Key Insights

The Asia-Pacific Gas Turbine Market is projected for substantial expansion, with an estimated size of $22.6 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 11.2%. This growth is underpinned by rising energy requirements across the region, driven by rapid industrialization and urbanization. The imperative for dependable and efficient power generation to support burgeoning economies, particularly in China and India, is a significant growth factor. Moreover, the ongoing shift towards cleaner energy solutions, where gas turbines are pivotal in complementing intermittent renewable sources, is a key trend. Investments in modernizing power infrastructure and the expansion of the oil and gas sector, necessitating robust and adaptable turbine solutions for exploration and processing, also contribute to market growth. The market is segmented by capacity, with a notable presence in the 31-120 MW range, serving diverse power generation needs. Both combined cycle and open cycle turbines command significant market shares, reflecting their respective applications in baseload and peaking power generation.

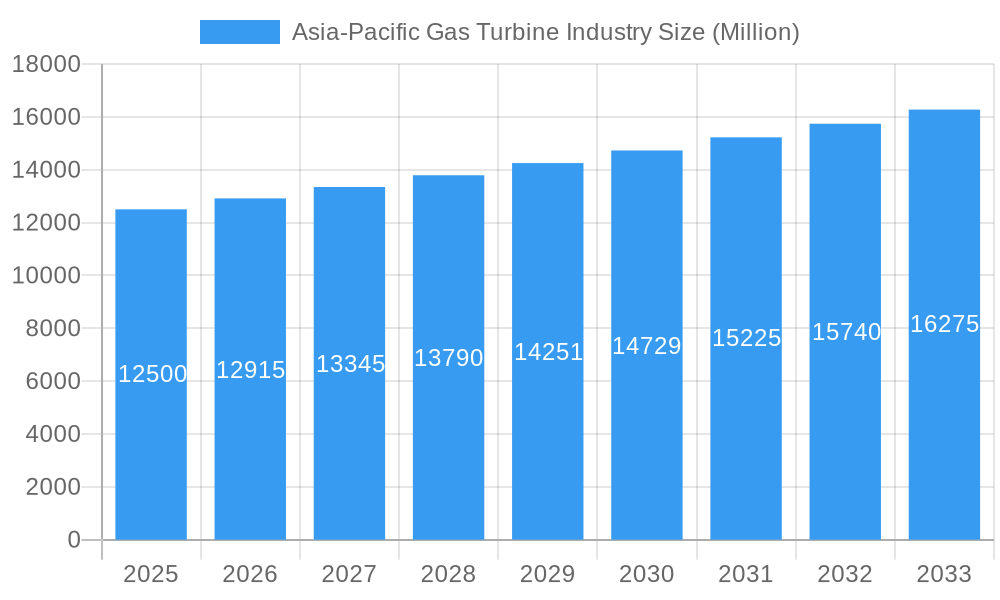

Asia-Pacific Gas Turbine Industry Market Size (In Billion)

Despite a positive outlook, certain challenges may moderate growth. Stringent environmental regulations concerning emissions, while promoting cleaner technologies, can increase deployment and operational costs. Volatility in natural gas prices, the primary fuel for gas turbines, can impact operational economics and investment decisions. Geographically, China and India are anticipated to lead the market, propelled by their substantial energy consumption and ongoing infrastructure development initiatives. Japan and the Rest of the Asia-Pacific region also represent key markets, emphasizing technological innovation and industrial efficiency. Leading companies such as Siemens AG, General Electric Company, and Mitsubishi Heavy Industries Ltd. are actively investing in research and development, focusing on improving turbine efficiency, reducing emissions, and developing solutions for emerging applications within the power, oil and gas, and other industrial sectors.

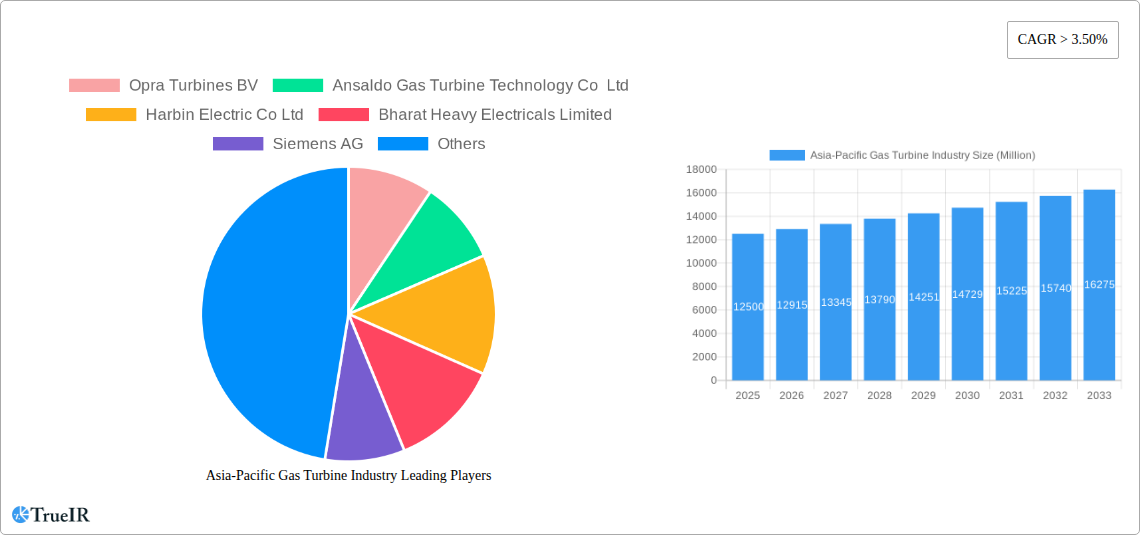

Asia-Pacific Gas Turbine Industry Company Market Share

Asia-Pacific Gas Turbine Industry Market Structure & Competitive Landscape

The Asia-Pacific gas turbine industry is characterized by a moderately concentrated market structure, with key players like Siemens AG, General Electric Company, and Mitsubishi Heavy Industries Ltd. holding significant market share. Innovation is a critical driver, fueled by a demand for higher efficiency, lower emissions, and enhanced reliability, especially with the growing integration of renewable energy sources requiring flexible power generation. Regulatory frameworks, particularly those promoting cleaner energy and stricter emission standards, are increasingly influencing market dynamics. The threat of product substitutes, such as advanced reciprocating engines and emerging energy storage solutions, exists but is mitigated by the superior power output and flexibility of gas turbines, particularly in large-scale power generation and critical industrial applications. End-user segmentation reveals a strong reliance on the power generation sector, followed by the oil and gas industry, with a smaller but growing segment in other industrial applications like manufacturing and transportation. Mergers and acquisitions (M&A) activity, while not at an extreme level, is present as companies seek to consolidate expertise, expand geographical reach, and acquire new technologies. For instance, consolidation in the upstream and downstream oil and gas sectors can indirectly influence the demand for gas turbine solutions. Concentration ratios are estimated to be around 60% for the top three players. M&A volumes have seen a steady increase, with approximately 5-7 significant deals annually over the historical period, primarily focused on technological acquisitions and market consolidation.

Asia-Pacific Gas Turbine Industry Market Trends & Opportunities

The Asia-Pacific gas turbine industry is poised for significant expansion, driven by robust economic growth, increasing energy demand, and a concerted push towards cleaner energy solutions. The market size is projected to grow from an estimated 25,000 Million in 2024 to 45,000 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period. This expansion is underpinned by several key trends. Firstly, the escalating demand for electricity across developing economies like China and India, coupled with the need to replace aging infrastructure, is a primary catalyst. Secondly, the global energy transition, while promoting renewables, also necessitates flexible and efficient power generation sources like gas turbines to balance grid stability and provide backup power. This has led to a growing interest in dual-fuel capabilities and hydrogen combustion readiness. Technological advancements are continuously improving turbine efficiency, reducing fuel consumption and emissions, and enhancing operational flexibility. Manufacturers are investing heavily in R&D to develop more compact, modular, and digitally integrated gas turbine solutions.

Consumer preferences are shifting towards solutions that offer lower operational expenditure, enhanced grid integration capabilities, and a reduced carbon footprint. This translates into a demand for advanced control systems, predictive maintenance capabilities, and turbines that can operate on a wider range of fuels, including hydrogen blends. The competitive landscape is dynamic, with established global players vying for market share against emerging regional manufacturers. Strategic partnerships and collaborations are becoming increasingly common to leverage complementary strengths and accelerate innovation. Market penetration rates for advanced gas turbine technologies are expected to rise as industries recognize their long-term economic and environmental benefits. The ongoing urbanization and industrialization across the region will continue to drive demand for reliable and scalable power generation. Furthermore, the increasing focus on energy security and diversification of energy sources will also contribute to the sustained growth of the gas turbine market. Opportunities lie in providing solutions for peak demand management, distributed power generation, and repowering of older, less efficient thermal power plants. The development of small modular reactors (SMRs) in the long term may present a competitive element, but for the foreseeable future, gas turbines remain the dominant flexible power solution.

Dominant Markets & Segments in Asia-Pacific Gas Turbine Industry

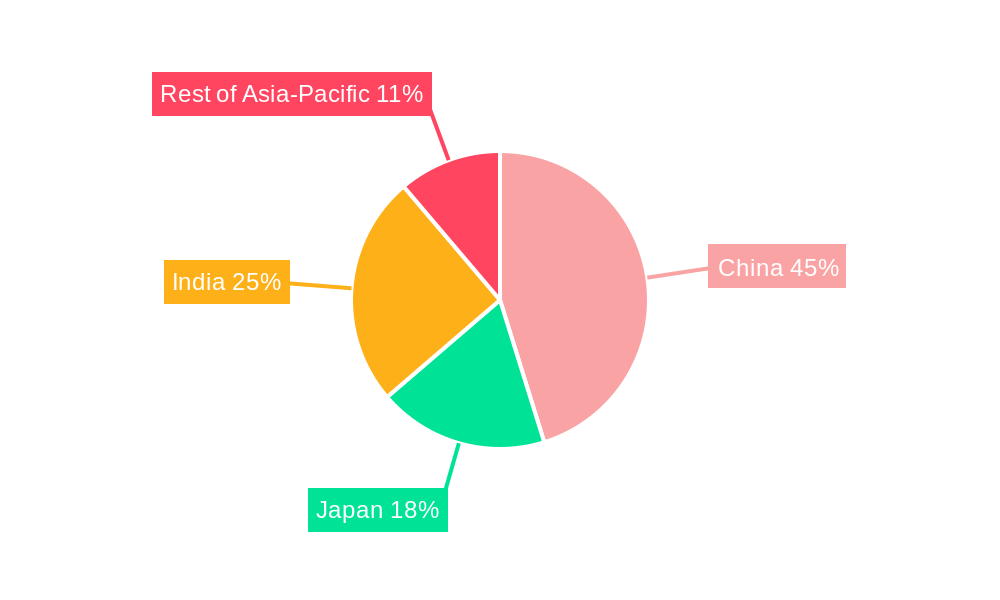

The Asia-Pacific gas turbine industry's dominance is clearly established in China and India, which collectively represent over 65% of the regional market demand. This preeminence is driven by a confluence of factors including rapid industrialization, massive population growth leading to escalating power needs, and significant government investments in energy infrastructure.

- China stands out as the largest single market, fueled by its expansive manufacturing base and ambitious renewable energy targets that necessitate complementary flexible power sources. The country's focus on upgrading its power grid and transitioning away from coal in certain regions further bolsters demand for gas turbines.

- India follows closely, propelled by its commitment to achieving energy security, electrifying rural areas, and meeting the burgeoning power requirements of its rapidly growing economy. Government initiatives promoting the use of natural gas and the expansion of gas pipeline infrastructure are significant growth enablers.

- The Rest of Asia-Pacific, encompassing countries like Japan, South Korea, and Southeast Asian nations, also contributes substantially, albeit with distinct drivers. Japan, with its advanced industrial sector and focus on energy efficiency, presents a market for high-efficiency and specialized gas turbine applications. Southeast Asian nations are increasingly investing in new power generation capacity to support their economic development.

Analyzing by segments:

- Application: Power clearly dominates the market, accounting for an estimated 75% of all gas turbine deployments. This is directly linked to the region's vast and growing electricity consumption needs.

- Capacity: 31-120 MW and Above 120 MW segments are seeing robust growth, catering to utility-scale power plants and large industrial complexes that require substantial and reliable power output. The demand for larger capacities is driven by the need for economies of scale in power generation.

- Type: Combined Cycle technology is the preferred choice for utility-scale power generation due to its significantly higher thermal efficiency compared to open cycle systems. This efficiency translates into lower fuel costs and reduced emissions.

- The Oil and Gas application segment, while smaller than power, is a critical and growing market. Gas turbines are essential for powering upstream exploration and production facilities, midstream compression stations, and downstream refining operations. The region's extensive oil and gas reserves and expanding exploration activities support this segment.

Key growth drivers include:

- Infrastructure Development: Massive investments in power grids and industrial facilities across China and India.

- Policy Support: Government incentives and regulations favoring natural gas as a cleaner transitional fuel and promoting energy efficiency.

- Economic Growth: Sustained industrialization and urbanization leading to a persistent increase in energy demand.

- Energy Security: The imperative for nations to secure reliable and diverse energy sources.

- Technological Advancements: Development of more efficient, cleaner, and flexible gas turbine technologies.

Asia-Pacific Gas Turbine Industry Product Analysis

The Asia-Pacific gas turbine industry is witnessing continuous product innovation focused on enhancing efficiency, reducing emissions, and increasing operational flexibility. Key advancements include the development of advanced aerodynamic designs, improved materials for higher operating temperatures, and sophisticated control systems. These innovations are critical for meeting stringent environmental regulations and catering to the evolving demands of the power, oil and gas, and other industrial sectors. The market is characterized by a strong competitive advantage derived from technological leadership, cost-effectiveness, and comprehensive after-sales support. Products are increasingly designed for modularity and ease of integration, supporting both large-scale utility applications and decentralized power generation needs.

Key Drivers, Barriers & Challenges in Asia-Pacific Gas Turbine Industry

Key Drivers:

- Rising Energy Demand: Rapid economic growth and urbanization across Asia-Pacific necessitate significant expansion of power generation capacity.

- Transition to Cleaner Fuels: Government policies promoting natural gas as a bridge fuel to cleaner energy sources, coupled with initiatives to reduce reliance on coal.

- Technological Advancements: Continuous improvements in gas turbine efficiency, emissions control, and operational flexibility are making them more attractive.

- Infrastructure Development: Substantial investments in new power plants, industrial facilities, and gas pipeline networks.

- Energy Security Concerns: Nations are prioritizing reliable and diverse energy sources, with gas turbines playing a crucial role in grid stability.

Barriers & Challenges:

- Natural Gas Availability and Infrastructure: The development of robust natural gas supply chains and infrastructure is still a bottleneck in certain sub-regions.

- Regulatory Complexities: Navigating diverse and evolving environmental regulations and permitting processes across different countries can be challenging.

- Competition from Renewables and Storage: The declining cost of renewable energy sources (solar, wind) and advancements in energy storage pose increasing competition.

- High Upfront Investment: The capital-intensive nature of gas turbine installations can be a barrier for some developing economies.

- Supply Chain Disruptions: Geopolitical factors and global events can impact the availability of components and raw materials.

Growth Drivers in the Asia-Pacific Gas Turbine Industry Market

The growth of the Asia-Pacific gas turbine industry is predominantly propelled by the insatiable demand for electricity stemming from rapid economic development and burgeoning populations across nations like China and India. Government-led initiatives promoting natural gas as a cleaner transitional fuel, alongside ambitious infrastructure development projects, provide significant policy-driven impetus. Technological advancements are also critical, with manufacturers consistently enhancing turbine efficiency, reducing emissions profiles, and improving operational flexibility. This pursuit of performance aligns with increasing global and regional energy security imperatives, as gas turbines offer a reliable and scalable power generation solution. For example, the widespread adoption of combined cycle gas turbine (CCGT) technology is a direct response to the need for high-efficiency power generation, optimizing fuel consumption and lowering operational costs.

Challenges Impacting Asia-Pacific Gas Turbine Industry Growth

Despite robust growth prospects, the Asia-Pacific gas turbine industry faces several critical challenges. The availability and accessibility of natural gas feedstock remain a significant constraint in some parts of the region, impacting the economics and deployment of gas turbine projects. Navigating the complex and often evolving regulatory landscapes across various countries, including stringent environmental standards and permitting procedures, presents a considerable hurdle. Furthermore, the rapidly decreasing costs of renewable energy sources like solar and wind, coupled with advancements in energy storage technologies, are creating a competitive pressure, particularly for new capacity additions. The substantial upfront capital investment required for gas turbine installations can also be a deterrent, especially for emerging economies with limited financial resources. Lastly, potential supply chain disruptions, influenced by geopolitical instability and global economic fluctuations, pose a risk to project timelines and cost management.

Key Players Shaping the Asia-Pacific Gas Turbine Industry Market

- Opra Turbines BV

- Ansaldo Gas Turbine Technology Co Ltd

- Harbin Electric Co Ltd

- Bharat Heavy Electricals Limited

- Siemens AG

- General Electric Company

- Kawasaki Heavy Industries Ltd

- Capstone Turbine Corporation

- Mitsubishi Heavy Industries Ltd

Significant Asia-Pacific Gas Turbine Industry Industry Milestones

- November 2022: Wärtsilä was awarded a contract to supply a gas-fueled 15.5 MW captive power plant under an engineering, procurement, and construction (EPC) contract along with a five-year Operation & Maintenance (O&M) agreement in Chennai, Tamilnadu, India. The order has been placed by Tamilnadu Petroproducts Limited (TPL), the world's leading manufacturer of linear alkyl benzene (LAB), a subsidiary of AM International, Singapore. This milestone highlights the growing demand for captive power solutions and Wärtsilä's expanding footprint in India.

- October 2022: National Thermal Power Corporation (NTPC) and GE Gas Power signed a Memorandum of Understanding (MoU) to investigate the feasibility of combining hydrogen (H2) with natural gas in GE's 9E gas turbines installed at NTPC's Kawas combined-cycle gas power plant in Gujarat, India. This development signifies a crucial step towards the decarbonization of gas turbine operations and the integration of hydrogen as a future fuel source in the region.

Future Outlook for Asia-Pacific Gas Turbine Industry Market

The future outlook for the Asia-Pacific gas turbine industry is exceptionally promising, driven by sustained economic expansion and the ongoing energy transition. Strategic opportunities lie in catering to the growing demand for flexible and efficient power generation to complement renewable energy sources. The industry is expected to witness significant growth in hybrid power solutions, incorporating hydrogen or other cleaner fuels. Furthermore, investments in upgrading aging power infrastructure and expanding industrial capacity will continue to fuel demand. The increasing focus on energy security and the desire to reduce reliance on imported fossil fuels will also contribute to the sustained market potential, particularly for domestically manufactured or locally supported gas turbine technologies.

Asia-Pacific Gas Turbine Industry Segmentation

-

1. Capacity

- 1.1. Less than 30 MW

- 1.2. 31-120 MW

- 1.3. Above 120 MW

-

2. Type

- 2.1. Combined Cycle

- 2.2. Open Cycle

-

3. Application

- 3.1. Power

- 3.2. Oil and Gas

- 3.3. Other Industries

-

4. Geography

- 4.1. China

- 4.2. Japan

- 4.3. India

- 4.4. Rest of Asia-Pacific

Asia-Pacific Gas Turbine Industry Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Rest of Asia Pacific

Asia-Pacific Gas Turbine Industry Regional Market Share

Geographic Coverage of Asia-Pacific Gas Turbine Industry

Asia-Pacific Gas Turbine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Supportive Government Policies and Incentives4.; Environmental Concerns

- 3.3. Market Restrains

- 3.3.1. 4.; Fossil Fuel Subsidies

- 3.4. Market Trends

- 3.4.1. The Power Generation Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Gas Turbine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Capacity

- 5.1.1. Less than 30 MW

- 5.1.2. 31-120 MW

- 5.1.3. Above 120 MW

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Combined Cycle

- 5.2.2. Open Cycle

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Power

- 5.3.2. Oil and Gas

- 5.3.3. Other Industries

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. Japan

- 5.5.3. India

- 5.5.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Capacity

- 6. China Asia-Pacific Gas Turbine Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Capacity

- 6.1.1. Less than 30 MW

- 6.1.2. 31-120 MW

- 6.1.3. Above 120 MW

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Combined Cycle

- 6.2.2. Open Cycle

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Power

- 6.3.2. Oil and Gas

- 6.3.3. Other Industries

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. Japan

- 6.4.3. India

- 6.4.4. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Capacity

- 7. Japan Asia-Pacific Gas Turbine Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Capacity

- 7.1.1. Less than 30 MW

- 7.1.2. 31-120 MW

- 7.1.3. Above 120 MW

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Combined Cycle

- 7.2.2. Open Cycle

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Power

- 7.3.2. Oil and Gas

- 7.3.3. Other Industries

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. Japan

- 7.4.3. India

- 7.4.4. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Capacity

- 8. India Asia-Pacific Gas Turbine Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Capacity

- 8.1.1. Less than 30 MW

- 8.1.2. 31-120 MW

- 8.1.3. Above 120 MW

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Combined Cycle

- 8.2.2. Open Cycle

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Power

- 8.3.2. Oil and Gas

- 8.3.3. Other Industries

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. Japan

- 8.4.3. India

- 8.4.4. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Capacity

- 9. Rest of Asia Pacific Asia-Pacific Gas Turbine Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Capacity

- 9.1.1. Less than 30 MW

- 9.1.2. 31-120 MW

- 9.1.3. Above 120 MW

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Combined Cycle

- 9.2.2. Open Cycle

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Power

- 9.3.2. Oil and Gas

- 9.3.3. Other Industries

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. Japan

- 9.4.3. India

- 9.4.4. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Capacity

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Opra Turbines BV

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Ansaldo Gas Turbine Technology Co Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Harbin Electric Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Bharat Heavy Electricals Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Siemens AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 General Electric Company

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Kawasaki Heavy Industries Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Capstone Turbine Corporation*List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Mitsubishi Heavy Industries Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Opra Turbines BV

List of Figures

- Figure 1: Asia-Pacific Gas Turbine Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Gas Turbine Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Gas Turbine Industry Revenue billion Forecast, by Capacity 2020 & 2033

- Table 2: Asia-Pacific Gas Turbine Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Asia-Pacific Gas Turbine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Asia-Pacific Gas Turbine Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Asia-Pacific Gas Turbine Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Gas Turbine Industry Revenue billion Forecast, by Capacity 2020 & 2033

- Table 7: Asia-Pacific Gas Turbine Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Asia-Pacific Gas Turbine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Asia-Pacific Gas Turbine Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Asia-Pacific Gas Turbine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Asia-Pacific Gas Turbine Industry Revenue billion Forecast, by Capacity 2020 & 2033

- Table 12: Asia-Pacific Gas Turbine Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 13: Asia-Pacific Gas Turbine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Asia-Pacific Gas Turbine Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Gas Turbine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Gas Turbine Industry Revenue billion Forecast, by Capacity 2020 & 2033

- Table 17: Asia-Pacific Gas Turbine Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Asia-Pacific Gas Turbine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Asia-Pacific Gas Turbine Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific Gas Turbine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Gas Turbine Industry Revenue billion Forecast, by Capacity 2020 & 2033

- Table 22: Asia-Pacific Gas Turbine Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 23: Asia-Pacific Gas Turbine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 24: Asia-Pacific Gas Turbine Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: Asia-Pacific Gas Turbine Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Gas Turbine Industry?

The projected CAGR is approximately 11.2%.

2. Which companies are prominent players in the Asia-Pacific Gas Turbine Industry?

Key companies in the market include Opra Turbines BV, Ansaldo Gas Turbine Technology Co Ltd, Harbin Electric Co Ltd, Bharat Heavy Electricals Limited, Siemens AG, General Electric Company, Kawasaki Heavy Industries Ltd, Capstone Turbine Corporation*List Not Exhaustive, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Asia-Pacific Gas Turbine Industry?

The market segments include Capacity, Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.6 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Supportive Government Policies and Incentives4.; Environmental Concerns.

6. What are the notable trends driving market growth?

The Power Generation Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Fossil Fuel Subsidies.

8. Can you provide examples of recent developments in the market?

November 2022: Wärtsilä was awarded a contract to supply a gas-fueled 15.5 MW captive power plant under an engineering, procurement, and construction (EPC) contract along with a five-year Operation & Maintenance (O&M) agreement in Chennai, Tamilnadu, India. The order has been placed by Tamilnadu Petroproducts Limited (TPL), the world's leading manufacturer of linear alkyl benzene (LAB), a subsidiary of AM International, Singapore.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Gas Turbine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Gas Turbine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Gas Turbine Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Gas Turbine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence