Key Insights

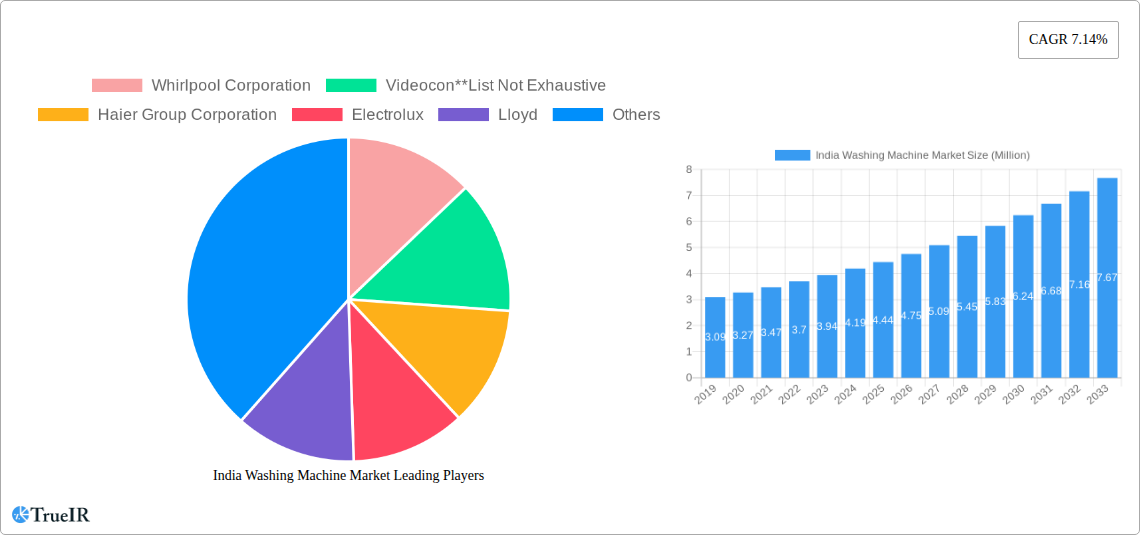

The India Washing Machine Market is poised for significant expansion, projected to reach a substantial size of USD 4.44 billion in 2025, with an impressive Compound Annual Growth Rate (CAGR) of 7.14% expected to sustain this momentum through 2033. This robust growth is primarily fueled by an escalating consumer demand for convenience and technological advancements. The increasing disposable incomes of Indian households, coupled with a growing preference for automated and energy-efficient appliances, are key drivers. The market is witnessing a strong shift towards fully automatic washing machines, reflecting a growing desire for ease of use and time-saving solutions. Furthermore, expanding urbanization and a rising nuclear family structure contribute to a higher adoption rate of modern home appliances like washing machines. The distribution landscape is also evolving, with online channels gaining significant traction alongside traditional supermarkets, hypermarkets, and specialty stores, offering consumers greater accessibility and choice.

India Washing Machine Market Market Size (In Million)

Several key trends are shaping the India Washing Machine Market. The penetration of smart home technology is increasing, with manufacturers introducing internet-connected washing machines offering remote control and diagnostics. Energy efficiency and water conservation are becoming paramount concerns for consumers, pushing demand for eco-friendly models. The competitive landscape is characterized by the presence of both established global players and prominent domestic brands, all vying for market share through product innovation, aggressive marketing, and competitive pricing strategies. While the market is on an upward trajectory, potential restraints could include fluctuating raw material costs, the economic impact of unforeseen global events, and the need for consistent infrastructure development to support increased electricity demands. However, the overall outlook remains highly optimistic, driven by the underlying economic growth and evolving consumer aspirations in India.

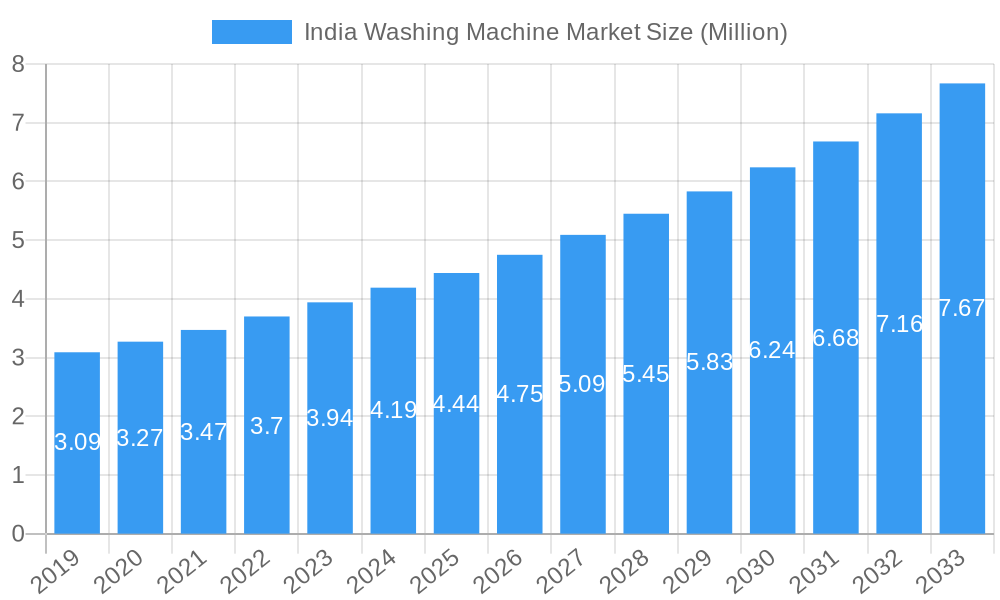

India Washing Machine Market Company Market Share

This in-depth report provides a granular analysis of the India Washing Machine Market, offering critical insights into its structure, trends, segmentation, and competitive landscape. Leveraging high-volume keywords such as "India washing machine market," "front load washing machines India," "fully automatic washing machine price," and "smart washing machines India," this report is optimized for search engines and designed to engage industry stakeholders, manufacturers, distributors, and investors. Covering the study period from 2019 to 2033, with a base and estimated year of 2025, this research delves into the market's historical performance, current state, and future trajectory.

India Washing Machine Market Market Structure & Competitive Landscape

The India washing machine market exhibits a moderately concentrated structure, with key players like Samsung India Electronics Ltd, LG Electronic Inc, Whirlpool Corporation, and Haier Group Corporation holding significant market shares. Innovation serves as a primary driver, fueled by the increasing demand for energy-efficient appliances, advanced features like AI integration, and smart connectivity. Regulatory impacts, primarily concerning energy efficiency standards and waste management (e.g., e-waste rules), are shaping product development and manufacturing practices. Product substitutes, such as washing services and manual washing, exist but are gradually losing ground to the convenience and efficiency of modern washing machines. End-user segmentation reveals a growing preference for mid-to-premium range appliances, particularly in urban and semi-urban areas. Mergers & Acquisitions (M&A) trends are less pronounced but are expected to increase as companies seek to consolidate market presence and expand their product portfolios. The market is characterized by intense competition, leading to continuous product innovation and competitive pricing strategies.

India Washing Machine Market Market Trends & Opportunities

The Indian washing machine market is poised for substantial growth, driven by evolving consumer lifestyles, increasing disposable incomes, and a growing preference for automated and technologically advanced home appliances. The market size is projected to witness a healthy Compound Annual Growth Rate (CAGR) over the forecast period. Key trends include the escalating adoption of fully automatic washing machines, both front-load and top-load variants, as consumers prioritize convenience and time-saving solutions. The penetration of smart washing machines, featuring AI-powered features, IoT connectivity, and advanced fabric care technologies, is also on a significant upward trajectory, creating new opportunities for manufacturers to cater to tech-savvy consumers. The "Make in India" initiative continues to influence production and sourcing strategies, fostering domestic manufacturing capabilities. Opportunities abound in rural market penetration, the development of affordable yet feature-rich washing machines, and the expansion of online sales channels, which have witnessed exponential growth. The increasing urbanization and the rise of nuclear families further bolster the demand for compact and efficient washing solutions. The focus on sustainability and energy efficiency is also a significant trend, prompting the development of eco-friendly washing machines with lower water and power consumption. The market is dynamic, with a constant influx of new technologies and product designs aimed at enhancing user experience and performance, thereby creating a fertile ground for both established and emerging players.

Dominant Markets & Segments in India Washing Machine Market

The India washing machine market is segmented by Type, Technology, and Distribution Channel, each exhibiting distinct growth patterns and dominance.

Type:

- Front Load Washing Machines: This segment is witnessing robust growth, driven by their superior washing performance, energy efficiency, and delicate fabric care. The increasing preference for premium appliances and rising awareness about advanced features contribute to their dominance, especially in urban centers.

- Top Load Washing Machines: While still holding a significant market share, particularly in the budget-friendly category, top-load machines are facing increasing competition from their front-load counterparts. However, advancements in semi-automatic and fully automatic top-load models continue to sustain their appeal.

Technology:

- Fully Automatic Washing Machines: This segment is the clear leader and is expected to dominate the market. The unparalleled convenience, diverse wash programs, and advanced features like AI integration, steam cycles, and sanitization options are driving their widespread adoption across various income groups.

- Semi-Automatic Washing Machines: These machines continue to appeal to a price-sensitive segment of the market, offering a balance between functionality and affordability. Their simpler operation and lower initial cost ensure their continued relevance, particularly in tier-2 and tier-3 cities.

Distribution Channel:

- Online: The online channel has emerged as a significant growth driver, offering convenience, a wider selection, competitive pricing, and easy access to product reviews. E-commerce platforms and brand-specific websites are crucial for reaching a broad customer base.

- Specialty Stores: Dedicated appliance showrooms continue to play a vital role, providing consumers with the opportunity to experience products firsthand and receive expert advice.

- Supermarkets and Hypermarkets: These channels are gaining traction, offering a convenient one-stop shopping experience for household appliances.

- Other Distribution Channels: This includes direct sales by manufacturers and smaller local retailers, which cater to specific regional demands.

The dominance of fully automatic front-load washing machines is a significant trend, fueled by consumer aspirations for convenience, advanced technology, and energy efficiency. The expanding reach of online retail and the increasing presence of manufacturers in tier-2 and tier-3 cities are key growth drivers. Government initiatives promoting energy efficiency and digital infrastructure further support the market's expansion.

India Washing Machine Market Product Analysis

The India washing machine market is characterized by a continuous stream of product innovations aimed at enhancing user convenience, performance, and energy efficiency. Key advancements include the integration of Artificial Intelligence (AI) for optimized washing cycles, AI Wash technology for automatic fabric sensing and water level adjustment, and Q-DriveTM for quieter and more durable operation. The introduction of Auto Dispense features, which automatically deliver the right amount of detergent and fabric softener, exemplifies the drive towards a more effortless laundry experience. AI-enabled Direct Motion Motor technology, as seen in Haier's offerings, enhances durability and reduces noise levels. Furthermore, improvements in semi-automatic models, such as Soft Closing lids and Toughened Glass Lids, address consumer safety and durability concerns. The competitive advantage lies in offering a compelling blend of advanced features, energy efficiency, and competitive pricing, catering to diverse consumer needs and preferences, from smart, connected appliances to robust and affordable basic models.

Key Drivers, Barriers & Challenges in India Washing Machine Market

Key Drivers:

- Rising Disposable Income & Urbanization: Increased purchasing power and the growth of urban populations drive demand for modern home appliances.

- Technological Advancements: AI, IoT, and energy-efficient technologies are creating demand for smarter and more advanced washing machines.

- Government Initiatives: Policies promoting energy efficiency (e.g., BEE star ratings) and the "Make in India" campaign encourage domestic production and adoption of better appliances.

- Growing Awareness of Convenience: Consumers are increasingly valuing time-saving and effortless laundry solutions offered by automatic washing machines.

Barriers & Challenges:

- Price Sensitivity: A significant portion of the Indian market remains price-sensitive, making it challenging for manufacturers to penetrate deeper with premium products.

- Power Supply & Water Scarcity: Inconsistent power supply and water scarcity in certain regions can hinder the adoption of fully automatic washing machines.

- After-Sales Service Network: Establishing and maintaining a robust after-sales service network, especially in rural and semi-urban areas, remains a challenge.

- Intense Competition: The market is highly competitive, leading to pressure on profit margins and a constant need for product differentiation. Supply chain disruptions, such as those impacting component availability, can also pose significant challenges.

Growth Drivers in the India Washing Machine Market Market

Several key factors are propelling the growth of the India washing machine market. Technologically, the increasing adoption of smart washing machines featuring AI and IoT capabilities is a major driver, appealing to the tech-savvy Indian consumer. Economic factors like rising disposable incomes and a growing middle class are enhancing purchasing power, enabling consumers to invest in more advanced and premium washing solutions. Government policies, such as the promotion of energy-efficient appliances through BEE star ratings and incentives under schemes like PLI (Production Linked Incentive), are further stimulating demand and domestic manufacturing. The "Make in India" initiative also plays a crucial role by fostering local production and potentially reducing costs. The growing urbanization and the trend of smaller, nuclear families also contribute by increasing the demand for convenient and space-saving laundry appliances.

Challenges Impacting India Washing Machine Market Growth

Despite the robust growth, the India washing machine market faces several significant challenges. Price sensitivity remains a pervasive barrier, particularly in semi-urban and rural areas, where a large segment of the population prioritizes affordability over advanced features. Inconsistent electricity supply and water scarcity in certain regions pose practical limitations for the widespread adoption of fully automatic washing machines, which are more reliant on stable utilities. Establishing and maintaining an efficient after-sales service network across a geographically diverse nation like India is a complex logistical challenge. Furthermore, the market is characterized by intense competition among domestic and international players, leading to price wars and pressure on profit margins. Supply chain disruptions, impacting the availability of critical electronic components and raw materials, can also lead to production delays and increased costs, thereby affecting market growth.

Key Players Shaping the India Washing Machine Market Market

- Whirlpool Corporation

- Videocon

- Haier Group Corporation

- Electrolux

- Lloyd

- Godrej

- IFB

- Bosch

- Samsung India Electronics Ltd

- LG Electronic Inc

Significant India Washing Machine Market Industry Milestones

- March 2024: Samsung launched a new lineup of AI EcobubbleTM fully automatic front-load washing machines, pioneering the 11 kg category with features like AI Wash, Q-DriveTM, and Auto Dispense.

- September 2023: Haier India introduced AI-enabled 959 Direct Motion Motor Fully Automatic Front Load Washing Machines as part of its 'Make in India, Made for India' mission.

- May 2023: Samsung unveiled its latest range of semi-automatic washing machines in India, featuring Soft Closing, Toughened Glass Lid, and Dual Magic Filter.

Future Outlook for India Washing Machine Market Market

The future outlook for the India washing machine market is highly promising, driven by a confluence of favorable economic, social, and technological factors. The continued rise in disposable incomes, coupled with increasing urbanization and a growing preference for convenience, will fuel the demand for both fully automatic and smart washing machines. Manufacturers are expected to focus on developing more energy-efficient and eco-friendly models to align with global sustainability trends and government regulations. Opportunities exist in expanding the reach into tier-2 and tier-3 cities, as well as rural areas, by offering a wider range of affordable yet feature-rich appliances. The growth of e-commerce will continue to be a significant catalyst, enabling wider market access. Innovations in AI, IoT, and advanced fabric care technologies will further differentiate products and create new market segments, ensuring a dynamic and evolving landscape for the Indian washing machine industry.

India Washing Machine Market Segmentation

-

1. Type

- 1.1. Front Load

- 1.2. Top Load

-

2. Technology

- 2.1. Fully Automatic

- 2.2. Semi Automatic

-

3. Distribution Channel

- 3.1. Supermarkets and Hypermarkets

- 3.2. Specialty Stores

- 3.3. Online

- 3.4. Other Distribution Channels

India Washing Machine Market Segmentation By Geography

- 1. India

India Washing Machine Market Regional Market Share

Geographic Coverage of India Washing Machine Market

India Washing Machine Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing disposable income and consumer spending; Increasing purchasing power and rapid urbanization

- 3.3. Market Restrains

- 3.3.1. Technological Disruptions Challenges Market Growth; Supply Chain Disruptions Impedes Market Growth

- 3.4. Market Trends

- 3.4.1. The Enhancement of Smart Home Technology is Driving Additional Expansion in the Washing Machine Industry.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Washing Machine Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Front Load

- 5.1.2. Top Load

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Fully Automatic

- 5.2.2. Semi Automatic

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets and Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Online

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Whirlpool Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Videocon**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Haier Group Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Electrolux

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lloyd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Godrej

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 IFB

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bosch

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Samsung India Electronics Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LG Electronic Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Whirlpool Corporation

List of Figures

- Figure 1: India Washing Machine Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Washing Machine Market Share (%) by Company 2025

List of Tables

- Table 1: India Washing Machine Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: India Washing Machine Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 3: India Washing Machine Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: India Washing Machine Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: India Washing Machine Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: India Washing Machine Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 7: India Washing Machine Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: India Washing Machine Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Washing Machine Market?

The projected CAGR is approximately 7.14%.

2. Which companies are prominent players in the India Washing Machine Market?

Key companies in the market include Whirlpool Corporation, Videocon**List Not Exhaustive, Haier Group Corporation, Electrolux, Lloyd, Godrej, IFB, Bosch, Samsung India Electronics Ltd, LG Electronic Inc.

3. What are the main segments of the India Washing Machine Market?

The market segments include Type, Technology, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.44 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing disposable income and consumer spending; Increasing purchasing power and rapid urbanization.

6. What are the notable trends driving market growth?

The Enhancement of Smart Home Technology is Driving Additional Expansion in the Washing Machine Industry..

7. Are there any restraints impacting market growth?

Technological Disruptions Challenges Market Growth; Supply Chain Disruptions Impedes Market Growth.

8. Can you provide examples of recent developments in the market?

In March 2024, Samsung, the leading consumer electronics brand in India, launched a new lineup of AI EcobubbleTM fully automatic front-load washing machines. This latest series of washing machines is the pioneer in the 11 kg category, offering innovative features such as AI Wash, Q-DriveTM, and Auto Dispense.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Washing Machine Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Washing Machine Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Washing Machine Market?

To stay informed about further developments, trends, and reports in the India Washing Machine Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence