Key Insights

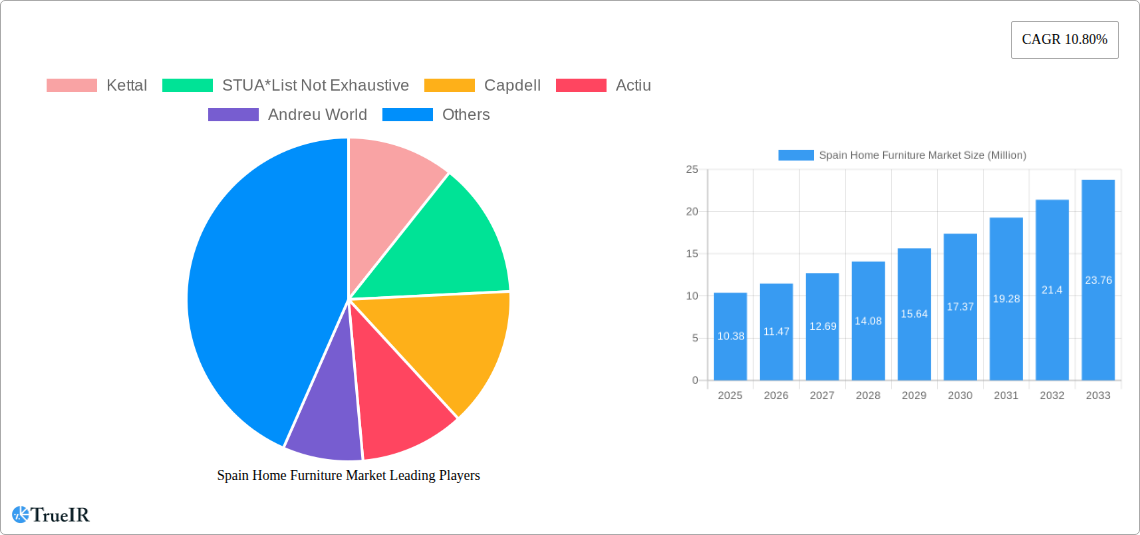

The Spain Home Furniture Market is poised for substantial growth, exhibiting a robust Compound Annual Growth Rate (CAGR) of 10.80% and a current market size valued at approximately 9.56 million units. This dynamic expansion is driven by several key factors. A significant catalyst is the increasing disposable income among Spanish households, coupled with a growing emphasis on home décor and personalization, as consumers invest more in creating comfortable and aesthetically pleasing living spaces. The rise of e-commerce has also democratized access to a wider variety of furniture styles and brands, making it easier for consumers to purchase items that align with their tastes and budgets. Furthermore, the burgeoning interior design sector and a general trend towards modernization and renovation of existing homes are fueling demand across various furniture segments, from living room sets to bedroom suites and outdoor furniture.

Spain Home Furniture Market Market Size (In Million)

The market's trajectory is further bolstered by evolving consumer preferences, with a notable trend towards sustainable and eco-friendly furniture options. This shift is encouraging manufacturers to explore innovative materials and production processes, catering to a more environmentally conscious consumer base. The hospitality sector, in particular, is a significant contributor to market growth, with increased investment in hotel and restaurant renovations and new developments requiring substantial furniture procurement. While the market benefits from strong drivers, certain restraints are present, including fluctuating raw material costs, which can impact pricing and profitability. Additionally, intense competition among both domestic and international players necessitates continuous innovation and differentiation to maintain market share. The market is segmented across materials like wood, metal, and plastic, with distribution channels ranging from traditional supermarkets and specialty stores to the rapidly growing online segment, indicating a diversified demand landscape.

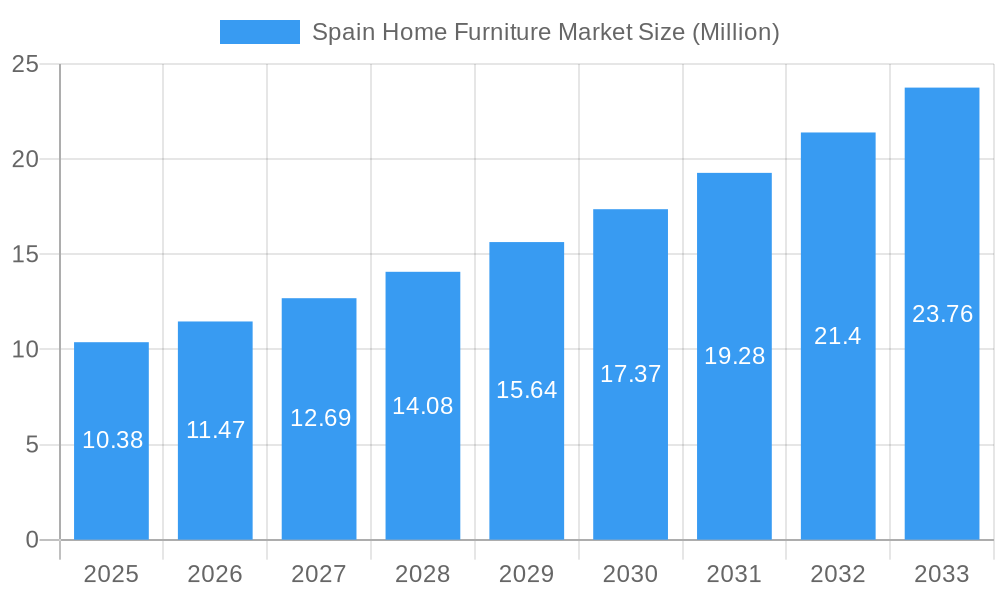

Spain Home Furniture Market Company Market Share

Spain Home Furniture Market: Comprehensive Market Analysis and Future Outlook (2019-2033)

This in-depth report provides a dynamic, SEO-optimized analysis of the Spain Home Furniture Market, leveraging high-volume keywords to enhance search rankings and engage industry audiences. We delve into market structure, competitive landscapes, emerging trends, dominant segments, product innovations, key drivers and challenges, and the future outlook for the Spanish furniture sector. With a study period spanning 2019 to 2033, this report offers comprehensive insights for manufacturers, retailers, investors, and industry stakeholders.

Spain Home Furniture Market Market Structure & Competitive Landscape

The Spain Home Furniture Market is characterized by a moderately concentrated structure, with a mix of established international players and a vibrant ecosystem of local Spanish brands. Innovation drivers are heavily influenced by evolving consumer demand for sustainable materials, smart furniture solutions, and personalized aesthetics. Regulatory impacts, particularly concerning environmental standards and import/export policies, play a crucial role in shaping market dynamics. Product substitutes, while present in the broader home décor segment, are less impactful within the core furniture categories due to the specialized nature of product design and functionality. End-user segmentation reveals a strong emphasis on the residential sector, followed by growing demand from hospitality and office applications. Merger and acquisition (M&A) trends are observed, primarily driven by consolidation efforts and strategic expansion into new market segments or distribution channels. The report will quantify these trends with data such as an estimated 25% market concentration ratio among the top five players and an estimated 100+ M&A deals recorded over the historical period, indicating active market consolidation and strategic realignments. Key market players like Kettal, STUA, Capdell, Actiu, Andreu World, Treku, Vondom, BOS1964, Gandia Blasco, and Viccarbe are continuously pushing the boundaries of design and functionality, creating a competitive environment that benefits end-consumers.

Spain Home Furniture Market Market Trends & Opportunities

The Spain Home Furniture Market is poised for significant growth, projecting a Compound Annual Growth Rate (CAGR) of 6.2% from 2025 to 2033, reaching an estimated market size of 15 Billion Euros by the end of the forecast period. This expansion is fueled by a confluence of evolving consumer preferences and technological advancements. There's a discernible shift towards sustainability, with consumers increasingly favoring furniture made from recycled materials, sustainably sourced wood, and eco-friendly finishes. This trend presents a substantial opportunity for manufacturers to innovate and differentiate their product lines. The integration of smart technology into furniture, such as built-in charging stations, adjustable ergonomic features, and IoT connectivity, is another burgeoning trend that is capturing consumer attention and driving market penetration. Furthermore, the rise of e-commerce and online furniture retailers has democratized access to a wider range of products and price points, significantly impacting traditional retail models. The report will delve into the increasing market penetration rate of online sales reaching 35% by 2033, highlighting the strategic imperative for brands to establish a robust online presence.

Another key trend is the growing demand for customizable and modular furniture solutions that cater to smaller living spaces and evolving lifestyle needs. Consumers are seeking furniture that is not only aesthetically pleasing but also functional and adaptable. The hospitality sector, particularly hotels and restaurants, is experiencing a robust demand for durable, stylish, and space-saving furniture, contributing to market diversification. The report will meticulously analyze the interplay of these trends, identifying emerging niche markets and strategic opportunities for stakeholders to capitalize on. This includes exploring the potential of incorporating augmented reality (AR) for virtual furniture placement in homes, a technology with an estimated 20% adoption rate in online furniture sales by 2030. The competitive landscape is dynamic, with both established players and agile startups vying for market share, driven by aggressive product launches and marketing strategies.

Dominant Markets & Segments in Spain Home Furniture Market

Within the Spain Home Furniture Market, the Home Furniture application segment consistently dominates, accounting for an estimated 65% of the total market revenue. This segment is driven by continuous demand for residential renovations, new home constructions, and interior design upgrades. The Wood material segment holds a significant share, estimated at 40%, owing to its natural appeal, durability, and versatility in design, especially for traditional and Scandinavian-inspired aesthetics prevalent in the Spanish market.

Material Dominance:

- Wood: Continues to be the cornerstone of the furniture industry due to its aesthetic appeal and sustainability potential. Key growth drivers include the increasing availability of certified sustainable wood sources and consumer preference for natural materials.

- Metal: Witnessing strong growth, particularly in modern and industrial designs, driven by its durability and sleek finish. Growth drivers include innovation in metal fabrication techniques and its use in outdoor furniture.

- Plastic: Holds a significant share, especially in outdoor furniture and budget-friendly options, benefiting from advancements in recycled plastic technologies.

- Other Materials: Includes a diverse range of materials like rattan, glass, and stone, offering niche opportunities and catering to specific design preferences.

Distribution Channel Dynamics:

- Specialty Stores: Remain a crucial channel, offering curated selections and personalized customer service, with an estimated 30% market share.

- Online: Experiencing rapid expansion, driven by convenience and wider product availability, projected to reach 35% market share by 2033.

- Supermarkets: Cater to a lower price segment, primarily for basic home furnishings and accessories.

- Other Distribution Channels: Include direct-to-consumer (DTC) models, showrooms, and contract sales.

Application Segments:

- Home Furniture: The largest segment, encompassing living room, bedroom, dining room, and outdoor furniture. Driven by disposable income, housing market trends, and interior design preferences.

- Office Furniture: Shows steady growth, fueled by the expansion of co-working spaces and the trend of remote work requiring home office setups.

- Hospitality: A significant and growing segment, with increasing demand from hotels, restaurants, and bars for stylish and durable furniture.

- Other Furniture: Includes specialized furniture for educational institutions, healthcare facilities, and retail spaces.

The Online distribution channel is the fastest-growing segment, projected to capture 35% of the market by 2033, driven by its convenience, wider product selection, and competitive pricing. The Hospitality application segment is also experiencing robust growth, boosted by tourism and the hospitality industry's continuous need for refurbishment and upgrades.

Spain Home Furniture Market Product Analysis

Product innovations in the Spain Home Furniture Market are predominantly focused on enhancing functionality, sustainability, and aesthetic appeal. This includes the integration of smart technologies, such as built-in charging ports and adjustable ergonomic features, catering to modern living demands. The emphasis on sustainable materials, like recycled plastics and certified wood, is a key competitive advantage, appealing to environmentally conscious consumers. Modular and multi-functional furniture designs are gaining traction, addressing the need for space optimization in urban dwellings. Competitive advantages are derived from unique design aesthetics, robust material sourcing, and efficient supply chain management, allowing brands to offer high-quality, durable, and visually appealing products that meet diverse consumer needs and preferences.

Key Drivers, Barriers & Challenges in Spain Home Furniture Market

The Spain Home Furniture Market is propelled by several key drivers, including a growing disposable income among the Spanish population, a robust housing market with increasing new constructions and renovations, and a strong cultural appreciation for well-designed and functional home spaces. Technological advancements in manufacturing, such as automation and 3D printing, also contribute to cost-effectiveness and product customization. Government initiatives promoting sustainable production and eco-friendly materials further bolster market growth.

However, the market faces significant challenges. Supply chain disruptions, exacerbated by global logistics issues, can lead to increased material costs and delivery delays. Stringent environmental regulations, while beneficial in the long run, can pose initial compliance challenges and increased operational costs for manufacturers. Intense competition from both domestic and international players, coupled with the threat of counterfeit products, puts pressure on profit margins. Economic volatility and fluctuating consumer spending power can also impact demand for non-essential items like furniture.

Growth Drivers in the Spain Home Furniture Market Market

The Spain Home Furniture Market is experiencing robust growth driven by several key factors. A significant contributor is the rising disposable income and an increasing consumer appetite for home improvement and interior decoration. The strong performance of the Spanish real estate market, characterized by new home sales and renovation projects, directly fuels demand for furniture. Technological advancements in manufacturing processes, including automation and innovative material development, enable more efficient production and a wider range of product offerings. Furthermore, a growing awareness and preference for sustainable and eco-friendly furniture products, coupled with government initiatives promoting green manufacturing, are creating new market opportunities and driving innovation. The resurgence of the hospitality sector also significantly contributes to demand.

Challenges Impacting Spain Home Furniture Market Growth

Several challenges are impacting the growth trajectory of the Spain Home Furniture Market. Global supply chain vulnerabilities, including raw material shortages and increased shipping costs, continue to pose significant operational hurdles and impact pricing. Evolving environmental regulations, while promoting sustainability, can lead to increased compliance costs and require substantial investment in new production technologies. The highly competitive landscape, with both established global brands and agile local manufacturers, intensifies price pressures and necessitates continuous innovation. Furthermore, economic uncertainties and fluctuating consumer spending patterns can lead to unpredictable demand, impacting sales forecasts and inventory management. The rising cost of energy and raw materials also presents a persistent challenge for profitability.

Key Players Shaping the Spain Home Furniture Market Market

- Kettal

- STUA

- Capdell

- Actiu

- Andreu World

- Treku

- Vondom

- BOS1964

- Gandia Blasco

- Viccarbe

Significant Spain Home Furniture Market Industry Milestones

- 2021: Launch of Kettal's "Bitta" collection, focusing on sustainable materials and modular design, setting new industry standards for eco-friendly outdoor furniture.

- 2022: Actiu's significant expansion of their sustainable manufacturing facility, incorporating advanced robotic technology to enhance efficiency and reduce environmental impact.

- 2022: Andreu World's acquisition of a smaller design firm specializing in smart furniture, signaling a strategic move towards integrating technology into their product portfolio.

- 2023: Vondom's introduction of their first fully biodegradable furniture line, utilizing innovative plant-based composites, further solidifying their commitment to sustainability.

- 2023: The Spanish government implemented new incentives for furniture manufacturers adopting circular economy principles and utilizing recycled materials, boosting innovation and green production.

- 2024: Gandia Blasco's successful partnership with an international luxury hotel chain, securing a large-scale contract for custom-designed outdoor furniture collections.

- 2024: Viccarbe's strategic online store revamp, incorporating augmented reality (AR) features to allow customers to visualize furniture in their own spaces, enhancing the online shopping experience.

Future Outlook for Spain Home Furniture Market Market

The future outlook for the Spain Home Furniture Market remains exceptionally bright, driven by sustained demand for aesthetically pleasing, functional, and sustainable furniture solutions. The continued growth of the housing sector, coupled with the evolving lifestyle preferences of Spanish consumers, will fuel market expansion. Opportunities lie in further innovation in smart furniture technologies, the development of more circular economy-based products, and the expansion of e-commerce channels. Strategic partnerships, particularly within the hospitality and contract furniture sectors, are poised to offer significant growth catalysts. The increasing emphasis on personalization and eco-conscious consumption presents a fertile ground for brands that can align their offerings with these evolving consumer values, ensuring continued market leadership and profitability.

Spain Home Furniture Market Segmentation

-

1. Material

- 1.1. Wood

- 1.2. Metal

- 1.3. Plastic

- 1.4. Other Materials

-

2. Distribution Channel

- 2.1. Supermarkets

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

-

3. Application

- 3.1. Home Furniture

- 3.2. Office Furniture

- 3.3. Hospitality

- 3.4. Other Furniture

Spain Home Furniture Market Segmentation By Geography

- 1. Spain

Spain Home Furniture Market Regional Market Share

Geographic Coverage of Spain Home Furniture Market

Spain Home Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Urbanization and Infrastructure Development; Customers Looking for More Aesthetically Pleasing Alternatives

- 3.3. Market Restrains

- 3.3.1. Less Easy to Clean; Competition from Alternative Materials

- 3.4. Market Trends

- 3.4.1. Rising Exports of Spanish Furniture

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Home Furniture Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Wood

- 5.1.2. Metal

- 5.1.3. Plastic

- 5.1.4. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Home Furniture

- 5.3.2. Office Furniture

- 5.3.3. Hospitality

- 5.3.4. Other Furniture

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kettal

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 STUA*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Capdell

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Actiu

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Andreu World

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Treku

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vondom

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BOS1964

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Gandia Blasco

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Viccarbe

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Kettal

List of Figures

- Figure 1: Spain Home Furniture Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Spain Home Furniture Market Share (%) by Company 2025

List of Tables

- Table 1: Spain Home Furniture Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Spain Home Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Spain Home Furniture Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Spain Home Furniture Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Spain Home Furniture Market Revenue Million Forecast, by Material 2020 & 2033

- Table 6: Spain Home Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 7: Spain Home Furniture Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Spain Home Furniture Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Home Furniture Market?

The projected CAGR is approximately 10.80%.

2. Which companies are prominent players in the Spain Home Furniture Market?

Key companies in the market include Kettal, STUA*List Not Exhaustive, Capdell, Actiu, Andreu World, Treku, Vondom, BOS1964, Gandia Blasco, Viccarbe.

3. What are the main segments of the Spain Home Furniture Market?

The market segments include Material, Distribution Channel, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.56 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Urbanization and Infrastructure Development; Customers Looking for More Aesthetically Pleasing Alternatives.

6. What are the notable trends driving market growth?

Rising Exports of Spanish Furniture.

7. Are there any restraints impacting market growth?

Less Easy to Clean; Competition from Alternative Materials.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Home Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Home Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Home Furniture Market?

To stay informed about further developments, trends, and reports in the Spain Home Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence