Key Insights

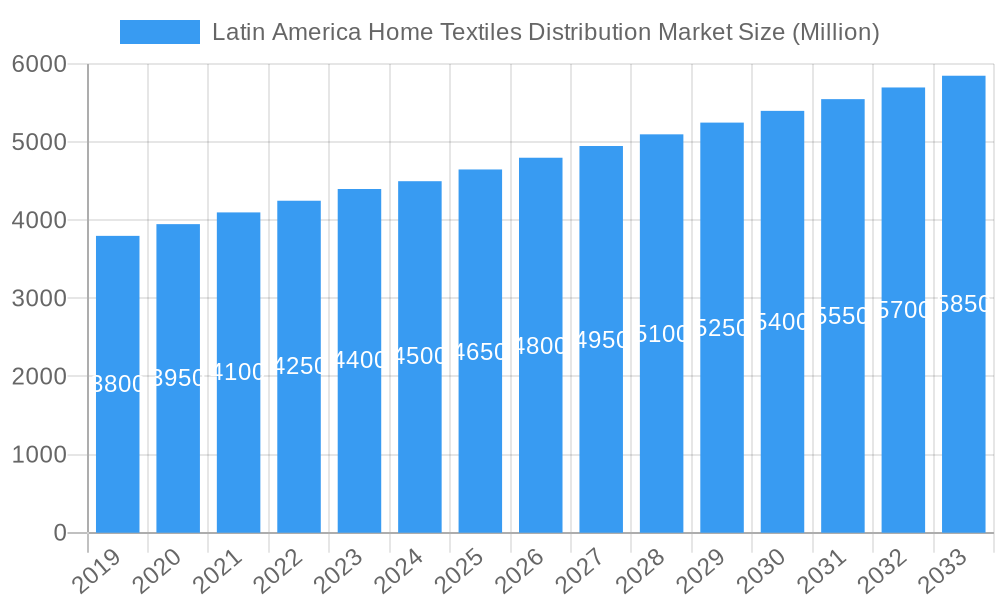

The Latin America Home Textiles Distribution Market is poised for steady expansion, with an estimated market size of $4,500 million in 2025 and a projected Compound Annual Growth Rate (CAGR) exceeding 3.00% through 2033. This growth is primarily fueled by a burgeoning middle class across key economies like Brazil, Mexico, and Colombia, leading to increased disposable income and a greater emphasis on home décor and comfort. E-commerce penetration is a significant driver, with online channels revolutionizing how consumers access and purchase home textiles, offering greater convenience and wider product selection. Furthermore, a growing trend towards home improvement and renovation, exacerbated by increased time spent at home, is stimulating demand for a diverse range of home textile products, from bedding and bath linens to upholstery and curtains. This dynamic market environment presents substantial opportunities for distributors to leverage digital platforms and cater to evolving consumer preferences.

Latin America Home Textiles Distribution Market Market Size (In Billion)

However, the market is not without its challenges. Economic volatility and currency fluctuations within some Latin American nations can impact consumer spending power and import costs, acting as restraints on rapid growth. Supply chain disruptions, including logistical complexities and raw material price volatility, also pose significant hurdles for distributors. Despite these headwinds, the overall outlook remains positive. Key players like Springs Global, Cenconsud, and Buddemeyer are actively investing in expanding their distribution networks and product portfolios, focusing on both traditional retail and robust e-commerce strategies. The segmentation of the market, encompassing production, consumption, imports, exports, and price trends, highlights the intricate nature of the Latin American home textiles distribution landscape, where localized strategies and adaptability are paramount for success.

Latin America Home Textiles Distribution Market Company Market Share

Unlock critical intelligence on the burgeoning Latin America Home Textiles Distribution Market. This in-depth report, covering the study period from 2019 to 2033 with a base and estimated year of 2025, offers unparalleled analysis of market dynamics, key players, and future trajectories. Dive into production and consumption patterns, import/export volumes, and price trends to strategically position your business for success in this dynamic region.

Latin America Home Textiles Distribution Market Market Structure & Competitive Landscape

The Latin America Home Textiles Distribution Market is characterized by a moderately concentrated landscape, with a few dominant players holding significant market share alongside a robust segment of smaller, agile distributors. Innovation is primarily driven by evolving consumer preferences for sustainable and technologically advanced materials, coupled with the increasing adoption of e-commerce platforms for product accessibility. Regulatory frameworks across different Latin American countries present a mixed bag of opportunities and challenges, influencing import/export policies and domestic production incentives. Product substitutes, ranging from lower-cost imported goods to locally manufactured alternatives, exert constant pressure on pricing and product differentiation strategies. End-user segmentation highlights strong demand from the residential sector, followed by hospitality and commercial establishments. Mergers and Acquisitions (M&A) activity, while not intensely high, signifies a strategic consolidation trend among larger entities seeking to expand their regional footprint and product portfolios, with an estimated XX Million USD in M&A volume in the historical period. Concentration ratios indicate that the top 5 players command approximately 45% of the market share.

Latin America Home Textiles Distribution Market Market Trends & Opportunities

The Latin America Home Textiles Distribution Market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.2% over the forecast period of 2025–2033. This upward trajectory is fueled by a confluence of factors including rising disposable incomes in key economies, a growing middle class with an increased appetite for home décor and comfort, and a burgeoning e-commerce penetration that is democratizing access to a wider array of home textile products. Technological shifts are playing a pivotal role, with advancements in fabric manufacturing, digital printing, and smart textiles creating new product categories and enhancing functionality. Consumers are increasingly prioritizing sustainability, driving demand for eco-friendly materials, organic cotton, and recycled textiles. This presents a significant opportunity for distributors to tap into the growing conscious consumer segment. Competitive dynamics are intensifying, with both established international brands and local manufacturers vying for market dominance. The expansion of organized retail channels and the increasing sophistication of online marketplaces are further reshaping the distribution landscape, offering both challenges and opportunities for market players. Emerging opportunities lie in catering to niche markets, such as premium organic linens, antimicrobial bedding, and customizable home textile solutions, driven by a discerning consumer base seeking unique and personalized products. The overall market penetration rate is expected to rise from 55% in 2019 to an estimated 70% by 2033, indicating significant room for expansion.

Dominant Markets & Segments in Latin America Home Textiles Distribution Market

The Brazilian market emerges as a dominant force within the Latin America Home Textiles Distribution Market, consistently leading in both production and consumption analysis. Its large population, robust industrial base, and significant domestic demand make it a cornerstone of regional activity. In terms of production, Brazil, Mexico, and Argentina are key contributors, leveraging their manufacturing capabilities and access to raw materials.

- Production Analysis: Brazil and Mexico lead with substantial production volumes, supported by government initiatives promoting local manufacturing and investments in textile technology. Argentina also plays a significant role, particularly in specialized textile segments.

- Consumption Analysis: Brazil's vast population and escalating middle class drive the highest consumption volumes. Mexico, with its strong ties to North American markets and growing domestic purchasing power, is another major consumption hub.

- Import Market Analysis (Value & Volume): Mexico and Colombia represent significant import markets due to their robust retail sectors and demand for specialized or design-led home textiles not readily produced locally. Imports in 2025 are estimated at over $2,500 Million for value and over 800 Million units for volume.

- Export Market Analysis (Value & Volume): Brazil and Mexico are key exporters, supplying home textiles to other Latin American nations and, to some extent, international markets. Exports in 2025 are projected at over $1,800 Million for value and over 600 Million units for volume.

- Price Trend Analysis: Price trends are influenced by fluctuating raw material costs (cotton, synthetics), currency exchange rates, and import duties. Competitive pricing strategies are crucial, with a clear segmentation between mass-market affordable options and premium, high-value products.

Latin America Home Textiles Distribution Market Product Analysis

The Latin America Home Textiles Distribution Market is witnessing a surge in product innovations centered around enhanced comfort, durability, and sustainability. Key product categories include bedding (sheets, duvets, pillows), bath textiles (towels, bathrobes), curtains, upholstery fabrics, and decorative items. Technological advancements are enabling the development of advanced materials such as antimicrobial fabrics, hypoallergenic options, and thermoregulating textiles, catering to health-conscious and comfort-seeking consumers. The competitive advantage lies in offering aesthetically appealing designs that align with local cultural preferences, combined with superior material quality and certifications for eco-friendliness.

Key Drivers, Barriers & Challenges in Latin America Home Textiles Distribution Market

Key Drivers:

- Rising Disposable Incomes: Increased purchasing power among the growing middle class fuels demand for home décor and upgrades.

- E-commerce Expansion: Online platforms provide wider product accessibility and convenience for consumers.

- Urbanization: Growing urban populations necessitate more furnished living spaces.

- Focus on Home Comfort: Post-pandemic trends emphasize creating comfortable and well-appointed living environments.

Barriers & Challenges:

- Economic Volatility & Currency Fluctuations: Unstable economic conditions and fluctuating exchange rates can impact pricing and import costs, with an estimated impact of 5-8% on profit margins.

- Logistical and Infrastructure Gaps: Inadequate transportation networks in some regions can increase distribution costs and lead times.

- Complex Regulatory Environments: Varying import duties, taxes, and compliance standards across countries create operational complexities.

- Intense Competition: A crowded market with both local and international players necessitates strong differentiation.

Growth Drivers in the Latin America Home Textiles Distribution Market Market

The Latin America Home Textiles Distribution Market is propelled by a combination of robust economic factors and evolving consumer behaviors. Growing disposable incomes and an expanding middle class are primary economic drivers, leading to increased discretionary spending on home furnishings. Technological advancements, particularly in online retail and digital marketing, are creating unprecedented access to products for consumers across the region. Government initiatives aimed at supporting local manufacturing and trade agreements can also foster growth by reducing import barriers and promoting regional commerce. Furthermore, a sustained focus on home improvement and comfort, amplified by global trends, continues to be a significant psychological driver for consumers to invest in their living spaces.

Challenges Impacting Latin America Home Textiles Distribution Market Growth

Several barriers and restraints challenge the expansion of the Latin America Home Textiles Distribution Market. Significant regulatory complexities, including diverse import/export regulations and tax structures across various nations, create operational hurdles and increase compliance costs, estimated to add 3-5% to operational expenses. Supply chain disruptions, exacerbated by logistical infrastructure limitations and geopolitical uncertainties, can lead to delays and increased costs, impacting delivery timelines by up to 15% during peak periods. Intense competitive pressures from both established global brands and agile local players necessitate continuous innovation and aggressive pricing strategies, potentially squeezing profit margins for smaller distributors. Economic instability and currency fluctuations within the region also pose a substantial risk, affecting import costs and consumer purchasing power.

Key Players Shaping the Latin America Home Textiles Distribution Market Market

- Cenconsud

- Buddemeyer

- Springs Global

- Kaltex

- Textil J Serrano

- Coteminas S A

- TEKA

- Jolitex Ternille

- Camesa

- Tex Brasil

- Muller Textiles

Significant Latin America Home Textiles Distribution Market Industry Milestones

- August 2023: Zona Franca de Iquique (Zofri), a pivotal hub of commerce and industry, announced its collaboration with cloud software company Infor. Zofri, an epicenter of trade for electronics, automotive, textiles, and household items, will implement Infor's warehouse management system to streamline processes and enhance customer experiences, facilitated by Cerca Technology.

- May 2023: Raff Military Textile strengthened its ties with Latin America by expanding its export of military textiles and seizing opportunities for collaboration and expansion in Colombia, aiming to gain insights into the local market.

Future Outlook for Latin America Home Textiles Distribution Market Market

The future outlook for the Latin America Home Textiles Distribution Market is overwhelmingly positive, driven by sustained economic growth, increasing urbanization, and a persistent consumer focus on enhancing home environments. Strategic opportunities abound in leveraging the expanding e-commerce landscape, catering to the growing demand for sustainable and ethically sourced products, and innovating with smart textiles. The market's potential lies in its ability to adapt to evolving consumer preferences, navigate regulatory landscapes effectively, and build resilient supply chains. Companies that prioritize customer experience, invest in digital transformation, and embrace innovation are well-positioned to capitalize on the significant growth catalysts anticipated in the coming years.

Latin America Home Textiles Distribution Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Latin America Home Textiles Distribution Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Home Textiles Distribution Market Regional Market Share

Geographic Coverage of Latin America Home Textiles Distribution Market

Latin America Home Textiles Distribution Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Disposable Income is Driving the Market; Urbanisation is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruptions are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Bed Linen Segment is Holding the Large Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Home Textiles Distribution Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cenconsud

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Buddemeyer

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Springs Global

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kaltex

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Textil J Serrano

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Coteminas S A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TEKA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Jolitex Ternille

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Camesa

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tex Brasil

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Muller Textiles**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Cenconsud

List of Figures

- Figure 1: Latin America Home Textiles Distribution Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Home Textiles Distribution Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Home Textiles Distribution Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Latin America Home Textiles Distribution Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Latin America Home Textiles Distribution Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Latin America Home Textiles Distribution Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Latin America Home Textiles Distribution Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Latin America Home Textiles Distribution Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Latin America Home Textiles Distribution Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Latin America Home Textiles Distribution Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Latin America Home Textiles Distribution Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Latin America Home Textiles Distribution Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Latin America Home Textiles Distribution Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Latin America Home Textiles Distribution Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Latin America Home Textiles Distribution Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Latin America Home Textiles Distribution Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Chile Latin America Home Textiles Distribution Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Colombia Latin America Home Textiles Distribution Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Mexico Latin America Home Textiles Distribution Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Peru Latin America Home Textiles Distribution Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Venezuela Latin America Home Textiles Distribution Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Ecuador Latin America Home Textiles Distribution Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Bolivia Latin America Home Textiles Distribution Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Paraguay Latin America Home Textiles Distribution Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Home Textiles Distribution Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Latin America Home Textiles Distribution Market?

Key companies in the market include Cenconsud, Buddemeyer, Springs Global, Kaltex, Textil J Serrano, Coteminas S A, TEKA, Jolitex Ternille, Camesa, Tex Brasil, Muller Textiles**List Not Exhaustive.

3. What are the main segments of the Latin America Home Textiles Distribution Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Disposable Income is Driving the Market; Urbanisation is Driving the Market.

6. What are the notable trends driving market growth?

Bed Linen Segment is Holding the Large Market Share.

7. Are there any restraints impacting market growth?

Supply Chain Disruptions are Restraining the Market.

8. Can you provide examples of recent developments in the market?

August 2023: Zona Franca de Iquique (Zofri), a pivotal hub of commerce and industry has announced its collaboration with cloud software company Infor. Zofri stands as an epicenter of trade, offering products spanning electronics, automotive, textiles, household items, and more. Zofri will be implementing Infor's warehouse management system, in streamlining its processes and enhancing customer experiences. The implementation will be facilitated by Cerca Technology, Infor's partner in the Latin American region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Home Textiles Distribution Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Home Textiles Distribution Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Home Textiles Distribution Market?

To stay informed about further developments, trends, and reports in the Latin America Home Textiles Distribution Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence