives. Within the Type segment, Masticating Juicers are projected to witness the highest growth rate, driven by increasing consumer awareness of their superior nutrient extraction capabilities and lower oxidation rates. While Centrifugal Juicers currently hold a larger market share due to their affordability and speed, the trend is shifting towards masticating variants for health-conscious consumers. The End-User segment of Residential consumers represents the largest and fastest-growing market, fueled by the rising trend of home juicing for health and wellness. Commercial end-users, while smaller in volume, contribute significantly to revenue due to the higher purchase value of professional-grade juicers. The Distribution Channel landscape is increasingly leaning towards Online sales, which are expected to capture over 40% of the market by 2033, offering unparalleled accessibility and a wider product selection. Supermarkets/Hypermarkets remain important for impulse purchases and accessibility, while specialty stores cater to niche markets and provide expert advice.

- Dominant Type Segment: Masticating Juicers

- Key Growth Drivers:

- Superior nutrient retention and enzyme preservation.

- Quieter operation compared to centrifugal juicers.

- Ability to juice leafy greens and softer fruits more effectively.

- Growing demand for cold-pressed juices.

- Key Growth Drivers:

- Dominant Category Type: Electric Juicers

- Key Growth Drivers:

- User-friendly operation and speed.

- Wide range of price points catering to diverse consumer needs.

- Technological advancements leading to improved performance and features.

- Key Growth Drivers:

- Dominant End-User: Residential Consumers

- Key Growth Drivers:

- Increased focus on personal health and preventative wellness.

- Growing popularity of home-based fitness and healthy eating trends.

- Desire for fresh, customized beverages.

- Convenience of preparing juices at home.

- Key Growth Drivers:

- Dominant Distribution Channel: Online Sales

- Key Growth Drivers:

- Extensive product variety and competitive pricing.

- Convenience of doorstep delivery.

- Influence of e-commerce platforms and digital marketing.

- Customer reviews and comparison tools aiding purchase decisions.

- Key Growth Drivers:

Juicers Market Product Analysis

The juicers market is characterized by continuous product innovation, focusing on enhanced efficiency, user convenience, and improved health benefits. Manufacturers are investing heavily in research and development to create juicers with quieter motors, easier cleaning mechanisms, and superior juice yields. Advanced masticating technologies, such as twin-gear systems, are gaining prominence for their ability to extract maximum nutrients from fruits, vegetables, and even nuts. The integration of smart features, like app connectivity for personalized recipes and usage tracking, is another significant trend. Competitive advantages are being built on the back of durable materials, ergonomic designs, and the ability to process a wider variety of ingredients, including leafy greens and fibrous vegetables.

Key Drivers, Barriers & Challenges in Juicers Market

The juicers market is propelled by several key drivers, including the burgeoning global health and wellness trend, increasing consumer disposable income, and the growing popularity of plant-based diets. Technological advancements, leading to more efficient and user-friendly juicer designs, are also significant growth catalysts. However, the market faces certain barriers and challenges. The initial cost of high-quality juicers can be a deterrent for some price-sensitive consumers. Supply chain disruptions, as witnessed in recent global events, can impact production and lead times. Intense competition among numerous brands necessitates continuous innovation and competitive pricing strategies.

- Key Drivers:

- Rising health consciousness and demand for nutrient-rich beverages.

- Growing popularity of plant-based and vegan diets.

- Technological advancements in juicer design and functionality.

- Increased disposable income in emerging economies.

- Key Barriers & Challenges:

- High initial purchase price of premium juicer models.

- Potential for supply chain disruptions affecting manufacturing and distribution.

- Intense competition and the need for continuous product differentiation.

- Consumer perception regarding the complexity of cleaning certain juicer types.

Growth Drivers in the Juicers Market Market

The juicers market's growth is primarily fueled by the escalating global focus on health and well-being, driving a significant demand for nutrient-rich beverages. The increasing adoption of plant-based diets and the consumer pursuit of natural, unprocessed food alternatives are further bolstering market expansion. Technological innovations, such as the development of quieter, more efficient, and easier-to-clean juicers, are making these appliances more appealing to a wider demographic. Additionally, rising disposable incomes, particularly in emerging economies, are enabling more consumers to invest in premium kitchen appliances like advanced juicers. Regulatory support for healthy food choices and increased awareness campaigns about the benefits of fresh juice also contribute to market growth.

Challenges Impacting Juicers Market Growth

Despite the positive growth trajectory, the juicers market faces several hurdles. The upfront cost of high-performance juicers can be a significant barrier for budget-conscious consumers, limiting market penetration in certain segments. Fluctuations in raw material prices and global supply chain vulnerabilities can impact manufacturing costs and product availability, potentially leading to price increases. The competitive landscape is fiercely contested, with numerous brands vying for consumer attention, often leading to price wars and margin pressures. Moreover, consumer education regarding the specific benefits of different juicer types and effective usage remains an ongoing challenge that requires sustained marketing efforts.

Key Players Shaping the Juicers Market Market

- Breville

- Cuisinart

- Hamilton Beach

- Hurom

- Omega

- Panasonic

- Philips

- Proctor Silex

- Sage Appliances

- Vitamix

Significant Juicers Market Industry Milestones

- February 2023: Angela Juicers launched its new website, enhancing its online presence for juicers, accessories, and recipes, catering to a wide range of juicer types including masticating and centrifugal models.

- January 2023: Prestige introduced the Prestige Plus Atlas 750 W Juicer Mixer Grinder, featuring a locking system and a 1.5-liter liquidizing jar, enhancing its product offering in the kitchen appliance segment.

Future Outlook for Juicers Market Market

The future of the juicers market appears exceptionally promising, driven by an unyielding consumer commitment to health and wellness. The continuous innovation in juicer technology, focusing on enhanced performance, user-friendliness, and sustainability, will be a key growth catalyst. The expanding online retail landscape will further democratize access to a wider array of juicing solutions, catering to diverse consumer needs and preferences. Emerging markets, with their burgeoning middle class and increasing awareness of healthy living, present significant untapped potential. Strategic opportunities lie in developing specialized juicers for niche markets, such as cold-pressed juice enthusiasts or those seeking high-fiber extraction, alongside a continued emphasis on smart features and energy efficiency to attract a tech-savvy consumer base. The market is set to experience sustained growth, with an increasing integration of juicing into mainstream healthy lifestyles.

Juicers Market Segmentation

-

1. Type

- 1.1. Centrifugal Juicer

- 1.2. Masticating Juicer

- 1.3. Triturating Juicer

- 1.4. Others

-

2. Category Type

- 2.1. Manual Juicers

- 2.2. Electric Juicers

-

3. End- User

- 3.1. Commercial

- 3.2. Residential

-

4. Distribution Channel

- 4.1. Supermarkets/Hypermarkets

- 4.2. Specialty Stores

- 4.3. Online

- 4.4. Other Distribution Channels

Juicers Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Juicers Market Regional Market Share

Geographic Coverage of Juicers Market

Juicers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The trend towards home cooking and DIY health solutions has led to increased interest in juicers. Consumers are looking for ways to make their own juices and health drinks at home

- 3.2.2 which drives demand for juicing appliances.

- 3.3. Market Restrains

- 3.3.1 High-quality juicers

- 3.3.2 especially masticating or cold-press models

- 3.3.3 can be expensive. The high initial cost may deter some consumers

- 3.3.4 particularly in price-sensitive markets.

- 3.4. Market Trends

- 3.4.1 The integration of smart technology is a growing trend in the juicers market. Smart juicers offer features such as programmable settings

- 3.4.2 connectivity with mobile apps

- 3.4.3 and remote control capabilities

- 3.4.4 enhancing user convenience and experience.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Juicers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Centrifugal Juicer

- 5.1.2. Masticating Juicer

- 5.1.3. Triturating Juicer

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Category Type

- 5.2.1. Manual Juicers

- 5.2.2. Electric Juicers

- 5.3. Market Analysis, Insights and Forecast - by End- User

- 5.3.1. Commercial

- 5.3.2. Residential

- 5.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.4.1. Supermarkets/Hypermarkets

- 5.4.2. Specialty Stores

- 5.4.3. Online

- 5.4.4. Other Distribution Channels

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. South America

- 5.5.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Juicers Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Centrifugal Juicer

- 6.1.2. Masticating Juicer

- 6.1.3. Triturating Juicer

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Category Type

- 6.2.1. Manual Juicers

- 6.2.2. Electric Juicers

- 6.3. Market Analysis, Insights and Forecast - by End- User

- 6.3.1. Commercial

- 6.3.2. Residential

- 6.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.4.1. Supermarkets/Hypermarkets

- 6.4.2. Specialty Stores

- 6.4.3. Online

- 6.4.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Juicers Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Centrifugal Juicer

- 7.1.2. Masticating Juicer

- 7.1.3. Triturating Juicer

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Category Type

- 7.2.1. Manual Juicers

- 7.2.2. Electric Juicers

- 7.3. Market Analysis, Insights and Forecast - by End- User

- 7.3.1. Commercial

- 7.3.2. Residential

- 7.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.4.1. Supermarkets/Hypermarkets

- 7.4.2. Specialty Stores

- 7.4.3. Online

- 7.4.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Juicers Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Centrifugal Juicer

- 8.1.2. Masticating Juicer

- 8.1.3. Triturating Juicer

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Category Type

- 8.2.1. Manual Juicers

- 8.2.2. Electric Juicers

- 8.3. Market Analysis, Insights and Forecast - by End- User

- 8.3.1. Commercial

- 8.3.2. Residential

- 8.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.4.1. Supermarkets/Hypermarkets

- 8.4.2. Specialty Stores

- 8.4.3. Online

- 8.4.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Juicers Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Centrifugal Juicer

- 9.1.2. Masticating Juicer

- 9.1.3. Triturating Juicer

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Category Type

- 9.2.1. Manual Juicers

- 9.2.2. Electric Juicers

- 9.3. Market Analysis, Insights and Forecast - by End- User

- 9.3.1. Commercial

- 9.3.2. Residential

- 9.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.4.1. Supermarkets/Hypermarkets

- 9.4.2. Specialty Stores

- 9.4.3. Online

- 9.4.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Juicers Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Centrifugal Juicer

- 10.1.2. Masticating Juicer

- 10.1.3. Triturating Juicer

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Category Type

- 10.2.1. Manual Juicers

- 10.2.2. Electric Juicers

- 10.3. Market Analysis, Insights and Forecast - by End- User

- 10.3.1. Commercial

- 10.3.2. Residential

- 10.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.4.1. Supermarkets/Hypermarkets

- 10.4.2. Specialty Stores

- 10.4.3. Online

- 10.4.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Breville

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cuisinart

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hamilton Beach

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hurom

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Omega

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Panasonic

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Philips

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Proctor Silex

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sage Appliances

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Vitamix

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Breville

List of Figures

- Figure 1: Global Juicers Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Juicers Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Juicers Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Juicers Market Revenue (billion), by Category Type 2025 & 2033

- Figure 5: North America Juicers Market Revenue Share (%), by Category Type 2025 & 2033

- Figure 6: North America Juicers Market Revenue (billion), by End- User 2025 & 2033

- Figure 7: North America Juicers Market Revenue Share (%), by End- User 2025 & 2033

- Figure 8: North America Juicers Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 9: North America Juicers Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America Juicers Market Revenue (billion), by Country 2025 & 2033

- Figure 11: North America Juicers Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Juicers Market Revenue (billion), by Type 2025 & 2033

- Figure 13: Europe Juicers Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Juicers Market Revenue (billion), by Category Type 2025 & 2033

- Figure 15: Europe Juicers Market Revenue Share (%), by Category Type 2025 & 2033

- Figure 16: Europe Juicers Market Revenue (billion), by End- User 2025 & 2033

- Figure 17: Europe Juicers Market Revenue Share (%), by End- User 2025 & 2033

- Figure 18: Europe Juicers Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 19: Europe Juicers Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 20: Europe Juicers Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Europe Juicers Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Juicers Market Revenue (billion), by Type 2025 & 2033

- Figure 23: Asia Pacific Juicers Market Revenue Share (%), by Type 2025 & 2033

- Figure 24: Asia Pacific Juicers Market Revenue (billion), by Category Type 2025 & 2033

- Figure 25: Asia Pacific Juicers Market Revenue Share (%), by Category Type 2025 & 2033

- Figure 26: Asia Pacific Juicers Market Revenue (billion), by End- User 2025 & 2033

- Figure 27: Asia Pacific Juicers Market Revenue Share (%), by End- User 2025 & 2033

- Figure 28: Asia Pacific Juicers Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific Juicers Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific Juicers Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Juicers Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: South America Juicers Market Revenue (billion), by Type 2025 & 2033

- Figure 33: South America Juicers Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: South America Juicers Market Revenue (billion), by Category Type 2025 & 2033

- Figure 35: South America Juicers Market Revenue Share (%), by Category Type 2025 & 2033

- Figure 36: South America Juicers Market Revenue (billion), by End- User 2025 & 2033

- Figure 37: South America Juicers Market Revenue Share (%), by End- User 2025 & 2033

- Figure 38: South America Juicers Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 39: South America Juicers Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: South America Juicers Market Revenue (billion), by Country 2025 & 2033

- Figure 41: South America Juicers Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Juicers Market Revenue (billion), by Type 2025 & 2033

- Figure 43: Middle East and Africa Juicers Market Revenue Share (%), by Type 2025 & 2033

- Figure 44: Middle East and Africa Juicers Market Revenue (billion), by Category Type 2025 & 2033

- Figure 45: Middle East and Africa Juicers Market Revenue Share (%), by Category Type 2025 & 2033

- Figure 46: Middle East and Africa Juicers Market Revenue (billion), by End- User 2025 & 2033

- Figure 47: Middle East and Africa Juicers Market Revenue Share (%), by End- User 2025 & 2033

- Figure 48: Middle East and Africa Juicers Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 49: Middle East and Africa Juicers Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 50: Middle East and Africa Juicers Market Revenue (billion), by Country 2025 & 2033

- Figure 51: Middle East and Africa Juicers Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Juicers Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Juicers Market Revenue billion Forecast, by Category Type 2020 & 2033

- Table 3: Global Juicers Market Revenue billion Forecast, by End- User 2020 & 2033

- Table 4: Global Juicers Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global Juicers Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Juicers Market Revenue billion Forecast, by Type 2020 & 2033

- Table 7: Global Juicers Market Revenue billion Forecast, by Category Type 2020 & 2033

- Table 8: Global Juicers Market Revenue billion Forecast, by End- User 2020 & 2033

- Table 9: Global Juicers Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 10: Global Juicers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Juicers Market Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Global Juicers Market Revenue billion Forecast, by Category Type 2020 & 2033

- Table 13: Global Juicers Market Revenue billion Forecast, by End- User 2020 & 2033

- Table 14: Global Juicers Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Juicers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Juicers Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Juicers Market Revenue billion Forecast, by Category Type 2020 & 2033

- Table 18: Global Juicers Market Revenue billion Forecast, by End- User 2020 & 2033

- Table 19: Global Juicers Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 20: Global Juicers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Juicers Market Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Global Juicers Market Revenue billion Forecast, by Category Type 2020 & 2033

- Table 23: Global Juicers Market Revenue billion Forecast, by End- User 2020 & 2033

- Table 24: Global Juicers Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 25: Global Juicers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Global Juicers Market Revenue billion Forecast, by Type 2020 & 2033

- Table 27: Global Juicers Market Revenue billion Forecast, by Category Type 2020 & 2033

- Table 28: Global Juicers Market Revenue billion Forecast, by End- User 2020 & 2033

- Table 29: Global Juicers Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global Juicers Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Juicers Market?

The projected CAGR is approximately 8.7%.

2. Which companies are prominent players in the Juicers Market?

Key companies in the market include Breville, Cuisinart, Hamilton Beach, Hurom, Omega, Panasonic, Philips, Proctor Silex, Sage Appliances, Vitamix.

3. What are the main segments of the Juicers Market?

The market segments include Type, Category Type, End- User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.17 billion as of 2022.

5. What are some drivers contributing to market growth?

The trend towards home cooking and DIY health solutions has led to increased interest in juicers. Consumers are looking for ways to make their own juices and health drinks at home. which drives demand for juicing appliances..

6. What are the notable trends driving market growth?

The integration of smart technology is a growing trend in the juicers market. Smart juicers offer features such as programmable settings. connectivity with mobile apps. and remote control capabilities. enhancing user convenience and experience..

7. Are there any restraints impacting market growth?

High-quality juicers. especially masticating or cold-press models. can be expensive. The high initial cost may deter some consumers. particularly in price-sensitive markets..

8. Can you provide examples of recent developments in the market?

On 5th February 2023, Angela Juicers announced the launch of their new website. Angela Juicers is an online store that offers juicers, accessories, and recipes. Angela Juicers offers a wide selection of juicers, from masticating to centrifugal, as well as a variety of accessories.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Juicers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Juicers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Juicers Market?

To stay informed about further developments, trends, and reports in the Juicers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence