Key Insights

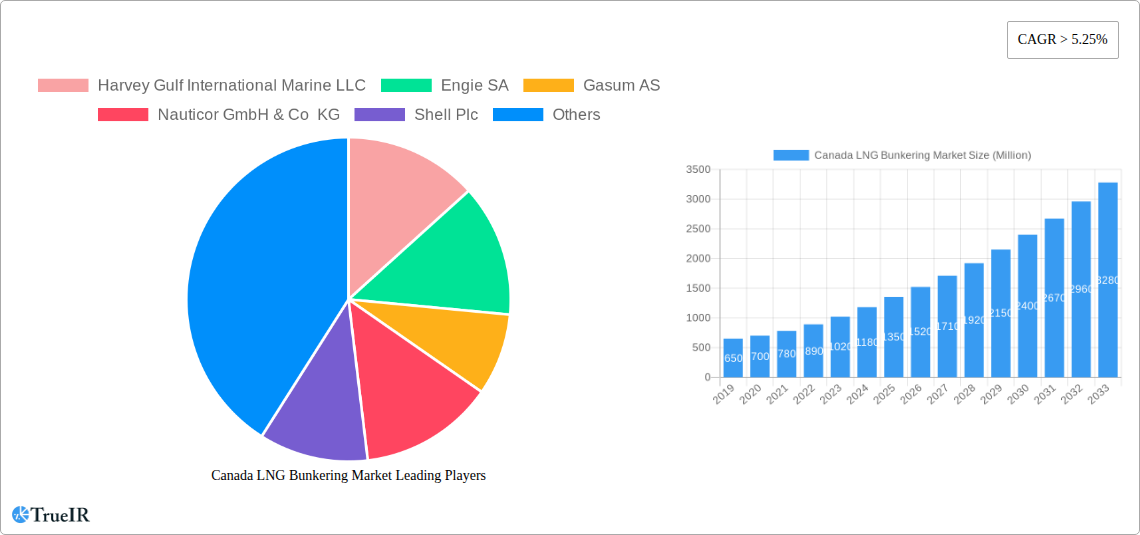

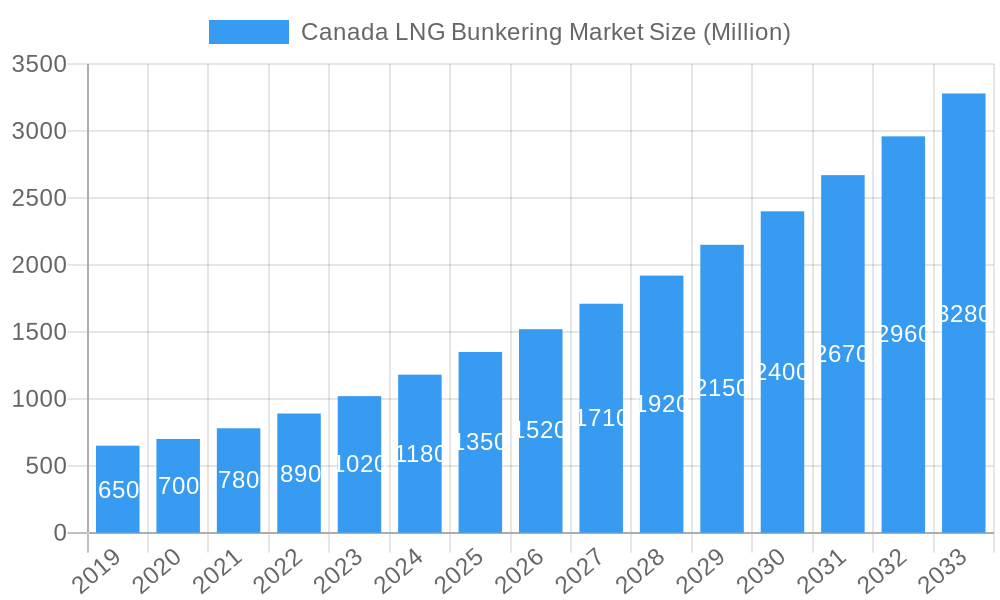

The Canadian LNG Bunkering Market is projected for significant expansion, with an estimated market size of $10.78 billion by 2025. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 46.6% through 2033. This growth is driven by the increasing adoption of Liquefied Natural Gas (LNG) as a cleaner and more cost-effective alternative to traditional marine fuels, spurred by stringent environmental regulations and the economic advantages of LNG. Government initiatives supporting cleaner transportation also play a crucial role in market development.

Canada LNG Bunkering Market Market Size (In Billion)

Key market trends include the expansion of LNG bunkering infrastructure at major Canadian ports, supporting demand from the Tanker Fleet and Bulk & General Cargo Fleet segments. The development of specialized LNG-powered vessels, including offshore support and ferries, further diversifies the market. Challenges include the high initial capital investment for infrastructure and vessel conversion, and the need for standardized bunkering protocols. Despite these, the Canadian LNG Bunkering Market is set for substantial growth, with major players like Shell Plc, Engie SA, and Gasum AS actively contributing.

Canada LNG Bunkering Market Company Market Share

This report provides an in-depth analysis of the Canada LNG Bunkering Market, covering market dynamics, growth trajectories, and competitive landscapes from 2019 to 2033. The analysis focuses on the period from 2025 to 2033, with 2025 serving as the base year.

Canada LNG Bunkering Market Market Structure & Competitive Landscape

The Canada LNG Bunkering Market exhibits a moderately concentrated structure, driven by significant capital investments required for infrastructure development and fleet expansion. Key innovation drivers include the global push for decarbonization in maritime shipping and Canada's strategic geographic position facilitating efficient LNG distribution. Regulatory impacts, such as stricter emissions standards and government incentives for cleaner fuels, are shaping market entry and operational strategies. Product substitutes, primarily traditional marine fuels like Heavy Fuel Oil (HFO) and Marine Gas Oil (MGO), are gradually being displaced by LNG's environmental advantages. The end-user segmentation highlights a growing demand across various vessel types, with significant opportunities in the tanker and container fleets due to their high fuel consumption and increasing adoption of cleaner technologies. Mergers and acquisitions (M&A) trends are anticipated to consolidate the market, with potential consolidation occurring as major players seek to secure market share and expand their service networks. The market concentration ratio is estimated at 45% for the top three players in the historical period, with projections to increase to 52% by 2033 due to strategic alliances and infrastructure investments. M&A activities have seen a steady volume, with an estimated 5 significant transactions in the historical period.

Canada LNG Bunkering Market Market Trends & Opportunities

The Canada LNG Bunkering Market is poised for substantial growth, driven by an escalating global imperative to reduce maritime emissions and Canada's abundant natural gas reserves. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of 18.5% from 2025 to 2033, reaching an estimated 25,000 Million by the end of the forecast period. Technological shifts are playing a pivotal role, with advancements in LNG liquefaction, storage, and bunkering technologies enhancing efficiency and safety. The development of smaller-scale, modular LNG liquefaction plants and the proliferation of LNG-powered vessels are key technological trends. Consumer preferences are increasingly tilting towards environmentally friendly fuel solutions, with shipowners actively seeking to comply with international maritime regulations and improve their corporate sustainability profiles. The competitive dynamics are characterized by strategic partnerships between energy providers, infrastructure developers, and shipping companies. Opportunities abound for the development of integrated LNG bunkering hubs along Canada's coastlines and major waterways, catering to both domestic and international shipping routes. The increasing adoption of LNG by ferry operators and offshore supply vessels (OSVs) presents a burgeoning segment for market players. Furthermore, the establishment of robust regulatory frameworks and supportive government policies will further accelerate market penetration, which is anticipated to grow from 15% in 2025 to 40% by 2033.

Dominant Markets & Segments in Canada LNG Bunkering Market

The dominant market within Canada's LNG bunkering landscape is projected to be along the Pacific coast, driven by the growth of the Port of Vancouver as a key hub for both imports and exports, and its strategic proximity to major shipping lanes. This region benefits from significant infrastructure investments and a strong policy push towards decarbonization.

- Tanker Fleet: This segment is a significant driver due to the substantial fuel requirements of large-scale tankers. The increasing number of LNG-powered tankers and the demand for cleaner fuels for crude oil and product transportation contribute to its dominance. Growth drivers include stringent emissions regulations for vessels operating in sensitive marine environments and the long-term fuel cost advantages of LNG.

- Container Fleet: The container shipping industry is rapidly adopting LNG-powered vessels to meet emissions targets, making this a crucial segment. Investments in LNG bunkering infrastructure at major container ports are essential for supporting this trend. Key growth drivers include the high volume of trade and the pressure on shipping lines to reduce their carbon footprint.

- Bulk & General Cargo Fleet: While traditionally slower to adopt cleaner fuels, the bulk and general cargo fleet is gradually transitioning. Increased environmental awareness and potential regulatory mandates for all vessel types are expected to drive growth in this segment. Infrastructure development in more remote ports will be critical.

- Ferries & OSV: Ferries operating on coastal and inland routes, along with offshore supply vessels supporting the energy sector, represent a significant and growing market. Their shorter routes and fixed schedules make them ideal candidates for LNG conversion. Key growth drivers include government initiatives to promote clean transportation and the development of dedicated bunkering facilities for these vessels.

- Other End-Users: This category may include smaller vessels, research ships, and specialized marine craft. While individually smaller, the collective demand from this diverse group contributes to the overall market.

The dominance of the Pacific coast is further bolstered by the planned expansion of LNG export facilities and the increasing transit of LNG carriers, creating a natural demand for bunkering services. Policies promoting clean energy adoption and the presence of major port authorities committed to sustainability initiatives are also critical factors.

Canada LNG Bunkering Market Product Analysis

The Canada LNG Bunkering Market is characterized by product innovations focused on safety, efficiency, and accessibility. LNG as a marine fuel offers significant environmental advantages over traditional fuels, including drastic reductions in sulfur oxides (SOx), nitrogen oxides (NOx), and particulate matter emissions, along with a substantial decrease in greenhouse gas (GHG) emissions. Competitive advantages stem from the growing global demand for cleaner shipping, supported by international regulations such as the IMO 2020 sulfur cap and upcoming GHG reduction targets. Technological advancements in liquefaction, transportation, and bunkering equipment, including specialized LNG bunker vessels and shore-side facilities, enhance the market's attractiveness. The market fit is strong for vessels undertaking long-haul voyages and those operating in Emission Control Areas (ECAs), where regulatory compliance is paramount.

Key Drivers, Barriers & Challenges in Canada LNG Bunkering Market

Key Drivers:

- Decarbonization Mandates: Global and national regulations pushing for reduced maritime emissions are the primary catalyst.

- Environmental Benefits: LNG significantly cuts down on SOx, NOx, and GHG emissions, appealing to environmentally conscious stakeholders.

- Infrastructure Development: Government and private investments in LNG liquefaction plants, terminals, and bunkering facilities are crucial.

- Growing LNG-Powered Fleet: The increasing construction and conversion of vessels to run on LNG create direct demand.

- Cost Competitiveness: In certain regions and under specific market conditions, LNG can offer cost advantages over traditional fuels.

Barriers & Challenges:

- High Upfront Investment: The cost of building LNG bunkering infrastructure and converting vessels is substantial, representing a significant barrier to entry.

- LNG Availability & Distribution: Ensuring a consistent and widespread supply of LNG across various Canadian ports remains a challenge.

- Safety & Handling Concerns: Though well-managed, the inherent safety considerations associated with cryogenic fuels require rigorous protocols and trained personnel.

- Regulatory Harmonization: Inconsistent or evolving regulations across different jurisdictions can create uncertainty for investors and operators.

- Competition from Alternative Fuels: Emerging alternative fuels like methanol and ammonia pose future competition to LNG.

Growth Drivers in the Canada LNG Bunkering Market Market

The growth of the Canada LNG Bunkering Market is propelled by a confluence of technological, economic, and regulatory factors. Technologically, the development of more efficient and cost-effective liquefaction processes and the innovation in LNG bunker vessel design are critical enablers. Economically, the increasing price volatility of traditional marine fuels and the long-term price stability of natural gas can favor LNG. Furthermore, government incentives, such as tax credits and subsidies for clean fuel adoption and infrastructure development, play a vital role in de-risking investments. The expansion of LNG export terminals in Canada also creates a natural synergy for developing domestic bunkering capabilities.

Challenges Impacting Canada LNG Bunkering Market Growth

The expansion of the Canada LNG Bunkering Market is hindered by several significant challenges. Regulatory complexities, including obtaining permits for infrastructure development and ensuring compliance with evolving international maritime standards, can slow down project timelines. Supply chain issues, such as the availability of specialized equipment and skilled labor for constructing and operating LNG facilities, also pose a constraint. Competitive pressures arise not only from traditional fuel suppliers but also from the emergence of other alternative marine fuels, such as methanol and hydrogen, which could gain traction in the future. The upfront capital investment required for both fleet conversion and infrastructure development remains a substantial financial hurdle for many market participants.

Key Players Shaping the Canada LNG Bunkering Market Market

- Harvey Gulf International Marine LLC

- Engie SA

- Gasum AS

- Nauticor GmbH & Co KG

- Shell Plc

- Gazpromneft Marine Bunker LLC

- ENN Energy Holdings Ltd

- TotalEnergies SE

Significant Canada LNG Bunkering Market Industry Milestones

- September 2022: Norway's Hoglund secured a contract from Canada's Seaspan Marine Transportation to build two 7,600-cbm LNG bunkering vessels, signaling a significant expansion of dedicated LNG bunkering capacity in Canada.

- February 2023: LNG Canada and FortisBC announced that the companies would join the First Nations LNG Alliance (FNLNGA) in March 2023. FortisBC is expanding Tilbury to enable LNG bunkering and small-scale marine exports, enhancing supply chain capabilities and regional accessibility.

Future Outlook for Canada LNG Bunkering Market Market

The future outlook for the Canada LNG Bunkering Market is highly optimistic, driven by sustained global and national decarbonization efforts. Strategic opportunities lie in expanding bunkering infrastructure along key trade routes and developing integrated supply chains to support the growing fleet of LNG-powered vessels. The market potential is substantial, fueled by increasing regulatory pressures and the demand for cleaner shipping solutions. Continued innovation in fuel cell technology and the integration of renewable natural gas (RNG) as a marine fuel could further bolster LNG's position. The market is expected to witness increased collaboration between energy majors, shipping lines, and port authorities to facilitate widespread adoption.

Canada LNG Bunkering Market Segmentation

- 1. Tanker Fleet

- 2. Container Fleet

- 3. Bulk & General Cargo Fleet

- 4. Ferries & OSV

- 5. Other End-Users

Canada LNG Bunkering Market Segmentation By Geography

- 1. Canada

Canada LNG Bunkering Market Regional Market Share

Geographic Coverage of Canada LNG Bunkering Market

Canada LNG Bunkering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 46.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Natural Gas Demand4.; Rising Pipeline Network and Associated Infrastructure Development

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Shift toward Renewable Energy

- 3.4. Market Trends

- 3.4.1. Ferries & OSV to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada LNG Bunkering Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Tanker Fleet

- 5.2. Market Analysis, Insights and Forecast - by Container Fleet

- 5.3. Market Analysis, Insights and Forecast - by Bulk & General Cargo Fleet

- 5.4. Market Analysis, Insights and Forecast - by Ferries & OSV

- 5.5. Market Analysis, Insights and Forecast - by Other End-Users

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Tanker Fleet

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Harvey Gulf International Marine LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Engie SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gasum AS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nauticor GmbH & Co KG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Shell Plc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gazpromneft Marine Bunker LLC*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ENN Energy Holdings Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TotalEnergies SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Harvey Gulf International Marine LLC

List of Figures

- Figure 1: Canada LNG Bunkering Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada LNG Bunkering Market Share (%) by Company 2025

List of Tables

- Table 1: Canada LNG Bunkering Market Revenue billion Forecast, by Tanker Fleet 2020 & 2033

- Table 2: Canada LNG Bunkering Market Revenue billion Forecast, by Container Fleet 2020 & 2033

- Table 3: Canada LNG Bunkering Market Revenue billion Forecast, by Bulk & General Cargo Fleet 2020 & 2033

- Table 4: Canada LNG Bunkering Market Revenue billion Forecast, by Ferries & OSV 2020 & 2033

- Table 5: Canada LNG Bunkering Market Revenue billion Forecast, by Other End-Users 2020 & 2033

- Table 6: Canada LNG Bunkering Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Canada LNG Bunkering Market Revenue billion Forecast, by Tanker Fleet 2020 & 2033

- Table 8: Canada LNG Bunkering Market Revenue billion Forecast, by Container Fleet 2020 & 2033

- Table 9: Canada LNG Bunkering Market Revenue billion Forecast, by Bulk & General Cargo Fleet 2020 & 2033

- Table 10: Canada LNG Bunkering Market Revenue billion Forecast, by Ferries & OSV 2020 & 2033

- Table 11: Canada LNG Bunkering Market Revenue billion Forecast, by Other End-Users 2020 & 2033

- Table 12: Canada LNG Bunkering Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada LNG Bunkering Market?

The projected CAGR is approximately 46.6%.

2. Which companies are prominent players in the Canada LNG Bunkering Market?

Key companies in the market include Harvey Gulf International Marine LLC, Engie SA, Gasum AS, Nauticor GmbH & Co KG, Shell Plc, Gazpromneft Marine Bunker LLC*List Not Exhaustive, ENN Energy Holdings Ltd, TotalEnergies SE.

3. What are the main segments of the Canada LNG Bunkering Market?

The market segments include Tanker Fleet, Container Fleet, Bulk & General Cargo Fleet, Ferries & OSV, Other End-Users.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.78 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Natural Gas Demand4.; Rising Pipeline Network and Associated Infrastructure Development.

6. What are the notable trends driving market growth?

Ferries & OSV to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Rising Shift toward Renewable Energy.

8. Can you provide examples of recent developments in the market?

September 2022: Norway's Hoglund secured a contract from Canada's seaspan marine transportation to build two 7,600-cbm LNG bunkering vessels.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada LNG Bunkering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada LNG Bunkering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada LNG Bunkering Market?

To stay informed about further developments, trends, and reports in the Canada LNG Bunkering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence