Key Insights

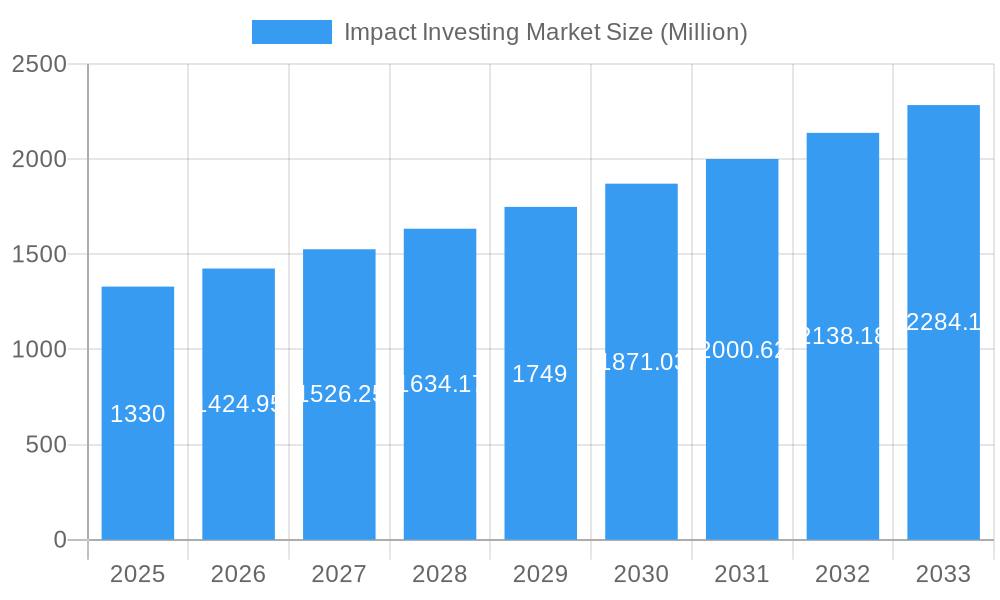

The global Impact Investing Market is poised for substantial expansion, projected to reach approximately USD 1.33 billion in 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.17% anticipated throughout the forecast period of 2025-2033. This growth is fueled by an increasing awareness and demand for investments that generate both financial returns and positive social or environmental impact. Key drivers include the growing recognition of climate change and its associated risks, the urgent need for sustainable development solutions, and a rising tide of corporate social responsibility initiatives. Investors, from institutional giants like BlackRock and Goldman Sachs to individual investors seeking purpose-driven portfolios, are actively allocating capital towards sectors addressing critical global challenges. The market's dynamism is further underscored by emerging trends such as the integration of Environmental, Social, and Governance (ESG) factors into mainstream investment strategies and the development of innovative financial instruments tailored for impact.

Impact Investing Market Market Size (In Billion)

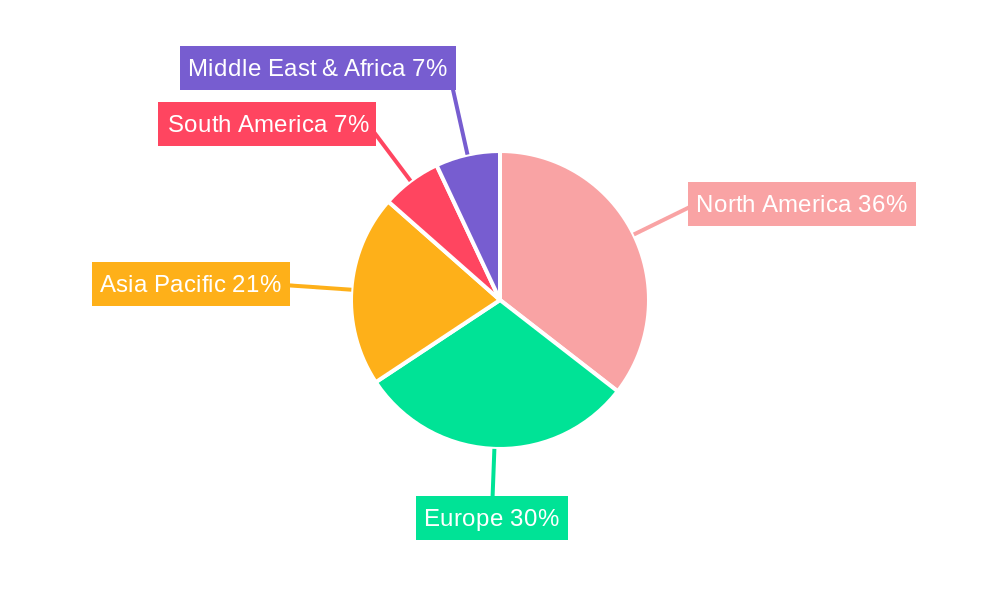

While the market exhibits strong growth potential, certain restraints warrant attention. These may include the need for standardized impact measurement and reporting frameworks, potential liquidity challenges in certain impact investment sectors, and the perceived higher risk associated with some early-stage impact ventures. However, the expanding universe of dedicated impact funds and the increasing sophistication of impact assessment tools are actively mitigating these challenges. The market is segmented by investor type, with both Institutional Investors and Individual Investors playing crucial roles, and by end-user sectors that highlight the diverse applications of impact investing, including Education, Agriculture, Healthcare, and Climate Tech. Geographically, North America and Europe are expected to lead market share, driven by established regulatory frameworks and a mature investor base, though significant growth is anticipated across all regions, including the dynamic Asia Pacific market.

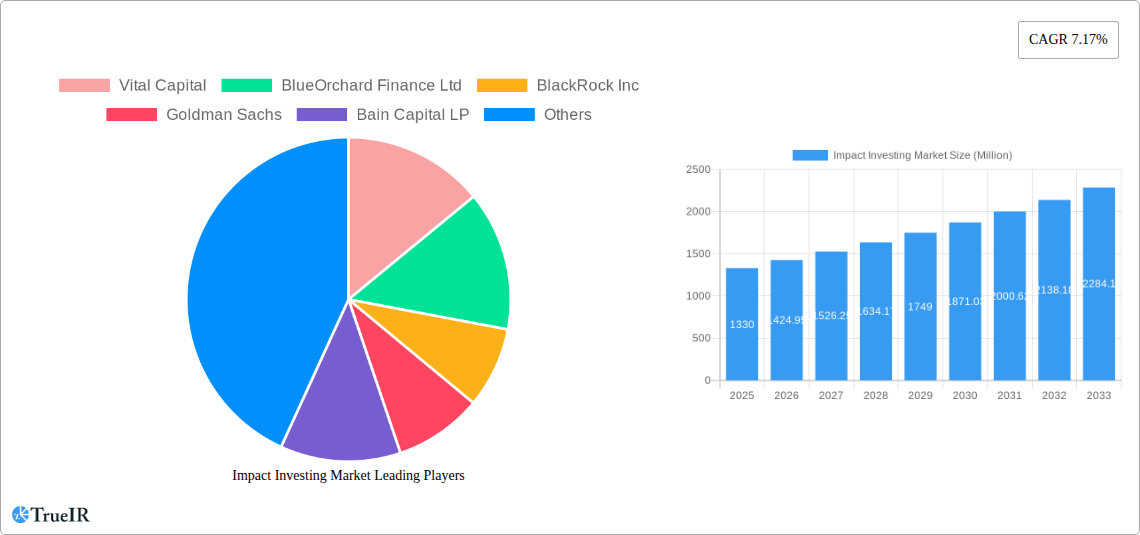

Impact Investing Market Company Market Share

Impact Investing Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report offers a dynamic and SEO-optimized analysis of the global Impact Investing Market, crucial for understanding its evolution and future trajectory. Leveraging high-volume keywords and a structured format, this report provides actionable insights for institutional investors, individual investors, and stakeholders across key end-user segments like Education, Agriculture, Healthcare, and Climate Tech. The study period spans from 2019 to 2033, with a base and estimated year of 2025, and a comprehensive forecast period from 2025 to 2033. Historical data from 2019 to 2024 is thoroughly examined.

Impact Investing Market Market Structure & Competitive Landscape

The Impact Investing Market is characterized by a dynamic and evolving structure, marked by increasing institutional adoption and a growing emphasis on measurable social and environmental outcomes alongside financial returns. Market concentration is moderately high, with a few dominant players influencing strategic direction, yet a significant number of niche and specialized firms contribute to innovation. Key innovation drivers include the demand for scalable solutions to global challenges, advancements in impact measurement methodologies, and the development of novel financial instruments tailored for impact. Regulatory impacts are becoming more pronounced, with governments worldwide introducing policies and frameworks to incentivize and standardize impact investing, thereby fostering greater investor confidence and market integrity. While direct product substitutes offering similar risk-return profiles with guaranteed impact are limited, the broader sustainable and ESG investing landscape presents a degree of competitive overlap. End-user segmentation highlights a growing diversification beyond traditional sectors, with significant expansion into Climate Tech, affordable housing, and gender lens investing. Mergers and acquisitions (M&A) trends are on the rise as larger financial institutions seek to integrate impact capabilities and specialized firms aim for scale. For instance, the January 2024 agreement for BlackRock Inc. to acquire Global Infrastructure Partners (GIP) for USD 3 billion and 12 million shares signifies a major consolidation move, enhancing BlackRock's infrastructure and impact investment capabilities. Similarly, BlackRock's August 2023 acquisition of Kreos Capital further solidified its position in venture debt financing for impactful technology and healthcare ventures. These M&A activities underscore a strategic imperative for growth and expanded market reach within the impact investing ecosystem.

Impact Investing Market Market Trends & Opportunities

The Impact Investing Market is poised for substantial growth, driven by a confluence of powerful trends and emerging opportunities. The market size is projected to expand significantly, with a compound annual growth rate (CAGR) expected to exceed 10% over the forecast period. This growth is fueled by increasing investor awareness of pressing global issues and a desire to align capital with positive societal and environmental impact. Technological shifts are playing a crucial role, enabling more sophisticated impact measurement and management (IMM) systems, thereby enhancing transparency and accountability. Innovations in areas like AI-driven impact analytics, blockchain for supply chain traceability, and digital platforms for impact fund distribution are democratizing access and improving efficiency. Consumer preferences are also evolving, with a growing segment of millennials and Gen Z actively seeking investments that reflect their values, driving demand for impact-focused products and services. This demographic shift represents a significant opportunity for financial institutions to cater to a new generation of socially conscious investors.

The competitive landscape within the Impact Investing Market is intensifying. While established financial giants like BlackRock Inc., Goldman Sachs, and Morgan Stanley are increasingly active, a vibrant ecosystem of specialized impact funds and asset managers continues to thrive. These specialized players often possess deep sector expertise and strong relationships with impact enterprises. Opportunities abound in developing innovative financial instruments, such as blended finance structures, green bonds, and social impact bonds, to mobilize greater capital towards impact objectives. The increasing focus on achieving the United Nations Sustainable Development Goals (SDGs) provides a clear framework and a vast opportunity pipeline for impact investors. Furthermore, the growing demand for impact investing in emerging markets, where pressing development needs are most acute, presents significant expansion potential. The integration of impact considerations into mainstream investment strategies is a meta-trend creating broader market penetration and creating a more sustainable and equitable global economy.

Dominant Markets & Segments in Impact Investing Market

The Impact Investing Market exhibits significant dominance in several regions and segments, driven by specific economic, policy, and social factors. North America and Europe currently lead in terms of capital deployment and market maturity, owing to well-established regulatory frameworks, a high concentration of institutional investors, and a robust pipeline of impact-focused enterprises. The United States, in particular, stands out as a dominant market, benefiting from a deep pool of capital and a strong culture of philanthropic and impact-driven innovation.

Within the Type segmentation, Institutional Investors represent the largest and most influential segment. This includes pension funds, endowments, foundations, and large asset managers who are increasingly incorporating impact mandates into their investment strategies. Their substantial capital allocation capacity, long-term investment horizons, and growing fiduciary duty to consider ESG and impact factors make them pivotal to market growth. Individual Investors, while representing a smaller portion of the total capital, are a rapidly growing segment. This growth is driven by a rising awareness of social and environmental issues, a desire for values-aligned investing, and the availability of more accessible impact investment products.

In terms of End User segmentation, Healthcare and Climate Tech are emerging as dominant and rapidly expanding sectors. The urgent need for accessible and affordable healthcare solutions globally, coupled with the accelerating transition to a low-carbon economy, has propelled these sectors to the forefront of impact investing. Investments in renewable energy, sustainable agriculture, clean transportation, and climate adaptation technologies are attracting significant capital. Agriculture also remains a critical focus area, with investments aimed at enhancing food security, promoting sustainable farming practices, and supporting rural development. Education continues to be an important segment, with investments focused on improving access to quality education, developing innovative learning technologies, and addressing educational disparities.

Key growth drivers in these dominant segments include government incentives and policy support, such as tax credits for renewable energy projects or subsidies for sustainable agriculture. The increasing availability of impact data and performance metrics is building investor confidence and attracting more capital. Furthermore, the demonstrable financial returns achieved by many impact investments are dispelling the myth that impact and profit are mutually exclusive, further encouraging broader adoption.

Impact Investing Market Product Analysis

The Impact Investing Market is characterized by a diverse array of innovative products and strategies designed to generate measurable social and environmental impact alongside financial returns. These innovations are continuously evolving to meet the demands of various investor types and address pressing global challenges. Key product developments include the rise of thematic funds focused on specific impact areas such as renewable energy, affordable housing, or gender equality. Blended finance structures, combining philanthropic capital with commercial investment, are becoming increasingly sophisticated, enabling greater leverage of private capital for development initiatives. Furthermore, the integration of impact measurement and management (IMM) tools directly into fund design and reporting enhances transparency and accountability, offering investors greater assurance of the impact achieved. Competitive advantages are increasingly derived from a deep understanding of specific impact sectors, robust due diligence processes that assess both financial and impact risks, and the ability to structure complex deals that mobilize diverse pools of capital.

Key Drivers, Barriers & Challenges in Impact Investing Market

Key Drivers:

The Impact Investing Market is propelled by several interconnected forces. Technologically, advancements in data analytics and impact measurement technologies enable more robust tracking and reporting of social and environmental outcomes. Economically, the growing realization that sustainable business practices can lead to long-term financial outperformance and reduced risk is a significant driver. Policy-driven factors, such as government incentives for green investments and commitments to the UN Sustainable Development Goals, are crucial in creating an enabling environment. For example, the European Union's Taxonomy for Sustainable Activities provides a clear framework for identifying environmentally sustainable economic activities, thereby guiding capital flows.

Barriers & Challenges:

Despite its growth, the Impact Investing Market faces significant challenges. Regulatory hurdles and a lack of standardized impact reporting frameworks can create complexity and investor hesitancy. Supply chain issues within nascent impact sectors can lead to project delays and increased costs. Competitive pressures from traditional investment vehicles, which may offer higher short-term returns without the impact mandate, remain a factor. Quantifiably, the perceived or actual higher upfront costs of certain impact projects or the longer time horizons required for impact realization can deter some investors. A lack of deep expertise in specific impact sectors can also act as a barrier to entry for mainstream investors.

Growth Drivers in the Impact Investing Market Market

The Impact Investing Market is experiencing robust growth driven by a confluence of factors. Technological advancements in impact measurement and data analytics are enhancing transparency and accountability, making impact investments more attractive. Economic shifts, including the increasing recognition of ESG (Environmental, Social, and Governance) factors in risk management and long-term value creation, are steering capital towards impact-oriented strategies. Regulatory catalysts, such as government mandates for sustainable finance and carbon pricing mechanisms, are creating a more favorable investment landscape. For instance, the implementation of stricter environmental regulations incentivizes investments in clean technologies. The growing demand for sustainable solutions to global challenges like climate change and social inequality further fuels this growth.

Challenges Impacting Impact Investing Market Growth

Despite its positive trajectory, the Impact Investing Market grapples with several barriers. Regulatory complexities and the absence of universal impact measurement standards can lead to investor confusion and due diligence challenges. Supply chain issues, particularly in emerging impact sectors, can cause project delays and cost overruns. Competitive pressures from traditional investment avenues that may offer perceived higher short-term returns without impact considerations remain a constant challenge. Quantifiably, the perceived or actual longer gestation periods for impact realization and the potential for higher initial investment costs in some impact ventures can deter risk-averse investors. Furthermore, a lack of standardized data and the difficulty in directly attributing specific impact outcomes can pose reporting challenges.

Key Players Shaping the Impact Investing Market Market

- Vital Capital

- BlueOrchard Finance Ltd

- BlackRock Inc

- Goldman Sachs

- Bain Capital LP

- Morgan Stanley

- Prudential Financial Inc

- Manulife Investment Management Holdings (Canada) Inc

- Leapfrog Investments

- Community Investment Management LLC

Significant Impact Investing Market Industry Milestones

- January 2024: BlackRock Inc. and Global Infrastructure Partners (GIP) jointly announced an agreement for BlackRock to acquire GIP for USD 3 billion in cash and approximately 12 million shares of BlackRock's common stock, significantly enhancing BlackRock's global infrastructure and impact investment capabilities.

- January 2024: Staley Point Capital and Bain Capital Real Estate concluded the sale of a 91,000 sq ft industrial asset for USD 38.4 million, demonstrating sustained demand for premium warehouse spaces in strategic infill locations and highlighting the role of impact in real estate development.

- August 2023: BlackRock Inc. finalized the acquisition of Kreos Capital, a London-based firm specializing in growth and venture debt financing for technology and healthcare companies, further bolstering BlackRock's position as a global credit asset manager with an impact focus.

Future Outlook for Impact Investing Market Market

The future outlook for the Impact Investing Market is exceptionally bright, characterized by sustained growth and increasing integration into mainstream finance. Key growth catalysts include the accelerating global imperative to address climate change and social inequality, which will continue to drive demand for impact-focused capital. Strategic opportunities lie in the development of more sophisticated impact measurement and management tools, further enhancing transparency and investor confidence. The expansion of impact investing into new geographies and asset classes, particularly in emerging markets and alternative investments, holds significant potential. As regulatory frameworks mature and investor education advances, the market is expected to attract an even broader base of institutional and individual investors, propelling the industry towards achieving both financial returns and profound, positive societal and environmental change.

Impact Investing Market Segmentation

-

1. Type

- 1.1. Institutional Investors

- 1.2. Individual Investors

-

2. End User

- 2.1. Education

- 2.2. Agriculture

- 2.3. Healthcare

- 2.4. Climate Tech

Impact Investing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Impact Investing Market Regional Market Share

Geographic Coverage of Impact Investing Market

Impact Investing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness of Environmental and Social Issues is Fueling the Desire for Impact Investment; Rising Interest from Traditional Not-for-Profit Fund Managers

- 3.3. Market Restrains

- 3.3.1. Growing Awareness of Environmental and Social Issues is Fueling the Desire for Impact Investment; Rising Interest from Traditional Not-for-Profit Fund Managers

- 3.4. Market Trends

- 3.4.1. Rising Investments from Institutional Investors

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Impact Investing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Institutional Investors

- 5.1.2. Individual Investors

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Education

- 5.2.2. Agriculture

- 5.2.3. Healthcare

- 5.2.4. Climate Tech

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Impact Investing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Institutional Investors

- 6.1.2. Individual Investors

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Education

- 6.2.2. Agriculture

- 6.2.3. Healthcare

- 6.2.4. Climate Tech

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Impact Investing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Institutional Investors

- 7.1.2. Individual Investors

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Education

- 7.2.2. Agriculture

- 7.2.3. Healthcare

- 7.2.4. Climate Tech

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Impact Investing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Institutional Investors

- 8.1.2. Individual Investors

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Education

- 8.2.2. Agriculture

- 8.2.3. Healthcare

- 8.2.4. Climate Tech

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Impact Investing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Institutional Investors

- 9.1.2. Individual Investors

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Education

- 9.2.2. Agriculture

- 9.2.3. Healthcare

- 9.2.4. Climate Tech

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Impact Investing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Institutional Investors

- 10.1.2. Individual Investors

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Education

- 10.2.2. Agriculture

- 10.2.3. Healthcare

- 10.2.4. Climate Tech

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Vital Capital

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BlueOrchard Finance Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BlackRock Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Goldman Sachs

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bain Capital LP

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Morgan Stanley

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Prudential Financial Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Manulife Investment Management Holdings (Canada) Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Leapfrog Investments

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Community Investment Management LLC**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Vital Capital

List of Figures

- Figure 1: Global Impact Investing Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Impact Investing Market Volume Breakdown (Trillion, %) by Region 2025 & 2033

- Figure 3: North America Impact Investing Market Revenue (Million), by Type 2025 & 2033

- Figure 4: North America Impact Investing Market Volume (Trillion), by Type 2025 & 2033

- Figure 5: North America Impact Investing Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Impact Investing Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Impact Investing Market Revenue (Million), by End User 2025 & 2033

- Figure 8: North America Impact Investing Market Volume (Trillion), by End User 2025 & 2033

- Figure 9: North America Impact Investing Market Revenue Share (%), by End User 2025 & 2033

- Figure 10: North America Impact Investing Market Volume Share (%), by End User 2025 & 2033

- Figure 11: North America Impact Investing Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Impact Investing Market Volume (Trillion), by Country 2025 & 2033

- Figure 13: North America Impact Investing Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Impact Investing Market Volume Share (%), by Country 2025 & 2033

- Figure 15: South America Impact Investing Market Revenue (Million), by Type 2025 & 2033

- Figure 16: South America Impact Investing Market Volume (Trillion), by Type 2025 & 2033

- Figure 17: South America Impact Investing Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: South America Impact Investing Market Volume Share (%), by Type 2025 & 2033

- Figure 19: South America Impact Investing Market Revenue (Million), by End User 2025 & 2033

- Figure 20: South America Impact Investing Market Volume (Trillion), by End User 2025 & 2033

- Figure 21: South America Impact Investing Market Revenue Share (%), by End User 2025 & 2033

- Figure 22: South America Impact Investing Market Volume Share (%), by End User 2025 & 2033

- Figure 23: South America Impact Investing Market Revenue (Million), by Country 2025 & 2033

- Figure 24: South America Impact Investing Market Volume (Trillion), by Country 2025 & 2033

- Figure 25: South America Impact Investing Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Impact Investing Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Impact Investing Market Revenue (Million), by Type 2025 & 2033

- Figure 28: Europe Impact Investing Market Volume (Trillion), by Type 2025 & 2033

- Figure 29: Europe Impact Investing Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Europe Impact Investing Market Volume Share (%), by Type 2025 & 2033

- Figure 31: Europe Impact Investing Market Revenue (Million), by End User 2025 & 2033

- Figure 32: Europe Impact Investing Market Volume (Trillion), by End User 2025 & 2033

- Figure 33: Europe Impact Investing Market Revenue Share (%), by End User 2025 & 2033

- Figure 34: Europe Impact Investing Market Volume Share (%), by End User 2025 & 2033

- Figure 35: Europe Impact Investing Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe Impact Investing Market Volume (Trillion), by Country 2025 & 2033

- Figure 37: Europe Impact Investing Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Impact Investing Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa Impact Investing Market Revenue (Million), by Type 2025 & 2033

- Figure 40: Middle East & Africa Impact Investing Market Volume (Trillion), by Type 2025 & 2033

- Figure 41: Middle East & Africa Impact Investing Market Revenue Share (%), by Type 2025 & 2033

- Figure 42: Middle East & Africa Impact Investing Market Volume Share (%), by Type 2025 & 2033

- Figure 43: Middle East & Africa Impact Investing Market Revenue (Million), by End User 2025 & 2033

- Figure 44: Middle East & Africa Impact Investing Market Volume (Trillion), by End User 2025 & 2033

- Figure 45: Middle East & Africa Impact Investing Market Revenue Share (%), by End User 2025 & 2033

- Figure 46: Middle East & Africa Impact Investing Market Volume Share (%), by End User 2025 & 2033

- Figure 47: Middle East & Africa Impact Investing Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East & Africa Impact Investing Market Volume (Trillion), by Country 2025 & 2033

- Figure 49: Middle East & Africa Impact Investing Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Impact Investing Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Impact Investing Market Revenue (Million), by Type 2025 & 2033

- Figure 52: Asia Pacific Impact Investing Market Volume (Trillion), by Type 2025 & 2033

- Figure 53: Asia Pacific Impact Investing Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Asia Pacific Impact Investing Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Asia Pacific Impact Investing Market Revenue (Million), by End User 2025 & 2033

- Figure 56: Asia Pacific Impact Investing Market Volume (Trillion), by End User 2025 & 2033

- Figure 57: Asia Pacific Impact Investing Market Revenue Share (%), by End User 2025 & 2033

- Figure 58: Asia Pacific Impact Investing Market Volume Share (%), by End User 2025 & 2033

- Figure 59: Asia Pacific Impact Investing Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Asia Pacific Impact Investing Market Volume (Trillion), by Country 2025 & 2033

- Figure 61: Asia Pacific Impact Investing Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Impact Investing Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Impact Investing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Impact Investing Market Volume Trillion Forecast, by Type 2020 & 2033

- Table 3: Global Impact Investing Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Impact Investing Market Volume Trillion Forecast, by End User 2020 & 2033

- Table 5: Global Impact Investing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Impact Investing Market Volume Trillion Forecast, by Region 2020 & 2033

- Table 7: Global Impact Investing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Impact Investing Market Volume Trillion Forecast, by Type 2020 & 2033

- Table 9: Global Impact Investing Market Revenue Million Forecast, by End User 2020 & 2033

- Table 10: Global Impact Investing Market Volume Trillion Forecast, by End User 2020 & 2033

- Table 11: Global Impact Investing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Impact Investing Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 13: United States Impact Investing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Impact Investing Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 15: Canada Impact Investing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Impact Investing Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 17: Mexico Impact Investing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Impact Investing Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 19: Global Impact Investing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Impact Investing Market Volume Trillion Forecast, by Type 2020 & 2033

- Table 21: Global Impact Investing Market Revenue Million Forecast, by End User 2020 & 2033

- Table 22: Global Impact Investing Market Volume Trillion Forecast, by End User 2020 & 2033

- Table 23: Global Impact Investing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Impact Investing Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 25: Brazil Impact Investing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Brazil Impact Investing Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 27: Argentina Impact Investing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina Impact Investing Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Impact Investing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Impact Investing Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 31: Global Impact Investing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Impact Investing Market Volume Trillion Forecast, by Type 2020 & 2033

- Table 33: Global Impact Investing Market Revenue Million Forecast, by End User 2020 & 2033

- Table 34: Global Impact Investing Market Volume Trillion Forecast, by End User 2020 & 2033

- Table 35: Global Impact Investing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Impact Investing Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 37: United Kingdom Impact Investing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom Impact Investing Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 39: Germany Impact Investing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Germany Impact Investing Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 41: France Impact Investing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: France Impact Investing Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 43: Italy Impact Investing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Italy Impact Investing Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 45: Spain Impact Investing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Spain Impact Investing Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 47: Russia Impact Investing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Russia Impact Investing Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 49: Benelux Impact Investing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Benelux Impact Investing Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 51: Nordics Impact Investing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Nordics Impact Investing Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe Impact Investing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe Impact Investing Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 55: Global Impact Investing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 56: Global Impact Investing Market Volume Trillion Forecast, by Type 2020 & 2033

- Table 57: Global Impact Investing Market Revenue Million Forecast, by End User 2020 & 2033

- Table 58: Global Impact Investing Market Volume Trillion Forecast, by End User 2020 & 2033

- Table 59: Global Impact Investing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Impact Investing Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 61: Turkey Impact Investing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Turkey Impact Investing Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 63: Israel Impact Investing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Israel Impact Investing Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 65: GCC Impact Investing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: GCC Impact Investing Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 67: North Africa Impact Investing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: North Africa Impact Investing Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 69: South Africa Impact Investing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: South Africa Impact Investing Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa Impact Investing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa Impact Investing Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 73: Global Impact Investing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 74: Global Impact Investing Market Volume Trillion Forecast, by Type 2020 & 2033

- Table 75: Global Impact Investing Market Revenue Million Forecast, by End User 2020 & 2033

- Table 76: Global Impact Investing Market Volume Trillion Forecast, by End User 2020 & 2033

- Table 77: Global Impact Investing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 78: Global Impact Investing Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 79: China Impact Investing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: China Impact Investing Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 81: India Impact Investing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: India Impact Investing Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 83: Japan Impact Investing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Japan Impact Investing Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 85: South Korea Impact Investing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: South Korea Impact Investing Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 87: ASEAN Impact Investing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: ASEAN Impact Investing Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 89: Oceania Impact Investing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Oceania Impact Investing Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific Impact Investing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific Impact Investing Market Volume (Trillion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Impact Investing Market?

The projected CAGR is approximately 7.17%.

2. Which companies are prominent players in the Impact Investing Market?

Key companies in the market include Vital Capital, BlueOrchard Finance Ltd, BlackRock Inc, Goldman Sachs, Bain Capital LP, Morgan Stanley, Prudential Financial Inc, Manulife Investment Management Holdings (Canada) Inc, Leapfrog Investments, Community Investment Management LLC**List Not Exhaustive.

3. What are the main segments of the Impact Investing Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.33 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness of Environmental and Social Issues is Fueling the Desire for Impact Investment; Rising Interest from Traditional Not-for-Profit Fund Managers.

6. What are the notable trends driving market growth?

Rising Investments from Institutional Investors.

7. Are there any restraints impacting market growth?

Growing Awareness of Environmental and Social Issues is Fueling the Desire for Impact Investment; Rising Interest from Traditional Not-for-Profit Fund Managers.

8. Can you provide examples of recent developments in the market?

January 2024: BlackRock Inc. and Global Infrastructure Partners (GIP), a prominent independent manager of infrastructure funds, jointly announced an agreement. As per this agreement, BlackRock would acquire GIP for a total value of USD 3 billion in cash and roughly 12 million shares of BlackRock's common stock.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Impact Investing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Impact Investing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Impact Investing Market?

To stay informed about further developments, trends, and reports in the Impact Investing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence