Key Insights

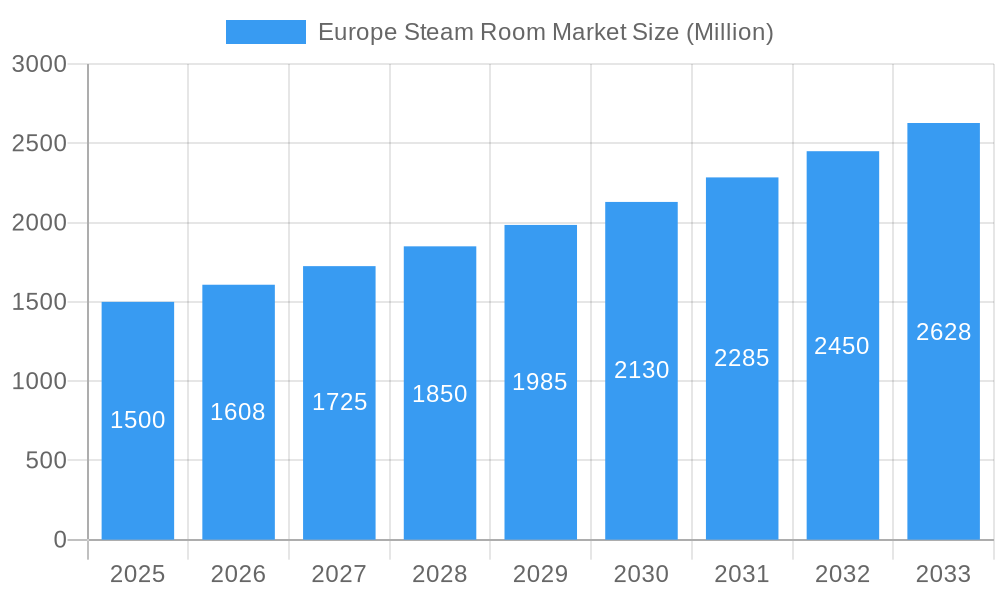

The European Steam Room Market is poised for significant expansion, driven by an increasing consumer focus on wellness, spa experiences, and the therapeutic benefits of steam therapy. With a projected market size of approximately €1.5 billion in 2025, the industry is expected to witness robust growth throughout the forecast period of 2025-2033. This expansion is underpinned by a compound annual growth rate (CAGR) estimated at 7.2% during the study period. Factors contributing to this upward trajectory include the rising disposable incomes across the continent, a growing trend in home renovations featuring luxury spa elements, and the increasing adoption of steam rooms in commercial settings such as hotels, gyms, and dedicated wellness centers. Furthermore, technological advancements leading to more energy-efficient and user-friendly steam room solutions are also stimulating market demand. The historical data from 2019-2024 indicates a steady climb, laying a strong foundation for accelerated growth in the coming years.

Europe Steam Room Market Market Size (In Billion)

Geographically, Western European nations such as Germany, France, the UK, and Italy are anticipated to lead the market, owing to established wellness cultures and higher consumer spending on luxury amenities. Eastern European markets are also expected to present considerable growth opportunities as awareness of health and wellness benefits spreads and infrastructure development continues. The market is segmented by product type (e.g., freestanding steam rooms, integrated steam shower systems) and end-user (residential, commercial). The increasing popularity of personalized wellness solutions and the demand for compact, easy-to-install steam room units in residential properties are key drivers. In the commercial sector, the integration of steam rooms as a premium offering in hospitality and fitness facilities is a significant growth catalyst. The market's overall outlook is exceptionally positive, reflecting a sustained and elevated consumer interest in self-care and holistic well-being.

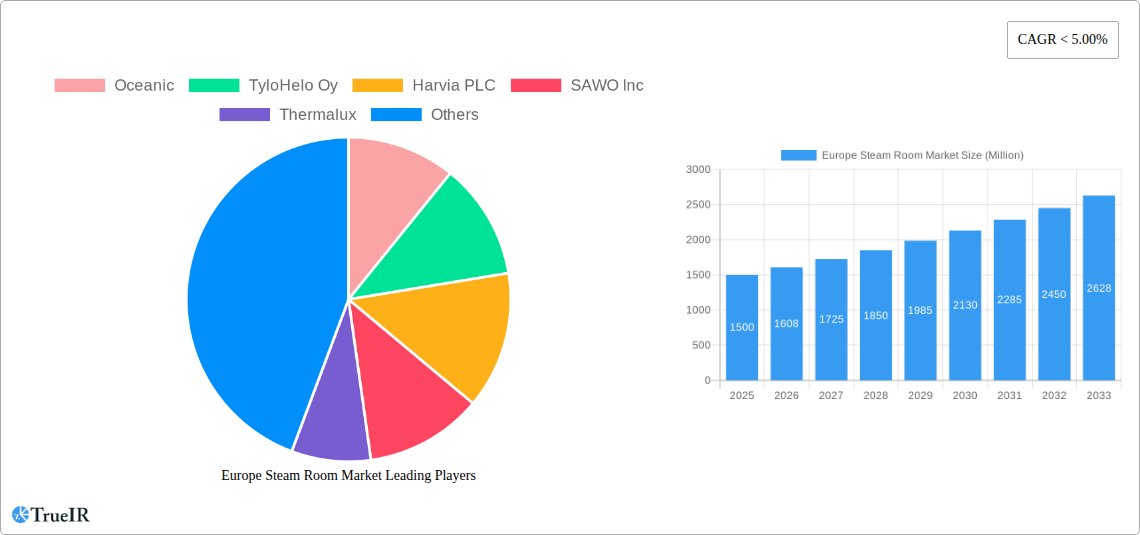

Europe Steam Room Market Company Market Share

This in-depth report provides a dynamic, SEO-optimized analysis of the Europe steam room market, leveraging high-volume keywords to enhance search rankings and engage industry audiences. Covering the study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period from 2025 to 2033, this report offers unparalleled insights into market structure, competitive landscape, trends, opportunities, and future outlook.

Europe Steam Room Market Market Structure & Competitive Landscape

The Europe steam room market exhibits a moderately consolidated structure, with a few key players holding significant market share. Innovation remains a crucial driver, fueled by advancements in infrared technology and energy efficiency. Regulatory frameworks, primarily focused on safety standards and environmental impact, play a vital role in shaping product development and market entry. Product substitutes, such as traditional saunas and other wellness facilities, present a competitive challenge. The end-user segmentation, encompassing residential, commercial, and industrial sectors, dictates diverse product needs and market penetration strategies. Mergers and acquisitions (M&A) are emerging as strategic tools for market expansion and consolidation. For instance, in August 2022, Harvia PLC acquired a 21.4% minority stake in EOS Group's German operations for EUR 19.5 million, consolidating its presence in a key European market. The overall market concentration ratio is estimated to be around 55-65% among the top five players. M&A activities have seen a steady increase of approximately 10% year-on-year over the historical period, indicating a trend towards strategic alliances and acquisitions to bolster market position.

Europe Steam Room Market Market Trends & Opportunities

The Europe steam room market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period. This expansion is driven by a confluence of factors including increasing consumer awareness of health and wellness benefits associated with steam therapy, a growing disposable income across key European nations, and a burgeoning trend towards home wellness solutions. The residential segment, in particular, is witnessing significant penetration rates as homeowners invest in luxury amenities and personalized wellness spaces. Technological advancements are also playing a pivotal role, with manufacturers continuously innovating to offer more energy-efficient, user-friendly, and feature-rich steam room systems. The shift towards smart home integration and the incorporation of advanced control systems, aromatherapy, and chromotherapy features are enhancing user experience and driving demand. The commercial sector, including hotels, spas, gyms, and wellness centers, continues to be a major revenue generator, with a constant demand for high-quality, durable, and aesthetically pleasing steam room installations. Emerging opportunities lie in the development of compact and modular steam room solutions catering to smaller living spaces and the increasing demand for customized wellness experiences. Furthermore, the growing emphasis on sustainable practices is pushing manufacturers to develop eco-friendly materials and energy-saving technologies, presenting a significant avenue for market differentiation and growth. The market penetration rate in the residential sector is estimated to reach 25% by the end of the forecast period, up from 15% in 2025.

Dominant Markets & Segments in Europe Steam Room Market

Germany currently stands as the dominant market within the Europe steam room landscape, driven by a strong economy, high disposable incomes, and a deeply ingrained wellness culture. The residential segment in Germany exhibits exceptional growth, with a significant proportion of high-net-worth individuals investing in luxury home spas. Key growth drivers in this region include:

- Strong Economic Performance: Germany's robust economic standing allows for significant consumer spending on premium home and commercial wellness facilities.

- Health & Wellness Consciousness: A widespread societal emphasis on health, fitness, and relaxation fuels demand for steam room solutions.

- Advanced Infrastructure: Well-developed construction and renovation infrastructure supports the installation of steam rooms in both new builds and existing properties.

- Supportive Policies: While not heavily regulated, policies promoting healthy living indirectly benefit the market.

In terms of product segments, the Conventional steam rooms continue to hold a dominant share due to their established reliability and cost-effectiveness. However, the Infrared steam room segment is experiencing a faster growth trajectory, driven by perceived health benefits such as detoxification and pain relief, coupled with lower energy consumption compared to traditional models. Within the end-user segments, the Residential market is witnessing a substantial surge, propelled by the "stay-at-home" economy and a growing desire for private wellness retreats. The Commercial segment, encompassing hotels, gyms, and spas, remains a vital contributor, with ongoing investments in upgrading facilities to attract and retain customers by offering premium wellness experiences. The market size for the residential segment is projected to grow at a CAGR of 8.2%, while the commercial segment is expected to grow at a CAGR of 6.8% during the forecast period.

Europe Steam Room Market Product Analysis

Product innovation in the Europe steam room market centers on enhancing user experience, energy efficiency, and customization. Manufacturers are integrating smart technology for intuitive control, personalized settings, and remote access. The application of advanced heating elements in infrared models offers targeted therapeutic benefits. Competitive advantages are derived from superior build quality, durable materials, sleek design aesthetics, and innovative features like aromatherapy diffusers and integrated sound systems. The focus is on creating immersive and therapeutic environments that cater to evolving consumer preferences for personalized wellness.

Key Drivers, Barriers & Challenges in Europe Steam Room Market

Key Drivers:

- Rising Health and Wellness Consciousness: Increasing awareness of the physical and mental health benefits of steam therapy.

- Growing Disposable Income: Enhanced purchasing power among consumers, particularly for luxury home improvements.

- Technological Advancements: Innovations in infrared technology, smart controls, and energy efficiency.

- Home Renovation Trends: The surge in home improvement projects and the desire for integrated wellness spaces.

Key Barriers & Challenges:

- High Initial Investment Costs: The upfront cost of steam room installation can be a deterrent for some consumers.

- Space Constraints: Limited living space in urban areas can pose a challenge for residential installations.

- Regulatory Compliance: Adhering to varying building codes and safety standards across European countries.

- Competition from Substitutes: The availability of alternative wellness solutions like traditional saunas and spas.

- Supply Chain Disruptions: Potential for delays and increased costs in sourcing components, estimated to impact lead times by 5-10% during periods of instability.

Growth Drivers in the Europe Steam Room Market Market

The Europe steam room market is propelled by a confluence of technological, economic, and lifestyle factors. The burgeoning health and wellness trend is a primary growth catalyst, with consumers actively seeking solutions that promote relaxation, detoxification, and stress relief. Economically, rising disposable incomes across key European nations empower individuals to invest in home wellness amenities, turning private residences into personal sanctuaries. Technological advancements, such as the development of more energy-efficient infrared heating elements and intuitive smart control systems, enhance user experience and reduce operational costs, making steam rooms a more attractive proposition. Furthermore, the increasing popularity of home renovation projects and the desire to add luxury and value to properties are significant drivers, particularly within the residential segment.

Challenges Impacting Europe Steam Room Market Growth

Despite the positive growth trajectory, the Europe steam room market faces several challenges. The significant initial investment required for a high-quality steam room installation can be a barrier for a segment of the consumer base. Urbanization and increasingly smaller living spaces in many European cities present a practical constraint for residential installations, necessitating the development of more compact and modular solutions. Navigating the diverse and sometimes complex regulatory landscape across different European countries, particularly concerning building codes, electrical safety, and water usage, can also pose hurdles for manufacturers and installers. Moreover, competitive pressures from alternative wellness offerings, such as traditional saunas, hot tubs, and professional spa services, require continuous innovation and value proposition enhancement.

Key Players Shaping the Europe Steam Room Market Market

- Oceanic

- TyloHelo Oy

- Harvia PLC

- SAWO Inc

- Thermalux

- Physiotherm

- KLAFS Group

- Corso

- Duravit

- Finnleo

Significant Europe Steam Room Market Industry Milestones

- August 2022: Harvia PLC acquired a 21.4% minority stake in EOS Group's German operations for EUR 19.5 million, strengthening its market position in Germany.

- March 2022: KLAFS Group received three consecutive "Brand of the Century" awards, underscoring its leadership in the sauna and steam room market.

- 2019-2024 (Historical Period): Continuous product development and increased adoption of smart technologies in steam rooms, contributing to market growth.

Future Outlook for Europe Steam Room Market Market

The future outlook for the Europe steam room market is exceptionally promising. Growth will be fueled by the persistent demand for home wellness solutions, driven by an aging population seeking therapeutic benefits and younger generations prioritizing self-care. The increasing integration of IoT and AI in steam room technology will offer unparalleled customization and health monitoring capabilities, attracting a tech-savvy consumer base. Opportunities for expansion exist in emerging markets within Eastern Europe and through the development of sustainable and energy-efficient models. Strategic collaborations between wellness technology providers and the hospitality sector are expected to drive innovation and market penetration, creating a vibrant and evolving market landscape for years to come.

Europe Steam Room Market Segmentation

-

1. Type

- 1.1. Infrared

- 1.2. Conventional

-

2. End User

- 2.1. Residential

- 2.2. Commercial

Europe Steam Room Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

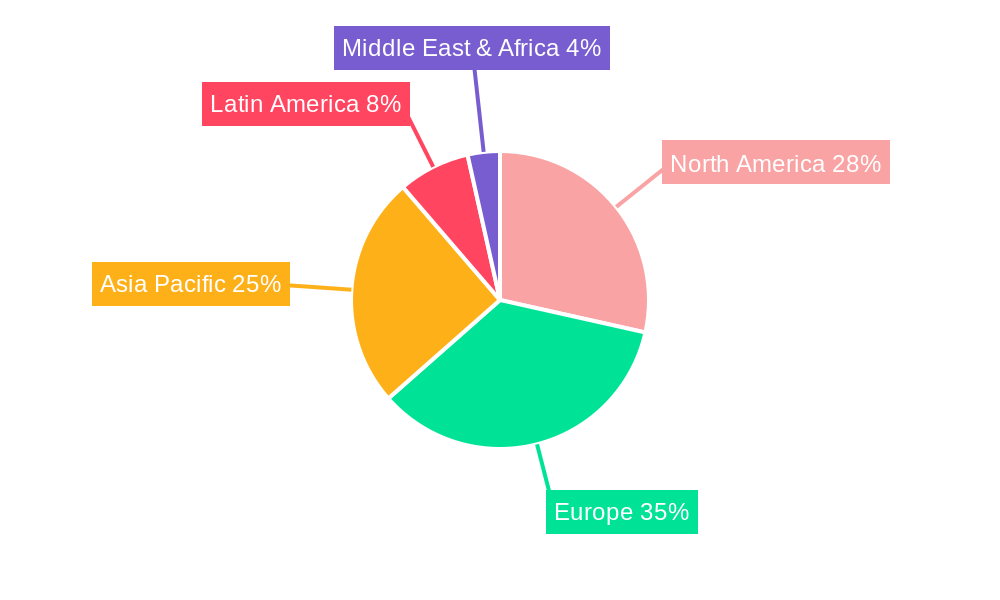

Europe Steam Room Market Regional Market Share

Geographic Coverage of Europe Steam Room Market

Europe Steam Room Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ceramic Sanitaryware Products are Dominating the Market; Growth in the construction activities in the industry

- 3.3. Market Restrains

- 3.3.1. Fluctuating demand in the construction industry

- 3.4. Market Trends

- 3.4.1. Rising Spending Capacities of Consumers Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Steam Room Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Infrared

- 5.1.2. Conventional

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Oceanic

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 TyloHelo Oy

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Harvia PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SAWO Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Thermalux

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Physiotherm

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 KLAFS Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Corso**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Duravit

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Finnleo

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Oceanic

List of Figures

- Figure 1: Europe Steam Room Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe Steam Room Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Steam Room Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Europe Steam Room Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Europe Steam Room Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Europe Steam Room Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Europe Steam Room Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Europe Steam Room Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Steam Room Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Steam Room Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: France Europe Steam Room Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Steam Room Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Steam Room Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Steam Room Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Steam Room Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Steam Room Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Steam Room Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Steam Room Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Steam Room Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Steam Room Market?

The projected CAGR is approximately 3.6%.

2. Which companies are prominent players in the Europe Steam Room Market?

Key companies in the market include Oceanic, TyloHelo Oy, Harvia PLC, SAWO Inc, Thermalux, Physiotherm, KLAFS Group, Corso**List Not Exhaustive, Duravit, Finnleo.

3. What are the main segments of the Europe Steam Room Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Ceramic Sanitaryware Products are Dominating the Market; Growth in the construction activities in the industry.

6. What are the notable trends driving market growth?

Rising Spending Capacities of Consumers Driving the Market.

7. Are there any restraints impacting market growth?

Fluctuating demand in the construction industry.

8. Can you provide examples of recent developments in the market?

In August 2022, Mr. Rainer Kunz, the managing director of EOS Group, sold a 21.4% minority stake in the German business to Harvia PLC. The cost of the purchase is EUR 19.5 million. Following the deal, Harvia now owns all of EOS Group's German activities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Steam Room Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Steam Room Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Steam Room Market?

To stay informed about further developments, trends, and reports in the Europe Steam Room Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence