Key Insights

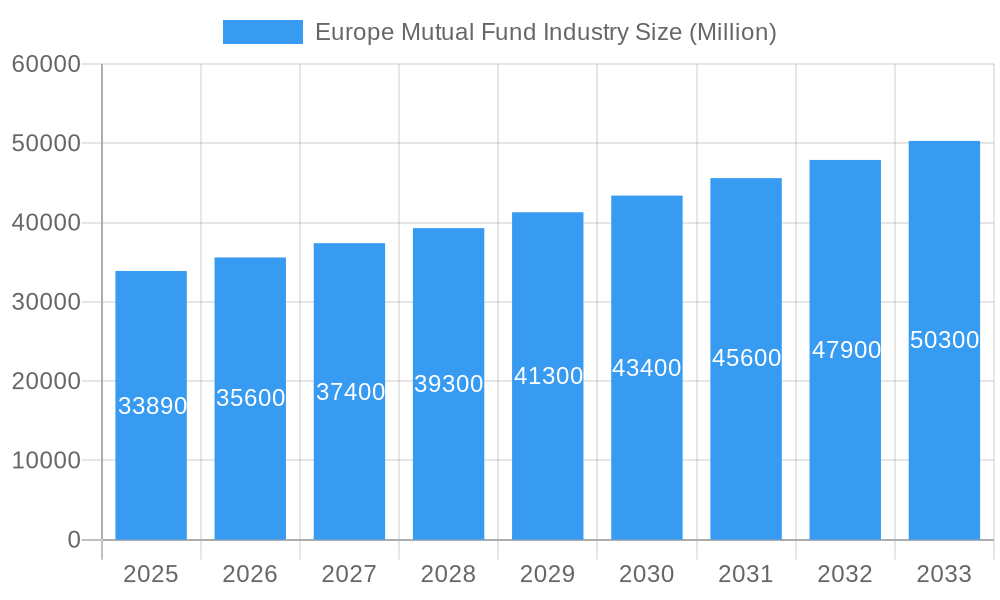

The European mutual fund industry is poised for substantial growth, with a current market size estimated at €33.89 billion. Projections indicate a Compound Annual Growth Rate (CAGR) exceeding 5.00% between 2025 and 2033, signaling a robust expansion trajectory for this vital sector. This growth is underpinned by a confluence of favorable market drivers. Increasing investor confidence, a desire for diversified investment portfolios, and the sustained need for wealth management solutions among both retail and institutional investors are key contributors. Furthermore, regulatory advancements aimed at enhancing investor protection and promoting transparency are likely to foster greater market participation. The industry's ability to adapt to evolving investor preferences, such as a growing demand for sustainable and ESG (Environmental, Social, and Governance) focused funds, will also be instrumental in driving this expansion. The proliferation of digital platforms and the ease of access to investment products are further democratizing investment, bringing more households into the mutual fund market.

Europe Mutual Fund Industry Market Size (In Billion)

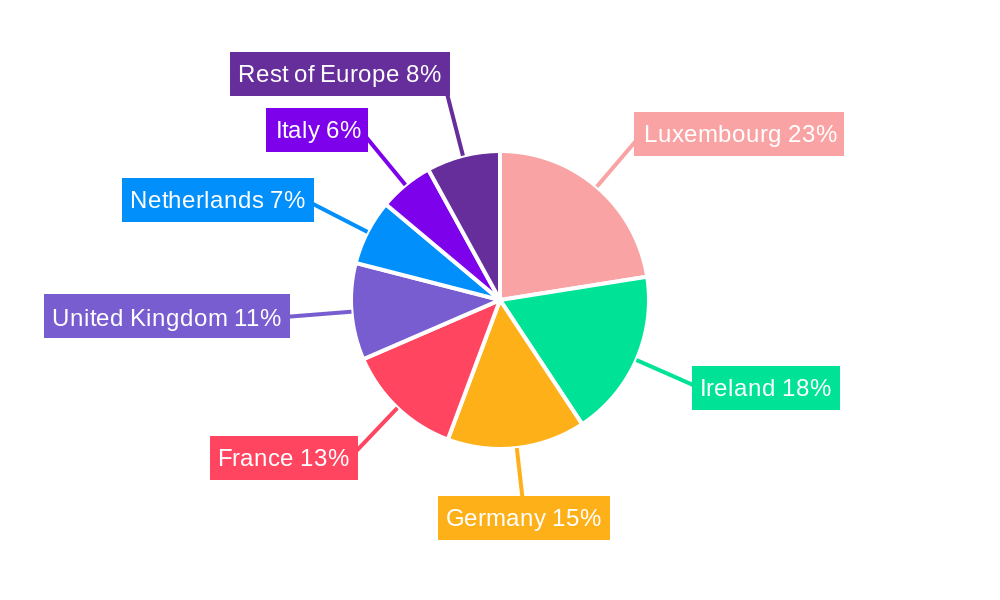

The market's dynamism is further characterized by a diverse segmentation across fund types and investor profiles. Equity, Debt, and Multi-Asset funds are expected to remain dominant categories, catering to varied risk appetites and investment objectives. Money market funds will continue to serve as a stable, liquidity-focused option. On the investor side, Households represent a significant and growing segment, driven by rising disposable incomes and a greater emphasis on long-term financial planning. Monetary Financial Institutions, Insurers & Pension Funds, and Non-Financial Corporations are also substantial contributors, leveraging mutual funds for asset management and strategic financial objectives. Geographically, Luxembourg, Ireland, Germany, France, and the United Kingdom are anticipated to lead the market, benefiting from established financial infrastructures, favorable regulatory environments, and a deep pool of investment expertise. The ongoing trend of consolidation and strategic partnerships among major asset management firms like BlackRock, Amundi, and JP Morgan will shape the competitive landscape, driving innovation and efficiency across the European mutual fund ecosystem.

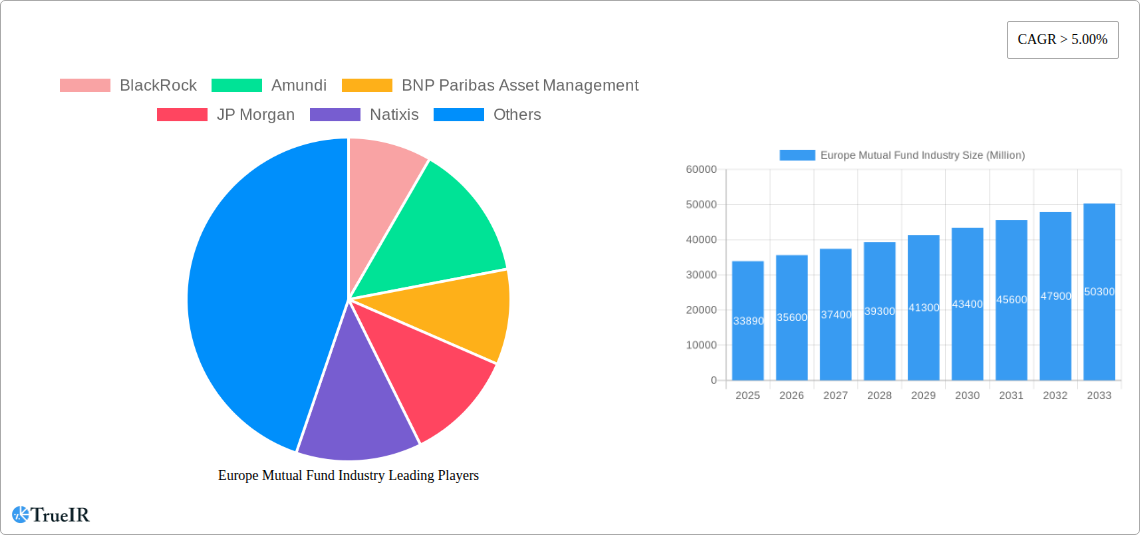

Europe Mutual Fund Industry Company Market Share

Here is the SEO-optimized report description for the Europe Mutual Fund Industry, designed for immediate use without modification:

Europe Mutual Fund Industry: Market Analysis, Trends, and Future Outlook 2025-2033

This comprehensive report delves into the dynamic landscape of the Europe Mutual Fund Industry, providing an in-depth analysis of market structure, competitive strategies, prevailing trends, and future opportunities. Leveraging high-volume keywords such as "European mutual funds," "asset management Europe," "investment funds Europe," and "fund industry growth," this report is meticulously crafted to enhance search engine rankings and captivate industry professionals, investors, and decision-makers. Our analysis spans the historical period of 2019–2024 and forecasts market evolution through 2033, with a base year of 2025. We quantify market dynamics with values presented in millions where applicable, utilizing xx for any unavailable data.

Europe Mutual Fund Industry Market Structure & Competitive Landscape

The European mutual fund industry is characterized by a highly concentrated market, with a few dominant players managing a significant portion of assets. BlackRock and Amundi consistently lead in assets under management (AUM), underscoring the importance of scale and global reach. Innovation drivers are primarily focused on technology adoption, such as AI-powered portfolio management and enhanced digital client experiences, alongside the growing demand for sustainable and ESG-integrated investment products. Regulatory frameworks, including UCITS and MiFID II, continue to shape market practices, influencing product development and distribution strategies. Product substitutes, like exchange-traded funds (ETFs) and alternative investment vehicles, present ongoing competition, pushing mutual fund providers to differentiate through specialized strategies and superior performance. End-user segmentation reveals a significant reliance on Households and Insurers & Pension Funds as key investor bases. Merger and acquisition (M&A) activity remains a strategic tool for consolidation and market expansion. For instance, the recent acquisition activities by major players signal a trend towards inorganic growth and capabilities enhancement. Key companies like BNP Paribas Asset Management, JP Morgan, and AXA actively engage in M&A to strengthen their market positions. The competitive landscape is fiercely contested, with significant investments in technology and client service to maintain and grow market share.

Europe Mutual Fund Industry Market Trends & Opportunities

The European mutual fund industry is poised for substantial growth, driven by evolving investor preferences and macroeconomic shifts. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.7% from 2025 to 2033, reaching an estimated value exceeding 20 Million Euros by the end of the forecast period. Technological advancements are a significant trend, with a rising adoption of AI and big data analytics for personalized investment solutions and enhanced risk management. The demand for Sustainable Investment Funds and ESG-compliant products continues to surge, representing a major opportunity for asset managers to cater to ethically conscious investors. Consumer preferences are shifting towards greater transparency, digital accessibility, and a focus on long-term wealth preservation and growth. Competitive dynamics are intensifying, with established players facing increasing pressure from agile fintech firms and the continued rise of passive investment vehicles. The trend towards active ownership and engagement with investee companies is also gaining traction, reflecting a more sophisticated investor base. Opportunities lie in developing innovative product offerings, expanding digital distribution channels, and leveraging data analytics to better understand and serve investor needs across various demographics and investment goals. The increasing regulatory focus on investor protection and sustainable finance also presents a fertile ground for specialized fund offerings.

Dominant Markets & Segments in Europe Mutual Fund Industry

The Equity fund segment consistently dominates the European mutual fund market, driven by investor appetite for capital appreciation and the availability of diverse investment strategies across geographies and sectors. However, Debt funds are experiencing robust growth, particularly in periods of economic uncertainty, offering stability and income generation. Multi-Asset funds are gaining traction as investors seek simplified diversification and risk management solutions in a complex market environment.

Leading Segments by Fund Type:

- Equity Funds: Remain the largest segment due to long-term growth objectives and a wide array of thematic and regional investment options.

- Debt Funds: Show strong performance, particularly government and corporate bonds, appealing to risk-averse investors and those seeking regular income.

- Multi-Asset Funds: Growing popularity stems from their ability to provide diversified portfolios and manage risk effectively, appealing to a broad investor base.

- Money Market Funds: Offer liquidity and capital preservation, essential for short-term investment needs.

Dominant Investor Types:

- Households: Represent a significant portion of mutual fund investment, driven by retirement planning, savings goals, and wealth accumulation.

- Insurers & Pension Funds: These institutional investors are crucial, allocating substantial capital to mutual funds for long-term liabilities and investment mandates.

- Monetary Financial Institutions: Active participants, utilizing mutual funds for liquidity management and investment portfolios.

Geographically, Germany, France, and the United Kingdom are the leading markets within Europe, characterized by mature financial sectors, significant institutional and retail investor bases, and a well-developed regulatory framework. The growth of infrastructure investment and supportive government policies in key European nations further bolster the mutual fund industry.

Europe Mutual Fund Industry Product Analysis

The European mutual fund industry is witnessing a significant influx of product innovations aimed at meeting evolving investor demands. Key advancements include the proliferation of Sustainable and ESG-focused funds, offering investors the ability to align their portfolios with environmental, social, and governance principles. Technological integration has led to the development of AI-driven thematic funds and robo-advisor accessible mutual fund portfolios, enhancing personalization and efficiency. Competitive advantages are increasingly derived from specialized investment strategies, robust risk management frameworks, and transparent fee structures. The focus on digital platforms and user-friendly interfaces is also a critical factor in attracting and retaining investors in a crowded marketplace.

Key Drivers, Barriers & Challenges in Europe Mutual Fund Industry

The European mutual fund industry is propelled by several key drivers. Technological advancements, such as AI and big data, are enhancing operational efficiency and product personalization. Economic growth and rising disposable incomes across Europe encourage greater investment. Furthermore, favorable regulatory environments that promote investor protection and market transparency, like the UCITS framework, are crucial. The increasing demand for sustainable investments is a significant growth catalyst.

Conversely, several barriers and challenges impede market growth. Regulatory complexities and evolving compliance requirements add significant operational costs and can slow product development. Intense competition from ETFs and other investment vehicles exerts pressure on fees and market share. Market volatility and macroeconomic uncertainties can deter risk-averse investors. Supply chain issues are less pronounced for fund management itself, but indirect impacts can arise from technology vendor disruptions. The estimated impact of these challenges on market growth is a reduction of xx% in potential gains.

Growth Drivers in the Europe Mutual Fund Industry Market

Key growth drivers for the Europe Mutual Fund Industry include the sustained demand for long-term investment solutions driven by an aging population and retirement planning needs. Technological innovation, particularly the integration of AI and blockchain, is streamlining operations and creating personalized investment experiences. Favorable economic conditions, such as low-interest rates and moderate inflation in certain regions, encourage a shift from savings to investment. Regulatory support for Sustainable and ESG investing is a significant catalyst, attracting substantial capital flows into environmentally and socially responsible funds. Furthermore, increasing financial literacy and the growing adoption of digital platforms for investment access are expanding the investor base.

Challenges Impacting Europe Mutual Fund Industry Growth

Significant challenges impacting the Europe Mutual Fund Industry include the increasing burden of regulatory compliance, which demands substantial investment in technology and skilled personnel. The fierce competition from passive investment vehicles like ETFs continues to erode market share and put pressure on management fees. Market volatility and geopolitical uncertainties create investor hesitancy and can lead to outflows from riskier asset classes. Furthermore, the need for continuous technological adaptation to meet evolving client expectations requires significant capital expenditure. The cost of acquiring and retaining talent with specialized skills in areas like ESG analysis and digital transformation also poses a challenge. Quantifiable impacts of these pressures can lead to reduced profit margins and slower AUM growth, estimated at xx% if unaddressed.

Key Players Shaping the Europe Mutual Fund Industry Market

- BlackRock

- Amundi

- BNP Paribas Asset Management

- JP Morgan

- Natixis

- AXA

- UBS

- HSBC

- DWS Group

- PIMCO

- Invesco

Significant Europe Mutual Fund Industry Industry Milestones

- March 2022: J.P. Morgan announced the acquisition of Global Shares, a leading cloud-based share plan management software provider. This move aims to bolster J.P. Morgan's capabilities in serving corporate clients and their employees, with Global Shares managing nearly USD 200 billion in assets for over 650,000 participants across 16 global locations.

- March 2022: Natixis CIB, through its retail networks, announced the adoption of nCino's Automated Spreading and Corporate Banking Solution. This leverages AI to accelerate credit journeys, automate operations, and enhance collaboration, aiming for speedier and more compliant credit decisions.

Future Outlook for Europe Mutual Fund Industry Market

The future outlook for the Europe Mutual Fund Industry is robust, driven by several key growth catalysts. The continued global shift towards sustainable investing will remain a dominant force, presenting significant opportunities for product innovation and capital accumulation. Advancements in FinTech and AI will further enhance operational efficiencies, personalize investor experiences, and unlock new distribution channels. The increasing demand for diversified and income-generating products due to an aging population and evolving retirement landscapes will also fuel growth. Strategic opportunities lie in expanding into underserved markets, developing tailored solutions for institutional and retail investors, and leveraging data analytics to gain competitive insights. The market potential remains substantial, with a projected sustained growth trajectory throughout the forecast period.

Europe Mutual Fund Industry Segmentation

-

1. Fund Type

- 1.1. Equity

- 1.2. Debt

- 1.3. Multi-Asset

- 1.4. Money Market

- 1.5. Other Fund Types

-

2. Investor Type

- 2.1. Households

- 2.2. Monetary Financial Institutions

- 2.3. General Government

- 2.4. Non-Financial Corporations

- 2.5. Insurers & Pension Funds

- 2.6. Other financial Intermediaries

Europe Mutual Fund Industry Segmentation By Geography

- 1. Luxembourg

- 2. Ireland

- 3. Germany

- 4. France

- 5. United Kingdom

- 6. Netherlands

- 7. Italy

- 8. Rest of Europe

Europe Mutual Fund Industry Regional Market Share

Geographic Coverage of Europe Mutual Fund Industry

Europe Mutual Fund Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Economic Growth; Low Interest Rates

- 3.3. Market Restrains

- 3.3.1. Economic Growth; Low Interest Rates

- 3.4. Market Trends

- 3.4.1. Investment Funds Domiciled in Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Europe Mutual Fund Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fund Type

- 5.1.1. Equity

- 5.1.2. Debt

- 5.1.3. Multi-Asset

- 5.1.4. Money Market

- 5.1.5. Other Fund Types

- 5.2. Market Analysis, Insights and Forecast - by Investor Type

- 5.2.1. Households

- 5.2.2. Monetary Financial Institutions

- 5.2.3. General Government

- 5.2.4. Non-Financial Corporations

- 5.2.5. Insurers & Pension Funds

- 5.2.6. Other financial Intermediaries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Luxembourg

- 5.3.2. Ireland

- 5.3.3. Germany

- 5.3.4. France

- 5.3.5. United Kingdom

- 5.3.6. Netherlands

- 5.3.7. Italy

- 5.3.8. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Fund Type

- 6. Luxembourg Europe Mutual Fund Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Fund Type

- 6.1.1. Equity

- 6.1.2. Debt

- 6.1.3. Multi-Asset

- 6.1.4. Money Market

- 6.1.5. Other Fund Types

- 6.2. Market Analysis, Insights and Forecast - by Investor Type

- 6.2.1. Households

- 6.2.2. Monetary Financial Institutions

- 6.2.3. General Government

- 6.2.4. Non-Financial Corporations

- 6.2.5. Insurers & Pension Funds

- 6.2.6. Other financial Intermediaries

- 6.1. Market Analysis, Insights and Forecast - by Fund Type

- 7. Ireland Europe Mutual Fund Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Fund Type

- 7.1.1. Equity

- 7.1.2. Debt

- 7.1.3. Multi-Asset

- 7.1.4. Money Market

- 7.1.5. Other Fund Types

- 7.2. Market Analysis, Insights and Forecast - by Investor Type

- 7.2.1. Households

- 7.2.2. Monetary Financial Institutions

- 7.2.3. General Government

- 7.2.4. Non-Financial Corporations

- 7.2.5. Insurers & Pension Funds

- 7.2.6. Other financial Intermediaries

- 7.1. Market Analysis, Insights and Forecast - by Fund Type

- 8. Germany Europe Mutual Fund Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Fund Type

- 8.1.1. Equity

- 8.1.2. Debt

- 8.1.3. Multi-Asset

- 8.1.4. Money Market

- 8.1.5. Other Fund Types

- 8.2. Market Analysis, Insights and Forecast - by Investor Type

- 8.2.1. Households

- 8.2.2. Monetary Financial Institutions

- 8.2.3. General Government

- 8.2.4. Non-Financial Corporations

- 8.2.5. Insurers & Pension Funds

- 8.2.6. Other financial Intermediaries

- 8.1. Market Analysis, Insights and Forecast - by Fund Type

- 9. France Europe Mutual Fund Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Fund Type

- 9.1.1. Equity

- 9.1.2. Debt

- 9.1.3. Multi-Asset

- 9.1.4. Money Market

- 9.1.5. Other Fund Types

- 9.2. Market Analysis, Insights and Forecast - by Investor Type

- 9.2.1. Households

- 9.2.2. Monetary Financial Institutions

- 9.2.3. General Government

- 9.2.4. Non-Financial Corporations

- 9.2.5. Insurers & Pension Funds

- 9.2.6. Other financial Intermediaries

- 9.1. Market Analysis, Insights and Forecast - by Fund Type

- 10. United Kingdom Europe Mutual Fund Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Fund Type

- 10.1.1. Equity

- 10.1.2. Debt

- 10.1.3. Multi-Asset

- 10.1.4. Money Market

- 10.1.5. Other Fund Types

- 10.2. Market Analysis, Insights and Forecast - by Investor Type

- 10.2.1. Households

- 10.2.2. Monetary Financial Institutions

- 10.2.3. General Government

- 10.2.4. Non-Financial Corporations

- 10.2.5. Insurers & Pension Funds

- 10.2.6. Other financial Intermediaries

- 10.1. Market Analysis, Insights and Forecast - by Fund Type

- 11. Netherlands Europe Mutual Fund Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Fund Type

- 11.1.1. Equity

- 11.1.2. Debt

- 11.1.3. Multi-Asset

- 11.1.4. Money Market

- 11.1.5. Other Fund Types

- 11.2. Market Analysis, Insights and Forecast - by Investor Type

- 11.2.1. Households

- 11.2.2. Monetary Financial Institutions

- 11.2.3. General Government

- 11.2.4. Non-Financial Corporations

- 11.2.5. Insurers & Pension Funds

- 11.2.6. Other financial Intermediaries

- 11.1. Market Analysis, Insights and Forecast - by Fund Type

- 12. Italy Europe Mutual Fund Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Fund Type

- 12.1.1. Equity

- 12.1.2. Debt

- 12.1.3. Multi-Asset

- 12.1.4. Money Market

- 12.1.5. Other Fund Types

- 12.2. Market Analysis, Insights and Forecast - by Investor Type

- 12.2.1. Households

- 12.2.2. Monetary Financial Institutions

- 12.2.3. General Government

- 12.2.4. Non-Financial Corporations

- 12.2.5. Insurers & Pension Funds

- 12.2.6. Other financial Intermediaries

- 12.1. Market Analysis, Insights and Forecast - by Fund Type

- 13. Rest of Europe Europe Mutual Fund Industry Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Fund Type

- 13.1.1. Equity

- 13.1.2. Debt

- 13.1.3. Multi-Asset

- 13.1.4. Money Market

- 13.1.5. Other Fund Types

- 13.2. Market Analysis, Insights and Forecast - by Investor Type

- 13.2.1. Households

- 13.2.2. Monetary Financial Institutions

- 13.2.3. General Government

- 13.2.4. Non-Financial Corporations

- 13.2.5. Insurers & Pension Funds

- 13.2.6. Other financial Intermediaries

- 13.1. Market Analysis, Insights and Forecast - by Fund Type

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 BlackRock

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Amundi

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 BNP Paribas Asset Management

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 JP Morgan

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Natixis

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 AXA

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 UBS

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 HSBC

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 DWS Group

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 PIMCO

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Invesco**List Not Exhaustive

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 BlackRock

List of Figures

- Figure 1: Global Europe Mutual Fund Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Europe Mutual Fund Industry Volume Breakdown (Trillion, %) by Region 2025 & 2033

- Figure 3: Luxembourg Europe Mutual Fund Industry Revenue (Million), by Fund Type 2025 & 2033

- Figure 4: Luxembourg Europe Mutual Fund Industry Volume (Trillion), by Fund Type 2025 & 2033

- Figure 5: Luxembourg Europe Mutual Fund Industry Revenue Share (%), by Fund Type 2025 & 2033

- Figure 6: Luxembourg Europe Mutual Fund Industry Volume Share (%), by Fund Type 2025 & 2033

- Figure 7: Luxembourg Europe Mutual Fund Industry Revenue (Million), by Investor Type 2025 & 2033

- Figure 8: Luxembourg Europe Mutual Fund Industry Volume (Trillion), by Investor Type 2025 & 2033

- Figure 9: Luxembourg Europe Mutual Fund Industry Revenue Share (%), by Investor Type 2025 & 2033

- Figure 10: Luxembourg Europe Mutual Fund Industry Volume Share (%), by Investor Type 2025 & 2033

- Figure 11: Luxembourg Europe Mutual Fund Industry Revenue (Million), by Country 2025 & 2033

- Figure 12: Luxembourg Europe Mutual Fund Industry Volume (Trillion), by Country 2025 & 2033

- Figure 13: Luxembourg Europe Mutual Fund Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Luxembourg Europe Mutual Fund Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Ireland Europe Mutual Fund Industry Revenue (Million), by Fund Type 2025 & 2033

- Figure 16: Ireland Europe Mutual Fund Industry Volume (Trillion), by Fund Type 2025 & 2033

- Figure 17: Ireland Europe Mutual Fund Industry Revenue Share (%), by Fund Type 2025 & 2033

- Figure 18: Ireland Europe Mutual Fund Industry Volume Share (%), by Fund Type 2025 & 2033

- Figure 19: Ireland Europe Mutual Fund Industry Revenue (Million), by Investor Type 2025 & 2033

- Figure 20: Ireland Europe Mutual Fund Industry Volume (Trillion), by Investor Type 2025 & 2033

- Figure 21: Ireland Europe Mutual Fund Industry Revenue Share (%), by Investor Type 2025 & 2033

- Figure 22: Ireland Europe Mutual Fund Industry Volume Share (%), by Investor Type 2025 & 2033

- Figure 23: Ireland Europe Mutual Fund Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: Ireland Europe Mutual Fund Industry Volume (Trillion), by Country 2025 & 2033

- Figure 25: Ireland Europe Mutual Fund Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Ireland Europe Mutual Fund Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Germany Europe Mutual Fund Industry Revenue (Million), by Fund Type 2025 & 2033

- Figure 28: Germany Europe Mutual Fund Industry Volume (Trillion), by Fund Type 2025 & 2033

- Figure 29: Germany Europe Mutual Fund Industry Revenue Share (%), by Fund Type 2025 & 2033

- Figure 30: Germany Europe Mutual Fund Industry Volume Share (%), by Fund Type 2025 & 2033

- Figure 31: Germany Europe Mutual Fund Industry Revenue (Million), by Investor Type 2025 & 2033

- Figure 32: Germany Europe Mutual Fund Industry Volume (Trillion), by Investor Type 2025 & 2033

- Figure 33: Germany Europe Mutual Fund Industry Revenue Share (%), by Investor Type 2025 & 2033

- Figure 34: Germany Europe Mutual Fund Industry Volume Share (%), by Investor Type 2025 & 2033

- Figure 35: Germany Europe Mutual Fund Industry Revenue (Million), by Country 2025 & 2033

- Figure 36: Germany Europe Mutual Fund Industry Volume (Trillion), by Country 2025 & 2033

- Figure 37: Germany Europe Mutual Fund Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Germany Europe Mutual Fund Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: France Europe Mutual Fund Industry Revenue (Million), by Fund Type 2025 & 2033

- Figure 40: France Europe Mutual Fund Industry Volume (Trillion), by Fund Type 2025 & 2033

- Figure 41: France Europe Mutual Fund Industry Revenue Share (%), by Fund Type 2025 & 2033

- Figure 42: France Europe Mutual Fund Industry Volume Share (%), by Fund Type 2025 & 2033

- Figure 43: France Europe Mutual Fund Industry Revenue (Million), by Investor Type 2025 & 2033

- Figure 44: France Europe Mutual Fund Industry Volume (Trillion), by Investor Type 2025 & 2033

- Figure 45: France Europe Mutual Fund Industry Revenue Share (%), by Investor Type 2025 & 2033

- Figure 46: France Europe Mutual Fund Industry Volume Share (%), by Investor Type 2025 & 2033

- Figure 47: France Europe Mutual Fund Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: France Europe Mutual Fund Industry Volume (Trillion), by Country 2025 & 2033

- Figure 49: France Europe Mutual Fund Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: France Europe Mutual Fund Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: United Kingdom Europe Mutual Fund Industry Revenue (Million), by Fund Type 2025 & 2033

- Figure 52: United Kingdom Europe Mutual Fund Industry Volume (Trillion), by Fund Type 2025 & 2033

- Figure 53: United Kingdom Europe Mutual Fund Industry Revenue Share (%), by Fund Type 2025 & 2033

- Figure 54: United Kingdom Europe Mutual Fund Industry Volume Share (%), by Fund Type 2025 & 2033

- Figure 55: United Kingdom Europe Mutual Fund Industry Revenue (Million), by Investor Type 2025 & 2033

- Figure 56: United Kingdom Europe Mutual Fund Industry Volume (Trillion), by Investor Type 2025 & 2033

- Figure 57: United Kingdom Europe Mutual Fund Industry Revenue Share (%), by Investor Type 2025 & 2033

- Figure 58: United Kingdom Europe Mutual Fund Industry Volume Share (%), by Investor Type 2025 & 2033

- Figure 59: United Kingdom Europe Mutual Fund Industry Revenue (Million), by Country 2025 & 2033

- Figure 60: United Kingdom Europe Mutual Fund Industry Volume (Trillion), by Country 2025 & 2033

- Figure 61: United Kingdom Europe Mutual Fund Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: United Kingdom Europe Mutual Fund Industry Volume Share (%), by Country 2025 & 2033

- Figure 63: Netherlands Europe Mutual Fund Industry Revenue (Million), by Fund Type 2025 & 2033

- Figure 64: Netherlands Europe Mutual Fund Industry Volume (Trillion), by Fund Type 2025 & 2033

- Figure 65: Netherlands Europe Mutual Fund Industry Revenue Share (%), by Fund Type 2025 & 2033

- Figure 66: Netherlands Europe Mutual Fund Industry Volume Share (%), by Fund Type 2025 & 2033

- Figure 67: Netherlands Europe Mutual Fund Industry Revenue (Million), by Investor Type 2025 & 2033

- Figure 68: Netherlands Europe Mutual Fund Industry Volume (Trillion), by Investor Type 2025 & 2033

- Figure 69: Netherlands Europe Mutual Fund Industry Revenue Share (%), by Investor Type 2025 & 2033

- Figure 70: Netherlands Europe Mutual Fund Industry Volume Share (%), by Investor Type 2025 & 2033

- Figure 71: Netherlands Europe Mutual Fund Industry Revenue (Million), by Country 2025 & 2033

- Figure 72: Netherlands Europe Mutual Fund Industry Volume (Trillion), by Country 2025 & 2033

- Figure 73: Netherlands Europe Mutual Fund Industry Revenue Share (%), by Country 2025 & 2033

- Figure 74: Netherlands Europe Mutual Fund Industry Volume Share (%), by Country 2025 & 2033

- Figure 75: Italy Europe Mutual Fund Industry Revenue (Million), by Fund Type 2025 & 2033

- Figure 76: Italy Europe Mutual Fund Industry Volume (Trillion), by Fund Type 2025 & 2033

- Figure 77: Italy Europe Mutual Fund Industry Revenue Share (%), by Fund Type 2025 & 2033

- Figure 78: Italy Europe Mutual Fund Industry Volume Share (%), by Fund Type 2025 & 2033

- Figure 79: Italy Europe Mutual Fund Industry Revenue (Million), by Investor Type 2025 & 2033

- Figure 80: Italy Europe Mutual Fund Industry Volume (Trillion), by Investor Type 2025 & 2033

- Figure 81: Italy Europe Mutual Fund Industry Revenue Share (%), by Investor Type 2025 & 2033

- Figure 82: Italy Europe Mutual Fund Industry Volume Share (%), by Investor Type 2025 & 2033

- Figure 83: Italy Europe Mutual Fund Industry Revenue (Million), by Country 2025 & 2033

- Figure 84: Italy Europe Mutual Fund Industry Volume (Trillion), by Country 2025 & 2033

- Figure 85: Italy Europe Mutual Fund Industry Revenue Share (%), by Country 2025 & 2033

- Figure 86: Italy Europe Mutual Fund Industry Volume Share (%), by Country 2025 & 2033

- Figure 87: Rest of Europe Europe Mutual Fund Industry Revenue (Million), by Fund Type 2025 & 2033

- Figure 88: Rest of Europe Europe Mutual Fund Industry Volume (Trillion), by Fund Type 2025 & 2033

- Figure 89: Rest of Europe Europe Mutual Fund Industry Revenue Share (%), by Fund Type 2025 & 2033

- Figure 90: Rest of Europe Europe Mutual Fund Industry Volume Share (%), by Fund Type 2025 & 2033

- Figure 91: Rest of Europe Europe Mutual Fund Industry Revenue (Million), by Investor Type 2025 & 2033

- Figure 92: Rest of Europe Europe Mutual Fund Industry Volume (Trillion), by Investor Type 2025 & 2033

- Figure 93: Rest of Europe Europe Mutual Fund Industry Revenue Share (%), by Investor Type 2025 & 2033

- Figure 94: Rest of Europe Europe Mutual Fund Industry Volume Share (%), by Investor Type 2025 & 2033

- Figure 95: Rest of Europe Europe Mutual Fund Industry Revenue (Million), by Country 2025 & 2033

- Figure 96: Rest of Europe Europe Mutual Fund Industry Volume (Trillion), by Country 2025 & 2033

- Figure 97: Rest of Europe Europe Mutual Fund Industry Revenue Share (%), by Country 2025 & 2033

- Figure 98: Rest of Europe Europe Mutual Fund Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Europe Mutual Fund Industry Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 2: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Fund Type 2020 & 2033

- Table 3: Global Europe Mutual Fund Industry Revenue Million Forecast, by Investor Type 2020 & 2033

- Table 4: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Investor Type 2020 & 2033

- Table 5: Global Europe Mutual Fund Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Region 2020 & 2033

- Table 7: Global Europe Mutual Fund Industry Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 8: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Fund Type 2020 & 2033

- Table 9: Global Europe Mutual Fund Industry Revenue Million Forecast, by Investor Type 2020 & 2033

- Table 10: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Investor Type 2020 & 2033

- Table 11: Global Europe Mutual Fund Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 13: Global Europe Mutual Fund Industry Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 14: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Fund Type 2020 & 2033

- Table 15: Global Europe Mutual Fund Industry Revenue Million Forecast, by Investor Type 2020 & 2033

- Table 16: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Investor Type 2020 & 2033

- Table 17: Global Europe Mutual Fund Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 19: Global Europe Mutual Fund Industry Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 20: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Fund Type 2020 & 2033

- Table 21: Global Europe Mutual Fund Industry Revenue Million Forecast, by Investor Type 2020 & 2033

- Table 22: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Investor Type 2020 & 2033

- Table 23: Global Europe Mutual Fund Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 25: Global Europe Mutual Fund Industry Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 26: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Fund Type 2020 & 2033

- Table 27: Global Europe Mutual Fund Industry Revenue Million Forecast, by Investor Type 2020 & 2033

- Table 28: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Investor Type 2020 & 2033

- Table 29: Global Europe Mutual Fund Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 31: Global Europe Mutual Fund Industry Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 32: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Fund Type 2020 & 2033

- Table 33: Global Europe Mutual Fund Industry Revenue Million Forecast, by Investor Type 2020 & 2033

- Table 34: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Investor Type 2020 & 2033

- Table 35: Global Europe Mutual Fund Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 37: Global Europe Mutual Fund Industry Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 38: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Fund Type 2020 & 2033

- Table 39: Global Europe Mutual Fund Industry Revenue Million Forecast, by Investor Type 2020 & 2033

- Table 40: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Investor Type 2020 & 2033

- Table 41: Global Europe Mutual Fund Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 43: Global Europe Mutual Fund Industry Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 44: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Fund Type 2020 & 2033

- Table 45: Global Europe Mutual Fund Industry Revenue Million Forecast, by Investor Type 2020 & 2033

- Table 46: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Investor Type 2020 & 2033

- Table 47: Global Europe Mutual Fund Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 49: Global Europe Mutual Fund Industry Revenue Million Forecast, by Fund Type 2020 & 2033

- Table 50: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Fund Type 2020 & 2033

- Table 51: Global Europe Mutual Fund Industry Revenue Million Forecast, by Investor Type 2020 & 2033

- Table 52: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Investor Type 2020 & 2033

- Table 53: Global Europe Mutual Fund Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 54: Global Europe Mutual Fund Industry Volume Trillion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Mutual Fund Industry?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Europe Mutual Fund Industry?

Key companies in the market include BlackRock, Amundi, BNP Paribas Asset Management, JP Morgan, Natixis, AXA, UBS, HSBC, DWS Group, PIMCO, Invesco**List Not Exhaustive.

3. What are the main segments of the Europe Mutual Fund Industry?

The market segments include Fund Type, Investor Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 33.89 Million as of 2022.

5. What are some drivers contributing to market growth?

Economic Growth; Low Interest Rates.

6. What are the notable trends driving market growth?

Investment Funds Domiciled in Europe.

7. Are there any restraints impacting market growth?

Economic Growth; Low Interest Rates.

8. Can you provide examples of recent developments in the market?

March 2022: J.P. Morgan announced that it had agreed to acquire Global Shares, a leading cloud-based share plan management software provider. Global Shares has an expansive client base of over 600 corporate clients that range from early-stage start-ups to mature multinational public corporations. The firm has nearly USD 200 billion assets under administration across 650,000 corporate employee participants. It operates with an experienced team of over 600 employees headquartered in Cork, Ireland, and 16 locations across Europe, the Middle East & Africa, North America, and Asia-Pacific.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Mutual Fund Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Mutual Fund Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Mutual Fund Industry?

To stay informed about further developments, trends, and reports in the Europe Mutual Fund Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence