Key Insights

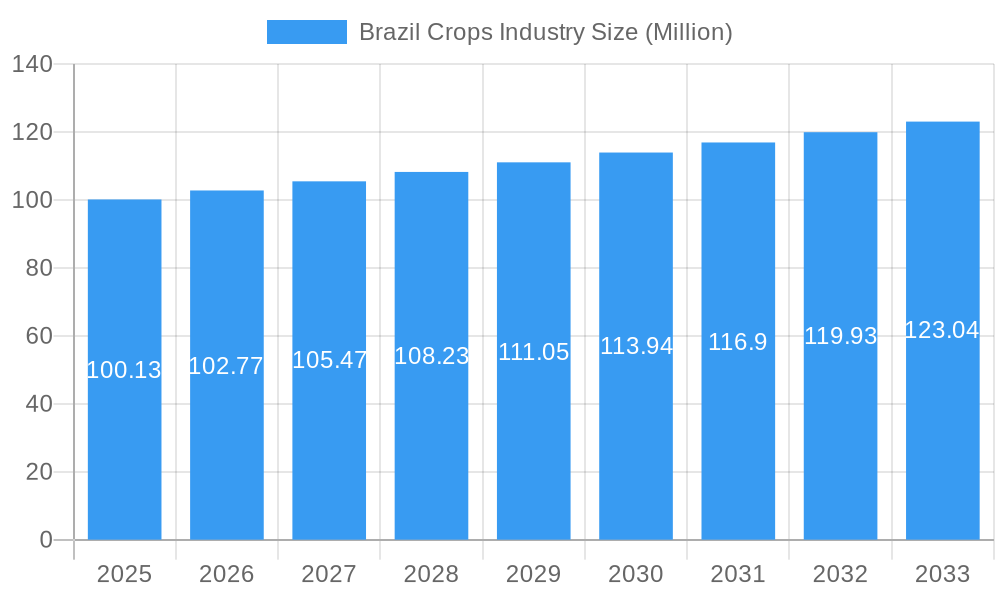

The Brazil crops industry, valued at $100.13 million in 2025, is projected to experience steady growth, driven by increasing global demand for food and biofuels, coupled with Brazil's favorable agricultural conditions. The Compound Annual Growth Rate (CAGR) of 2.60% from 2025-2033 indicates a consistent expansion, although this rate may fluctuate based on factors like weather patterns, global economic conditions, and government policies. Key segments include soybeans, corn, and cotton, which benefit from strong export markets and domestic consumption. The food and feed applications are major drivers, while the growing biofuel sector contributes significantly to the industry's expansion. Leading players like Bayer, Syngenta, BASF, and other multinational corporations are investing heavily in research and development, focusing on genetically modified crops and improved farming techniques to boost yields and efficiency. However, challenges remain, including land scarcity, water resource management, and the need for sustainable farming practices to mitigate environmental impacts.

Brazil Crops Industry Market Size (In Million)

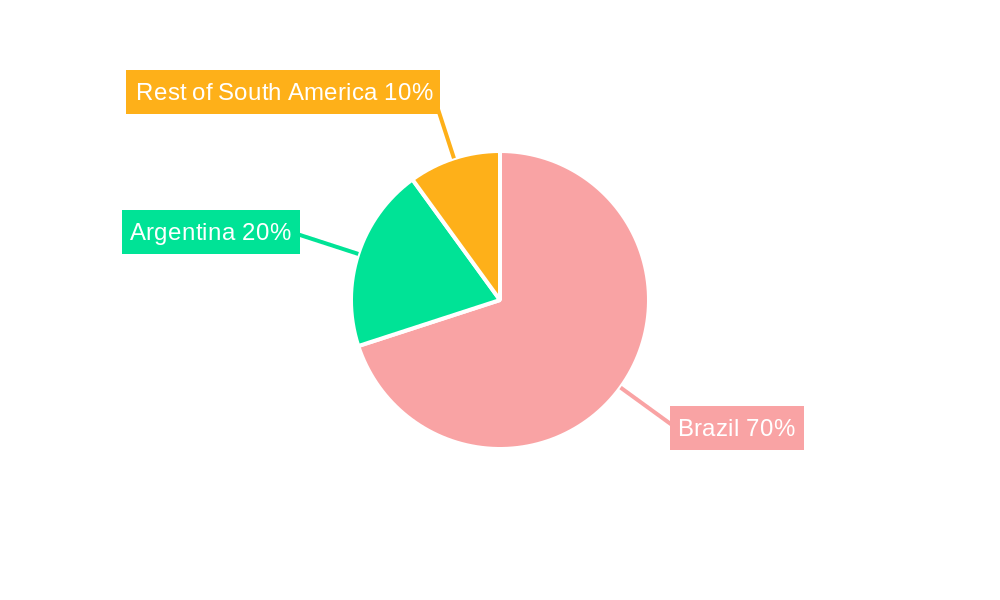

The South American region, particularly Brazil and Argentina, constitutes a significant share of the market. Brazil’s vast arable land and favorable climate make it a global powerhouse in agricultural production. However, competition from other agricultural exporters and global price fluctuations can affect market dynamics. While the "Other Crops" segment holds a less dominant position, its growth is anticipated to follow general market trends. To maintain its competitive edge, the industry must focus on technological innovation, efficient supply chain management, and sustainable practices to ensure long-term viability and meet increasing consumer demand for food security and environmentally responsible agricultural products. The forecast period of 2025-2033 suggests continued expansion, but precise projections require continuous monitoring of environmental factors, global economic trends, and technological developments.

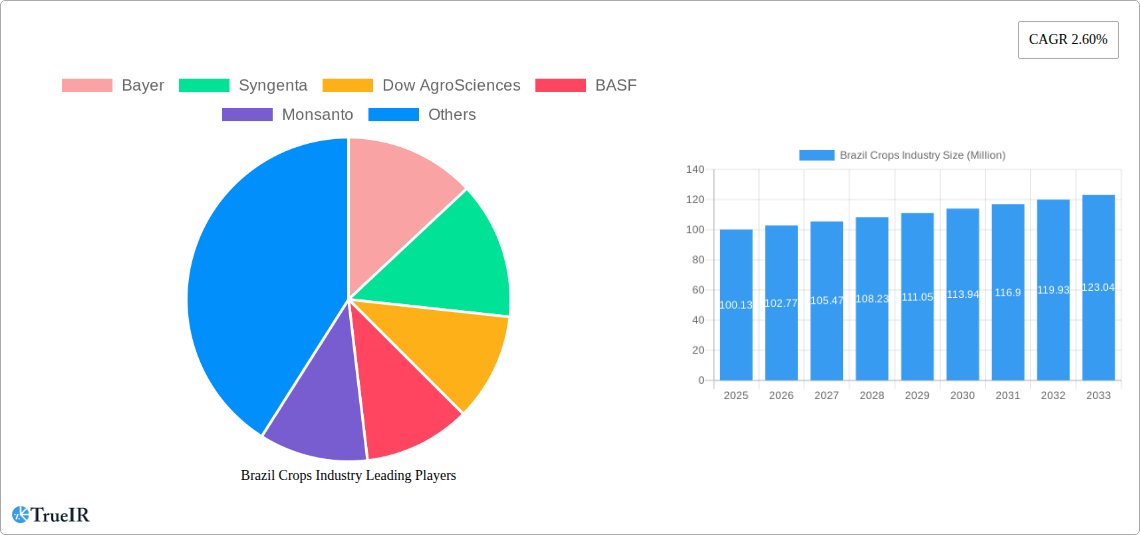

Brazil Crops Industry Company Market Share

Brazil Crops Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a deep dive into the thriving Brazil crops industry, offering invaluable insights for investors, industry professionals, and strategic planners. Leveraging extensive data analysis and expert insights, this report forecasts robust growth, driven by technological advancements, favorable government policies, and increasing global demand for food, feed, and biofuels. The study period covers 2019-2033, with a focus on the base year 2025 and a forecast period spanning 2025-2033. Key players like Bayer, Syngenta, Dow AgroSciences, BASF, and Monsanto are analyzed in detail.

Brazil Crops Industry Market Structure & Competitive Landscape

The Brazilian crops industry exhibits a moderately concentrated market structure, with a few multinational corporations holding significant market share. The Herfindahl-Hirschman Index (HHI) for 2025 is estimated at xx, indicating a moderately concentrated market. Innovation, driven by the need for higher yields and pest resistance, is a key competitive factor. Stringent regulatory frameworks concerning pesticide use and genetically modified organisms (GMOs) significantly impact industry operations. Product substitutes, such as organic farming practices, pose a growing competitive threat. The end-user segmentation is primarily divided into food, feed, and biofuel sectors, with food processing companies and livestock producers forming the core customer base.

- Market Concentration: HHI (2025) estimated at xx.

- Innovation Drivers: Development of drought-resistant and high-yield crop varieties, precision agriculture technologies.

- Regulatory Impacts: Stringent regulations on pesticide use, GMO approvals, and environmental protection.

- Product Substitutes: Organic farming, alternative protein sources.

- End-User Segmentation: Food processing, livestock feed, biofuel production.

- M&A Trends: A moderate level of mergers and acquisitions is observed, with xx Million in total deal value recorded between 2019 and 2024.

Brazil Crops Industry Market Trends & Opportunities

The Brazilian crops industry demonstrates strong growth potential, with the market size projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is propelled by several key factors. Technological advancements such as precision agriculture and improved seed varieties are enhancing crop yields and efficiency. Increasing consumer demand for food and biofuels globally fuels the expansion of cultivated land and agricultural production. The competitive landscape is characterized by intense competition among multinational corporations and local players, leading to continuous innovation and improvements in crop production techniques. Market penetration rates for advanced technologies like precision agriculture are steadily increasing, indicating substantial room for further growth.

Dominant Markets & Segments in Brazil Crops Industry

Soybeans dominate the Brazilian crops market, accounting for the largest share of production and export revenue. The Cerrado region, known for its fertile soil and favorable climate, is the primary producer of soybeans, corn, and cotton.

- Soybeans: Key growth drivers include high global demand, favorable government policies supporting soybean production and export, and investments in infrastructure development.

- Corn: The corn market benefits from its dual use in animal feed and ethanol production, driving consistent growth.

- Cotton: Brazil's cotton industry benefits from international demand and advancements in cotton varieties.

- Wheat: Wheat production is concentrated in specific regions, with growth driven by domestic demand and export opportunities.

- Other Crops: Rice, sugarcane, and coffee contribute substantially to the Brazilian agricultural economy.

- Food Application: The food processing industry forms a major component of the market, benefiting from domestic consumption and export potential.

- Feed Application: The growing livestock industry drives demand for feed grains, leading to substantial growth in corn and soybean production.

- Biofuel Application: Brazil is a leader in biofuel production, with sugarcane and corn playing major roles in the ethanol sector.

Brazil Crops Industry Product Analysis

The Brazilian crops industry witnesses continuous product innovation, focusing on developing high-yield, pest-resistant, and climate-resilient varieties. Technological advancements, such as genetically modified (GM) crops and precision agriculture techniques, play a pivotal role in boosting productivity and efficiency. These innovations enhance the competitiveness of Brazilian crops in the global market, offering superior quality and yield compared to traditional farming methods.

Key Drivers, Barriers & Challenges in Brazil Crops Industry

Key Drivers: High global demand for agricultural commodities, technological advancements in crop production, supportive government policies promoting agricultural growth, and investments in infrastructure are major drivers.

Challenges: Climate change (droughts and extreme weather events), fluctuations in global commodity prices, land-use conflicts, and regulatory hurdles related to pesticide use and GMOs pose significant challenges. Supply chain disruptions due to logistical issues and infrastructure limitations impact the sector's performance. Intense competition from other global agricultural producers can lead to price pressures.

Growth Drivers in the Brazil Crops Industry Market

Technological advancements like precision agriculture, improved seed varieties, and efficient irrigation systems are key growth drivers. Favorable government policies supporting agricultural research and development and export promotion also stimulate growth. Rising global demand for food, feed, and biofuels further contributes to industry expansion.

Challenges Impacting Brazil Crops Industry Growth

Climate change-related risks, including droughts and extreme weather events, create uncertainty and impact yields. Fluctuations in international commodity prices affect profitability. The complexity of regulatory frameworks and logistical challenges in the supply chain present significant operational barriers.

Key Players Shaping the Brazil Crops Industry Market

Significant Brazil Crops Industry Industry Milestones

- 2020: Launch of a new drought-resistant soybean variety by Bayer.

- 2021: Implementation of new regulations concerning pesticide use.

- 2022: Significant investment in precision agriculture technologies by Syngenta.

- 2023: Acquisition of a smaller local agricultural company by BASF.

- 2024: Government initiatives to improve agricultural infrastructure and logistics.

Future Outlook for Brazil Crops Industry Market

The Brazil crops industry is poised for sustained growth, driven by technological innovation, rising global demand, and supportive government policies. Strategic investments in research and development, improvements in agricultural infrastructure, and proactive risk management strategies will be crucial for maximizing market potential. The industry's future hinges on adapting to climate change challenges and maintaining a competitive edge in the global market.

Brazil Crops Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Brazil Crops Industry Segmentation By Geography

- 1. Brazil

Brazil Crops Industry Regional Market Share

Geographic Coverage of Brazil Crops Industry

Brazil Crops Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Food Security Concerns; Inclination Toward a Healthy Lifestyle

- 3.3. Market Restrains

- 3.3.1. ; Unfavorable Climatic Conditions; Higher Market Entry Cost

- 3.4. Market Trends

- 3.4.1. Increasing Food Crop Production

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Crops Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bayer

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Syngenta

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dow AgroSciences

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BASF

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Monsanto

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Bayer

List of Figures

- Figure 1: Brazil Crops Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Brazil Crops Industry Share (%) by Company 2025

List of Tables

- Table 1: Brazil Crops Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Brazil Crops Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Brazil Crops Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Brazil Crops Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Brazil Crops Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Brazil Crops Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Brazil Crops Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Brazil Crops Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Brazil Crops Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Brazil Crops Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Brazil Crops Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Brazil Crops Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Crops Industry?

The projected CAGR is approximately 2.60%.

2. Which companies are prominent players in the Brazil Crops Industry?

Key companies in the market include Bayer, Syngenta, Dow AgroSciences, BASF, Monsanto.

3. What are the main segments of the Brazil Crops Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 100.13 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Food Security Concerns; Inclination Toward a Healthy Lifestyle.

6. What are the notable trends driving market growth?

Increasing Food Crop Production.

7. Are there any restraints impacting market growth?

; Unfavorable Climatic Conditions; Higher Market Entry Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Crops Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Crops Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Crops Industry?

To stay informed about further developments, trends, and reports in the Brazil Crops Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence