Key Insights

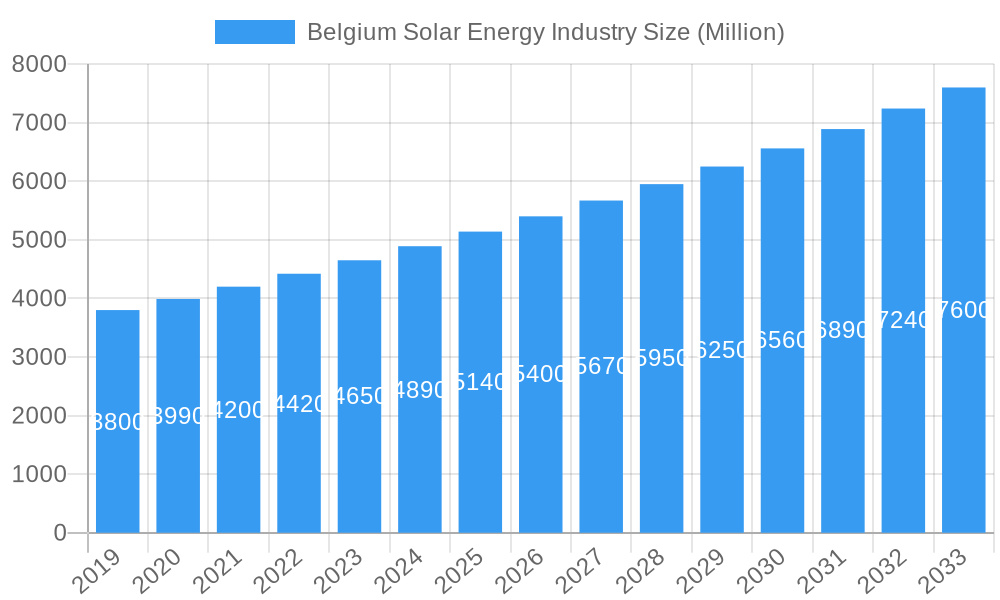

The Belgium solar energy market is set for substantial growth, fueled by favorable government initiatives, rising environmental awareness, and escalating demand for sustainable power. The market is projected to reach a size of $5.8 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 6.58% from the base year of 2025.

Key growth drivers include Belgium's ambitious renewable energy targets, promoting both large-scale solar farms and distributed rooftop systems. Decreasing solar photovoltaic (PV) costs enhance investment attractiveness for commercial and residential users, accelerating adoption. Technological advancements in solar PV are boosting efficiency and performance, making solar a more competitive alternative to conventional energy sources.

Belgium Solar Energy Industry Company Market Share

The market's robust expansion is anticipated from 2019 to 2033, with consistent investment in Solar PV and Concentrated Solar Power (CSP) technologies. Solar PV is expected to lead market share due to its established infrastructure and cost-effectiveness. Leading companies like 7C Solarparken AG, First Solar Inc., and Sungrow Power Supply Co Ltd are instrumental in this growth through project development, innovation, and strategic alliances. While challenges such as grid integration and land availability exist, they are being mitigated by smart grid solutions and advanced installation techniques, reinforcing the Belgium solar energy sector's crucial role in the nation's clean energy transition.

Belgium Solar Energy Industry Market Structure & Competitive Landscape

The Belgian solar energy industry is characterized by a moderately concentrated market structure, with a growing number of established players and emerging innovators vying for market share. Innovation drivers are primarily focused on enhancing solar panel efficiency, durability, and cost-effectiveness, with a particular emphasis on perovskite solar technologies and advanced PV module designs. Regulatory impacts are significant, with government incentives, feed-in tariffs, and renewable energy targets playing a crucial role in shaping investment and deployment. Product substitutes, such as wind energy and other renewable sources, exist but the unique benefits of solar, including decentralized generation and declining costs, maintain its competitive edge. End-user segmentation includes residential, commercial, and industrial sectors, each with distinct energy demands and adoption rates. Mergers and acquisitions (M&A) activity, while not yet at a scale of hundreds of millions, is a growing trend as larger companies seek to consolidate their market presence and acquire innovative technologies. For example, the acquisition of smaller installation companies by larger energy providers aims to streamline operations and expand customer reach. The presence of companies like 7C Solarparken AG and First Solar Inc. signifies established international interest, while local players like 3E and Zonnecentrale Overpelt NV contribute to the domestic ecosystem.

Belgium Solar Energy Industry Market Trends & Opportunities

The Belgian solar energy market is poised for substantial growth, projecting a Compound Annual Growth Rate (CAGR) of 15% over the forecast period of 2025–2033. This expansion is driven by a confluence of factors, including supportive government policies, increasing environmental consciousness, and the relentless pursuit of technological advancements. The market size, currently estimated to be around 12 Billion Euros in the base year of 2025, is expected to reach approximately 35 Billion Euros by 2033. Technological shifts are prominently featuring the integration of advanced materials like perovskites, which offer higher conversion efficiencies and the potential for flexible and transparent solar cells. The development of bifacial solar panels, capable of capturing sunlight from both sides, further enhances energy yield, as demonstrated by the 92% efficiency retention observed in thermally stable perovskite panels after 1,000 hours. Consumer preferences are increasingly leaning towards sustainable energy solutions, with a growing demand for rooftop solar installations in the residential sector and large-scale solar farms in the commercial and industrial segments. This is further fueled by rising electricity prices and a desire for energy independence. Competitive dynamics are intensifying, with traditional energy companies diversifying into solar, alongside specialized solar developers and manufacturers. Companies like Sungrow Power Supply Co Ltd are contributing to this by offering advanced inverters, crucial for optimizing solar energy conversion and grid integration. The increasing adoption of smart grid technologies and energy storage solutions, such as batteries, is also creating new opportunities for integrated solar energy systems, enhancing grid stability and enabling greater penetration of variable renewable sources. Furthermore, the European Union's ambitious renewable energy targets and the post-pandemic economic recovery initiatives are providing significant impetus for solar energy investments across Belgium. The focus on energy efficiency and decarbonization within industrial processes also presents a substantial opportunity for solar adoption.

Dominant Markets & Segments in Belgium Solar Energy Industry

The Solar Photovoltaic (PV) segment overwhelmingly dominates the Belgian solar energy industry, accounting for over 98% of the total market share. Concentrated Solar Photovoltaic (CSP) technology, while promising for large-scale thermal energy storage, has not yet gained significant traction in Belgium due to geographical and climatic conditions that favor PV's more widespread applicability. Within the PV segment, the residential sector represents a significant portion of installations, driven by favorable feed-in tariffs and a growing consumer desire for energy autonomy and cost savings. The commercial and industrial (C&I) sector is emerging as a key growth driver, with businesses increasingly investing in solar to reduce operational costs, meet sustainability goals, and enhance their corporate social responsibility profiles.

Key growth drivers for the PV segment include:

- Supportive Government Policies and Incentives: Belgium has consistently implemented policies like net metering, tax credits, and subsidies that encourage solar adoption. These policies have been instrumental in driving down the payback period for solar investments.

- Declining Technology Costs: The continuous reduction in the cost of solar panels, inverters, and mounting structures has made solar energy increasingly competitive with traditional energy sources.

- Rising Electricity Prices: Fluctuations and general increases in conventional electricity prices make solar power a more attractive and predictable long-term energy investment for consumers and businesses alike.

- Technological Advancements: Innovations in solar panel efficiency, such as bifacial panels and the development of more stable perovskite solar cells, are enhancing energy generation capabilities and driving adoption.

- Grid Modernization and Energy Storage: Investments in smart grid infrastructure and the increasing availability and affordability of battery storage solutions are enabling higher solar energy integration and greater grid stability.

The market dominance of Solar PV is further solidified by the sheer versatility of the technology, suitable for a wide range of applications from small residential rooftops to vast utility-scale solar farms. The ease of deployment and scalability of PV systems compared to CSP, which requires specific geographical conditions and significant upfront investment, has cemented its leading position in the Belgian market. The robust supply chain for PV components, including panels and inverters, and the availability of skilled labor for installation and maintenance further contribute to PV's entrenched dominance.

Belgium Solar Energy Industry Product Analysis

Belgian solar energy products are witnessing significant innovation focused on enhancing efficiency and durability. The development of perovskite solar panels by Belgian scientists, achieving 92% initial efficiency retention after 1,000 hours, exemplifies this trend towards higher performance and longevity. Belinus's new PV modules, boasting 420 W nominal power and 20.1% power conversion efficiency, highlight advancements in panel technology. Competitive advantages stem from these technological leaps, offering greater energy yields per unit area and reduced installation costs over the lifetime of the system. Applications span residential, commercial, and industrial sectors, with growing interest in integrated solutions that combine solar power with energy storage.

Key Drivers, Barriers & Challenges in Belgium Solar Energy Industry

Key Drivers: Technological advancements, particularly in perovskite solar cells and bifacial panels, are significantly boosting efficiency and reducing costs. Supportive government policies, including incentives and renewable energy targets, are crucial. The declining cost of solar technology and rising conventional electricity prices make solar an economically attractive investment. Economic drivers include job creation and energy independence.

Barriers & Challenges: Grid integration capacity remains a significant challenge, requiring substantial infrastructure upgrades to handle increasing intermittent solar generation. Regulatory complexities and permitting processes can cause delays and increase project development costs. Supply chain disruptions for key components can impact project timelines and costs, with the potential for price volatility. Competitive pressures from other renewable energy sources and evolving energy market dynamics also present challenges. For instance, the cost of raw materials like polysilicon has seen fluctuations impacting module prices.

Growth Drivers in the Belgium Solar Energy Industry Market

Key growth drivers in the Belgium solar energy market are multifaceted. Technological innovation, exemplified by advancements in perovskite solar cells and bifacial panel technology, continues to push efficiency boundaries. Economic factors, such as declining manufacturing costs for solar components and rising conventional electricity prices, enhance the economic viability of solar investments. Furthermore, robust government support in the form of subsidies, tax incentives, and ambitious renewable energy targets, such as those mandated by the European Union, are instrumental in accelerating deployment. Increased consumer and corporate demand for sustainable energy solutions, coupled with a growing awareness of climate change impacts, further fuels market expansion. The development of energy storage solutions is also a significant growth catalyst, enabling greater grid stability and solar self-consumption.

Challenges Impacting Belgium Solar Energy Industry Growth

Several challenges impact the growth of the Belgium solar energy industry. Grid integration remains a primary concern, as the existing infrastructure needs significant upgrades to accommodate the increasing intermittency of solar power generation. Complex and time-consuming permitting processes can lead to project delays and increase development costs. Supply chain vulnerabilities, including potential disruptions and price volatility for key components like polysilicon and rare earth metals, can impact project feasibility and timelines. Intense competition from other renewable energy sources, such as wind power, and the evolving energy market landscape necessitate continuous innovation and cost optimization. Moreover, ensuring the long-term financial stability of solar projects amidst changing policy landscapes and electricity market dynamics can be a restraint. The recycling and disposal of end-of-life solar panels also presents a growing environmental challenge that requires scalable and cost-effective solutions.

Key Players Shaping the Belgium Solar Energy Industry Market

- 7C Solarparken AG

- First Solar Inc.

- Orka Power

- SolarPower Europe

- 3E

- Zonnecentrale Overpelt NV

- Sungrow Power Supply Co Ltd

Significant Belgium Solar Energy Industry Industry Milestones

- April 2023: Scientists in Belgium developed perovskite solar panels with a thermally stable device stack. The encapsulated bifacial panels they created with this configuration retained around 92% of their initial efficiency after 1,000 hours, marking a significant advancement in solar cell durability and performance.

- March 2022: Belgium-based Belinus announced its new PV modules, featuring a nominal power rating of 420 W and a power conversion efficiency of 20.1%. They had plans to build a 500 MW solar panel factory at an unspecified Belgian site, indicating significant domestic manufacturing expansion and capacity building.

Future Outlook for Belgium Solar Energy Industry Market

The future outlook for the Belgian solar energy industry is exceptionally bright, projecting continued robust growth driven by a synergistic blend of technological innovation, supportive policy frameworks, and increasing market demand. Strategic opportunities lie in the further development and integration of advanced solar technologies, including enhanced perovskite cells and efficient energy storage solutions, which will be crucial for maximizing grid penetration and ensuring grid stability. The expansion of utility-scale solar farms, coupled with decentralized rooftop solar installations, will play a pivotal role in achieving Belgium's ambitious renewable energy targets. Investments in grid infrastructure modernization and smart grid technologies will be essential to facilitate this expansion. The market is also expected to witness increased activity in the areas of solar-plus-storage solutions, electric vehicle charging integration, and green hydrogen production powered by solar electricity, further diversifying applications and market potential. The continuous decline in solar technology costs is anticipated to make solar energy an even more competitive and accessible energy source for all segments of the Belgian economy.

Belgium Solar Energy Industry Segmentation

- 1. Solar Photovotaic (PV)

- 2. Concentrated Solar Photovoltaic (CSP)

Belgium Solar Energy Industry Segmentation By Geography

- 1. Belgium

Belgium Solar Energy Industry Regional Market Share

Geographic Coverage of Belgium Solar Energy Industry

Belgium Solar Energy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.58% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Demand for Clean Energy Sources4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Other Alternative Clean Energy Sources

- 3.4. Market Trends

- 3.4.1. Solar PV Type Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Belgium Solar Energy Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Solar Photovotaic (PV)

- 5.2. Market Analysis, Insights and Forecast - by Concentrated Solar Photovoltaic (CSP)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Belgium

- 5.1. Market Analysis, Insights and Forecast - by Solar Photovotaic (PV)

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 7C Solarparken AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 First Solar Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Orka Power

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SolarPower Europe

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 3E

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Zonnecentrale Overpelt NV*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sungrow Power Supply Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 7C Solarparken AG

List of Figures

- Figure 1: Belgium Solar Energy Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Belgium Solar Energy Industry Share (%) by Company 2025

List of Tables

- Table 1: Belgium Solar Energy Industry Revenue billion Forecast, by Solar Photovotaic (PV) 2020 & 2033

- Table 2: Belgium Solar Energy Industry Revenue billion Forecast, by Concentrated Solar Photovoltaic (CSP) 2020 & 2033

- Table 3: Belgium Solar Energy Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Belgium Solar Energy Industry Revenue billion Forecast, by Solar Photovotaic (PV) 2020 & 2033

- Table 5: Belgium Solar Energy Industry Revenue billion Forecast, by Concentrated Solar Photovoltaic (CSP) 2020 & 2033

- Table 6: Belgium Solar Energy Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Belgium Solar Energy Industry?

The projected CAGR is approximately 6.58%.

2. Which companies are prominent players in the Belgium Solar Energy Industry?

Key companies in the market include 7C Solarparken AG, First Solar Inc, Orka Power, SolarPower Europe, 3E, Zonnecentrale Overpelt NV*List Not Exhaustive, Sungrow Power Supply Co Ltd.

3. What are the main segments of the Belgium Solar Energy Industry?

The market segments include Solar Photovotaic (PV), Concentrated Solar Photovoltaic (CSP).

4. Can you provide details about the market size?

The market size is estimated to be USD XXX billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Demand for Clean Energy Sources4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Solar PV Type Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Other Alternative Clean Energy Sources.

8. Can you provide examples of recent developments in the market?

April 2023: Scientists in Belgium developed perovskite solar panels with a thermally stable device stack. The encapsulated bifacial panels they created with this configuration retained around 92% of their initial efficiency after 1,000 hours.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Belgium Solar Energy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Belgium Solar Energy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Belgium Solar Energy Industry?

To stay informed about further developments, trends, and reports in the Belgium Solar Energy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence