Key Insights

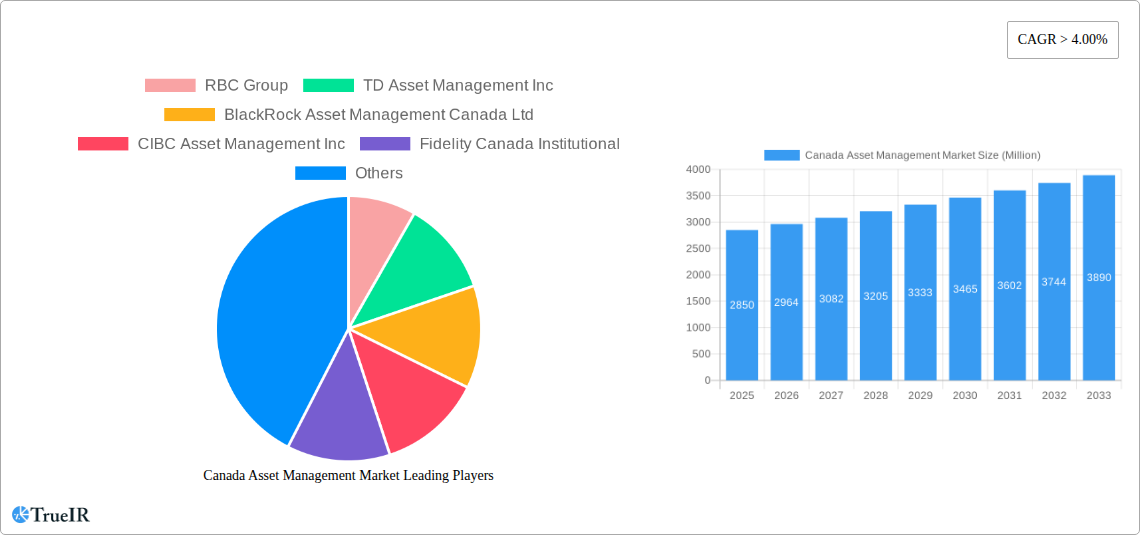

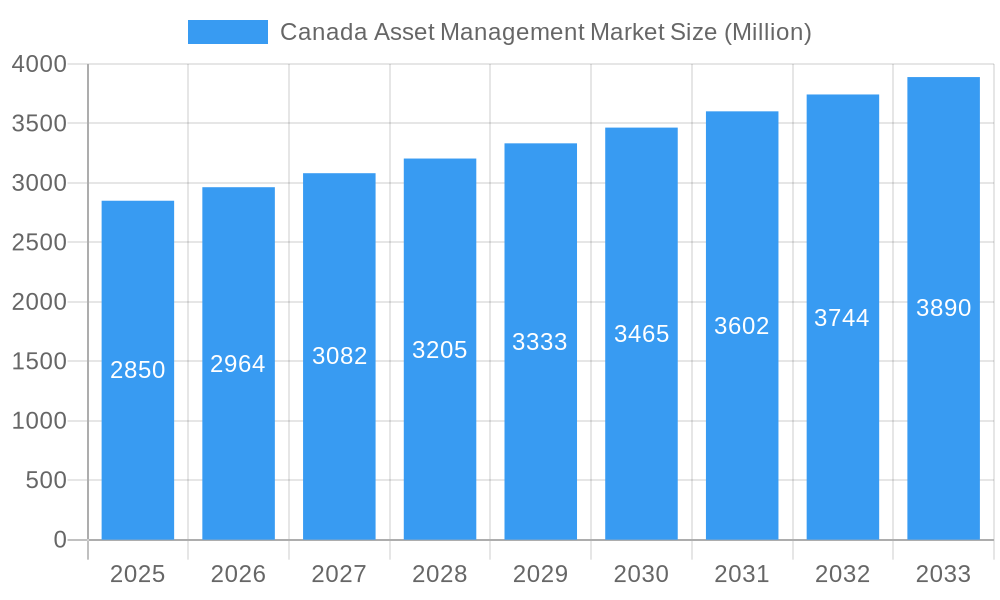

Canada's asset management market is projected for substantial growth, with a Compound Annual Growth Rate (CAGR) of 12.6%. The market size was valued at $489.4 billion in the base year of 2025 and is expected to expand significantly through 2033. This expansion is fueled by rising demand for diversified investment options, increasing institutional capital, and evolving individual investor needs. Key growth drivers include the persistent demand for retirement planning solutions, heightened awareness of wealth management services, and ongoing innovation in investment products such as Exchange Traded Funds (ETFs) and alternative investments. The market is witnessing a notable shift towards asset class diversification, with equities and fixed income remaining central, while alternative investments and hybrid funds gain prominence for their potential to deliver enhanced returns and mitigate risk. Digital transformation in the financial sector, encompassing advanced analytics, robo-advisory services, and improved client engagement platforms, is also a significant contributor to market expansion.

Canada Asset Management Market Market Size (In Billion)

However, the market faces certain challenges that may temper its growth trajectory. Increased regulatory scrutiny and rising compliance costs can impact operational efficiency and profitability for asset management firms. Economic uncertainties, including inflation, interest rate volatility, and geopolitical instability, can influence investor sentiment and capital allocation strategies. Furthermore, intense competition from a broad spectrum of asset management firms, ranging from large financial institutions and mutual fund providers to specialized private equity and hedge funds, necessitates continuous product innovation and cost-effectiveness to maintain market share. The market is also segmenting, with pension funds and insurance companies representing significant capital sources, alongside growing contributions from individual and corporate investors. While large financial institutions and mutual funds/ETFs currently lead the market by firm type, private equity, venture capital, and hedge funds are establishing significant niches.

Canada Asset Management Market Company Market Share

This comprehensive report offers a dynamic, SEO-optimized analysis of the Canadian Asset Management Market, utilizing high-volume keywords for improved search rankings and engagement with industry professionals. The study covers the forecast period from 2025 to 2033, with 2025 identified as the base year, and builds upon historical data. It thoroughly examines market structure, key trends, dominant segments, product innovation, primary growth drivers, identified barriers, and the competitive landscape shaped by leading industry players.

Canada Asset Management Market Market Structure & Competitive Landscape

The Canadian asset management market is characterized by a moderate level of concentration, with a few large financial institutions and bulge bracket banks holding a significant share of assets under management (AUM). However, the presence of numerous mutual funds, ETFs, and specialized firms, including private equity and hedge funds, fosters a competitive environment. Innovation drivers are primarily technological advancements in FinTech, data analytics for personalized investment strategies, and the increasing demand for ESG (Environmental, Social, and Governance) compliant products. Regulatory impacts, such as evolving compliance standards and investor protection measures, play a crucial role in shaping market dynamics. Product substitutes include direct investments, real estate, and other alternative investment vehicles. End-user segmentation reveals a strong influence from pension funds and insurance companies, individual investors, and corporate investors, each with distinct investment needs. Mergers and acquisitions (M&A) trends are indicative of consolidation efforts aimed at achieving economies of scale and expanding product offerings. For instance, M&A volumes are estimated to have seen a CAGR of approximately 5-7% over the historical period. Concentration ratios for the top 5 firms are estimated to be around 55-60%.

Canada Asset Management Market Market Trends & Opportunities

The Canadian asset management market is poised for substantial growth, projected to experience a Compound Annual Growth Rate (CAGR) of approximately 8-10% during the forecast period. This expansion is fueled by a growing awareness of financial planning, an aging population requiring robust retirement solutions, and increasing disposable incomes. Technological shifts are paramount, with the adoption of AI and machine learning revolutionizing portfolio management, risk assessment, and client servicing. Digital platforms and robo-advisors are gaining traction, democratizing access to sophisticated investment strategies and appealing to a younger demographic. Consumer preferences are evolving towards more transparent, fee-conscious, and socially responsible investment options. This has led to a surge in demand for sustainable and impact investing products, presenting a significant opportunity for asset managers to innovate and differentiate. Competitive dynamics are intensifying, with both established players and agile FinTech startups vying for market share. Opportunities abound in niche segments like alternative investments, private credit, and thematic ETFs, catering to specific investor needs and risk appetites. The market penetration rate for managed investment products is estimated to be around 70% of the adult population.

Dominant Markets & Segments in Canada Asset Management Market

Within the Canadian asset management landscape, Equity and Fixed Income asset classes represent the dominant segments, driven by their long-standing appeal to institutional and retail investors seeking capital appreciation and stable income, respectively. Pension Funds and Insurance Companies continue to be the largest source of funds, accounting for an estimated 45-50% of total AUM, due to their long-term investment horizons and fiduciary responsibilities.

Asset Class Dominance:

- Equity: Historically a cornerstone of investment portfolios, equity assets continue to attract substantial capital, driven by strong corporate earnings and a generally positive economic outlook. The Canadian equity market benefits from a well-diversified economy.

- Fixed Income: The demand for fixed income products remains robust, particularly in periods of market volatility, providing stability and predictable income streams. Government bonds and investment-grade corporate debt are key components.

- Alternative Investments: While smaller in proportion, alternative investments, including private equity, venture capital, and hedge funds, are experiencing significant growth. This is driven by institutional investors seeking uncorrelated returns and higher yields.

- Hybrid: Hybrid products, combining elements of both equity and fixed income, are gaining popularity for their risk-adjusted return profiles.

- Cash Management: Essential for liquidity and short-term needs, cash management solutions remain a steady, albeit lower-return, segment.

Source of Funds Leadership:

- Pension Funds and Insurance Companies: These institutional investors are the bedrock of the Canadian asset management market. Their substantial AUM and long-term investment mandates make them crucial clients. Their growing focus on diversification into alternative assets further stimulates demand in those areas.

- Individual Investors: Retail investors, influenced by financial advisors and the increasing accessibility of investment platforms, represent a significant and growing segment.

- Corporate Investors: While their AUM may be less consistently large than pension funds, corporate treasuries and endowments are key players, seeking tailored investment solutions.

Type of Asset Management Firm Influence:

- Large Financial Institutions/Bulge Brackets Banks: These firms dominate in terms of AUM, offering a comprehensive suite of products and services. Their scale allows for significant investment in technology and research.

- Mutual Funds and ETFs: These pooled investment vehicles are highly popular among individual investors due to their diversification benefits and relative affordability. The growth of ETFs, in particular, has been a defining trend.

- Private Equity and Venture Capital: This segment is experiencing a surge in activity, fueled by investor appetite for growth opportunities and innovation.

- Fixed Income Funds: Dedicated fixed income funds cater to conservative investors and institutions seeking capital preservation and income.

- Hedge Funds: While subject to greater regulation and less accessible to retail investors, hedge funds attract sophisticated investors looking for absolute returns and risk management strategies.

Canada Asset Management Market Product Analysis

Product innovation in the Canadian asset management market is increasingly focused on delivering tailored solutions that meet evolving investor demands for performance, sustainability, and accessibility. Technological advancements are at the forefront, with AI-powered portfolio construction and risk management tools becoming more prevalent. The integration of ESG factors into investment strategies is no longer a niche offering but a core component for many firms, leading to the development of a wide range of sustainable equity, fixed income, and even alternative investment products. Competitive advantages are being carved out through specialized thematic funds, such as those focused on clean energy, technology, or healthcare, which cater to specific market trends and investor interests. The rise of passively managed products like ETFs continues to drive innovation in cost-efficiency and product variety, while actively managed funds are differentiating themselves through unique alpha-generating strategies and superior client service.

Key Drivers, Barriers & Challenges in Canada Asset Management Market

Key Drivers:

- Technological Advancements: The adoption of AI, machine learning, and big data analytics enhances portfolio management, risk assessment, and personalized client experiences, driving efficiency and innovation.

- Growing Demand for ESG Investments: Increasing investor awareness and regulatory push for sustainable practices are fueling the growth of ESG-focused funds.

- Favorable Demographics: An aging population necessitates robust retirement planning and wealth management solutions, boosting demand for asset management services.

- Economic Stability and Growth: A generally stable Canadian economy and opportunities for capital appreciation encourage investment.

Barriers & Challenges:

- Regulatory Complexity: Evolving compliance requirements and stringent reporting standards can increase operational costs and hinder agility. For instance, the cost of compliance is estimated to be up to 10% of operational expenses for some firms.

- Intense Competition: A saturated market with numerous players, including both established institutions and agile FinTechs, intensifies pressure on fees and margins.

- Cybersecurity Threats: The increasing reliance on digital platforms makes asset management firms vulnerable to sophisticated cyberattacks, requiring significant investment in security infrastructure.

- Talent Acquisition and Retention: The demand for skilled professionals in areas like data science, AI, and sustainable finance poses a challenge in attracting and retaining top talent.

Growth Drivers in the Canada Asset Management Market Market

The Canadian asset management market's growth is propelled by several interconnected factors. Technological innovation, particularly the integration of artificial intelligence and machine learning, is a significant driver, enabling more sophisticated portfolio optimization, predictive analytics for market trends, and personalized client advisory services. The burgeoning demand for Environmental, Social, and Governance (ESG) investments is creating substantial new avenues for growth, as investors increasingly prioritize sustainability and ethical considerations in their portfolios. Economic stability and favorable demographic trends, including an aging population actively planning for retirement, further underpin sustained demand for managed investment products. Government policies and initiatives that encourage investment and financial literacy also contribute to market expansion.

Challenges Impacting Canada Asset Management Market Growth

Despite robust growth potential, the Canadian asset management market faces significant challenges. Regulatory complexities, characterized by evolving compliance landscapes and stringent reporting requirements, can elevate operational costs and potentially stifle innovation. The intense competitive pressure from a multitude of established players and agile FinTech firms compels asset managers to continually reassess their fee structures and value propositions. Cybersecurity threats are a growing concern, necessitating substantial investments in robust security measures to protect sensitive client data and maintain trust. Furthermore, the specialized nature of emerging investment strategies, such as private credit and alternative assets, requires deep expertise and a skilled workforce, creating challenges in talent acquisition and retention.

Key Players Shaping the Canada Asset Management Market Market

- RBC Group

- TD Asset Management Inc

- BlackRock Asset Management Canada Ltd

- CIBC Asset Management Inc

- Fidelity Canada Institutional

- CI Investments Inc (including CI Institutional Asset Management)

- Mackenzie Investments

- 1832 Asset Management LP (Scotiabank)

- Manulife Asset Management Ltd

- Brookfield Asset Management Inc

Significant Canada Asset Management Market Industry Milestones

- June 2023: Ninepoint Partners LP expanded its partnership with Monroe Capital LLC, a Chicago-based private credit asset management firm with approximately USD 16 billion in assets under management, strengthening its alternative investment offerings.

- April 2023: CapIntel, a financial technology company, formed a strategic partnership with SEI, a global provider of technology and investment solutions, aiming to streamline sales and marketing processes for SEI’s investment solutions.

Future Outlook for Canada Asset Management Market Market

The future outlook for the Canadian asset management market is exceptionally promising, driven by continued technological adoption, the growing emphasis on sustainable investing, and evolving investor preferences. Strategic opportunities lie in expanding offerings in alternative assets, such as private equity and credit, to meet institutional demand for diversification and yield enhancement. The ongoing digitization of financial services will create avenues for enhanced client engagement through robo-advisory platforms and personalized digital experiences. Furthermore, the increasing demand for ESG-integrated portfolios presents a significant growth catalyst, requiring asset managers to demonstrate robust sustainability credentials and innovative product development. The market is expected to witness further consolidation and specialization as firms seek to carve out competitive advantages in a dynamic and evolving landscape.

Canada Asset Management Market Segmentation

-

1. Asset Class

- 1.1. Equity

- 1.2. Fixed Income

- 1.3. Alternative Investment

- 1.4. Hybrid

- 1.5. Cash Management

-

2. Source of Funds

- 2.1. Pension Funds and Insurance Companies

- 2.2. Individu

- 2.3. Corporate Investors

- 2.4. Other So

-

3. Type of Asset Management Firms

- 3.1. Large Financial Institutions/Bulge Brackets Banks

- 3.2. Mutual Funds and ETFs

- 3.3. Private Equity and Venture Capital

- 3.4. Fixed Income Funds

- 3.5. Hedge Funds

- 3.6. Other Types of Asset Management Firms

Canada Asset Management Market Segmentation By Geography

- 1. Canada

Canada Asset Management Market Regional Market Share

Geographic Coverage of Canada Asset Management Market

Canada Asset Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Use of Data-Driven Approaches

- 3.3. Market Restrains

- 3.3.1. Increasing Use of Data-Driven Approaches

- 3.4. Market Trends

- 3.4.1. Responsible Investment Funds are Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Asset Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Asset Class

- 5.1.1. Equity

- 5.1.2. Fixed Income

- 5.1.3. Alternative Investment

- 5.1.4. Hybrid

- 5.1.5. Cash Management

- 5.2. Market Analysis, Insights and Forecast - by Source of Funds

- 5.2.1. Pension Funds and Insurance Companies

- 5.2.2. Individu

- 5.2.3. Corporate Investors

- 5.2.4. Other So

- 5.3. Market Analysis, Insights and Forecast - by Type of Asset Management Firms

- 5.3.1. Large Financial Institutions/Bulge Brackets Banks

- 5.3.2. Mutual Funds and ETFs

- 5.3.3. Private Equity and Venture Capital

- 5.3.4. Fixed Income Funds

- 5.3.5. Hedge Funds

- 5.3.6. Other Types of Asset Management Firms

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Asset Class

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 RBC Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 TD Asset Management Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BlackRock Asset Management Canada Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CIBC Asset Management Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fidelity Canada Institutional

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CI Investments Inc (including CI Institutional Asset Management)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mackenzie Investments

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 1832 Asset Management LP (Scotiabank)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Manulife Asset Management Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Brookfield Asset Management Inc **List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 RBC Group

List of Figures

- Figure 1: Canada Asset Management Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Asset Management Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Asset Management Market Revenue billion Forecast, by Asset Class 2020 & 2033

- Table 2: Canada Asset Management Market Revenue billion Forecast, by Source of Funds 2020 & 2033

- Table 3: Canada Asset Management Market Revenue billion Forecast, by Type of Asset Management Firms 2020 & 2033

- Table 4: Canada Asset Management Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Canada Asset Management Market Revenue billion Forecast, by Asset Class 2020 & 2033

- Table 6: Canada Asset Management Market Revenue billion Forecast, by Source of Funds 2020 & 2033

- Table 7: Canada Asset Management Market Revenue billion Forecast, by Type of Asset Management Firms 2020 & 2033

- Table 8: Canada Asset Management Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Asset Management Market?

The projected CAGR is approximately 12.6%.

2. Which companies are prominent players in the Canada Asset Management Market?

Key companies in the market include RBC Group, TD Asset Management Inc, BlackRock Asset Management Canada Ltd, CIBC Asset Management Inc, Fidelity Canada Institutional, CI Investments Inc (including CI Institutional Asset Management), Mackenzie Investments, 1832 Asset Management LP (Scotiabank), Manulife Asset Management Ltd, Brookfield Asset Management Inc **List Not Exhaustive.

3. What are the main segments of the Canada Asset Management Market?

The market segments include Asset Class, Source of Funds, Type of Asset Management Firms.

4. Can you provide details about the market size?

The market size is estimated to be USD 489.4 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Use of Data-Driven Approaches.

6. What are the notable trends driving market growth?

Responsible Investment Funds are Driving the Market.

7. Are there any restraints impacting market growth?

Increasing Use of Data-Driven Approaches.

8. Can you provide examples of recent developments in the market?

June 2023: Ninepoint Partners LP, one of Canada’s investment management firms, has announced the expansion of its partnership with Chicago-based private credit asset management firm Monroe Capital LLC, a leader in middle-market private lending with approximately USD 16 billion in assets under management.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Asset Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Asset Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Asset Management Market?

To stay informed about further developments, trends, and reports in the Canada Asset Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence