Key Insights

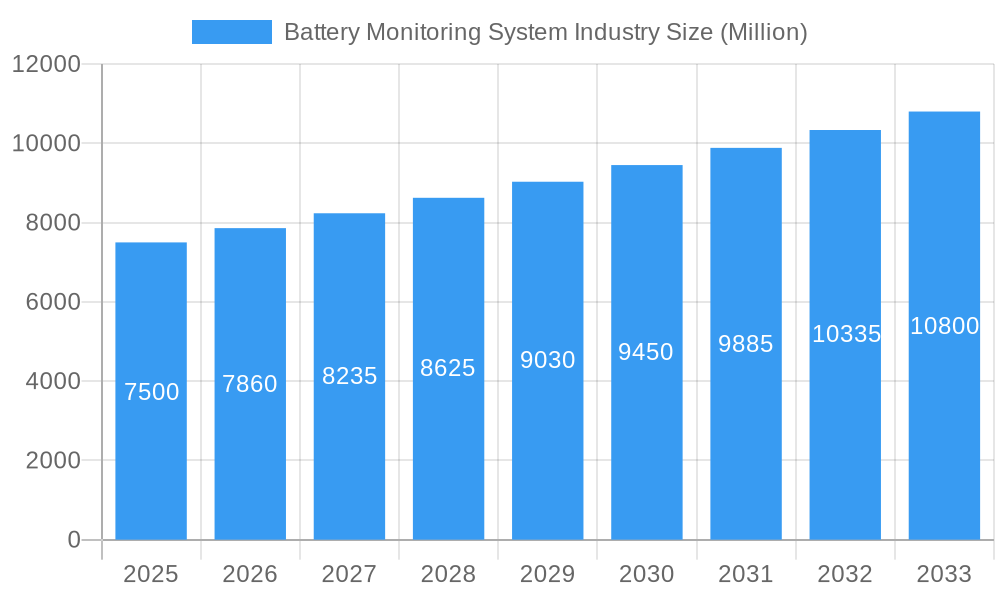

The global Battery Monitoring System (BMS) market is poised for significant expansion, projected to reach an estimated USD 9.30 billion by the end of the study period. Driven by a robust Compound Annual Growth Rate (CAGR) of 4.85%, this growth trajectory underscores the increasing integration of advanced battery technologies across a diverse range of applications. The surging demand for electric vehicles (EVs), coupled with the proliferation of renewable energy storage solutions and the persistent need for reliable power management in portable electronics, are key catalysts propelling the market forward. Emerging economies are also contributing to this expansion, driven by investments in grid modernization and the adoption of sustainable energy infrastructure. The market's dynamism is further fueled by continuous innovation in battery chemistry, leading to higher energy densities and longer lifespans, which in turn necessitates sophisticated monitoring and management systems to ensure optimal performance, safety, and longevity.

Battery Monitoring System Industry Market Size (In Billion)

The BMS market is segmented into Stationary, Portable, and Transportation applications, each exhibiting unique growth patterns. The Transportation segment, particularly the automotive sector with the rapid adoption of EVs, is expected to be a primary growth engine. Stationary applications, encompassing renewable energy storage and grid backup systems, are also witnessing substantial uptake. Portable electronics, while a mature market, continues to demand advanced BMS for improved safety and extended battery life. Key players like BMS Powersafe, LION Smart GmbH, Sensata Technologies Inc., and Texas Instruments Incorporated are at the forefront of this innovation, introducing sophisticated hardware and software solutions. However, challenges such as the high initial cost of advanced BMS for certain applications and the need for standardization across different battery chemistries and platforms may temper growth. Despite these restraints, the overarching trend towards electrification and the critical need for battery safety and efficiency will continue to drive robust market expansion.

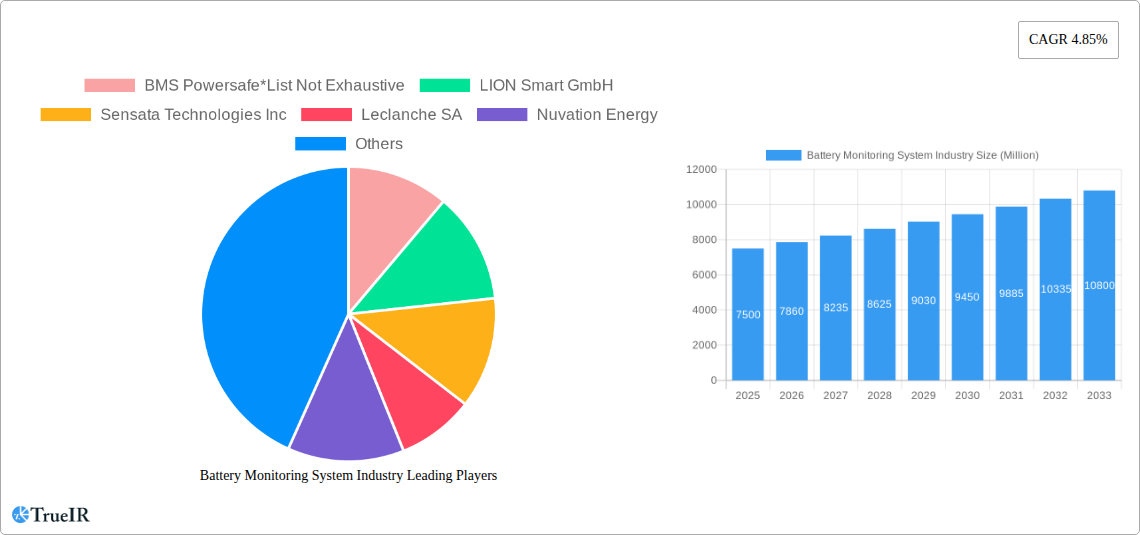

Battery Monitoring System Industry Company Market Share

Here's the SEO-optimized report description for the Battery Monitoring System Industry, designed for immediate use without modification:

Battery Monitoring System Industry Market Structure & Competitive Landscape

The Battery Monitoring System (BMS) industry exhibits a moderately concentrated market structure, driven by increasing demand for advanced battery management solutions across diverse applications. Key innovation drivers include the escalating adoption of electric vehicles (EVs), the proliferation of renewable energy storage systems, and the growing need for enhanced battery safety and performance in portable electronics. Regulatory impacts, such as stringent safety standards and emissions regulations, are further shaping the competitive landscape, encouraging players to invest in robust and compliant BMS technologies. Product substitutes, while present in simpler monitoring solutions, are largely outpaced by the sophisticated features offered by dedicated BMS, especially for high-power and critical applications. The end-user segmentation reveals a dynamic interplay between the transportation, stationary, and portable sectors, each with unique requirements and growth trajectories. Merger and acquisition (M&A) trends are significant, with an estimated XX number of significant M&A activities observed in the historical period (2019-2024), indicating strategic consolidation and expansion by leading market participants aiming to broaden their technological portfolios and market reach. Concentration ratios are estimated to be around XX% for the top five players, highlighting a competitive yet consolidated environment.

Battery Monitoring System Industry Market Trends & Opportunities

The global Battery Monitoring System (BMS) industry is poised for substantial growth, driven by an insatiable demand for efficient, safe, and long-lasting battery solutions. The market size is projected to reach an estimated value of $XX Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This robust expansion is fueled by transformative technological shifts, including the advent of advanced sensor technologies, sophisticated algorithms for battery health prediction, and the integration of artificial intelligence (AI) and machine learning (ML) for predictive maintenance and performance optimization. Consumer preferences are increasingly leaning towards products that offer extended battery life, enhanced safety features, and greater sustainability, directly benefiting the adoption of superior BMS. The competitive dynamics are characterized by an intense focus on innovation, with companies vying to offer integrated solutions that cater to the evolving needs of electric vehicles, renewable energy storage, and consumer electronics. Market penetration rates for advanced BMS are expected to surge as battery technologies become more complex and critical for operational efficiency. The ongoing electrification trend across multiple sectors, from personal mobility to grid-scale energy storage, presents a significant market opportunity for BMS providers. Furthermore, the increasing complexity of battery chemistries, such as solid-state batteries, will necessitate even more sophisticated monitoring and management systems, creating a continuous demand for cutting-edge BMS solutions. The drive for energy independence and the transition to cleaner energy sources are also propelling the growth of stationary battery storage, a key segment for BMS deployment. As the world embraces a more electrified future, the role of intelligent battery monitoring systems will become indispensable, unlocking unprecedented growth potential and strategic opportunities for market players.

Dominant Markets & Segments in Battery Monitoring System Industry

The Transportation segment stands out as the dominant market within the Battery Monitoring System (BMS) industry, driven by the exponential growth of the electric vehicle (EV) market. This dominance is underpinned by several key growth drivers:

- Infrastructure Development: The widespread expansion of EV charging infrastructure globally necessitates robust and reliable battery management to ensure optimal performance and safety of EV batteries.

- Government Policies and Incentives: Favorable government policies, subsidies, and stringent emission regulations in major automotive markets are aggressively pushing for EV adoption, directly translating into higher demand for BMS.

- Automotive Manufacturer Investments: Major automotive manufacturers are investing billions in EV research, development, and production, creating a substantial and consistent demand for advanced BMS integrated into their vehicle platforms.

- Performance and Safety Demands: The high-voltage, high-energy nature of EV battery packs demands sophisticated BMS to monitor state of charge (SoC), state of health (SoH), prevent thermal runaway, and optimize charging and discharging cycles for longevity and driver safety.

The Stationary application segment is also experiencing significant traction, propelled by the increasing deployment of battery energy storage systems (BESS) for grid stabilization, renewable energy integration, and backup power solutions. Key growth drivers in this segment include:

- Renewable Energy Integration: The intermittency of solar and wind power necessitates BESS to store excess energy and provide a stable power supply, with BMS being critical for managing these large-scale battery arrays.

- Grid Modernization: Utilities are investing in smart grid technologies that rely on BESS for load balancing and grid reliability, driving demand for advanced monitoring solutions.

- Commercial and Industrial Backup Power: Businesses are increasingly adopting BESS for uninterrupted power supply, enhancing operational resilience, thereby boosting the demand for dependable BMS.

While the Portable segment, encompassing consumer electronics and portable power tools, remains a significant market, its growth is relatively more mature compared to transportation and stationary applications. However, the continuous innovation in portable devices, from smartphones and laptops to advanced medical equipment, still sustains a consistent demand for efficient and compact BMS solutions.

Battery Monitoring System Industry Product Analysis

Product innovations in the Battery Monitoring System (BMS) industry are increasingly focused on enhancing accuracy, intelligence, and connectivity. Companies are developing advanced BMS with integrated AI/ML capabilities for predictive battery health analysis, significantly extending battery lifespan and reducing maintenance costs. The focus is on miniaturization, lower power consumption, and improved communication protocols (e.g., CAN, Ethernet) to facilitate seamless integration into diverse platforms. Competitive advantages are being carved out through superior algorithm precision in estimating State of Charge (SoC) and State of Health (SoH), enhanced thermal management capabilities, and robust safety features that prevent overcharging, over-discharging, and thermal runaway.

Key Drivers, Barriers & Challenges in Battery Monitoring System Industry

Key Drivers: The Battery Monitoring System (BMS) industry is propelled by several pivotal factors. The accelerating adoption of electric vehicles (EVs) is a primary driver, as BMS are crucial for EV battery performance, safety, and longevity. The burgeoning renewable energy sector, with its increasing reliance on battery energy storage systems (BESS), also fuels demand. Technological advancements in battery chemistries, requiring more sophisticated management, coupled with government incentives and regulations promoting cleaner energy and electric mobility, further bolster market growth. The growing need for enhanced safety and reliability in all battery-powered applications is a constant impetus.

Barriers & Challenges: Despite the positive outlook, the industry faces challenges. The high cost of advanced BMS can be a restraint, particularly for cost-sensitive applications. Supply chain disruptions for critical components and raw materials can impact production and pricing. Stringent and evolving regulatory landscapes across different regions require continuous adaptation and compliance efforts. Intense competitive pressure from established players and new entrants can lead to price wars and margin erosion. Furthermore, the complexity of integrating BMS with diverse battery technologies and vehicle platforms presents engineering hurdles.

Growth Drivers in the Battery Monitoring System Industry Market

The Battery Monitoring System (BMS) industry's growth is significantly driven by the global surge in electric vehicle (EV) adoption, necessitating sophisticated battery management for optimal performance and safety. The expansion of renewable energy sources like solar and wind power also fuels demand for Battery Energy Storage Systems (BESS), where advanced BMS are critical for efficient operation and grid integration. Technological advancements in battery chemistries and the increasing need for precise State of Charge (SoC) and State of Health (SoH) estimations are pushing innovation. Favorable government policies, subsidies for EVs and renewable energy, and stringent safety regulations worldwide act as strong catalysts. The growing trend towards electrification across various sectors, from transportation to industrial equipment, creates a broad and expanding market for BMS solutions.

Challenges Impacting Battery Monitoring System Industry Growth

Several challenges can impact the growth of the Battery Monitoring System (BMS) industry. The high initial cost of advanced BMS can be a significant barrier, particularly for smaller manufacturers or less critical applications. Supply chain vulnerabilities for essential semiconductor components and raw materials can lead to production delays and increased costs. Navigating diverse and evolving regulatory frameworks across different countries and regions requires substantial investment and adaptation. Intense competition among existing players and the emergence of new innovators can put pressure on profit margins. Furthermore, the increasing complexity of battery technologies and the need for highly accurate predictive algorithms present ongoing technical development challenges.

Key Players Shaping the Battery Monitoring System Industry Market

- BMS Powersafe

- LION Smart GmbH

- Sensata Technologies Inc

- Leclanche SA

- Nuvation Energy

- RCRS Innovations Pvt Ltd

- Renesas Electronics Corporation

- Eberspaecher Vecture Inc

- Texas Instruments Incorporated

- Elithion Inc

Significant Battery Monitoring System Industry Industry Milestones

- May 2022: A leading global vehicle manufacturer selected BorgWarner's battery management system (BMS) for its entire B-segment, C-segment, and light commercial vehicle platforms. This significant development is expected to optimize battery pack performance, safety, and longevity starting mid-2023. BorgWarner's BMS for hybrid and electric vehicles features a master control unit linked to multiple cell management control units, designed to monitor battery cell state of charge, health, temperature, and precisely measure battery pack current and voltage.

- March 2022: Battrixx, a prominent manufacturer of lithium-ion battery packs for e-vehicles, completed the full acquisition of Pune-based Varos Technology Pvt. Ltd. Varos Technology specializes in the development and utilization of IoT tools for EV infrastructure and battery management systems. This strategic partnership is anticipated to foster growth within the overall segment and create synergy between Battrixx's products and services. Varos Technology's capabilities in leveraging cloud-based artificial intelligence (AI)-driven analytics are expected to enable the development of end-to-end battery management systems that can predict battery life and monitor battery performance.

Future Outlook for Battery Monitoring System Industry Market

The future outlook for the Battery Monitoring System (BMS) industry is exceptionally bright, fueled by the persistent global push towards electrification and sustainable energy solutions. The continuous evolution of battery technologies, including the anticipated rise of solid-state batteries, will necessitate increasingly sophisticated and intelligent BMS. Strategic opportunities lie in developing integrated solutions that offer comprehensive battery lifecycle management, from manufacturing to end-of-life recycling. Market potential is immense, driven by ongoing investments in electric vehicles, large-scale battery energy storage systems for grid stability, and the demand for enhanced safety and performance in all battery-powered devices. The industry is poised for significant innovation in AI-driven predictive analytics and wireless BMS technologies.

Battery Monitoring System Industry Segmentation

-

1. Application

- 1.1. Stationary

- 1.2. Portable

- 1.3. Transportation

Battery Monitoring System Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. Francy

- 2.3. Italy

- 2.4. United Kingdom

- 2.5. Russian Federation

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

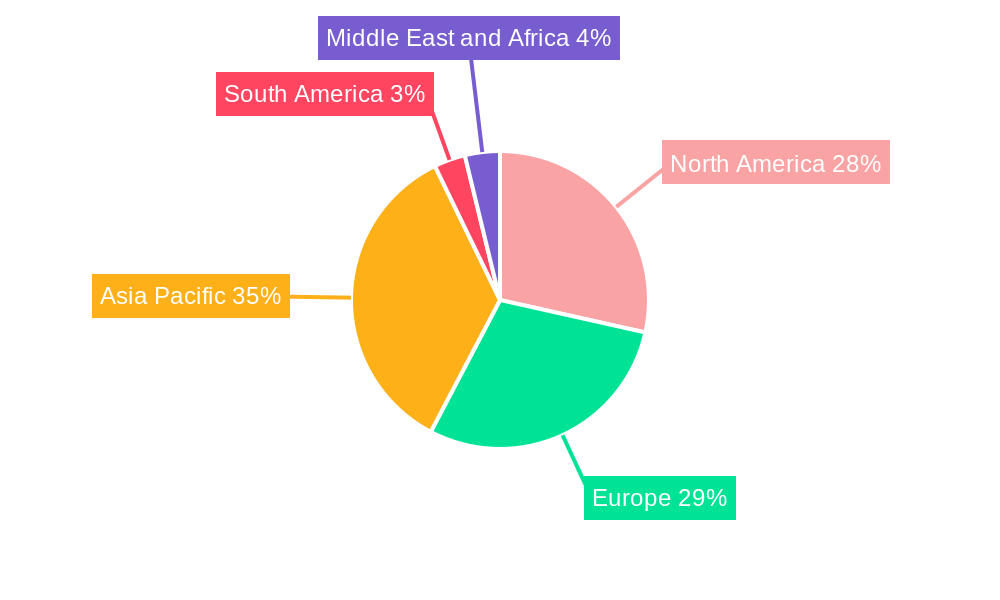

Battery Monitoring System Industry Regional Market Share

Geographic Coverage of Battery Monitoring System Industry

Battery Monitoring System Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Global Inclination towards Renewable-based Power Generation4.; Growing Power Demand in Line with the Increasing Population

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Cost

- 3.4. Market Trends

- 3.4.1. Transportation Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Battery Monitoring System Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Stationary

- 5.1.2. Portable

- 5.1.3. Transportation

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Battery Monitoring System Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Stationary

- 6.1.2. Portable

- 6.1.3. Transportation

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Battery Monitoring System Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Stationary

- 7.1.2. Portable

- 7.1.3. Transportation

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Battery Monitoring System Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Stationary

- 8.1.2. Portable

- 8.1.3. Transportation

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Battery Monitoring System Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Stationary

- 9.1.2. Portable

- 9.1.3. Transportation

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Battery Monitoring System Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Stationary

- 10.1.2. Portable

- 10.1.3. Transportation

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 BMS Powersafe*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 LION Smart GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sensata Technologies Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Leclanche SA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nuvation Energy

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 RCRS Innovations Pvt Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Renesas Electronics Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Eberspaecher Vecture Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Texas Instruments Incorporated

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Elithion Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 BMS Powersafe*List Not Exhaustive

List of Figures

- Figure 1: Global Battery Monitoring System Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Battery Monitoring System Industry Volume Breakdown (K Units, %) by Region 2025 & 2033

- Figure 3: North America Battery Monitoring System Industry Revenue (Million), by Application 2025 & 2033

- Figure 4: North America Battery Monitoring System Industry Volume (K Units), by Application 2025 & 2033

- Figure 5: North America Battery Monitoring System Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Battery Monitoring System Industry Volume Share (%), by Application 2025 & 2033

- Figure 7: North America Battery Monitoring System Industry Revenue (Million), by Country 2025 & 2033

- Figure 8: North America Battery Monitoring System Industry Volume (K Units), by Country 2025 & 2033

- Figure 9: North America Battery Monitoring System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Battery Monitoring System Industry Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Battery Monitoring System Industry Revenue (Million), by Application 2025 & 2033

- Figure 12: Europe Battery Monitoring System Industry Volume (K Units), by Application 2025 & 2033

- Figure 13: Europe Battery Monitoring System Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Battery Monitoring System Industry Volume Share (%), by Application 2025 & 2033

- Figure 15: Europe Battery Monitoring System Industry Revenue (Million), by Country 2025 & 2033

- Figure 16: Europe Battery Monitoring System Industry Volume (K Units), by Country 2025 & 2033

- Figure 17: Europe Battery Monitoring System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Battery Monitoring System Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Battery Monitoring System Industry Revenue (Million), by Application 2025 & 2033

- Figure 20: Asia Pacific Battery Monitoring System Industry Volume (K Units), by Application 2025 & 2033

- Figure 21: Asia Pacific Battery Monitoring System Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Battery Monitoring System Industry Volume Share (%), by Application 2025 & 2033

- Figure 23: Asia Pacific Battery Monitoring System Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: Asia Pacific Battery Monitoring System Industry Volume (K Units), by Country 2025 & 2033

- Figure 25: Asia Pacific Battery Monitoring System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Battery Monitoring System Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: South America Battery Monitoring System Industry Revenue (Million), by Application 2025 & 2033

- Figure 28: South America Battery Monitoring System Industry Volume (K Units), by Application 2025 & 2033

- Figure 29: South America Battery Monitoring System Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: South America Battery Monitoring System Industry Volume Share (%), by Application 2025 & 2033

- Figure 31: South America Battery Monitoring System Industry Revenue (Million), by Country 2025 & 2033

- Figure 32: South America Battery Monitoring System Industry Volume (K Units), by Country 2025 & 2033

- Figure 33: South America Battery Monitoring System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Battery Monitoring System Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Middle East and Africa Battery Monitoring System Industry Revenue (Million), by Application 2025 & 2033

- Figure 36: Middle East and Africa Battery Monitoring System Industry Volume (K Units), by Application 2025 & 2033

- Figure 37: Middle East and Africa Battery Monitoring System Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: Middle East and Africa Battery Monitoring System Industry Volume Share (%), by Application 2025 & 2033

- Figure 39: Middle East and Africa Battery Monitoring System Industry Revenue (Million), by Country 2025 & 2033

- Figure 40: Middle East and Africa Battery Monitoring System Industry Volume (K Units), by Country 2025 & 2033

- Figure 41: Middle East and Africa Battery Monitoring System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Battery Monitoring System Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Battery Monitoring System Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Battery Monitoring System Industry Volume K Units Forecast, by Application 2020 & 2033

- Table 3: Global Battery Monitoring System Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Battery Monitoring System Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 5: Global Battery Monitoring System Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Battery Monitoring System Industry Volume K Units Forecast, by Application 2020 & 2033

- Table 7: Global Battery Monitoring System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Battery Monitoring System Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 9: United States Battery Monitoring System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United States Battery Monitoring System Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 11: Canada Battery Monitoring System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Battery Monitoring System Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 13: Rest of North America Battery Monitoring System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Rest of North America Battery Monitoring System Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 15: Global Battery Monitoring System Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 16: Global Battery Monitoring System Industry Volume K Units Forecast, by Application 2020 & 2033

- Table 17: Global Battery Monitoring System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Battery Monitoring System Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 19: Germany Battery Monitoring System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Battery Monitoring System Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 21: Francy Battery Monitoring System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Francy Battery Monitoring System Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 23: Italy Battery Monitoring System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Italy Battery Monitoring System Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 25: United Kingdom Battery Monitoring System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Battery Monitoring System Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 27: Russian Federation Battery Monitoring System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russian Federation Battery Monitoring System Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Battery Monitoring System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Europe Battery Monitoring System Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 31: Global Battery Monitoring System Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 32: Global Battery Monitoring System Industry Volume K Units Forecast, by Application 2020 & 2033

- Table 33: Global Battery Monitoring System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Global Battery Monitoring System Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 35: China Battery Monitoring System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: China Battery Monitoring System Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 37: India Battery Monitoring System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: India Battery Monitoring System Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 39: Japan Battery Monitoring System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Japan Battery Monitoring System Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 41: South Korea Battery Monitoring System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: South Korea Battery Monitoring System Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 43: Rest of Asia Pacific Battery Monitoring System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Rest of Asia Pacific Battery Monitoring System Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 45: Global Battery Monitoring System Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 46: Global Battery Monitoring System Industry Volume K Units Forecast, by Application 2020 & 2033

- Table 47: Global Battery Monitoring System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global Battery Monitoring System Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 49: Brazil Battery Monitoring System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Brazil Battery Monitoring System Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 51: Argentina Battery Monitoring System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Argentina Battery Monitoring System Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 53: Rest of South America Battery Monitoring System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of South America Battery Monitoring System Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 55: Global Battery Monitoring System Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 56: Global Battery Monitoring System Industry Volume K Units Forecast, by Application 2020 & 2033

- Table 57: Global Battery Monitoring System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 58: Global Battery Monitoring System Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 59: Saudi Arabia Battery Monitoring System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Saudi Arabia Battery Monitoring System Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 61: United Arab Emirates Battery Monitoring System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: United Arab Emirates Battery Monitoring System Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 63: South Africa Battery Monitoring System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: South Africa Battery Monitoring System Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Battery Monitoring System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Battery Monitoring System Industry Volume (K Units) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Battery Monitoring System Industry?

The projected CAGR is approximately 4.85%.

2. Which companies are prominent players in the Battery Monitoring System Industry?

Key companies in the market include BMS Powersafe*List Not Exhaustive, LION Smart GmbH, Sensata Technologies Inc, Leclanche SA, Nuvation Energy, RCRS Innovations Pvt Ltd, Renesas Electronics Corporation, Eberspaecher Vecture Inc, Texas Instruments Incorporated, Elithion Inc.

3. What are the main segments of the Battery Monitoring System Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.30 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Global Inclination towards Renewable-based Power Generation4.; Growing Power Demand in Line with the Increasing Population.

6. What are the notable trends driving market growth?

Transportation Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Initial Cost.

8. Can you provide examples of recent developments in the market?

In May 2022, a leading global vehicle manufacturer selected BorgWarner's battery management system (BMS) to fit its entire B-segment, C-segment, and light commercial vehicle platforms. Starting mid-2023, the new BorgWarner BMS technology is expected to optimize battery pack performance, safety, and longevity. BorgWarner's battery management system for hybrid and electric vehicles contains a master control unit connected to multiple cell management control units. It is designed to monitor the state of charge, health, and battery temperature of each battery cell and also precisely measure battery pack current and voltage.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Battery Monitoring System Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Battery Monitoring System Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Battery Monitoring System Industry?

To stay informed about further developments, trends, and reports in the Battery Monitoring System Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence