Key Insights

The Asia-Pacific silica sand market is projected to reach $8.21 billion by 2025 and expand at a Compound Annual Growth Rate (CAGR) of 6.8% through 2033. This robust growth is primarily propelled by the escalating demand from the construction sector for high-quality silica sand in concrete and mortar, alongside its crucial role in glass manufacturing, particularly for electronics and renewable energy applications. The region's expanding industrial infrastructure further bolsters market potential. Key growth inhibitors include stringent environmental regulations for sand extraction and logistics, and volatile raw material pricing. The market is segmented by silica sand grade and application, with leading players like Chongqing Changjiang River Moulding Material (Group) Co Ltd, Fairmount Santrol, and Mitsubishi Corporation actively influencing market dynamics through strategic initiatives and innovations. Intensifying competition from established and emerging regional producers is anticipated.

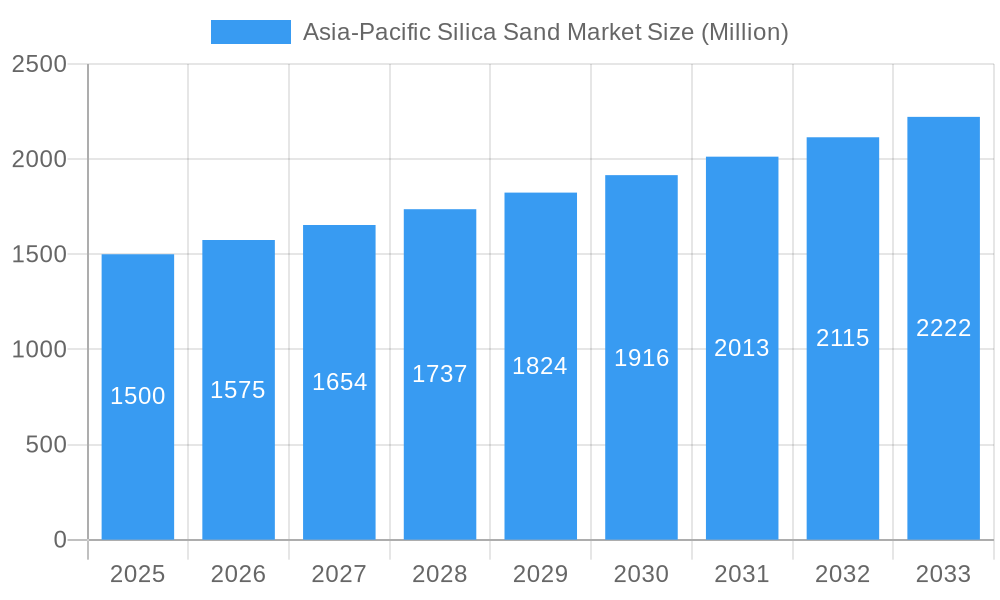

Asia-Pacific Silica Sand Market Market Size (In Billion)

The forecast period (2025-2033) indicates sustained market expansion for Asia-Pacific silica sand, driven by ongoing infrastructure development. Higher-grade silica sands for specialized applications, such as electronics and solar energy, are expected to outpace growth in traditional segments like construction. Market success will depend on players' adeptness in managing environmental compliance, securing supply chains, and adapting to technological advancements and evolving customer needs. Macroeconomic conditions in the Asia-Pacific region and global silica sand demand will also influence future growth. Continuous adaptation and innovation are paramount for sustained profitability and market share amidst competitive pressures.

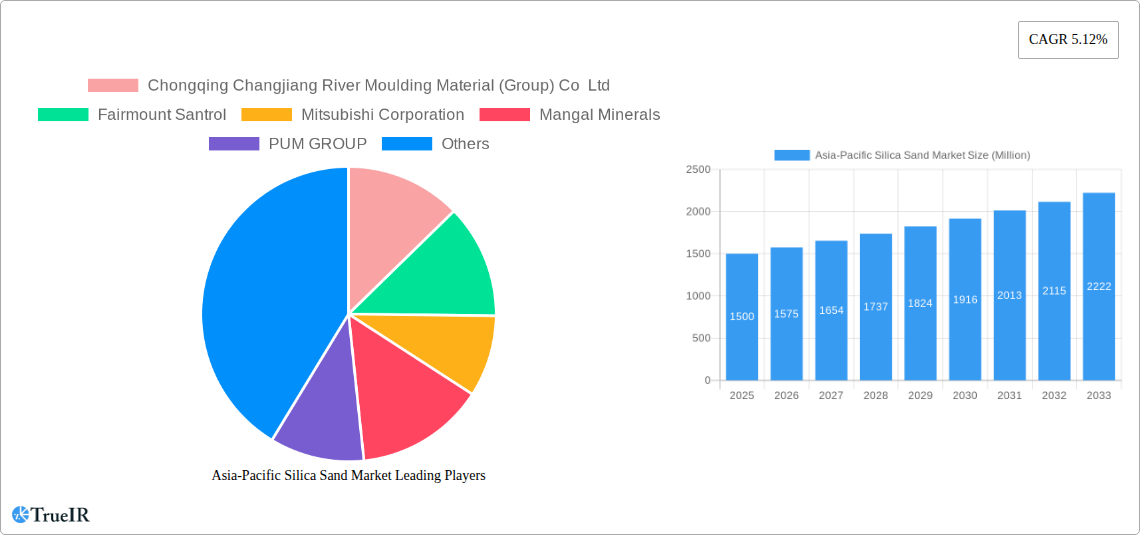

Asia-Pacific Silica Sand Market Company Market Share

Asia-Pacific Silica Sand Market: A Comprehensive Market Report 2019-2033

This dynamic report provides a comprehensive analysis of the Asia-Pacific silica sand market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Leveraging extensive research and data analysis across the period 2019-2033 (base year 2025, forecast period 2025-2033), this report offers a detailed understanding of market trends, opportunities, and challenges. High-volume keywords such as "silica sand market," "Asia-Pacific silica sand," "silica sand industry," and "silica sand applications" are strategically integrated throughout to maximize search engine optimization (SEO) and audience reach. The report’s findings are supported by quantitative and qualitative data, providing a robust and reliable resource for informed business decisions. The total market size in 2025 is estimated at xx Million.

Asia-Pacific Silica Sand Market Structure & Competitive Landscape

The Asia-Pacific silica sand market exhibits a moderately consolidated structure. The market concentration ratio (CR4) in 2025 is estimated at xx%, indicating the presence of both large multinational corporations and regional players. Innovation is a key driver, with companies continuously investing in R&D to improve silica sand quality and expand applications. Regulatory landscape influences vary across countries in the region, impacting extraction practices and environmental compliance. Product substitutes, such as synthetic silica, pose a competitive threat, although natural silica sand still holds a dominant market share due to cost advantages.

End-user segmentation is dominated by the construction and glass industries, followed by the foundry and water filtration sectors. Mergers and acquisitions (M&A) activity has been moderate in recent years, with a total M&A volume of approximately xx Million in the past five years. This activity reflects strategic efforts by larger players to expand their market share and geographical reach. The trend includes vertical integration, with some companies acquiring mines to secure raw material supplies. Furthermore, regional variations in market dynamics are significant, necessitating a nuanced understanding of the competitive landscape in specific countries and regions.

Asia-Pacific Silica Sand Market Market Trends & Opportunities

The Asia-Pacific silica sand market is poised for substantial growth, with a projected Compound Annual Growth Rate (CAGR) of approximately **6.5% to 7.5%** from 2025 to 2033. This upward trajectory is primarily fueled by relentless infrastructure development, particularly in burgeoning urban centers across economies like India, China, Vietnam, and Indonesia. The escalating demand for construction materials such as concrete, mortar, and glass is a direct consequence of these development initiatives.

Beyond construction, burgeoning manufacturing sectors, including electronics and automotive, are also contributing to the demand for high-purity silica sand for specialized applications. Technological innovations are playing a crucial role, with advancements in beneficiation techniques leading to enhanced purity and the development of tailored silica sand grades for diverse industrial needs. Furthermore, a growing emphasis on sustainable construction practices and a rising awareness of the environmental impact of material sourcing are influencing market dynamics, driving interest in responsibly sourced and processed silica sand.

The competitive landscape is characterized by a mix of established global players and emerging regional manufacturers. Companies are increasingly focusing on operational efficiency, strategic acquisitions, and expanding their product portfolios to cater to specialized market segments. While market penetration in core sectors like construction is already significant, substantial opportunities lie in niche applications such as advanced filtration systems, performance abrasives, and the burgeoning renewable energy sector (e.g., for solar panel manufacturing). Navigating these trends and capitalizing on emerging opportunities will be key for stakeholders in the Asia-Pacific silica sand market.

Dominant Markets & Segments in Asia-Pacific Silica Sand Market

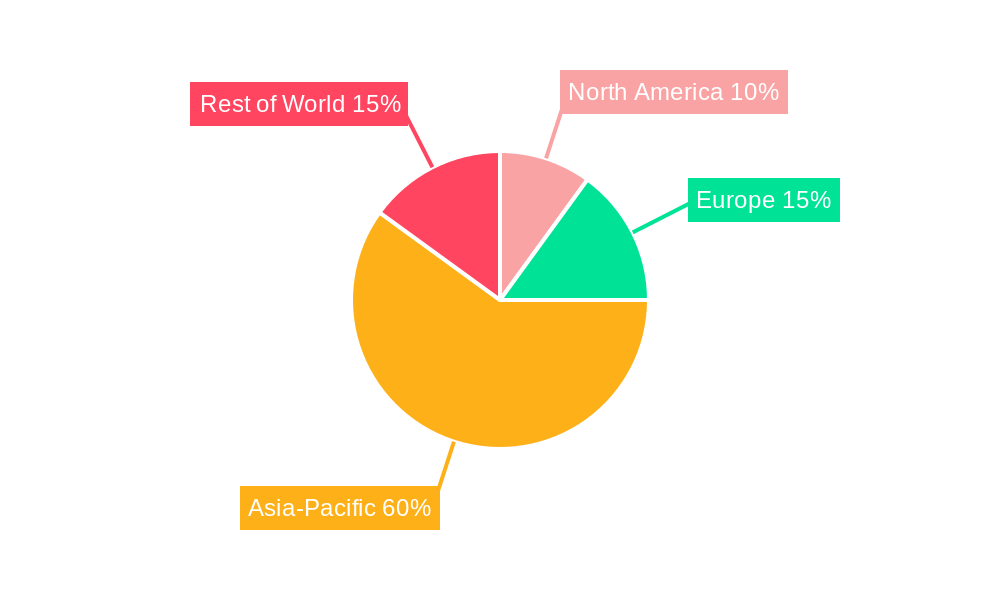

China holds the largest market share in the Asia-Pacific silica sand market, driven by its massive construction industry and robust economic growth.

- Key Growth Drivers in China:

- Extensive infrastructure development projects (high-speed rail, roads, bridges).

- Rapid urbanization and growth of megacities.

- Favorable government policies supporting construction and industrial development.

- Large domestic silica sand reserves.

India is the second largest market, exhibiting significant growth potential due to its rapidly expanding economy and rising construction activity. Other key markets include Australia, Japan, and South Korea, each with unique growth drivers and market characteristics.

- Key Growth Drivers in Other Markets:

- Australia: Robust mining industry and increasing demand for high-quality silica sand in various applications.

- Japan: Advanced manufacturing sector and significant demand for high-purity silica sand in electronics and other industries.

- South Korea: Strong construction activity and focus on technologically advanced applications of silica sand.

The construction and glass segments are the dominant end-use sectors, accounting for a combined xx% of total market consumption.

Asia-Pacific Silica Sand Market Product Analysis

The Asia-Pacific silica sand market encompasses a range of products, including refined silica sand with varying levels of purity and particle size distribution. Technological advancements focus on optimizing beneficiation processes to improve sand quality and reduce impurities. These innovations enhance the performance of silica sand in various applications, leading to enhanced product value and competitive advantages for producers. Product differentiation strategies often center on tailoring silica sand properties to meet specific end-use requirements. This includes offering customized particle size distributions, surface area modifications, and other specialized properties that optimize performance in specific applications.

Key Drivers, Barriers & Challenges in Asia-Pacific Silica Sand Market

Key Drivers: The sustained and robust expansion of construction activities across the Asia-Pacific region, driven by rapid urbanization, population growth, and significant government investments in infrastructure projects (roads, bridges, housing, and public facilities), forms the bedrock of market growth. Economic dynamism and industrial diversification, particularly in emerging economies, are bolstering demand for silica sand across a wide array of industrial applications, including glass manufacturing, foundries, and chemical production. Proactive government policies, including incentives for construction, manufacturing, and infrastructure development, serve as powerful catalysts, further accelerating market expansion.

Challenges: The market grapples with the volatility of raw material prices, including extraction costs and the increasing expense of specialized processing agents. Escalating transportation and logistics costs, particularly in a geographically diverse region like Asia-Pacific, can significantly impact profitability and supply chain efficiency. Stringent and evolving environmental regulations concerning mining practices, water usage, and waste management pose significant hurdles, necessitating substantial investment in sustainable technologies and compliance measures. Furthermore, the consistent need to adhere to international quality standards for various applications and the potential for competition from meticulously engineered synthetic silica products add layers of complexity to market operations.

Growth Drivers in the Asia-Pacific Silica Sand Market Market

The relentless pace of urbanization and the ambitious scale of infrastructure development projects across the Asia-Pacific region are the primary engines driving the silica sand market. Robust economic growth and the continuous expansion of industrial sectors, especially in economies such as China, India, and Southeast Asian nations, are directly translating into elevated demand for silica sand in diverse manufacturing processes. Favorable government initiatives, including policy support, subsidies, and infrastructure spending plans, provide a conducive environment for market growth. Moreover, ongoing technological advancements in mining, processing, and beneficiation are not only improving the efficiency of silica sand production but also enabling the creation of specialized, high-purity grades that cater to sophisticated industrial requirements, thereby unlocking new application areas and stimulating market expansion.

Challenges Impacting Asia-Pacific Silica Sand Market Growth

The imposition of increasingly rigorous environmental regulations governing silica sand extraction, processing, and land reclamation poses a significant operational challenge and can lead to higher compliance costs. Fluctuations in global commodity prices, coupled with rising transportation and logistics expenses, can create price volatility and impact profit margins. Intense competition from readily available synthetic silica alternatives and other emerging materials designed for specific industrial functions presents a constant threat. Furthermore, the inherent vulnerability of global supply chains to geopolitical instability, trade disputes, and unforeseen natural disasters can lead to disruptions, affecting the consistent availability and timely delivery of silica sand. Addressing these multifaceted challenges requires proactive risk management, continuous innovation in sustainable practices, and strategic supply chain diversification.

Key Players Shaping the Asia-Pacific Silica Sand Market Market

- Mitsubishi Corporation

- Sibelco

- Chongqing Changjiang River Moulding Material (Group) Co Ltd

- Fairmount Santrol (now part of Covia Holdings)

- Mangal Minerals

- PUM GROUP

- JFE MINERAL Co LTD

- Raghav Productivity Enhancers Limited

- Shivam Chemicals

- TOCHU CORPORATION

- Xinyi Golden Ruite Quartz Materials Co Ltd

- *List Not Exhaustive

Significant Asia-Pacific Silica Sand Market Industry Milestones

- 2022 Q3: Mitsubishi Corporation announces a strategic investment in a new silica sand processing facility in Vietnam.

- 2021 Q4: Sibelco launches a new line of high-purity silica sand for the electronics industry.

- 2020 Q1: Xinyi Golden Ruite Quartz Materials Co Ltd completes a major expansion of its silica sand mining operations in China.

- Further details on recent developments are included in the complete study.

Future Outlook for Asia-Pacific Silica Sand Market Market

The Asia-Pacific silica sand market is poised for continued growth, driven by sustained infrastructure development and industrial expansion. Emerging applications of silica sand in advanced technologies, such as solar energy and water purification, offer significant opportunities for market expansion. Strategic partnerships and technological innovation are expected to shape the future competitive landscape. The market presents substantial potential for companies that can effectively navigate regulatory hurdles and address environmental concerns while providing high-quality silica sand products to meet the growing demand.

Asia-Pacific Silica Sand Market Segmentation

-

1. End User Industry

- 1.1. Glass Manufacturing

- 1.2. Foundry

- 1.3. Chemical Production

- 1.4. Construction

- 1.5. Paints and Coatings

- 1.6. Ceramics and Refractories

- 1.7. Filtration

- 1.8. Oil and Gas Recovery

- 1.9. Other End User Industries

-

2. Geography

- 2.1. China

- 2.2. India

- 2.3. Japan

- 2.4. South Korea

- 2.5. Indonesia

- 2.6. Thailand

- 2.7. Malaysia

- 2.8. Singapore

- 2.9. Philippines

- 2.10. Vietnam

Asia-Pacific Silica Sand Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Indonesia

- 6. Thailand

- 7. Malaysia

- 8. Singapore

- 9. Philippines

- 10. Vietnam

Asia-Pacific Silica Sand Market Regional Market Share

Geographic Coverage of Asia-Pacific Silica Sand Market

Asia-Pacific Silica Sand Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consistent Economic Growth Leading to Increase in Construction; Increasing Use in the Foundry Industry; Others Drivers

- 3.3. Market Restrains

- 3.3.1. Consistent Economic Growth Leading to Increase in Construction; Increasing Use in the Foundry Industry; Others Drivers

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Glass Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Asia-Pacific Silica Sand Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Glass Manufacturing

- 5.1.2. Foundry

- 5.1.3. Chemical Production

- 5.1.4. Construction

- 5.1.5. Paints and Coatings

- 5.1.6. Ceramics and Refractories

- 5.1.7. Filtration

- 5.1.8. Oil and Gas Recovery

- 5.1.9. Other End User Industries

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. India

- 5.2.3. Japan

- 5.2.4. South Korea

- 5.2.5. Indonesia

- 5.2.6. Thailand

- 5.2.7. Malaysia

- 5.2.8. Singapore

- 5.2.9. Philippines

- 5.2.10. Vietnam

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Indonesia

- 5.3.6. Thailand

- 5.3.7. Malaysia

- 5.3.8. Singapore

- 5.3.9. Philippines

- 5.3.10. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. China Asia-Pacific Silica Sand Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 6.1.1. Glass Manufacturing

- 6.1.2. Foundry

- 6.1.3. Chemical Production

- 6.1.4. Construction

- 6.1.5. Paints and Coatings

- 6.1.6. Ceramics and Refractories

- 6.1.7. Filtration

- 6.1.8. Oil and Gas Recovery

- 6.1.9. Other End User Industries

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. India

- 6.2.3. Japan

- 6.2.4. South Korea

- 6.2.5. Indonesia

- 6.2.6. Thailand

- 6.2.7. Malaysia

- 6.2.8. Singapore

- 6.2.9. Philippines

- 6.2.10. Vietnam

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 7. India Asia-Pacific Silica Sand Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 7.1.1. Glass Manufacturing

- 7.1.2. Foundry

- 7.1.3. Chemical Production

- 7.1.4. Construction

- 7.1.5. Paints and Coatings

- 7.1.6. Ceramics and Refractories

- 7.1.7. Filtration

- 7.1.8. Oil and Gas Recovery

- 7.1.9. Other End User Industries

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. India

- 7.2.3. Japan

- 7.2.4. South Korea

- 7.2.5. Indonesia

- 7.2.6. Thailand

- 7.2.7. Malaysia

- 7.2.8. Singapore

- 7.2.9. Philippines

- 7.2.10. Vietnam

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 8. Japan Asia-Pacific Silica Sand Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 8.1.1. Glass Manufacturing

- 8.1.2. Foundry

- 8.1.3. Chemical Production

- 8.1.4. Construction

- 8.1.5. Paints and Coatings

- 8.1.6. Ceramics and Refractories

- 8.1.7. Filtration

- 8.1.8. Oil and Gas Recovery

- 8.1.9. Other End User Industries

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. India

- 8.2.3. Japan

- 8.2.4. South Korea

- 8.2.5. Indonesia

- 8.2.6. Thailand

- 8.2.7. Malaysia

- 8.2.8. Singapore

- 8.2.9. Philippines

- 8.2.10. Vietnam

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 9. South Korea Asia-Pacific Silica Sand Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 9.1.1. Glass Manufacturing

- 9.1.2. Foundry

- 9.1.3. Chemical Production

- 9.1.4. Construction

- 9.1.5. Paints and Coatings

- 9.1.6. Ceramics and Refractories

- 9.1.7. Filtration

- 9.1.8. Oil and Gas Recovery

- 9.1.9. Other End User Industries

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. India

- 9.2.3. Japan

- 9.2.4. South Korea

- 9.2.5. Indonesia

- 9.2.6. Thailand

- 9.2.7. Malaysia

- 9.2.8. Singapore

- 9.2.9. Philippines

- 9.2.10. Vietnam

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 10. Indonesia Asia-Pacific Silica Sand Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 10.1.1. Glass Manufacturing

- 10.1.2. Foundry

- 10.1.3. Chemical Production

- 10.1.4. Construction

- 10.1.5. Paints and Coatings

- 10.1.6. Ceramics and Refractories

- 10.1.7. Filtration

- 10.1.8. Oil and Gas Recovery

- 10.1.9. Other End User Industries

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. India

- 10.2.3. Japan

- 10.2.4. South Korea

- 10.2.5. Indonesia

- 10.2.6. Thailand

- 10.2.7. Malaysia

- 10.2.8. Singapore

- 10.2.9. Philippines

- 10.2.10. Vietnam

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 11. Thailand Asia-Pacific Silica Sand Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by End User Industry

- 11.1.1. Glass Manufacturing

- 11.1.2. Foundry

- 11.1.3. Chemical Production

- 11.1.4. Construction

- 11.1.5. Paints and Coatings

- 11.1.6. Ceramics and Refractories

- 11.1.7. Filtration

- 11.1.8. Oil and Gas Recovery

- 11.1.9. Other End User Industries

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. China

- 11.2.2. India

- 11.2.3. Japan

- 11.2.4. South Korea

- 11.2.5. Indonesia

- 11.2.6. Thailand

- 11.2.7. Malaysia

- 11.2.8. Singapore

- 11.2.9. Philippines

- 11.2.10. Vietnam

- 11.1. Market Analysis, Insights and Forecast - by End User Industry

- 12. Malaysia Asia-Pacific Silica Sand Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by End User Industry

- 12.1.1. Glass Manufacturing

- 12.1.2. Foundry

- 12.1.3. Chemical Production

- 12.1.4. Construction

- 12.1.5. Paints and Coatings

- 12.1.6. Ceramics and Refractories

- 12.1.7. Filtration

- 12.1.8. Oil and Gas Recovery

- 12.1.9. Other End User Industries

- 12.2. Market Analysis, Insights and Forecast - by Geography

- 12.2.1. China

- 12.2.2. India

- 12.2.3. Japan

- 12.2.4. South Korea

- 12.2.5. Indonesia

- 12.2.6. Thailand

- 12.2.7. Malaysia

- 12.2.8. Singapore

- 12.2.9. Philippines

- 12.2.10. Vietnam

- 12.1. Market Analysis, Insights and Forecast - by End User Industry

- 13. Singapore Asia-Pacific Silica Sand Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by End User Industry

- 13.1.1. Glass Manufacturing

- 13.1.2. Foundry

- 13.1.3. Chemical Production

- 13.1.4. Construction

- 13.1.5. Paints and Coatings

- 13.1.6. Ceramics and Refractories

- 13.1.7. Filtration

- 13.1.8. Oil and Gas Recovery

- 13.1.9. Other End User Industries

- 13.2. Market Analysis, Insights and Forecast - by Geography

- 13.2.1. China

- 13.2.2. India

- 13.2.3. Japan

- 13.2.4. South Korea

- 13.2.5. Indonesia

- 13.2.6. Thailand

- 13.2.7. Malaysia

- 13.2.8. Singapore

- 13.2.9. Philippines

- 13.2.10. Vietnam

- 13.1. Market Analysis, Insights and Forecast - by End User Industry

- 14. Philippines Asia-Pacific Silica Sand Market Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - by End User Industry

- 14.1.1. Glass Manufacturing

- 14.1.2. Foundry

- 14.1.3. Chemical Production

- 14.1.4. Construction

- 14.1.5. Paints and Coatings

- 14.1.6. Ceramics and Refractories

- 14.1.7. Filtration

- 14.1.8. Oil and Gas Recovery

- 14.1.9. Other End User Industries

- 14.2. Market Analysis, Insights and Forecast - by Geography

- 14.2.1. China

- 14.2.2. India

- 14.2.3. Japan

- 14.2.4. South Korea

- 14.2.5. Indonesia

- 14.2.6. Thailand

- 14.2.7. Malaysia

- 14.2.8. Singapore

- 14.2.9. Philippines

- 14.2.10. Vietnam

- 14.1. Market Analysis, Insights and Forecast - by End User Industry

- 15. Vietnam Asia-Pacific Silica Sand Market Analysis, Insights and Forecast, 2020-2032

- 15.1. Market Analysis, Insights and Forecast - by End User Industry

- 15.1.1. Glass Manufacturing

- 15.1.2. Foundry

- 15.1.3. Chemical Production

- 15.1.4. Construction

- 15.1.5. Paints and Coatings

- 15.1.6. Ceramics and Refractories

- 15.1.7. Filtration

- 15.1.8. Oil and Gas Recovery

- 15.1.9. Other End User Industries

- 15.2. Market Analysis, Insights and Forecast - by Geography

- 15.2.1. China

- 15.2.2. India

- 15.2.3. Japan

- 15.2.4. South Korea

- 15.2.5. Indonesia

- 15.2.6. Thailand

- 15.2.7. Malaysia

- 15.2.8. Singapore

- 15.2.9. Philippines

- 15.2.10. Vietnam

- 15.1. Market Analysis, Insights and Forecast - by End User Industry

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2025

- 16.2. Company Profiles

- 16.2.1 Chongqing Changjiang River Moulding Material (Group) Co Ltd

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Fairmount Santrol

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Mitsubishi Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Mangal Minerals

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 PUM GROUP

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 JFE MINERAL Co LTD

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Raghav Productivity Enhancers Limited

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Sibelco

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Shivam Chemicals

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 TOCHU CORPORATION

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Xinyi Golden Ruite Quartz Materials Co Ltd *List Not Exhaustive

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 Chongqing Changjiang River Moulding Material (Group) Co Ltd

List of Figures

- Figure 1: Global Asia-Pacific Silica Sand Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: China Asia-Pacific Silica Sand Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 3: China Asia-Pacific Silica Sand Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 4: China Asia-Pacific Silica Sand Market Revenue (billion), by Geography 2025 & 2033

- Figure 5: China Asia-Pacific Silica Sand Market Revenue Share (%), by Geography 2025 & 2033

- Figure 6: China Asia-Pacific Silica Sand Market Revenue (billion), by Country 2025 & 2033

- Figure 7: China Asia-Pacific Silica Sand Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: India Asia-Pacific Silica Sand Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 9: India Asia-Pacific Silica Sand Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 10: India Asia-Pacific Silica Sand Market Revenue (billion), by Geography 2025 & 2033

- Figure 11: India Asia-Pacific Silica Sand Market Revenue Share (%), by Geography 2025 & 2033

- Figure 12: India Asia-Pacific Silica Sand Market Revenue (billion), by Country 2025 & 2033

- Figure 13: India Asia-Pacific Silica Sand Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Japan Asia-Pacific Silica Sand Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 15: Japan Asia-Pacific Silica Sand Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 16: Japan Asia-Pacific Silica Sand Market Revenue (billion), by Geography 2025 & 2033

- Figure 17: Japan Asia-Pacific Silica Sand Market Revenue Share (%), by Geography 2025 & 2033

- Figure 18: Japan Asia-Pacific Silica Sand Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Japan Asia-Pacific Silica Sand Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South Korea Asia-Pacific Silica Sand Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 21: South Korea Asia-Pacific Silica Sand Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 22: South Korea Asia-Pacific Silica Sand Market Revenue (billion), by Geography 2025 & 2033

- Figure 23: South Korea Asia-Pacific Silica Sand Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: South Korea Asia-Pacific Silica Sand Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South Korea Asia-Pacific Silica Sand Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Indonesia Asia-Pacific Silica Sand Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 27: Indonesia Asia-Pacific Silica Sand Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 28: Indonesia Asia-Pacific Silica Sand Market Revenue (billion), by Geography 2025 & 2033

- Figure 29: Indonesia Asia-Pacific Silica Sand Market Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Indonesia Asia-Pacific Silica Sand Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Indonesia Asia-Pacific Silica Sand Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Thailand Asia-Pacific Silica Sand Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 33: Thailand Asia-Pacific Silica Sand Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 34: Thailand Asia-Pacific Silica Sand Market Revenue (billion), by Geography 2025 & 2033

- Figure 35: Thailand Asia-Pacific Silica Sand Market Revenue Share (%), by Geography 2025 & 2033

- Figure 36: Thailand Asia-Pacific Silica Sand Market Revenue (billion), by Country 2025 & 2033

- Figure 37: Thailand Asia-Pacific Silica Sand Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Malaysia Asia-Pacific Silica Sand Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 39: Malaysia Asia-Pacific Silica Sand Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 40: Malaysia Asia-Pacific Silica Sand Market Revenue (billion), by Geography 2025 & 2033

- Figure 41: Malaysia Asia-Pacific Silica Sand Market Revenue Share (%), by Geography 2025 & 2033

- Figure 42: Malaysia Asia-Pacific Silica Sand Market Revenue (billion), by Country 2025 & 2033

- Figure 43: Malaysia Asia-Pacific Silica Sand Market Revenue Share (%), by Country 2025 & 2033

- Figure 44: Singapore Asia-Pacific Silica Sand Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 45: Singapore Asia-Pacific Silica Sand Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 46: Singapore Asia-Pacific Silica Sand Market Revenue (billion), by Geography 2025 & 2033

- Figure 47: Singapore Asia-Pacific Silica Sand Market Revenue Share (%), by Geography 2025 & 2033

- Figure 48: Singapore Asia-Pacific Silica Sand Market Revenue (billion), by Country 2025 & 2033

- Figure 49: Singapore Asia-Pacific Silica Sand Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Philippines Asia-Pacific Silica Sand Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 51: Philippines Asia-Pacific Silica Sand Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 52: Philippines Asia-Pacific Silica Sand Market Revenue (billion), by Geography 2025 & 2033

- Figure 53: Philippines Asia-Pacific Silica Sand Market Revenue Share (%), by Geography 2025 & 2033

- Figure 54: Philippines Asia-Pacific Silica Sand Market Revenue (billion), by Country 2025 & 2033

- Figure 55: Philippines Asia-Pacific Silica Sand Market Revenue Share (%), by Country 2025 & 2033

- Figure 56: Vietnam Asia-Pacific Silica Sand Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 57: Vietnam Asia-Pacific Silica Sand Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 58: Vietnam Asia-Pacific Silica Sand Market Revenue (billion), by Geography 2025 & 2033

- Figure 59: Vietnam Asia-Pacific Silica Sand Market Revenue Share (%), by Geography 2025 & 2033

- Figure 60: Vietnam Asia-Pacific Silica Sand Market Revenue (billion), by Country 2025 & 2033

- Figure 61: Vietnam Asia-Pacific Silica Sand Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 2: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 5: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 8: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 11: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 14: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 17: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 20: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 21: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 23: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 26: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 27: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 29: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 32: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 33: Global Asia-Pacific Silica Sand Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Silica Sand Market?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the Asia-Pacific Silica Sand Market?

Key companies in the market include Chongqing Changjiang River Moulding Material (Group) Co Ltd, Fairmount Santrol, Mitsubishi Corporation, Mangal Minerals, PUM GROUP, JFE MINERAL Co LTD, Raghav Productivity Enhancers Limited, Sibelco, Shivam Chemicals, TOCHU CORPORATION, Xinyi Golden Ruite Quartz Materials Co Ltd *List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Silica Sand Market?

The market segments include End User Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.21 billion as of 2022.

5. What are some drivers contributing to market growth?

Consistent Economic Growth Leading to Increase in Construction; Increasing Use in the Foundry Industry; Others Drivers.

6. What are the notable trends driving market growth?

Increasing Demand from the Glass Industry.

7. Are there any restraints impacting market growth?

Consistent Economic Growth Leading to Increase in Construction; Increasing Use in the Foundry Industry; Others Drivers.

8. Can you provide examples of recent developments in the market?

The recent developments pertaining to the major players in the market are covered in the complete study.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Silica Sand Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Silica Sand Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Silica Sand Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Silica Sand Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence