Key Insights

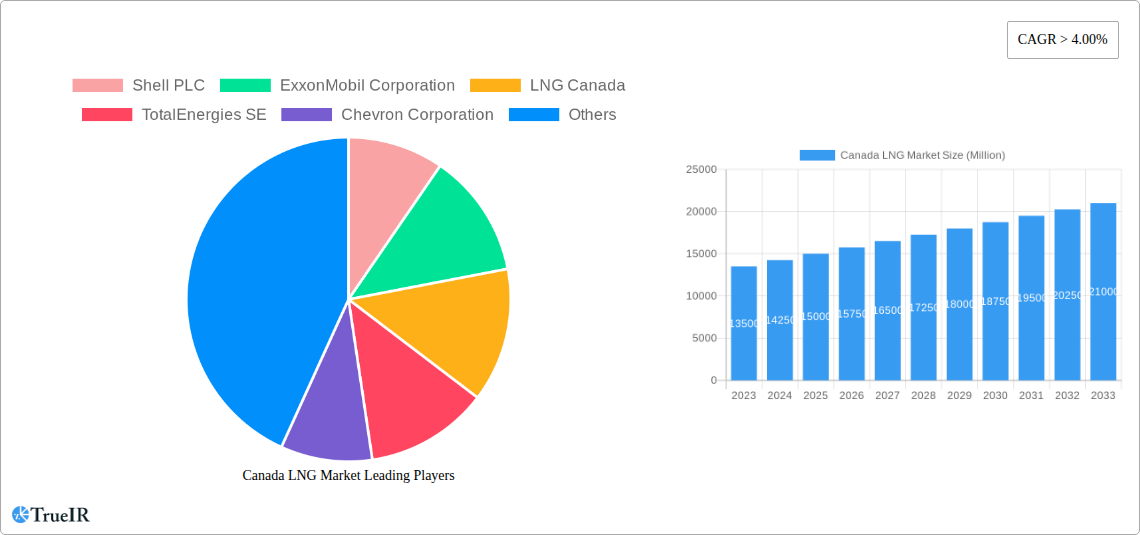

The Canadian Liquefied Natural Gas (LNG) market is poised for significant expansion, projecting a market size of approximately USD 15,000 million in 2025 and a Compound Annual Growth Rate (CAGR) exceeding 4.00% through 2033. This growth is primarily propelled by escalating global demand for cleaner energy sources and Canada's abundant natural gas reserves. Key drivers include the increasing adoption of LNG as a transportation fuel, especially in heavy-duty trucking and shipping, and its growing role in power generation, offering a more environmentally friendly alternative to coal. Furthermore, substantial investments in LNG infrastructure, including the development of new liquefaction plants and the expansion of regasification facilities, are critical enablers of this market surge. The ongoing development of LNG shipping capabilities is also vital to connect Canadian producers with international markets, thereby bolstering export opportunities and domestic supply chains.

Canada LNG Market Market Size (In Billion)

The market is characterized by several influential trends, including a strong focus on decarbonization efforts and the development of smaller-scale, modular LNG facilities to serve remote communities and specialized industrial applications. The robust growth in LNG infrastructure, from liquefaction to shipping, is directly addressing the increasing demand across various applications, particularly in transportation and power generation. However, the market faces certain restraints, such as the high capital expenditure required for large-scale LNG projects and the complexities associated with obtaining regulatory approvals and navigating environmental considerations. Despite these challenges, the presence of major global players like Shell PLC, ExxonMobil Corporation, and TotalEnergies SE, alongside Canadian giants like LNG Canada, signifies a competitive landscape driven by innovation and strategic partnerships. The ongoing expansion of LNG infrastructure and applications within Canada is expected to solidify its position as a key player in the global LNG market.

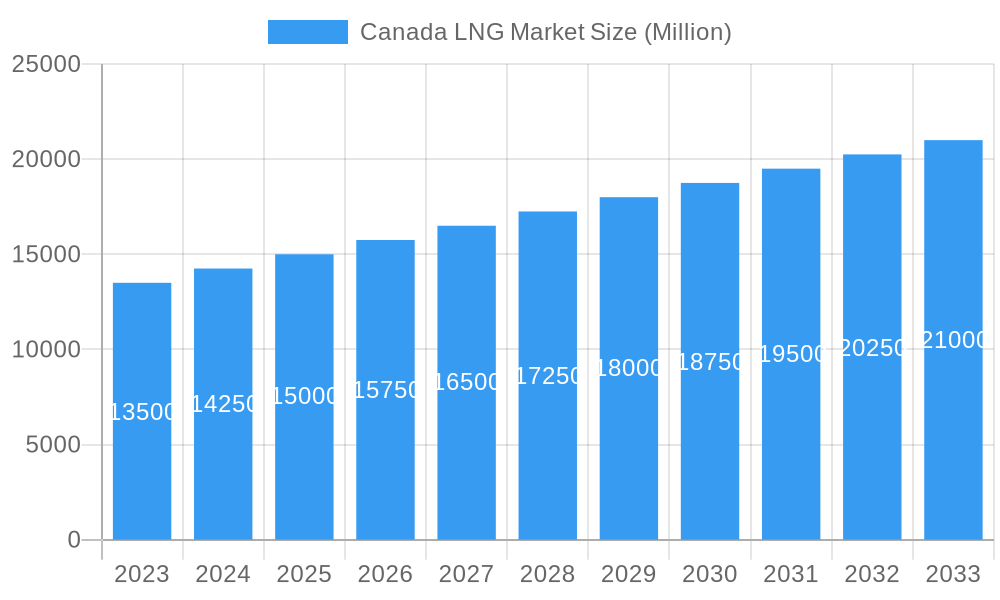

Canada LNG Market Company Market Share

Unlocking Canada's Liquefied Natural Gas Potential: A Comprehensive Market Analysis (2019-2033)

This in-depth report provides a dynamic and SEO-optimized analysis of the Canada LNG Market, a critical sector poised for significant expansion. Leveraging high-volume keywords such as "Canada LNG," "Liquefied Natural Gas Canada," "LNG Exports," and "LNG Infrastructure Canada," this report is designed to engage industry professionals, investors, and policymakers. Our comprehensive coverage spans from 2019 to 2033, with a base year of 2025 and an extensive forecast period of 2025–2033, building upon a historical period of 2019–2024. Delve into the intricate details of market structure, emerging trends, dominant segments, product innovations, key growth drivers, challenges, influential players, and pivotal industry milestones that are shaping the future of Canada's liquefied natural gas landscape.

Canada LNG Market Market Structure & Competitive Landscape

The Canada LNG Market is characterized by a moderately concentrated structure, with a few major international energy giants and prominent Canadian entities driving development. Innovation is primarily fueled by advancements in liquefaction technology, offshore infrastructure solutions, and the pursuit of lower emission intensity production. Regulatory impacts are significant, with federal and provincial policies on environmental protection, Indigenous consultation, and project permitting playing a crucial role in project timelines and viability. Product substitutes, while present in energy markets, are not direct replacements for the specific advantages of LNG in global export markets. End-user segmentation is diversifying, moving beyond traditional industrial and power generation applications to include the burgeoning transportation fuel sector. Mergers and acquisitions (M&A) trends are focused on consolidating expertise in project development, infrastructure construction, and the securing of long-term offtake agreements. The overall market concentration ratio for major projects is estimated to be around 60%, indicating a significant influence of key players. M&A volumes are projected to reach several billion dollars in the coming years as companies seek strategic partnerships and scale.

- Market Concentration: Dominated by major integrated energy companies and specialized LNG developers.

- Innovation Drivers: Focus on emissions reduction, modularization of liquefaction plants, and advanced transportation solutions.

- Regulatory Impacts: Stringent environmental reviews and evolving carbon pricing mechanisms are key considerations.

- Product Substitutes: While other fuels exist, LNG's export-oriented advantages remain distinct.

- End-User Segmentation: Expanding to include marine and heavy-duty road transportation.

- M&A Trends: Consolidation for project financing, technology acquisition, and market access.

Canada LNG Market Market Trends & Opportunities

The Canada LNG Market is on an upward trajectory, driven by global demand for cleaner energy alternatives and Canada's abundant natural gas reserves. Market size growth is anticipated to be robust, with a projected Compound Annual Growth Rate (CAGR) of approximately 8% over the forecast period. Technological shifts are transforming the industry, with a greater emphasis on floating liquefaction facilities and the decarbonization of LNG production through carbon capture and storage (CCS) initiatives. Consumer preferences, particularly in importing nations, are increasingly favoring LNG as a transitional fuel with lower emissions compared to coal. Competitive dynamics are intensifying, with Canada aiming to capture a larger share of the international LNG market, challenging established exporters. Opportunities abound in developing the necessary export infrastructure, including world-class liquefaction plants and associated pipelines, as well as in advancing LNG as a marine fuel for coastal and international shipping. The ongoing development of large-scale projects like LNG Canada and the potential for smaller-scale, modular facilities present significant growth catalysts. Furthermore, the exploration of new export markets beyond traditional Asian destinations is a key strategic imperative. The market penetration rate for LNG in domestic transportation is still nascent but holds substantial long-term potential.

Dominant Markets & Segments in Canada LNG Market

The Canada LNG Market is experiencing significant growth across various segments, with LNG Infrastructure holding a pivotal position. Within this, LNG Liquefaction Plants are the primary enablers of export capacity, representing the most substantial segment in terms of investment and projected revenue. The development of terminals in British Columbia, such as LNG Canada, underscores the dominance of this segment. LNG Shipping is another critical component, with increasing demand for specialized vessels to transport liquefied natural gas globally. While LNG Regasification Facilities are primarily located in importing countries, their development is indirectly influenced by Canada's export ambitions. In terms of application, Power Generation remains a significant driver for LNG demand, offering a cleaner alternative to fossil fuels. However, the Transportation Fuel segment is emerging as a key growth area, particularly for marine and heavy-duty road transport, driven by environmental regulations and the pursuit of reduced carbon footprints.

Dominant Segment: LNG Infrastructure

- LNG Liquefaction Plants: Critical for converting natural gas into a liquid state for export. Projects like LNG Canada are central to this dominance, with substantial planned capacity nearing completion. The scale of investment in these facilities directly correlates with market growth.

- LNG Shipping: Essential for global trade. The expansion of LNG carrier fleets and the demand for efficient, lower-emission ships are key trends. Canada's strategic location necessitates robust shipping capabilities for its exports.

- LNG Regasification Facilities: While not directly built in Canada for export, the availability and expansion of these facilities in target import markets are crucial for the success of Canadian LNG projects.

Dominant Application: Power Generation & Emerging Transportation Fuel

- Power Generation: Historically a major driver, providing a bridge fuel towards renewable energy sources with reduced emissions.

- Transportation Fuel: A rapidly growing segment, especially for long-haul trucking and marine vessels, driven by stricter environmental mandates and the availability of LNG infrastructure for bunkering. The potential for "trucked" LNG for remote communities also adds to its significance.

Canada LNG Market Product Analysis

The Canada LNG Market is characterized by the production and export of standard, high-quality Liquefied Natural Gas (LNG). Product innovations are not in the composition of LNG itself, but rather in the efficiency and environmental performance of its production, liquefaction, and transportation. Companies are focused on developing and deploying advanced liquefaction technologies that minimize energy consumption and reduce greenhouse gas emissions. Competitive advantages are being built on the basis of competitive pricing, reliable supply chains, and demonstrable commitment to environmental, social, and governance (ESG) principles, including lower upstream methane intensity. The market fit for Canadian LNG is strong due to its geographical proximity to major Asian markets and its vast, low-cost natural gas reserves.

Key Drivers, Barriers & Challenges in Canada LNG Market

The Canada LNG Market is propelled by several key drivers, including robust global demand for cleaner energy sources, Canada's substantial natural gas reserves, and supportive government policies aimed at fostering energy exports. Technological advancements in liquefaction and transportation further enhance its attractiveness.

However, the market faces significant barriers and challenges. These include the substantial capital investment required for large-scale LNG projects, navigating complex and evolving regulatory frameworks, and ensuring timely and cost-effective pipeline infrastructure development to transport natural gas to export terminals. Public perception and environmental concerns surrounding the extraction and transportation of natural gas also present challenges, necessitating a strong focus on emissions reduction and stakeholder engagement. Supply chain disruptions and the availability of skilled labor for project construction can also impact timelines and costs.

Growth Drivers in the Canada LNG Market Market

Several key factors are propelling the Canada LNG Market. Technologically, the development of more efficient liquefaction processes and the exploration of carbon capture technologies are enhancing the market's appeal. Economically, the significant global demand for natural gas as a transitional fuel, coupled with Canada's abundant and relatively low-cost reserves, creates a strong competitive advantage. Regulatory factors, including government support for export-oriented projects and streamlined permitting processes, are also crucial. The increasing focus on energy security in importing nations further boosts demand for reliable LNG suppliers like Canada.

Challenges Impacting Canada LNG Market Growth

The Canada LNG Market faces considerable challenges. Regulatory complexities, including stringent environmental assessments and evolving Indigenous consultation requirements, can lead to project delays and increased costs. Supply chain issues, such as the availability of specialized equipment and skilled labor for construction and operation, pose significant risks to project timelines. Competitive pressures from established LNG exporters and emerging producers worldwide also necessitate continuous innovation and cost optimization. Furthermore, public and environmental scrutiny regarding methane emissions and the broader climate impact of natural gas production requires proactive and transparent mitigation strategies to maintain social license to operate.

Key Players Shaping the Canada LNG Market Market

- Shell PLC

- ExxonMobil Corporation

- LNG Canada

- TotalEnergies SE

- Chevron Corporation

- Fluor Corporation

- TechnipFMC PLC

Significant Canada LNG Market Industry Milestones

- October 2022: LNG Canada significantly ramped up construction at its Kitimat liquefied natural gas (LNG) terminal. The workforce was projected to peak at 7,500 people in the following year. The first phase of the LNG project reached 70% completion, and the Coastal GasLink (CGL) pipeline was 75% completed. Upon completion, this terminal will be crucial for exporting LNG produced by the project's partners from the Montney Formation gas fields near Dawson Creek.

- February 2022: The Haisla Nation-owned Cedar Liquefied Natural Gas Project (Cedar LNG) achieved critical milestones for its proposed export facility in Kitimat, British Columbia. The project submitted its application for an Environmental Assessment Certificate (EAC) to the British Columbia Environmental Assessment Office, initiating the 180-day application review phase. This achievement followed extensive detailed studies, engineering work, and meaningful engagement with Indigenous and local communities. Cedar LNG is a partnership between the Haisla Nation and Pembina Pipeline Corporation (Pembina).

Future Outlook for Canada LNG Market Market

The Canada LNG Market is poised for substantial growth, driven by increasing global demand for cleaner energy and Canada's strategic position as a reliable supplier. Key growth catalysts include the successful execution of ongoing large-scale export projects, the potential development of smaller, modular facilities to cater to diverse market needs, and the expanding role of LNG as a marine fuel. Strategic opportunities lie in enhancing supply chain efficiency, further reducing the carbon intensity of LNG production through innovative technologies, and forging new international partnerships. The market potential is significant, offering Canada the opportunity to become a leading global exporter of liquefied natural gas, contributing to both domestic economic prosperity and global energy security.

Canada LNG Market Segmentation

-

1. LNG Infrastructure

- 1.1. LNG Liquefaction Plants

- 1.2. LNG Regasification Facilities

- 1.3. LNG Shipping

-

2. Application

- 2.1. Transportation Fuel

- 2.2. Power Generation

- 2.3. Other Application Types

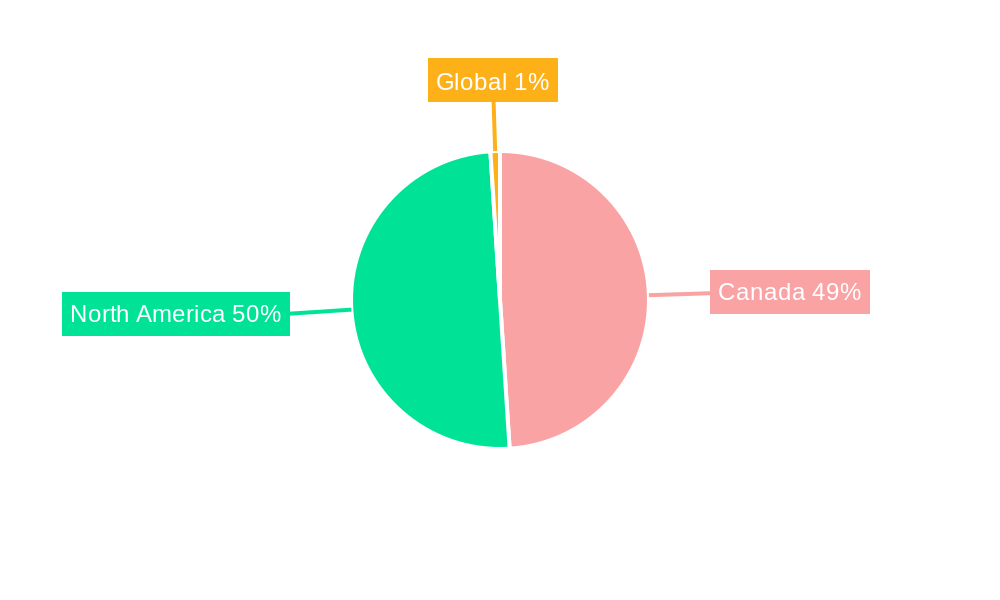

Canada LNG Market Segmentation By Geography

- 1. Canada

Canada LNG Market Regional Market Share

Geographic Coverage of Canada LNG Market

Canada LNG Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Offshore Oil and Gas Projects

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Penetration of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Upcoming LNG Projects Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada LNG Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by LNG Infrastructure

- 5.1.1. LNG Liquefaction Plants

- 5.1.2. LNG Regasification Facilities

- 5.1.3. LNG Shipping

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Transportation Fuel

- 5.2.2. Power Generation

- 5.2.3. Other Application Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by LNG Infrastructure

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Shell PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ExxonMobil Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 LNG Canada

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 TotalEnergies SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Chevron Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fluor Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TechnipFMC PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Shell PLC

List of Figures

- Figure 1: Canada LNG Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada LNG Market Share (%) by Company 2025

List of Tables

- Table 1: Canada LNG Market Revenue Million Forecast, by LNG Infrastructure 2020 & 2033

- Table 2: Canada LNG Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Canada LNG Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Canada LNG Market Revenue Million Forecast, by LNG Infrastructure 2020 & 2033

- Table 5: Canada LNG Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Canada LNG Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada LNG Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Canada LNG Market?

Key companies in the market include Shell PLC, ExxonMobil Corporation, LNG Canada, TotalEnergies SE, Chevron Corporation, Fluor Corporation, TechnipFMC PLC.

3. What are the main segments of the Canada LNG Market?

The market segments include LNG Infrastructure, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Offshore Oil and Gas Projects.

6. What are the notable trends driving market growth?

Upcoming LNG Projects Expected to Drive the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Penetration of Renewable Energy.

8. Can you provide examples of recent developments in the market?

October 2022: LNG Canada ramped construction at its Kitimat liquefied natural gas (LNG) terminal. The workforce is expected to peak at 7,500 people next year. The first phase of the LNG project is 70% completed, and the Coastal GasLink (CGL) pipeline is 75% completed. Once complete, the terminal for the liquefaction, storage, and loading of liquefied natural gas will export LNG produced by the project's partners in the Montney Formation gas fields near Dawson Creek.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada LNG Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada LNG Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada LNG Market?

To stay informed about further developments, trends, and reports in the Canada LNG Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence