Key Insights

The Australian Rooftop Solar Panel Market is projected for substantial growth, driven by increasing renewable energy demand and government decarbonization initiatives. With a Compound Annual Growth Rate (CAGR) of 7.6%, the market, valued at $2.3 billion in 2020, is expected to expand significantly. Key growth drivers include declining solar panel costs, attractive government incentives, and rising consumer awareness of solar energy's environmental and economic advantages. The residential sector leads adoption as homeowners seek lower energy bills and reduced carbon footprints. Concurrently, the Commercial and Industrial (C&I) segment is experiencing robust uptake as businesses prioritize sustainability and energy cost reductions. Technological advancements in solar panel efficiency and durability further enhance market confidence and investment.

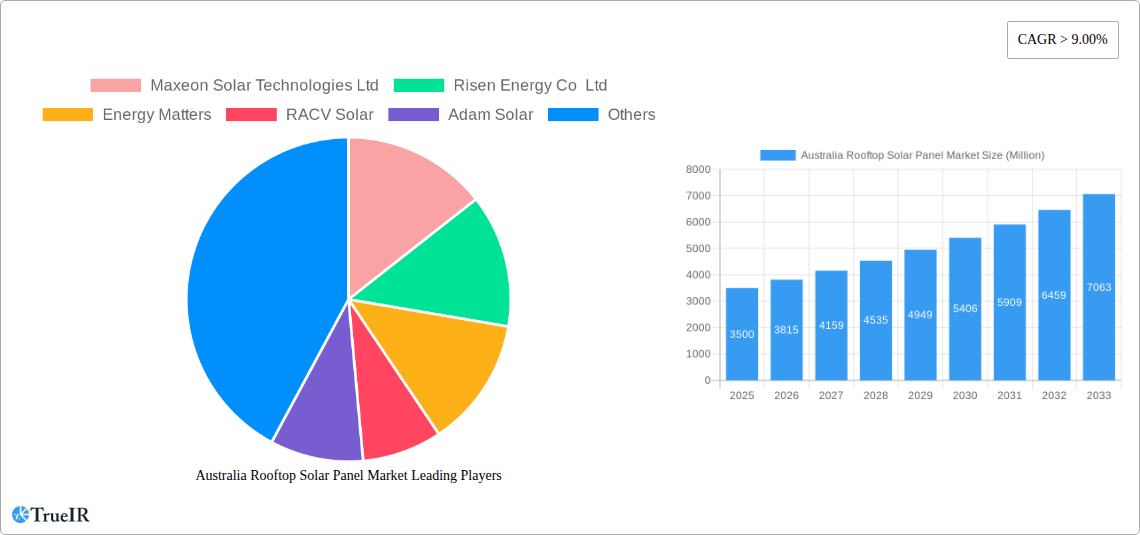

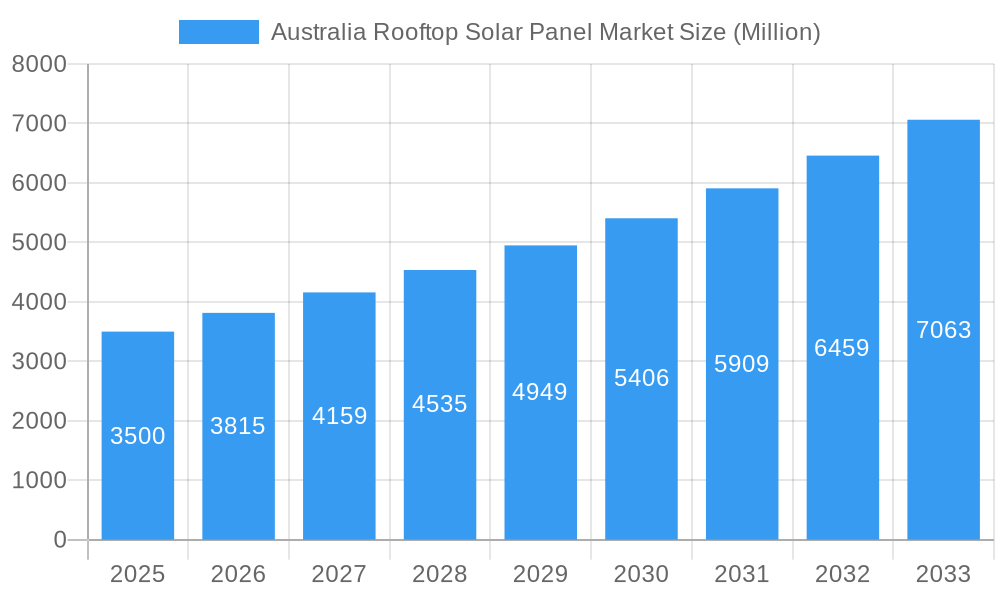

Australia Rooftop Solar Panel Market Market Size (In Billion)

Evolving energy policies and a commitment to net-zero emissions targets further support market expansion. While facing challenges such as grid integration and initial capital investment, these are being mitigated by innovation and supportive policies. Major players including Maxeon Solar Technologies Ltd, Risen Energy Co Ltd, and Trina Solar are actively investing in Australia. Domestic manufacturing and local installation expertise, seen with companies like Tindo Solar and GEM Energy, also contribute to market resilience. The market is shifting towards a decentralized and sustainable energy future, with rooftop solar at its forefront.

Australia Rooftop Solar Panel Market Company Market Share

Australia Rooftop Solar Panel Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a dynamic and SEO-optimized analysis of the Australia Rooftop Solar Panel Market. Leveraging high-volume keywords such as "Australia rooftop solar," "solar panel installation Australia," "residential solar power," "commercial solar Australia," and "renewable energy Australia," this report is designed to engage industry professionals and stakeholders. We cover the market structure, competitive landscape, evolving trends, dominant segments, product innovations, key drivers, barriers, and future outlook, with a comprehensive study period from 2019 to 2033, featuring a base year of 2025. All quantitative values are presented in Millions (Mn).

Australia Rooftop Solar Panel Market Market Structure & Competitive Landscape

The Australia Rooftop Solar Panel Market exhibits a moderately concentrated structure, driven by a blend of established global manufacturers and agile local installers. Innovation in solar technology, particularly advancements in panel efficiency and inverter capabilities, alongside evolving battery storage solutions, are key drivers. Regulatory frameworks, including government incentives like the Small-scale Renewable Energy Scheme (SRES) and various state-based initiatives, significantly impact market growth and investment. Product substitutes, such as alternative energy sources and energy efficiency measures, pose a continuous competitive pressure, though rooftop solar's declining costs and environmental benefits maintain its strong appeal. The end-user segmentation between residential and commercial and industrial (C&I) sectors is a defining characteristic, each with distinct adoption drivers and installation requirements. Merger and acquisition (M&A) activities, though not extensively documented with specific volume data in this description, are indicative of consolidation efforts by larger players seeking to expand their market share and service offerings. Concentration ratios are estimated to be in the XX range for top players, reflecting a competitive yet consolidating environment.

Australia Rooftop Solar Panel Market Market Trends & Opportunities

The Australia Rooftop Solar Panel Market is poised for substantial growth, driven by a confluence of favorable economic, technological, and environmental factors. Market size is projected to expand from an estimated XX Mn in 2025 to XX Mn by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX%. Technological shifts are central to this expansion, with increasing adoption of high-efficiency solar panels and advanced battery storage systems enhancing system performance and grid independence. Consumer preferences are increasingly leaning towards sustainable energy solutions, driven by rising electricity prices, environmental consciousness, and a desire for energy security. The residential segment, characterized by a high market penetration rate of approximately XX% of suitable rooftops, continues to be a significant contributor. Simultaneously, the Commercial and Industrial (C&I) segment is witnessing accelerated adoption due to attractive payback periods and corporate sustainability goals. Competitive dynamics are evolving, with a focus on integrated energy solutions, smart grid connectivity, and enhanced customer service. Opportunities abound for companies offering innovative financing models, advanced monitoring and maintenance services, and integrated solar-plus-storage solutions. The ongoing transition towards a low-carbon economy and increasing demand for energy independence will further fuel market penetration and technological advancements.

Dominant Markets & Segments in Australia Rooftop Solar Panel Market

The Residential segment represents the dominant market within Australia's rooftop solar landscape, driven by a strong combination of factors. With an estimated market size of XX Mn in 2025, this segment benefits from widespread homeowner adoption, fueled by a desire for reduced electricity bills, increased energy independence, and growing environmental awareness. Government incentives, such as the Renewable Energy Target (RET) and various state-specific rebates and feed-in tariffs, have historically played a crucial role in making solar installations more accessible and economically viable for households. High energy prices in Australia further accentuate the savings potential for homeowners, making rooftop solar an attractive long-term investment. The sheer volume of suitable residential rooftops across the nation provides an expansive addressable market.

Conversely, the Commercial and Industrial (C&I) segment is demonstrating robust growth and presents significant future potential, projected to reach XX Mn by 2033. This segment's expansion is driven by businesses seeking to reduce operational costs, meet sustainability targets, and enhance their brand image. The larger scale of C&I installations allows for greater economies of scale, potentially leading to more attractive payback periods for businesses. Favorable financing options, such as power purchase agreements (PPAs) and leasing models, are increasingly available, lowering the upfront capital expenditure barrier for C&I adopters. Furthermore, the increasing focus on corporate social responsibility and the growing demand for green credentials are compelling businesses to invest in renewable energy solutions. Infrastructure development, particularly in the warehousing and manufacturing sectors, often incorporates large roof spaces ideal for solar panel installation, as evidenced by large-scale projects in southwestern Sydney.

Australia Rooftop Solar Panel Market Product Analysis

Product innovation in the Australia Rooftop Solar Panel Market centers on enhancing efficiency, durability, and integration. High-efficiency photovoltaic (PV) panels, featuring monocrystalline and PERC technologies, are becoming standard, maximizing energy generation from limited rooftop space. Advancements in solar inverter technology, including intelligent microinverters with grid-forming capabilities and seamless battery integration, are crucial for system optimization and resilience. The competitive advantage lies in offering integrated solutions that combine solar panels, inverters, and battery storage, providing a holistic energy management system for both residential and commercial users. These innovations not only improve system performance but also offer enhanced safety features and grid support functionalities, crucial for navigating Australia's evolving energy landscape.

Key Drivers, Barriers & Challenges in Australia Rooftop Solar Panel Market

Key Drivers:

- Declining Solar Panel Costs: Continued reductions in manufacturing costs have made solar installations more affordable for a broader consumer base.

- Rising Electricity Prices: Increasing grid electricity tariffs incentivize homeowners and businesses to seek self-generated power solutions.

- Government Incentives and Policies: Schemes like the SRES and various state-level rebates encourage adoption.

- Environmental Awareness and Sustainability Goals: Growing public and corporate concern for climate change drives demand for clean energy.

- Technological Advancements: Improved panel efficiency and integrated battery storage systems enhance system performance and value.

Challenges & Restraints:

- Grid Connection Limitations: The aging grid infrastructure in some areas can restrict the capacity for new solar connections, potentially delaying installations.

- Regulatory Complexity and Policy Uncertainty: Frequent changes or inconsistencies in government policies can create uncertainty for investors and consumers.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and cost of solar components, leading to project delays.

- Skilled Workforce Shortages: A growing demand for solar installers can sometimes outpace the availability of qualified professionals, affecting installation timelines and quality.

- Intermittency of Solar Power: Reliance on daylight and weather conditions necessitates efficient energy storage solutions, adding to overall system costs.

Growth Drivers in the Australia Rooftop Solar Panel Market Market

The Australia Rooftop Solar Panel Market is propelled by a powerful synergy of technological advancements, favorable economics, and supportive government initiatives. Technological innovation, particularly in higher-efficiency solar panels and advanced battery storage systems, is a significant growth catalyst, enabling greater energy generation and grid independence. Economically, the persistently high cost of grid electricity in Australia makes rooftop solar a compelling investment for both households and businesses, offering substantial savings on energy bills. Government policies, including the ongoing support through renewable energy schemes and evolving state-level incentives, continue to de-risk investments and encourage adoption. The increasing consumer and corporate focus on sustainability and reducing carbon footprints further bolsters demand for clean, renewable energy solutions.

Challenges Impacting Australia Rooftop Solar Panel Market Growth

Despite robust growth, the Australia Rooftop Solar Panel Market faces several challenges that can impede its expansion. Regulatory complexities and the potential for policy shifts can create uncertainty for long-term investment and consumer confidence. Supply chain disruptions, exacerbated by global events, can lead to increased component costs and extended lead times for installations. Furthermore, the sheer scale of solar deployment in some areas has put pressure on the existing electricity grid infrastructure, necessitating upgrades and potentially leading to connection delays. Intense competition within the installer market can also lead to price wars, potentially impacting the profitability of smaller players and the quality of installations if cost-cutting measures are implemented.

Key Players Shaping the Australia Rooftop Solar Panel Market Market

- Maxeon Solar Technologies Ltd

- Risen Energy Co Ltd

- Energy Matters

- RACV Solar

- Adam Solar

- GEM Energy

- Trina Solar

- Tindo Solar

- Infinite Energy

- Soltek Energy

Significant Australia Rooftop Solar Panel Market Industry Milestones

- January 2022: Semper Solaris partnered with Enphase Energy, Inc., a global energy technology company, to deploy IQ8 solar microinverters, which provide sunlight backup during an outage for residential rooftop installation. This milestone underscored the growing importance of grid independence and resilient energy solutions.

- September 2022: Solar Bay and Logos commenced construction of Australia's largest roof-mounted solar storage project, airlifting in the first of more than 120,000 solar panels that were expected to be installed atop an 800,000 sqm industrial warehousing facility in southwestern Sydney. This project highlighted the significant potential for large-scale commercial and industrial solar deployments in Australia.

Future Outlook for Australia Rooftop Solar Panel Market Market

The future outlook for the Australia Rooftop Solar Panel Market remains exceptionally bright, driven by sustained growth catalysts. Continued technological innovation, particularly in solar panel efficiency and the integration of advanced battery storage, will further enhance system performance and affordability. The increasing volatility of traditional energy prices and a deepening societal commitment to sustainability will continue to fuel consumer and corporate demand for rooftop solar. Strategic opportunities lie in the expansion of integrated energy solutions, smart grid compatibility, and innovative financing models tailored to diverse customer needs. As Australia progresses towards its renewable energy targets, the rooftop solar sector is set to play a pivotal role in achieving energy security, environmental stewardship, and economic growth. The market is projected to reach XX Mn by 2033, indicating substantial expansion and opportunity for stakeholders.

Australia Rooftop Solar Panel Market Segmentation

- 1. Residential

- 2. Commercial and Industrial (C&I)

Australia Rooftop Solar Panel Market Segmentation By Geography

- 1. Australia

Australia Rooftop Solar Panel Market Regional Market Share

Geographic Coverage of Australia Rooftop Solar Panel Market

Australia Rooftop Solar Panel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand for Backup Applications in Data Centers4.; Rising Power Outages to Increase the Demand for UPS

- 3.3. Market Restrains

- 3.3.1. 4.; High Capital Cost and Operation Expenditure of UPS Systems

- 3.4. Market Trends

- 3.4.1. Residential Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Rooftop Solar Panel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Residential

- 5.2. Market Analysis, Insights and Forecast - by Commercial and Industrial (C&I)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Residential

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Maxeon Solar Technologies Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Risen Energy Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Energy Matters

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 RACV Solar

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Adam Solar

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GEM Energy

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Trina Solar

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tindo Solar

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Infinite Energy

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Soltek Energy

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Maxeon Solar Technologies Ltd

List of Figures

- Figure 1: Australia Rooftop Solar Panel Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Australia Rooftop Solar Panel Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Rooftop Solar Panel Market Revenue billion Forecast, by Residential 2020 & 2033

- Table 2: Australia Rooftop Solar Panel Market Volume Gigawatt Forecast, by Residential 2020 & 2033

- Table 3: Australia Rooftop Solar Panel Market Revenue billion Forecast, by Commercial and Industrial (C&I) 2020 & 2033

- Table 4: Australia Rooftop Solar Panel Market Volume Gigawatt Forecast, by Commercial and Industrial (C&I) 2020 & 2033

- Table 5: Australia Rooftop Solar Panel Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Australia Rooftop Solar Panel Market Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 7: Australia Rooftop Solar Panel Market Revenue billion Forecast, by Residential 2020 & 2033

- Table 8: Australia Rooftop Solar Panel Market Volume Gigawatt Forecast, by Residential 2020 & 2033

- Table 9: Australia Rooftop Solar Panel Market Revenue billion Forecast, by Commercial and Industrial (C&I) 2020 & 2033

- Table 10: Australia Rooftop Solar Panel Market Volume Gigawatt Forecast, by Commercial and Industrial (C&I) 2020 & 2033

- Table 11: Australia Rooftop Solar Panel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Australia Rooftop Solar Panel Market Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Rooftop Solar Panel Market?

The projected CAGR is approximately 7.6%.

2. Which companies are prominent players in the Australia Rooftop Solar Panel Market?

Key companies in the market include Maxeon Solar Technologies Ltd, Risen Energy Co Ltd, Energy Matters, RACV Solar, Adam Solar, GEM Energy, Trina Solar, Tindo Solar, Infinite Energy, Soltek Energy.

3. What are the main segments of the Australia Rooftop Solar Panel Market?

The market segments include Residential, Commercial and Industrial (C&I).

4. Can you provide details about the market size?

The market size is estimated to be USD 2.3 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Backup Applications in Data Centers4.; Rising Power Outages to Increase the Demand for UPS.

6. What are the notable trends driving market growth?

Residential Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Capital Cost and Operation Expenditure of UPS Systems.

8. Can you provide examples of recent developments in the market?

January 2022: Semper Solaris partnered with Enphase Energy, Inc., a global energy technology company, to deploy IQ8 solar microinverters, which provide sunlight backup during an outage for residential rooftop installation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Rooftop Solar Panel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Rooftop Solar Panel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Rooftop Solar Panel Market?

To stay informed about further developments, trends, and reports in the Australia Rooftop Solar Panel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence