Key Insights

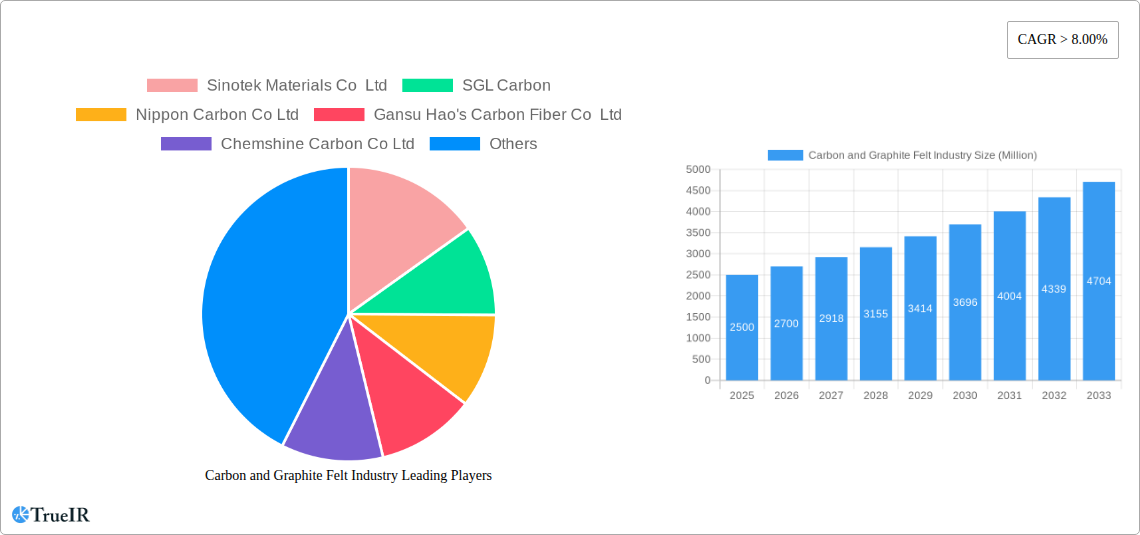

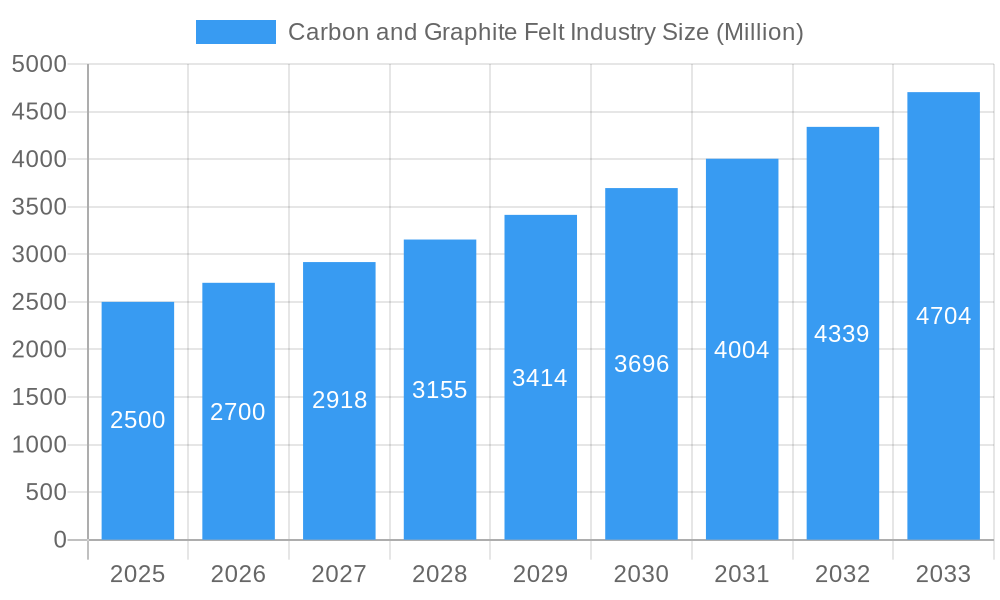

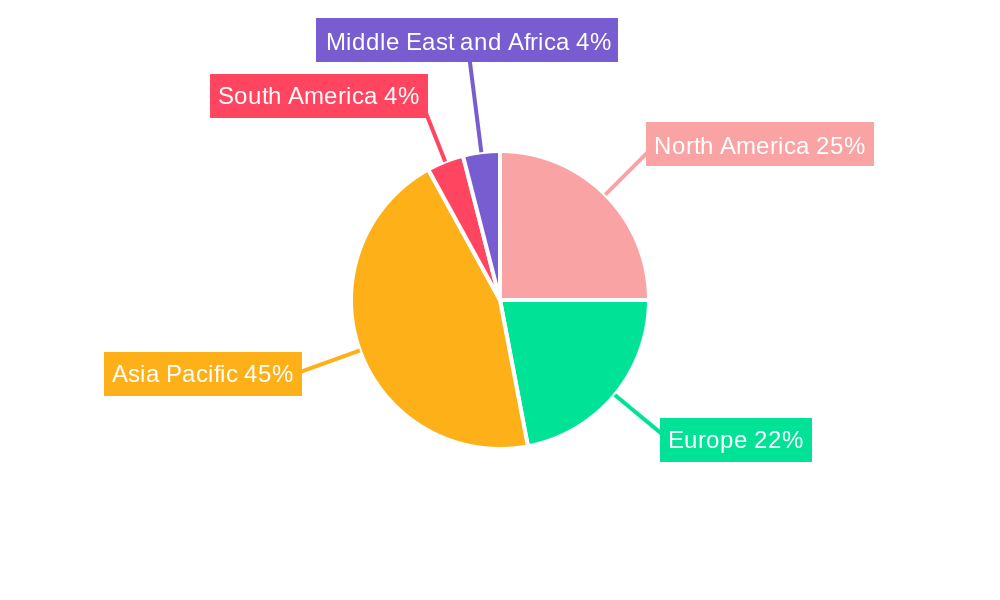

The carbon and graphite felt market is experiencing robust growth, driven by increasing demand across diverse sectors. The market, currently valued at approximately $XX million in 2025 (assuming a logical estimate based on a provided CAGR of >8% and unspecified market size), is projected to witness a Compound Annual Growth Rate (CAGR) exceeding 8% from 2025 to 2033. This expansion is fueled primarily by the burgeoning battery industry, where carbon and graphite felts serve as crucial components in various battery types, including lithium-ion batteries. The rising adoption of electric vehicles (EVs) and energy storage systems (ESS) is significantly contributing to this demand. Furthermore, the increasing utilization of carbon and graphite felts in heat insulation applications, particularly in the aerospace and automotive industries, is bolstering market growth. Advancements in semiconductor manufacturing processes also necessitate high-quality carbon and graphite felts, further expanding market opportunities. While supply chain disruptions and raw material price fluctuations pose potential restraints, ongoing research and development efforts focused on enhancing material properties and expanding applications are expected to mitigate these challenges. The Asia-Pacific region, particularly China, is currently the dominant market player, benefiting from a strong manufacturing base and significant investments in related industries.

Carbon and Graphite Felt Industry Market Size (In Billion)

The segmentation of the carbon and graphite felt market reveals key insights into its growth drivers. Polyacrylonitrile (PAN) based felts currently dominate the raw material segment due to their superior performance characteristics. However, rayon-based felts are gaining traction owing to their cost-effectiveness. Within application segments, heat insulation and batteries hold the largest market shares, reflecting their crucial roles in various industries. The competitive landscape is marked by the presence of both established global players and regional manufacturers. Key players are actively focusing on strategic partnerships, acquisitions, and product innovations to maintain their market positions and capitalize on emerging opportunities. The continued growth of the EV sector, advancements in battery technology, and the expansion of renewable energy infrastructure are poised to drive significant market growth throughout the forecast period. The market's future success will hinge on technological advancements, sustainable sourcing practices, and meeting the ever-evolving demands of key industries.

Carbon and Graphite Felt Industry Company Market Share

Carbon and Graphite Felt Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Carbon and Graphite Felt industry, offering invaluable insights for businesses, investors, and researchers seeking to understand this dynamic market. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive data and expert analysis to deliver a clear picture of current market conditions and future growth trajectories. The total market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Carbon and Graphite Felt Industry Market Structure & Competitive Landscape

The carbon and graphite felt market exhibits a moderately concentrated structure, with several key players commanding significant market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately competitive landscape. Innovation in material science and manufacturing processes, particularly in advanced graphite felt for high-temperature applications, is a key driver of market growth. Regulatory pressures related to environmental sustainability and worker safety influence manufacturing practices and product development. Substitute materials, such as ceramic fibers, pose a challenge but are limited by their performance characteristics in certain applications.

- End-User Segmentation: The industry serves diverse sectors including heat insulation (xx Million), batteries (xx Million), semiconductors (xx Million), absorptive materials (xx Million), and other applications (xx Million). The semiconductor segment is experiencing rapid growth driven by the increasing demand for high-performance electronics.

- M&A Activity: The past five years have witnessed xx mergers and acquisitions within the industry, primarily driven by strategic expansions and technological integration. The total value of these transactions is estimated at xx Million.

Carbon and Graphite Felt Industry Market Trends & Opportunities

The global carbon and graphite felt market is experiencing substantial growth driven by increasing demand across diverse applications. Key trends include the rising adoption of electric vehicles, the expansion of the semiconductor industry, and growing awareness of sustainable insulation materials. Technological advancements, such as the development of high-performance graphite felt with enhanced thermal conductivity and chemical resistance, are fueling market expansion.

The market is witnessing a shift towards specialized felt grades tailored to specific application requirements, emphasizing high purity, tailored porosity, and improved mechanical strength. Market penetration rates are highest in established markets such as heat insulation and are rapidly increasing in growth sectors like batteries and semiconductors. Competitive dynamics are characterized by both price competition and innovation-led differentiation, with leading companies investing heavily in R&D to enhance product offerings and expand their market share. The global market size is projected to reach xx Million by 2033.

Dominant Markets & Segments in Carbon and Graphite Felt Industry

The Asia-Pacific region dominates the carbon and graphite felt market, driven by significant manufacturing activity in China and Japan. Within this region, China holds the largest market share due to robust industrial growth and substantial investments in renewable energy and electronics manufacturing.

Key Growth Drivers:

- Rapid industrialization and urbanization in developing economies.

- Increasing demand for high-performance materials in advanced technologies.

- Stringent environmental regulations promoting the adoption of sustainable insulation solutions.

- Government initiatives supporting the development of renewable energy technologies.

Dominant Segments:

- Type: Graphite felt currently commands a larger market share than carbon felt due to its superior performance in high-temperature applications.

- Application: The heat insulation segment holds the largest market share, followed by the battery and semiconductor sectors experiencing rapid growth.

- Raw Material: Polyacrylonitrile (PAN) is the dominant raw material due to its ability to produce high-quality carbon fibers.

Carbon and Graphite Felt Industry Product Analysis

Product innovation focuses on enhancing material properties such as thermal conductivity, chemical resistance, and mechanical strength to cater to specific application requirements. Advanced manufacturing techniques, such as chemical vapor deposition (CVD) and electrospinning, are employed to produce high-performance felts with precise pore size distribution and improved consistency. The market is characterized by a shift towards customized products tailored to meet the demanding performance needs of various industries, offering competitive advantages through superior functionality and enhanced durability.

Key Drivers, Barriers & Challenges in Carbon and Graphite Felt Industry

Key Drivers:

- The burgeoning demand for high-performance materials in the electronics and renewable energy sectors is a primary driver.

- Technological advancements in material synthesis and processing lead to superior product characteristics.

- Favorable government policies and incentives for sustainable technologies stimulate market growth.

Key Challenges:

- Fluctuations in raw material prices and supply chain disruptions significantly impact production costs and profitability.

- Stringent environmental regulations require continuous innovation to meet increasingly stringent standards.

- Intense competition from substitute materials and the emergence of new technologies pose a challenge. The impact is estimated to reduce the market growth rate by approximately xx% by 2033.

Growth Drivers in the Carbon and Graphite Felt Industry Market

The growth of the carbon and graphite felt industry is fueled by several key factors. The rising demand for electric vehicles and energy storage systems is driving a surge in the need for high-performance battery materials, including graphite felt. Advances in semiconductor technology require innovative materials with enhanced thermal management capabilities, further boosting demand. Government regulations promoting sustainable building practices and energy efficiency are also contributing to increased adoption of carbon and graphite felt in thermal insulation applications.

Challenges Impacting Carbon and Graphite Felt Industry Growth

Despite considerable growth prospects, the carbon and graphite felt industry faces various challenges. Fluctuations in raw material prices, particularly for precursors like PAN and rayon, impact production costs and profitability. The complex and often lengthy regulatory approval processes can delay product launches and increase development costs. Moreover, intense competition from other high-performance materials necessitates continuous innovation and cost optimization to maintain market share.

Key Players Shaping the Carbon and Graphite Felt Industry Market

- Sinotek Materials Co Ltd

- SGL Carbon

- Nippon Carbon Co Ltd

- Gansu Hao's Carbon Fiber Co Ltd

- Chemshine Carbon Co Ltd

- Morgan Advanced Materials plc

- CGT Carbon GmbH

- Fiber Materials Inc

- CFCCARBON CO LTD

- Beijing Great Wall Co Ltd

- KUREHA CORPORATION

- TORAY INDUSTRIES INC

- CeraMaterials

- Advanced Graphite Materials LLC

- CeTech Co Ltd

Significant Carbon and Graphite Felt Industry Industry Milestones

June 2022: Toray Industries, Inc., announced its plan to establish a new Environment and Mobility Development Center, enhancing its sales and marketing capabilities for carbon and graphite felt applications in the automotive and environmental sectors. This initiative significantly impacts market dynamics by strengthening Toray's competitive position and expanding its market reach.

August 2022: SGL Carbon Company announced plans to expand its graphite product capacities in Shanghai, St. Marys, and Meitingen, specifically targeting the semiconductor industry. This expansion signifies a strong positive outlook for the industry and indicates an increasing demand for high-quality graphite felt in this rapidly growing sector.

Future Outlook for Carbon and Graphite Felt Industry Market

The carbon and graphite felt industry is poised for sustained growth, driven by the expanding applications in renewable energy, electric vehicles, and advanced electronics. Strategic investments in research and development, coupled with innovative manufacturing processes, will create new opportunities for market expansion. The increasing focus on sustainability and resource efficiency will further propel demand for eco-friendly carbon and graphite felt materials, making it a lucrative sector for both established and emerging players.

Carbon and Graphite Felt Industry Segmentation

-

1. Raw Material Type

- 1.1. Polyacrylonitrile (PAN)

- 1.2. Rayon

- 1.3. Other Raw Material Types

-

2. Type

- 2.1. Carbon Felt

- 2.2. Graphite Felt

-

3. Application

- 3.1. Heat Insulation

- 3.2. Batteries

- 3.3. Semiconductors

- 3.4. Absorptive Materials

- 3.5. Other Applications

Carbon and Graphite Felt Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Carbon and Graphite Felt Industry Regional Market Share

Geographic Coverage of Carbon and Graphite Felt Industry

Carbon and Graphite Felt Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 8.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Improved Performance of Carbon Fiber in High Temperature Applications; The Rising Investments in Research and Development by Manufacturers in Carbon Felt and Graphite Felt

- 3.3. Market Restrains

- 3.3.1. High Cost Associated With Carbon Felt Manufacturing

- 3.4. Market Trends

- 3.4.1. Growing Demand from Heat Insulation Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Carbon and Graphite Felt Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 5.1.1. Polyacrylonitrile (PAN)

- 5.1.2. Rayon

- 5.1.3. Other Raw Material Types

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Carbon Felt

- 5.2.2. Graphite Felt

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Heat Insulation

- 5.3.2. Batteries

- 5.3.3. Semiconductors

- 5.3.4. Absorptive Materials

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 6. Asia Pacific Carbon and Graphite Felt Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 6.1.1. Polyacrylonitrile (PAN)

- 6.1.2. Rayon

- 6.1.3. Other Raw Material Types

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Carbon Felt

- 6.2.2. Graphite Felt

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Heat Insulation

- 6.3.2. Batteries

- 6.3.3. Semiconductors

- 6.3.4. Absorptive Materials

- 6.3.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 7. North America Carbon and Graphite Felt Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 7.1.1. Polyacrylonitrile (PAN)

- 7.1.2. Rayon

- 7.1.3. Other Raw Material Types

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Carbon Felt

- 7.2.2. Graphite Felt

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Heat Insulation

- 7.3.2. Batteries

- 7.3.3. Semiconductors

- 7.3.4. Absorptive Materials

- 7.3.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 8. Europe Carbon and Graphite Felt Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 8.1.1. Polyacrylonitrile (PAN)

- 8.1.2. Rayon

- 8.1.3. Other Raw Material Types

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Carbon Felt

- 8.2.2. Graphite Felt

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Heat Insulation

- 8.3.2. Batteries

- 8.3.3. Semiconductors

- 8.3.4. Absorptive Materials

- 8.3.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 9. South America Carbon and Graphite Felt Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 9.1.1. Polyacrylonitrile (PAN)

- 9.1.2. Rayon

- 9.1.3. Other Raw Material Types

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Carbon Felt

- 9.2.2. Graphite Felt

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Heat Insulation

- 9.3.2. Batteries

- 9.3.3. Semiconductors

- 9.3.4. Absorptive Materials

- 9.3.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 10. Middle East and Africa Carbon and Graphite Felt Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 10.1.1. Polyacrylonitrile (PAN)

- 10.1.2. Rayon

- 10.1.3. Other Raw Material Types

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Carbon Felt

- 10.2.2. Graphite Felt

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Heat Insulation

- 10.3.2. Batteries

- 10.3.3. Semiconductors

- 10.3.4. Absorptive Materials

- 10.3.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Sinotek Materials Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 SGL Carbon

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nippon Carbon Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Gansu Hao's Carbon Fiber Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Chemshine Carbon Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Morgan Advanced Materials plc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CGT Carbon GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Fiber Materials Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 CFCCARBON CO LTD

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Beijing Great Wall Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 KUREHA CORPORATION

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 TORAY INDUSTRIES INC *List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 CeraMaterials

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Advanced Graphite Materials LLC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 CeTech Co Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Sinotek Materials Co Ltd

List of Figures

- Figure 1: Global Carbon and Graphite Felt Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Carbon and Graphite Felt Industry Revenue (Million), by Raw Material Type 2025 & 2033

- Figure 3: Asia Pacific Carbon and Graphite Felt Industry Revenue Share (%), by Raw Material Type 2025 & 2033

- Figure 4: Asia Pacific Carbon and Graphite Felt Industry Revenue (Million), by Type 2025 & 2033

- Figure 5: Asia Pacific Carbon and Graphite Felt Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: Asia Pacific Carbon and Graphite Felt Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: Asia Pacific Carbon and Graphite Felt Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: Asia Pacific Carbon and Graphite Felt Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Asia Pacific Carbon and Graphite Felt Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Carbon and Graphite Felt Industry Revenue (Million), by Raw Material Type 2025 & 2033

- Figure 11: North America Carbon and Graphite Felt Industry Revenue Share (%), by Raw Material Type 2025 & 2033

- Figure 12: North America Carbon and Graphite Felt Industry Revenue (Million), by Type 2025 & 2033

- Figure 13: North America Carbon and Graphite Felt Industry Revenue Share (%), by Type 2025 & 2033

- Figure 14: North America Carbon and Graphite Felt Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: North America Carbon and Graphite Felt Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: North America Carbon and Graphite Felt Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: North America Carbon and Graphite Felt Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Carbon and Graphite Felt Industry Revenue (Million), by Raw Material Type 2025 & 2033

- Figure 19: Europe Carbon and Graphite Felt Industry Revenue Share (%), by Raw Material Type 2025 & 2033

- Figure 20: Europe Carbon and Graphite Felt Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Europe Carbon and Graphite Felt Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Carbon and Graphite Felt Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: Europe Carbon and Graphite Felt Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe Carbon and Graphite Felt Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Carbon and Graphite Felt Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Carbon and Graphite Felt Industry Revenue (Million), by Raw Material Type 2025 & 2033

- Figure 27: South America Carbon and Graphite Felt Industry Revenue Share (%), by Raw Material Type 2025 & 2033

- Figure 28: South America Carbon and Graphite Felt Industry Revenue (Million), by Type 2025 & 2033

- Figure 29: South America Carbon and Graphite Felt Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: South America Carbon and Graphite Felt Industry Revenue (Million), by Application 2025 & 2033

- Figure 31: South America Carbon and Graphite Felt Industry Revenue Share (%), by Application 2025 & 2033

- Figure 32: South America Carbon and Graphite Felt Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Carbon and Graphite Felt Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Carbon and Graphite Felt Industry Revenue (Million), by Raw Material Type 2025 & 2033

- Figure 35: Middle East and Africa Carbon and Graphite Felt Industry Revenue Share (%), by Raw Material Type 2025 & 2033

- Figure 36: Middle East and Africa Carbon and Graphite Felt Industry Revenue (Million), by Type 2025 & 2033

- Figure 37: Middle East and Africa Carbon and Graphite Felt Industry Revenue Share (%), by Type 2025 & 2033

- Figure 38: Middle East and Africa Carbon and Graphite Felt Industry Revenue (Million), by Application 2025 & 2033

- Figure 39: Middle East and Africa Carbon and Graphite Felt Industry Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East and Africa Carbon and Graphite Felt Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Carbon and Graphite Felt Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Carbon and Graphite Felt Industry Revenue Million Forecast, by Raw Material Type 2020 & 2033

- Table 2: Global Carbon and Graphite Felt Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Carbon and Graphite Felt Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Carbon and Graphite Felt Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Carbon and Graphite Felt Industry Revenue Million Forecast, by Raw Material Type 2020 & 2033

- Table 6: Global Carbon and Graphite Felt Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Global Carbon and Graphite Felt Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Carbon and Graphite Felt Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Carbon and Graphite Felt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Carbon and Graphite Felt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Japan Carbon and Graphite Felt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: South Korea Carbon and Graphite Felt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific Carbon and Graphite Felt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Carbon and Graphite Felt Industry Revenue Million Forecast, by Raw Material Type 2020 & 2033

- Table 15: Global Carbon and Graphite Felt Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 16: Global Carbon and Graphite Felt Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 17: Global Carbon and Graphite Felt Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: United States Carbon and Graphite Felt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Canada Carbon and Graphite Felt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Mexico Carbon and Graphite Felt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Carbon and Graphite Felt Industry Revenue Million Forecast, by Raw Material Type 2020 & 2033

- Table 22: Global Carbon and Graphite Felt Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Global Carbon and Graphite Felt Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Carbon and Graphite Felt Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Germany Carbon and Graphite Felt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Carbon and Graphite Felt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: France Carbon and Graphite Felt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Italy Carbon and Graphite Felt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Carbon and Graphite Felt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Carbon and Graphite Felt Industry Revenue Million Forecast, by Raw Material Type 2020 & 2033

- Table 31: Global Carbon and Graphite Felt Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Carbon and Graphite Felt Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 33: Global Carbon and Graphite Felt Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Brazil Carbon and Graphite Felt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Argentina Carbon and Graphite Felt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Carbon and Graphite Felt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Carbon and Graphite Felt Industry Revenue Million Forecast, by Raw Material Type 2020 & 2033

- Table 38: Global Carbon and Graphite Felt Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 39: Global Carbon and Graphite Felt Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 40: Global Carbon and Graphite Felt Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Saudi Arabia Carbon and Graphite Felt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: South Africa Carbon and Graphite Felt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Rest of Middle East and Africa Carbon and Graphite Felt Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Carbon and Graphite Felt Industry?

The projected CAGR is approximately > 8.00%.

2. Which companies are prominent players in the Carbon and Graphite Felt Industry?

Key companies in the market include Sinotek Materials Co Ltd, SGL Carbon, Nippon Carbon Co Ltd, Gansu Hao's Carbon Fiber Co Ltd, Chemshine Carbon Co Ltd, Morgan Advanced Materials plc, CGT Carbon GmbH, Fiber Materials Inc, CFCCARBON CO LTD, Beijing Great Wall Co Ltd, KUREHA CORPORATION, TORAY INDUSTRIES INC *List Not Exhaustive, CeraMaterials, Advanced Graphite Materials LLC, CeTech Co Ltd.

3. What are the main segments of the Carbon and Graphite Felt Industry?

The market segments include Raw Material Type, Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Improved Performance of Carbon Fiber in High Temperature Applications; The Rising Investments in Research and Development by Manufacturers in Carbon Felt and Graphite Felt.

6. What are the notable trends driving market growth?

Growing Demand from Heat Insulation Segment.

7. Are there any restraints impacting market growth?

High Cost Associated With Carbon Felt Manufacturing.

8. Can you provide examples of recent developments in the market?

June 2022: Toray Industries, Inc., announced its plan to set up the Environment and Mobility Development Center in Otsu, Shiga Prefecture, and Nagoya, Aichi Prefecture. The development center will help the company strengthen the capabilities of the Corporate Marketing Planning Division to enhance sales and marketing functions in those areas.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Carbon and Graphite Felt Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Carbon and Graphite Felt Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Carbon and Graphite Felt Industry?

To stay informed about further developments, trends, and reports in the Carbon and Graphite Felt Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence