Key Insights

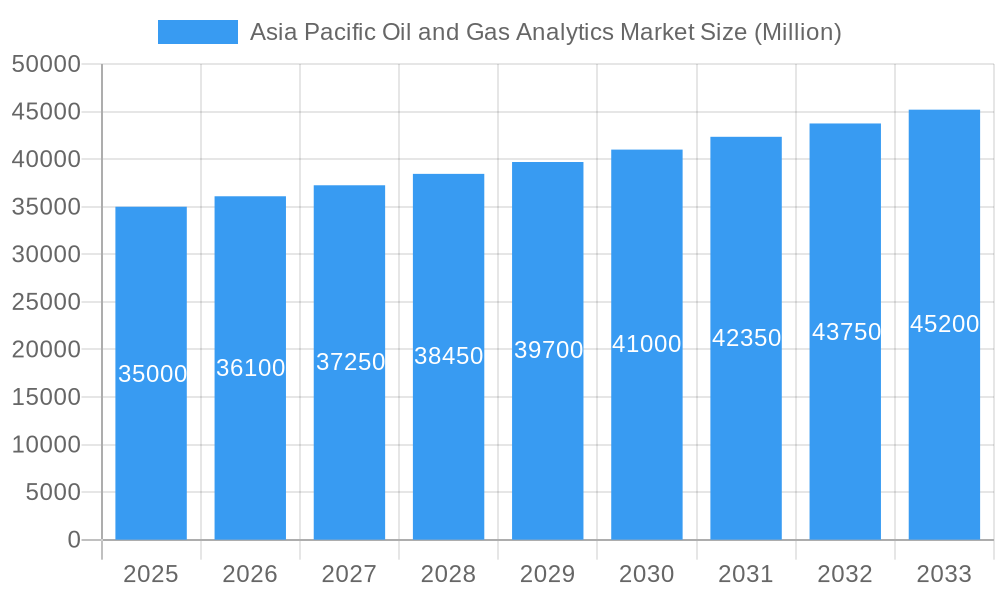

The Asia Pacific Oil and Gas Analytics Market is set for substantial growth, with an anticipated Compound Annual Growth Rate (CAGR) of 13.25%. The market size is projected to reach $9.36 billion by 2025, with the forecast period extending to 2033. This expansion is driven by the increasing need for advanced analytical solutions to optimize exploration, production, and refining processes amidst market volatility and evolving regulations. Key growth factors include the demand for enhanced operational efficiency, predictive maintenance, and improved safety standards across all segments of the oil and gas value chain. The adoption of AI and machine learning technologies is crucial for cost reduction, minimizing downtime, and maximizing hydrocarbon recovery. Significant investments in digital transformation by major industry players and the development of new energy resources further fuel market expansion.

Asia Pacific Oil and Gas Analytics Market Market Size (In Billion)

Emerging trends, such as the integration of IoT for real-time data and big data analytics for reservoir characterization and production forecasting, are shaping market dynamics. While the energy transition is a long-term consideration, oil and gas remain central to the Asia Pacific's energy sector, necessitating sophisticated analytical tools. Challenges like data security, the need for skilled professionals, and legacy system integration require attention. However, the persistent drive for cost optimization, efficient resource management, and regulatory compliance will sustain market growth, particularly in key economies like China and India.

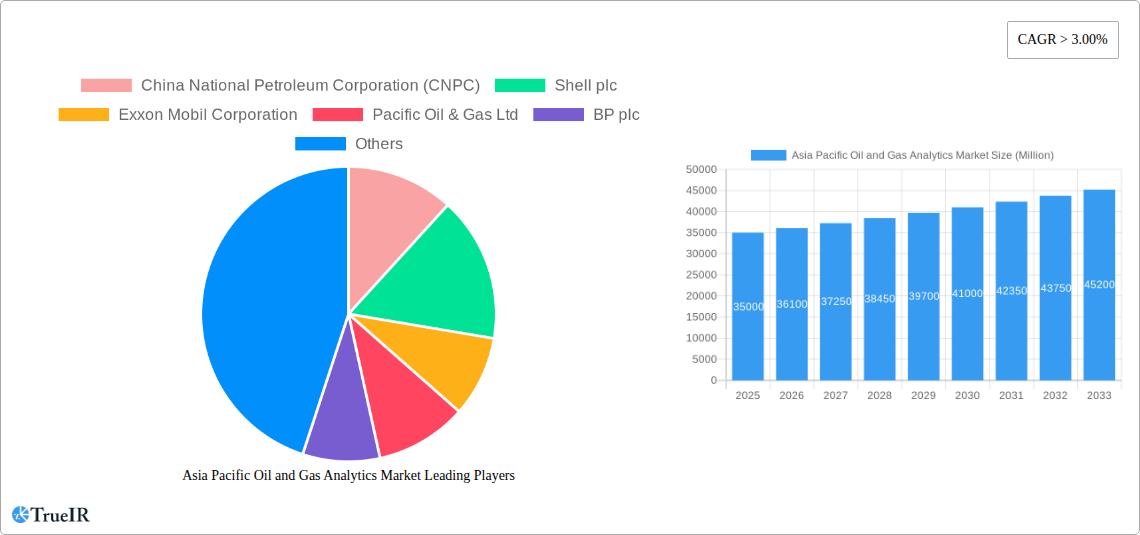

Asia Pacific Oil and Gas Analytics Market Company Market Share

This report offers a comprehensive analysis of the Asia Pacific Oil and Gas Analytics Market, providing actionable insights for stakeholders. It examines the critical role of data analytics in optimizing operations, mitigating risks, and boosting profitability across the region's energy landscape, from upstream exploration to downstream refining. Our extensive study, with a base year of 2025 and an estimated market size of $9.36 billion, forecasts market evolution from 2025 to 2033, incorporating historical data.

Asia Pacific Oil and Gas Analytics Market Market Structure & Competitive Landscape

The Asia Pacific Oil and Gas Analytics Market is characterized by a moderately concentrated landscape, with key players investing heavily in advanced analytics solutions to gain a competitive edge. Innovation is a primary driver, fueled by the increasing adoption of AI, machine learning, and big data technologies to enhance exploration success rates, optimize production, and streamline supply chains. Regulatory frameworks, while evolving, are generally supportive of technological advancements aimed at improving safety and environmental compliance. Product substitutes, such as traditional manual analysis methods, are gradually being phased out as the benefits of digital transformation become more apparent. End-user segmentation reveals significant demand across upstream (exploration and production), midstream (transportation and storage), and downstream (refining and marketing) sectors. Mergers and acquisitions (M&A) trends indicate consolidation, with larger entities acquiring smaller, specialized analytics firms to bolster their capabilities. For instance, several major oil and gas corporations have either acquired or partnered with analytics providers to integrate cutting-edge solutions into their operations. The market concentration is estimated to be around 45%, with the top five companies holding a significant market share. M&A volumes have seen a steady increase, with an estimated 15-20 significant deals in the last five years, focusing on acquiring niche technologies and expanding market reach.

Asia Pacific Oil and Gas Analytics Market Market Trends & Opportunities

The Asia Pacific Oil and Gas Analytics Market is poised for substantial growth, driven by the escalating demand for operational efficiency, cost optimization, and enhanced decision-making capabilities across the entire oil and gas value chain. The market size is projected to expand significantly, with a compound annual growth rate (CAGR) of approximately 18% during the forecast period of 2025–2033. This growth is fueled by the imperative to extract more from existing reserves, manage the complexities of offshore and onshore operations, and adapt to evolving energy demands. Technological shifts are at the forefront, with the widespread adoption of the Internet of Things (IoT) generating vast amounts of real-time data, which analytics platforms are designed to process and interpret. Artificial intelligence (AI) and machine learning (ML) algorithms are becoming indispensable for predictive maintenance, anomaly detection, reservoir characterization, and optimizing drilling parameters. Consumer preferences, within the industry context, are increasingly shifting towards data-driven insights that can lead to tangible improvements in safety, environmental performance, and profitability. Competitive dynamics are intense, with both established technology providers and specialized analytics firms vying for market share. Opportunities abound for companies offering solutions that can address specific industry pain points, such as reducing downtime, improving exploration success rates, optimizing logistics, and ensuring regulatory compliance. The penetration rate of advanced analytics solutions is expected to climb from approximately 30% in the base year to over 70% by the end of the forecast period. The increasing complexity of exploration and production activities, particularly in deep-water and challenging onshore environments, necessitates sophisticated analytical tools for risk assessment and resource management. Furthermore, the growing emphasis on sustainability and reducing the environmental footprint of oil and gas operations is creating a demand for analytics that can monitor emissions, optimize energy consumption, and support the transition to cleaner energy sources.

Dominant Markets & Segments in Asia Pacific Oil and Gas Analytics Market

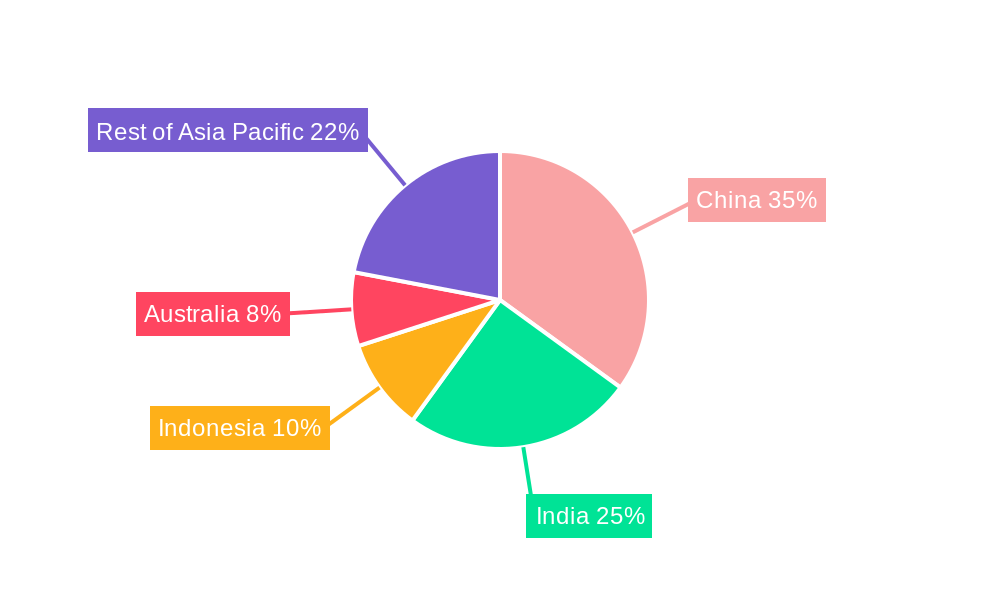

China is emerging as a dominant market within the Asia Pacific Oil and Gas Analytics landscape, propelled by its vast energy consumption, significant investments in both upstream and downstream sectors, and a strong government push towards digital transformation in its state-owned energy giants like China National Petroleum Corporation (CNPC). The upstream sector, particularly for oil and gas analytics, exhibits the highest growth potential due to the continuous need for exploration, enhanced oil recovery, and efficient production management. Offshore operations, while capital-intensive, are also witnessing increased adoption of analytics for managing complex subsea infrastructure and deep-water exploration. India follows closely, with its rapidly expanding energy demand and substantial investments in oil and gas infrastructure, creating a fertile ground for analytics solutions. ONGC and Cairn Oil & Gas are actively integrating advanced analytics to boost domestic production and optimize refining processes. Indonesia and Australia also represent significant markets, with Australia's mature offshore industry and Indonesia's growing upstream activities contributing to the demand for sophisticated analytics. The "Rest of Asia Pacific" region, encompassing countries like Malaysia, Thailand, and Vietnam, presents a burgeoning opportunity as these nations expand their exploration efforts and upgrade their refining capacities.

- Dominant Geography: China leads the market due to its substantial domestic demand, extensive exploration activities, and the strategic integration of analytics by national oil companies.

- Dominant Sector: The Upstream sector is a primary focus for oil and gas analytics, driven by the need for improved reservoir characterization, predictive maintenance of drilling equipment, and optimized production strategies.

- Dominant Location: Offshore analytics solutions are gaining traction due to the increasing complexity and high-value nature of deep-water exploration and production projects.

- Key Growth Drivers:

- Infrastructure Development: Extensive investments in new pipelines, refineries, and exploration projects necessitate advanced analytics for efficient management.

- Government Policies: Supportive policies encouraging technological adoption and digitalization in the energy sector are significant enablers.

- Technological Advancements: The proliferation of AI, ML, and IoT technologies provides the foundation for sophisticated analytics solutions.

- Cost Optimization: The drive to reduce operational expenditures and improve profitability makes analytics indispensable.

Asia Pacific Oil and Gas Analytics Market Product Analysis

The Asia Pacific Oil and Gas Analytics Market is witnessing a surge in product innovations focused on delivering real-time insights and actionable intelligence. Key product categories include predictive maintenance solutions for equipment reliability, reservoir modeling and simulation tools for optimized extraction, supply chain optimization platforms for efficient logistics, and safety and compliance monitoring systems. These products leverage advanced algorithms such as machine learning for anomaly detection, deep learning for complex pattern recognition, and big data processing for handling massive datasets from sensors and operational systems. Competitive advantages are derived from the accuracy of predictions, the ease of integration with existing infrastructure, and the ability to provide customizable solutions that address specific operational challenges across upstream, midstream, and downstream segments.

Key Drivers, Barriers & Challenges in Asia Pacific Oil and Gas Analytics Market

The Asia Pacific Oil and Gas Analytics Market is propelled by several key drivers, including the imperative for enhanced operational efficiency, the need to reduce costs and mitigate risks in complex extraction environments, and the growing adoption of digital transformation initiatives across the industry. Technological advancements in AI, machine learning, and IoT are enabling more sophisticated data analysis, leading to better decision-making.

Challenges include significant upfront investment costs for implementing advanced analytics solutions, a shortage of skilled data scientists and analysts within the region, and concerns surrounding data security and privacy. Cybersecurity threats pose a continuous risk to sensitive operational data.

Growth Drivers in the Asia Pacific Oil and Gas Analytics Market Market

Key growth drivers in the Asia Pacific Oil and Gas Analytics Market are multi-faceted, encompassing technological advancements, economic imperatives, and evolving regulatory landscapes. The relentless pursuit of operational efficiency and cost reduction in a volatile commodity market is a primary economic driver. Technological advancements, particularly in AI, ML, and IoT, provide the tools to unlock valuable insights from the massive data generated by exploration, production, and refining activities. Supportive government policies and initiatives promoting digitalization within the energy sector further accelerate adoption. For instance, initiatives aimed at increasing domestic energy production often include provisions for technological integration.

Challenges Impacting Asia Pacific Oil and Gas Analytics Market Growth

Challenges impacting the growth of the Asia Pacific Oil and Gas Analytics Market include significant implementation costs associated with sophisticated analytical software and hardware, and the persistent gap in skilled talent, with a shortage of experienced data scientists and analytics professionals within the region. Cybersecurity risks, including data breaches and operational disruptions, pose a substantial threat to the adoption of cloud-based analytics solutions. Additionally, fragmented regulatory frameworks across different countries can create complexities in data governance and cross-border data sharing, impacting the seamless deployment of analytics across the region.

Key Players Shaping the Asia Pacific Oil and Gas Analytics Market Market

- China National Petroleum Corporation (CNPC)

- Shell plc

- Exxon Mobil Corporation

- Pacific Oil & Gas Ltd

- BP plc

- Oil and Natural Gas Corporation (ONGC)

- Cairn Oil & Gas a vertical of Vedanta Limited

- Chevron Corporation

- Equinor ASA

- TotalEnergies SE

Significant Asia Pacific Oil and Gas Analytics Market Industry Milestones

- April 2022: GAIL announced that its joint venture company Bengal Gas Co and Hindustan Petroleum Corporation Ltd. aims to invest more than INR 17,000 Million in various CNG projects in West Bengal over the next five years, indicating a significant push towards data-driven operational planning and expansion.

- September 2021: The Indonesian government acquired an investment of USD 20.3 Million from the auction of two oil and gas blocks in South CPP Block and Liman Block. PT Energi Mega Persada Tbk and Husky Energy International won the auction, signaling continued upstream investment and the potential for analytics to optimize exploration and production in these newly acquired blocks.

Future Outlook for Asia Pacific Oil and Gas Analytics Market Market

The future outlook for the Asia Pacific Oil and Gas Analytics Market is exceptionally bright, fueled by an intensifying focus on digital transformation, sustainable energy practices, and the relentless pursuit of operational excellence. Strategic opportunities lie in the widespread adoption of AI and ML for predictive maintenance, reservoir optimization, and enhanced safety protocols. The growing demand for cleaner energy solutions will also drive the need for analytics that can support carbon capture, utilization, and storage (CCUS) initiatives and optimize renewable energy integration. As the region's energy landscape continues to evolve, companies that effectively leverage data analytics will be best positioned to navigate complexities, capitalize on emerging trends, and achieve sustainable growth and profitability in the coming years. The market is projected to witness robust growth, with an estimated market size of over $5,000 Million by 2033.

Asia Pacific Oil and Gas Analytics Market Segmentation

-

1. Sector

- 1.1. Upstream

- 1.2. Midstream

- 1.3. Downstream

-

2. Location

- 2.1. Onshore

- 2.2. Offshore

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Indonesia

- 3.4. Australia

- 3.5. Rest of Asia Pacific

Asia Pacific Oil and Gas Analytics Market Segmentation By Geography

- 1. China

- 2. India

- 3. Indonesia

- 4. Australia

- 5. Rest of Asia Pacific

Asia Pacific Oil and Gas Analytics Market Regional Market Share

Geographic Coverage of Asia Pacific Oil and Gas Analytics Market

Asia Pacific Oil and Gas Analytics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Surging Demand For Refined Petroleum Products4.; Significant Untapped Petroleum Reserves in the Sedimentary Basins

- 3.3. Market Restrains

- 3.3.1. 4.; High Volatility of Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. Upstream is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Oil and Gas Analytics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Upstream

- 5.1.2. Midstream

- 5.1.3. Downstream

- 5.2. Market Analysis, Insights and Forecast - by Location

- 5.2.1. Onshore

- 5.2.2. Offshore

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Indonesia

- 5.3.4. Australia

- 5.3.5. Rest of Asia Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Indonesia

- 5.4.4. Australia

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. China Asia Pacific Oil and Gas Analytics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Upstream

- 6.1.2. Midstream

- 6.1.3. Downstream

- 6.2. Market Analysis, Insights and Forecast - by Location

- 6.2.1. Onshore

- 6.2.2. Offshore

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Indonesia

- 6.3.4. Australia

- 6.3.5. Rest of Asia Pacific

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. India Asia Pacific Oil and Gas Analytics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Upstream

- 7.1.2. Midstream

- 7.1.3. Downstream

- 7.2. Market Analysis, Insights and Forecast - by Location

- 7.2.1. Onshore

- 7.2.2. Offshore

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Indonesia

- 7.3.4. Australia

- 7.3.5. Rest of Asia Pacific

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Indonesia Asia Pacific Oil and Gas Analytics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Upstream

- 8.1.2. Midstream

- 8.1.3. Downstream

- 8.2. Market Analysis, Insights and Forecast - by Location

- 8.2.1. Onshore

- 8.2.2. Offshore

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Indonesia

- 8.3.4. Australia

- 8.3.5. Rest of Asia Pacific

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Australia Asia Pacific Oil and Gas Analytics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Upstream

- 9.1.2. Midstream

- 9.1.3. Downstream

- 9.2. Market Analysis, Insights and Forecast - by Location

- 9.2.1. Onshore

- 9.2.2. Offshore

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Indonesia

- 9.3.4. Australia

- 9.3.5. Rest of Asia Pacific

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Rest of Asia Pacific Asia Pacific Oil and Gas Analytics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 10.1.1. Upstream

- 10.1.2. Midstream

- 10.1.3. Downstream

- 10.2. Market Analysis, Insights and Forecast - by Location

- 10.2.1. Onshore

- 10.2.2. Offshore

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Indonesia

- 10.3.4. Australia

- 10.3.5. Rest of Asia Pacific

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 China National Petroleum Corporation (CNPC)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Shell plc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Exxon Mobil Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Pacific Oil & Gas Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BP plc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Oil and Natural Gas Corporation (ONGC)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cairn Oil & Gas a vertical of Vedanta Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Chevron Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Equinor ASA*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TotalEnergies SE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 China National Petroleum Corporation (CNPC)

List of Figures

- Figure 1: Asia Pacific Oil and Gas Analytics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Oil and Gas Analytics Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Oil and Gas Analytics Market Revenue billion Forecast, by Sector 2020 & 2033

- Table 2: Asia Pacific Oil and Gas Analytics Market Revenue billion Forecast, by Location 2020 & 2033

- Table 3: Asia Pacific Oil and Gas Analytics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Asia Pacific Oil and Gas Analytics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia Pacific Oil and Gas Analytics Market Revenue billion Forecast, by Sector 2020 & 2033

- Table 6: Asia Pacific Oil and Gas Analytics Market Revenue billion Forecast, by Location 2020 & 2033

- Table 7: Asia Pacific Oil and Gas Analytics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Asia Pacific Oil and Gas Analytics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Asia Pacific Oil and Gas Analytics Market Revenue billion Forecast, by Sector 2020 & 2033

- Table 10: Asia Pacific Oil and Gas Analytics Market Revenue billion Forecast, by Location 2020 & 2033

- Table 11: Asia Pacific Oil and Gas Analytics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Asia Pacific Oil and Gas Analytics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia Pacific Oil and Gas Analytics Market Revenue billion Forecast, by Sector 2020 & 2033

- Table 14: Asia Pacific Oil and Gas Analytics Market Revenue billion Forecast, by Location 2020 & 2033

- Table 15: Asia Pacific Oil and Gas Analytics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Asia Pacific Oil and Gas Analytics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Asia Pacific Oil and Gas Analytics Market Revenue billion Forecast, by Sector 2020 & 2033

- Table 18: Asia Pacific Oil and Gas Analytics Market Revenue billion Forecast, by Location 2020 & 2033

- Table 19: Asia Pacific Oil and Gas Analytics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Asia Pacific Oil and Gas Analytics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Asia Pacific Oil and Gas Analytics Market Revenue billion Forecast, by Sector 2020 & 2033

- Table 22: Asia Pacific Oil and Gas Analytics Market Revenue billion Forecast, by Location 2020 & 2033

- Table 23: Asia Pacific Oil and Gas Analytics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Asia Pacific Oil and Gas Analytics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Oil and Gas Analytics Market?

The projected CAGR is approximately 13.25%.

2. Which companies are prominent players in the Asia Pacific Oil and Gas Analytics Market?

Key companies in the market include China National Petroleum Corporation (CNPC), Shell plc, Exxon Mobil Corporation, Pacific Oil & Gas Ltd, BP plc, Oil and Natural Gas Corporation (ONGC), Cairn Oil & Gas a vertical of Vedanta Limited, Chevron Corporation, Equinor ASA*List Not Exhaustive, TotalEnergies SE.

3. What are the main segments of the Asia Pacific Oil and Gas Analytics Market?

The market segments include Sector, Location, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.36 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Surging Demand For Refined Petroleum Products4.; Significant Untapped Petroleum Reserves in the Sedimentary Basins.

6. What are the notable trends driving market growth?

Upstream is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Volatility of Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

In April 2022, GAIL announced that its joint venture company Bengal Gas Co and Hindustan Petroleum Corporation Ltd. aims to invest more than INR 17,000 in various CNG projects in West Bengal will be over the next five years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Oil and Gas Analytics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Oil and Gas Analytics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Oil and Gas Analytics Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Oil and Gas Analytics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence